false

0001614806

0001614806

2024-07-24

2024-07-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): July 24, 2024

GREAT AJAX CORP.

(Exact name of registrant as specified in charter)

| Maryland |

|

001-36844 |

|

46-5211870 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

799 Broadway

New York, NY 10003

(Address of principal executive offices)

Registrant’s telephone number, including

area code:

212-850-7770

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

AJX |

|

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| us-gaap:CommonStockMember |

Common Stock |

| Item 2.02. |

Results of Operations and Financial Condition |

On July 24, 2024, Great Ajax Corp., a Maryland corporation (the

“Company”), issued a press release regarding its financial results for the second quarter ended June 30, 2024 (the “Press

Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is available on the Company’s website.

The information provided in Item 2.02 of this report, including Exhibit

99.1, shall be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

| Item 9.01. |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

GREAT AJAX CORP. |

| |

|

| |

By: |

/s/ Mary Doyle |

| |

Name: |

Mary Doyle |

| |

Title: |

Principal Financial Officer and Principal Accounting Officer |

Dated: July 24, 2024

Exhibit 99.1

GREAT AJAX CORP. ANNOUNCES RESULTS FOR THE

QUARTER

ENDED JUNE 30, 2024

New York, NY—July 24, 2024

—Great Ajax Corp. (NYSE: AJX, "Great Ajax" or the "Company"), a Maryland corporation today announced the following

financial results for the quarter ended June 30, 2024.

Second Quarter Financial Highlights

| · | GAAP Net Loss attributable to common stockholders of $(12.7) million, or $(0.32) per diluted common sharei |

| · | Earnings Available for Distribution of $(9.6) million or $(0.24) per diluted common sharei,ii |

| · | Book value per common share of $5.56 at June 30, 2024i |

| · | Common dividend of $2.2 million paid, or $0.06 per common share |

| | |

Q2 2024 | | |

Q1 2024 | |

| Summary of Operating Results | |

| | | |

| | |

| GAAP Net Loss per Diluted Common Shareiz | |

$ | (0.32 | ) | |

$ | (2.41 | ) |

| GAAP Net Loss | |

$ | (12.7 | )million | |

$ | (74.3 | )million |

| | |

| | | |

| | |

| Non-GAAP Results | |

| | | |

| | |

| Earnings Available for Distribution per Diluted Common Sharei, ii | |

$ | (0.24 | ) | |

$ | (0.16 | ) |

| Earnings Available for Distributionii | |

$ | (9.6 | )million | |

$ | (4.8 | )million |

| | |

| | | |

| | |

| Book Value | |

| | | |

| | |

| Book Value per Common Sharei | |

$ | 5.56 | | |

$ | 6.87 | |

| Book Value | |

$ | 253.6 | million | |

$ | 254.3 | million |

| | |

| | | |

| | |

| Common Dividend | |

| | | |

| | |

| Common Dividend per Share | |

$ | 0.06 | | |

$ | 0.10 | |

| Common Dividend | |

$ | 2.2 | million | |

$ | 3.7 | million |

“We are very excited to be taking over the

management of Great Ajax,” said Michael Nierenberg, Chief Executive Officer of Rithm Capital. “As we transition away from

the legacy strategy, we will be repositioning the portfolio to take advantage of attractive opportunities in the commercial real estate

sector. We have already begun deploying capital into higher yielding assets and expect to see earnings grow over time. We look forward

to creating value for shareholders and are excited about the future of Great Ajax.”

Second Quarter Company Highlights

| · | The Company's Book Value per share decreased for the quarter ended June 30, 2024, primarily as a result of its GAAP net loss and by

equity issuance in connection with the Strategic Transaction. |

| · | Strategic Transaction: The Company completed the previously announced strategic transaction (such transactions together, the

“Strategic Transaction”) with Rithm Capital Corp. (“Rithm”) whereby an affiliate of Rithm, RCM GA Manager LLC

(“RCM GA”), became the Company’s new external manager. |

| ◦ | Marks a significant milestone for the Company, with plans to transition into an opportunistic vehicle focused on commercial real estate. |

| ◦ | The Company expects to leverage the scope of Rithm's operating platform and network to realize strategic benefits as it transforms

its investment focus. |

| ◦ | The Strategic Transaction also included: (i) termination of the Company’s previous management agreement with Thetis Asset Management

