AssetMark Financial Holdings, Inc. (“the Company”), a leading

wealth management technology platform for financial advisors, today

began a new era of strategic growth and expansion by announcing the

closing of its acquisition by GTCR, a leading private equity firm

with substantial investment expertise in financial technology,

wealth, and asset management.

The closing of the acquisition marks a significant milestone in

AssetMark's journey and concludes a successful, multiyear

partnership with Huatai Securities. With the completion of the

go-private transaction, AssetMark will now operate as an

independent, privately owned company.

Concurrent with the closing, AssetMark announced the appointment

of Lou Maiuri to the role of Chairman and Group CEO of its parent

company, AssetMark Financial Holdings, Inc. Mr. Maiuri brings more

than three decades of experience across asset management and

financial services, including strong entrepreneurial expertise in

building businesses, managing technology development, and leading

operational transformations. Michael Kim, President and CEO of

AssetMark, will continue in his current role.

Mr. Maiuri and Mr. Kim will partner to collectively run

AssetMark, and both will join the Board of Directors of AssetMark

Financial Holdings, Inc. Under their leadership and in partnership

with GTCR, AssetMark will focus on expanding its client offerings

with new product capabilities and maintaining its reputation for

delivering exceptional value and providing excellent service to its

advisors and their clients.

“Today marks the start of an exciting new chapter for

AssetMark,” said Michael Kim, President and CEO of AssetMark.

“We’ve been very successful over the past eight years under

Huatai’s leadership and look forward to partnering with GTCR to

accelerate our growth and industry leadership position. This

pivotal moment would not have been possible without the dedication

of the entire AssetMark team and the support of our advisors, and I

am excited to partner with a tremendous leader such as Lou as we

embark on this next chapter together.”

“I’m thrilled to be joining the AssetMark team as the Company

looks to propel its next phase of growth with GTCR,” said Lou

Maiuri, Chairman and Group CEO of AssetMark Financial Holdings,

Inc. “The wealth management industry is evolving, and the

technology solutions and services that AssetMark provides will play

a critical role in shaping outcomes for clients, their businesses,

and ultimately, the investors they serve. I look forward to working

closely with GTCR, Michael, and the entire AssetMark team to

strategically grow the business and unlock the company’s future

potential.”

Mr. Maiuri is the former President, COO, and Head of Investment

Servicing at State Street Bank. During his tenure, Mr. Maiuri held

broad responsibility for operations, technology, and service and

led large-scale technology modernization, revenue transformation,

and cost-efficiency initiatives. Prior to State Street, he was EVP

and Deputy CEO of Bank of New York Mellon (“BNY”) Asset Servicing

and Chairman of BNY subsidiary Eagle Investment Systems, where he

also served as CEO from 2006-2009. Prior to its acquisition by BNY,

Mr. Maiuri built Eagle Investment Systems from a small start-up to

a scaled investment technology platform as part of its founding

leadership team from 1996-2004.

“AssetMark's unique combination of high-quality service and

innovative technology has solidified its position as a leader in

the wealth management industry,” said Collin Roche, Co-CEO and

Managing Director at GTCR. “We are excited to partner with Lou,

Michael and the AssetMark team to build on this success and drive

further growth, both organically and through strategic

acquisitions.”

“We look forward to leveraging GTCR’s expertise in asset

management and wealth technology alongside AssetMark’s tremendous

team and the strong platform they have built, to further transform

the business through investment in the Company’s technology,

products and people,” said Michael Hollander, Managing Director at

GTCR.

The acquisition, valued at approximately $2.7 billion, was

executed with the Company’s shareholders receiving $35.25 per share

in cash. The transaction was approved unanimously by AssetMark's

Board of Directors and was subsequently approved by written consent

of shareholders representing a majority of the outstanding voting

interests of the Company. GTCR has acquired a 100% interest in

AssetMark, and its common stock is no longer publicly

traded.

Morgan Stanley & Co. LLC served as exclusive financial

advisor to AssetMark, and Davis Polk & Wardwell LLP provided

legal counsel. UBS Investment Bank and Barclays served as co-lead

financial advisors to GTCR and are providing debt financing support

for the transaction. BofA Securities and Jefferies LLC also served

as financial advisors. Kirkland & Ellis LLP provided legal

counsel and Paul Hastings LLP provided regulatory legal

counsel.

About AssetMark

AssetMark operates a wealth management platform whose mission is

to help financial advisors and their clients. AssetMark, together

with its affiliates AssetMark Trust Company, Voyant, and Adhesion

Wealth Advisor Solutions, serves advisors at every stage of their

journey with flexible, purpose-built solutions that champion client

engagement and drive efficiency. Its ecosystem of solutions equips

advisors with services and capabilities to help deliver better

investor outcomes by enhancing their productivity, profitability,

and client satisfaction.

With a history going back to 1996, AssetMark has over 1,000

employees, and its platform serves over 9,200 financial advisors

and over 261,000 investor households. As of June 30, 2024, the

Company had over $119 billion in platform assets. AssetMark, Inc.

is a Registered Investment Adviser with the U.S. Securities and

Exchange Commission. For more information, please visit

www.assetmark.com. Follow us on LinkedIn.

About GTCR

Founded in 1980, GTCR is a leading private equity firm that

invests through The Leaders Strategy™ – finding and partnering with

management leaders in core domains to identify, acquire and build

market-leading companies through organic growth and strategic

acquisitions. GTCR is focused on investing in transformative growth

in companies in the Business & Consumer Services, Financial

Services & Technology, Healthcare and Technology, Media &

Telecommunications sectors. Since its inception, GTCR has invested

more than $25 billion in over 280 companies, and the firm currently

manages $40 billion in equity capital. GTCR is based in Chicago

with offices in New York and West Palm Beach. For more information,

please visit www.gtcr.com. Follow us

on LinkedIn.

Media Contacts

Vesselina Davenport PR &

Communications,

AssetMark vesselina.davenport@assetmark.com

Andrew Johnson Chief Marketing &

Communications Officer, GTCR andrew.johnson@gtcr.com

SOURCE: AssetMark Financial Holdings, Inc.

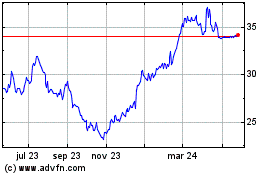

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

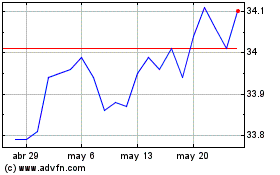

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025