AptarGroup, Inc. (NYSE:ATR), a global leader in drug and

consumer product dosing, dispensing and protection technologies,

today reported solid second quarter results driven by continued

growth of the company’s proprietary drug delivery systems and

margin improvement. Reported sales increased by 2% and core sales,

excluding currency and acquisition effects, increased by 3%. Aptar

reported net income of $90 million for the quarter, a 9% increase

from the prior year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240725389689/en/

Photo: Aptar

“Strong sales growth in our Pharma business and broad-based

margin expansion helped us achieve another quarter of strong

earnings per share growth. Our proprietary drug delivery systems

continue to see healthy demand, sales for our active material

science technologies grew nicely in the quarter and volumes for

consumer dispensing solutions continued to progressively improve in

North America. For the first six months of the year, we achieved

double-digit earnings growth and delivered strong net cash provided

by operations,” said Stephan B. Tanda, Aptar President and CEO,

commenting on the second quarter results.

Second Quarter 2024 Highlights

- Reported sales increased 2% and core sales increased

3%

- Reported earnings per share increased 8% to $1.34 and

adjusted earnings per share increased 12% to $1.37

- Reported net income increased 9% to $90 million and adjusted

EBITDA increased 6% from the prior year to $193 million

- Pharma segment delivered reported sales growth of 6% and

core sales growth of 7% with continued demand for proprietary drug

delivery systems

- Margins continued to improve over the prior year quarter,

driven by sales of higher value products, and improved operational

performance and cost management efforts

- Increased the quarterly dividend by approximately 10% to

$0.45 per share

First Six Months 2024 Highlights

- Double-digit EPS growth over the prior year period

- Net cash provided by operations increased to $236 million

compared to $182 million in the prior year period

- Free cash flow increased to $92 million compared to $27

million in the prior year

Second Quarter Results

For the quarter ended June 30, 2024, reported sales increased 2%

to $910 million compared to $896 million in the prior year. Core

sales, excluding the impact from changes in currency exchange rates

and acquisitions, increased 3%.

Second Quarter Segment Sales

Analysis (Change Over Prior Year)

Aptar Pharma

Aptar Beauty

Aptar Closures

Total AptarGroup

Reported Sales Growth

6%

(2)%

(1)%

2%

Currency Effects (1)

1%

1%

1%

1%

Acquisitions

0%

0%

0%

0%

Core Sales Growth

7%

(1)%

0%

3%

(1) - Currency effects are approximated by

translating last year's amounts at this year's foreign exchange

rates.

Aptar Pharma had an increase in reported sales of 6% and core

sales of 7% over the prior year quarter. The segment’s strong

performance was driven by continued growth for proprietary drug

delivery systems used for allergic rhinitis, central nervous system

therapeutics, emergency and pain medicines, as well as eye care and

nasal decongestants. Sales declined in the Injectables division

compared to the prior year quarter as sales normalized following

last year’s strong second quarter catch up from the Enterprise

Resource Planning (ERP) implementation in the first quarter of

2023. For the first six months of the year, the Injectables

division grew 14%. The Active Material Science division returned to

growth after a period of destocking due to COVID.

Aptar Beauty’s reported sales decreased 2%, and with currency

effects core sales were down 1% compared to the prior year quarter.

Volumes in the quarter grew over the prior year period as sales in

North America continued to show progressive improvement, however,

this was offset by higher tooling sales in the prior year period.

Margins continued to improve year over year even with softer sales,

due to operational performance and ongoing cost management.

Aptar Closures’ reported sales decreased 1% from the prior year

quarter and the segment’s core sales were flat. Increased volumes

were offset by the pass through of lower resin costs. Margins for

Closures were flat over the prior year quarter as ongoing cost

containment efforts and operational performance were offset by the

timing of pass through of lower resin costs.

Aptar reported second quarter earnings per share of $1.34, an

increase of 8%, compared to $1.24 during the same period a year

ago. Second quarter adjusted earnings per share, excluding

restructuring charges and the unrealized gains or losses on an

equity investment, were $1.37, an increase of 12%, compared to

$1.22 in the prior year, including comparable exchange rates.

Year-To-Date Results

For the six months ended June 30, 2024, reported sales increased

4% to $1.83 billion compared to $1.76 billion in the prior year.

Core sales, excluding the impact from changes in currency exchange

rates and acquisitions, increased 4%.

