- Operating income of $1.9 million in Q3 2024 and $7.0 million

year-to-date.

- Improved margins in Forged and Cast Engineered Products lead

operating results higher than prior year.

- Strong U.S. forged business results including impact of new

equipment more than offsets cyclically weak cast roll

demand.

- Higher sequential backlog in Q3 2024 vs Q2 2024 led by

higher roll order intake.

Ampco-Pittsburgh Corporation (NYSE: AP) reported net sales of

$96.2 million and $317.4 million for the three and nine months

ended September 30, 2024, respectively, compared to $102.2 million

and $314.2 million for the three and nine months ended September

30, 2023, respectively. The net sales decline for the three months

ended September 30, 2024, compared to the prior year was

attributable to lower shipment volumes and lower surcharge

pass-through revenues in the Forged and Cast Engineered Products

segment while the net sales increase for the nine months ended

September 30, 2024, was attributable to growth in the Air and

Liquid Processing segment.

The Corporation reported income from operations for the three

and nine months ended September 30, 2024, of $1.9 million and $7.0

million, respectively, compared to $1.7 million and $7.0 million

for the three and nine months ended September 30, 2023,

respectively. For the three months ended September 30, 2024, income

from operations improved slightly versus the prior year period,

which included a $0.2 million recovery from an insolvent

asbestos-related insurance carrier ("Asbestos-Related Credit"). The

underlying improvement was primarily higher pricing net of

surcharges and improved manufacturing cost absorption leading to

margin expansion in the Forged and Cast Engineered Products segment

which more than offset weaker shipment volumes. The nine months

ended September 30, 2023, included a benefit from a $1.9 million

foreign energy credit. The underlying improvement for the nine

months compared to prior year was primarily margin improvement in

the Forged and Cast Engineered Products segment which more than

offset its weaker sales volumes.

Commenting on the quarter, Ampco-Pittsburgh’s CEO, Brett

McBrayer, said, “As we expected, our third quarter earnings

reflected our seasonal plant shutdowns and were therefore lower

than prior quarter, but continue to benefit from pricing actions in

the roll business and the margin improvement we have seen versus

prior year in the Forged and Cast Engineered segment. This has

helped us offset the weaker roll demand in our cast roll business

and in forged engineered products. We have seen significant

improvement in our U.S forged business results with the operating

efficiencies from our new equipment being a key driver. In

addition, our sales order backlog improved sequentially due to roll

order intake during the quarter.”

Interest expense for the three and nine months ended September

30, 2024, increased in comparison to the same periods of the prior

year primarily due to the higher equipment financing debt balance,

higher average revolving credit facility borrowings and higher

average interest rates. Other income – net declined for the three

and nine months ended September 30, 2024, compared to the same

periods of the prior year, primarily due to higher losses on

foreign exchange.

The income tax provision was higher for the three and nine

months ended September 30, 2024, primarily due to the establishment

of a valuation allowance on the net deferred tax assets of our U.K.

operations at December 31, 2023, given its three-year cumulative

loss history due to continued soft cast roll demand. As a result,

the income tax provision in 2024 does not include any income tax

benefit on the operating losses of the U.K. By comparison, the

income tax provision for the three and nine months ended September

30, 2023, included income tax benefits of $0.6 million and $1.2

million, respectively, for the operating losses of the U.K. The

income tax provisions are otherwise approximately comparable with

slight fluctuations for income mix by jurisdictions not under

valuation allowances.

Net loss for the current year periods equaled $(2.0) million, or

$(0.10) per diluted share, and $(2.7) million, or $(0.13) per

diluted share, for the three and nine months ended September 30,

2024, respectively. This compares to net income of $0.8 million, or

$0.04 per diluted share, and $1.9 million, or $0.10 per diluted

share, for the three and nine months ended September 30, 2023,

respectively. Net income and earnings per share for the three

months ended September 30, 2023, include an after-tax benefit of

$0.2 million or $0.01 per share for the Asbestos-Related Credit.

Net income and basic earnings per share for the nine months ended

September 30, 2023, include after-tax benefits of $2.1 million or

$0.11 per share associated with the Asbestos-Related Credit and the

Foreign Energy Credit.

Segment Results

Forged and Cast Engineered

Products

Sales for the Forged and Cast Engineered Products segment for

the three and nine months ended September 30, 2024, declined from

the same periods of the prior year primarily due to a lower volume

of shipments and lower surcharge pass-throughs, offset in part by

improved base pricing.

