WHLR Real Estate Investment Trust, Inc.

(NASDAQ:WHLR) (“WHLR” or the “Company”) today reported

financial and operating results for the three and twelve months

ended December 31, 2019.

|

|

Three Months Ended |

|

Years Ended |

|

|

December 31, |

|

December 31, |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

Net loss per common share |

$ |

(0.45 |

) |

|

$ |

(1.66 |

) |

|

$ |

(2.34 |

) |

|

$ |

(3.17 |

) |

|

FFO per common share and common unit |

|

0.11 |

|

|

|

(0.05 |

) |

|

|

(0.06 |

) |

|

|

0.42 |

|

|

AFFO per common share and common units |

|

0.02 |

|

|

|

0.15 |

|

|

|

0.40 |

|

|

|

0.73 |

|

2019 FOURTH QUARTER

HIGHLIGHTS

(all comparisons to the same prior year

period unless otherwise noted)

- Total revenue from continuing operations increased by 0.64% or

$102 thousand primarily due to increased tenant reimbursement

recoveries as well as increased revenue from our JANAF asset. This

increase was partially offset by revenue declines of $301 thousand

due to asset sales.

- Same store property revenues increased 3.57%.

- Same store Net Operating Income ("NOI") increased by 3.14% and

by 1.97% on a cash basis.

- Reduced the KeyBank Line of Credit by $7.2 million through a

refinancing of Litchfield Market Village, which represented a

collateralized portion of the line of credit.

- Executed 41 lease renewals totaling 480,008 square feet at a

weighted-average increase of $0.33 per square foot, representing an

increase of 4.50% over in-place rental rates.

- Signed 13 new leases totaling approximately 40,631 square feet

with a weighted-average rental rate of $12.57 per square foot.

- Net loss attributable to WHLR's common stock, $0.01 par value

per share ("Common Stock") shareholders of $4.3 million, or ($0.45)

per share.

- NOI from property operations remained flat at $11.2 million

despite declines in NOI resulting from the impact of selling four

income producing properties, totaling approximately $205 thousand,

and increases in real estate tax and insurance expenses, which was

offset by increases in tenant reimbursement revenue.

- Adjusted Funds from Operations ("AFFO") of $0.02 per share of

the Company's Common Stock and common unit ("Common Unit") in our

operating partnership, Wheeler REIT, L.P.

- Recognized a $51 thousand impairment charge on St. Matthews, a

29,000 square foot shopping center that was held for sale as of

December 31, 2019.

2019 YEAR-TO-DATE

HIGHLIGHTS

- Sold three properties and an undeveloped land parcel for $16.0

million, resulting in a total gain of $1.7 million and net proceeds

of $3.6 million.

- Reduced WHLR's weighted-average interest rate to 4.71%, with an

average loan term of 4.19 years from 4.84% with a term of 4.31

years at December 31, 2018.

- Paid in full:º Bulldog Senior Convertible notes through

scheduled principal and interest payments; andº Revere Term

Loan through a combination of asset sale proceeds, operating cash

flows and $300 thousand in monthly scheduled principal

payments.

- Paid down the KeyBank Line of Credit to $17.9 million with

proceeds from the following sources:º $30.2 million of

refinancings from the Village of Martinsville, Laburnum Square and

Litchfield Market Village;º $1.9 million in specific principal

payments; as well asº $2.2 million in monthly scheduled

principal payments.

- The 1,986,600 publicly traded warrants (CUSIP No.: 963025119)

(NASQAQ: WHLRW) exchangeable into 248,325 shares of our Common

Stock expired on April 29, 2019.

- Recognized a $5.0 million impairment charge on Sea Turtle

Development notes receivable bringing the carrying value to

zero.

- Recognized a total of $1.6 million in impairment charges on

Perimeter Square, which was sold on July 12, 2019, and St.

Matthews, which was sold on January 21, 2020, subsequent to year

end, December 31, 2019.

- Corporate general and administrative expenses decreased 19.39%

resulting from decreases in employee share based compensation,

severance, professional fees and debt financing expenses and

savings from not pursing acquisition and development projects.

- Net loss attributable to WHLR's Common Stock shareholders of

$22.7 million, or ($2.34) per share.

- Total revenue from continuing operations decreased by 3.24% or

$2.1 million primarily due to the 2018 early termination fees of

$1.3 million associated with Berkley Center Shopping Center and

Southeastern Grocers ("SEG") recaptures as well as the revenue

declines from the impact of selling five properties, approximately

$1.3 million, partially offset by an increase of 5.53% in JANAF

revenue and tenant reimbursement recoveries of $774 thousand.

- NOI from property operations decreased by 5.36% to $43.9

million primarily due to the 2018 early termination fees of $1.3

million associated with Berkley Center Shopping Center and SEG

recaptures and the declines in NOI resulting from the impact of

selling five properties, approximately $984 thousand. These

declines in NOI were partially offset by an increase of $93

thousand or 1.20% in NOI generated by JANAF.

