0001739445false00017394452024-08-012024-08-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | | August 1, 2024 |

Arcosa, Inc.

__________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| Delaware | | 1-38494 | | 82-5339416 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| 500 N. Akard Street, Suite 400 | | | | |

| Dallas, | Texas | | | | 75201 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (972) 942-6500

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

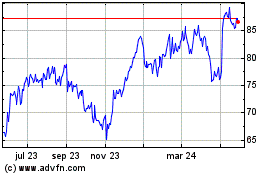

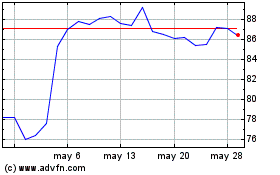

| Common Stock ($0.01 par value) | ACA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 1, 2024, Arcosa MS9, LLC (“Purchaser”), a Delaware limited liability company and wholly owned subsidiary of Arcosa, Inc. (“Arcosa”), entered into a Membership Interest and Asset Purchase Agreement (the “Purchase Agreement”) with Stavola Holding Corporation, a New Jersey corporation (“Stavola NJ”), Stavola Holdings Pennsylvania LLC, a Delaware limited liability company (“Stavola PA” and, together with Stavola NJ, the “Equity Sellers”), Stavola Trucking Company, Inc., a New Jersey corporation (“STC”), Stavola Management Company, Inc., a New Jersey corporation (“SMC”), and Stavola Realty Company, a New Jersey general partnership (“SRC” and, together with STC and SMC, the “Asset Sellers” and, together with the Equity Sellers, the “Sellers”), Arcosa, and the other parties thereto. The Target (as defined below) is an aggregates-led and vertically integrated construction materials company primarily serving the New York-New Jersey Metropolitan Statistical Area through its network of five hard rock natural aggregates quarries, twelve asphalt plants, and three recycled aggregates sites.

At the closing of the Transaction (as defined below), Purchaser would acquire from the Sellers all of the issued and outstanding membership interests and certain identified assets, as applicable, of the entities set forth in the Purchase Agreement (together, the “Target,” and such transaction, the “Transaction”), for a cash purchase price of approximately $1.2 billion subject to customary purchase price adjustments, upon the terms and subject to the conditions set forth in the Purchase Agreement. In addition, Purchaser will assume certain customary Target liabilities.

In connection with entry into the Purchase Agreement, Arcosa has entered into a commitment letter, dated August 1, 2024 (the “Commitment Letter”), among Arcosa, JPMorgan Chase Bank, N.A. (“JPMorgan”), Bank of America, N.A. (“Bank of America”), BofA Securities, Inc. (“BofA Securities”) and Barclays Bank PLC (“Barclays” and, together with JPMorgan and Bank of America, the “Initial Lenders”; the Initial Lenders, together with BofA Securities and any other financial institutions appointed as additional arrangers or agents, collectively, the “Commitment Parties”, pursuant to which and subject to the terms and conditions set forth therein, the Commitment Parties have agreed to provide a senior secured 364-day bridge loan facility (the “Bridge Facility”) of up to $1.2 billion in the aggregate, as well as a backstop to an amendment to Arcosa’s existing $600.0 million revolving credit facility, for the purpose of providing the financing necessary to fund the consideration to be paid pursuant to the terms of the Purchase Agreement and related fees and expenses. The funding of the Bridge Facility is contingent on the satisfaction of certain customary conditions set forth in the Commitment Letter, including (i) the execution and delivery of definitive documentation with respect to the Bridge Facility in accordance with the terms sets forth in the Commitment Letter, and (ii) the consummation of the Transaction in accordance with the Purchase Agreement. Prior to the close of the Transaction, Arcosa anticipates accessing the long-term debt markets for permanent financing with a mix of secured and unsecured debt that incorporates prepayment flexibility.

The Transaction is expected to close in the fourth quarter of 2024 and is subject to customary closing conditions, including, among others, (i) the absence of legal restraints preventing the consummation of the acquisition, (ii) the accuracy of the representations and warranties contained in the Purchase Agreement (subject to certain qualifications), and (iii) the performance by the parties of their respective obligations under the Purchase Agreement in all material respects. The Purchase Agreement contains certain standard termination rights for Purchaser and Sellers including the right to terminate the Purchase Agreement if the Transaction has not been consummated before November 1, 2024. Arcosa’s obligation to consummate the transaction is not subject to any condition related to the availability of financing.

In addition, the Purchase Agreement includes customary representations, warranties, and covenants, as well as indemnification provisions subject to specified limitations. From the date of the Purchase Agreement, the Sellers are required to operate Target’s business in the ordinary course and to comply with certain covenants regarding the operation of the business. The parties have also agreed to cooperate with each other and use reasonable best efforts to obtain all consents, approvals and authorizations of all governmental entities to the extent required by law in connection with the execution, delivery and performance of the Purchase Agreement and the consummation of the Transaction contemplated thereby, subject to specified limitations.

The foregoing description of the Purchase Agreement and the Transaction contemplated thereby is qualified in its entirety by the full text of the Purchase Agreement, which will be filed as an exhibit to Arcosa’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

The Purchase Agreement will be included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about Arcosa, Purchaser or any of their respective businesses, subsidiaries or affiliates. The representations, warranties and covenants contained in the Purchase Agreement (a) were made by the parties thereto only for purposes of that agreement and as of specific dates; (b) were made solely for the benefit of the parties to the Purchase Agreement; (c) may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Purchase Agreement (such disclosures include information that has been included in public disclosures, as well as additional non-public information); (d) may have been made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts; and (e) may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of Arcosa, Purchaser or any of their respective businesses, subsidiaries or affiliates. Additionally, the representations, warranties, covenants, conditions and other terms of the Purchase Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in Arcosa’s public disclosures. The Purchase Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Target and Arcosa that is or will be contained in, or incorporated by reference into, the Forms 10-K, Forms 10-Q and other documents that are filed with the Securities and Exchange Commission.

Item 2.02 Results of Operation and Financial Condition.

Attached as Exhibit 99.1 is the Acosa’s earnings release for the second quarter of 2024, issued August 1, 2024. This release is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in such filing.

Item 7.01 Regulation FD Disclosure.

On August 1, 2024, Arcosa issued a press release announcing that Purchaser had entered into the Purchase Agreement to acquire the Target. A copy of this press release is furnished as Exhibit 99.2 to this report on Form 8-K.

The information in Item 7.01 of this report (including Exhibit 99.2) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Exchange Act (the "Exchange Act"), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing. Additionally, the submission of this Item 7.01 is not an admission of the materiality of any information in this Item 7.01 that is required to be disclosed solely by Regulation FD.

