0001477720FALSE00014777202024-08-272024-08-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 27, 2024

__________________________

Asana, Inc.

(Exact name of Registrant as Specified in Its Charter)

__________________________

| | | | | | | | |

| Delaware | 001-39495 | 26-3912448 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 633 Folsom Street | Suite 100 | | |

| San Francisco, | CA | | 94107 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(415) 525-3888

(Registrant’s Telephone Number, Including Area Code)

__________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.00001 par

value | | ASAN | | New York Stock Exchange |

| | | | Long-Term Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Chief Financial Officer

On August 28, 2024, Tim Wan tendered to the Board of Directors (the “Board”) of Asana, Inc. (the “Company”) his resignation as Chief Financial Officer of the Company, effective as of September 10, 2024. Mr. Wan remains an employee of the Company and will assist with the transition of his duties for a period of time. There were no disagreements between Mr. Wan and the Company, and his departure is not related to the operations, policies, or practices of the Company or any issues regarding accounting policies or practices.

Appointment of Chief Financial Officer

On August 28, 2024, the Board appointed Ms. Sonalee Parekh as Chief Financial Officer and Head of Finance of the Company, effective as of September 11, 2024, and Ms. Parekh entered into an employment offer letter with the Company (the “Parekh Offer Letter”) on August 27, 2024.

Ms. Parekh, age 51, most recently served as Chief Financial Officer of RingCentral, Inc., a cloud-based collaboration and communication SaaS company, from May 2022 through August 2024, where she was responsible for accounting, FP&A, treasury, tax, internal audit and investor relations. Previously, Ms. Parekh served as Divisional CFO and Senior Vice President of Corporate Development and Investor Relations at Hewlett Packard Enterprise (“HPE”), a Fortune 500 public technology company, from September 2019 to April 2022, where she oversaw critical growth initiatives, including global M&A and integration, corporate strategy, strategic investments, and managed all buyside and sellside communication. Prior to HPE, Ms. Parekh held senior leadership roles at several global investment banks, including Goldman Sachs, Jeffries and Barclays Capital. Ms. Parekh currently serves as a director and chair of the audit committee for Indie Semiconductor. Ms. Parekh holds a Bachelor of Commerce degree from McGill University and is a Chartered Accountant.

Pursuant to the Parekh Offer Letter, Ms. Parekh will receive an annual base salary of $750,000 and an equity grant of $15,000,000 restricted stock units (the “RSUs”). The RSUs will be subject to the terms of the Company’s 2020 Equity Incentive Plan. Subject to Ms. Parekh’s continuous service with the Company, the RSUs will vest as follows: (i) 35% of the RSUs will vest on the on the first anniversary of the vesting commencement date determined by the Board or Compensation Committee of the Board (the “VCD”), (ii) 30% of the total RSUs will vest quarterly between the first and second anniversary of the VCD; (iii) 20% of the total RSUs will vest quarterly between the second and third anniversary of the VCD; and (iv) the remaining 15% of the total RSUs will vest quarterly between the third and fourth anniversary of the VCD.

The foregoing is a summary only and does not purport to be a complete description of all of the terms, provisions and agreements contained in the Parekh Offer Letter, and is subject to and qualified in its entirety by reference to the complete text of the Parekh Offer Letter, a copy of which is filed as Exhibit 10.1 hereto.

There are no arrangements or understandings between Ms. Parekh and any other persons pursuant to which she was appointed as an executive officer of the Company. There are no family relationships between Ms. Parekh and any other director or executive officer of the Company and she has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated by the SEC.

The press release announcing Ms. Parekh’s appointment is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASANA, INC. |

| | |

| Dated: September 3, 2024 | By: | /s/ Eleanor Lacey |

| | Eleanor Lacey |

| | General Counsel and Corporate Secretary |

633 Folsom Street, Suite 100

San Francisco, CA 94107

August 27, 2024

Sonalee Parekh

Dear Sonalee,

Welcome to Asana, Inc., a Delaware corporation (the “Company”). This letter sets out the terms and conditions of your employment.

1.POSITION. You will serve in a full-time capacity as an employee at the Company starting on September 11, 2024 and, subject to Board approval, as Chief Financial Officer and Head of Finance, effective September 11, 2024 reporting to Dustin Moskovitz, the Chief Executive Officer, working at our facility located in San Francisco, California. Subject to the other provisions of this letter agreement, we may change your position, duties, and work location from time to time at our discretion.

