0000008947false00000089472024-07-152024-07-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

July 15, 2024

Date of Report (Date of earliest event reported)

AZZ Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Texas | | 1-12777 | | 75-0948250 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

(Address of principal executive offices) (Zip Code)

(817) 810-0095

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AZZ | | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 5 – Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 15, 2024 (the "Effective Date"), AZZ Inc. (the "Company"), entered into an employment agreement (the "Employment Agreement") with Mr. Bryan Stovall, who serves as President and Chief Operating Officer of the Company's Metal Coatings segment. The Employment Agreement has an initial two-year term, unless terminated earlier in accordance with the terms of the Employment Agreement, and is subject to automatic extensions for successive one-year periods unless either the Company or Mr. Stovall gives written notice to the other at least one hundred twenty (120) days before such extension would otherwise occur of the Company’s or Mr. Stovall's election not to extend the term. In connection with entering into and in accordance with the terms of the Employment Agreement, Mr. Stovall will receive (i) a cash retention bonus in the amount of $425,000; and (ii) a special one-time equity award valued at $1,500,000 consisting of restricted stock units (“RSUs”) granted pursuant to the Company’s 2023 Long Term Incentive Plan (the “2023 Plan”) that will vest ratably over two years with 50% of the RSUs vesting on May 31, 2025 and the remaining 50% of RSUs vesting on May 31, 2026 so long as Mr. Stovall remains employed at the Company though both vesting dates.

Mr. Stovall will continue to be eligible to receive an annual cash incentive bonus under the Company’s Senior Management Bonus Plan (the “STI Plan”), which provides for an annual cash incentive target based upon 80% of Mr. Stovall’s annual base salary pursuant to the achievement of certain individual and Company performance criteria. He will also continue to be eligible each year for an annual equity award, the amount and nature to be determined annually by the Company’s Board of Directors (the “Board”) and/or the Board’s Compensation Committee. For the Company’s fiscal year ending February 28, 2025, Mr. Stovall’s equity award target value was based upon 100% of his annual base salary and consisted of 50% performance share units (“PSUs”) and 50% RSUs granted pursuant to the 2023 Plan. The following table summarizes the key terms noted above:

| | | | | | | | | | | | | | | | | | | | |

| Name | Position | FY2025

Base Salary | One-Time Equity Award Value (RSUs) | Award Vesting Dates | FY2025

STI Plan Target | FY2025

LTI Plan Target Awards |

| | | | | | |

| Bryan Stovall | President and Chief Operating Officer – Metal Coatings | $472,427 | $1,500,000 | 5/31/2025 and 5/31/2026 | $377,942 | $472,427 |

The Employment Agreement also provides for severance payments upon certain events in accordance with the terms of the Company's Executive Severance Plan (the "Severance Plan"), which may include base salary and accrued paid time off through the date of termination, as well as a pro-rated annual cash bonus, based upon the Company’s actual performance and the number of days of employment in the fiscal year of termination, in the event Mr. Stovall’s employment is terminated by the Company without Cause, by Mr. Stovall for Good Reason or in connection with a Change in Control (each term as defined in the Severance Plan). In the event of a termination, the receipt of severance payments is conditioned upon the execution of a general release in a form approved by the Company. Mr. Stovall is also subject to confidentiality and other restrictive covenants prohibiting competition, solicitation of customers and employees and interference with business relationships during his employment and for a period of 12 months thereafter.

The foregoing summary descriptions of Mr. Stovall’s Employment Agreement and the Company's STI Plan, 2023 Plan and Severance Plan, do not purport to be complete and are qualified in their entirety by reference to the terms of the Employment Agreement, a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference, the terms of the STI Plan, a copy of which is included as Appendix B to Company's Proxy Statement on Schedule 14A, which was filed with the Securities and Exchange Commission (the “SEC”) on May 28, 2015 and incorporated herein by reference, the terms of the 2023 Plan, a copy of which is included as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC by the Company on July 11, 2023 and incorporated herein by reference, and the terms of the Severance Plan, a copy of which was included as Exhibit 10.7 to the Company’s Quarterly Report on Form 10-Q, filed with the SEC on October 12, 2021 and incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 10.1 | |

104 | Cover Page Interactive File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| AZZ Inc. |

| Date: July 19, 2024 |

By: /s/ Tara D. Mackey |

| Tara D. Mackey Chief Legal Officer and Secretary |

EMPLOYMENT AGREEMENT

This EMPLOYMENT AGREEMENT (this "Agreement") made and entered into as of the 15th day of July 2024, by and between AZZ Inc., a Texas corporation (the "Company"), and Bryan Stovall ("Executive").