Six Months Year-To-Date

Segment Sales Analysis (Change Over Prior Year)

Aptar Pharma

Aptar Beauty

Aptar Closures

Total AptarGroup

Total Reported Sales Growth

10%

(1)%

0%

4%

Currency Effects (1)

0%

0%

0%

0%

Acquisitions

0%

0%

0%

0%

Core Sales Growth

10%

(1)%

0%

4%

(1) - Currency effects are approximated by

translating last year's amounts at this year's foreign exchange

rates.

For the six months ended June 30, 2024, Aptar’s reported

earnings per share were $2.57, an increase of 24%, compared to

$2.07 reported a year ago. Current year adjusted earnings per

share, excluding restructuring charges, acquisition costs, and the

unrealized gains or losses on an equity investment, were $2.63 and

increased 21% from prior year adjusted earnings per share of $2.18,

including comparable exchange rates. The prior year’s adjusted

earnings included an effective tax rate of 25% (approximately $0.10

per share negative impact compared to the current year effective

tax rate of 22%).

Outlook

Regarding Aptar’s outlook, Tanda stated, “We had a strong first

half, and we expect growth to continue in the third quarter. We

anticipate growth for our proprietary drug delivery systems to

continue, driven by increased demand for nasally delivered central

nervous system drugs and allergy therapies. We are also seeing

growing demand for elastomeric components used for GLP-1. For our

consumer dispensing technologies, we are seeing pockets of strength

and progressive recovery in North America. As volumes come back, we

believe we will benefit from our continued focus on cost management

and improved operational leverage. Our solid operational

performance and our strong balance sheet should position us well

for future growth. Even in a slowing economy, we believe in the

resilience of our portfolio as demonstrated by our recent dividend

increase of approximately 10% on top of last year’s nearly 8%

increase.”

Aptar currently expects earnings per share for the third quarter

of 2024, excluding any restructuring expenses, changes in the fair

value of equity investments and acquisition costs, to be in the

range of $1.38 to $1.46. This guidance is based on an effective tax

rate range of 23.5% to 25.5% with a comparable adjusted prior year

effective tax rate of 24%. The earnings per share guidance range

was based on spot rates at the end of June for all currencies. Our

currency exchange rate assumptions equate to an approximately $0.02

per share headwind when compared to the prior year third quarter

earnings.

Cash Dividends and Share Repurchases

As previously announced, Aptar’s Board of Directors increased

the quarterly cash dividend by approximately 10% to $0.45 per

share. The payment date is August 15, 2024, to stockholders of

record as of July 25, 2024. During the second quarter, Aptar

repurchased 34 thousand shares for approximately $5 million. Aptar

may repurchase shares through the open market, privately negotiated

transactions or other programs, subject to market conditions.

Open Conference Call

There will be a conference call held on Friday, July 26, 2024 at

8:00 a.m. Central Time to discuss the company’s second quarter

results for 2024. The call will last approximately one hour.

Interested parties are invited to listen to a live webcast by

visiting the Investor Relations website at investors.aptar.com.

Replay of the conference call can also be accessed for a limited

time on the Investor Relations page of the website.

About Aptar

Aptar is a global leader in drug and consumer product dosing,

dispensing and protection technologies. Aptar serves a number of

attractive end markets including pharmaceutical, beauty, food,

beverage, personal care and home care. Using market expertise,

proprietary design, engineering and science to create innovative

solutions for many of the world’s leading brands, Aptar in turn

makes a meaningful difference in the lives, looks, health and homes

of millions of patients and consumers around the world. Aptar is

headquartered in Crystal Lake, Illinois and has more than 13,000

dedicated employees in 20 countries. For more information, visit

www.aptar.com.

Presentation of Non-GAAP Information

This press release refers to certain non-GAAP financial

measures, including current year adjusted earnings per share and

adjusted EBITDA, which exclude the impact of restructuring

initiatives, acquisition-related costs, certain purchase accounting

adjustments related to acquisitions and investments and net

unrealized investment gains and losses related to observable market

price changes on equity securities. Core sales and adjusted

earnings per share also neutralize the impact of foreign currency

translation effects when comparing current results to the prior

year. Non-GAAP financial measures may not be comparable to

similarly titled non-GAAP financial measures provided by other

companies. Aptar’s management believes these non-GAAP financial

measures provide useful information to our investors because they

allow for a better period over period comparison of operating

results by removing the impact of items that, in management’s view,

do not reflect Aptar’s core operating performance. These non-GAAP

financial measures also provide investors with certain information

used by Aptar’s management when making financial and operational

decisions. Free cash flow is calculated as cash provided by

operating activities less capital expenditures plus proceeds from

government grants related to capital expenditures. We use free cash

flow to measure cash flow generated by operations that is available

for dividends, share repurchases, acquisitions and debt repayment.

