Wynn Resorts, Limited (NASDAQ: WYNN) ("Wynn Resorts" or the

"Company") today reported financial results for the fourth quarter

ended December 31, 2023.

Operating revenues were $1.84 billion for the fourth quarter of

2023, an increase of $835.5 million from $1.00 billion for the

fourth quarter of 2022. Net income attributable to Wynn Resorts,

Limited was $729.2 million for the fourth quarter of 2023, compared

to net income attributable to Wynn Resorts, Limited of $32.4

million for the fourth quarter of 2022. The increase in net income

attributable to Wynn Resorts, Limited was primarily the result of

increased operating revenues from our Macau Operations and our Las

Vegas Operations, as well as an income tax benefit related to the

release of valuation allowance on certain deferred tax assets as a

result of achieving sustained profitability in the U.S. Diluted net

income per share was $6.19 for the fourth quarter of 2023, compared

to diluted net income per share of $0.29 for the fourth quarter of

2022. Adjusted Property EBITDAR(1) was $630.4 million for the

fourth quarter of 2023, compared to Adjusted Property EBITDAR of

$195.1 million for the fourth quarter of 2022.

"The strong momentum we built throughout 2023 continued during

the fourth quarter with Adjusted Property EBITDAR reaching a new

all-time record. These impressive results highlight our team’s

relentless focus on delivering five-star hospitality, which

continues to elevate our properties above our peers as the

destinations of choice for luxury guests in Las Vegas, Boston and

Macau," said Craig Billings, CEO of Wynn Resorts, Limited. "On the

development front, construction of Wynn Al Marjan Island continues,

with much of the hotel tower and podium foundation complete, and

preparations underway to start vertical construction of the hotel

tower. We are confident the resort will be a 'must see' tourism

destination in the UAE. We are excited about the outlook for the

Company, and we will continue to focus on driving long-term returns

for shareholders."

Consolidated Results

Operating revenues were $1.84 billion for the fourth quarter of

2023, an increase of $835.5 million from $1.00 billion for the

fourth quarter of 2022. For the fourth quarter of 2023, operating

revenues increased $411.3 million, $309.0 million, $111.3 million,

and $5.1 million at Wynn Palace, Wynn Macau, our Las Vegas

Operations, and Wynn Interactive, respectively, and decreased $1.2

million at Encore Boston Harbor, from the fourth quarter of

2022.

Net income attributable to Wynn Resorts, Limited was $729.2

million for the fourth quarter of 2023, compared to net income

attributable to Wynn Resorts, Limited of $32.4 million for the

fourth quarter of 2022. The increase in net income attributable to

Wynn Resorts, Limited was primarily the result of increased

operating revenues from our Macau Operations and our Las Vegas

Operations, as well as an income tax benefit related to the release

of valuation allowance on certain deferred tax assets as a result

of achieving sustained profitability in the U.S. Diluted net income

per share was $6.19 for the fourth quarter of 2023, compared to

diluted net income per share of $0.29 for the fourth quarter of

2022. Adjusted net income attributable to Wynn Resorts, Limited(2)

was $213.7 million, or $1.91 per diluted share, for the fourth

quarter of 2023, compared to adjusted net loss attributable to Wynn

Resorts, Limited of $138.7 million, or $1.23 per diluted share, for

the fourth quarter of 2022.

Adjusted Property EBITDAR was $630.4 million for the fourth

quarter of 2023, an increase of $435.3 million compared to Adjusted

Property EBITDAR of $195.1 million for the fourth quarter of 2022.

For the fourth quarter of 2023, Adjusted Property EBITDAR increased

$195.1 million, $161.0 million, $51.5 million, $26.5 million, and

$1.1 million at Wynn Palace, Wynn Macau, our Las Vegas Operations,

Wynn Interactive, and Encore Boston Harbor, respectively, from the

fourth quarter of 2022.

For the year ended December 31, 2023, operating revenues were

$6.53 billion, an increase of $2.78 billion from $3.76 billion for

the year ended December 31, 2022. Operating revenues for the year

ended December 31, 2023 increased $1.48 billion, $902.3 million,

$348.5 million, $34.7 million, and $13.0 million at Wynn Palace,

Wynn Macau, our Las Vegas Operations, Encore Boston Harbor, and

Wynn Interactive, respectively, from the year ended December 31,

2022.