WITNESS ETH

WHEREAS, the Executive is currently serving as the President and Chief Operating Officer - AZZ Metal Coatings; and

WHEREAS, in connection with entering into this Agreement, the Company will grant the Executive a special one-time equity award consisting of restricted stock units ("RSUs") that will be valued at $1,500,000 on the grant date, and such RSUs will vest ratably over the next two years, with 50% vesting on May 31, 2025, and 50% vesting on May 31, 2026. The grant date for the special one-time RSUs will be the first open trading window after the Company issues its fiscal year 2025 ("FY2025") first quarter financial results. The special one-time RSU award will be subject to Executive remaining employed at the Company, and the other terms and conditions set forth in the respective equity award agreement and the Company's 2023 Long-Term Incentive Plan (the "2023 Plan");

WHEREAS, in connection with entering into this Agreement, the Company will also provide the Executive with a $425,000 retention bonus to be awarded on the first day of the next open trading window after the Company issues its FY2025 first quarter financial results.

NOW THEREFORE, in consideration of the mutual covenants set forth below, and intending to be legally bound hereby, it is hereby agreed as follows:

ARTICLE I

Employment

1.01 Employment Term. The Company agrees to continue to employ Executive, and Executive agrees to be so continually employed, in the capacity as President and Chief Operating Officer - AZZ Metal Coatings of the Company, for a term commencing on July 15, 2024 and ending on July 15, 2026; provided, however, that, commencing on July 15, 2026 and on each one year anniversary thereafter, the term shall automatically be extended for one additional year unless either the Company or Executive gives written notice to the other at least one hundred twenty (120) days before such extension would otherwise occur of the Company's or Executive's election not to extend the term; provided, further, that notwithstanding anything to the contrary set forth in this Agreement, this Agreement may be earlier terminated pursuant to the terms hereof. "Employment Term" as used herein shall mean the duration of Executive's employment by or service to the Company, whether in the capacity of an independent contractor or consultant, on an at-will employment basis, or under this Agreement, without giving effect to any extensions thereof not yet effected, and regardless of any change in Executive's status or the capacity in which he is employed by or serves the Company.

1.02 Position and Duties. Executive shall (in accordance with Section 6.01 hereof) diligently and conscientiously continue to devote Executive's full business time, attention, energy, skill and best efforts to the business of the Company and the discharge of Executive's duties hereunder. Executive's duties under this Agreement shall be to continue to serve as President and Chief Operating Officer - AZZ Metal Coatings, with the responsibilities, rights, authority and duties customarily pertaining to such offices and as may be established from time to time by or under the direction of the board of directors of the Company, or the board of directors or other governing body of any successor entity to the Company (collectively, the "Board"), or its designees. Executive shall also act as an officer, director and/or manager of such Affiliates (as defined below) of the Company as may be designated by the Board from time to time, commensurate with Executive's office, all without any further compensation other than as provided in this Agreement. As used herein, "Affiliate" means any entity that directly or indirectly controls, is controlled by, or is under common control with, the Company.

1.03 Place of Employment. Executive's place of employment shall be Fort Worth, TX.

ARTICLE II

Compensation

2.01 Base Salary. The Company shall continue to pay Executive an annual base salary of Four Hundred Seventy-Two Thousand Four Hundred Twenty-Seven Dollars and Twenty-Eight Cents ($472,427.28) payable semi-monthly and otherwise in accordance with the regular payroll practices of the Company. At least annually, the CEO along with the Board, and/or the Compensation Committee thereof (the "Committee"), shall consider and review the annual contributions of the Executive to the Company; annual increases will be determined based on performance, experience, and market competitiveness. Executive's annual base salary payable hereunder, as it may be maintained or changed from time to time in accordance herewith, is referred to herein as "Base Salary."

2.02 Executive Incentive Bonus. Executive shall continue to be eligible to receive an annual cash incentive bonus under the Company's Senior Management Bonus Plan ("STI Plan"), as may be implemented and modified from time to time by the Company. The Committee shall have the right to interpret and to construe the terms and provisions of any such plan, and the actions of the Committee in this regard shall be final and conclusive. Executive's annual cash incentive bonus shall be determined by the Committee based upon the Company's pre-determined performance metrics that are tied to annual business objectives and the Executive's individual performance goals, with the Executive's target amount for the remainder of FY2025 and going forward to be equal to eighty percent (80%) of Executive's Base Salary as of the first day of such fiscal year and the maximum amount of such annual cash incentive bonus to be no greater than two hundred percent (200%) of the Executive's target annual bonus amount. Executive's annual cash incentive bonus shall be subject to Section 9.10 of this Agreement.