- AFFO of $0.40 per share of the Company's Common Stock and

Common Unit in our operating partnership, Wheeler REIT, L.P.

SUBSEQUENT EVENTS

- The Company and KeyBank entered into a Second Amendment to the

KeyBank Line of Credit effective December 21, 2019 and the Company

began making monthly principal payments of $350 thousand on

November 1, 2019. The Second Amendment, among other provisions,

requires a pledge of additional collateral of $15.00 million in

residual equity interests. In addition, the Second Amendment

requires the KeyBank Line of Credit to be reduced to $10.0 million

by January 31, 2020, $2.0 million by April 30, 2020 and fully

matures on June 30, 2020.

- Reduced the KeyBank Line of Credit by $7.5 million through the

below, leaving a remaining balance, as required by the Second

Amendment, as of January 31, 2020 of $10.0 million, as noted

below:º sold St. Matthews for a contract price of $1.8

million; andº refinanced the Shoppes at Myrtle Park for $6.0

million at a fixed rate of 4.45%.

- The Company and the Synovus Bank agreed to extend the Rivergate

Shopping Center loan to March 20, 2020.

BALANCE SHEET

- Cash and cash equivalents totaled $5.5 million at December 31,

2019, compared to $3.5 million at December 31, 2018.

- Restricted cash totaled $16.1 million at December 31, 2019,

compared to $14.5 million at December 31, 2018. These funds

are held in lender reserves for the purpose of tenant improvements,

lease commissions, real estate taxes and insurance expenses.

- Accounts payable, accrued expenses and other liabilities

totaled $9.6 million at December 31, 2019, compared to $12.1

million at December 31, 2018, a decrease of $2.6 million.

- Total debt was $347.1 million at December 31, 2019 (including

debt associated with assets held for sale), compared to $369.6

million at December 31, 2018. The decrease of $22.6 million in debt

is primarily a result of:º $1.1 million Revere Term Loan

pay-off;º $12.3 million in payoffs as a result of asset

sales;º $4.1 million of additional and scheduled principal

pay-downs on the KeyBank Line of Credit; andº regularly

scheduled principal payments.

- WHLR's weighted-average interest rate was 4.71% with a term of

4.19 years at December 31, 2019 (including debt associated with

assets held for sale).

- Net investment properties as of December 31, 2019 totaled

at $417.9 million (including assets held for sale), compared to

$441.4 million as of December 31, 2018.

DIVIDENDS

- At December 31, 2019, the Company had accumulated

undeclared dividends of approximately $17.0 million to holders of

shares of our Series A Preferred Stock, Series B Preferred Stock,

and Series D Preferred Stock of which $3.5 million and $14.0

million are attributable to the three and twelve months ended

December 31, 2019, respectively.

OPERATIONS AND LEASING

- The Company's real estate portfolio is 89.8% leased as of

December 31, 2019.

- YTD 2019 Leasing Activityº Executed 149 lease renewals

totaling 1,036,017 square feet at a weighted-average increase of

$0.34 per square foot, representing an increase of 4.17% over

in-place rental rates.º Signed 43 new leases totaling

approximately 117,605 square feet with a weighted-average rental

rate of $12.82 per square foot.

- A new grocer tenant, ALDI, completed construction and opened in

December 2019 an approximate 20,000 square foot grocery store,

which replaced an existing approximate 10,000 square foot outparcel

building at JANAF Shopping Center. The annual base rent increases

$58 thousand with the new tenant and the lease expiration extends

17 years. As a result of the demolition of the existing

building, the Company incurred a $331 thousand noncash

write-off.

- In September, a 20 year ground lease was executed for the

development of a new Planet Fitness in the parking field at Freeway

Junction in Stockbridge, Georgia.

- The Company’s gross leasable area ("GLA"), which is subject to

leases that expire over the next twelve months and includes

month-to-month leases, increased to approximately 13.10% at

December 31, 2019, compared to 7.08% at December 31, 2018. At

December 31, 2019, 44.34% of this expiring GLA is subject to

renewal options.

SAME STORE RESULTS

The same store property pool includes those properties owned

during all periods presented in their entirety, while the non-same

stores property pool consists of those properties acquired or

disposed of during the periods presented.

- Same store NOI for the three months ended December 31, 2019

compared to December 31, 2018, increased by 3.14% and 1.97% on a

cash basis. Same store results were impacted by a 4.6%

increase in property expenses, primarily due to increased real

estate tax and insurance expenses, which was offset by increases in

tenant reimbursement revenue.

- Same store NOI for the years ended December 31, 2019 compared

to December 31, 2018, declined by 4.27% and 2.84% on a cash basis.

Same store results were impacted by a 2.04% decrease in property

revenues, primarily a result of the 2018 early termination fee

associated with Farm Fresh at Berkley Center Shopping Center, rent

modifications to certain 2018 SEG leases, reduced rent at the SEG

recaptured and backfilled locations and incremental vacancies. Same

Store property expenses increased 3.48% due to an increase in

repairs and maintenance expense related to buildings and parking

lots.