Net income attributable to Wynn Resorts, Limited was $730.0

million, or $6.32 per diluted share for the year ended December 31,

2023, compared to net loss attributable to Wynn Resorts, Limited of

$423.9 million, or $3.73 per diluted share for the year ended

December 31, 2022. The increase in net income attributable to Wynn

Resorts, Limited was primarily the result of increased operating

revenues from our Macau Operations and our Las Vegas Operations, as

well as an income tax benefit related to the release of valuation

allowance on certain deferred tax assets as a result of achieving

sustained profitability in the U.S. Adjusted net income

attributable to Wynn Resorts, Limited was $462.3 million, or $4.10

per diluted share, for the year ended December 31, 2023, compared

to adjusted net loss attributable to Wynn Resorts, Limited of

$507.4 million, or $4.47 per diluted share, for the year ended

December 31, 2022.

Adjusted Property EBITDAR was $2.11 billion for the year ended

December 31, 2023, compared to $725.4 million for the year ended

December 31, 2022. Adjusted Property EBITDAR for the year ended

December 31, 2023 increased $712.4 million, $462.1 million, $145.1

million, $55.8 million, and $14.0 million, at Wynn Palace, Wynn

Macau, our Las Vegas Operations, Wynn Interactive, and Encore

Boston Harbor, respectively, from the year ended December 31,

2022.

Wynn Resorts, Limited also announced today that its Board of

Directors has declared a cash dividend of $0.25 per share, payable

on February 29, 2024 to stockholders of record as of February 20,

2024.

Property Results

Macau Operations

Wynn Palace

Operating revenues from Wynn Palace were $524.4 million for the

fourth quarter of 2023, an increase of $411.3 million from $113.1

million for the fourth quarter of 2022. Adjusted Property EBITDAR

from Wynn Palace was $171.1 million for the fourth quarter of 2023,

compared to $(23.9) million for the fourth quarter of 2022. Table

games win percentage in mass market operations was 23.6%, above the

23.3% experienced in the fourth quarter of 2022. VIP table games

win as a percentage of turnover was 2.97%, below the property's

expected range of 3.1% to 3.4% and above the 0.11% experienced in

the fourth quarter of 2022.

Wynn Macau

Operating revenues from Wynn Macau were $386.2 million for the

fourth quarter of 2023, an increase of $309.0 million from $77.2

million for the fourth quarter of 2022. Adjusted Property EBITDAR

from Wynn Macau was $125.8 million for the fourth quarter of 2023,

compared to $(35.2) million for the fourth quarter of 2022. Table

games win percentage in mass market operations was 19.1%, above the

17.2% experienced in the fourth quarter of 2022. VIP table games

win as a percentage of turnover was 4.37%, above the property's

expected range of 3.1% to 3.4% and above the 1.20% experienced in

the fourth quarter of 2022.

Las Vegas Operations

Operating revenues from our Las Vegas Operations were $696.8

million for the fourth quarter of 2023, an increase of $111.3

million from $585.5 million for the fourth quarter of 2022.

Adjusted Property EBITDAR from our Las Vegas Operations for the

fourth quarter of 2023 was $270.8 million, compared to $219.3

million for the fourth quarter of 2022. Table games win percentage

for the fourth quarter of 2023 was 25.4%, within the property's

expected range of 22% to 26% and above the 21.2% experienced in the

fourth quarter of 2022.

Encore Boston Harbor

Operating revenues from Encore Boston Harbor were $217.1 million

for the fourth quarter of 2023, a decrease of $1.2 million from

$218.3 million for the fourth quarter of 2022. Adjusted Property

EBITDAR from Encore Boston Harbor for the fourth quarter of 2023

was $64.4 million, compared to $63.3 million for the fourth quarter

of 2022. Table games win percentage for the fourth quarter of 2023

was 22.0%, within the property's expected range of 18% to 22% and

slightly above the 21.9% experienced in the fourth quarter of

2022.

Balance Sheet

Our cash and cash equivalents as of December 31, 2023 totaled

$2.88 billion, comprised of $1.32 billion held by Wynn Macau,

Limited ("WML") and subsidiaries, $361.5 million held by Wynn

Resorts Finance, LLC ("WRF") and subsidiaries excluding WML, and

$1.20 billion held at Corporate and other. In addition, as of

December 31, 2023, we had $697.9 million and $147.3 million in

short-term investments held at WML and Corporate and other,

respectively. As of December 31, 2023, the available borrowing

capacity under the Wynn Resorts Finance Revolver was $736.5

million, and the WM Cayman II Revolver was fully drawn.

Total current and long-term debt outstanding at December 31,

2023 was $11.74 billion, comprised of $6.74 billion of Macau

related debt, $2.25 billion of Wynn Las Vegas debt, $2.13 billion

of WRF debt, and $614.1 million of debt held by the retail joint

venture which we consolidate.