We believe that it is meaningful to investors in evaluating our

financial performance and measuring our ability to generate cash

internally to fund our initiatives. These non-GAAP financial

measures should not be considered in isolation or as a substitute

for GAAP financial results but should be read in conjunction with

the unaudited condensed consolidated statements of income and other

information presented herein. A reconciliation of non-GAAP

financial measures to the most directly comparable GAAP measures is

included in the accompanying tables. Our outlook is provided on a

non-GAAP basis because certain reconciling items are dependent on

future events that either cannot be controlled, such as exchange

rates and changes in the fair value of equity investments, or

reliably predicted because they are not part of the company's

routine activities, such as restructuring and acquisition

costs.

This press release contains forward-looking statements,

including certain statements set forth under the “Outlook” section

of this press release. Words such as “expects,” “anticipates,”

“believes,” “estimates,” “future,” “potential,” “continues” and

other similar expressions or future or conditional verbs such as

“will,” “should,” “would” and “could” are intended to identify such

forward-looking statements. Forward-looking statements are made

pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 and are based on our beliefs as well as assumptions

made by and information currently available to us. Accordingly, our

actual results or other events may differ materially from those

expressed or implied in such forward-looking statements due to

known or unknown risks and uncertainties that exist in our

operations and business environment including, but not limited to:

geopolitical conflicts worldwide including the invasion of Ukraine

by the Russian military and the recent events in the Middle East

and the resulting indirect impact on demand from our customers

selling their products into these countries, as well as rising

input costs and certain supply chain disruptions; the availability

of raw materials and components (particularly from sole sourced

suppliers for some of our Pharma solutions) as well as the

financial viability of these suppliers; lower demand and asset

utilization due to an economic recession either globally or in key

markets we operate within; economic conditions worldwide, including

inflationary conditions and potential deflationary conditions in

other regions we rely on for growth; the execution of our fixed

cost reduction initiatives, including our optimization initiative;

fluctuations in the cost of materials, components, transportation

cost as a result of supply chain disruptions and labor shortages,

and other input costs (particularly resin, metal, anodization costs

and energy costs); significant fluctuations in foreign currency

exchange rates or our effective tax rate; the impact of tax reform

legislation, changes in tax rates and other tax-related events or

transactions that could impact our effective tax rate; financial

conditions of customers and suppliers; consolidations within our

customer or supplier bases; changes in customer and/or consumer

spending levels; loss of one or more key accounts; our ability to

successfully implement facility expansions and new facility

projects; our ability to offset inflationary impacts with cost

containment, productivity initiatives and price increases; changes

in capital availability or cost, including rising interest rates;

volatility of global credit markets; our ability to identify

potential new acquisitions and to successfully acquire and

integrate such operations, including the successful integration of

the businesses we have acquired, including contingent consideration

valuation; our ability to build out acquired businesses and

integrate the product/service offerings of the acquired entities

into our existing product/service portfolio; direct or indirect

consequences of acts of war, terrorism or social unrest;

cybersecurity threats against our systems and/or service providers

that could impact our networks and reporting systems; the impact of

natural disasters and other weather-related occurrences; fiscal and

monetary policies and other regulations; changes, difficulties or

failures in complying with government regulation, including FDA or

similar foreign governmental authorities; changing regulations or

market conditions regarding environmental sustainability; work

stoppages due to labor disputes; competition, including

technological advances; our ability to protect and defend our

intellectual property rights, as well as litigation involving

intellectual property rights; the outcome of any legal proceeding

that has been or may be instituted against us and others; our

ability to meet future cash flow estimates to support our goodwill

impairment testing; the demand for existing and new products; the

success of our customers’ products, particularly in the

pharmaceutical industry; our ability to manage worldwide customer

launches of complex technical products, particularly in developing

markets; difficulties in product development and uncertainties

related to the timing or outcome of product development;

significant product liability claims; and other risks associated

with our operations. For additional information on these and other

risks and uncertainties, please see our filings with the Securities

and Exchange Commission, including the discussion under “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our Form 10-K and Form

10-Qs. We undertake no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

AptarGroup, Inc.

