Form SD - Specialized disclosure report

25 Septiembre 2024 - 1:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

ALAMOS GOLD INC.

(Exact name of the registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ontario | | 001-35783 | | Not Applicable |

| (State or other jurisdiction of | | (Commission file number) | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | | | |

Brookfield Place, 181 Bay Street, Suite 3910

Toronto, Ontario, M5J 2T3

Canada

(Address of principal executive offices)

Gregory Fisher

Chief Financial Officer

(416) 368-9932

(Name and telephone number, including area code,

of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

☐ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, _______.

☒ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023.

SECTION 1 - CONFLICT MINERALS DISCLOSURE

| | | | | |

| Item 1.01 - Conflict Minerals Disclosure and Report |

Not applicable.

Not applicable.

SECTION 2 – RESOURCE EXTRACTION ISSUER DISCLOSURE

| | | | | |

| Item 2.01 - Resource Extraction Issuer Disclosure and Report |

This Form SD of Alamos Gold Inc. (the “Company”) is filed pursuant to Rule 13q-1 promulgated under the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2023.

(c) Alternative Reporting

The Company is subject to Canada’s Extractive Sector Transparency Measures Act (“ESTMA”). The Company is relying on the alternative reporting provision under Item 2.01(c) and providing its ESTMA report for the year ended December 31, 2023 to satisfy the requirements of Item 2.01. The Company's payment disclosure required by Form SD is included as Exhibit 2.01. A copy of the Company’s ESTMA report is furnished as Exhibit 99.1 to this Form SD and is also publicly available at https://www.alamosgold.com/sustainability/default.aspx.

The Company is also filing on behalf of Argonaut Gold Inc. (“Argonaut”) and Orford Mining Corporation (“Orford”), each of which are subsidiaries of the Company that the Company acquired in 2024. In respect of each of Argonaut and Orford, the Company is also relying on the alternative reporting provision of Item 2.01 and providing each of their ESTMA reports for the year ended December 31, 2023 to satisfy the requirements of Item 2.01 in respect of those subsidiaries. Argonaut's payment disclosure required by Form SD is included as Exhibit 2.01 and a copy of Argonaut’s ESTMA report is furnished as Exhibit 99.2 to this Form SD. Orford's payment disclosure required by Form SD is included as Exhibit 2.01 and a copy of Orford’s ESTMA report is furnished as Exhibit 99.3 to this Form SD. Each of Argonaut’s and Orford’s ESTMA reports is also publicly available at https://www.alamosgold.com/sustainability/default.aspx.

SECTION 3 - EXHIBITS

The following exhibits are filed as part of this Form SD.

| | | | | | | | |

| Exhibit | | Title |

| |

| 2.01 | | Interactive Data File (Form SD for the year ended December 31, 2023 filed in XBRL) |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | |

| Date: September 25, 2024 | ALAMOS GOLD INC. |

| | |

| By: | /s/ Gregory Fisher |

| Name: Gregory Fisher |

| | Title: Chief Financial Officer |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report | |

| Reporting Entity Name | Alamos Gold Inc. |

| Reporting Year | From | 1/1/2023 | To: | 12/31/2023 | Date submitted | 5/29/2024 |

| Reporting Entity ESTMA Identification Number | E695115 | ¤ Original Submission ¦ Amended Report | | |

| |

Other Subsidiaries Included

(optional field) | N/A | |

| | |

| For Consolidated Reports - Subsidiary Reporting Entities Included in Report: | Minas de Oro Nacional S.A. de C.V. (E529821), Minera Santa Rita, S. de R.L. de C.V. (E619187), Dogu Biga Madencilik Sanayi Ticaret A.S. (E427533), Kuzey Biga Madencilik Sanayi Ticaret A.S. (E227782), Quartz Mountain Gold Ltd. (E370515), Richmont Mines Inc. (E538246) | |