During the fourth quarter of 2023, the Company repurchased

1,609,625 shares of its common stock under its publicly announced

equity repurchase program at an average price of $86.56 per share,

for an aggregate cost of $139.3 million, bringing the total

repurchases by the Company for the year ended December 31, 2023 to

2,206,573 shares of its common stock for an aggregate cost of

$195.5 million.

Conference Call and Other Information

The Company will hold a conference call to discuss its results,

including the results of Wynn Resorts Finance, LLC and Wynn Las

Vegas, LLC, on February 7, 2024 at 2:00 p.m. PT (5:00 p.m. ET).

Interested parties are invited to join the call by accessing a live

audio webcast at http://www.wynnresorts.com. On or before March 30,

2024, the Company will make Wynn Resorts Finance, LLC and Wynn Las

Vegas, LLC financial information for the quarter ended December 31,

2023 available to noteholders, prospective investors,

broker-dealers and securities analysts. Please contact our investor

relations office at 702-770-7555 or at

investorrelations@wynnresorts.com, to obtain access to such

financial information.

Forward-looking Statements

This release contains forward-looking statements regarding

operating trends and future results of operations. Such

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from those we express in these forward-looking statements,

including, but not limited to, reductions in discretionary consumer

spending, adverse macroeconomic conditions and their impact on

levels of disposable consumer income and wealth, changes in

interest rates, inflation, a decline in general economic activity

or recession in the U.S. and/or global economies, extensive

regulation of our business, pending or future legal proceedings,

ability to maintain gaming licenses and concessions, dependence on

key employees, general global political conditions, adverse tourism

trends, travel disruptions caused by events outside of our control,

dependence on a limited number of resorts, competition in the

casino/hotel and resort industries, uncertainties over the

development and success of new gaming and resort properties,

construction and regulatory risks associated with current and

future projects (including Wynn Al Marjan Island), cybersecurity

risk and our leverage and ability to meet our debt service

obligations. Additional information concerning potential factors

that could affect the Company's financial results is included in

the Company's Annual Report on Form 10-K for the year ended

December 31, 2022, as supplemented by the Company's other periodic

reports filed with the Securities and Exchange Commission from time

to time. The Company is under no obligation to (and expressly

disclaims any such obligation to) update or revise its

forward-looking statements as a result of new information, future

events or otherwise, except as required by law.

Non-GAAP Financial Measures

(1) "Adjusted Property EBITDAR" is net income (loss) before

interest, income taxes, depreciation and amortization, pre-opening

expenses, impairment of goodwill and intangible assets, property

charges and other, triple-net operating lease rent expense related

to Encore Boston Harbor, management and license fees, corporate

expenses and other (including intercompany golf course, meeting and

convention, and water rights leases), stock-based compensation,

change in derivatives fair value, loss on debt financing

transactions, and other non-operating income and expenses. Adjusted

Property EBITDAR is presented exclusively as a supplemental

disclosure because management believes that it is widely used to

measure the performance, and as a basis for valuation, of gaming

companies. Management uses Adjusted Property EBITDAR as a measure

of the operating performance of its segments and to compare the

operating performance of its properties with those of its

competitors, as well as a basis for determining certain incentive

compensation. We also present Adjusted Property EBITDAR because it

is used by some investors to measure a company's ability to incur

and service debt, make capital expenditures and meet working

capital requirements. Gaming companies have historically reported

EBITDAR as a supplement to GAAP. In order to view the operations of

their casinos on a more stand-alone basis, gaming companies,

including us, have historically excluded from their EBITDAR

calculations pre-opening expenses, property charges, corporate

expenses and stock-based compensation, that do not relate to the

management of specific casino properties. However, Adjusted

Property EBITDAR should not be considered as an alternative to

operating income (loss) as an indicator of our performance, as an

alternative to cash flows from operating activities as a measure of

liquidity, or as an alternative to any other measure determined in

accordance with GAAP. Unlike net income (loss), Adjusted Property

EBITDAR does not include depreciation or interest expense and

therefore does not reflect current or future capital expenditures

or the cost of capital. We have significant uses of cash flows,

including capital expenditures, triple-net operating lease rent

expense related to Encore Boston Harbor, interest payments, debt

principal repayments, income taxes and other non-recurring charges,

which are not reflected in Adjusted Property EBITDAR. Also, our

calculation of Adjusted Property EBITDAR may be different from the

calculation methods used by other companies and, therefore,

comparability may be limited.