Condensed Consolidated

Financial Statements (Unaudited)

(In Thousands, Except Per Share

Data)

Consolidated Statements of

Income

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net Sales

$

910,063

$

895,906

$

1,825,511

$

1,755,973

Cost of Sales (exclusive of depreciation

and amortization shown below)

567,440

573,711

1,150,196

1,131,133

Selling, Research & Development and

Administrative

149,330

141,428

302,110

289,351

Depreciation and Amortization

64,968

62,267

129,317

121,526

Restructuring Initiatives

2,315

1,943

5,795

13,467

Operating Income

126,010

116,557

238,093

200,496

Other Income (Expense):

Interest Expense

(10,061

)

(9,688

)

(20,236

)

(19,916

)

Interest Income

3,102

648

6,000

1,320

Net Investment (Loss) Gain

(140

)

2,891

452

3,079

Equity in Results of Affiliates

130

643

(91

)

512

Miscellaneous Expense, net

(795

)

(173

)

(1,654

)

(1,344

)

Income before Income Taxes

118,246

110,878

222,564

184,147

Provision for Income Taxes

27,788

27,831

49,173

46,514

Net Income

$

90,458

$

83,047

$

173,391

$

137,633

Net (Gain) Loss Attributable to

Noncontrolling Interests

(4

)

25

167

203

Net Income Attributable to AptarGroup,

Inc.

$

90,454

$

83,072

$

173,558

$

137,836

Net Income Attributable to AptarGroup,

Inc. per Common Share:

Basic

$

1.36

$

1.27

$

2.62

$

2.11

Diluted

$

1.34

$

1.24

$

2.57

$

2.07

Average Numbers of Shares Outstanding:

Basic

66,312

65,568

66,188

65,470

Diluted

67,575

66,855

67,509

66,748

AptarGroup, Inc.

Condensed Consolidated

Financial Statements (Unaudited)

(continued)

($ In Thousands)

Consolidated Balance

Sheets

June 30, 2024

December 31, 2023

ASSETS

Cash and Equivalents

$

221,492

$

223,643

Short-term Investments

2,399

—

Accounts and Notes Receivable, Net

737,764

677,822

Inventories

484,608

513,053

Prepaid and Other

147,387

134,761

Total Current Assets

1,593,650

1,549,279

Property, Plant and Equipment, Net

1,466,276

1,478,063

Goodwill

950,075

963,418

Other Assets

443,256

461,130

Total Assets

$

4,453,257

$

4,451,890

LIABILITIES AND STOCKHOLDERS’ EQUITY

Short-Term Obligations

$

405,719

$

458,220

Accounts Payable, Accrued and Other

Liabilities

762,390

793,089

Total Current Liabilities

1,168,109

1,251,309

Long-Term Obligations

681,532

681,188

Deferred Liabilities and Other

193,401

198,095

Total Liabilities

2,043,042

2,130,592

AptarGroup, Inc. Stockholders' Equity

2,396,449

2,306,824

Noncontrolling Interests in

Subsidiaries

13,766

14,474

Total Stockholders' Equity

2,410,215

2,321,298

Total Liabilities and Stockholders'

Equity

$

4,453,257

$

4,451,890

AptarGroup, Inc.

Reconciliation of Adjusted

EBIT and Adjusted EBITDA to Net Income (Unaudited)

($ In Thousands)

Three Months Ended June 30,

2024

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate & Other

Net Interest

Net Sales

$

910,063

$

414,533

$

321,487

$

174,043

$

—

$

—

Reported net income

$

90,458

Reported income taxes

27,788

Reported income before income

taxes

118,246

111,814

22,773

11,971

(21,353

)

(6,959

)

Adjustments:

Restructuring initiatives

2,315

65

1,199

893

158

Net investment loss

140

—

—

—

140

Transaction costs related to

acquisitions

140

—

140

—

—

Adjusted earnings before income taxes

120,841

111,879

24,112

12,864

(21,055

)

(6,959

)

Interest expense

10,061

10,061

Interest income

(3,102

)

(3,102

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

127,800

111,879

24,112

12,864

(21,055

)

—

Depreciation and amortization

64,968

29,609

20,526

14,254

579

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

192,768

$

141,488

$

44,638

$

27,118

$

(20,476

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

9.9

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

21.2

%

34.1

%

13.9

%

15.6

%

Three Months Ended June 30,

2023

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate & Other

Net Interest

Net Sales

$

895,906

$

390,700

$

329,587

$

175,619

$

—

$

—

Reported net income

$

83,047

Reported income taxes

27,831

Reported income before income

taxes

110,878

98,100

21,796

14,232

(14,210

)

(9,040

)

Adjustments:

Restructuring initiatives

1,943

434

479

440

590

Net investment gain

(2,891

)

—

—

—

(2,891

)

Adjusted earnings before income taxes

109,930

98,534

22,275

14,672

(16,511

)

(9,040

)

Interest expense

9,688

9,688

Interest income

(648

)

(648

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

118,970

98,534

22,275

14,672

(16,511

)

—

Depreciation and amortization

62,267

27,332

20,825

13,100

1,010

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

181,237

$

125,866

$

43,100

$

27,772

$

(15,501

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

9.3

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

20.2

%

32.2

%

13.1

%

15.8

%

AptarGroup, Inc.