Cautionary Statements Regarding Forward-Looking Statements

Statements in this report on Form 8-K, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” “plans,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding the failure to successfully complete or integrate acquisitions, including the Target, or divest any business, or failure to achieve the expected benefits of acquisitions or divestitures; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; the impact of inflation and costs of materials; assumptions regarding achievements of the expected benefits from the Inflation Reduction Act; the delivery or satisfaction of any backlog or firm orders; the impact of pandemics on Arcosa’s business; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see “Risk Factors” and the “Forward-Looking Statements” section of “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Arcosa's Form 10-K for the year ended December 31, 2023 and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| Arcosa, Inc. Earnings Release, dated August 1, 2024. |

| Arcosa, Inc. Press Release, dated August 1, 2024. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Arcosa, Inc. |

| (Registrant) |

| | |

August 1, 2024 | By: | /s/ Gail M. Peck |

| | Name: Gail M. Peck |

| | Title: Chief Financial Officer |

News Release

FOR IMMEDIATE RELEASE

Arcosa, Inc. Announces Second Quarter 2024 Results

–Record Quarterly Revenues and Adjusted EBITDA, Driven by Solid Organic Growth and Contribution from Acquisitions

–Adjusted EBITDA Growth of 31% and 230 Basis Points of Margin Expansion

–Raised Low End of Full Year 2024 Adjusted EBITDA Guidance Reflecting Strong Second Quarter Results

–Healthy Balance Sheet with Net Debt to Adjusted EBITDA of 1.5x Provides Support for Acquisition Financing

–In a Separate Release, Announced Several Strategic Portfolio Actions Including Agreement to Acquire the Construction Materials Business of Stavola Holding Corporation for $1.2 Billion

DALLAS, Texas - ARCOSA, Inc. - August 1, 2024:

Arcosa, Inc. (NYSE: ACA) (“Arcosa,” the “Company,” “We,” or “Our”), a provider of infrastructure-related products and solutions, today announced results for the second quarter ended June 30, 2024.

Second Quarter 2024 Highlights

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2024 | | 2023 | | % Change |

| | | | | |

| ($ in millions, except per share amounts) | | |

| Revenues | $ | 664.7 | | | $ | 584.8 | | | 14 | % |

| | | | | |

| Net income | $ | 45.6 | | | $ | 40.9 | | | 11 | % |

Adjusted Net Income(1) | $ | 44.7 | | | $ | 37.3 | | | 20 | % |

| Diluted EPS | $ | 0.93 | | | $ | 0.84 | | | 11 | % |

Adjusted Diluted EPS(1) | $ | 0.91 | | | $ | 0.76 | | | 20 | % |

Adjusted EBITDA(1) | $ | 112.7 | | | $ | 85.8 | | | 31 | % |

Adjusted EBITDA Margin(1) | 17.0 | % | | 14.7 | % | | 230 | bps |

| Net cash provided by operating activities | $ | 38.3 | | | $ | 127.6 | | | (70) | % |

Free Cash Flow(1) | $ | (6.1) | | | $ | 75.6 | | | (108) | % |

bps - basis points

(1) Non-GAAP financial measure. See reconciliation tables included in this release.

Antonio Carrillo, President and Chief Executive Officer, noted, “Our second quarter was highlighted by several events, that on a combined basis, demonstrate steady advancement of our long-term strategic vision. Financial results for the second quarter reflect records for quarterly revenues and Adjusted EBITDA, with significant year-over-year margin expansion. During the quarter, we performed well across our three segments, generating double-digit Adjusted EBITDA growth on an organic basis that was augmented by the accretive contribution from recent acquisitions. At the same time, we executed on value enhancing portfolio actions to accelerate our growth in attractive markets and reduce the overall complexity and cyclicality of our portfolio.

“In Construction Products, Adjusted Segment EBITDA increased 22% and margin expanded 360 basis points, led by significant organic growth and the contribution from recent bolt-on acquisitions in Florida, Texas and Arizona. We continued to benefit from strong pricing momentum, which compensated for volume headwinds in aggregates from elevated rainfall, particularly in Texas. Operating improvements in our specialty materials and trench shoring businesses also contributed to organic growth during the quarter. Additionally, we took steps to optimize our operations and improve margin by disposing of certain underperforming locations.

“Within Engineered Structures, we executed well and delivered a 48% increase in Adjusted Segment EBITDA driven by higher volumes in wind towers and utility structures, improved operating efficiencies, and the accretive impact of the Ameron Pole Products acquisition that closed earlier in the quarter. We were pleased to deliver our first completed wind towers from our new plant in New Mexico, which continues to operate on-time and within budget.

“Second quarter Adjusted Segment EBITDA increased 7% in Transportation Products and margin expanded 90 basis points reflecting higher volumes and improved margin for barges. Order inquiries for liquid barges continued to demonstrate momentum for a third consecutive quarter. Our barge backlog of $252 million, roughly flat with the start of the year, extends well into 2025 providing solid production visibility.”

Mr. Carrillo continued, “In a separate release today, we also announced the $1.2 billion acquisition of Stavola, an aggregates-led provider of construction materials operating in the nation’s largest MSA. Concurrently, we also announced the divestiture of our steel components business within our Transportation Products segment. Together these transactions closely align with our strategic vision and enhance our ability to continue delivering sustainable growth and superior value for our shareholders.”

2024 Outlook and Guidance

The Company made the following adjustments to its full year 2024 guidance:

•Tightened its consolidated revenues range to $2.60 billion to $2.72 billion from $2.58 billion to $2.78 billion previously.

•Increased the low end of its consolidated Adjusted EBITDA range to $420 million from $410 million, resulting in a full year range of $420 million to $440 million.

Commenting on the outlook, Carrillo noted, “I am pleased with our year-to-date performance, and the underlying trends in our businesses remain strong. As a result, we are raising the low end of our 2024 Adjusted EBITDA guidance. At the mid-point of our Adjusted EBITDA range and without consideration for today’s strategic announcements, we anticipate 24% year-over-year growth, normalizing for the land sale gain in 2023. We plan to update our guidance following the close of the Stavola acquisition announced today.”

Second Quarter 2024 Results and Commentary

Construction Products

•Revenues increased 4% to $276.1 million primarily due to recent acquisitions. Organic aggregates and specialty materials revenues were roughly flat as higher pricing was mostly offset by lower volumes, a decline in freight revenues, and a reduction in revenue related to recently divested operations. Revenues for our trench shoring business increased 8% primarily due to higher volumes.

•Organic volumes for our aggregates business, which includes both natural and recycled, were impacted by unseasonably wet weather conditions during the period, particularly in Texas. Year-over-year pricing gains were strong and overall demand remains healthy when weather conditions are favorable.

•Adjusted Segment EBITDA increased 22% to $68.8 million primarily due to solid operating improvements in our specialty materials and shoring businesses and the accretive impact of recent acquisitions.

•Adjusted Segment EBITDA Margin increased 360 basis points to 25.2% from 21.6% in the prior year period and Freight-Adjusted Segment EBITDA Margin was 28.0% compared to 24.4% in the prior year period.

•During the current period, the Company recognized a gain on the sale of a subscale, singe-location asphalt and paving operation and impaired assets related to the closure of a small aggregates operation in west Texas resulting in a net loss of $0.8 million, which has been excluded from Adjusted Segment EBITDA.

Engineered Structures

•Revenues for utility, wind, and related structures increased 33% to $274.8 million due to higher volumes in our utility structures and wind towers businesses and the contribution from the recently acquired Ameron Pole Products ("Ameron") business.

•Adjusted Segment EBITDA increased 48% to $41.7 million, and margin expanded 160 basis points to 15.2% due to strong organic growth in our wind towers and utility structures businesses and the accretive impact of the Ameron acquisition.