| | |

| Not Substituted | | | | |

| | |

| Attestation by Reporting Entity | | | | | | | |

| In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. | |

| |

| |

| |

| |

| | | | | | | | |

| | | | | | | | |

| Full Name of Director or Officer of Reporting Entity | Greg Fisher | Date | 5/29/2024 | |

| Position Title | Chief Financial Officer | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | |

| Reporting Entity Name | Alamos Gold Inc. | | Currency of the Report | USD | | |

| Reporting Entity ESTMA Identification Number | E695115 | | | | | |

| Subsidiary Reporting Entities (if necessary) | Minas de Oro Nacional S.A. de C.V. (E529821), Minera Santa Rita, S. de R.L. de C.V. (E619187), Dogu Biga Madencilik Sanayi Ticaret A.S. (E427533), Kuzey Biga Madencilik Sanayi Ticaret A.S. (E227782), Quartz Mountain Gold Ltd. (E370515), Richmont Mines Inc. (E538246) | | | | |

| Payments by Payee |

| Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 |

| Canada | Municipality of Matachewan | | 670,000 | | | | | | | 670,000 | |

| Canada | Matachewan First Nation | | | | 2,030,000 | | | | | 2,030,000 | |

| Canada | Temagami First Nation | | | | 620,000 | | | | | 620,000 | |

| Canada | Municipality of Dubreuilville | | 200,000 | | 30,000 | | | | | 230,000 | |

| Canada | Batchewana First Nation | | | | 1,430,000 | | | | | 1,430,000 | |

| Canada | Michipicoten First Nation | | | | 380,000 | | | | | 380,000 | |

| Canada | Marcel Colomb First Nation | | | | 1,720,000 | | | | | 1,720,000 | |

| Mexico | Federal Government of Mexico | | 7,100,000 | 1,370,000 | 1,050,000 | | | | | 9,520,000 | |

| Mexico | Municipality of Sahuaripa | | 30,000 | | | | | | 1,330,000 | 1,360,000 | The reported amount includes $1,330,000 of payments based on the cost incurred by the company for the maintenance of community roads and construction of a bridge. |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Additional Notes: | (a) All payments are reported in US dollars (USD), the functional currency of the Reporting Entity. All reported payments have been rounded to the nearest $10,000 USD.

(b) Where payments were made in currencies other than US dollars, the payments were converted into US dollars using the average annual rates as follows:

1 USD = CAD: 1.3497

1 USD = MXN: 17.7334 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | |

| Reporting Entity Name | Alamos Gold Inc. | | Currency of the Report | USD | | |

| Reporting Entity ESTMA Identification Number | E695115 | | | | |

| Subsidiary Reporting Entities (if necessary) | Minas de Oro Nacional S.A. de C.V. (E529821), Minera Santa Rita, S. de R.L. de C.V. (E619187), Dogu Biga Madencilik Sanayi Ticaret A.S. (E427533), Kuzey Biga Madencilik Sanayi Ticaret A.S. (E227782), Quartz Mountain Gold Ltd. (E370515), Richmont Mines Inc. (E538246) | | | |

| Payments by Project |

| Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 |

| Canada | Young-Davidson | 670,000 | | 2,650,000 | | | | | 3,320,000 | |

| Canada | Island Gold | 200,000 | | 1,840,000 | | | | | 2,040,000 | |

| Canada | Lynn Lake | | | 1,720,000 | | | | | 1,720,000 | |

| Mexico | Mulatos | 7,130,000 | 1,370,000 | 790,000 | | | | 1,330,000 | 10,620,000 | |

| Mexico | Chanate | | | 260,000 | | | | | 260,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Additional Notes3: | (a) All payments are reported in US dollars (USD), the functional currency of the Reporting Entity. All reported payments have been rounded to the nearest $10,000 USD.

