Meiwu Announces Pricing of Convertible Note Offering

29 Abril 2022 - 7:00AM

Meiwu Technology Company Limited (Fka: Wunong Net Technology

Company Limited) (“Meiwu”),

(NASDAQ: WNW), is

pleased to announce that it has signed a securities purchase

agreement (“Agreement”) with five individual investors on April 28,

2022, pursuant to which, Meiwu agreed to issue to each of the

investors a $1,100,000 unsecured promissory note (the

“

Notes”) and accompanying

warrants (the “

Warrants”) to purchase 1,600,000

ordinary shares of Meiwu, no par value each (the “

Ordinary

Shares”). The gross proceeds for this offering will be

$5,000,000 before deducting any offering expenses and costs. The

closing of this offering is expected to occur on or about May 5,

2022, subject to customary closing conditions.

Each of the Notes shall include an Original

Issue Discount of 9% and shall bear interest at the rate of 10% per

annum. The Note shall be due 18 months after its issuance date. The

Warrants will be exercisable immediately upon the date of issuance

and have an initial exercise price of $0.60. The Warrants will

expire twenty-four months from the date of issuance.

At any time following the six-month anniversary

of the issuance date, each of the Investors, at its election, can

convert the Note in whole or in part at the lower of (i) $0.50 or

(ii) 80% of the lowest daily volume-weighted average price in the

20 trading days prior to the date on which the conversion price is

measured (the “Market Price”). Notwithstanding the foregoing, in no

event that the investors will convert the Notes at a price lower

than $0.30 per share. The Note may be prepaid, at Meiwu’s sole

election, at an amount equal to 120% of the outstanding principal

and the accrued and unpaid interest.

The Notes, the Ordinary Shares underlying the

Notes, the Warrants, and Ordinary Shares issuable upon exercise of

the Warrants, are exempt from the registration requirements of the

Securities Act, pursuant to Section 4(a)(2) of the Securities Act

and/or Regulation D.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

The CEO of Meiwu, Mr. Xinliang Zhang commented

that: “we believe this offering provides the best attributes of

stocks and bonds, combining the long-term growth potential of

stocks and the security and income advantages of bonds. Different

from pure equity financing, convertible bonds have the pressure of

conversion or redemption during their existence. This pressure can

urge the managers of Meiwu Technology to make prudent decisions on

its investment, strive to improve business performance and maintain

good growth of the company. Since its listing, the company has been

continuously increasing its investment in product promotion and

marketing, optimizing its organizational structure and continuously

strengthening its market competitiveness. In the future, the

management will continue to strive to achieve the sustainable and

healthy development of the company, and return the benefits of our

growth with all investors.”

About Meiwu Technology Company

Limited

Meiwu Technology Company Limited is a British

Virgin Islands company incorporated on December 4, 2018, and

conduct our business in China through our subsidiaries and variable

interest entity, Wunong Technology (Shenzhen) Co., Ltd. Currently

we conduct our business through our online retail store on the

website www.wnw108.com. Optimizing the Website and real-time data,

we are able to respond to and match supply with demand for food

products in keeping with consumer trends.

Safe Harbor Statement

Certain statements made in this release are

“forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors, among others, are: the ability to manage growth; ability

to identify and integrate other future acquisitions; ability to

obtain additional financing in the future to fund capital

expenditures; fluctuations in general economic and business

conditions; costs or other factors adversely affecting our

profitability; litigation involving patents, intellectual property,

and other matters; potential changes in the legislative and

regulatory environment; a pandemic or epidemic. The forward-looking

statements contained in this release are also subject to other

risks and uncertainties, including those more fully described in

the Company’s filings with the Securities and Exchange Commission,

which are available for review at www.sec.gov. The Company

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by applicable law. Such

information speaks only as of the date of this release.

ContactMeiwu Technology

Company LimitedXiaoyu LiEmail: meiwuBS@usmeiwu.com

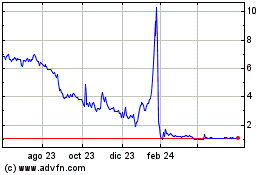

Meiwu Technology (NASDAQ:WNW)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

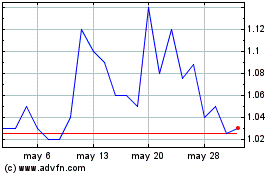

Meiwu Technology (NASDAQ:WNW)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025