Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

22 Julio 2024 - 4:05PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration No. 333-276975

$3,400,000,000

AMERICAN EXPRESS COMPANY

$1,200,000,000 5.043% Fixed-to-Floating Rate Notes due

July 26, 2028

$1,700,000,000 5.284%

Fixed-to-Floating Rate Notes due July 26, 2035

$500,000,000 Floating Rate Notes due July 26, 2028

Terms and Conditions Applicable to all Notes

|

|

|

| Issuer: |

|

American Express Company |

|

|

| Expected Ratings(1): |

|

A2/BBB+/A (Stable/Positive/Stable) (Moody’s/S&P/Fitch) |

|

|

| Ranking: |

|

Senior Unsecured |

|

|

| Trade Date: |

|

July 22, 2024 |

|

|

| Settlement Date: |

|

July 26, 2024 (T+4). Pursuant to Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in one business day,

unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on any date prior to one business day before delivery will be required, by virtue of the fact that the Notes are initially expected

to settle in T+4, to specify alternative settlement arrangements to prevent a failed settlement. |

|

|

| Total Net Proceeds to American Express Company: |

|

$3,388,100,000 (before expenses) |

|

|

| Use of Proceeds: |

|

The issuer intends to use the net proceeds from this offering for general corporate purposes. |

|

|

| Listing: |

|

The Notes will not be listed on any exchange. |

|

|

| Minimum Denominations/Multiples: |

|

Minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

|

|

| Joint Book-Running Managers: |

|

Morgan Stanley & Co. LLC Barclays

Capital Inc. BofA Securities, Inc. RBC Capital Markets,

LLC Wells Fargo Securities, LLC |

|

|

|

| Co-Managers: |

|

CastleOak Securities, L.P. NatWest Markets

Securities Inc. SG Americas Securities, LLC SMBC Nikko

Securities America, Inc. Standard Chartered Bank TD

Securities (USA) LLC |

|

|

| Junior Co-Managers: |

|

Drexel Hamilton, LLC Siebert Williams

Shank & Co., LLC |

|

|

| Risk Factors: |

|

Investing in the Notes involves risks. You should carefully consider the information under “Risk Factors” beginning on page 3 of the base prospectus (as defined below) and in the issuer’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024 and the other information

incorporated by reference in the base prospectus. |

|

|

| Calculation Agent: |

|

The Bank of New York Mellon |

Terms and Conditions Applicable to the 5.043% Fixed-to-Floating Rate Notes due July 26, 2028

|

|

|

| Maturity Date: |

|

July 26, 2028 |

|

|

| Par Amount: |

|

$1,200,000,000 |

|

|

| Benchmark Treasury: |

|

UST 4.375% due July 15, 2027 |

|

|

| Benchmark Treasury Price and Yield: |

|

100-7 ¼; 4.293% |

|

|

| Re-offer Spread to Benchmark: |

|

+75 bps |

|

|

| Re-offer Yield: |

|

5.043% |

|

|

| Interest Rates: |

|

The Notes will bear interest (i) during the Fixed Rate Period at a fixed rate per annum equal to 5.043%, and (ii) during the Floating Rate Period at a floating rate per annum equal to Compounded SOFR (determined in

accordance with the provisions set forth in the base prospectus) plus 0.930%. |

|

|

| Fixed Rate Period: |

|

From, and including, the Settlement Date to, but excluding, July 26, 2027 |

|

|

|

| Floating Rate Period: |

|

From, and including, July 26, 2027 to, but excluding, the Maturity Date |

|

|

| Public Offering Price: |

|

100.000% |

|

|

| Underwriters’ Discount: |

|

0.250% |

|

|

| Net Proceeds to American Express Company: |

|

$1,197,000,000 (before expenses) |

|

|

| Interest Payment Dates: |

|

(i) With respect to the Fixed Rate Period, January 26 and July 26 of each year, beginning January 26, 2025 and ending on July 26, 2027 and (ii) with respect to the Floating Rate Period, January 26,

