The research-based product has attracted over

$1 billion in client assets due to consistently strong

performance

Columbia Threadneedle Investments recently celebrated the

five-year anniversary of its equity exchange-traded fund (ETF)—the

Columbia Research Enhanced Core ETF (NYSE Arca: RECS). In the five

years since its launch, RECS has attracted more than $1 billion in

client assets due to consistently strong performance.

RECS has outperformed its performance benchmark, the Russell

1000 Index®, through its unique rules-based approach that

emphasizes the application of proprietary investment research.1

This approach aims to optimize the ETF’s core equity exposure by

eliminating stocks from the performance benchmark that are rated

unfavorably by the Columbia Threadneedle quantitative research

team. In doing so, this strategy addresses a key issue expressed by

recently surveyed financial advisors -- nearly 9-in-10 advisors

feel frustrated with not being able to remove underperforming

stocks in their index investments.2

“Our goal when we launched RECS was to take a common-sense

research approach to US large capitalization core investing and

clearly that goal is still resonating today,” said Marc Zeitoun,

Head of North America Product and Business Intelligence. “Five

years later, strong returns and positive investor response have

encouraged us to further broaden our research-enhanced offering

across other asset classes and to offer the strategy in other

wrappers, such as retail SMAs.”

Driven by strong performance, RECS boasts a 5-star Overall

Morningstar Rating, with its returns falling within the top 10% of

Morningstar’s U.S. Large Blend category for the five-year time

period ending on September 30, 2024. Launched in September 2019,

this ETF offers a cost-effective and tax-efficient solution to

investors seeking core equity exposure and has earned a Morningstar

Medalist Rating of Silver. RECS has a total expense ratio of

0.15%.3

RECS is managed by Christopher Lo, Head of Managed and Indexed

Portfolio Solutions, Jason Wang, Head of Quantitative Research, and

Henry Hom, Senior Portfolio Manager. The rules-based approach

designed by the team uses Columbia Threadneedle’s proprietary

quantitative investment models to evaluate and categorize companies

in the Russell 1000 Index®. These models are designed to rate each

company based on quality, value, and catalyst factors, including

favorably rated securities while excluding those that do not meet

the criteria.

“RECS seeks to generate alpha through the elimination of names

that our quantitative models rate unfavorably – an approach that is

often overlooked in favor of overweighting stocks with a positive

view,” added Lo, who has been managing the Fund since its

inception. “As evidenced by it crossing the $1 billion threshold in

client assets, RECS is a powerful example of the value that

Columbia Threadneedle’s strong quantitative research and investment

expertise can generate for investors.”

As of September 30, 2024, the RECS ETF contained 357 US

large-cap stocks, across growth and value, each

market-capitalization weighted.

Ratings and rankings4

Time Period

Overall

1-Year

3-Year

5-Year

Percentile Ranking

16%

19%

9%

10%

# of Peers

1292

1414

1292

1292

Star Rating

5

-

5

5

About Columbia Threadneedle

Investments

Columbia Threadneedle Investments is a leading global asset

manager that provides a broad range of investment strategies and

solutions for individual, institutional and corporate clients

around the world. With more than 2,500 people, including over 650

investment professionals based in North America, Europe and Asia,

we manage $642 billion of assets across developed and emerging

market equities, fixed income, asset allocation solutions and

alternatives.5

Columbia Threadneedle Investments is the global asset management

group of Ameriprise Financial, Inc. (NYSE: AMP). For more

information, please visit columbiathreadneedleus.com.

Columbia Threadneedle Investments (Columbia Threadneedle) is the

global brand name of the Columbia and Threadneedle group of

companies.

1 Rules are as defined in the Columbia Threadneedle custom

index, the Beta Advantage® Researched Enhanced U.S. Equity Index

(the RECS Index) 2 Columbia Threadneedle Investments ETF Survey

conducted in November 2023 of 172 financial advisors 3 Morningstar,

as of September 2024 4 Based on Morningstar category: Large Blend,

as of September 30, 2024 5 As of June 30, 2024

Past performance does not guarantee future results.

Investors should consider the investment objectives, risks,

charges and expenses of a mutual fund carefully before investing.

For a free prospectus or a summary prospectus, which contains this

and other important information about the funds, visit

www.columbiathreadneedleus.com/investor/. Read the prospectus

carefully before investing.

Investing involves risks, including the risk of loss of

principal. Market risk may affect a single issuer, sector of

the economy, industry or the market as a whole. The fund is

passively managed and seeks to track the performance of an

index. The fund’s use of a “representative sampling” approach in

seeking to track the performance of its index (investing in only

some of the components of the index that collectively are believed

to have an investment profile similar to that of the index) may not

allow the fund to track its index with the same degree of accuracy

as would an investment vehicle replicating the entire Index. There

is no guarantee that the index and, correspondingly, the fund will

achieve positive returns. Risk exists that the index provider may

not follow its methodology for index construction. Errors

may result in a negative fund performance. The fund’s net

value will generally decline when the market value of its

targeted index declines. The fund concentrates its

investments in issuers of one or more particular industries to the

same extent as the underlying index. Investments in a narrowly

focused sector may exhibit higher volatility than investments with

a broader focus. Investments selected using quantitative

methods may perform differently from the market as a whole and

may not enable the fund to achieve its objective. Investment in

larger companies may involve certain risks associated with

their larger size and may be less able to respond quickly to new

competitive challenges than smaller competitors. Investments in

mid-cap companies often involve greater risks that

investments in larger companies and may have less predictable

earning and be less liquid than the securities of larger firms.

