Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

19 Julio 2024 - 4:20PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No, 1)

ARC

DOCUMENT SOLUTIONS, INC. |

| (Name

of Issuer) |

| |

Common

Stock, par value $0.001 per share |

| (Title

of Class of Securities) |

| |

00191G103 |

| (CUSIP

Number) |

Kumarakulasingam Suriyakumar

Suriyakumar Family Trust

Shiyulli Suriyakumar 2013 Irrevocable Trust

Seiyonne Suriyakumar 2013 Irrevocable Trust

Dilantha Wijesuriya

Jorge Avalos

Rahul Roy

Sujeewa Sean Pathiratne

Copies to:

Mitchell S. Nussbaum, Esq.

Angela M. Dowd, Esq..

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

(212)

407-4159

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

July,

16, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box ☐.

Note:

Six copies of this statement, including all exhibits, should be filed with the Commission. See Rule 13d-1(a) for other parties to whom

copies are to be sent.

| * |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

| |

|

| |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however see the Notes). |

(Continued

on following pages)

| 1 |

NAME

OF REPORTING PERSON

KUMARAKULASINGAM

SURIYAKUMAR |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

BK,

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

2,055,576 |

| 8 |

SHARED

VOTING POWER

2,732,171 |

| 9 |

SOLE

DISPOSITIVE POWER

2,055,576 |

| 10 |

SHARED

DISPOSITIVE POWER

2,732,171 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,787,747 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.08%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,179,344 shares of common stock, par value $0.001 per share (the “Common Stock”) of ARC Document Solutions,

Inc. (“Issuer”) issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately 11.08%

of the issued and outstanding Common Stock of the Issuer. Does not include certain shares of Common Stock that the Reporting Person

may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group but does include (i) 1,732,171 shares of

Common Stock held by the Suriyakumar Family Trust, for which the Reporting Person and his spouse, share voting and dispositive

power and (ii) an additional 1,000,000 shares of Common Stock that the Reporting Person may be deemed to beneficially own that

are held by the Shiyulli Suriyakumar 2013 Irrevocable Trust and the Seiyonne Suriyakumar 2013 Irrevocable Trust which

trusts were established by the Reporting Person for estate planning purposes, but as to which the Reporting Person disclaims

beneficial ownership except to the extent of his pecuniary interest therein. See Items 3 and 5. |

| 1 |

NAME

OF REPORTING PERSON

SURIYAKUMAR

FAMILY TRUST |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH: |

7 |

SOLE

VOTING POWER

1,732,171 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

1,732,171 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,732,171 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.0%* |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

4.0% of the issued and outstanding Common Stock of the Issuer. Mr. Suriyakumar and his spouse, as trustees of the Reporting Person,

share voting and dispositive power over these shares. Does not include certain shares of Common Stock that the Reporting Person may

be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

| 1 |

NAME

OF REPORTING PERSON

SHIYULLI

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

500,000 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

500,000 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

500,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.2%* |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

1.2% of the issued and outstanding Common Stock of the Issuer. Mr. Suriyakumar shares voting and dispositive power over these shares. Does not include certain shares of Common Stock that the

Reporting Person may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

| 1 |

NAME

OF REPORTING PERSON

SEIYONNE

SURIYUKUMAR 2013 IRREVOCABLE TRUST |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

500,000 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

500,000 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

500,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.2%* |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

1.2% of the issued and outstanding Common Stock of the Issuer. Mr. Suriyakumar shares voting and dispositive power over these shares. Does not include certain shares of Common Stock that the

Reporting Person may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

| 1 |

NAME

OF REPORTING PERSON

DILANTHA

WIJESURIYA |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

1,149,038 |

| 8 |

SHARED

VOTING POWER

647,771 |

| 9 |

SOLE

DISPOSITIVE POWER

1,149,038 |

| 10 |

SHARED

DISPOSITIVE POWER

647,771 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,796,809 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.2%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

4.2% of the issued and outstanding Common Stock of the Issuer. Includes 971,156 shares of Common Stock issuable upon exercise of

outstanding stock options exercisable within 60 days of the date of this report, and 647,771 shares held by the Wijesuriya Family