(2) "Adjusted net income (loss) attributable to Wynn Resorts,

Limited" is net income (loss) attributable to Wynn Resorts, Limited

before pre-opening expenses, impairment of goodwill and intangible

assets, property charges and other, change in derivatives fair

value, loss on debt financing transactions, foreign currency

remeasurement and other, and nonrecurring income tax benefit from

release of valuation allowance, net of noncontrolling interests and

income taxes calculated using the specific tax treatment applicable

to the adjustments based on their respective jurisdictions.

Adjusted net income (loss) attributable to Wynn Resorts, Limited

and adjusted net income (loss) attributable to Wynn Resorts,

Limited per diluted share are presented as supplemental disclosures

to financial measures in accordance with GAAP because management

believes that these non-GAAP financial measures are widely used to

measure the performance, and as a principal basis for valuation, of

gaming companies. These measures are used by management and/or

evaluated by some investors, in addition to net income (loss) and

loss per share computed in accordance with GAAP, as an additional

basis for assessing period-to-period results of our business.

Adjusted net income (loss) attributable to Wynn Resorts, Limited

and adjusted net income (loss) attributable to Wynn Resorts,

Limited per diluted share may be different from the calculation

methods used by other companies and, therefore, comparability may

be limited.

The Company has included schedules in the tables that accompany

this release that reconcile (i) net income (loss) attributable to

Wynn Resorts, Limited to adjusted net income (loss) attributable to

Wynn Resorts, Limited, (ii) operating income (loss) to Adjusted

Property EBITDAR, and (iii) net income (loss) attributable to Wynn

Resorts, Limited to Adjusted Property EBITDAR.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Operating revenues:

Casino

$

1,065,958

$

423,218

$

3,718,402

$

1,632,541

Rooms

347,299

233,252

1,185,671

802,138

Food and beverage

271,558

217,648

1,028,637

846,214

Entertainment, retail and other

155,645

130,819

599,187

475,932

Total operating revenues

1,840,460

1,004,937

6,531,897

3,756,825

Operating expenses:

Casino

643,910

291,757

2,238,671

1,099,801

Rooms

82,857

69,869

307,132

261,343

Food and beverage

216,947

183,034

822,323

700,549

Entertainment, retail and other

79,402

91,676

340,437

328,529

General and administrative

279,484

232,017

1,065,022

830,450

Provision for credit losses

2,350

4,036

(3,964

)

(7,295

)

Pre-opening

2,646

7,247

9,468

20,643

Depreciation and amortization

176,527

172,292

687,270

692,318

Gain on EBH Transaction, net

—

(181,989

)

—

(181,989

)

Impairment of goodwill and intangible

assets

—

—

94,490

48,036

Property charges and other

(1,388

)

35,790

130,877

65,116

Total operating expenses

1,482,735

905,729

5,691,726

3,857,501

Operating income (loss)

357,725

99,208

840,171

(100,676

)

Other income (expense):

Interest income

44,931

18,895

175,785

29,758

Interest expense, net of amounts

capitalized

(184,955

)

(178,620

)

(751,509

)

(650,885

)

Change in derivatives fair value

48,353

1,155

45,098

15,956

Loss on debt financing transactions

—

—

(12,683

)

—

Other

8,315

31,901

(11,479

)

5,811

Other income (expense), net

(83,356

)

(126,669

)

(554,788

)

(599,360

)

Income (loss) before income

taxes

274,369

(27,461

)

285,383

(700,036

)

Benefit (provision) for income taxes

499,408

(6,084

)

496,834

(9,332

)

Net income (loss)

773,777

(33,545

)

782,217

(709,368

)

Less: net (income) loss attributable to

noncontrolling interests

(44,621

)

65,956

(52,223

)

285,512

Net income (loss) attributable to Wynn

Resorts, Limited

$

729,156

$

32,411

$

729,994

$

(423,856

)

Basic and diluted net income (loss) per

common share:

Net income (loss) attributable to Wynn

Resorts, Limited:

Basic

$

6.53

$

0.29

$

6.49

$

(3.73

)

Diluted

$

6.19

$

0.29

$

6.32

$

(3.73

)

Weighted average common shares

outstanding:

Basic

111,661

112,321

112,523

113,623

Diluted

112,033

112,795

112,855

113,623

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

(LOSS) ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME (LOSS)

ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands, except per

share data)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Net income (loss) attributable to Wynn

Resorts, Limited

$

729,156

$

32,411

$

729,994

$

(423,856

)

Pre-opening expenses

2,646

7,247

9,468

20,643

Gain on EBH Transaction, net

—

(181,989

)

—

(181,989

)

Impairment of goodwill and intangible

assets

—

—

94,490

48,036

Property charges and other

(1,388

)

35,790

130,877

65,116

Change in derivatives fair value

(48,353

)

(1,155

)

