ADT Inc. (NYSE: ADT) (“ADT” or the “Company”) today announced a

proposed secondary public offering of 56,000,000 shares of the

Company’s common stock held by certain entities managed by

affiliates of Apollo Global Management, Inc. (the “Selling

Stockholders”). The underwriters will have a 30-day option to

purchase up to an additional 8,400,000 shares of common stock from

the Selling Stockholders. The Company is not selling any shares and

will not receive any proceeds from the proposed offering.

In addition, ADT has authorized the concurrent purchase from the

underwriters of 16,000,000 shares of common stock as part of the

secondary public offering (the “Share Repurchase”) subject to the

completion of the offering. The Share Repurchase is part of the

Company’s existing $350 million share repurchase program. The

underwriters will not receive any underwriting fees for the shares

being repurchased by the Company.

The underwriters may offer the shares of common stock, other

than shares subject to the Share Repurchase, from time to time for

sale in one or more transactions to purchasers, directly or through

agents, or through brokers in brokerage transactions, on the New

York Stock Exchange, in the over-the-counter market,

through negotiated transactions or in a combination of such methods

of sale, at a fixed price or prices, which may be changed, or

otherwise at market prices prevailing at the time of sale, at

prices related to prevailing market prices or at negotiated prices,

subject to receipt and acceptance by them and subject to their

right to reject any order in whole or in part.

Barclays, Citigroup and BTIG are acting as book-running managers

for the proposed offering.

A shelf registration statement (including a prospectus) relating

to these securities has been filed with the Securities and Exchange

Commission (the “Commission”) and is effective. A preliminary

prospectus supplement relating to the offering has also been filed

with the Commission. Before investing, interested parties should

read the shelf registration statement, preliminary prospectus

supplement and other documents filed with the Commission for

information about ADT and the offering. You may get these documents

for free by visiting EDGAR on the Commission’s website at sec.gov.

Alternatively, a copy may be obtained from: Barclays Capital Inc.,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue

Edgewood, NY 11717, by telephone: (888) 603-5847 or by email at

Barclaysprospectus@broadridge.com, Citigroup, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

by telephone at (800-831-9146) and BTIG, LLC, 350 Bush Street, 9th

FL, San Francisco, CA 94104, Attention: Syndicate Department, by

telephone: (415-248-2200) or by email at

prospectusdelivery@btig.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About ADT Inc.

ADT provides safe, smart and sustainable solutions for people,

homes and small businesses. Through innovative offerings, unrivaled

safety and a premium customer experience, all delivered by the

largest network of smart home security professionals in the U.S.,

we empower people to protect and connect to what matters most.

ADT Contacts

Investor Relations: investorrelations@adt.com; 888-238-8525

Media Relations: media@adt.com.

Forward-Looking Statements

ADT has made statements in this press release that may

constitute “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995 and are made

in reliance on the safe harbor protections provided thereunder.

While ADT has specifically identified certain information as being

forward-looking in the context of its presentation, we caution you

that all statements contained in this press release that are not

clearly historical in nature, including, among other things, the

proposed secondary public offering of the common stock; the

proposed repurchase of shares of the common stock; any stated or

implied outcomes with regards to the foregoing; and other matters.

Without limiting the generality of the preceding sentences, any

time the Company uses the words “ongoing,” “expects,” “intends,”

“will,” “anticipates,” “believes,” “confident,” “continue,”

“propose,” “seeks,” “could,” “may,” “should,” “estimates,”

“forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,”

“projects,” and, in each case, their negative or other various or

comparable terminology, and similar expressions, the Company

intends to clearly express that the information deals with possible

future events and is forward-looking in nature. However, the

absence of these words or similar expressions does not mean that a

statement is not forward-looking. For ADT, particular uncertainties

that could cause our actual results to be materially different than

those expressed in our forward-looking statements include, without

limitation, risks related to and the effect of the proposed

secondary public offering of the common stock; activity in

repurchasing shares of ADT’s common stock; and risks that are

described in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, the Company’s Quarterly Report on Form

10-Q for the quarter ended March 31, 2024, the Company’s Quarterly

Report on Form 10-Q for the quarter ended June 30, 2024 and the

Company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024 and other filings with the Commission, including

the sections titled “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations”

contained therein. Any forward-looking statement represents our

estimates and assumptions only as of the date of this press release

and, except as required by law, ADT undertakes no obligation to

update or review publicly any forward-looking statements, whether

as a result of new information, future events, or otherwise after

the date of this press release.

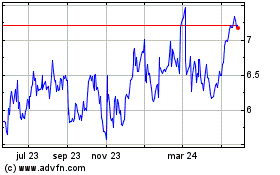

ADT (NYSE:ADT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

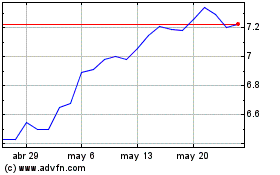

ADT (NYSE:ADT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024