Trust. Mr. Wijesuriya and his spouse, as trustees of the Wijesuriya Family Trust share voting and dispositive power over the shares

held by the trust. Does not include certain shares of Common Stock that the Reporting Person may be deemed to beneficially own pursuant

to its membership in a Rule 13d-5 group. See Item 5. |

| 1 |

NAME

OF REPORTING PERSON

JORGE

AVALOS |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

737,025 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

737,025 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

737,025 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.7%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

1.7% of the issued and outstanding Common Stock of the Issuer. Includes 183,678 shares of Common Stock issuable upon exercise of

outstanding stock options exercisable within 60 days of the date of this report. .Does not include certain shares of Common Stock

that the Reporting Person may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

| 1 |

NAME

OF REPORTING PERSON

RAHUL

ROY |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

708,167 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

708,167 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

708,167 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.6%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

1.6t% of the issued and outstanding Common Stock of the Issuer. Includes 240,666 shares issuable upon exercise of outstanding stock

options exercisable within 60 days of this report. .Does not include certain shares of Common Stock that the Reporting Person may

be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

| 1 |

NAME

OF REPORTING PERSON

SUJEEWA

SEAN PATHIRATNE |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

443,274 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

443,274 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

443,274 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.0%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,179,344 shares of Common Stock issued and outstanding as of April 29, 2024, the Reporting Person beneficially owns approximately

1.0% of the issued and outstanding Common Stock of the Issuer. Does not include certain shares of Common Stock that the Reporting

Person may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

Introductory

Note

This

Amendment No.1 (this “Amendment No.1”) to statement on Schedule 13D, is filed with respect to shares of Common Stock of the

Issuer on behalf of the group that may be deemed to be formed under Rule 13d-5 consisting of (i) Mr. Kumarakulasingam Suriyakumar (“Mr.

Suriyakumar” or the “Founder”), director, chairman and chief executive officer of the Issuer; (ii) the Suriyakumar

Family Trust (the “Family Trust”), by and through Mr. Suriyakumar as trustee; (iii) the Shiyulli Suriyakumar 2013 Irrevocable

Trust (the “Shiyulli Trust”), by and through Ms. Shiyulli Suriyakumar (“Ms. Suriyakumar”) as trustee; (iv) the

Seiyonne Suriyakumar 2013 Irrevocable Trust (the “Seiyonne Trust”), by and through Mr. Seiyonne Suriyakumar (“Mr. Seiyonne

Suriyakumar”) as trustee; (v) Mr. Dilantha Wijesuriya, Chief Operating Officer of the Issuer (“Mr. Wijesuriya”); (vi)

Mr. Jorge Avalos, Chief Financial Officer of the Issuer (“Mr. Avalos”); (vii) Mr. Rahul Roy, Chief Technical Officer of the

Issuer (“Mr. Roy”); and (viii) Mr. Sujeewa Sean Pathiratne, a private investor (“Mr. Pathiratne” and, collectively

with Mr. Suriyakumar, the Family Trust, the Shiyulli Trust, the Seiyonne Trust, Mr. Wijesuriya, Mr. Avalos, and Mr. Roy, the “Reporting

Persons”).

This

Amendment No. 1 amends and supplements the Schedule 13D, with respect to the Issuer filed by the Reporting Persons with the Securities

and Exchange Commission (as amended and supplemented to date, the “Schedule 13D”). Except as provided herein, this Schedule

13D does not modify any of the information previously reported on the Schedule 13D.

| |

Item

4. |

Purpose

of Transaction. |

The

information set forth in this Item 4 shall be deemed to supplement Item 4 of the Schedule 13D filed by the Reporting Persons on June

28, 2024.

On

July 16, 2024, the Reporting Persons entered into a Consortium Agreement dated as of July 12, 2024 (the “Consortium Agreement”)

providing that they would use their reasonable best efforts to work together to structure, negotiate and do all things necessary or desirable,

subject to the approval of the Special Committee of the Issuer’s Board of Directors and/or the Issuer’s approval, to enter

into definitive agreements and other ancillary documents in connection with the Acquisition (the “Definitive Agreements”).