(45,098

)

(15,956

)

Loss on debt financing transactions

—

—

12,683

—

Foreign currency remeasurement and

other

(8,315

)

(31,901

)

11,479

(5,811

)

Income tax impact on adjustments

(1,033

)

(198

)

(2,088

)

(294

)

Nonrecurring income tax benefit from

release of valuation allowance

(474,214

)

—

(474,214

)

—

Noncontrolling interests impact on

adjustments

15,160

1,110

(5,243

)

(13,317

)

Adjusted net income (loss) attributable

to Wynn Resorts, Limited

$

213,659

$

(138,685

)

$

462,348

$

(507,428

)

Adjusted net income (loss) attributable

to Wynn Resorts, Limited per diluted share

$

1.91

$

(1.23

)

$

4.10

$

(4.47

)

Weighted average common shares outstanding

- diluted

112,033

112,795

112,855

113,623

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING

INCOME (LOSS) TO ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

Three Months Ended December

31, 2023

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Wynn Interactive

Corporate and Other

Total

Operating income (loss)

$

95,071

$

90,545

$

(15,860

)

$

169,756

$

167,080

$

(15,865

)

$

(8,617

)

$

45,371

$

357,725

Pre-opening expenses

93

—

—

93

—

33

—

2,520

2,646

Depreciation and amortization

54,502

20,165

381

75,048

60,730

31,220

6,118

3,411

176,527

Property charges and other

451

(676

)

4

(221

)

389

710

(2,452

)

186

(1,388

)

Management and license fees

16,782

12,029

—

28,811

33,387

10,665

—

(72,863

)

—

Corporate expenses and other

2,733

2,175

14,397

19,305

7,369

1,824

1,905

13,685

44,088

Stock-based compensation

1,501

1,579

1,078

4,158

1,830

402

1,296

7,690

15,376

Triple-net operating lease rent

expense

—

—

—

—

—

35,404

—

—

35,404

Adjusted Property EBITDAR

$

171,133

$

125,817

$

—

$

296,950

$

270,785

$

64,393

$

(1,750

)

$

—

$

630,378

Three Months Ended December

31, 2022

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Wynn Interactive

Corporate and Other

Total

Operating income (loss)

$

(105,945

)

$

(65,599

)

$

(9,801

)

$

(181,345

)

$

121,311

$

184,411

$

(50,642

)

$

25,473

$

99,208

Pre-opening expenses

—

—

—

—

5,420

15

1,511

301

7,247

Depreciation and amortization

52,817

20,364

381

73,562

55,865

35,610

4,974

2,281

172,292

Gain on EBH Transaction, net

—

—

—

—

—

(181,989

)

—

—

(181,989

)

Property charges and other

20,378

2,116

16

22,510

361

692

12,908

(681

)

35,790

Management and license fees

3,809

2,508

—

6,317

27,996

10,654

—

(44,967

)

—

Corporate expenses and other

1,352

1,373

8,718

11,443

5,874

1,743

373

12,301

31,734

Stock-based compensation

3,654

4,069

686

8,409

2,424

345

2,588

5,292

19,058

Triple-net operating lease rent

expense

—

—

—

—

—

11,773

—

—

11,773

Adjusted Property EBITDAR

$

(23,935

)

$

(35,169

)

$

—

$

(59,104

)

$

219,251

$

63,254

$

(28,288

)

$

—

$

195,113

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING

INCOME (LOSS) TO ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

Year Ended December 31,

2023

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Wynn Interactive

Corporate and Other

Total

Operating income (loss)

$

307,698

$

190,126

$

(32,157

)

$

465,667

$

551,128

$

(60,887

)

$

(276,646

)

$

160,909

$

840,171

Pre-opening expenses

93

—

—

93

81

1,286

5,591

2,417

9,468

Depreciation and amortization

216,562

81,673

1,522

299,757

232,685

122,452

22,051

10,325

687,270

Impairment of goodwill and intangible

assets

—

—

—

—

—

—

94,490

—

94,490

Property charges and other

13,365

9,807

19

23,191

8,863

1,419

97,218

186

130,877

Management and license fees

60,377

38,019

—

98,396

118,019

42,179

—

(258,594

)

—

Corporate expenses and other

10,208

9,766

26,431

46,405

28,519

7,517

6,746

57,243

146,430

Stock-based compensation

7,543

8,700

4,185

20,428

6,948

1,721

7,904

27,514

64,515

Triple-net operating lease rent

expense

—

—

—

—

—

141,722

—

—

141,722

Adjusted Property EBITDAR

$

615,846

$

338,091

$

—

$

953,937

$

946,243

$

257,409

$

(42,646

)