ACQUISITIONS

- In April 2019, the Company absorbed an approximate 25,000

square foot outparcel at JANAF as a result of an unlawful detainer

with a delinquent tenant.

DISPOSITIONS

- Sold Jenks Plaza for a contract price of $2.2 million,

generating a gain of $387 thousand and net proceeds of $1.8

million.

- Sold a 1.28-acre portion of an undeveloped land parcel at

Harbor Pointe for a contract price of $550 thousand resulting in

net proceeds of $19 thousand, paying off associated debt and

retaining an approximate 4-acre unleveraged parcel.

- Sold Graystone Crossing for a contract price of $6.0 million,

generating a gain of $1.4 million and net proceeds of $1.7

million.

- Sold Perimeter Square for a contract price of $7.2 million,

generating a loss of $95 thousand and paying off associated

debt.

SUPPLEMENTAL INFORMATION

Further details regarding Wheeler Real Estate Investment Trust,

Inc.’s operations and financials for the year ended December 31,

2019, including a supplemental presentation, are available at

https://ir.whlr.us/.

ABOUT WHEELER REAL ESTATE INVESTMENT TRUST,

INC.

Headquartered in Virginia Beach, VA, Wheeler Real Estate

Investment Trust, Inc. is a fully-integrated, self-managed

commercial real estate investment company focused on owning and

operating income-producing retail properties with a primary focus

on grocery-anchored centers. Wheeler’s portfolio contains

well-located, potentially dominant retail properties in secondary

and tertiary markets that generate attractive, risk-adjusted

returns, with a particular emphasis on grocery-anchored retail

centers. For additional information about the Company, please

visit: www.whlr.us.

A copy of Wheeler’s Annual Report on Form 10-K, which includes

the Company’s consolidated financial statements and management’s

discussion & analysis of financial condition and results of

operations, will be available upon filing via the U.S. Securities

and Exchange Commission website (www.sec.gov) or through Wheeler’s

website at www.whlr.us.

DEFINITIONS

FFO, AFFO, Property NOI, EBITDA and Adjusted EBITDA are non-GAAP

financial measures within the meaning of the rules of the

Securities and Exchange Commission. Wheeler considers FFO, AFFO,

Property NOI, EBITDA and Adjusted EBITDA to be important

supplemental measures of its operating performance and believes it

is frequently used by securities analysts, investors and other

interested parties in the evaluation of REITs, many of which

present FFO when reporting their results. FFO is intended to

exclude GAAP historical cost depreciation and amortization of real

estate and related assets, which assumes that the value of real

estate assets diminishes ratably over time. Historically, however,

real estate values have risen or fallen with market conditions.

Because FFO excludes depreciation and amortization unique to real

estate and gains and losses from property dispositions, the Company

believes that it provides a performance measure that, when compared

year-over-year, reflects the impact to operations from trends in

occupancy rates, rental rates, operating costs, development

activities and interest costs, providing perspective not

immediately apparent from the closest GAAP measurement, net

income.

Management believes that the computation of FFO in accordance

with NAREIT’s definition includes certain items that are not

indicative of the operating performance of the Company’s real

estate assets. These items include, but are not limited to,

nonrecurring expenses, legal settlements, legal and professional

fees, and acquisition costs. Management uses AFFO, which is a

non-GAAP financial measure, to exclude such items. Management

believes that reporting AFFO in addition to FFO is a useful

supplemental measure for the investment community to use when

evaluating the operating performance of the Company on a

comparative basis. Management also believes that Property NOI,

EBITDA and Adjusted EBITDA represent important supplemental

measures for securities analysts, investors and other interested

parties, as they are often used in calculating net asset value,

leverage and other financial metrics used by these parties in the

evaluation of REITs.

FORWARD LOOKING STATEMENTS

This press release may contain “forward-looking” statements as

defined in the Private Securities Litigation Reform Act of 1995.

When the Company uses words such as “may,” “will,” “intend,”

“should,” “believe,” “expect,” “anticipate,” “project,” “estimate”

or similar expressions that do not relate solely to historical

matters, it is making forward-looking statements. Forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that may cause the actual results to differ

materially from the Company’s expectations discussed in the

forward-looking statements. The Company’s expected results may not

be achieved, and actual results may differ materially from

expectations. Specifically, the Company’s statements regarding; 1)

future generation of financial returns from its portfolio; 2) its

ability to create higher occupancy rates, increases in annual rent

spreads and increased NOI; and 3) its ability to enter into an

amendment to the Amended and Restated Credit Agreement with KeyBank

are forward-looking statements. These statements are not guarantees

of future performance and are subject to risks, uncertainties and

other factors, some of which are beyond our control, are difficult

to predict and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

For these reasons, among others, investors are cautioned not to

place undue reliance upon any forward-looking statements in this

press release.