2.EMPLOYEE BENEFITS. As a regular employee of the Company, you are eligible to participate in the Company’s standard benefits, subject to the terms and conditions of such plans and programs. Subject to the other provisions of this letter agreement, we may change compensation and benefits from time to time at our discretion.

3.SALARY. Your annual base salary is $750,000, payable in semi-monthly installments in accordance with the Company’s standard payroll practices for salaried employees. This salary will be subject to adjustment pursuant to the Company’s employee compensation policies in effect from time to time.

4.EQUITY. Subject to the approval of the Company’s Board of Directors or a sub-committee thereof (the “Board”), you will be granted restricted stock units (“RSUs”) with a total grant value of $15,000,000. The number of RSUs to be granted will be calculated by the Company based on the Company’s policy at the time of such grant and based on the average closing price of Asana Class A Common Stock on each trading day for the month prior to your start date. The RSU grant will be subject to the terms and conditions applicable to RSUs granted under the Company’s 2020 Equity Incentive Plan (the “Equity Incentive Plan”), and as described in the Equity Incentive Plan and the applicable RSU agreement that you will be required to sign as a condition of the grant. Generally, the RSU grant will vest:

a.35% of the RSUs on the first anniversary of your vesting commencement date (“VCD”), as approved by the Board;

b.a total of 30% of the RSUs quarterly between the first and second anniversary of the VCD;

c.a total of 20% of the RSUs quarterly between the second and third anniversary of the VCD; and

d.the remaining 15% of the RSUs quarterly between the third and fourth anniversary of the VCD.

You will also have stock ownership guidelines, as set forth in the Company’s Corporate Governance Guidelines, that are a multiple of your annual base salary that you will be expected to achieve over five years.

5.CONFIDENTIAL INFORMATION AND INVENTION ASSIGNMENT AGREEMENT. As a condition of your employment with the Company, you are required to sign the enclosed Company standard Confidential Information and Invention Assignment Agreement.

6.PERIOD OF EMPLOYMENT. Your employment with the Company will be “at will,” meaning that either you or the Company may terminate your employment at any time and for any reason, with or without cause. This remains the full and complete agreement between you and the Company on this term. Although your job duties, title, compensation and benefits, as well as the Company’s personnel policies and procedures, may change from time to time, the “at will” nature of your employment may only be changed in an express written agreement signed by you and a duly authorized officer of the Company.

7.SEVERANCE. You will be eligible for severance benefits under the terms and conditions of the Company’s Executive Severance and Change in Control Benefit Plan.

8.INDEMNIFICATION. You will be provided with indemnification to the maximum extent permitted by law by the Company’s directors and officers insurance policies, if any, and pursuant to the Company’s standard form of Indemnification Agreement for its officers.

9.AMENDMENT. This letter agreement (except for terms reserved to the Company’s discretion) may not be amended or modified except by an express written agreement signed by you and a duly authorized officer of the Company.

10.ARBITRATION. To ensure the rapid and economical resolution of disputes that may arise in connection with your employment with the Company, you and the Company agree that any and all disputes, claims, or causes of action, in law or equity, including but not limited to statutory claims, arising from or relating to the