(the “Former Manager”) and payment of the applicable termination fees, (ii) the issuance to an affiliate of Rithm in May 2024

of five-year warrants to purchase up to approximately 3.3 million shares of the Company’s common stock, (iii) the issuance to Rithm

in June 2024 of 2.9 million shares of the Company’s common stock pursuant to the terms of a stock purchase agreement and (iv) the

entry in February 2024 into a $70.0 million term loan with NIC RMBS LLC, an affiliate of Rithm, which remains undrawn. In connection with

the Strategic Transaction, the Company terminated its agreement with its former loan servicer, Gregory Funding LLC. On June 1, 2024, the

Company assigned all of the servicing agreements for its mortgage loans and real property to Newrez LLC, an affiliate

of Rithm. The terms of the agreements remain unchanged. |

| · | Loan Sales & Redemption of Convertible Notes: Sold loans with approximately $305 million in unpaid principal balance, generating

net proceeds of approximately $45.1 million. |

| ◦ | A portion of the net proceeds was used to redeem the Company’s 7.25% convertible senior notes that matured on April 30, 2024. |

| · | Repurchase Financing: Moved repurchase financing from full daily mark to market financing to either full non-mark to market

or non-daily mark to market with margin holidays. |

| | · | Dividend Declaration: On July 23, 2024, our board declared a cash dividend of $0.06 per common

share to be paid on August 30, 2024, to stockholders of record as of August 15, 2024. |

Earnings Conference Call

Great Ajax will host a conference call at 8:00

AM ET on Wednesday, July 24, 2024 to review its financial results for the second quarter of 2024. The conference call may be accessed

by dialing 1-844-746-0740 (from within the U.S.) or 1-412-317-5106 (from outside of the U.S.) ten minutes prior to the scheduled start

of the call; please reference “Great Ajax Second Quarter 2024 Earnings Call.”

A simultaneous webcast of the conference call will

be available to the public on a listen-only basis at www.greatajax.com. Please allow extra time prior to the call to visit the website

and download any necessary software required to listen to the internet broadcast.

A telephonic replay of the conference call will

also be available two hours following the call’s completion through 11:59 P.M. Eastern Time on Wednesday, July 31, 2024 by dialing

1-877-344-7529 (from within the U.S.) or 1-412-317-0088 (from outside of the U.S.); please reference access code “8087714.”

About Great Ajax Corp.

Great Ajax Corp. is a real estate investment platform

externally managed by RCM GA Manager LLC, an affiliate of Rithm Capital Corp. Great Ajax has historically focused on acquiring, investing

in and managing re-performing loans and non-performing loans secured by single-family residences and commercial properties. In connection

with its recent strategic transaction with Rithm Capital, the Company expects to transition to a flexible commercial real estate focused

investment strategy. Great Ajax is a Maryland corporation that is organized and conducts its operations to qualify as a real estate investment

trust (REIT) for federal income tax purposes.

Forward-Looking Statements

This press release contains certain information

which constitutes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “may,” “will,” “seek,” “believes,” “intends,” “expects,”

“projects,” “anticipates,” “plans” and “future” or similar expressions are intended to

identify forward-looking statements. These statements are not historical facts. These forward-looking statements represent management’s

current expectations regarding future events and are subject to the inherent uncertainties in predicting future results and conditions,

many of which are beyond our control. Accordingly, you should not place undue reliance on any forward-looking statements contained herein.

For a discussion of some of the risks and important factors that could affect such forward-looking statements see the sections entitled

“Cautionary Statement Regarding Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in the Company’s most recent annual and quarterly reports and

other filings, including the Company’s recent proxy statements, filed with the Securities and Exchange Commission. The Company expressly

disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events

or otherwise, except as may be required by law.