•During the quarter, the Company recognized a $7.5 million gain on the sale of a non-operating facility that previously supported a divested business, which has been excluded from Adjusted EBITDA.

•Order activity for utility and related structures remains healthy and conversations with customers for additional wind tower orders continue.

•At the end of the second quarter, the combined backlog for utility, wind, and related structures was $1,338.7 million compared to $1,507.4 million at the end of the second quarter of 2023. We expect to deliver approximately 37% of our current backlog in 2024.

Transportation Products

•Revenues were $113.8 million, roughly flat as higher barge revenues were mostly offset by lower steel component volumes. Barge revenues increased 4% driven by higher hopper barge deliveries.

•Adjusted Segment EBITDA increased $1.1 million, or 7%, to $16.7 million, representing a 14.7% margin compared to 13.8% in the prior period. The increase was driven by higher volumes and improved margin in the barge business.

•During the quarter, we received orders totaling approximately $33 million, primarily for tank barges, representing a book-to-bill of 0.4.

•Backlog for inland barges at the end of the quarter was $251.5 million, roughly flat with the start of the year. We expect to deliver approximately 69% of our current backlog in 2024.

Corporate and Other Financial Notes

•Excluding acquisition and divestiture-related costs, which have been excluded from Adjusted EBITDA, corporate expenses decreased to $16.0 million in the second quarter from $16.4 million in the prior year.

•Acquisition and divestiture-related costs were $3.9 million in the second quarter compared to $0.3 million in the prior year.

•The effective tax rate in the second quarter was 14.3% compared to 12.0% in the prior year. The increase in the tax rate was primarily due to foreign currency impacts partially offset by increased Advanced Manufacturing Production ("AMP") tax credits.

Cash Flow and Liquidity

•Operating cash flow was $38.3 million during the second quarter, a decrease of $89.3 million compared to the prior year driven by an increase in working capital.

•Working capital was a $49.3 million net use of cash for the quarter compared to the prior year's $41.0 million net source of cash. The increase in working capital was driven by higher accounts receivable primarily in our wind towers business.

•Capital expenditures in the second quarter were $47.6 million, compared to $52.5 million in the prior year, as we continue to make progress on organic projects underway in Construction Products and Engineered Structures.

•Free Cash Flow for the quarter was $(6.1) million, down from $75.6 million in the prior year.

•We invested $179.9 million, net of cash acquired, for the purchase of Ameron, initially borrowing $160.0 million under our revolving credit facility to partially fund the acquisition and repaid $60 million within the quarter.

•In July 2024, we completed the acquisition of a Phoenix, Arizona based natural aggregates business for a total purchase price of $35.0 million, which will be included in our Construction Products segment.

•We ended the quarter with total liquidity of $393.0 million, including $103.7 million of cash and cash equivalents, and Net Debt to Adjusted EBITDA was 1.5X for the trailing twelve months.

Non-GAAP Financial Information

This earnings release contains financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Reconciliations of non-GAAP financial measures to the closest GAAP measure are included in the accompanying tables to this earnings release.

Conference Call Information

A conference call is scheduled for 8:30 a.m. Eastern Time on August 2, 2024 to discuss second quarter 2024 results and the strategic actions announced today in a separate release. To listen to the conference call webcast, please visit the Investor Relations section of Arcosa’s website at https://ir.arcosa.com. A slide presentation for this conference call will be posted on the Company’s website in advance of the call at https://ir.arcosa.com. The audio conference call number is 800-343-1703 for domestic callers and 785-424-1116 for international callers. The conference ID is ARCOSA and the passcode is 24246. An audio playback will be available through 11:59 p.m. Eastern Time on August 16, 2024, by dialing 800-839-1162 for domestic callers and 402-220-0398 for international callers. A replay of the webcast will be available for one year on Arcosa’s website at https://ir.arcosa.com/news-events/events-presentations.

About Arcosa

Arcosa, Inc. (NYSE:ACA), headquartered in Dallas, Texas, is a provider of infrastructure-related products and solutions with leading positions in construction, engineered structures, and transportation markets. Arcosa reports its financial results in three principal business segments: Construction Products, Engineered Structures, and Transportation Products. For more information, visit www.arcosa.com.

Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” “plans,” “goal,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding failure to successfully complete or integrate acquisitions, including Ameron and Stavola, or divest any business, including the steel components business, or failure to achieve the expected benefits of acquisitions or divestitures; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; the impact of inflation and costs of materials; assumptions regarding achievements of the expected benefits from the Inflation Reduction Act; the delivery or satisfaction of any backlog or firm orders; the impact of pandemics on Arcosa’s business; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see “Risk Factors” and the “Forward-Looking Statements” section of “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Arcosa's Form 10-K for the year ended December 31, 2023 and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

INVESTOR CONTACTS

| | | | | | | | |

| Gail M. Peck | Erin Drabek | David Gold |

| Chief Financial Officer | Director of Investor Relations | ADVISIRY Partners |

| | |

| T 972.942.6500 | | T 212.661.2220 |

| InvestorResources@arcosa.com | David.Gold@advisiry.com |

MEDIA CONTACT

TABLES TO FOLLOW

Arcosa, Inc.

Condensed Consolidated Statements of Operations

(in millions, except per share amounts)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 664.7 | | | $ | 584.8 | | | $ | 1,263.3 | | | $ | 1,134.0 | |

| Operating costs: | | | | | | | |

| Cost of revenues | 526.7 | | | 463.7 | | | 1,013.7 | | | 904.3 | |

| Selling, general, and administrative expenses | 79.5 | | | 70.7 | | | 148.6 | | | 133.2 | |

| Gain on disposition of property, plant, equipment, and other assets | (2.0) | | | (0.6) | | | (5.9) | | | (23.2) | |

| Gain on sale of businesses | (12.5) | | | — | | | (19.5) | | | (6.4) | |

| Impairment charge | 5.8 | | | — | | | 5.8 | | | — | |

| 597.5 | | | 533.8 | | | 1,142.7 | | | 1,007.9 | |

| Operating profit | 67.2 | | | 51.0 | | | 120.6 | | | 126.1 | |

| | | | | | | |

| Interest expense | 11.4 | | | 7.1 | | | 19.7 | | | 14.2 | |

| Other, net (income) expense | 2.6 | | | (2.6) | | | 0.4 | | | (4.5) | |

| 14.0 | | | 4.5 | | | 20.1 | | | 9.7 | |

| Income before income taxes | 53.2 | | | 46.5 | | | 100.5 | | | 116.4 | |

| Provision for income taxes | 7.6 | | | 5.6 | | | 15.7 | | | 19.8 | |

Net income | $ | 45.6 | | | $ | 40.9 | | | $ | 84.8 | | | $ | 96.6 | |

| | | | | | | |

| Net income per common share: | | | | | | | |

| Basic | $ | 0.93 | | | $ | 0.84 | | | $ | 1.74 | | | $ | 1.99 | |

| Diluted | $ | 0.93 | | | $ | 0.84 | | | $ | 1.74 | | | $ | 1.98 | |

| Weighted average number of shares outstanding: | | | | | | | |

| Basic | 48.6 | | | 48.5 | | | 48.5 | | | 48.4 | |

| Diluted | 48.7 | | | 48.7 | | | 48.7 | | | 48.6 | |

Arcosa, Inc.