April 26, July 26 and October 26, beginning October 26, 2027 and ending on the Maturity Date. |

|

|

| Interest Periods: |

|

Semi-annually in arrears during the Fixed Rate Period and quarterly in arrears during the Floating Rate Period. |

|

|

| Floating Rate Interest Determination Dates: |

|

Two U.S. Government Securities Business Days preceding each Floating Rate Interest Payment Date (or in the final Floating Rate Interest Period, preceding the Maturity Date, or in the case of the redemption of any Notes, preceding

the Redemption Date). |

|

|

| Business Day Convention: |

|

Fixed Rate Period: Following Unadjusted Business Day Convention

Floating Rate Period: Modified Following Adjusted Business Day Convention, except Following Unadjusted Business Day Convention for the Maturity Date and any

Redemption Date. |

|

|

| Day Count: |

|

Fixed Rate Period: 30 / 360 Floating Rate

Period: Actual / 360 |

|

|

| Optional Par Call Redemption: |

|

(i) In whole but not in part on July 26, 2027 or (ii) in whole or in part during the 31-day period prior to the Maturity Date, in each case at a redemption price equal to the

principal amount of the Notes being redeemed, together with any accrued and unpaid interest thereon to, but excluding, the date fixed for redemption. |

|

|

|

| Optional Make-Whole Redemption: |

|

In whole or in part, on or after January 26, 2025 (or if additional Notes are issued after July 26, 2024, on or after the date that is six months after the issue date of such additional Notes) and prior to July 26,

2027, at a redemption price as calculated and paid in the manner described in the base prospectus, with a Treasury Rate “spread” of 12.5 basis points. |

|

|

| CUSIP: |

|

025816 DV8 |

|

|

| ISIN: |

|

US025816DV84 |

Terms and Conditions Applicable to the 5.284% Fixed-to-Floating Rate Notes due July 26, 2035

|

|

|

| Maturity Date: |

|

July 26, 2035 |

|

|

| Par Amount: |

|

$1,700,000,000 |

|

|

| Benchmark Treasury: |

|

UST 4.375% due May 15, 2034 |

|

|

| Benchmark Treasury Price and Yield: |

|

100-30+; 4.254% |

|

|

| Re-offer Spread to Benchmark: |

|

+103 bps |

|

|

| Re-offer Yield: |

|

5.284% |

|

|

| Interest Rates: |

|

The Notes will bear interest (i) during the Fixed Rate Period at a fixed rate per annum equal to 5.284%, and (ii) during the Floating Rate Period at a floating rate per annum equal to Compounded SOFR (determined in

accordance with the provisions set forth in the base prospectus) plus 1.420%. |

|

|

| Fixed Rate Period: |

|

From, and including, the Settlement Date to, but excluding, July 26, 2034 |

|

|

| Floating Rate Period: |

|

From, and including, July 26, 2034 to, but excluding, the Maturity Date |

|

|

| Public Offering Price: |

|

100.000% |

|

|

| Underwriters’ Discount: |

|

0.450% |

|

|

| Net Proceeds to American Express Company: |

|

$1,692,350,000 (before expenses) |

|

|

| Interest Payment Dates: |

|

(i) With respect to the Fixed Rate Period, January 26 and July 26 of each year, beginning January 26, 2025 and ending on July 26, 2034 and (ii) with respect to the Floating Rate Period, January 26,

April 26, July 26 and October 26, beginning October 26, 2034 and ending on the Maturity Date. |

|

|

|

| Interest Periods: |

|

Semi-annually in arrears during the Fixed Rate Period and quarterly in arrears during the Floating Rate Period. |

|

|

| Floating Rate Interest Determination Dates: |

|

Two U.S. Government Securities Business Days preceding each Floating Rate Interest Payment Date (or in the final Floating Rate Interest Period, preceding the Maturity Date, or in the case of the redemption of any Notes, preceding

the Redemption Date). |

|

|

| Business Day Convention: |

|

Fixed Rate Period: Following Unadjusted Business Day Convention

Floating Rate Period: Modified Following Adjusted Business Day Convention, except Following Unadjusted Business Day Convention for the Maturity Date and any