| Investor Relations |

| 646-868-5483 |

| IR@great-ajax.com |

GREAT AJAX CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands except per share amounts)

| | |

Three months ended | |

| | |

June 30, 2024 | | |

March 31, 2024 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| INCOME | |

| | |

| |

| Interest income | |

$ | 11,915 | | |

$ | 15,738 | |

| Interest expense | |

| (11,567 | ) | |

| (14,106 | ) |

| Net interest income | |

| 348 | | |

| 1,632 | |

| Net change in the allowance for credit losses | |

| — | | |

| (4,230 | ) |

| Net interest income/(loss) after the net change in the allowance for credit losses | |

| 348 | | |

| (2,598 | ) |

| | |

| | | |

| | |

| (Loss)/income from equity method investments | |

| (974 | ) | |

| 521 | |

| Mark to market loss on mortgage loans held-for-sale, net | |

| (6,488 | ) | |

| (47,307 | ) |

| Other (loss)/income | |

| (1,844 | ) | |

| 3 | |

| Total loss on revenue, net | |

| (8,958 | ) | |

| (49,381 | ) |

| | |

| | | |

| | |

| EXPENSE | |

| | | |

| | |

| Related party expense - loan servicing fees | |

| 1,324 | | |

| 1,734 | |

| Related party expense - management fee | |

| 2,173 | | |

| 17,459 | |

| Professional fees | |

| 855 | | |

| 705 | |

| Fair value adjustment on mark to market liabilities | |

| (4,430 | ) | |

| 1,353 | |

| Other expense | |

| 4,753 | | |

| 2,445 | |

| Total expense | |

| 4,675 | | |

| 23,696 | |

| Loss before provision for income taxes | |

| (13,633 | ) | |

| (73,077 | ) |

| Provision for income taxes (benefit) | |

| (772 | ) | |

| 915 | |

| Consolidated net loss | |

| (12,861 | ) | |

| (73,992 | ) |

| Less: consolidated net loss attributable to non-controlling interests | |

| (119 | ) | |

| (14 | ) |

| Consolidated net loss attributable to the Company | |

| (12,742 | ) | |

| (73,978 | ) |

| Less: dividends on preferred stock | |

| — | | |

| 341 | |

| Consolidated net loss attributable to common stockholders | |

$ | (12,742 | ) | |

$ | (74,319 | ) |

| Basic loss per common share | |

$ | (0.32 | ) | |

$ | (2.41 | ) |

| Diluted loss per common share | |

$ | (0.32 | ) | |

$ | (2.41 | ) |

| | |

| | | |

| | |

| Weighted average shares – basic | |

| 39,344,128 | | |

| 30,700,278 | |

| Weighted average shares – diluted | |

| 39,344,128 | | |

| 30,893,391 | |

GREAT AJAX CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands except per share amounts)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 72,026 | | |

$ | 52,834 | |

| Mortgage loans held-for-sale, net(1,2) | |

| 108,868 | | |

| 55,718 | |

| Mortgage loans held-for-investment, net(1,2) | |

| 413,916 | | |

| 864,551 | |

| Real estate owned properties, net(3) | |

| 4,309 | | |

| 3,785 | |

| Investments in securities available-for-sale(4) | |

| 140,614 | | |

| 131,558 | |

| Investments in securities held-to-maturity(5) | |

| 48,050 | | |

| 59,691 | |

| Investments in beneficial interests(6) | |

| 88,269 | | |

| 104,162 | |

| Receivable from servicer | |

| 3,594 | | |

| 7,307 | |

| Investments in affiliates | |

| 24,771 | | |

| 28,000 | |

| Prepaid expenses and other assets | |

| 7,099 | | |

| 28,685 | |

| Total assets | |

$ | 911,516 | | |

$ | 1,336,291 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Secured borrowings, net(1,7) | |

$ | 276,458 | | |

$ | 411,212 | |

| Borrowings under repurchase transactions | |

| 246,497 | | |

| 375,745 | |

| Convertible senior notes(7) | |

| — | | |

| 103,516 | |

| Notes payable, net(7) | |

| 107,216 | | |

| 106,844 | |

| Management fee payable | |

| 1,572 | | |

| 1,998 | |

| Warrant liability | |

| — | | |

| 16,644 | |

| Accrued expenses and other liabilities | |

| 25,292 | | |

| 9,437 | |

| Total liabilities | |

| 657,035 | | |

| 1,025,396 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Preferred stock $0.01 par value, 25,000,000 shares authorized | |