Condensed Segment Data

(in millions)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| Revenues: | 2024 | | 2023 | | 2024 | | 2023 |

| Aggregates and specialty materials | $ | 235.5 | | | $ | 227.1 | | | $ | 457.2 | | | $ | 438.1 | |

| Construction site support | 40.6 | | | 37.7 | | | 70.1 | | | 62.8 | |

| Construction Products | 276.1 | | | 264.8 | | | 527.3 | | | 500.9 | |

| | | | | | | |

| Utility, wind, and related structures | 274.8 | | | 207.0 | | | 506.4 | | | 414.7 | |

| Engineered Structures | 274.8 | | | 207.0 | | | 506.4 | | | 414.7 | |

| | | | | | | |

| Inland barges | 75.7 | | | 72.5 | | | 155.4 | | | 140.6 | |

| Steel components | 38.1 | | | 40.5 | | | 74.2 | | | 77.8 | |

| Transportation Products | 113.8 | | | 113.0 | | | 229.6 | | | 218.4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Consolidated Total | $ | 664.7 | | | $ | 584.8 | | | $ | 1,263.3 | | | $ | 1,134.0 | |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| Operating profit (loss): | 2024 | | 2023 | | 2024 | | 2023 |

| Construction Products | $ | 39.4 | | | $ | 34.4 | | | $ | 68.2 | | | $ | 83.9 | |

| Engineered Structures | 35.1 | | | 21.7 | | | 61.4 | | | 51.6 | |

| Transportation Products | 12.6 | | | 11.6 | | | 27.2 | | | 21.7 | |

| | | | | | | |

| Segment Total | 87.1 | | | 67.7 | | | 156.8 | | | 157.2 | |

| Corporate | (19.9) | | | (16.7) | | | (36.2) | | | (31.1) | |

| | | | | | | |

| Consolidated Total | $ | 67.2 | | | $ | 51.0 | | | $ | 120.6 | | | $ | 126.1 | |

| | | | | | | | | | | |

| Backlog: | June 30, 2024 | | June 30, 2023 |

| Engineered Structures: | | | |

| Utility, wind, and related structures | $ | 1,338.7 | | | $ | 1,507.4 | |

| Transportation Products: | | | |

| Inland barges | $ | 251.5 | | | $ | 287.1 | |

Arcosa, Inc.

Condensed Consolidated Balance Sheets

(in millions)

(unaudited) | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 103.7 | | | $ | 104.8 | |

| Receivables, net of allowance | 442.8 | | | 357.1 | |

| Inventories | 405.9 | | | 401.8 | |

| | | |

| Other | 38.5 | | | 48.3 | |

| Total current assets | 990.9 | | | 912.0 | |

| | | |

| Property, plant, and equipment, net | 1,415.3 | | | 1,336.3 | |

| Goodwill | 1,023.4 | | | 990.7 | |

| Intangibles, net | 313.1 | | | 270.7 | |

| Deferred income taxes | 6.9 | | | 6.8 | |

| Other assets | 58.3 | | | 61.4 | |

| $ | 3,807.9 | | | $ | 3,577.9 | |

| Current liabilities: | | | |

| Accounts payable | $ | 263.7 | | | $ | 272.5 | |

| Accrued liabilities | 126.9 | | | 117.4 | |

| Advance billings | 32.2 | | | 34.5 | |

| | | |

| Current portion of long-term debt | 6.6 | | | 6.8 | |

| Total current liabilities | 429.4 | | | 431.2 | |

| | | |

| Debt | 699.9 | | | 561.9 | |

| Deferred income taxes | 198.1 | | | 179.6 | |

| Other liabilities | 65.5 | | | 73.2 | |

| 1,392.9 | | | 1,245.9 | |

| | | |

| Stockholders' equity: | | | |

| Common stock | 0.5 | | | 0.5 | |

| Capital in excess of par value | 1,686.5 | | | 1,682.8 | |

| Retained earnings | 744.8 | | | 664.9 | |

| Accumulated other comprehensive loss | (16.8) | | | (16.2) | |

| | | |

| 2,415.0 | | | 2,332.0 | |

| $ | 3,807.9 | | | $ | 3,577.9 | |

Arcosa, Inc.

Consolidated Statements of Cash Flows

(in millions)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net income | $ | 84.8 | | | $ | 96.6 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| | | |

| Depreciation, depletion, and amortization | 89.4 | | | 78.3 | |

| Impairment charge | 5.8 | | | — | |

| Stock-based compensation expense | 14.1 | | | 12.6 | |

| Provision for deferred income taxes | 14.4 | | | 12.9 | |

| Gain on disposition of property, plant, equipment, and other assets | (5.9) | | | (23.2) | |

| Gain on sale of businesses | (19.5) | | | (6.4) | |

| (Increase) decrease in other assets | (4.2) | | | (0.3) | |

| Increase (decrease) in other liabilities | (9.7) | | | (3.4) | |

| Other | (5.7) | | | 2.2 | |

| Changes in current assets and liabilities: | | | |

| (Increase) decrease in receivables | (80.6) | | | (30.7) | |

| (Increase) decrease in inventories | 21.9 | | | (34.6) | |

| (Increase) decrease in other current assets | 11.3 | | | 10.3 | |

| Increase (decrease) in accounts payable | (11.3) | | | 43.4 | |

| Increase (decrease) in advance billings | (2.3) | | | 4.0 | |

| Increase (decrease) in accrued liabilities | 16.3 | | | (6.8) | |

| Net cash provided by operating activities | 118.8 | | | 154.9 | |

| Investing activities: | | | |

| Proceeds from disposition of property, plant, equipment, and other assets | 7.4 | | | 24.4 | |

| Proceeds from sale of businesses | 33.3 | | | 2.0 | |

| Capital expenditures | (102.0) | | | (96.9) | |

| Acquisitions, net of cash acquired | (179.9) | | | (15.6) | |

| Net cash required by investing activities | (241.2) | | | (86.1) | |

| Financing activities: | | | |

| Payments to retire debt | (63.4) | | | (5.4) | |

| Proceeds from issuance of debt | 200.0 | | | — | |

| | | |

| Dividends paid to common stockholders | (4.9) | | | (4.8) | |

| Purchase of shares to satisfy employee tax on vested stock | (10.4) | | | (11.1) | |

| Holdback payment from acquisition | — | | | (10.0) | |

| | | |

| | | |

| Net cash provided (required) by financing activities | 121.3 | | | (31.3) | |

| Net increase (decrease) in cash and cash equivalents | (1.1) | | | 37.5 | |

| Cash and cash equivalents at beginning of period | 104.8 | | | 160.4 | |

| Cash and cash equivalents at end of period | $ | 103.7 | | | $ | 197.9 | |

| | | | | | | | |

| 972.942.6500 | 10 | arcosa.com |

Arcosa, Inc.

