Wynn Resorts Announces Final Results of Tender Offer for Cash by Wynn Las Vegas, LLC for its 5.500% Senior Notes due 2025

08 Marzo 2024 - 7:39PM

Business Wire

Wynn Resorts, Limited (NASDAQ: WYNN) (“Wynn Resorts”) today

announced the final results of the previously announced tender

offer (the “Tender Offer”) by its indirect wholly-owned subsidiary,

Wynn Las Vegas, LLC, to purchase a portion of Wynn Las Vegas, LLC

and Wynn Las Vegas Capital Corp.’s outstanding 5.500% Senior Notes

due 2025 (the “Notes”). The Tender Offer is subject to the terms

and conditions set forth in the Offer to Purchase dated February 8,

2024 (the “Offer to Purchase”).

The following table sets forth, among other things, the

principal amount of Notes validly tendered and accepted for

purchase as of 5:00 p.m., New York City time, on March 8, 2024

(such date, the “Expiration Date”):

Title of Notes

CUSIP Numbers

Aggregate Principal Amount

Outstanding

Tender Cap

Principal Amount Tendered at Expiration

Date

Principal Amount Accepted for

Purchase

5.500% Senior Notes due 2025

983130 AV7

U98347 AK0

$1,400,001,000

$800,000,000

$680,986,000

$680,986,000

The Tender Offer expired at 5:00 P.M., New York City time, on

March 8, 2024 (the “Expiration Time”). Withdrawal and revocation

rights expired at 5:00 p.m., New York City time, on February 22,

2024. Notes that have been tendered may no longer be withdrawn.

For Notes that were validly tendered after 5:00 P.M., New York

City time, on February 22, 2024 but on or before the Expiration

Time and that are accepted for payment and purchase, settlement

will occur on the “Final Settlement Date,” which is currently

expected to occur on March 11, 2024. Payment for the Notes that are

purchased will include accrued and unpaid interest from the last

interest payment date to, but excluding, the Final Settlement

Date.

Wynn Las Vegas, LLC and Wynn Las Vegas Capital Corp. are also

redeeming $119,015,000 of the Notes on March 27, 2024.

This press release does not constitute an offer to purchase or

the solicitation of an offer to sell the securities described

herein, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

Deutsche Bank Securities Inc. and Scotia Capital (USA) Inc. are

the dealer managers for the Tender Offer. Persons with questions

regarding the Tender Offer should contact Deutsche Bank Securities

Inc. by telephone at (855) 287-1922 (U.S. toll-free) and (212)

250-7527 (collect) or Scotia Capital (USA) Inc. by telephone at

(833) 498-1660. Requests for copies of the Offer to Purchase should

be directed to D.F. King & Co., Inc., the tender and

information agent for the Tender Offer, at wynn@dfking.com, by

telephone at (866) 796-3441 (U.S. toll free) and (212) 269-5550

(banks and brokers) or in writing at D.F. King & Co., Inc., 48

Wall Street, 22nd Floor, New York, NY 10005, Attention: Michael

Horthman.

Forward-Looking Statements

This release contains forward-looking statements, including

those related to the tender for Notes, the redemption and whether

or not Wynn Las Vegas, LLC will consummate the Tender Offer or the

redemption. Such forward-looking statements are subject to a number

of risks and uncertainties that could cause actual results to

differ materially from those we express in these forward-looking

statements, including, but not limited to, reductions in

discretionary consumer spending, adverse macroeconomic conditions

and their impact on levels of disposable consumer income and

wealth, changes in interest rates, inflation, a decline in general

economic activity or recession in the U.S. and/or global economies,

extensive regulation of our business, pending or future legal

proceedings, ability to maintain gaming licenses and concessions,

dependence on key employees, general global political conditions,

adverse tourism trends, travel disruptions caused by events outside

of our control, dependence on a limited number of resorts,

competition in the casino/hotel and resort industries,

uncertainties over the development and success of new gaming and

resort properties, construction and regulatory risks associated

with current and future projects (including Wynn Al Marjan Island),

cybersecurity risk and our leverage and ability to meet our debt

service obligations. Additional information concerning potential

factors that could affect Wynn Resorts’ financial results is

included in Wynn Resorts’ Annual Report on Form 10-K for the year

ended December 31, 2022, as supplemented by Wynn Resorts’ other

periodic reports filed with the Securities and Exchange Commission

from time to time. Neither Wynn Resorts nor Wynn Las Vegas, LLC are

under any obligation to (and expressly disclaim any such obligation

to) update or revise their forward-looking statements as a result

of new information, future events or otherwise, except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240308452890/en/

Price Karr 702-770-7555 investorrelations@wynnresorts.com

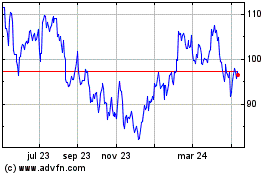

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

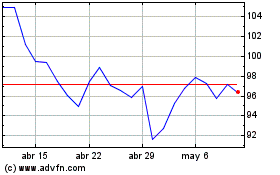

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024