(b) Where payments were made in currencies other than US dollars, the payments were converted into US dollars using the average annual rates as follows:

1 USD = CAD: 1.3497

1 USD = MXN: 17.7334 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report | |

| Reporting Entity Name | Argonaut Gold Inc. |

| Reporting Year | From | 2023-01-01 | To: | 2023-12-31 | Date submitted | 2024-05-29 |

| Reporting Entity ESTMA Identification Number | E217052 | ¤ Original Submission ¦ Amended Report | | |

| | |

Other Subsidiaries Included

(optional field) | | |

| | |

| For Consolidated Reports - Subsidiary Reporting Entities Included in Report: | E268348 Castle Gold Corporation, E499979 Pediment Gold Corp., E270359 Alio Gold Inc., E310952 Alio Gold (US) Inc. | |

| | |

| Not Substituted | | | | |

| | |

| Attestation by Reporting Entity | | | | | | | |

| In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. | |

| |

| |

| |

| |

| | | | | | | | |

| | | | | | | | |

| Full Name of Director or Officer of Reporting Entity | David Ponczoch | Date | 2024-05-29 | |

| Position Title | Chief Financial Officer | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 2023-01-01 | To: | 2023-12-31 | | | | | | |

| Reporting Entity Name | Argonaut Gold Inc. | Currency of the Report | USD | | | | |

| Reporting Entity ESTMA Identification Number | E217052 | | | | | |

| Subsidiary Reporting Entities (if necessary) | E268348 Castle Gold Corporation, E499979 Pediment Gold Corp., E270359 Alio Gold Inc., E310952 Alio Gold (US) Inc. | | | | |

| Payments by Payee |

| Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 |

| Canada | Batchewana First Nation | | - | - | 10,000 | - | 110,000 | - | - | 120,000 | The amount paid to the payee represents payments paid to the Batchewana First Nation of US$120,000 paid in cash for annual fees and commercial production bonuses. |

| Canada | Michipicoten First Nation | | - | - | 140,000 | - | 2,020,000 | - | - | 2,160,000 | The amount paid to the payee represents payments paid to the Michipicoten First

Nation of US$140,000 paid in cash for annual fees, US$1,280,000 paid in cash for commercial production bonuses and US$740,000 paid in-kind through share issuances of common shares at the market price on date of issuance. |

| Canada | Missanabie Cree First Nation | | - | - | 100,000 | - | - | - | - | 100,000 | The amount paid to the payee represents payments paid to the Missanabie Cree First Nation of US$100,000 paid in cash for annual fees. |

| Canada | Métis Nation of Ontario | | - | - | 60,000 | - | 190,000 | - | - | 250,000 | The amount paid to the payee represents payments paid to the Métis Nation of Ontario of US$60,000 paid in cash for annual fees and US$190,000 for commercial production bonuses. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mexico | Federal Government of Mexico | | 3,060,000 | 1,650,000 | 1,980,000 | - | - | - | - | 6,690,000 | The amount paid to the payee represents payments comprising royalties on precious metals revenue paid in cash of US$1,650,000; permit and concession fees paid in cash of US$1,980,000; mining taxes paid in cash of US$1,650,000 and corporate income taxes paid in cash of US$1,410,000. |

| United States of America | Federal Government of the United States of America | | 430,000 | - | 100,000 | - | - | - | - | 530,000 | The amount paid to the payee represents US$430,000 of tax payments paid in cash to the US Department of the Treasury and US$100,000 of concession payments paid in cash to the Bureau of Land Management. |

| United States of America | State of Nevada | | 1,310,000 | - | 210,000 | - | - | - | - | 1,520,000 | The breakdown of amounts paid to the Payee represents the following: (1) Nevada Department of Taxation: state mining taxes paid in cash of US$1,310,000, and (2) Nevada Division of Environmental Protection: reclamation permit fees and annual air quality permit fees paid in cash amounting to US$170,000, and (3) other Nevada Divisions fees paid in cash amounting to US$40,000 |

| | | | | | | | | | | |

| Additional Notes: | (a) All payments are reported in US dollars (USD), the functional currency of the Reporting Entity. All reported payments have been rounded to the nearest $10,000 USD. (b) Where payments were made in currencies other than US dollars, the payments were converted into US dollars using the average annual rates as follows: 1 USD = CAD: 1.3497 1 USD = MXN: 17.7334 |