Additional factors are discussed in the Company's filings with

the U.S. Securities and Exchange Commission, which are available

for review at www.sec.gov. The Company undertakes no obligation to

publicly revise these forward-looking statements to reflect events

or circumstances that arise after the date hereof.

Mary JensenInvestor

Relationsmjensen@whlr.us(757) 627-9088

Wheeler Real Estate Investment Trust,

Inc. and SubsidiariesConsolidated Statements of

Operations(in thousands, except share and per

share data)

|

|

Three Months Ended December 31, |

|

Years EndedDecember 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| REVENUE: |

|

|

|

|

|

|

|

|

Rental revenues |

$ |

15,896 |

|

|

$ |

15,748 |

|

|

$ |

62,442 |

|

|

$ |

63,036 |

|

|

Asset management fees |

18 |

|

|

46 |

|

|

60 |

|

|

266 |

|

|

Commissions |

— |

|

|

38 |

|

|

65 |

|

|

140 |

|

|

Other revenues |

156 |

|

|

136 |

|

|

595 |

|

|

1,833 |

|

|

Total Revenue |

16,070 |

|

|

15,968 |

|

|

63,162 |

|

|

65,275 |

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

Property operations |

4,839 |

|

|

4,669 |

|

|

19,127 |

|

|

18,473 |

|

|

Non-REIT management and leasing services |

— |

|

|

16 |

|

|

25 |

|

|

75 |

|

|

Depreciation and amortization |

5,150 |

|

|

6,151 |

|

|

21,319 |

|

|

27,094 |

|

|

Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

5,486 |

|

|

Impairment of notes receivable |

— |

|

|

1,739 |

|

|

5,000 |

|

|

1,739 |

|

|

Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

3,938 |

|

|

Impairment of assets held for sale |

51 |

|

|

— |

|

|

1,598 |

|

|

— |

|

|

Corporate general & administrative |

2,090 |

|

|

1,749 |

|

|

6,633 |

|

|

8,228 |

|

|

Other operating expenses |

— |

|

|

— |

|

|

— |

|

|

250 |

|

|

Total Operating Expenses |

12,130 |

|

|

23,748 |

|

|

53,702 |

|

|

65,283 |

|

|

(Loss) Gain on disposal of properties |

(33 |

) |

|

151 |

|

|

1,394 |

|

|

2,463 |

|

| Operating Income

(Loss) |

3,907 |

|

|

(7,629 |

) |

|

10,854 |

|

|

2,455 |

|

|

Interest income |

— |

|

|

1 |

|

|

2 |

|

|

4 |

|

|

Interest expense |

(4,591 |

) |

|

(5,288 |

) |

|

(18,985 |

) |

|

(20,228 |

) |

| Net Loss from Continuing

Operations Before Income Taxes |

(684 |

) |

|

(12,916 |

) |

|

(8,129 |

) |

|

(17,769 |

) |

|

Income tax benefit (expense) |

8 |

|

|

32 |

|

|

(15 |

) |

|

(40 |

) |

| Net Loss from Continuing

Operations |

(676 |

) |

|

(12,884 |

) |

|

(8,144 |

) |

|

(17,809 |

) |

| Net Income from

Discontinued Operations |

— |

|

|

— |

|

|

— |

|

|

903 |

|

| Net Loss |

(676 |

) |

|

(12,884 |

) |

|

(8,144 |

) |

|

(16,906 |

) |

|

Less: Net loss attributable to noncontrolling interests |

(5 |

) |

|

(336 |

) |

|

(105 |

) |

|

(406 |

) |

| Net Loss Attributable to

Wheeler REIT |

(671 |

) |

|

(12,548 |

) |

|

(8,039 |

) |

|

(16,500 |

) |

|

Preferred Stock dividends - declared |

— |

|

|

(169 |

) |

|

— |

|

|

(9,790 |

) |

|

Preferred Stock dividends - undeclared |

(3,657 |

) |

|

(3,037 |

) |

|

(14,629 |

) |

|

(3,037 |

) |

| Net Loss Attributable to

Wheeler REIT Common Shareholders |

$ |

(4,328 |

) |

|

$ |

(15,754 |

) |

|

$ |

(22,668 |

) |

|

$ |

(29,327 |

) |

| |

|

|

|

|

|

|

|

|

Loss per share from continuing operations (basic and diluted) |

$ |

(0.45 |

) |

|

$ |

(1.66 |

) |

|

$ |

(2.34 |

) |

|

$ |

(3.26 |

) |

|

Income per share from discontinued operations |

— |

|

|

— |

|

|

— |

|

|

0.09 |

|

|

|

$ |

(0.45 |

) |

|

$ |

(1.66 |

) |

|

$ |

(2.34 |

) |

|

$ |

(3.17 |

) |

|

Weighted-average number of shares: |

|

|

|

|

|

|

|

|

Basic and Diluted |

9,693,403 |

|

|

9,484,185 |

|

|

9,671,847 |

|

|

9,256,234 |

|

Wheeler Real Estate Investment Trust,

Inc. and SubsidiariesConsolidated Balance

Sheets(in thousands, except par value and share

data)

