Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 Julio 2024 - 6:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-41840

WEBUY GLOBAL LTD

35 Tampines Street 92 Singapore 528880

+65 8859 9762

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

On January 26, 2024, WEBUY GLOBAL

LTD (the “Company”) received a written notice from the Listing Qualifications Department of the Nasdaq Stock Market, LLC (“Nasdaq”)

notifying the Company that, based on the closing bid price of the Company’s Class A ordinary shares, par value US$0.000000385 per

share (the “Ordinary Shares”), for the last 30 consecutive trading days, the Company fails to comply with the minimum bid

price requirement for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5450(a)(1) requires listed securities

to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq Listing Rule 5810(c)(3)(A) provides

that a failure to meet the Minimum Bid Price Requirement exists if the deficiency continues for a period of 30 consecutive trading

days. The Company was provided a period of 180 calendar days, until July 24, 2024, to regain

compliance.

On July 25, 2023, the Company received

a written notice from Nasdaq (the “Notice”) stating that, although the Company had not regained compliance with the minimum

bid price requirement by July 24, 2024, in accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company is eligible for an

additional 180 calendar day period, or until January 21, 2025, to regain compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance,

the closing bid price of the Company’s common stock must meet or exceed $1.00 per share for a minimum of ten consecutive business

days during this 180-day period.

The Notice has no immediate effect on the listing

of the Ordinary Shares on the Nasdaq Capital Market. If the Company does not regain compliance by January

21, 2025, Nasdaq will provide notice that the Company’s Ordinary Shares will be subject to delisting. The Company would then

be entitled to appeal Nasdaq’s determination to a Nasdaq Listing Qualifications Panel and request a hearing.

The Company intends to monitor the closing bid

price of the Ordinary Shares and consider its available options to resolve the noncompliance with the Minimum Bid Price Requirement. There

can be no assurance that the Company will be able to regain compliance with the Nasdaq Capital Market’s continued listing requirements

or that Nasdaq will grant the Company a further extension of time to regain compliance, if applicable.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

WEBUY GLOBAL LTD |

| |

|

|

| Date: July 26, 2024 |

By: |

/s/ Bin Xue |

| |

Name: |

Bin Xue |

| |

Title: |

Chief Executive Officer |

2

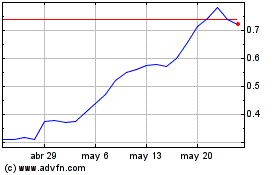

WeBuy Global (NASDAQ:WBUY)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

WeBuy Global (NASDAQ:WBUY)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024