$

—

$

2,114,943

Year Ended December 31,

2022

Wynn Palace

Wynn Macau

Other Macau

Total Macau Operations

Las Vegas Operations

Encore Boston Harbor

Wynn Interactive

Corporate and Other

Total

Operating income (loss)

$

(357,666

)

$

(247,727

)

$

(22,190

)

$

(627,583

)

$

450,073

$

209,962

$

(240,111

)

$

106,983

$

(100,676

)

Pre-opening expenses

—

—

—

—

15,451

214

4,677

301

20,643

Depreciation and amortization

207,110

81,114

2,709

290,933

199,973

152,906

39,422

9,084

692,318

Gain on EBH Transaction, net

—

—

—

—

—

(181,989

)

—

—

(181,989

)

Impairment of goodwill and intangible

assets

—

—

—

—

—

—

48,036

—

48,036

Property charges and other

23,296

11,482

43

34,821

3,680

1,366

33,015

(7,766

)

65,116

Management and license fees

13,895

11,354

—

25,249

101,170

40,464

—

(166,883

)

—

Corporate expenses and other

6,081

6,283

16,980

29,344

22,736

7,125

5,877

37,457

102,539

Stock-based compensation

10,727

13,447

2,458

26,632

8,012

1,565

10,594

20,824

67,627

Triple-net operating lease rent

expense

—

—

—

—

—

11,773

—

—

11,773

Adjusted Property EBITDAR

$

(96,557

)

$

(124,047

)

$

—

$

(220,604

)

$

801,095

$

243,386

$

(98,490

)

$

—

$

725,387

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

(LOSS) ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO

ADJUSTED PROPERTY

EBITDAR

(in thousands)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Net income (loss) attributable to Wynn

Resorts, Limited

$

729,156

$

32,411

$

729,994

$

(423,856

)

Net income (loss) attributable to

noncontrolling interests

44,621

(65,956

)

52,223

(285,512

)

Pre-opening expenses

2,646

7,247

9,468

20,643

Depreciation and amortization

176,527

172,292

687,270

692,318

Gain on EBH Transaction, net

—

(181,989

)

—

(181,989

)

Impairment of goodwill and intangible

assets

—

—

94,490

48,036

Property charges and other

(1,388

)

35,790

130,877

65,116

Triple-net operating lease rent

expense

35,404

11,773

141,722

11,773

Corporate expenses and other

44,088

31,734

146,430

102,539

Stock-based compensation

15,376

19,058

64,515

67,627

Interest income

(44,931

)

(18,895

)

(175,785

)

(29,758

)

Interest expense, net of amounts

capitalized

184,955

178,620

751,509

650,885

Change in derivatives fair value

(48,353

)

(1,155

)

(45,098

)

(15,956

)

Loss on debt financing transactions

—

—

12,683

—

Other

(8,315

)

(31,901

)

11,479

(5,811

)

(Benefit) provision for income taxes

(499,408

)

6,084

(496,834

)

9,332

Adjusted Property EBITDAR

$

630,378

$

195,113

$

2,114,943

$

725,387

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

Percent Change

2023

2022

Percent Change

Wynn Palace Supplemental

Information

Operating revenues

Casino

$

417,273

$

68,918

505.5

$

1,471,280

$

255,886

475.0

Rooms

50,472

12,266

311.5

201,783

40,079

403.5

Food and beverage

29,538

11,519

156.4

104,566

35,546

194.2

Entertainment, retail and other

27,075

20,362

33.0

109,215

78,778

38.6

Total

$

524,358

$

113,065

363.8

$

1,886,844

$

410,289

359.9

Adjusted Property EBITDAR (6)

$

171,133

$

(23,935

)

NM

$

615,846

$

(96,557

)

NM

Casino Statistics:

VIP:

Average number of table games

59

50

18.0

56

53

5.7

VIP turnover

$

3,161,083

$

1,047,561

201.8

$

11,363,248

$

2,641,321

330.2

VIP table games win (1)

$

93,892

$

1,118

NM

$

383,384

$

23,471

NM

VIP table games win as a % of turnover

2.97

%

0.11

%

3.37

%

0.89

%

Table games win per unit per day

$

17,381

$

245

NM

$

18,744

$

1,259

NM

Mass market:

Average number of table games

245

237

3.4

242

229

5.7

Table drop (2)

$

1,711,850

$

373,312

358.6

$

6,126,841

$

1,312,786

366.7

Table games win (1)