| |

December 31, |

| |

2019 |

|

2018 |

| ASSETS: |

|

|

|

|

Investment properties, net |

$ |

416,215 |

|

|

$ |

436,006 |

|

|

Cash and cash equivalents |

5,451 |

|

|

3,544 |

|

|

Restricted cash |

16,140 |

|

|

14,455 |

|

|

Rents and other tenant receivables, net |

6,905 |

|

|

5,539 |

|

|

Notes receivable, net |

— |

|

|

5,000 |

|

|

Assets held for sale |

1,737 |

|

|

6,118 |

|

|

Above market lease intangibles, net |

5,241 |

|

|

7,346 |

|

|

Operating lease right-of-use assets |

11,651 |

|

|

— |

|

|

Deferred costs and other assets, net |

21,025 |

|

|

30,073 |

|

|

Total Assets |

$ |

484,365 |

|

|

$ |

508,081 |

|

|

LIABILITIES: |

|

|

|

|

Loans payable, net |

$ |

340,913 |

|

|

$ |

360,190 |

|

|

Liabilities associated with assets held for sale |

2,026 |

|

|

4,520 |

|

|

Below market lease intangibles, net |

6,716 |

|

|

10,045 |

|

|

Operating lease liabilities |

11,921 |

|

|

— |

|

|

Accounts payable, accrued expenses and other liabilities |

9,557 |

|

|

12,116 |

|

|

Total Liabilities |

371,133 |

|

|

386,871 |

|

| Series D Cumulative Convertible

Preferred Stock (no par value, 4,000,000 shares authorized,

3,600,636 shares issued and outstanding; $101.66 million and $91.98

million aggregate liquidation preference, respectively) |

87,225 |

|

|

76,955 |

|

| |

|

|

|

| EQUITY: |

|

|

|

|

Series A Preferred Stock (no par value, 4,500 shares authorized,

562 shares issued and outstanding) |

453 |

|

|

453 |

|

|

Series B Convertible Preferred Stock (no par value, 5,000,000

authorized, 1,875,748 shares issued and outstanding; $46.90 million

aggregate liquidation preference) |

41,087 |

|

|

41,000 |

|

|

Common Stock ($0.01 par value, 18,750,000 shares authorized,

9,694,284 and 9,511,464 shares issued and outstanding,

respectively) |

97 |

|

|

95 |

|

|

Additional paid-in capital |

233,870 |

|

|

233,697 |

|

|

Accumulated deficit |

(251,580 |

) |

|

(233,184 |

) |

|

Total Shareholders’ Equity |

23,927 |

|

|

42,061 |

|

|

Noncontrolling interests |

2,080 |

|

|

2,194 |

|

|

Total Equity |

26,007 |

|

|

44,255 |

|

|

Total Liabilities and Equity |

$ |

484,365 |

|

|

$ |

508,081 |

|

Wheeler Real Estate Investment Trust,

Inc. and Subsidiaries Reconciliation

of Funds From Operations (FFO)(unaudited, in

thousands)

| |

Three Months Ended December 31, |

| |

Same Store |

|

Non-same Store |

|

Total |

|

Period Over PeriodChanges |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

$ |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Income |

$ |

(939 |

) |

|

$ |

(12,868 |

) |

|

$ |

263 |

|

|

$ |

(16 |

) |

|

$ |

(676 |

) |

|

$ |

(12,884 |

) |

|

$ |

12,208 |

|

|

94.75 |

% |

| Depreciation and amortization of

real estate assets |

4,249 |

|

|

4,709 |

|

|

901 |

|

|

1,442 |

|

|

5,150 |

|

|

6,151 |

|

|

(1,001 |

) |

|

(16.27 |

)% |

| Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

— |

|

|

— |

|

|

5,486 |

|

|

(5,486 |

) |

|

(100.00 |

)% |

| Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,938 |

|

|

(3,938 |

) |

|

(100.00 |

)% |

| Impairment of assets held for

sale |

51 |

|

|

— |

|

|

— |

|

|

— |

|

|

51 |

|

|

— |

|

|

51 |

|

|

100.00 |

% |

| Loss (gain) on disposal of

properties |

— |

|

|

— |

|

|

33 |

|

|

(151 |

) |

|

33 |

|

|

(151 |

) |

|

184 |

|

|

121.85 |

% |

| FFO |

$ |

3,361 |

|

|

$ |

1,265 |

|

|

$ |

1,197 |

|

|

$ |

1,275 |

|

|

$ |

4,558 |

|

|

$ |

2,540 |

|

|

$ |

2,018 |

|

|

79.45 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Years Ended December 31, |