Operating results for the three and nine months ended September

30, 2024, improved when compared to the same periods of the prior

year primarily due to improved net pricing and favorable

manufacturing cost variances due in part to improved productivity,

which more than offset lower shipment volumes. The nine months

ended September 30, 2023, included a $1.9 million benefit for a

foreign energy credit.

Air and Liquid Processing

Sales for the Air and Liquid Processing segment for the three

months ended September 30, 2024, were comparable with the prior

year quarter. Sales for the nine months ended September 30, 2024,

improved compared to the same periods of the prior year due

primarily to an increase in shipments of air handling systems as a

result of expansion of its sales distribution network and the

additional manufacturing facility opened in the third quarter of

2023.

Operating results for the three months and nine months ended

September 30, 2024, declined compared to the prior year period. The

benefit from the higher year-to-date sales volume was minimized by

an unfavorable product mix of heat exchangers and of centrifugal

pumps, due to shipping older lower margin orders. In addition,

higher selling and administrative expenses primarily due to higher

commissions and employee-related costs, including those associated

with expanding the segment’s sales distribution network negatively

impacted operating income when compared to the prior year

periods.

Teleconference Access

Ampco-Pittsburgh Corporation will hold a conference call on

Tuesday, November 12, 2024, at 10:30 a.m. Eastern Time (ET) to

discuss its financial results for the third quarter ended September

30, 2024. The Corporation encourages participants to pre-register

at any time, including up to and after the call start time via this

link: https://dpregister.com/sreg/10193601/fdb4826d90. Those

without internet access or unable to pre-register should dial in at

least five minutes before the start time using:

- Participant Dial-in (Toll Free): 1-844-308-3408

- Participant International Dial-in: 1-412-317-5408

For those unable to listen to the live broadcast, a replay will

be available one hour after the event concludes on the

Corporation’s website under the Investors menu at

www.ampcopgh.com.

About Ampco-Pittsburgh Corporation

Ampco-Pittsburgh Corporation manufactures and sells highly

engineered, high-performance specialty metal products and

customized equipment utilized by industry throughout the world.

Through its operating subsidiary, Union Electric Steel Corporation,

it is a leading producer of forged and cast rolls for the global

steel and aluminum industries. It also manufactures open-die forged

products that are sold principally to customers in the steel

distribution market, oil and gas industry, and the aluminum and

plastic extrusion industries. The Corporation is also a producer of

air and liquid processing equipment, primarily custom-engineered

finned tube heat exchange coils, large custom air handling systems

and centrifugal pumps. It operates manufacturing facilities in the

United States, England, Sweden, and Slovenia and participates in

three operating joint ventures located in China. It has sales

offices in North America, Asia, Europe, and the Middle East.

Corporate headquarters is located in Carnegie, Pennsylvania.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by us or

on behalf of the Corporation. This press release may include, but

is not limited to, statements about operating performance, trends

and events that the Corporation may expect or anticipate will occur

in the future, statements about sales and production levels,

restructurings, the impact from pandemics and geopolitical

conflicts, profitability and anticipated expenses, inflation, the

global supply chain, future proceeds from the exercise of

outstanding warrants, and cash outflows. All statements in this

document other than statements of historical fact are statements

that are, or could be, deemed “forward-looking statements” within

the meaning of the Act and words such as “may,” “will,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,” “target,”

“goal,” “forecast” and other terms of similar meaning that indicate

future events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations, and involve risks

and uncertainties. For the Corporation, these risks and

uncertainties include, but are not limited to: economic downturns,

cyclical demand for our products and insufficient demand for our

products; excess global capacity in the steel industry; limitations

in availability of capital to fund our strategic plan; inability to

maintain adequate liquidity to meet our operating cash flow

requirements, repay maturing debt and meet other financial

obligations; fluctuations in the value of the U.S. dollar relative

to other currencies; increases in commodity prices or insufficient

hedging against increases in commodity prices, reductions in

electricity and natural gas supply or shortages of key production

materials for us or our customers; inability to obtain necessary

capital or financing on satisfactory terms to acquire capital

expenditures that may be necessary to support our growth strategy;