enforcement, breach, performance, or interpretation of this agreement, your employment with the Company, or the termination of your employment, shall be resolved pursuant to the Federal Arbitration Act, 9 U.S.C. § 1-16, to the fullest extent permitted by law, by final, binding and confidential arbitration conducted by JAMS or its successor, under JAMS’ then applicable rules and procedures for employment disputes before a single arbitrator (available upon request and also currently available at http://www.jamsadr.com/rules-employment-arbitration/). You acknowledge that by agreeing to this arbitration procedure, both you and the Company waive the right to resolve any such dispute through a trial by jury or judge or administrative proceeding. In addition, all claims, disputes, or causes of action under this section, whether by you or the Company, must be brought in an individual capacity, and shall not be brought as a plaintiff (or claimant) or class member in any purported class or representative proceeding, nor joined or consolidated with the claims of any other person or entity. The arbitrator may not consolidate the claims of more than one person or entity, and may not preside over any form of representative or class proceeding. To the extent that the preceding sentences regarding class claims or proceedings are found to violate applicable law or are otherwise found unenforceable, any claim(s) alleged or brought on behalf of a class shall proceed in a court of law rather than by arbitration. This paragraph shall not apply to any action or claim that cannot be subject to mandatory arbitration as a matter of law, including, without limitation, claims brought pursuant to the California Private Attorneys General Act of 2004, as amended, the California Fair Employment and Housing Act, as amended, and the California Labor Code, as amended, to the extent such claims are not permitted by applicable law(s) to be submitted to mandatory arbitration and the applicable law(s) are not preempted by the Federal Arbitration Act or otherwise invalid (collectively, the “Excluded Claims”). In the event you intend to bring multiple claims, including one of the Excluded Claims listed above, the Excluded Claims may be filed with a court, while any other claims will remain subject to mandatory arbitration. You will have the right to be represented by legal counsel at any arbitration proceeding. Questions of whether a claim is subject to arbitration under this agreement shall be decided by the arbitrator. Likewise, procedural questions which grow out of the dispute and bear on the final disposition are also matters for the arbitrator. The arbitrator shall: (a) have the authority to compel adequate discovery for the resolution of the dispute and to award such relief as would otherwise be permitted by law; and (b) issue a written statement signed by the arbitrator regarding the disposition of each claim and the relief, if any, awarded as to each claim, the reasons for the award, and the arbitrator’s essential findings and conclusions on which the award is based. The arbitrator shall be authorized to award all relief that you or the Company would be entitled to seek in a court of law. The Company shall pay all JAMS arbitration fees in excess of the administrative fees that you would be required to pay if the dispute were decided in a court of law. Nothing in this letter agreement is intended to prevent either you or the Company from obtaining injunctive relief in court to prevent irreparable harm pending the conclusion of any such

arbitration. Any awards or orders in such arbitrations may be entered and enforced as judgments in the federal and state courts of any competent jurisdiction.

* * *

This letter, together with your Confidential Information and Invention Assignment Agreement, equity agreements, and other agreements referenced herein), forms the complete and exclusive statement of your employment agreement with the Company and supersedes any other agreements or promises made to you by anyone, whether oral or written, with respect to the subject matter hereof. If any provision of this offer letter agreement is determined to be invalid or unenforceable, in whole or in part, this determination shall not affect any other provision of this offer letter agreement and the provision in question shall be modified so as to be rendered enforceable in a manner consistent with the intent of the parties insofar as possible under applicable law. This letter may be delivered and executed via facsimile, electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act or other applicable law) or other transmission method and shall be deemed to have been duly and validly delivered and executed and be valid and effective for all purposes.

Please sign and date this letter below to indicate your agreement with its terms.

Sincerely,

/s/ Dustin Moskovitz

Dustin Moskovitz

Chief Executive Officer

ACCEPTED AND AGREED TO:

/s/ Sonalee Parekh

Sonalee Parekh

Dated: August 27, 2024

Asana Appoints Seasoned Finance Executive,

Sonalee Parekh, as New Chief Financial Officer

September 3, 2024 – San Francisco, CA – Asana, Inc. (NYSE: ASAN)(LTSE: ASAN), a leading work management platform, today announced the appointment of Sonalee Parekh as Chief Financial Officer, effective September 11, 2024. Parekh will succeed Tim Wan, who has served in the role since 2017. Wan will remain with the company in an advisory position to support the transition.

Parekh brings more than 25 years of experience in the technology and banking sectors to Asana, having previously held executive finance roles at leading public companies including Chief Financial Officer (CFO) at RingCentral and Divisional CFO, Head of Corporate Development and Investor Relations at Hewlett Packard Enterprise (HPE). At Asana, Parekh will oversee the global finance organization and play a strategic role in supporting the company's next phase of growth and innovation.

Dustin Moskovitz, Asana’s co-founder and CEO, welcomed Parekh to the leadership team: “Sonalee’s public company experience and market perspective, coupled with her proven track record of driving growth and profitability at scale, makes her the ideal person to partner with me and the leadership team as we execute on the large opportunity ahead of us. She’s had a front-row seat to some of the most transformative technology trends and we’re in the midst of another pivotal moment. AI has the enormous potential to reshape not only the work management category but the entire software industry. Sonalee’s experience overseeing and fostering efficient growth during critical inflection points will be invaluable to Asana.”

As CFO at RingCentral, Parekh guided the company through a period of rapid growth, overseeing a doubling of operating profit while maintaining double-digit revenue growth and exceeding $2 billion in annual recurring revenue (ARR). She was also instrumental in the company’s successful expansion into a multi-product portfolio.

