| | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 |

|

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to §240.14a-12 |

| |

| ALLETE, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

The following is the transcript of a video message from Andrew Alley, Managing Director, Head of Infrastructure, North America & Australasia, CPP Investments, made available by ALLETE, Inc. to the employees of ALLETE, Inc. and its subsidiaries on May 17, 2024:

Hey everyone, I’m just really excited to be able to be here today to introduce myself to the ALLETE team. And also very honored to be here alongside GIP to discuss the transaction. By way of introduction to myself, I’m Andrew Alley, I lead the infrastructure business for CPP Investments in North America.

And I’ve been very fortunate to be able to meet and get to know the ALLETE team over the last number of months. And just have to say- very impressed, very strong team, there’s been a strong reputation coming in, and our work to date has only confirmed that - really seeing ALLETE as pioneers in the transition to a clean energy future.

Just by way of introduction to ourselves as an organization, CPP Investments invests on behalf of more than 22 million Canadian contributors and beneficiaries for the Canada Pension Plan – This is Canada’s national pension plan. The purpose is long term.

We invest to secure the financial security for generations of Canadians. And when we think about how we invest to do that, that can be in a variety of areas, there’s stocks and bonds or real estate investments, but infrastructure is a huge focus. It’s companies like ALLETE that really serve as the backbone to the world’s economies.

And ALLETE had specifically just really stood out to us as a company that’s very well run, but also running in the right direction. We are completely aligned with the management team’s plans to work towards long-term growth and a lower-carbon future. And we are also very proud that our investment is going to help facilitate the Sustainability in Action strategy, which will help secure affordable, reliable, and increasingly clean energy for customers.

We’re confident that our partnership’s going to be a great fit. Our cultures are just so similar. Our Guiding Principles of Partnership, Integrity and High Performance drive everything that we do.

And we’re really looking forward to getting to know you better and to hitting the ground running following the completion of the transaction.

So, huge thank you for your support. We’re really excited to be able to work together as partners in success over the years to come. And we hope that you share in our excitement for the journey ahead.

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

The following is the transcript of a video message from Jonathan Bram, Founding Partner, Global Infrastructure Partners, made available by ALLETE, Inc. to the employees of ALLETE, Inc. and its subsidiaries on May 17, 2024:

Hello Team ALLETE.

My name is Jonathan Bram and I am a Founding Partner at Global Infrastructure Partners and I am really happy to be speaking to you today.

Before I say another word, I just want to say, over these last several months how impressed the senior leadership at GIP has been with the senior leadership team at ALLETE, with every person we have met down into the organization.

What I would like to do right now is to give you a little bit of a review as to who GIP is, why we are interested in working with you and what is making us so excited.

Global Infrastructure Partners is a large infrastructure fund manager. We manage about $112 billion right now and we focus only on energy, transportation, waste / water and digital infrastructure but in all of those spaces, we are looking at it through the lens of energy transition. When we were looking at making an investment in ALLETE, one of the things that really animated our discussions and made us so excited were the proactive steps the company is taking through its Sustainability in Action to both decarbonize but at the same time safely provide reliable, low-cost energy to its customers.

That is why we are so excited and as we take this next step in the ALLETE journey and enter this next chapter, we are really counting on each and everyone of you to be our partners in this endeavor.

So, I look forward to seeing you in the future and want to say we are really excited to be with you.

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is

not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

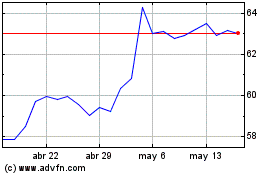

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

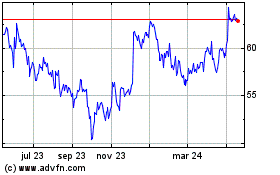

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024