1 Enter the proper name of the Payee receiving the money (i.e. the municipality of x, the province of y, national government of z). | |

2 Optional field. | |

3 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. | |

4 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the Additional notes row or the Notes column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 2023-01-01 | To: | 2023-12-31 | | | | | | |

| Reporting Entity Name | Argonaut Gold Inc. | Currency of the Report | USD | | |

| Reporting Entity ESTMA Identification Number | E217052 | | | | |

| Subsidiary Reporting Entities (if necessary) | E268348 Castle Gold Corporation, E499979 Pediment Gold Corp., E270359 Alio Gold Inc., E310952 Alio Gold (US) Inc. | | | |

| Payments by Project |

| Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 |

| Canada | Magino | - | - | 310,000 | - | 2,320,000 | - | - | 2,630,000 | The amount Includes US$740,000 paid to the Michipicoten First Nation in-kind through share issuance of common shares at the market price on date of issuance. |

| Mexico | Ana Paula | - | - | 800,000 | - | - | - | - | 800,000 | |

| Mexico | Cerro del Gallo | 150,000 | - | 220,000 | - | - | - | - | 370,000 | |

| Mexico | El Castillo Complex | 2,130,000 | 1,190,000 | 150,000 | - | - | - | - | 3,470,000 | |

| Mexico | La Colorada | 780,000 | 460,000 | 240,000 | - | - | - | - | 1,480,000 | |

| Mexico | San Antonio | - | - | 570,000 | - | - | - | - | 570,000 | |

| United States of America | Florida Canyon | 1,740,000 | - | 310,000 | - | - | - | - | 2,050,000 | |

| | | | | | | | | | | |

| Additional Notes: | (a) All payments are reported in US dollars (USD), the functional currency of the Reporting Entity. All reported payments have been rounded to the nearest $10,000 USD. (b) Where payments were made in currencies other than US dollars, the payments were converted into US dollars using the average annual rates as follows: 1 USD = CAD: 1.3497 1 USD = MXN: 17.7334 |

1 Enter the project that the payment is attributed to. Some payments may not be attributable to a specific project, and do not need to be disclosed in the "Payments by Project" table. |

2 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

3 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the "Additional Notes" row or the "Notes" column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report | |

| Reporting Entity Name | Orford Mining Corporation |

| Reporting Year | From | 1/1/2023 | To: | 12/31/2023 | Date submitted | 5/30/2024 |

| Reporting Entity ESTMA Identification Number | E002193 | ¤ Original Submission ¦ Amended Report | | |

| | |

Other Subsidiaries Included

(optional field) | | |

| | |

| Not Consolidated | | |

| | |

| Not Substituted | | | | |

| | |

| Attestation by Reporting Entity | | | | | | | |

| In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. | |

| |

| |

| |

| |

| | | | | | | | |

| | | | | | | | |

| Full Name of Director or Officer of Reporting Entity | Lynsey Sherry | Date | 5/30/2024 | |

| Position Title | VP, Finance | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | |

| Reporting Entity Name | Orford Mining Corporation | Currency of the Report | USD | | | | |

| Reporting Entity ESTMA Identification Number | E002193 | | | | | |

| Subsidiary Reporting Entities (if necessary) | | | | | |

| Payments by Payee |

| Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 |

| Canada -Quebec | Gouvernement du Québec | Ministère des Ressources naturelles et des Forêts | | | 180,000 | | | | | 180,000 | Mineral claim renewals |

| Canada -Quebec | Gouvernement du Québec | Energie et Ressources Naturelles Quebec | | | 190,000 | | | | | 190,000 | Mineral claim renewals |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Additional Notes: | (a) All payments are reported in US dollars (USD), the functional currency of the Reporting Entity. All reported payments have been rounded to the nearest $10,000 USD. (b) Where payments were made in currencies other than US dollars, the payments were converted into US dollars using the average annual rates as follows: 1 USD = CAD: 1.3497 |