2.03 Equity Awards. Executive shall continue to be eligible to receive annual equity awards (including, without limitation, RSUs, performance share units ("PSUs") and other restricted shares under the Company's 2023 Plan, as may subsequently be amended, or any similar equity compensation plan subsequently adopted by the Company and its shareholders (each, an "Equity Plan" and collectively, the "Equity Plans"). The amount and nature of such awards shall be

determined at least annually by the Board and/or the Committee, in their sole and absolute discretion. Executive will be eligible to receive a combination of PSUs and RSUs with a target value of 100% of Executive's Base Salary, such awards will be comprised fifty percent (50%) of PSUs and fifty percent (50%) of RSUs. Executive will receive similar annual equity awards hereunder, subject to the Committee's sole discretion. For the avoidance of doubt, all such equity awards, shall be governed by the terms of the applicable Equity Plan under which such awards are granted as evidenced by the award agreements between the Company and Executive with respect to such awards.

2.04 Benefits. Executive shall continue to be eligible to participate in all other employee benefit programs of the Company offered from time to time during the Employment Term by the Company to employees or executives of Executive's rank, to the extent that Executive qualifies under the eligibility provisions of the applicable plan or plans, in each case consistent with the Company's then-current practice as approved by the Board and/or the Committee from time to time. The foregoing shall not be construed to require the Company to establish such plans or to prevent the modification or termination of such plans once established, and no such action or failure thereof shall affect this Agreement. Executive recognizes that the Company and its Affiliates have the right, in their sole discretion, to amend, modify or terminate their benefit plans without creating any rights in Executive.

2.05 Vacation. Executive shall be entitled to four (4) weeks of paid vacation per year.

2.06 Business Expenses. To the extent that Executive's reasonable and necessary expenditures for travel, entertainment and similar items made in furtherance of Executive's duties under this Agreement comply with the Company's travel and expense reimbursement policy and are documented as required by the immediately following sentence, the Company shall promptly reimburse Executive for such expenditures. Executive shall document and substantiate all such expenditures, including an itemized list of all expenses incurred, the business purposes for which such expenses were incurred, and all receipts related thereto, and shall submit such items in accordance with Company policy.

ARTICLE III

Termination of Employment

3.01 Death or Disability.

(a) In the event of Executive's death during the Employment Term, the Employment Term shall automatically terminate.

(b) The Company shall have the right to terminate the Employment Term in the event of Executive's Disability as defined in the AZZ Inc. Executive Officer Severance Plan ("Executive Severance Plan").

3.02 By the Company.

(a) The Company shall have the right to terminate the Employment Term for Cause, as defined in the Executive Severance Plan.

(b) The Company shall have the right to terminate the Employment Term without Cause upon thirty (30) days' prior written notice being provided to Executive.

3.03 By Executive.

(a) Executive shall have the right to terminate the Employment Term for Good Reason as defined in the Executive Severance Plan.

(b) Executive shall have the right to terminate his employment other than for Good Reason upon one hundred twenty (120) days' prior written notice to the Committee.

3.04 Change in Control. If Executive's employment is terminated during a "Change in Control" Period as defined in Section 3.4 of the Executive Severance Plan, this Agreement shall terminate, and the provisions of ARTICLE V and ARTICLE VI of this Agreement shall survive the termination of this Agreement.

ARTICLE IV

Termination Payments

4.01 In the event of Executive's termination, the provisions of the Executive Severance Plan shall apply, except for the special one-time RSU award with a fair market value of $1,500,000 which shall be subject to Executive remaining employed at the Company through both vesting dates as set forth above.

ARTICLE V

Confidential Information

5.01 Information. "Confidential Information" as used in this Agreement, includes but is not limited to, specialized training received by Executive; research and development materials, projects and specialized products and processes developed at the Company; electronic databases; computer programs and production efficiency technologies; marketing and/or scientific studies and analysis; product and pricing knowledge; manufacturing processes and hot-dip galvanizing methodologies; long and short term corporate strategy; supplier and vendor lists and related information; any and all information concerning past, present and future customers, referral sources; contracts and licenses; management structure, company ownership, personnel information (including the performance, skills, abilities and compensation paid to employees); purchasing, accounting and business systems; short and long range business planning; data regarding the Company's and/or its Affiliates' past, current and future financial performance, sales performance, and current and/or future plans to increase the Company's and/or its Affiliates' market share by targeting specific demographic and geographic markets; financial information; trade secrets; business policies; methods of operation; production flow and layout of any hot-dip galvanizing facilities; implementation strategies for any new products or continuous improvement initiatives; promotional information and techniques; marketing presentations; price lists; business files or other information; pricing strategies; computer files; samples; customer originals; or any other confidential information concerning the business and affairs of the Company and/or its Affiliates.

