whytestocks

6 años hace

whytestocks

6 años hace

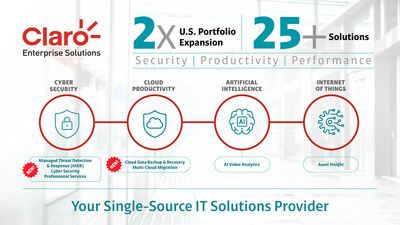

News: $AMX SparkCognition and Global HITSS offer artificial intelligence solutions to advance digital transformation in various industries

AUSTIN, Texas , Jan. 23, 2019 /PRNewswire/ -- Global HITSS, an América Móvil company, and SparkCognition announce a strategic alliance to expand the use of artificial intelligence applications in companies throughout 25 countries. Global HITSS, a company dedicated ...

In case you are interested https://marketwirenews.com/news-releases/sparkcognition-and-global-hitss-offer-artificial-intelligence-solutions-to-advance-digital-transformation-in-various-industries-7517624.html

CyberCall™

7 años hace

CyberCall™

7 años hace

I know this stock like the back of my hand. Everything from the ADR SPonsor, to who the largest player in America Movil, SA the ordinary. My ARBTIGRAGE boyz were hungry for electronic trading....and I was the FIRST to give it to them. I was the first to INTRODUCE AN ELECTRONIC MACHINE on the decks of the TOP 10 BANKS IN MEXICO!!!!!!! I was paid good money for this business, and I can do it again. I will get in through the top. TOP DOWN APPROACH much better than BOTTOMs UP APPROACH.

Always.

Hit that send button, and in milliseconds, the REPORT back. BAMM! FAST!!

investora2z

11 años hace

investora2z

11 años hace

The company's prospects have been discussed in a report by Zacks. The analysts have maintained their neutral recommendation on America Movil. The company is expected to do well based on increased penetration of 4G mobile services and expansion of its PayTV platform. However, it is likely to face regulatory challenges especially in Mexico. Stiff competition in markets like Brazil and high promotional spending can lead to lower margins. Huge customer churn may also hurt topline growth. The PayTV business is doing very well and has become a significant revenue contributor for the company. However, being a low margins business, increase in PayTV's weightage can put pressure on the overall margins. It remains the largest player in Latin America, and is making investments for expansion of its network to serve the customers better. Launch of the 4G mobile services in Mexico will help the growth prospects of the company. Revenue growth is expected to be good in regions like Brazil and Mexico where the focus is on winning contract subscribers, thereby reducing the churning. The growth prospects are relatively better compared to some other players operating in more saturated markets. AT&T (T) and Verizon (VZ) are facing competition from old and new players like America Movil (AMX) and Deutsche Telekom (DTEGF.PK) who are giants in their respective countries. They are offering lower priced, less restrictive contracts which makes the competition more cost based. Availability of handsets without contracts e.g. at Wal-Mart (WMT) stores, and an increasing demand for used handsets is likely to make top-line growth difficult. Usell (USEL), which provides a platform for buying / selling used phones, reported phenomenal growth in revenues in the first half of 2013. These markets may undergo some consolidation, but the short term growth prospects are not that robust. For America Movil, the telecom bill in Mexico is likely to adversely impact the company’s performance. Going forward, the company is likely to face challenges, but the revenue growth prospects are relatively better.

Hockmir

14 años hace

Hockmir

14 años hace

America Movil 3rd-qtr net seen up 35 pct on merger

Thu Oct 21, 2010 1:49pm EDT

MEXICO CITY, Oct 21 (Reuters) - Mexico's America Movil, one

of the world's top telecommunications companies, is seen

posting a 35 percent jump in third quarter profit next

Wednesday as billionaire Carlos Slim's flagship consolidates

his Americawide fleet of firms.

America Movil (AMXL.MX) (AMX.N) probably had net earnings

of 25.239 billion pesos ($1.999 billion) in the July to

September period, according to the average estimate of eight

analysts consulted by Reuters.

America Movil's report next week will be the first to

showcase the results of this year's consolidation of Slim's

wireless, fixed line and cable assets across Latin America, the

United States and the Caribbean.

Analysts expect revenue from data services, such as

streaming video, to pad growth from mobile companies even as

margins will be crimped due to the inclusion this quarter of

results from fixed-line firms.

After years of fast growth, Slim has strung up a network

that UBS said in a recent report is unrivaled on the planet,

wiring the hemisphere from north to south.

Third quarter revenue was expected to surge 57 percent to

156.902 billion pesos. Earnings before interest, tax,

depreciation and amortization (EBITDA) was seen 52 percent

higher for the period, compared to last year, at 61.305 billion

pesos.

Goldman Sachs analyst Lucio Aldworth expects EBITDA margins

to be 3 percent lower as fixed-line assets pressure the

profitability of the mobile business. Slim's Mexican fixed-line

company Telmex has been hurt by increasing competition.

The company likely added 4.58 million mobile clients during

the third quarter, up nearly 15 percent from the same period a

year ago.

In June, America Movil acquired dominant Mexican fixed-line

operator Telmex (TELMEXL.MX) and regional fixed-line operator

Telmex Internacional (TELINTL.MX), both of which Slim had

majority-owned.

Slim is aiming to improve efficiencies as competition heats

up with Spain's Telefonica (TEF.MC) to dominate Latin America's

market.

http://www.reuters.com/article/idCNN2123456320101021?rpc=44

Hot Features

Hot Features