Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

01 Agosto 2024 - 3:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

AMREP CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with

preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

August 1, 2024

To Our Owners:

Our

headline financial results for 2024 included $51.4 million in revenues, $10.7 million in net cash

provided by operating activities and $6.7 million in net income. Highlights of the year included:

| · | Core Businesses: We generated developed residential land sale revenues of $18.5 million and our

homebuilding segment closed on the sale of 36 homes with $17.2 million in revenues. This performance took place in an operating environment

with mortgage rates at 20-year highs and input costs at sustained high levels. During 2024, we continued to moderate the number and scope

of our active land development projects and delayed proceeding with certain new land development projects due to market headwinds and

uncertainty, entitlement delays and infrastructure availability. |

| · | Other Property: We generated undeveloped land sale revenues of $7.8 million, which included the

sale of our land inventory in Brighton, Colorado. We generated developed commercial land

sale revenues of $550,000 with sales of 1.5 acres of developed commercial land in New Mexico. |

| · | Pension: We terminated our defined benefit pension plan and the liabilities

thereunder were assumed by an insurance company through an annuity purchase. |

| · | Taxes: We utilized $1.5 million of our $12.5 million deferred tax asset, leaving $11.0 million

of deferred tax assets available to reduce future income taxes that would otherwise be payable. |

| · | Inventory and Investment Assets: We increased our real estate inventory and investment assets by

$756,000 in connection with the production of finished residential lots and homes and acquisitions of land to supplement our current land

holdings. |

| · | Cash Position: Our cash position as of April 30, 2024 was $29.7 million. We were able to limit

our debt financing needs by relying on cash flow from operations and available cash. |

We encourage you to read our annual report on

Form 10-K to understand the details of these results.

Our core areas of focus today are to monetize

our land assets in Rio Rancho, New Mexico and to become a leading homebuilder in the Rio Rancho area. We categorize our land assets, which

we sell both to third party homebuilders and to our own homebuilding operations, based on contiguous ownership and availability of entitlements

or infrastructure as follows:

| · | Land where we have high contiguous ownership: |

| o | Property with a meaningful level of completed or planned

entitlements or infrastructure: These properties

include existing and planned residential subdivisions and commercial properties and are in various stages of readiness for monetization,

ranging from ready for immediate sale to multiple years of required work prior to sale. We also target expanding our inventory of property

in this category through strategic land acquisitions. |

AMREP

CORPORATION

850 West Chester Pike, Suite 205 ● Havertown, Pennsylvania

19083

| o | Property without a meaningful level of completed or planned

entitlements or infrastructure: The majority of

these properties are expected to be used for residential purposes, but may be a significant distance from infrastructure required for

a subdivision (requiring significant commitments from us, local government and infrastructure authorities), may be dependent on the completion

of other projects or may require the acquisition of additional lots to fill-in ownership gaps in order to have a viable subdivision. |

| · | Land where we have low contiguous ownership: |

| o | Scattered lots near power and water infrastructure:

We have made continuing efforts to systematically monetize these lots through our internal homebuilding operations and through strategic

sales. |

| o | Scattered lots not near power and water infrastructure:

We aim to sell these lots in their as-is condition. The pace of sales of such lots is slow given the lack of demand in the market. |

A significant limiting factor for the monetization

of our land assets is the number of expected residential building permits that can be reasonably achieved each year in Rio Rancho and

the percentage of those permits we would expect to be situated on our lots or in one of our subdivisions. For example, single family residential

permits in Rio Rancho averaged 812 homes per year during the 5 most recent calendar years of 2019 through 2023 and 660 homes per year

during the 10 most recent calendar years of 2014 through 2023.

The systematic monetization of our land assets

matches our continued focus on delivering sustainable and growing profitability that will benefit long-term holders of our common stock.

As we have said in the past, our strategy is to be a leading New Mexico real estate company focused on sustainable long-term success and

profitability through careful advance planning and meticulous project execution.

We continue to leverage our talented and highly

dedicated team of employees to expand our operations through homebuilding, land development and other value-added real estate capabilities.

Our strategy and operations are intended to generate strong future returns on capital and maximize per share equity value on a long-term

basis.

We appreciate your continued support.

Sincerely,

|

Christopher V. Vitale

President and Chief Executive Officer |

Edward B. Cloues, II

Chairman of the Board |

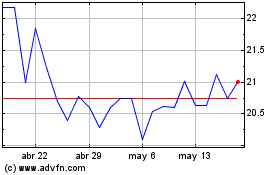

AMREP (NYSE:AXR)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

AMREP (NYSE:AXR)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024