$

404,468

$

86,933

365.3

$

1,373,436

$

282,138

386.8

Table games win %

23.6

%

23.3

%

22.4

%

21.5

%

Table games win per unit per day

$

17,934

$

3,987

349.8

$

15,574

$

3,489

346.4

Average number of slot machines

585

578

1.2

580

623

(6.9

)

Slot machine handle

$

624,688

$

229,341

172.4

$

2,385,033

$

732,197

225.7

Slot machine win (3)

$

27,580

$

8,306

232.0

$

102,816

$

31,295

228.5

Slot machine win per unit per day

$

512

$

156

228.2

$

486

$

142

242.3

Room statistics:

Occupancy

98.3

%

50.1

%

94.9

%

38.4

%

ADR (4)

$

311

$

146

113.0

$

323

$

156

107.1

REVPAR (5)

$

306

$

73

319.2

$

306

$

60

410.0

NM: Not meaningful.

Note: The results of operations of Wynn

Palace for the three and twelve months ended December 31, 2022 were

negatively impacted by certain travel-related restrictions and

conditions, including COVID-19 testing and other mitigation

procedures, related to the COVID-19 pandemic.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

(continued)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

Percent Change

2023

2022

Percent Change

Wynn Macau Supplemental

Information

Operating revenues

Casino

$

320,642

$

51,418

523.6

$

970,269

$

216,639

347.9

Rooms

29,534

7,144

313.4

109,308

25,691

325.5

Food and beverage

20,762

7,456

178.5

68,017

25,334

168.5

Entertainment, retail and other

15,261

11,180

36.5

65,940

43,585

51.3

Total

$

386,199

$

77,198

400.3

$

1,213,534

$

311,249

289.9

Adjusted Property EBITDAR (6)

$

125,817

$

(35,169

)

NM

$

338,091

$

(124,047

)

NM

Casino Statistics:

VIP:

Average number of table games

30

52

(42.3

)

41

41

—

VIP turnover

$

1,405,523

$

429,575

227.2

$

5,132,628

$

1,771,143

189.8

VIP table games win (1)

$

61,362

$

5,135

NM

$

191,936

$

55,999

242.7

VIP table games win as a % of turnover

4.37

%

1.20

%

3.74

%

3.16

%

Table games win per unit per day

$

22,233

$

1,074

NM

$

12,699

$

3,828

231.7

Mass market:

Average number of table games

221

217

1.8

216

235

(8.1

)

Table drop (2)

$

1,558,372

$

317,801

390.4

$

5,155,929

$

1,170,633

340.4

Table games win (1)

$

297,671

$

54,695

444.2

$

910,825

$

189,769

380.0

Table games win %

19.1

%

17.2

%

17.7

%

16.2

%

Table games win per unit per day

$

14,655

$

2,740

434.9

$

11,560

$

2,284

406.1

Average number of slot machines

557

691

(19.4

)

530

646

(18.0

)

Slot machine handle

$

652,498

$

218,935

198.0

$

2,212,196

$

895,466

147.0

Slot machine win (3)

$

20,775

$

7,867

164.1

$

68,667

$

31,768

116.2

Slot machine win per unit per day

$

405

$

124

226.6

$

355

$

139

155.4

Poker rake

$

4,460

$

223

NM

$

18,266

$

357

NM

Room statistics:

Occupancy

99.4

%

51.8

%

96.5

%

41.1

%

ADR (4)

$

282

$

135

108.9

$

281

$

154

82.5

REVPAR (5)

$

281

$

70

301.4

$

271

$

63

330.2

NM: Not meaningful.

Note: The results of operations of Wynn

Macau for three and twelve months ended December 31, 2022 were

negatively impacted by certain travel-related restrictions and

conditions, including COVID-19 testing and other mitigation

procedures, related to the COVID-19 pandemic.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

(continued)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

Percent

Change

2023

2022

Percent

Change

Las Vegas Operations Supplemental

Information

Operating revenues

Casino

$

167,579

$

141,349

18.6

$

628,185

$

535,279

17.4

Rooms

242,993

190,584

27.5

784,385

651,291

20.4

Food and beverage

199,706

176,126

13.4

770,401

702,515

9.7

Entertainment, retail and other

86,526

77,433

11.7

297,635

243,051

22.5

Total

$

696,804

$

585,492

19.0

$

2,480,606

$

2,132,136

16.3

Adjusted Property EBITDAR (6)

$

270,785

$

219,251

23.5

$

946,243

$

801,095

18.1

Casino Statistics:

Average number of table games

232

234

(0.9

)

233

234

(0.4

)

Table drop (2)

$

657,564

$

590,693

11.3

$

2,425,621

$

2,274,010

6.7

Table games win (1)