Reconciliation of Adjusted Net Income and Adjusted Diluted EPS

(unaudited)

GAAP does not define “Adjusted Net Income” and it should not be considered as an alternative to earnings measures defined by GAAP, including net income. We use this metric to assess the operating performance of our consolidated business. We adjust net income for certain items that are not reflective of the normal operations of our business to provide investors with what we believe is a more consistent comparison of earnings performance from period to period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| (in millions) | | | | |

| Net Income | $ | 45.6 | | | $ | 40.9 | | | $ | 84.8 | | | $ | 96.6 | | | | | |

| | | | | | | | | | | |

| Gain on sale of businesses, net of tax | (9.7) | | | — | | | (15.0) | | | (4.5) | | | | | |

Impact of acquisition and divestiture-related expenses, net of tax(1) | 4.3 | | | 0.2 | | | 6.4 | | | 0.7 | | | | | |

| Benefit from reduction in holdback obligation, net of tax | — | | | (3.8) | | | — | | | (3.8) | | | | | |

| Impairment charge, net of tax | 4.5 | | | — | | | 4.5 | | | — | | | | | |

| | | | | | | | | | | |

| Adjusted Net Income | $ | 44.7 | | | $ | 37.3 | | | $ | 80.7 | | | $ | 89.0 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

GAAP does not define “Adjusted Diluted EPS” and it should not be considered as an alternative to earnings measures defined by GAAP, including diluted EPS. We use this metric to assess the operating performance of our consolidated business. We adjust diluted EPS for certain items that are not reflective of the normal operations of our business to provide investors with what we believe is a more consistent comparison of earnings performance from period to period.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in dollars per share) |

| Diluted EPS | $ | 0.93 | | | $ | 0.84 | | | $ | 1.74 | | | $ | 1.98 | |

| Gain on sale of businesses | (0.20) | | | — | | | (0.31) | | | (0.09) | |

Impact of acquisition and divestiture-related expenses(1) | 0.09 | | | — | | | 0.13 | | | 0.01 | |

| Benefit from reduction in holdback obligation | — | | | (0.08) | | | — | | | (0.08) | |

| Impairment charge | 0.09 | | | — | | | 0.09 | | | — | |

| | | | | | | |

| Adjusted Diluted EPS | $ | 0.91 | | | $ | 0.76 | | | $ | 1.65 | | | $ | 1.82 | |

(1) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs.

| | | | | | | | |

| 972.942.6500 | 11 | arcosa.com |

Arcosa, Inc.

Reconciliation of Adjusted EBITDA

($ in millions)

(unaudited)

“EBITDA” is defined as net income plus interest, taxes, depreciation, depletion, and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for certain items that are not reflective of the normal earnings of our business. GAAP does not define EBITDA or Adjusted EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including net income. We use Adjusted EBITDA to assess the operating performance of our consolidated business, as a metric for incentive-based compensation, as a measure within our lending arrangements, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry, we believe Adjusted EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items which can vary significantly depending on many factors. “Adjusted EBITDA Margin” is defined as Adjusted EBITDA divided by Revenues.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | Full Year 2024 Guidance(3) |

| 2024 | | 2023 | | 2024 | | 2023 | | Low | | High |

| Revenues | $ | 664.7 | | | $ | 584.8 | | | $ | 1,263.3 | | | $ | 1,134.0 | | | $ | 2,600.0 | | | $ | 2,720.0 | |

| | | | | | | | | | | |

| Net income | 45.6 | | | 40.9 | | | 84.8 | | | 96.6 | | | 172.6 | | | 180.7 | |

| Add: | | | | | | | | | | | |

| Interest expense, net | 10.7 | | | 5.7 | | | 17.3 | | | 11.6 | | | 34.0 | | | 36.0 | |

| Provision for income taxes | 7.6 | | | 5.6 | | | 15.7 | | | 19.8 | | | 35.3 | | | 39.7 | |

Depreciation, depletion, and amortization expense(1) | 46.6 | | | 39.5 | | | 89.4 | | | 78.3 | | | 180.0 | | | 185.0 | |

| EBITDA | 110.5 | | | 91.7 | | | 207.2 | | | 206.3 | | | 421.9 | | | 441.4 | |

| Add (less): | | | | | | | | | | | |

| Gain on sale of businesses | (12.5) | | | — | | | (19.5) | | | (6.4) | | | (19.5) | | | (19.5) | |

Impact of acquisition and divestiture-related expenses(2) | 5.6 | | | 0.3 | | | 8.4 | | | 0.9 | | | 9.0 | | | 9.5 | |

| Benefit from reduction in holdback obligation | — | | | (5.0) | | | — | | | (5.0) | | | — | | | — | |

| Impairment charge | 5.8 | | | — | | | 5.8 | | | — | | | 5.8 | | | 5.8 | |

| | | | | | | | | | | |

| Other, net (income) expense | 3.3 | | | (1.2) | | | 2.8 | | | (1.9) | | | 2.8 | | | 2.8 | |

| Adjusted EBITDA | $ | 112.7 | | | $ | 85.8 | | | $ | 204.7 | | | $ | 193.9 | | | $ | 420.0 | | | $ | 440.0 | |

| Adjusted EBITDA Margin | 17.0 | % | | 14.7 | % | | 16.2 | % | | 17.1 | % | | 16.2 | % | | 16.2 | % |

(1) Includes the impact of the fair value markup of acquired long-lived assets, subject to final purchase price adjustments.

(2) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs.

(3) Full year 2024 guidance does not include the strategic actions announced in a separate release today. We plan to update our guidance following the close of the Stavola acquisition.

| | | | | | | | |

| 972.942.6500 | 12 | arcosa.com |

Arcosa, Inc.

Reconciliation of Adjusted Segment EBITDA

($ in millions)

(unaudited)

“Segment EBITDA” is defined as segment operating profit plus depreciation, depletion, and amortization. “Adjusted Segment EBITDA” is defined as Segment EBITDA adjusted for certain items that are not reflective of the normal earnings of our business. GAAP does not define Segment EBITDA or Adjusted Segment EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including segment operating profit. We use Adjusted Segment EBITDA to assess the operating performance of our businesses, as a metric for incentive-based compensation, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry we believe Adjusted Segment EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items, which can vary significantly depending on many factors. “Adjusted Segment EBITDA Margin” is defined as Adjusted Segment EBITDA divided by Revenues.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | Twelve Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 | | 2024 |

| Construction Products | | | | | | | | | |

| Revenues | $ | 276.1 | | | $ | 264.8 | | | $ | 527.3 | | | $ | 500.9 | | | $ | 1,027.7 | |

| | | | | | | | | |

| Operating Profit | 39.4 | | | 34.4 | | | 68.2 | | | 83.9 | | | 122.9 | |

Add: Depreciation, depletion, and amortization expense(1) | 29.4 | | | 27.8 | | | 59.5 | | | 54.7 | | | 116.5 | |

| Segment EBITDA | 68.8 | | | 62.2 | | | 127.7 | | | 138.6 | | | 239.4 | |

| Less: Gain on sale of businesses | (5.0) | | | — | | | (5.0) | | | — | | | (5.0) | |

