Olympic Steel Acquires Central Tube & Bar

02 Octubre 2023 - 7:00AM

Business Wire

Company completes seventh acquisition in the

past six years. Transaction marks the Company’s latest pipe and

tube segment expansion, continuing its growth into products and

services with higher-margin returns.

Olympic Steel Inc. (Nasdaq: ZEUS), a leading national

metals service center, today announced that it has acquired Central

Tube & Bar (CTB). The all-cash purchase is expected to be

immediately accretive. Terms were not disclosed.

CTB was founded in 1996 and serves large original equipment

manufacturers (OEMs) and fabricators across the Mid-South from

three facilities in Conway, Arkansas, and Tulsa, Oklahoma, totaling

162,000 square feet of warehouse and production space. The business

offers a range of value-added fabrication services, including tube

laser cutting, tube bending, robotic welding, flat laser burning

and brake press forming. CTB’s trailing 12-month revenue for the

period ended August 31, 2023, approximated $40 million.

CTB services the transportation, agricultural, commercial

furniture and data center construction industries with fabricated

tube and bar products, including round, square, rectangular and

special shaped tubes. The business will continue to operate as

Central Tube & Bar, an Olympic Steel Company, led by Dustin

Ward, President, and his experienced management team.

“The acquisition of Central Tube & Bar represents our latest

strategic move to invest in consistently high-performing

businesses. We are delighted to welcome Dustin Ward and his capable

team to the Olympic Steel family,” said Richard T. Marabito, Chief

Executive Officer. “Olympic Steel’s tubular and pipe products

segment has historically been our highest EBITDA-to-sales margin

segment, and CTB’s historical financial performance has

consistently exceeded our tubular and pipe products returns. CTB is

a well-run, growing organization, and a great cultural fit for

Olympic Steel.”

“In addition to expanding our geographic reach into the

high-growth markets in the Mid-South, Central Tube & Bar

extends our value-added contract manufacturing capabilities,” said

Andrew Greiff, President and Chief Operating Officer. “The addition

of CTB into our tubular and pipe products segment, combined with

the existing success of our Chicago Tube & Iron business,

provides great opportunities for growth and synergies.”

Central Tube & Bar will be included in Olympic Steel’s

tubular and pipe products segment, led by William Zielinski,

President – Chicago Tube & Iron.

Following the acquisition of CTB, Olympic Steel's total debt

under its revolving credit facility is approximately $234 million,

with availability of approximately $359 million, leaving

significant capital to continue its diversification strategy

through investments in additional acquisitions, new capacity and

increased efficiency through automation to deliver shareholder

value.

Forward-Looking Statements

Forward-looking statements in this release are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are typically

identified by words or phrases such as "may," "will," "anticipate,"

"should," "intend," "expect," "believe," "estimate," "project,"

"plan," "potential," and "continue," as well as the negative of

these terms or similar expressions. Such forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ materially from those implied by such

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements. Such risks and uncertainties

include, but are not limited to: our ability to successfully

integrate CTB into our business and risks inherent with the CTB

acquisition in the achievement of expected results, including

whether the acquisition will be accretive and within the expected

time frame, and our ability to successfully execute our

diversification strategy. We undertake no obligation to publicly

release any revisions to any forward-looking statements or to

otherwise update any forward-looking statements whether as a result

of new information or to reflect events, circumstances or any other

unanticipated developments arising after the date on which such

statements are made. A further list and description of risks,

uncertainties and other factors can be found in our Annual Report

on Form 10-K for the year ended December 31, 2022, and in our

reports on Forms 10-Q and 8-K.

About Olympic Steel

Founded in 1954, Olympic Steel is a leading U.S. metals service

center focused on the direct sale and value-added processing of

carbon and coated sheet, plate, and coil products; stainless steel

sheet, plate, bar and coil; aluminum sheet, plate and coil; pipe,

tube, valves and fittings; and tin plate. The Company was founded

in 1954 and operates from 47 locations across North America.

For additional information, please visit the Company’s website

at www.olysteel.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230929641726/en/

Richard A. Manson Chief Financial Officer (216) 672-0522

ir@olysteel.com

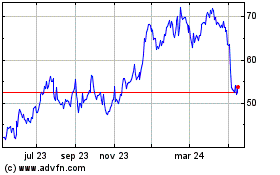

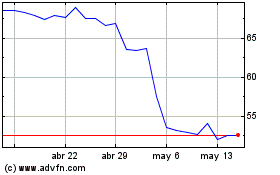

Olympic Steel (NASDAQ:ZEUS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Olympic Steel (NASDAQ:ZEUS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024