| |

Same Store |

|

Non-same Store |

|

Total |

|

Year Over Year Changes |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

$ |

|

% |

|

Net (Loss) Income |

$ |

(9,122 |

) |

|

$ |

(20,071 |

) |

|

$ |

978 |

|

|

$ |

3,165 |

|

|

$ |

(8,144 |

) |

|

$ |

(16,906 |

) |

|

$ |

8,762 |

|

|

51.83 |

% |

| Depreciation and amortization of

real estate assets |

17,298 |

|

|

21,944 |

|

|

4,021 |

|

|

5,150 |

|

|

21,319 |

|

|

27,094 |

|

|

(5,775 |

) |

|

(21.31 |

)% |

| Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

— |

|

|

— |

|

|

5,486 |

|

|

(5,486 |

) |

|

(100.00 |

)% |

| Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,938 |

|

|

(3,938 |

) |

|

(100.00 |

)% |

| Impairment of assets held for

sale |

451 |

|

|

— |

|

|

1,147 |

|

|

— |

|

|

1,598 |

|

|

— |

|

|

1,598 |

|

|

100.00 |

% |

| Gain on disposal of

properties |

— |

|

|

— |

|

|

(1,394 |

) |

|

(2,463 |

) |

|

(1,394 |

) |

|

(2,463 |

) |

|

1,069 |

|

|

43.40 |

% |

| Gain on disposal of

properties-discontinued operations |

— |

|

|

— |

|

|

— |

|

|

(903 |

) |

|

— |

|

|

(903 |

) |

|

903 |

|

|

100.00 |

% |

| FFO |

$ |

8,627 |

|

|

$ |

11,297 |

|

|

$ |

4,752 |

|

|

$ |

4,949 |

|

|

$ |

13,379 |

|

|

$ |

16,246 |

|

|

$ |

(2,867 |

) |

|

(17.65 |

)% |

Wheeler Real Estate Investment Trust,

Inc. and Subsidiaries Reconciliation

of Funds From Operations (FFO)(unaudited, in

thousands)

| |

Three Months EndedDecember

31, |

|

Years EndedDecember 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net Loss |

$ |

(676 |

) |

|

$ |

(12,884 |

) |

|

$ |

(8,144 |

) |

|

$ |

(16,906 |

) |

| Depreciation and amortization

of real estate assets |

5,150 |

|

|

6,151 |

|

|

21,319 |

|

|

27,094 |

|

| Loss (Gain) on disposal of

properties |

33 |

|

|

(151 |

) |

|

(1,394 |

) |

|

(2,463 |

) |

| Gain on disposal of

properties-discontinued operations |

— |

|

|

— |

|

|

— |

|

|

(903 |

) |

| Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

5,486 |

|

| Impairment of assets held for

sale |

51 |

|

|

— |

|

|

1,598 |

|

|

— |

|

| Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

3,938 |

|

| FFO |

4,558 |

|

|

2,540 |

|

|

13,379 |

|

|

16,246 |

|

| Preferred stock dividends

declared |

— |

|

|

(169 |

) |

|

— |

|

|

(9,790 |

) |

| Preferred stock dividends

undeclared |

(3,657 |

) |

|

(3,037 |

) |

|

(14,629 |

) |

|

(3,037 |

) |

| Preferred stock accretion

adjustments |

170 |

|

|

169 |

|

|

680 |

|

|

678 |

|

| FFO available to common

shareholders and common unitholders |

1,071 |

|

|

(497 |

) |

|

(570 |

) |

|

4,097 |

|

| Impairment of notes

receivable |

— |

|

|

1,739 |

|

|

5,000 |

|

|

1,739 |

|

| Acquisition and development

costs |

1 |

|

|

(46 |

) |

|

26 |

|

|

300 |

|

| Capital related costs |

4 |

|

|

168 |

|

|

144 |

|

|

576 |

|

| Other non-recurring and

non-cash expenses (1) |

(19 |

) |

|

— |

|

|

42 |

|

|

103 |

|

| Share-based compensation |

(242 |

) |

|

213 |

|

|

2 |

|

|

940 |

|

| Straight-line rental revenue,

net straight-line expense |

7 |

|

|

(244 |

) |

|

6 |

|

|

(1,197 |

) |

| Loan cost amortization |

371 |

|

|

681 |

|

|

1,707 |

|

|

2,363 |

|

| (Below) above market lease

amortization |

(676 |

) |

|

(274 |

) |

|

(1,261 |

) |

|

(695 |

) |

| Recurring capital expenditures

and tenant improvement reserves |

(280 |

) |

|

(285 |

) |

|

(1,126 |

) |

|

(1,143 |

) |

| AFFO |

$ |

237 |

|

|

$ |

1,455 |

|

|

$ |

3,970 |

|

|

$ |

7,083 |

|

|

|

|

|

|

|

|

|

|

| Weighted Average Common

Shares |

9,693,403 |

|

|

9,484,185 |

|

|

9,671,847 |

|

|

9,256,234 |

|

| Weighted Average Common

Units |

234,900 |

|

|

259,054 |

|

|

234,999 |

|

|

389,421 |

|

| Total Common Shares and

Units |

9,928,303 |

|

|

9,743,239 |

|

|

9,906,846 |

|

|

9,645,655 |

|

| FFO per Common Share and

Common Units |

$ |

0.11 |

|

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

0.42 |

|

| AFFO per Common Share and

Common Units |

$ |

0.02 |

|

|

$ |

0.15 |

|

|

$ |

0.40 |

|

|

$ |

0.73 |

|

(1) Other non-recurring expenses are described in "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" included in our Annual Report on Form 10-K for the year

ended December 31, 2019.