Add: Impact of acquisition and divestiture-related expenses(2) | 0.1 | | | — | | | 1.3 | | | — | | | 1.3 | |

| Less: Benefit from reduction in holdback obligation | — | | | (5.0) | | | — | | | (5.0) | | | — | |

| Add: Impairment charge | 5.8 | | | — | | | 5.8 | | | — | | | 5.8 | |

| Adjusted Segment EBITDA | $ | 69.7 | | | $ | 57.2 | | | $ | 129.8 | | | $ | 133.6 | | | $ | 241.5 | |

| Adjusted Segment EBITDA Margin | 25.2 | % | | 21.6 | % | | 24.6 | % | | 26.7 | % | | 23.5 | % |

| | | | | | | | | |

| Engineered Structures | | | | | | | | | |

| Revenues | $ | 274.8 | | | $ | 207.0 | | | $ | 506.4 | | | $ | 414.7 | | | $ | 965.2 | |

| | | | | | | | | |

| Operating Profit | 35.1 | | | 21.7 | | | 61.4 | | | 51.6 | | | 105.5 | |

Add: Depreciation and amortization expense(1) | 12.5 | | | 6.4 | | | 20.4 | | | 13.0 | | | 34.0 | |

| Segment EBITDA | 47.6 | | | 28.1 | | | 81.8 | | | 64.6 | | | 139.5 | |

Add: Impact of acquisition and divestiture-related expenses(2) | 1.6 | | | — | | | 1.6 | | | — | | | 1.6 | |

| | | | | | | | | |

| Less: Gain on sale of businesses | (7.5) | | | — | | | (14.5) | | | (6.4) | | | (14.5) | |

| Adjusted Segment EBITDA | $ | 41.7 | | | $ | 28.1 | | | $ | 68.9 | | | $ | 58.2 | | | $ | 126.6 | |

| Adjusted Segment EBITDA Margin | 15.2 | % | | 13.6 | % | | 13.6 | % | | 14.0 | % | | 13.1 | % |

| | | | | | | | | |

| Transportation Products | | | | | | | | | |

| Revenues | $ | 113.8 | | | $ | 113.0 | | | $ | 229.6 | | | $ | 218.4 | | | $ | 444.7 | |

| | | | | | | | | |

| Operating Profit | 12.6 | | | 11.6 | | | 27.2 | | | 21.7 | | | 51.3 | |

| Add: Depreciation and amortization expense | 4.1 | | | 4.0 | | | 8.1 | | | 8.0 | | | 16.1 | |

| Segment EBITDA | 16.7 | | | 15.6 | | | 35.3 | | | 29.7 | | | 67.4 | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted Segment EBITDA | $ | 16.7 | | | $ | 15.6 | | | $ | 35.3 | | | $ | 29.7 | | | $ | 67.4 | |

| Adjusted Segment EBITDA Margin | 14.7 | % | | 13.8 | % | | 15.4 | % | | 13.6 | % | | 15.2 | % |

| | | | | | | | | |

| | | | | | | | | |

| Operating Loss - Corporate | $ | (19.9) | | | $ | (16.7) | | | $ | (36.2) | | | $ | (31.1) | | | $ | (67.9) | |

Add: Impact of acquisition and divestiture-related expenses - Corporate(2) | 3.9 | | | 0.3 | | | 5.5 | | | 0.9 | | | 6.8 | |

| | | | | | | | | |

| | | | | | | | | |

| Add: Corporate depreciation expense | 0.6 | | | 1.3 | | | 1.4 | | | 2.6 | | | 4.0 | |

| Adjusted EBITDA | $ | 112.7 | | | $ | 85.8 | | | $ | 204.7 | | | $ | 193.9 | | | $ | 378.4 | |

(1) Includes the impact of the fair value markup of acquired long-lived assets, subject to final purchase price adjustments.

(2) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs.

| | | | | | | | |

| 972.942.6500 | 13 | arcosa.com |

Arcosa, Inc.

Reconciliation of Freight-Adjusted Revenues for Construction Products

($ in millions)

(unaudited)

“Freight-Adjusted Revenues” for Construction Products is defined as segment revenues less freight and delivery, which are pass-through activities. GAAP does not define Freight-Adjusted Revenues and they should not be considered as alternatives to earnings measures defined by GAAP, including revenues. We use Freight-Adjusted Revenues in the review of our operating results. We also believe that this presentation is consistent with our competitors. As a widely used metric by analysts and investors, this metric assists in comparing a company's performance on a consistent basis. “Freight-Adjusted Segment Margin” is defined as Freight-Adjusted Revenues divided by Adjusted Segment EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Construction Products | | | | | | | |

| Revenues | $ | 276.1 | | | $ | 264.8 | | | $ | 527.3 | | | $ | 500.9 | |

Less: Freight revenues(1) | 27.1 | | | 30.5 | | | 51.0 | | | 59.0 | |

| | | | | | | |

| Freight-Adjusted Revenues | $ | 249.0 | | | $ | 234.3 | | | $ | 476.3 | | | $ | 441.9 | |

| | | | | | | |

Adjusted Segment EBITDA(2) | $ | 69.7 | | | $ | 57.2 | | | $ | 129.8 | | | $ | 133.6 | |

Adjusted Segment EBITDA Margin(2) | 25.2 | % | | 21.6 | % | | 24.6 | % | | 26.7 | % |

| | | | | | | |

| Freight-Adjusted Segment EBITDA Margin | 28.0 | % | | 24.4 | % | | 27.3 | % | | 30.2 | % |

(1) The freight revenue amount shown for the three and six months ended June 30, 2023 has been updated from the prior year disclosure due to a reclass between freight revenue and product revenue.

(2) See Reconciliation of Adjusted Segment EBITDA table.

| | | | | | | | |

| 972.942.6500 | 14 | arcosa.com |

Arcosa, Inc.

Reconciliation of Free Cash Flow and Net Debt to Adjusted EBITDA

($ in millions)

(unaudited)

GAAP does not define “Free Cash Flow” and it should not be considered as an alternative to cash flow measures defined by GAAP, including cash flow from operating activities. We define Free Cash Flow as cash provided by operating activities less capital expenditures net of the proceeds from the disposition of property, plant, equipment, and other assets. The Company also uses “Free Cash Flow Conversion”, which we define as Free Cash Flow divided by net income. We use these metrics to assess the liquidity of our consolidated business. We present these metrics for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash Provided by Operating Activities | $ | 38.3 | | | $ | 127.6 | | | $ | 118.8 | | | $ | 154.9 | |

| Capital expenditures | (47.6) | | | (52.5) | | | (102.0) | | | (96.9) | |

| Proceeds from disposition of property, plant, equipment, and other assets | 3.2 | | | 0.5 | | | 7.4 | | | 24.4 | |

| Free Cash Flow | $ | (6.1) | | | $ | 75.6 | | | $ | 24.2 | | | $ | 82.4 | |

| | | | | | | |

| Net income | $ | 45.6 | | | $ | 40.9 | | | $ | 84.8 | | | $ | 96.6 | |

| Free Cash Flow Conversion | (13) | % | | 185 | % | | 29 | % | | 85 | % |

GAAP does not define “Net Debt” and it should not be considered as an alternative to cash flow or liquidity measures defined by GAAP. The Company uses Net Debt, which it defines as total debt minus cash and cash equivalents to determine the extent to which the Company’s outstanding debt obligations would be satisfied by its cash and cash equivalents on hand. The Company also uses “Net Debt to Adjusted EBITDA”, which it defines as Net Debt divided by Adjusted EBITDA for the trailing twelve months as a metric of its current leverage position. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions.