| | | |

| | |

| Series A 7.25% Fixed-to-Floating Rate Cumulative Redeemable, $25.00 liquidation preference per share, zero shares issued and outstanding at June 30, 2024 and 424,949 shares issued and outstanding at December 31, 2023 | |

| — | | |

| 9,411 | |

| Series B 5.00% Fixed-to-Floating Rate Cumulative Redeemable, $25.00 liquidation preference per share, zero shares issued and outstanding at June 30, 2024 and 1,135,590 shares issued and outstanding at December 31, 2023 | |

| — | | |

| 25,143 | |

| Common stock $0.01 par value; 125,000,000 shares authorized, 45,605,549 shares issued and outstanding at June 30, 2024 and 27,460,161 shares issued and outstanding at December 31, 2023 | |

| 466 | | |

| 285 | |

| Additional paid-in capital | |

| 423,899 | | |

| 352,060 | |

| Treasury stock | |

| (9,557 | ) | |

| (9,557 | ) |

| Retained deficit | |

| (147,361 | ) | |

| (54,382 | ) |

| Accumulated other comprehensive loss | |

| (13,895 | ) | |

| (14,027 | ) |

| Equity attributable to stockholders | |

| 253,552 | | |

| 308,933 | |

| Non-controlling interests(8) | |

| 929 | | |

| 1,962 | |

| Total equity | |

| 254,481 | | |

| 310,895 | |

| Total liabilities and equity | |

$ | 911,516 | | |

$ | 1,336,291 | |

| (1) | Mortgage loans held-for-sale, net and mortgage loans held-for-investment, net include $487.3 million and $628.6 million of loans at

June 30, 2024 and December 31, 2023, respectively, transferred to securitization trusts that are variable interest entities

(“VIEs”); these loans can only be used to settle obligations of the VIEs. Secured borrowings consist of notes issued by VIEs

that can only be settled with the assets and cash flows of the VIEs. The creditors do not have recourse to the primary beneficiary (Great

Ajax Corp.). Mortgage loans held-for-investment, net include zero and $3.4 million of allowance for expected credit losses at June 30,

2024 and December 31, 2023, respectively. |

| (2) | As of June 30, 2024 and December 31, 2023, balances for Mortgage loans held-for-investment, net include zero and $0.6 million,

respectively, from a 50.0% owned joint venture, which we consolidate under U.S. GAAP. As of June 30, 2024, there is a balance for

Mortgage loans held-for-sale, net of $0.5 million from the 50.0% owned joint venture. |

| (3) | Real estate owned properties, net, are presented net of valuation allowances of $1.7 million and $1.2 million at June 30, 2024

and December 31, 2023, respectively. |

| (4) | Investments in securities AFS are presented at fair value. As of June 30, 2024, Investments in securities available for sale

("AFS") include an amortized cost basis of $150.1 million and a net unrealized loss of $9.5 million. As of December 31,

2023, Investments in securities AFS include an amortized cost basis of $139.6 million and net unrealized loss of $8.0 million. |

| (5) | On January 1, 2023, we transferred certain of our Investments in securities AFS to held to maturity ("HTM") due to

European risk retention regulations. As of June 30, 2024, Investments in securities HTM includes an allowance for expected credit

losses of zero and remaining discount of $4.4 million related to the unamortized unrealized loss in accumulated other comprehensive income

("AOCI"). As of December 31, 2023, Investments in securities HTM includes an allowance for expected credit losses of $0.00

and remaining discount of $6.0 million related to the unamortized unrealized loss in AOCI. |

| (6) | Investments in beneficial interests includes allowance for expected credit losses of $9.1 million and $6.9 million at June 30,

2024 and December 31, 2023, respectively. |

| (7) | Secured borrowings, net are presented net of deferred issuance costs of $1.7 million at June 30, 2024 and $3.1 million at December 31,

2023. Convertible senior notes are presented net of deferred issuance costs of zero at both June 30, 2024 and December 31, 2023.