Wheeler Real Estate Investment Trust,

Inc. and SubsidiariesReconciliation of Property

Net Operating Income(unaudited, in

thousands)

| |

Three Months Ended December 31, |

| |

Same Store |

|

Non-same Store |

|

Total |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net (Loss) Income |

$ |

(939 |

) |

|

$ |

(12,868 |

) |

|

$ |

263 |

|

|

$ |

(16 |

) |

|

$ |

(676 |

) |

|

$ |

(12,884 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit |

(8 |

) |

|

(32 |

) |

|

— |

|

|

— |

|

|

(8 |

) |

|

(32 |

) |

|

Interest expense |

3,873 |

|

|

4,355 |

|

|

718 |

|

|

933 |

|

|

4,591 |

|

|

5,288 |

|

|

Interest income |

— |

|

|

(1 |

) |

|

— |

|

|

— |

|

|

— |

|

|

(1 |

) |

|

Loss (gain) on disposal of properties |

— |

|

|

— |

|

|

33 |

|

|

(151 |

) |

|

33 |

|

|

(151 |

) |

|

Corporate general & administrative |

2,051 |

|

|

1,719 |

|

|

39 |

|

|

30 |

|

|

2,090 |

|

|

1,749 |

|

|

Impairment of assets held for sale |

51 |

|

|

— |

|

|

— |

|

|

— |

|

|

51 |

|

|

— |

|

|

Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,938 |

|

|

Impairment of notes receivable |

— |

|

|

1,739 |

|

|

— |

|

|

— |

|

|

— |

|

|

1,739 |

|

|

Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

— |

|

|

— |

|

|

5,486 |

|

|

Depreciation and amortization |

4,249 |

|

|

4,709 |

|

|

901 |

|

|

1,442 |

|

|

5,150 |

|

|

6,151 |

|

|

Non-REIT management and leasing services |

— |

|

|

16 |

|

|

— |

|

|

— |

|

|

— |

|

|

16 |

|

|

Asset management and commission revenues |

(18 |

) |

|

(84 |

) |

|

— |

|

|

— |

|

|

(18 |

) |

|

(84 |

) |

| Property Net Operating

Income |

$ |

9,259 |

|

|

$ |

8,977 |

|

|

$ |

1,954 |

|

|

$ |

2,238 |

|

|

$ |

11,213 |

|

|

$ |

11,215 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Property revenues |

$ |

13,213 |

|

|

$ |

12,758 |

|

|

$ |

2,839 |

|

|

$ |

3,126 |

|

|

$ |

16,052 |

|

|

$ |

15,884 |

|

|

Property expenses |

3,954 |

|

|

3,781 |

|

|

885 |

|

|

888 |

|

|

4,839 |

|

|

4,669 |

|

| Property Net Operating

Income |

$ |

9,259 |

|

|

$ |

8,977 |

|

|

$ |

1,954 |

|

|

$ |

2,238 |

|

|

$ |

11,213 |

|

|

$ |

11,215 |

|

Wheeler Real Estate Investment Trust,

Inc. and SubsidiariesReconciliation of Property

Net Operating Income (Continued)(unaudited, in

thousands)

| |

Years Ended December 31, |

| |

Same Store |

|

Non-same Store |

|

Total |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net (Loss) Income |

$ |

(9,122 |

) |

|

$ |

(20,071 |

) |

|

$ |

978 |

|

|

$ |

3,165 |

|

|

$ |

(8,144 |

) |

|

$ |

(16,906 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Income from Discontinued Operations |