| | | | | | | | | |

| June 30, 2024 | | | | |

| Total debt excluding debt issuance costs | $ | 710.4 | | | | | |

| Cash and cash equivalents | 103.7 | | | | | |

| Net Debt | $ | 606.7 | | | | | |

| | | | | |

Adjusted EBITDA (trailing twelve months)(1) | $ | 393.3 | | | | | |

| Net Debt to Adjusted EBITDA | 1.5 | | | | | |

(1) Adjusted EBITDA includes a pro forma adjustment for Ameron of $14.9 million, which reflects an amount equal to 75% of Ameron’s historical Adjusted EBITDA for the twelve months ended December 31, 2023 of $19.8 million, as previously disclosed, to approximate the nine-month pro forma impact on our Adjusted EBTIDA as if the acquisition had occurred on June 30, 2023. We acquired Ameron on April 9, 2024.

| | | | | | | | |

| 972.942.6500 | 15 | arcosa.com |

News Release

FOR IMMEDIATE RELEASE

Arcosa, Inc. Announces Agreement to Acquire the Construction Materials Business of Stavola Holding Corporation for $1.2 Billion and Other Value Enhancing Portfolio Actions to Accelerate Long-Term Strategy

–Provides Scaled Aggregates-Led Platform with Revenues of $283 Million, Adjusted EBITDA of $100 Million, and Margin Accretive to Construction Products Segment

–Extends Footprint into Nation's Largest MSA

–Financing to Include New Long-Term Debt with Clear Path to Deleveraging

–Additionally, Executed Definitive Agreement to Divest Steel Components Business and Completed Sale of Other Non-Core Assets for Total Consideration of $137 Million

–Transactions Accelerate Shift to Higher Margin Construction Products While Advancing Strategy to Reduce Complexity and Cyclicality of Overall Portfolio

–Arcosa Will Host a Conference Call to Discuss These Transactions and Its Second Quarter 2024 Results at 8:30 AM ET on Friday August 2nd

DALLAS, Texas - ARCOSA, Inc. - August 1, 2024:

Arcosa, Inc. (NYSE: ACA) (“Arcosa,” the “Company,” “We,” or “Our”), a provider of infrastructure-related products and solutions, today announced portfolio actions that advance the Company's long-term strategy.

Acquisition of Stavola

Arcosa has entered into a definitive agreement to acquire the construction materials business of Stavola Holding Corporation and its affiliated entities ("Stavola") for $1.2 billion in cash, subject to customary post-closing adjustments. Founded in 1948, Stavola is an aggregates-led and vertically integrated construction materials company primarily serving the New York-New Jersey Metropolitan Statistical Area (“MSA”) through its network of five hard rock natural aggregates quarries, twelve asphalt plants, and three recycled aggregates sites. For the last twelve months ended June 30, 2024 (“LTM”), Stavola generated revenues of $283 million and Adjusted EBITDA of $100 million, representing a 35% Adjusted EBITDA Margin. The aggregates business contributed 56% to Stavola’s LTM Adjusted EBITDA. The structure of the transaction is expected to create tax benefits attributable to Arcosa with a net present value of approximately $125 million.

Commenting on the acquisition, Antonio Carrillo, Arcosa’s President and Chief Executive Officer, noted, "Since becoming an independent public company in 2018, Arcosa has successfully executed against its long-term vision to grow in attractive markets and reduce the complexity and cyclicality of the overall business through strategic acquisitions and select divestitures. Over that time, we have expanded our Construction Products business both organically and inorganically, deploying approximately $1.5 billion on value enhancing acquisitions to date and increasing our aggregates presence in the top 50 MSAs.

“The acquisition of Stavola accelerates Arcosa’s strategic transformation by adding a premier aggregates-led platform in the nation’s largest MSA with favorable attributes from its exposure to lower volatility infrastructure-led end-markets. Pro forma for the transactions, Construction Products represents 65% of Arcosa’s LTM Adjusted EBITDA, and consolidated LTM Adjusted EBITDA Margin expands approximately 220 basis points. Stavola brings an experienced management team, a reputation for strong customer service, and a successful track record.”

Strategic Divestitures

Divestiture of Steel Components

Arcosa has also entered into a definitive agreement to sell its steel components business to Stellex Capital Management LLC, a New York-based private equity firm.

With a 150+ year legacy, Arcosa’s steel components business is a leading supplier of railcar coupling devices, railcar axles, and circular forgings. Based in Pennsylvania and operating under the brands McConway & Torley, Standard Forged Products, and McKees Rock Forgings, the business serves rail, mining, and other infrastructure-related industries. Reported within the Company’s Transportation Products segment, LTM revenues were $150 million for the steel components business.

Additional Portfolio Actions

During the second quarter of 2024, the Company took additional actions to optimize its portfolio and improve margins:

–Divested its single-location subscale asphalt and paving operation located in Tennessee that was operating at a modest loss

–Sold a non-operating facility within Engineered Structures

–Exited a small underperforming natural aggregates operation serving the Permian Basin in west Texas and redeployed the equipment.

Total consideration for the divestitures was $137 million, which will be used to pay down debt.

Commenting on the portfolio actions, Carrillo continued, "Today’s announcements underscore the strength of our company and our confidence in the growth opportunities ahead of us. Construction Products and Engineered Structures are benefitting from increased scale and more resilient platforms and are well-positioned to benefit from infrastructure-driven tailwinds. Additionally, our two remaining cyclical businesses, wind towers and barge, command industry-leading positions with solid backlog visibility in place and anticipated multi-year market recoveries underway.

“We have committed financing in place to fund the purchase of Stavola that will result in initial net leverage above our targeted range. Our permanent financing strategy will allow for rapid deleveraging at an attractive cost of capital. Based on the anticipated strength of our cash flow generation, our goal is to return to our long-term net leverage targeted range within 18 months."

Carrillo concluded, “We believe these portfolio actions underscore our commitment to increasing long-term shareholder value and our disciplined approach to capital allocation. We look forward to welcoming the Stavola team and customer base to Arcosa, and express our gratitude to the employees of our steel components business for their dedication and contributions to Arcosa.”

Strategic and Financial Rationale for Portfolio Actions

–Extends Construction Products footprint into the nation’s largest MSA with a scaled and vertically integrated aggregates and FOB asphalt operation. Stavola operates in an attractive region with increased exposure to lower volatility, infrastructure-led end markets. Competitive advantages include a difficult to replicate leadership position underpinned by long-term customer relationships and an estimated 350 million tons of hard rock aggregates reserves commanding industry-leading profitability metrics.

–Represents attractive valuation for a scaled aggregates-led business with premium financial attributes. The $1.2 billion purchase price reflects a 10.7x multiple of Stavola’s LTM Adjusted EBITDA, net of the present value of tax attributes created from the acquisition, and 12.0x on a gross basis.

–Increases Arcosa's exposure to higher margin Construction Products Adjusted EBITDA. Stavola enhances the scale and margin profile of our Construction Products segment. On a pro forma LTM basis, Construction Products revenues increase 28% to $1.3 billion and Adjusted Segment EBITDA grows 42% to $342 million, resulting in 260 basis points of Adjusted Segment EBITDA margin improvement.