$

167,106

$

125,441

33.2

$

599,001

$

511,746

17.1

Table games win %

25.4

%

21.2

%

24.7

%

22.5

%

Table games win per unit per day

$

7,816

$

5,823

34.2

$

7,038

$

5,990

17.5

Average number of slot machines

1,631

1,678

(2.8

)

1,645

1,703

(3.4

)

Slot machine handle

$

1,689,839

$

1,591,100

6.2

$

6,423,374

$

5,617,775

14.3

Slot machine win (3)

$

125,950

$

115,802

8.8

$

451,833

$

394,052

14.7

Slot machine win per unit per day

$

840

$

750

12.0

$

752

$

634

18.6

Poker rake

$

9,477

$

6,950

36.4

$

25,720

$

19,680

30.7

Room statistics:

Occupancy

88.9

%

89.9

%

89.6

%

86.7

%

ADR (4)

$

631

$

492

28.3

$

513

$

454

13.0

REVPAR (5)

$

561

$

443

26.6

$

459

$

393

16.8

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR, and REVPAR)

(unaudited)

(continued)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

Percent Change

2023

2022

Percent Change

Encore Boston Harbor Supplemental

Information

Operating revenues

Casino

$

160,464

$

161,534

(0.7

)

$

648,668

$

624,738

3.8

Rooms

24,300

23,259

4.5

90,195

85,078

6.0

Food and beverage

21,552

22,546

(4.4

)

85,653

82,818

3.4

Entertainment, retail and other

10,829

11,001

(1.6

)

41,270

38,439

7.4

Total

$

217,145

$

218,340

(0.5

)

$

865,786

$

831,073

4.2

Adjusted Property EBITDAR (6)

$

64,393

$

63,254

1.8

$

257,409

$

243,386

5.8

Casino Statistics:

Average number of table games

185

194

(4.6

)

191

187

2.1

Table drop (2)

$

358,324

$

370,590

(3.3

)

$

1,422,416

$

1,447,851

(1.8

)

Table games win (1)

$

78,720

$

81,032

(2.9

)

$

308,890

$

315,057

(2.0

)

Table games win %

22.0

%

21.9

%

21.7

%

21.8

%

Table games win per unit per day

$

4,621

$

4,546

1.6

$

4,429

$

4,604

(3.8

)

Average number of slot machines

2,560

2,601

(1.6

)

2,550

2,716

(6.1

)

Slot machine handle

$

1,323,309

$

1,303,782

1.5

$

5,256,696

$

5,007,772

5.0

Slot machine win (3)

$

105,061

$

103,846

1.2

$

421,190

$

402,688

4.6

Slot machine win per unit per day

$

446

$

434

2.8

$

452

$

406

11.3

Poker rake

$

5,389

$

4,895

10.1

$

21,505

$

9,476

126.9

Room statistics:

Occupancy

93.3

%

93.9

%

93.0

%

91.4

%

ADR (4)

$

424

$

404

5.0

$

398

$

382

4.2

REVPAR (5)

$

395

$

380

3.9

$

370

$

349

6.0

(1)

Table games win is shown before discounts,

commissions and the allocation of casino revenues to rooms, food

and beverage and other revenues for services provided to casino

customers on a complimentary basis.

(2)

In Macau, table drop is the amount of cash

that is deposited in a gaming table's drop box plus cash chips

purchased at the casino cage. In Las Vegas, table drop is the

amount of cash and net markers issued that are deposited in a

gaming table's drop box. At Encore Boston Harbor, table drop is the

amount of cash and gross markers that are deposited in a gaming

table's drop box.

(3)

Slot machine win is calculated as gross

slot machine win minus progressive accruals and free play.

(4)

ADR is average daily rate and is

calculated by dividing total room revenues including

complimentaries (less service charges, if any) by total rooms

occupied.

(5)

REVPAR is revenue per available room and

is calculated by dividing total room revenues including

complimentaries (less service charges, if any) by total rooms

available.

(6)

Refer to accompanying reconciliations of

Operating Income (Loss) to Adjusted Property EBITDAR and Net Income

(Loss) Attributable to Wynn Resorts, Limited to Adjusted Property

EBITDAR.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240207256310/en/

Price Karr 702-770-7555 investorrelations@wynnresorts.com

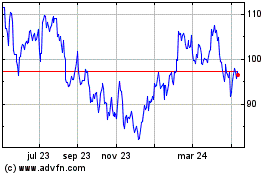

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

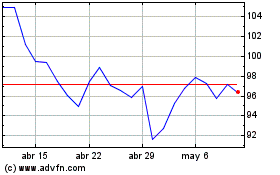

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024