Notes payable, net are presented net of deferred issuance costs and discount of $2.8 million at June 30, 2024 and $3.2 million at

December 31, 2023. |

| (8) | As of June 30, 2024, non-controlling interests includes $0.8 million from a 50.0% owned joint venture, zero from a 53.1% owned

subsidiary and $0.1 million from a 99.9% owned subsidiary which we consolidate. As of December 31, 2023, non-controlling interests

includes $0.8 million from a 50.0% owned joint venture, $1.0 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned

subsidiary which we consolidate under U.S. GAAP. |

Appendix A - Earnings per share

The following table sets forth the components of

basic and diluted EPS ($ in thousands, except per share):

| |

|

Three months ended |

|

| |

|

June 30, 2024 |

|

|

March 31, 2024 |

|

| |

|

Income

(Numerator) |

|

|

Shares

(Denominator) |

|

|

Per Share

Amount |

|

|

Income

(Numerator) |

|

|

Shares

(Denominator) |

|

|

Per Share

Amount |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| Basic EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net loss attributable to common stockholders |

|

$ |

(12,742 |

) |

|

|

39,344,128 |

|

|

|

|

|

|

$ |

(74,319 |

) |

|

|

30,700,278 |

|

|

|

|

|

| Allocation of loss to participating restricted shares |

|

|

55 |

|

|

|

— |

|

|

|

|

|

|

|

465 |

|

|

|

— |

|

|

|

|

|

| Consolidated net loss attributable to unrestricted common stockholders |

|

$ |

(12,687 |

) |

|

|

39,344,128 |

|

|

$ |

(0.32 |

) |

|

$ |

(73,854 |

) |

|

|

30,700,278 |

|

|

$ |

(2.41 |

) |

| Effect of dilutive securities(1,2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted stock grants and director fee shares(3) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

(465 |

) |

|

|

193,113 |

|

|

|

|

|

| Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net loss attributable to common stockholders and dilutive securities |

|

$ |

(12,687 |

) |

|

|

39,344,128 |

|

|

$ |

(0.32 |

) |

|

$ |

(74,319 |

) |

|

|

30,893,391 |

|

|

$ |

(2.41 |

) |

| (1) | Our outstanding warrants and the effect of the interest expense and assumed conversion of shares from convertible notes would have

an anti-dilutive effect on diluted earnings per share for all periods shown and have not been included in the calculation. |

| (2) | The effect of the amortization of put option on our diluted earnings per share ("EPS") calculation for all periods shown

would have been anti-dilutive and has been removed from the calculation. |

| (3) | The effect of restricted stock grants and manager and director fee shares on our diluted EPS calculation for the three months ended

June 30, 2024 would have been anti-dilutive and has been removed from the calculation. |

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP NET LOSS

“Earnings available for

distribution” is a non-GAAP financial measure of the Company’s operating performance, which is used by management to

evaluate the Company’s performance excluding: (i) net realized and unrealized gains and losses on certain assets and

liabilities; (ii) other net income and losses not related to the performance of the investment portfolio; and (iii) non-capitalized

transaction related expenses.

The Company has three primary variables that impact

its performance: (i) Net interest margin on assets held within the investment portfolio; (ii) realized and unrealized gains or losses

on assets held within the investment portfolio, including any impairment or reserve for expected credit losses; and, (iii) the Company’s

operating expenses and taxes.

The Company’s definition of earnings

available for distribution excludes certain realized and unrealized losses, which although they represent a part of the

Company’s recurring operations, are subject to significant variability and are generally limited to a potential indicator of

future economic performance. Within other net income and losses, management primarily excludes equity-based compensation

expenses.

With regard to non-capitalized transaction-related

expenses, management does not view these costs as part of the Company’s core operations, as they are considered by management to

be similar to realized losses incurred at acquisition. Non-capitalized transaction-related expenses generally relate to legal and valuation

service costs, as well as other professional service fees, incurred when the Company acquires certain investments.