–Reduces the complexity and cyclicality of the portfolio. Divestiture of the steel components business, along with the other recent strategic actions, results in reduced exposure to cyclical end-markets and improved margin.

–Enhances Arcosa's overall profitability and financial profile. Pro forma for the transactions, Construction Products will represent 65% of Arcosa’s Adjusted EBITDA excluding corporate costs, and the Company’s LTM Adjusted EBITDA Margin expands approximately 220 basis points. Today’s announcements are decisive actions to optimize our portfolio, enhance the quality of our earnings, and deliver superior value for our shareholders.

–Portfolio resilience supports Arcosa’s ability to maintain a healthy balance sheet through prudent deleveraging. Upon completion of the acquisition of Stavola, the Company’s pro forma LTM Net Debt to Adjusted EBITDA is approximately 3.7x. The increased scale of our growth businesses and anticipated market recovery in our cyclical businesses, bolstered by current backlog visibility, gives us line of sight to increased cash flow generation. With debt reduction as our near-term capital allocation priority, our goal is to de-lever to our long-term target of 2.0 to 2.5x within 18 months.

Financing

Arcosa has obtained $1.2 billion of committed secured bridge loan financing in connection with the execution of the agreement to acquire Stavola, as well as a backstop to its existing $600 million revolving credit facility. Prior to the transaction close, the Company anticipates accessing the long-term debt capital markets for permanent financing with a mix of secured and unsecured debt that incorporates prepayment flexibility.

Approvals and Timing

The actions announced today have been unanimously approved by the Company’s Board of Directors. Arcosa has obtained all necessary regulatory approvals for the acquisition of Stavola and the divestiture of the steel components business. The Company anticipates the acquisition will be completed in the fourth quarter and the divestiture is expected to close during the third quarter.

Advisors

Barclays and Evercore served as financial advisors to Arcosa on the acquisition of Stavola. Evercore also served as financial advisor to Arcosa on the divestiture of the steel components business. Kirkland & Ellis served as legal advisor to the Company on the acquisition, and Gibson, Dunn, & Crutcher served as legal advisor to Arcosa on the divestiture. J.P. Morgan, Bank of America Securities and Barclays have provided committed financing to Arcosa in connection with the acquisition of Stavola. Baker Botts served as the Company’s legal advisor on the committed financing.

Conference Call Details

A conference call is scheduled for 8:30 a.m. Eastern Time on August 2, 2024 to discuss the transactions and our second quarter 2024 results announced today in a separate release. To listen to the conference call webcast, please visit the Investor Relations section of Arcosa’s website at https://ir.arcosa.com. A slide presentation for this conference call will be posted on the Company’s website in advance of the call at https://ir.arcosa.com. The audio conference call number is 800-343-1703 for domestic callers and 785-424-1116 for international callers. The conference ID is ARCOSA and the passcode is 24246. An audio playback will be available through 11:59 p.m. Eastern Time on August 16, 2024, by dialing 800-839-1162 for domestic callers and 402-220-0398 for international callers. A replay of the webcast will be available for one year on Arcosa’s website at https://ir.arcosa.com/news-events/events-presentations.

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider of infrastructure-related products and solutions with leading positions in construction, engineered structures, and transportation markets. Arcosa reports its financial results in three principal business segments: Construction Products, Engineered Structures, and Transportation Products. For more information, visit www.arcosa.com.

Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” “plans,” “goal,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding failure to successfully complete and integrate acquisitions, including Ameron and Stavola, or divest any business, including the steel components business, or failure to achieve the expected benefits of acquisitions or divestitures; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; the impact of inflation and costs of materials; assumptions regarding achievements of the expected benefits from the Inflation Reduction Act; the delivery or satisfaction of any backlog or firm orders; the impact of pandemics on Arcosa’s business; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see “Risk Factors” and the “Forward-Looking Statements” section of “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Arcosa's Form 10-K for the year ended December 31, 2023 and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

INVESTOR CONTACTS

| | | | | | | | |

| Gail M. Peck | Erin Drabek | David Gold |

| Chief Financial Officer | Director of Investor Relations | ADVISIRY Partners |

| | |

| T 972.942.6500 | | T 212.661.2220 |

| InvestorResources@arcosa.com | David.Gold@advisiry.com |

MEDIA CONTACT

TABLES TO FOLLOW

Reconciliation of Stavola and Steel Components Adjusted EBITDA

(in millions)

(unaudited)

“EBITDA” is defined as net income plus interest, taxes, depreciation, depletion, and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for certain items that are not reflective of normal earnings. GAAP does not define EBITDA or Adjusted EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including net income. We believe Adjusted EBITDA assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items which can vary significantly depending on many factors.

| | | | | |

| Twelve Months Ended

June 30, 2024 |

| Stavola: | |

| Net income | $ | 71.8 | |

| Add: | |

| Interest expense, net | 0.8 | |

| Provision for income taxes | — | |

| Depreciation, depletion, and amortization expense | 18.9 | |

| EBITDA | 91.5 | |

| Non-recurring adjustments | 9.0 | |

| Stavola Adjusted EBITDA | $ | 100.5 | |

| | | | | |

| Twelve Months Ended

June 30, 2024 |

| Steel components business: | |

| Operating profit | $ | 11.3 | |

| Add: Depreciation and amortization | 9.6 | |

| Steel components EBITDA | 20.9 | |

| Steel components Adjusted EBITDA | $ | 20.9 | |

Reconciliation of Net Debt to Adjusted EBITDA

($ in millions)

(unaudited)

GAAP does not define “Net Debt” and it should not be considered as an alternative to cash flow or liquidity measures defined by GAAP. The Company uses Net Debt, which it defines as total debt minus cash and cash equivalents to determine the extent to which the Company’s outstanding debt obligations would be satisfied by its cash and cash equivalents on hand. The Company also uses “Net Debt to Adjusted EBITDA”, which it defines as Net Debt divided by Adjusted EBITDA for the trailing twelve months as a metric of its current leverage position. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions.

| | | | | | | | | | | | | | | | | |

| June 30, 2024(1) | | Pro forma Stavola | | Pro forma

June 30, 2024 |

| Total Debt, excluding debt issuance costs | $ | 710.4 | | | $ | 1,200.0 | | | $ | 1,910.4 | |

| Cash and cash equivalents | 103.7 | | | — | | | 103.7 | |

| Net Debt | $ | 606.7 | | | $ | 1,200.0 | | | $ | 1,806.7 | |

| | | | | |

Adjusted EBITDA (last twelve months)(1) | $ | 393.3 | | | $ | 100.5 | | | $ | 493.8 | |

| Net Debt to Adjusted EBITDA | 1.5 | | | | | 3.7 | |

(1) See separate press release announcing Arcosa's second quarter 2024 earnings results.

v3.24.2.u1

Cover Page and DEI Document

|

Aug. 01, 2024 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001739445

|

| Title of 12(b) Security |

Common Stock ($0.01 par value)

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

Arcosa, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-38494

|

| Entity Tax Identification Number |

82-5339416

|

| Entity Address, Address Line One |

500 N. Akard Street, Suite 400

|

| Entity Address, City or Town |

Dallas,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

972

|

| Local Phone Number |

942-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

ACA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12