5.02 Confidentiality. Executive will not use, copy, remove, disclose or disseminate to any person or entity, the Confidential Information, except (i) as required in the course of performing Executive's duties with the Company, for the benefit of the Company and its Affiliates, or (ii) when required to do so by a court of law, by any governmental agency having supervisory authority over the business of the Company and/or its Affiliates or by any administrative or legislative body (including a committee thereof) with apparent jurisdiction to order Executive to divulge, disclose or make accessible such information, it being understood that Executive will promptly notify the Company of such requirement so that the Company or its Affiliates, as applicable, may seek to obtain a protective order.

5.03 Ownership. To the fullest extent permitted by law, all rights worldwide with respect to any intellectual or other property of any nature conceived, developed, produced, created, suggested or acquired by Executive during Executive's employment with the Company (or any of its predecessors, Affiliates or predecessors of its Affiliates) through the use of the Company's assets, including, but not limited to, (or such predecessors', such Affiliates' or such predecessors' of such Affiliates') equipment, facilities, trade secrets or Confidential Information during the period of Executive's employment with the Company (or such predecessor(s), such Affiliate(s) or such predecessor(s) of such Affiliate(s)), through the date that is twelve (12) months after termination or expiration of the Employment Term, shall be deemed to be a work made for hire and shall be the sole and exclusive property of the Company or its Affiliates, as applicable. Executive agrees to execute, acknowledge and deliver to the Company, at the Company's request, such further documents as the Company or its legal counsel find appropriate to evidence the Company's rights in such property.

5.04 Injunction. Executive recognizes that Executive's services hereunder are of a special, unique, unusual, extraordinary and intellectual character giving them a peculiar value, the loss of which cannot be reasonably or adequately compensated for in damages. Executive acknowledges that if Executive were to leave the employ of the Company for any reason and compete, directly or indirectly, with the Company or any of its Affiliates, or use or disclose, directly or indirectly, the Confidential Information (whether in tangible form or memorized), that such competition, use and/or disclosure would cause the Company and its Affiliates irreparable harm and injury for which no adequate remedy at law exists. Executive agrees this Agreement is the narrowest way to protect the Company's and/or its Affiliates' interests. Therefore, in the event of the breach or threatened breach of the provisions of this Agreement by Executive, the Company and its Affiliates shall be entitled to obtain injunctive relief to enjoin such breach or threatened breach, in addition to all other remedies and alternatives that may be available at law or in equity. Executive acknowledges that the remedies contained in this Agreement for violation of this Agreement are not the exclusive remedies that the Company or its Affiliates may pursue.

5.05 Permitted Disclosures. Nothing in the Agreement, or any other policy or agreement by or with the Company shall prohibit or restrict Executive from (i) voluntarily communicating with an attorney retained by Executive, (ii) voluntarily communicating with any law enforcement, government agency, including the Security and Exchange Commission ("SEC"), the Equal Employment Opportunity Commission, or a local commission on human rights, or any self-regulatory organization regarding possible violations of law, in each case without advance notice to the Company, or otherwise initiating, testifying, assisting, complying with a subpoena from, or participating in any manner with an investigation conducted by such government agency,

(iii) recovering a SEC whistleblower award as provided under Section 21F of the Securities Exchange Act of 1934, or (iv) disclosing any confidential information to a court or other administrative or legislative body in response to a subpoena, provided that Executive first promptly notifies and provides the Company with the opportunity to seek, and join in its efforts at the sole expense of the Company, to challenge the subpoena or obtain a protective order limited its disclosure, or other appropriate remedy.

5.06 Notice of Immunity under the Defend Trade Secrets Act of 2016. Notwithstanding any other provision of this Agreement, Executive will not be held criminally or civilly liable under any federal or state trade secret law for any disclosure of a trade secret that (i) is made (A) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and (B) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. If Executive files a lawsuit for retaliation by the Company for reporting a suspected violation of law, Executive may disclose the Company's trade secrets to Executive 's attorney and use the trade secret information in the court proceeding if Executive: (i) files any document containing the trade secret under seal; and (ii) does not disclose the trade secret, except pursuant to court order.