1 Enter the proper name of the Payee receiving the money (i.e. the municipality of x, the province of y, national government of z). |

2 Optional field. |

3 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

4 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the Additional notes row or the Notes column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | | | |

| Reporting Entity Name | Orford Mining Corporation | Currency of the Report | USD | | |

| Reporting Entity ESTMA Identification Number | E002193 | | | | |

| Subsidiary Reporting Entities (if necessary) | | | | | |

| Payments by Project |

| Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 |

| Canada -Quebec | West Raglan | | | 150,000 | | | | | 150,000 | Mineral claim renewals |

| Canada -Quebec | Joutel Properties | | | 10,000 | | | | | 10,000 | Mineral claim renewals |

| Canada -Quebec | Qiqavik Properties | | | 80,000 | | | | | 80,000 | Mineral claim renewals |

| Canada -Quebec | Lithium Properties | | | 130,000 | | | | | 130,000 | Mineral claim renewals |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Additional Notes3: | (a) All payments are reported in US dollars (USD), the functional currency of the Reporting Entity. All reported payments have been rounded to the nearest $10,000 USD. (b) Where payments were made in currencies other than US dollars, the payments were converted into US dollars using the average annual rates as follows: 1 USD = CAD: 1.3497 |

1 Enter the project that the payment is attributed to. Some payments may not be attributable to a specific project, and do not need to be disclosed in the "Payments by Project" table. |

2 When payments are made in-kind, the notes field must highlight which payment includes in-kind contributions and the method for calculating the value of the payment. |

3 Any payments made in currencies other than the report currency must be identified. The Reporting Entity may use the "Additional Notes" row or the "Notes" column to identify any payments that are converted, along with the exchange rate and primary method used for currency conversions. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_AlternativeReportingRegime |

| Namespace Prefix: |

rxp_ |

| Data Type: |

rxp:alternativeReportingRegimeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Payments, by Category - 12 months ended Dec. 31, 2023 - USD ($)

$ in Thousands |

Alamos Gold, Inc. [Member] |

Argonaut Gold, Inc. [Member] |

Orford Mining Corporation [Member] |

| Payments: |

|

|

|

| Taxes |

$ 8,000

|

$ 4,800

|

|

| Royalties |

1,370

|

1,650

|

|

| Fees |

7,260

|

2,600

|

$ 370

|

| Bonuses |

|

2,320

|

|

| Infrastructure |

1,330

|

|

|

| Total Payments |

$ 17,960

|

$ 11,370

|

$ 370

|

| X |

- References

+ Details

| Name: |

rxp_Bonuses |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_Fees |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_InfrastructureImprovements |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_PaymentsLineItems |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_Royalties |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_Taxes |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

rxp_TotalPayments |

| Namespace Prefix: |

rxp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

v3.24.3

Payments, by Project - 12 months ended Dec. 31, 2023 - USD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Bonuses |

