AssetMark Enhances Advisor Offerings with Expanded Cash Solutions Suite

12 Agosto 2024 - 3:15PM

AssetMark (NYSE: AMK), a leading wealth management platform

for financial advisors, today announced the expansion of its Cash

Solutions suite with the addition of FDIC-insured certificates of

deposit (CD Plus) and purchased Money Market Funds (MMFs). This

strategic initiative enhances AssetMark's existing offerings,

empowering advisors to capitalize on the estimated $8 billion share

of wallet opportunity within the wealth client cash holding space,

as identified by AssetMark's analysis.

“Cash is a critical component of any sound financial plan, yet

it has often been overlooked,” said David McNatt, EVP, Head of

Investment Solutions at AssetMark. “With elevated interest rates

for the first time in decades, AssetMark Cash Solutions provides

advisors a compelling value proposition to help clients capitalize

on this environment and improve their short and long-term financial

outcomes. By integrating cash management into the wealth planning

conversation, advisors can demonstrate their strategic value and

strengthen client relationships.”

AssetMark Cash Solutions suite transcends traditional “rate

shopping” by equipping advisors with compelling products,

professional guidance, and robust resources necessary to engage in

consultative conversations about clients' short-term funding needs

and goals. AssetMark newly launched CD Plus provides FDIC insurance

coverage on multi-million-dollar cash balances, competitive rates,

flexible terms, and convenient account management, enabling clients

to save smarter. Combined with the recent launch of purchased money

market funds and a suite of existing cash and short-term liquidity

products, AssetMark is enabling advisors to create custom solutions

that meet their clients' needs across different return, risk, and

liquidity profiles.

AssetMark Cash Solutions empowers advisors to enhance client

outcomes by improving portfolio diversification, managing cash

flow, and optimizing short-term funding goals. Advisors can

leverage historically high interest rates to potentially generate

higher returns on cash holdings compared to traditional savings

accounts. Furthermore, providing diverse and personalized cash

management solutions can attract new clients seeking a holistic

approach to wealth planning.

This is for informational purposes only, is not a solicitation,

and should not be considered investment, legal, or tax advice.

Investors seeking more information should consult with their

financial advisor.

Investments are not FDIC insured, not bank guaranteed,

and can lose value.

Investing involves risk, including the possible loss of

principal. Past performance does not guarantee future

results.

About AssetMark

AssetMark operates a wealth management platform that powers

independent financial advisors and their clients. Together with our

affiliates Voyant and Adhesion Wealth, we serve advisors of all

models at every stage of their journey with flexible, purpose-built

solutions that champion client engagement and drive efficiency. Our

ecosystem of solutions equips advisors with services and

capabilities that would otherwise require significant investments

of time and money, ultimately enabling them to deliver better

investor outcomes and enhance their productivity, profitability,

and client satisfaction.

Founded in 1996 and based in Concord, California, the company

has over 1,000 employees. Today, the AssetMark platform serves over

9,200 financial advisors and over 261,000 investor households. As

of June 30, 2024, the company had $119.4 billion in platform

assets.

ContactsInvestors:Taylor J. Hamilton, CFAHead

of Investor RelationsInvestorRelations@assetmark.com

Media:Vesselina DavenportManager, PR & Communications

Vesselina.Davenport@assetmark.com

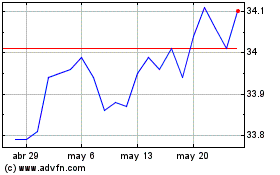

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

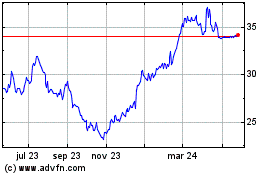

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025