ARTICLE VI

Non-Competition; Non-Solicitation; and Other Restrictive Covenants

6.01 Executive's Promises. In exchange for the consideration provided by the Company pursuant to this Agreement, Executive hereby promises and acknowledges as follows:

(a) Executive agrees that Executive's employment hereunder is on an exclusive basis and that, during the Employment Term, Executive shall diligently and conscientiously devote Executive's full business time, attention, energy, skill and best efforts operating the Company's and its Affiliates' hot-dip galvanizing business and the discharge of Executive's duties hereunder. Notwithstanding the foregoing, nothing in this Agreement shall preclude Executive from (i) serving on the governing bodies of other companies (subject to the approval of the Company's President and Chief Executive Officer, which shall not be unreasonably withheld), provided that such service does not result in a breach of any applicable securities law or regulation or listing requirement or create any disclosure obligation under Item 407(e)(4) of Regulation S-K (i.e., with respect to "Compensation Committee Interlocks and Insider Participation") or under any similar federal or state regulation applicable to the Company, (ii) engaging in charitable and public service activities, or engaging in speaking and writing activities, or (iii) managing Executive's personal investments; provided, that such activities under clauses (i) and (ii) are disclosed in writing to the Company's President and Chief Executive Officer in a notice that specifically references this provision and the activities under clauses (i) and (ii) do not interfere with Executive's availability or ability to perform Executive's duties and responsibilities hereunder and do not breach Executive's duty of loyalty to the Company, and other obligations hereunder (including, without limitation, Executive's obligations under ARTICLE VI of this Agreement). •

(b) Following employment termination, Executive will immediately return to the Company all materials created (including but not limited to any inventions, trade secrets and

intellectual property), received or utilized in any way in conjunction with Executive's work performed with the Company or any of its Affiliates.

(c) Executive acknowledges that the Company intends to grow the business of the Company and its Affiliates to provide other types of manufacturing solutions than those provided as of the date hereof and that, due to Executive's position with the Company and his ownership (directly or indirectly) of the Company's equity securities, he will be in a position to have or obtain knowledge of the Company's and/or its Affiliates' expansion plans. Upon request of the Company at any time during the Employment Term, Executive agrees to execute and deliver to the Company one or more supplements to this Agreement acknowledging any such expansion plans for the Company's and or its Affiliates' business.

(d) Executive acknowledges that the market for the Company's products, manufacturing solutions, and activities covers North America, that the Company and its Affiliates currently conduct operations and provides metal coatings in numerous markets across North America and that the Company and its Affiliates currently have plans to expand operations across additional domestic markets. Moreover, Executive recognizes that the Company's customers may be contacted by telephone, in person, or in writing (including, without limitation, via e-mail or the Internet). Executive further acknowledges that due to the scope of the Company's customer and client base, the covenants set forth in the following Sections in this ARTICLE VI are necessary and essential to protect the Company's and its Affiliates' interests.

(e) Executive acknowledges that a portion of the compensation payable to Executive under this Agreement is considered, and shall be deemed for all purposes to be, consideration for performance of the obligations set forth below in this ARTICLE VI.

6.02 Non-Compete.

(a) During the Restricted Period (as defined below) and subject to Section 6.02(d), Executive shall not, directly or indirectly, engage in or participate (including, without limitation, as an investor, owner, officer, employee, director, agent, or consultant (any such capacity, being a "Participant")) in or on behalf of any entity engaging in any line of business competitive with that of the Company or any of its Affiliates on the date of termination of Executive's employment with the Company, or any line of business competitive with any line of business that the Company or any of its Affiliates was conducting or contemplating within the twenty-four (24) months prior to the date of termination of Executive's employment with the Company.

(b) During the Restricted Period (as defined below) and subject to Section 6.02(d), Executive shall not, directly or indirectly, except as an employee of the Company, in any capacity for Executive or others, directly or indirectly call on, service, or solicit competing business from customers, vendors, suppliers or prospective customers of the Company or its Affiliates (collectively with the obligations set forth in Section 6.02(a) the "Non-Compete Obligations"); provided, however, that nothing herein shall prevent Executive from investing as a less than 5% shareholder in securities of any company listed on a national securities exchange or quoted on an automated quotation system.

(c) The Non-Compete Obligations shall remain in effect during the Employment Term and for a period of twelve (12) months from the date on which the Employment Term is terminated (without regard to the reason for such termination of employment) (the applicable period of time being referred to herein as the "Restricted Period"). For the avoidance of doubt, the Non-Compete Obligations shall survive, and the Restricted Period shall not be terminated by, the termination of this Agreement under Section 3.04.