Without limitation of the foregoing ,the Reporting Persons agreed pursuant to the Consortium Agreement that they would coordinate with

each other in performing due diligence, securing debt (as applicable) and equity financing, and structuring and negotiating the Acquisition,

including establishing appropriate legal entities for the purpose of the Acquisition. The Consortium Agreement contemplates that the

Reporting Persons will utilize TechPrint Holdings, LLC, a limited liability company formed by Founder in the State of Delaware (the “Parent”),

as the acquisition entity for as the purpose of pursuing the Acquisition.

Pursuant

to the Consortium Agreement, each Reporting Person has agreed to bear and pay the fees and expenses of such Reporting Person’s

legal, financial and other advisors engaged by such Reporting Person with respect to the Consortium Agreement and the Acquisition. The

parties have further agreed that in the event that any legal, financial, or other advisors (the “Consortium Advisors”) are

to be engaged to represent Parent and/or the Reporting Parties collectively with respect to the Consortium Agreement and/or the Acquisition,

such advisors shall be selected by the Founder. Pursuant to the Consortium Agreement, the Reporting Persons have also agreed that if

the Acquisition is not consummated or the Consortium Agreement expires or is terminated with respect to any Reporting Person prior to

the closing of the Acquisition without any breach by any Reporting Person, the Founder shall bear all fees and out-of-pocket expenses

payable to the advisors to the Founder and any Consortium Advisors, and to any lender or other financing sources, in connection with

the Acquisition. Upon consummation of the Acquisition, the Reporting Persons have agreed that Parent shall reimburse the Founder for

all fees and out-of-pocket expenses incurred by him (including fees and expenses of the advisors to the Founder and/or any Consortium

Advisors in connection with the Acquisition. The Consortium Agreement provides that the Founder shall be solely entitled to receive any

termination, topping, break-up or other fees or amounts (including amounts paid in settlement of any disputes or litigation relating

to the Acquisition) payable to Parent (or one or more of its affiliates or designees), net of any expenses required to be borne by the

Founder pursuant to the Consortium Agreement.

No

assurances can be given that any agreement with the Issuer relating to the proposed Acquisition will be entered into or be consummated.

| |

Item

7. |

Material

to be Filed as Exhibits. |

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement

is true, complete and correct.

Dated:

July 18, 2024

| |

/s/

Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam

Suriyakumar |

| |

|

|

| |

SURIYAKUMAR

FAMILY TRUST |

| |

|

|

| |

By: |

/s/

Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam

Suriyakumar |

| |

Title: |

Trustee |

| |

|

|

| |

SHIYULLI

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| |

|

|

| |

By: |

/s/

Shiyulli Suriyakumar |

| |

Name: |

Shiyulli

Suriyakumar |

| |

Title: |

Trustee |

| |

|

|

| |

SEIYONNE

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| |

|

|

| |

By: |

/s/

Seiyonne Suriyakumar |

| |

Name: |

Seiyonne

Suriyakumar |

| |

Title: |

Trustee |

| |

/s/

Dilantha Wijesuriya |

| |

Name: |

Dilantha

Wijesuriya |

| |

|

|

| |

/s/

Jorge Avalos |

| |

Name: |

Jorge

Avalos |

| |

|

|

| |

/s/

Rahul Roy |

| |

Name: |

Rahul

Roy |

| |

|

|

| |

/s/

Sujeewa Sean Pathiratne |

| |

Name: |

Sujeewa

Sean Pathiratne |

Exhibit 7.01

[CONSORTIUM AGREEMENT

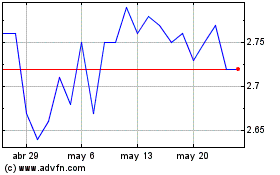

ARC Document Solutions (NYSE:ARC)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

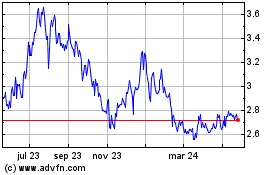

ARC Document Solutions (NYSE:ARC)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024