Infrastructure |

Total Payments |

| Alamos Gold, Inc. [Member] |

|

|

|

|

|

|

| Total |

$ 8,000

|

$ 1,370

|

$ 7,260

|

|

$ 1,330

|

$ 17,960

|

| Alamos Gold, Inc. [Member] | Young-Davidson [Member] |

|

|

|

|

|

|

| Total |

670

|

|

2,650

|

|

|

3,320

|

| Alamos Gold, Inc. [Member] | Island Gold [Member] |

|

|

|

|

|

|

| Total |

200

|

|

1,840

|

|

|

2,040

|

| Alamos Gold, Inc. [Member] | Lynn Lake [Member] |

|

|

|

|

|

|

| Total |

|

|

1,720

|

|

|

1,720

|

| Alamos Gold, Inc. [Member] | Mulatos [Member] |

|

|

|

|

|

|

| Total |

7,130

|

1,370

|

790

|

|

$ 1,330

|

10,620

|

| Alamos Gold, Inc. [Member] | Chanate [Member] |

|

|

|

|

|

|

| Total |

|

|

260

|

|

|

260

|

| Argonaut Gold, Inc. [Member] |

|

|

|

|

|

|

| Total |

4,800

|

1,650

|

2,600

|

$ 2,320

|

|

11,370

|

| Argonaut Gold, Inc. [Member] | Magino [Member] |

|

|

|

|

|

|

| Total |

|

|

310

|

$ 2,320

|

|

2,630

|

| Argonaut Gold, Inc. [Member] | Ana Paula [Member] |

|

|

|

|

|

|

| Total |

|

|

800

|

|

|

800

|

| Argonaut Gold, Inc. [Member] | Cerro del Gallo [Member] |

|

|

|

|

|

|

| Total |

150

|

|

220

|

|

|

370

|

| Argonaut Gold, Inc. [Member] | El Castillo Complex [Member] |

|

|

|

|

|

|

| Total |

2,130

|

1,190

|

150

|

|

|

3,470

|

| Argonaut Gold, Inc. [Member] | La Colorada [Member] |

|

|

|

|

|

|

| Total |

780

|

$ 460

|

240

|

|

|

1,480

|

| Argonaut Gold, Inc. [Member] | San Antonio [Member] |

|

|

|

|

|

|

| Total |

|

|

570

|

|

|

570

|

| Argonaut Gold, Inc. [Member] | Florida Canyon [Member] |

|

|

|

|

|

|

| Total |

$ 1,740

|

|

310

|

|

|

2,050

|

| Orford Mining Corporation [Member] |

|

|

|

|

|

|

| Total |

|

|

370

|

|

|

370

|

| Orford Mining Corporation [Member] | West Raglan [Member] |

|

|

|

|

|

|

| Total |

|

|

150

|

|

|

150

|

| Orford Mining Corporation [Member] | Joutel Properties [Member] |

|

|

|

|

|

|

| Total |

|

|

10

|

|

|

10

|

| Orford Mining Corporation [Member] | Qiqavik Properties [Member] |

|

|

|

|

|

|

| Total |

|

|

80

|

|

|

80

|

| Orford Mining Corporation [Member] | Lithium Properties [Member] |

|

|

|

|

|

|

| Total |

|

|

$ 130

|

|

|

$ 130

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=agi_AlamosGoldInc.Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_YoungDavidsonMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_IslandGoldMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_LynnLakeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_MulatosMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_ChanateMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=agi_ArgonautGoldInc.Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_MaginoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_AnaPaulaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_CerroDelGalloMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_ElCastilloComplexMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_LaColoradaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_SanAntonioMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_FloridaCanyonMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=agi_OrfordMiningCorporationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_WestRaglanMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_JoutelPropertiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_QiqavikPropertiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=agi_LithiumPropertiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

Payments, by Government - 12 months ended Dec. 31, 2023 - USD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Bonuses |

Infrastructure |

Total Payments |

| Alamos Gold, Inc. [Member] |

|

|

|

|

|

|

| Total |

$ 8,000

|

$ 1,370

|

$ 7,260

|

|

$ 1,330

|

$ 17,960

|

| Alamos Gold, Inc. [Member] | CANADA | Municipality of Matachewan [Member] |

|

|

|

|

|

|

| Total |

670

|

|

|

|

|

670

|

| Alamos Gold, Inc. [Member] | CANADA | Matachewan First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

2,030

|

|

|

2,030

|

| Alamos Gold, Inc. [Member] | CANADA | Temagami First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

620

|

|

|

620

|

| Alamos Gold, Inc. [Member] | CANADA | Municipality of Dubreuilville [Member] |

|

|

|

|

|

|

| Total |

200

|

|

30

|

|

|

230

|

| Alamos Gold, Inc. [Member] | CANADA | Batchewana First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