(d) The geographic limitation for the Non-Compete Obligations is any state or province (or substantially equivalent designation of a geographic area within Canada) (i) in which the Company or its Affiliates provide its products, manufacturing solutions or conducted business activities during the twenty-four (24) months prior to the termination of the Employment Term,

(ii) in which the Company or its Affiliates had plans to provide or contemplated providing its products, manufacturing solutions, or conducting business activities during the twenty-four (24) months prior to the date of termination of the Employment Term, or (iii) in which a customer or vendor of the Company or its Affiliates is located.

6.03 Non-Solicitation of Employees. Executive agrees that during the Employment Term and during the Restricted Period, Executive will not, directly or indirectly, (a) induce or solicit any person who was an employee, consultant or independent contractor of the Company or any of its Affiliates to terminate such individual's employment or service with the Company or any of its Affiliates, (b) hire or retain the services of any such person, regardless of whether such person had been solicited for employment, or (c) assist any other person or entity in such activities.

6.04 Standstill. Executive agrees that during the Employment Term and during the Restricted Period, Executive shall not, except at the specific written request of the Board, directly or indirectly:

(a) engage in or propose, or be a Participant in any entity that directly or indirectly engages in or proposes, any transaction between the Company or any of its Affiliates (or any of their successors), on the one hand, and Executive or any entity in which Executive is a Participant, consultant or owner, on the other hand;

(b) acquire any equity securities of the Company or any of its Affiliates (or any of their successors) during any black out period in accordance with the Company's Insider Trading Policy (other than through entering into a qualified 10(b)5-1 Plan during an open trading window or equity securities issued to Executive by the Company upon the vesting of RSUs and PSUs issued to Executive by the Company) or be a Participant in any entity that, directly or indirectly, acquires any equity securities of the Company or any of its Affiliates (or any of their successors), provided that this Section 6.04(b) shall not restrict Executive from participating in the AZZ Inc. 2018 Employee Stock Purchase Plan, or from acquiring equity securities of the Company through such participation, in accordance with the terms and conditions thereof as may be amended from time to time;

(c) solicit proxies, or be a Participant in any entity that directly or indirectly solicits proxies, or become a Participant in any solicitation of proxies, with respect to the election of directors of the Company or any of its Affiliates (or any of their successors) in opposition to the nominees recommended by the board of directors or similar governing body of any such entity; or

(d) engage in or be a Participant in any other activity that would be reasonably expected to result in a Change in Control of the Company or any Affiliate (or any of their successors).

Notwithstanding the foregoing, the foregoing provisions of this Section 6.04 shall not be construed to prohibit or restrict the manner in which Executive exercises Executive's voting rights in respect of equity securities of the Company acquired in a manner that is not a violation of the terms of this Agreement.

6.05 Non-Disparagement. During the Employment Term and during the Restricted Period, Executive will not, directly or indirectly, make any public or private statements (whether orally or in writing) that disparage, denigrate or malign the Company or any of its Affiliates, their respective businesses, activities, operations, affairs, reputations or prospects or any of their respective officers, employees, directors, partners, agents, members or shareholders. The Company will not, at any time during the Restricted Period, directly (or through any director, officer or other entity) make any public or private statements (whether orally or in writing) that disparage, denigrate or malign Executive.

6.06 Acknowledgments. Executive acknowledges and agrees that:

(a) the terms of this Agreement are reasonable, valid and fully enforceable and the restricted period, definitions and geographical limitations specified in the Sections above in this ARTICLE VI are reasonable in view of the nature of the business in which the Company and its Affiliates are engaged and the knowledge of the Company's operations and customer relationships that Executive will continue to maintain or grow by virtue of Executive's position;

(b) this limited prohibition against unfair competition is narrowly tailored to safeguard the Company's legitimate business interests while not unreasonably interfering with Executive's ability to obtain other employment and that his ability to earn a livelihood without violating such restrictions is a material condition to both his continued employment with the Company and the retention awards that were granted to Executive pursuant to this Agreement;

(c) Executive's continuous and engaged employment with the Company, the one-time retention equity grant valued at $1.5 million on the date of the grant, a special one-time $425,000 cash bonus to be paid upon execution of this Agreement, regular compensation paid to Executive by the Company, the provision of benefits provided to Executive by the Company, Executive's current ownership (directly or indirectly) in the Company, and Executive's commitment not to disclose Confidential Information not to compete, not to solicit to hire Company and/or Affiliate employees, among other things, are sufficient consideration for Executive's covenants contained herein;

(d) subject to the Early Resolution Conference provision set forth in Section

6.07 of this Agreement, Executive has a duty to contact the Company if Executive has any questions regarding whether or not a particular entity or conduct by Executive would be restricted by this Agreement;