Reconciliation of Adjusted

EBIT and Adjusted EBITDA to Net Income (Unaudited)

($ In Thousands)

Six Months Ended June 30,

2024

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate & Other

Net Interest

Net Sales

$

1,825,511

$

821,826

$

648,807

$

354,878

$

—

$

—

Reported net income

$

173,391

Reported income taxes

49,173

Reported income before income

taxes

222,564

215,166

39,969

24,841

(43,176

)

(14,236

)

Adjustments:

Restructuring initiatives

5,795

89

3,909

1,653

144

Net investment gain

(452

)

—

—

—

(452

)

Transaction costs related to

acquisitions

140

—

140

—

—

Adjusted earnings before income taxes

228,047

215,255

44,018

26,494

(43,484

)

(14,236

)

Interest expense

20,236

20,236

Interest income

(6,000

)

(6,000

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

242,283

215,255

44,018

26,494

(43,484

)

—

Depreciation and amortization

129,317

58,411

41,754

27,785

1,367

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

371,600

$

273,666

$

85,772

$

54,279

$

(42,117

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

9.5

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

20.4

%

33.3

%

13.2

%

15.3

%

Six Months Ended June 30,

2023

Consolidated

Aptar Pharma

Aptar Beauty

Aptar Closures

Corporate & Other

Net Interest

Net Sales

$

1,755,973

$

746,746

$

655,976

$

353,251

$

—

$

—

Reported net income

$

137,633

Reported income taxes

46,514

Reported income before income

taxes

184,147

180,490

29,228

27,527

(34,502

)

(18,596

)

Adjustments:

Restructuring initiatives

13,467

1,565

9,770

962

1,170

Net investment gain

(3,079

)

—

—

—

(3,079

)

Transaction costs related to

acquisitions

255

—

199

56

—

Adjusted earnings before income taxes

194,790

182,055

39,197

28,545

(36,411

)

(18,596

)

Interest expense

19,916

19,916

Interest income

(1,320

)

(1,320

)

Adjusted earnings before net interest and

taxes (Adjusted EBIT)

213,386

182,055

39,197

28,545

(36,411

)

—

Depreciation and amortization

121,526

53,109

41,108

25,235

2,074

—

Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA)

$

334,912

$

235,164

$

80,305

$

53,780

$

(34,337

)

$

—

Reported net income margins (Reported

net income / Reported Net Sales)

7.8

%

Adjusted EBITDA margins (Adjusted EBITDA /

Reported Net Sales)

19.1

%

31.5

%

12.2

%

15.2

%

AptarGroup, Inc.

Reconciliation of Adjusted

Earnings Per Diluted Share (Unaudited)

(In Thousands, Except Per Share

Data)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Income before Income Taxes

$

118,246

$

110,878

$

222,564

$

184,147

Adjustments:

Restructuring initiatives

2,315

1,943

5,795

13,467

Net investment loss (gain)

140

(2,891

)

(452

)

(3,079

)

Transaction costs related to

acquisitions

140

—

140

255

Foreign currency effects (1)

(1,007

)

230

Adjusted Earnings before Income Taxes

$

120,841

$

108,923

$

228,047

$

195,020

Provision for Income Taxes

$

27,788

$

27,831

$

49,173

$

46,514

Adjustments:

Restructuring initiatives

567

494

1,458

3,559

Net investment loss (gain)

34

(708

)

(111

)

(754

)

Transaction costs related to

acquisitions

35

—

35

65

Foreign currency effects (1)

(253

)

58

Adjusted Provision for Income Taxes

$

28,424

$

27,364

$

50,555

$

49,442

Net (Income) Loss Attributable to

Noncontrolling Interests

$

(4

)

$

25

$

167

$

203

Net Income Attributable to AptarGroup,

Inc.