Management believes that the adjustments to

compute “earnings available for distribution” specified above allow investors and analysts to readily identify and track

the operating performance of the assets that form the core of the Company’s activity, assist in comparing the core operating

results between periods, and enable investors to evaluate the Company’s current core performance using the same financial

measure that management uses to operate the business. Management also utilizes earnings available for distribution as a financial

measure in its decision-making process relating to improvements to the underlying fundamental operations of the Company’s

investments, as well as the allocation of resources between those investments, and management also relies on earnings available for

distribution as an indicator of the results of such decisions. Earnings available for distribution excludes certain recurring items,

such as gains and losses (including impairment) and non-capitalized transaction-related expenses, because they are not considered by

management to be part of the Company’s core operations for the reasons described herein. As such earnings available for

distribution is not intended to reflect all of the Company’s activity and should be considered as only one of the factors used

by management in assessing the Company’s performance, along with GAAP net income which is inclusive of all of the

Company’s activities.

The Company views earnings available for

distribution as a consistent financial measure of its portfolio’s ability to generate income for distribution to common

stockholders. Earnings available for distribution does not represent and should not be considered as a substitute for, or superior

to, net income or as a substitute for, or superior to, cash flows from operating activities, each as determined in accordance with

GAAP, and the Company’s calculation of this financial measure may not be comparable to similarly entitled financial measures

reported by other companies. Furthermore, to maintain qualification as a REIT, U.S. federal income tax law generally requires that

the Company distribute at least 90% of its REIT taxable income annually, determined without regard to the deduction for dividends

paid and excluding net capital gains. Because the Company views earnings available for distribution as a consistent financial

measure of its ability to generate income for distribution to common stockholders, earnings available for distribution is one

metric, but not the exclusive metric, that the Company’s board of directors uses to determine the amount, if any, and the

payment date of dividends on common stock. However, earnings available for distribution should not be considered as an indication of

the Company’s taxable income, a guaranty of its ability to pay dividends or as a proxy for the amount of dividends it may pay,

as earnings available for distribution excludes certain items that impact its cash needs.

The table below provides a reconciliation of

earnings available for distribution to the most directly comparable GAAP financial measure (dollars in thousands, except share and

per share data):

Appendix B - Reconciliation of GAAP Net Loss

to Earnings Available for Distribution

(Dollars in thousands except per share amounts)

| | |

Three months ended | |

| | |

June 30, 2024 | | |

March 31, 2024 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Consolidated net loss attributable to common stockholders | |

$ | (12,742 | ) | |

$ | (74,319 | ) |

| Adjustments | |

| | | |

| | |

| Dividends on preferred stock | |

| — | | |

| 341 | |

| Provision for income taxes (benefit) | |

| (772 | ) | |

| 915 | |

| Consolidated net loss attributable to non-controlling interest | |

| (119 | ) | |

| (14 | ) |

| Realized and Unrealized Gains and Losses | |

| 2,058 | | |

| 48,660 | |

| Expenses related to the Strategic Transaction | |

| 883 | | |

| 15,506 | |

| Net change in the allowance for credit losses | |

| — | | |

| 4,230 | |

| Other adjustments | |

| 1,094 | | |

| (125 | ) |

| Earnings Available for Distribution | |

$ | (9,598 | ) | |

$ | (4,806 | ) |

| Basic Earnings Available for Distribution per common share | |

$ | (0.24 | ) | |

$ | (0.16 | ) |

| Diluted Earnings Available for Distribution per common share | |

$ | (0.24 | ) | |

$ | (0.16 | ) |

i Per common share calculations for both GAAP Net Loss and

Earnings Available for Distribution are based on 39,344,128 and 30,893,391 weighted average diluted shares for the quarters ended June 30,

2024 and March 31, 2024, respectively. Per share calculations of Book Value are based on 45,605,549 common shares outstanding as

of June 30, 2024.

ii Earnings Available for Distribution is a non-GAAP financial

measure. For a reconciliation of Earnings Available for Distribution to GAAP Net Loss, as well as an explanation of this measure, please

refer to the section entitled Non-GAAP Financial Measures and Reconciliation to GAAP Net (Loss).

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

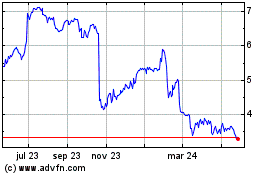

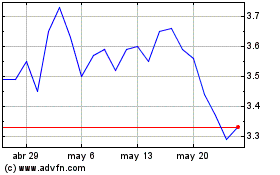

Great Ajax (NYSE:AJX)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Great Ajax (NYSE:AJX)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024