— |

|

|

— |

|

|

— |

|

|

(903 |

) |

|

— |

|

|

(903 |

) |

|

Income tax expense |

15 |

|

|

40 |

|

|

— |

|

|

— |

|

|

15 |

|

|

40 |

|

|

Interest expense |

15,788 |

|

|

16,581 |

|

|

3,197 |

|

|

3,647 |

|

|

18,985 |

|

|

20,228 |

|

|

Interest income |

(2 |

) |

|

(4 |

) |

|

— |

|

|

— |

|

|

(2 |

) |

|

(4 |

) |

|

Gain on disposal of properties |

— |

|

|

— |

|

|

(1,394 |

) |

|

(2,463 |

) |

|

(1,394 |

) |

|

(2,463 |

) |

|

Other operating expenses |

— |

|

|

— |

|

|

— |

|

|

250 |

|

|

— |

|

|

250 |

|

|

Corporate general & administrative |

6,439 |

|

|

8,040 |

|

|

194 |

|

|

188 |

|

|

6,633 |

|

|

8,228 |

|

|

Impairment of assets held for sale |

451 |

|

|

— |

|

|

1,147 |

|

|

— |

|

|

1,598 |

|

|

— |

|

|

Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,938 |

|

|

Impairment of notes receivable |

5,000 |

|

|

1,739 |

|

|

— |

|

|

— |

|

|

5,000 |

|

|

1,739 |

|

|

Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

— |

|

|

— |

|

|

5,486 |

|

|

Depreciation and amortization |

17,298 |

|

|

21,944 |

|

|

4,021 |

|

|

5,150 |

|

|

21,319 |

|

|

27,094 |

|

|

Non-REIT management and leasing services |

25 |

|

|

75 |

|

|

— |

|

|

— |

|

|

25 |

|

|

75 |

|

|

Asset management and commission revenues |

(125 |

) |

|

(406 |

) |

|

— |

|

|

— |

|

|

(125 |

) |

|

(406 |

) |

| Property Net Operating

Income |

$ |

35,767 |

|

|

$ |

37,362 |

|

|

$ |

8,143 |

|

|

$ |

9,034 |

|

|

$ |

43,910 |

|

|

$ |

46,396 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Property revenues |

$ |

51,355 |

|

|

$ |

52,426 |

|

|

$ |

11,682 |

|

|

$ |

12,443 |

|

|

$ |

63,037 |

|

|

$ |

64,869 |

|

|

Property expenses |

15,588 |

|

|

15,064 |

|

|

3,539 |

|

|

3,409 |

|

|

19,127 |

|

|

18,473 |

|

| Property Net Operating

Income |

$ |

35,767 |

|

|

$ |

37,362 |

|

|

$ |

8,143 |

|

|

$ |

9,034 |

|

|

$ |

43,910 |

|

|

$ |

46,396 |

|

Wheeler Real Estate Investment Trust,

Inc. and SubsidiariesReconciliation of Earnings

Before Interest, Taxes, Depreciation and Amortization -

EBITDA(unaudited, in thousands)

| |

Three Months EndedDecember

31, |

|

Years EndedDecember 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net Loss |

$ |

(676 |

) |

|

$ |

(12,884 |

) |

|

$ |

(8,144 |

) |

|

$ |

(16,906 |

) |

| Add back: |

Depreciation and amortization

(1) |

4,474 |

|

|

5,877 |

|

|

20,058 |

|

|

26,399 |

|

| |

Interest Expense (2) |

4,591 |

|

|

5,288 |

|

|

18,985 |

|

|

20,228 |

|

| |

Income tax (benefit)

expense |

(8 |

) |

|

(32 |

) |

|

15 |

|

|

40 |

|

| EBITDA |

8,381 |

|

|

(1,751 |

) |

|

30,914 |

|

|

29,761 |

|

| Adjustments for

items affecting comparability: |

|

|

|

|

|

|

|

| |

Acquisition and development

costs |

1 |

|

|

(46 |

) |

|

26 |

|

|

300 |

|

| |

Capital related costs |

4 |

|

|

168 |

|

|

144 |

|

|

576 |

|

| |

Other non-recurring and

non-cash expenses (3) |

(19 |

) |

|

— |

|

|

42 |

|

|

103 |

|

| |

Impairment of goodwill |

— |

|

|

5,486 |

|

|

— |

|

|

5,486 |

|

| |

Impairment of notes

receivable |

— |

|

|

1,739 |

|

|

5,000 |

|

|

1,739 |

|

| |

Impairment of assets held for

sale |

51 |

|

|

— |

|

|

1,598 |

|

|

— |

|

| |

Impairment of real estate |

— |

|

|

3,938 |

|

|

— |

|

|

3,938 |

|

| |

Loss (Gain) on disposal of

properties |

33 |

|

|

(151 |

) |

|

(1,394 |

) |

|

(2,463 |

) |

| |

Gain on disposal of properties

- discontinued operations |

— |

|

|

— |

|

|

— |

|

|

(903 |

) |

| Adjusted

EBITDA |

$ |

8,451 |

|

|

$ |

9,383 |

|

|

$ |

36,330 |

|

|

$ |

38,537 |

|

(1) Includes above (below) market lease amortization.(2)

Includes loan cost amortization.(3) Other non-recurring expenses

are described in "Management's Discussion and Analysis of Financial

Condition and Results of Operations" included in our Annual Report

on Form 10-K for the period ended December 31, 2019.

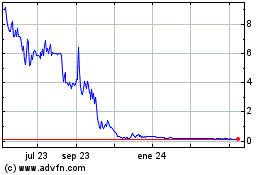

Wheeler Real Estate Inve... (NASDAQ:WHLR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

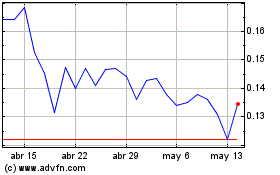

Wheeler Real Estate Inve... (NASDAQ:WHLR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024