1,430

|

|

|

1,430

|

| Alamos Gold, Inc. [Member] | CANADA | Michipicoten First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

380

|

|

|

380

|

| Alamos Gold, Inc. [Member] | CANADA | Marcel Colomb First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

1,720

|

|

|

1,720

|

| Alamos Gold, Inc. [Member] | MEXICO | Federal Government of Mexico [Member] |

|

|

|

|

|

|

| Total |

7,100

|

1,370

|

1,050

|

|

|

9,520

|

| Alamos Gold, Inc. [Member] | MEXICO | Municipality of Sahuaripa [Member] |

|

|

|

|

|

|

| Total |

30

|

|

|

|

$ 1,330

|

1,360

|

| Argonaut Gold, Inc. [Member] |

|

|

|

|

|

|

| Total |

4,800

|

1,650

|

2,600

|

$ 2,320

|

|

11,370

|

| Argonaut Gold, Inc. [Member] | CANADA | Batchewana First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

10

|

110

|

|

120

|

| Argonaut Gold, Inc. [Member] | CANADA | Michipicoten First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

140

|

2,020

|

|

2,160

|

| Argonaut Gold, Inc. [Member] | CANADA | Missanabie Cree First Nation [Member] |

|

|

|

|

|

|

| Total |

|

|

100

|

|

|

100

|

| Argonaut Gold, Inc. [Member] | CANADA | Métis Nation of Ontario [Member] |

|

|

|

|

|

|

| Total |

|

|

60

|

$ 190

|

|

250

|

| Argonaut Gold, Inc. [Member] | MEXICO | Federal Government of Mexico [Member] |

|

|

|

|

|

|

| Total |

3,060

|

$ 1,650

|

1,980

|

|

|

6,690

|

| Argonaut Gold, Inc. [Member] | UNITED STATES | Federal Government of the United States of America [Member] |

|

|

|

|

|

|

| Total |

430

|

|

100

|

|

|

530

|

| Argonaut Gold, Inc. [Member] | UNITED STATES | State of Nevada [Member] |

|

|

|

|

|

|

| Total |

$ 1,310

|

|

210

|

|

|

1,520

|

| Orford Mining Corporation [Member] |

|

|

|

|

|

|

| Total |

|

|

370

|

|

|

370

|

| Orford Mining Corporation [Member] | CANADA | Gouvernement du Québec - Ministère des Ressources naturelles et des Forêts [Member] |

|

|

|

|

|

|

| Total |

|

|

180

|

|

|

180

|

| Orford Mining Corporation [Member] | CANADA | Gouvernement du Québec - Energie et Ressources Naturelles Quebec [Member] |

|

|

|

|

|

|

| Total |

|

|

$ 190

|

|

|

$ 190

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=agi_AlamosGoldInc.Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_CA |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MunicipalityOfMatachewanMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MatachewanFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_TemagamiFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MunicipalityOfDubreuilvilleMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_BatchewanaFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MichipicotenFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MarcelColombFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_MX |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_FederalGovernmentOfMexicoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MunicipalityOfSahuaripaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=agi_ArgonautGoldInc.Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MissanabieCreeFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_MetisNationOfOntarioMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_US |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_FederalGovernmentOfTheUnitedStatesOfAmericaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_StateOfNevadaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=agi_OrfordMiningCorporationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_GouvernementDuQuebecMinistereDesRessourcesNaturellesEtDesForetsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=agi_GouvernementDuQuebecEnergieEtRessourcesNaturellesQuebecMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

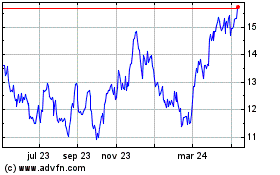

Alamos Gold (NYSE:AGI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

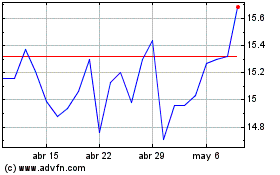

Alamos Gold (NYSE:AGI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025