(e) Executive has a duty immediately to inform the Company in writing of any employment, consulting agreement or similar relationship Executive enters into after termination of employment with the Company during the Restricted Period set forth above;

(f) the provisions in ARTICLE VI hereof shall survive the termination of this

Agreement;

(g) the Restricted Period set forth herein is a material term of this Agreement

and the Company is entitled to Executive's compliance with the terms of this ARTICLE VI during the entire period. Therefore, Executive agrees that the Restricted Period will be tolled during any period of non-compliance by Executive. If the Company must seek injunctive relief or judicial intervention to enforce this Agreement, the Restricted Period set forth herein does not commence until Executive is judged by a court of competent jurisdiction to be in full compliance with this Agreement; and

(h) the covenants contained in ARTICLE VI are reasonable with respect to their duration, geographic area and scope. If, at the time of enforcement of such covenants, a court holds that the restrictions stated herein are unreasonable under the circumstances then existing, the parties hereto agree that the maximum period, scope or geographic area legally permissible under such circumstances will be substituted for the period, scope or area stated herein.

6.07 Early Resolution Conference. The parties are entering into this Agreement with the understanding that this Agreement is clear and fully enforceable. If Executive decides to contend that any restriction on his activities under this Agreement is not enforceable, Executive first will notify the Company in writing and meet with a Company representative at least fourteen (14) days before engaging in any activity that could foreseeably fall within the questioned restriction, in an effort for both parties to reach a clear interpretation and resolution of such activities (an "Early Resolution Conference"). Should the parties not resolve the dispute at the Early Resolution Conference, the parties may pursue their rights hereunder, including, but not limited to, the injunctive relief available to the Company pursuant to Sections 5.04 and 9.06 of this Agreement.

ARTICLE VII

Representation of the Parties

7.01 Representations of Executive. Executive represents and warrants to the Company that Executive has the capacity to enter into this Agreement and the other agreements referenced to herein, and that the execution, delivery and performance of this Agreement and such other agreements by Executive will not violate any agreement, undertaking or covenant to which Executive is party or is otherwise bound.

7.02 Representations of the Company. The Company represents and warrants to Executive that it is duly formed and is validly operating under the laws of the State of Texas, that it is fully authorized and empowered by all necessary action to enter into this Agreement and that performance of its obligations under this Agreement will not violate any agreement between it and any other person, firm or other entity.

ARTICLE VIII

Certain Tax Matters

8.01 Section 409A. The intent of the parties is that payments and benefits under this Agreement shall comply with or be exempt from Section 409A of the Code and the Treasury regulations and administrative guidance thereunder (collectively, "Code Section 409A"), and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted to be in compliance therewith. If any provision of this Agreement (or of any award of compensation, including equity compensation or benefits) would cause Executive to incur any additional tax or interest under Code Section 409A, the Company shall, after consulting with and receiving the approval of Executive, reform such provision in a manner intended to avoid the occurrence by Executive of any such additional tax or interest; provided, however, that the Company shall maintain, to the maximum extent practicable, the original intent and economic benefit to Executive of the applicable provision without violating the provisions of Code Section 409A.

8.02 Termination of Employment. A termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of any amounts or benefits that are considered nonqualified deferred compensation under Code Section 409A upon or following a termination of employment unless such termination is also a "separation from service" within the meaning of Code Section 409A, and, for purposes of any such provision of this Agreement, references to a "termination," "termination of employment" or like terms and concepts shall mean a "separation from service" within the meaning of Code Section 409A, and references to "date of termination" shall mean the date on which a "separation from service" occurs. In general, Executive will incur a "separation from service" on the date the Company and Executive reasonably believe that no further services will be performed or that the level of bona fide services (whether as an employee or independent contractor) will permanently decrease to no more than twenty (20) percent of the level of services performed over the immediately preceding thirty-six (36) months. The determination of whether and when a "separation from service" has occurred for proposes of this Agreement shall be made in accordance with Section 1.409A-l(h) of the Treasury Regulations.

8.03 Nonqualified Deferred Compensation. Any provision of this Agreement to the contrary notwithstanding, if at the time of Executive's termination, the Company determines that Executive is a "specified employee," within the meaning of Code Section 409A, then, to the extent any payment or benefit that Executive becomes entitled to under this Agreement on account of such separation from service would be considered nonqualified deferred compensation under Code Section 409A, such payment or benefit shall be paid or provided at the date that is the earlier of (a) six (6) months and one day after such termination and (b) the date of Executive's death (the "Delay Period"). Upon the expiration of the Delay Period, all payments and benefits delayed pursuant to this Section 8.03 (whether they would have otherwise been payable in a single sum or in installments in the absence of such delay) shall be paid or provided to Executive in a lump-sum, and any remaining payments and benefits due under this Agreement shall be paid or provided in accordance with the normal payment dates specified for them herein.