Redemption Date. |

|

|

| Day Count: |

|

Fixed Rate Period: 30 / 360 Floating Rate

Period: Actual / 360 |

|

|

| Optional Par Call Redemption: |

|

(i) In whole but not in part on July 26, 2034 or (ii) in whole or in part during the 3-month period prior to the Maturity Date, in each case at a redemption price equal to the

principal amount of the Notes being redeemed, together with any accrued and unpaid interest thereon to, but excluding, the date fixed for redemption. |

|

|

| Optional Make-Whole Redemption: |

|

In whole or in part, on or after January 26, 2025 (or if additional Notes are issued after July 26, 2024, on or after the date that is six months after the issue date of such additional Notes) and prior to July 26,

2034, at a redemption price as calculated and paid in the manner described in the base prospectus, with a Treasury Rate “spread” of 20 basis points. |

|

|

| CUSIP: |

|

025816 DW6 |

|

|

| ISIN: |

|

US025816DW67 |

Terms and Conditions Applicable to the Floating Rate Notes due July 26, 2028

|

|

|

| Maturity Date: |

|

July 26, 2028 |

|

|

| Par Amount: |

|

$500,000,000 |

|

|

| Base Rate: |

|

Compounded SOFR (as determined in accordance with the provisions set forth in the base prospectus). |

|

|

| Spread: |

|

+93 bps |

|

|

| Public Offering Price: |

|

100.000% |

|

|

| Underwriters’ Discount: |

|

0.250% |

|

|

| Net Proceeds to American Express Company: |

|

$498,750,000 (before expenses) |

|

|

| Interest Payment Dates: |

|

January 26, April 26, July 26 and October 26 of each year, beginning October 26, 2024. |

|

|

| Interest Periods: |

|

Quarterly. The initial period will be the period from, and including the Settlement Date to, but excluding, October 26, 2024, the initial Interest Payment Date. The subsequent interest periods will be the periods from, and

including the applicable Interest Payment Date to, but excluding, the next Interest Payment Date or the Maturity Date, as applicable. |

|

|

| Interest Determination Dates: |

|

Two U.S. Government Securities Business Days preceding each Interest Payment Date (or in the final Interest Period, preceding the Maturity Date, or in the case of the redemption of any Notes, preceding the Redemption

Date). |

|

|

| Business Day Convention: |

|

Modified Following Adjusted Business Day Convention, except Following Unadjusted Business Day Convention for the Maturity Date and any Redemption Date. |

|

|

| Day Count: |

|

Actual / 360 |

|

|

| Optional Par Call Redemption: |

|

(i) In whole but not in part on July 26, 2027 or (ii) in whole or in part during the 31-day period prior to the Maturity Date, in each case at a redemption price equal to the

principal amount of the Notes being redeemed, together with any accrued and unpaid interest thereon to, but excluding, the date fixed for redemption. |

|

|

|

| CUSIP: |

|

025816 DX4 |

|

|

| ISIN: |

|

US025816DX41 |

| (1) |

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating

agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The rating of the Notes should be evaluated independently from similar ratings of other

securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. |

The issuer has filed a registration statement (including a base prospectus (the “base prospectus”) dated February 9, 2024) with the SEC for the

offering to which this communication relates. Capitalized terms used but not defined herein have the meanings ascribed to them in the base prospectus. Before you invest, you should read the base prospectus and other documents the issuer has filed

with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the

offering will arrange to send you the base prospectus if you request it by calling Morgan Stanley & Co. LLC at

1-866-718-1649, Barclays Capital Inc. at 1-888-603-5847, BofA Securities, Inc. at 1-800-294-1322, RBC Capital Markets, LLC

at 1-866-375-6829 and Wells Fargo Securities, LLC at 1-800-645-3751.

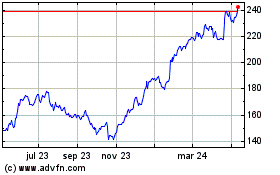

American Express (NYSE:AXP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

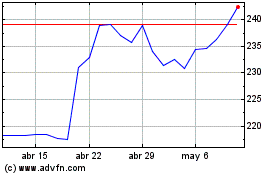

American Express (NYSE:AXP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024