inoperability of certain equipment on which we rely; inability to

execute our capital expenditure plan; liability of our subsidiaries

for claims alleging personal injury from exposure to

asbestos-containing components historically used in certain

products of our subsidiaries; changes in the existing regulatory

environment; inability to successfully restructure our operations

and/or invest in operations that will yield the best long-term

value to our shareholders; consequences of pandemics and

geopolitical conflicts; work stoppage or another industrial action

on the part of any of our unions; inability to satisfy the

continued listing requirements of the New York Stock Exchange or

the NYSE American Exchange; potential attacks on information

technology infrastructure and other cyber-based business

disruptions; failure to maintain an effective system of internal

control; and those discussed more fully elsewhere in Item 1A, Risk

Factors, in Part I of the Corporation’s latest Annual Report on

Form 10-K and Part II of the latest Quarterly Report on Form 10-Q.

The Corporation cannot guarantee any future results, levels of

activity, performance or achievements. In addition, there may be

events in the future that it is not able to predict accurately or

control which may cause actual results to differ materially from

expectations expressed or implied by forward-looking statements.

Except as required by applicable law, the Corporation assumes no

obligation, and disclaims any obligation, to update forward-looking

statements whether as a result of new information, events or

otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL SUMMARY

(in thousands, except per

share amounts)

Three

months ended

Nine months

ended

September

30,

September

30,

2024

2023

2024

2023

Total net sales

$

96,166

$

102,218

$

317,369

$

314,232

Costs of products sold (excl. depreciation

and amortization)

76,389

84,490

256,563

256,333

Selling and administrative

13,332

11,821

39,855

38,101

Depreciation and amortization

4,586

4,382

13,954

13,110

Credit for asbestos litigation

-

(191

)

-

(191

)

(Gain) loss on disposal of assets

(11

)

(6

)

2

(124

)

Total operating costs and expenses

94,296

100,496

310,374

307,229

Income from operations

1,870

1,722

6,995

7,003

Other expense - net:

Investment-related income

77

98

104

114

Interest expense

(2,976

)

(2,468

)

(8,750

)

(6,784

)

Other income — net

211

1,959

2,496

3,424

Total other expense — net

(2,688

)

(411

)

(6,150

)

(3,246

)

(Loss) income before income taxes

(818

)

1,311

845

3,757

Income tax provision

(636

)

(76

)

(1,953

)

(541

)

Net (loss) income

(1,454

)

1,235

(1,108

)

3,216

Less: Net income attributable to

noncontrolling interest

505

426

1,556

1,308

Net (loss) income attributable to

Ampco-Pittsburgh

$

(1,959

)

$

809

$

(2,664

)

$

1,908

Net (loss) income per share attributable

to Ampco-Pittsburgh common shareholders:

Basic

$

(0.10

)

$

0.04

$

(0.13

)

$

0.10

Diluted

$

(0.10

)

$

0.04

$

(0.13

)

$

0.10

Weighted-average number of common shares

outstanding:

Basic

19,980

19,729

19,857

19,580

Diluted

19,980

19,729

19,857

19,633

AMPCO-PITTSBURGH

CORPORATION

SEGMENT INFORMATION

(in thousands)

Three

months ended

Nine months

ended

September

30,

September

30,

2024

2023

2024

2023

Net sales:

Forged and Cast Engineered Products

$

67,203

$

73,625

$

220,105

$

228,004

Air and Liquid Processing

28,963

28,593

97,264

86,228

Consolidated

$

96,166

$

102,218

$

317,369

$

314,232

Income from Operations:

Forged and Cast Engineered Products

$

2,456

$

1,448

$

9,393

$

7,576

Air and Liquid Processing

3,134

3,456

8,290

9,386

Corporate costs

(3,720

)

(3,182

)

(10,688

)

(9,959

)

Consolidated

$

1,870

$

1,722

$

6,995

$

7,003

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112628357/en/

Michael G. McAuley Senior Vice President, Chief Financial

Officer and Treasurer (412) 429-2472 mmcauley@ampcopgh.com

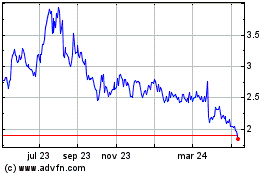

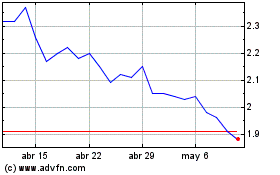

Ampco Pittsburgh (NYSE:AP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Ampco Pittsburgh (NYSE:AP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024