At HPE, Parekh played a critical role in the company's transition to an as-a-service business model and led key acquisitions in high growth areas. Parekh has also previously held senior leadership roles at several global investment banks, including Goldman Sachs, Jeffries and Barclays Capital.

"Asana is uniquely positioned to capitalize on the opportunity to leverage AI in the work management category to drive productivity and efficiency benefits for workers across the globe," said Parekh. "I’m excited to partner with Dustin and Asana’s seasoned management team in driving Asana's next phase of growth."

Parekh will be supported by exiting Asana CFO, Tim Wan, for a transition period. Moskovitz continued: “We’ve been incredibly lucky to have the skills and experience of Tim with us for so long. Under his leadership, the company has grown to more than $689 million in revenue. He’s embodied all of our Asana values and been integral to the company’s expansion from fewer than 300 employees to nearly 2000. He’ll be sincerely missed and we thank him for his many contributions.”

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include, but are not limited to, statements about our market opportunity, the potential and impact of AI, our ability to execute on our current strategies, our technology and brand position. Forward-looking statements generally relate to future events or Asana’s future financial or operating performance. Forward-looking statements include all

statements that are not historical facts and in some cases can be identified by terms such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “continue,” “could,” “potential,” “may,” “will,” “goal,” or similar expressions and the negatives of those terms. However, not all forward-looking statements contain these identifying words. Forward-looking statements involve known and unknown risks, uncertainties and other factors, including factors beyond Asana’s control, that may cause Asana’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks include, but are not limited to, risks and uncertainties related to: Asana’s ability to achieve future growth and sustain its growth rate, Asana’s ability to attract and retain customers and increase sales to its customers, Asana’s ability to develop and release new products and services and to scale its platform, including the successful integration of AI, Asana’s ability to increase adoption of its platform through Asana’s self-service model, Asana’s ability to maintain and grow its relationships with strategic partners, the highly competitive and rapidly evolving market in which Asana participates, Asana’s international expansion strategies, and broader macroeconomic conditions. Further information on risks that could cause actual results to differ materially from forecasted results are included in Asana’s filings with the SEC, including Asana’s Annual Report on Form 10-K for the year ended January 31, 2024 and subsequent filings with the SEC. Any forward-looking statements contained in this press release are based on assumptions that Asana believes to be reasonable as of this date. Except as required by law, Asana assumes no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

About Asana

Asana, the #1 AI work management platform, is where work connects to goals. Over 150,000 customers like Amazon, Accenture, and Suzuki rely on Asana to manage and automate everything from goal setting and tracking to capacity planning to product launches. To learn more, visit asana.com.

Disclosure of Material Information

Asana announces material information to its investors using SEC filings, press releases, public conference calls, and on its investor relations page of Asana’s website at https://investors.asana.com. Asana uses these channels, as well as social media, including its X (formerly Twitter) account (@asana), its blog (blog.asana.com), its LinkedIn page (www.linkedin.com/company/asana), its Instagram account (@asana), its Facebook page (www.facebook.com/asana/), Threads profiles (@asana and @moskov), and TikTok account (@asana), to communicate with investors and the public about Asana, its products and services and other matters. Therefore, Asana encourages investors, the media and others interested in Asana to review the information it makes public in these locations, as such information could be deemed to be material information.

Contacts

Catherine Buan

Asana Investor Relations

ir@asana.com

Frances Ward

Asana Corporate Communications

press@asana.com

v3.24.2.u1

Cover

|

Aug. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 27, 2024

|

| Entity Registrant Name |

Asana, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39495

|

| Entity Tax Identification Number |

26-3912448

|

| Entity Address, Address Line One |

633 Folsom Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

San Francisco,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

(415)

|

| Local Phone Number |

525-3888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.00001 par value

|

| Trading Symbol |

ASAN

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0001477720

|

| Amendment Flag |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

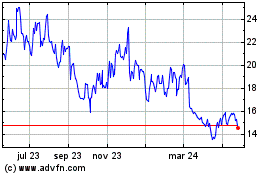

Asana (NYSE:ASAN)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

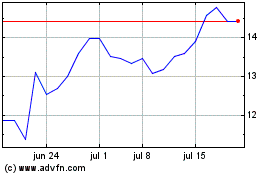

Asana (NYSE:ASAN)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024