Growth securities, at times, may not perform as well as

value securities or the stock market in general and may be out of

favor with investors. Although the fund’s shares are listed on an

exchange, there can be no assurance that an active, liquid

or otherwise orderly trading market for shares will be established

or maintained. The Fund may have portfolio turnover, which

may cause an adverse cost impact. There may be additional

portfolio turnover risk as active market trading of the

fund’s shares may cause more frequent creation or redemption

activities that could, in certain circumstances, increase the

number of portfolio transactions as well as tracking error to the

Index and as high levels of transactions increase brokerage and

other transaction costs and may result in increased taxable capital

gains. This fund is new and has limited operating history.

Morningstar category percentile rankings: Morningstar

Ranking/Number of Funds in Category displays the Fund's actual rank

within its Morningstar Category based on average annual total

return and number of funds in that Category. The returns assume

reinvestment of dividends and do not reflect any applicable sales

charge. Absent expense limitation, total return would be less.

Morningstar Percentile Rankings are the Fund's total return rank

relative to all funds in the same Morningstar category, where 1 is

the highest percentile and 100 is the lowest percentile.

Morningstar Percentile Rankings are based on the average annual

total returns of the funds in the category for the periods stated.

They do not include sales charges or redemption fees but do include

operating expenses and the reinvestment of dividends and capital

gains distributions. Share class rankings vary due to different

expenses. If sales charges or redemption fees were included, total

returns would be lower.

Morningstar category percentile rankings: Morningstar

Ranking/Number of Funds in Category displays the Fund's actual rank

within its Morningstar Category based on average annual total

return and number of funds in that Category. The returns assume

reinvestment of dividends and do not reflect any applicable sales

charge. Absent expense limitation, total return would be less.

Morningstar Percentile Rankings are the Fund's total return rank

relative to all funds in the same Morningstar category, where 1 is

the highest percentile and 100 is the lowest percentile.

For each fund with at least a three-year history, Morningstar

calculates a Morningstar Rating™ used to rank the fund against

other funds in the same category. It is calculated based on a

Morningstar Risk-Adjusted Return measure that accounts for

variation in a fund’s monthly excess performance, without any

adjustments for loads (front-end, deferred, or redemption fees),

placing more emphasis on downward variations and rewarding

consistent performance. Exchange-traded funds and open-ended mutual

funds are considered a single population for comparative purposes.

The top 10% of funds in each category receive 5 stars, the next

22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5%

receive 2 stars and the bottom 10% receive 1 star. (Each share

class is counted as a fraction of one fund within this scale and

rated separately, which may cause slight variations in the

distribution percentages.) The Overall Morningstar Rating for a

fund is derived from a weighted average of the performance figures

associated with its three-, five- and ten-year (if applicable)

Morningstar Rating metrics.

The Morningstar Medalist Ratings are not statements of fact, nor

are they credit or risk ratings. The Morningstar Medalist Rating

(i) should not be used as the sole basis in evaluating an

investment product, (ii) involves unknown risks and uncertainties

which may cause expectations not to occur or to differ

significantly from what was expected, (iii) are not guaranteed to

be based on complete or accurate assumptions or models when

determined algorithmically, (iv) involve the risk that the return

target will not be met due to such things as unforeseen changes in

changes in management, technology, economic development, interest

rate development, operating and/or material costs, competitive

pressure, supervisory law, exchange rate, tax rates, exchange rate

changes, and/or changes in political and social conditions, and (v)

should not be considered an offer or solicitation to buy or sell

the investment product. A change in the fundamental factors

underlying the Morningstar Medalist Rating can mean that the rating

is subsequently no longer accurate.

©2024 Morningstar, Inc. All rights reserved. The Morningstar

information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed;

and (3) is not warranted to be accurate, complete or timely.

Neither Morningstar nor its content providers are responsible for

any damages or losses arising from any use of this information.

Columbia funds are distributed by Columbia Management Investment

Distributors, Inc., member FINRA, and managed by Columbia

Management Investment Advisers, LLC.

Columbia Management Investment Advisers, LLC serves as the

investment manager to the ETFs. The ETFs are distributed by ALPS

Distributors, Inc., which is not affiliated with Columbia

Management Investment Advisers, LLC or its parent company

Ameriprise Financial, Inc.

AdTrax: CTNA7197122.1 ALPS: CET002237

© 2024 Columbia Management Investment Advisers, LLC. All rights

reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021468893/en/

Meghan Shields Meghan.Shields@columbiathreadneedle.com

617.451.0739

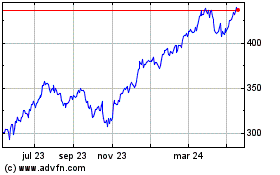

Ameriprise Financial (NYSE:AMP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

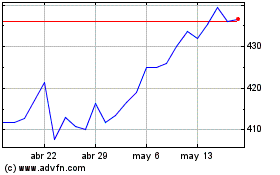

Ameriprise Financial (NYSE:AMP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024