$

90,454

$

83,072

$

173,558

$

137,836

Adjustments:

Restructuring initiatives

1,748

1,449

4,337

9,908

Net investment loss (gain)

106

(2,183

)

(341

)

(2,325

)

Transaction costs related to

acquisitions

105

—

105

190

Foreign currency effects (1)

(754

)

172

Adjusted Net Income Attributable to

AptarGroup, Inc.

$

92,413

$

81,584

$

177,659

$

145,781

Average Number of Diluted Shares

Outstanding

67,575

66,855

67,509

66,748

Net Income Attributable to AptarGroup,

Inc. Per Diluted Share

$

1.34

$

1.24

$

2.57

$

2.07

Adjustments:

Restructuring initiatives

0.03

0.02

0.06

0.15

Net investment loss (gain)

—

(0.03

)

—

(0.04

)

Transaction costs related to

acquisitions

—

—

—

—

Foreign currency effects (1)

(0.01

)

—

Adjusted Net Income Attributable to

AptarGroup, Inc. Per Diluted Share

$

1.37

$

1.22

$

2.63

$

2.18

(1) Foreign currency effects are

approximations of the adjustment necessary to state the prior year

earnings and earnings per share using current period foreign

currency exchange rates.

AptarGroup, Inc.

Reconciliation of Free Cash

Flow to Net Cash Provided by Operations (Unaudited)

(In Thousands)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Net Cash Provided by Operations

$

143,579

$

83,897

$

235,912

$

182,201

Capital Expenditures

(68,205

)

(77,187

)

(143,866

)

(155,012

)

Free Cash Flow

$

75,374

$

6,710

$

92,046

$

27,189

AptarGroup, Inc.

Reconciliation of Adjusted

Earnings Per Diluted Share (Unaudited)

(In Thousands, Except Per Share

Data)

Three Months Ending September

30,

Expected 2024

2023

Income before Income Taxes

$

110,049

Adjustments:

Restructuring initiatives

6,161

Net investment loss

1,240

Realized gain on investments included in

net investment loss above

4,188

Transaction costs related to

acquisitions

—

Foreign currency effects (1)

(1,412

)

Adjusted Earnings before Income Taxes

$

120,226

Provision for Income Taxes

$

25,751

Adjustments:

Restructuring initiatives

1,611

Net investment loss

304

Realized gain on investments included in

net investment loss above

1,026

Transaction costs related to

acquisitions

—

Foreign currency effects (1)

(330

)

Adjusted Provision for Income Taxes

$

28,362

Net Loss Attributable to Noncontrolling

Interests

$

(2

)

Net Income Attributable to AptarGroup,

Inc.

$

84,296

Adjustments:

Restructuring initiatives

4,550

Net investment loss

936

Realized gain on investments included in

net investment loss above

3,162

Transaction costs related to

acquisitions

—

Foreign currency effects (1)

(1,082

)

Adjusted Net Income Attributable to

AptarGroup, Inc.

$

91,862

Average Number of Diluted Shares

Outstanding

67,035

Net Income Attributable to AptarGroup,

Inc. Per Diluted Share (3)

$

1.26

Adjustments:

Restructuring initiatives

0.07

Net investment loss

0.01

Realized gain on investments included in

net investment loss above

0.05

Transaction costs related to

acquisitions

—

Foreign currency effects (1)

(0.02

)

Adjusted Net Income Attributable to

AptarGroup, Inc. Per Diluted Share (2)

$1.38 - $1.46

$

1.37

(1) Foreign currency effects are

approximations of the adjustment necessary to state the prior year

earnings and earnings per share using spot rates as of June 30,

2024 for all applicable foreign currency exchange rates.

(2) AptarGroup’s expected earnings per

share range for the third quarter of 2024, excluding any

restructuring expenses, acquisition costs and changes in fair value

of equity investments, is based on an effective tax rate range of

23.5% to 25.5%. This tax rate range compares to our third quarter

of 2023 effective tax rate of 23% on reported earnings per share

and 24% on adjusted earnings per share.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725389689/en/

Investor Relations Contact:

Mary Skafidas mary.skafidas@aptar.com 815-479-5530

Media Contact: Katie Reardon

katie.reardon@aptar.com 815-479-5671

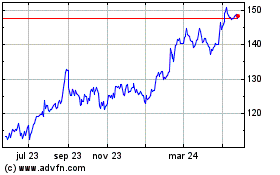

AptarGroup (NYSE:ATR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

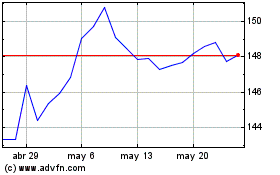

AptarGroup (NYSE:ATR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024