8.04 Deferred Compensation. Any reimbursements and in-kind benefits provided under this Agreement that constitute deferred compensation within the meaning of Code Section 409A shall be made or provided in accordance with the requirements of Code Section 409A, including

that (a) in no event shall any fees, expenses or other amounts eligible to be reimbursed by the Company under this Agreement be paid later than the last day of the calendar year next following the calendar year in which the applicable fees, expenses or other amounts were incurred; (b) the amount of expenses eligible for reimbursement, or in-kind benefits that the Company is obligated to pay or provide, in any given calendar year shall not affect the expenses that the Company is obligated to reimburse, or the in-kind benefits that the Company is obligated to pay or provide, in any other calendar year, provided that this clause (b) shall not be violated with regard to expenses reimbursed under any arrangement covered by Section 105(b) of the Code solely because such expenses are subject to a limit related to the period the arrangement is in effect; (c) Executive's right to have the Company pay or provide such reimbursements and in-kind benefits may not be liquidated or exchanged for any other benefit; and (d) in no event shall the Company's obligations to make such reimbursements or to provide such in-kind benefits apply later than two (2) years after the termination of this Agreement.

8.05 Installment Payments. For purposes of Code Section 409A, Executive's right, if any, to receive any installment payments shall be treated as a right to receive a series of separate and distinct payments. Whenever a payment under this Agreement specifies a payment period with reference to a number of days, the actual date of payment within the specified period shall be within the sole discretion of the Company. In no event may Executive, directly or indirectly, designate the calendar year of any payment to be made under this Agreement to the extent such payment is subject to Code Section 409A.

ARTICLE IX

Miscellaneous

9.01 Notices. All notices given under this Agreement shall be in writing and shall be deemed to have been duly given (a) when hand delivered in writing and in person, (b) three business days after being mailed by first class certified mail, return receipt requested, postage prepaid, (c) one business day after being sent by a reputable overnight delivery service, postage or delivery charges prepaid, or (d) on the date on which an email is transmitted to the parties at their respective addresses stated below. Any party may change its address for notice and the address to which copies must be sent by giving notice of the new addresses to the other parties in accordance with this Section 9.01, except that any such change of address notice shall not be effective unless and until received.

If to the Company or the Committee: AZZ Inc.

One Museum Place, Suite 500

Fort Worth, Texas 76107

Attn: Chairman of the Board of Directors

Email: [Redacted due to being personally identifiable information]

If to Executive:

Bryan Stovall ·

[Address redacted due to being personally identifiable information]

Email: [Redacted due to being personally identifiable information]

9.02 Entire Agreement, Amendments, Waivers, Etc.

(a) No amendment or modification of this Agreement shall be effective unless set forth in a writing signed by the Company and Executive. No waiver by either party of any breach by the other party of any provision or condition of this Agreement shall be deemed a waiver of any similar or dissimilar provision or condition at the same or any prior or subsequent time. Any waiver must be in writing and signed by the waiving party.

(b) This Agreement, together with the documents referred to herein (including, without limitation, the Executive Severance Plan and the Equity Plans), sets forth the entire understanding and agreement of the parties with respect to the subject matter hereof and supersedes and replaces all prior oral and written understandings and agreements with respect to the subject matter hereof. There are no representations, agreements, arrangements or understandings, oral or written, among the parties relating to the subject matter hereof which are not expressly set forth herein, and no party hereto has been induced to enter into this Agreement, except by the agreements expressly contained herein.

(c) Nothing herein contained shall be construed so as to require the commission of any act contrary to law, and wherever there is a conflict between any provision of this Agreement and any present or future statute, law, ordinance or regulation, the latter shall prevail, but in such event the provision of this Agreement affected shall be curtailed and limited only to the extent necessary to bring it within legal requirements.

(d) This Agreement shall inure to the benefit of and be enforceable by Executive and Executive's heirs, executors, administrators and legal representatives and by the Company and its Affiliates and their successors and assigns. This Agreement and all rights hereunder are personal to Executive and shall not be assignable. The Company may assign its rights and/or delegate its obligations under this Agreement to any successor, whether by operation of law, agreement or otherwise (including, without limitation, any Person who acquires all or a substantial portion of the business of the Company and its Affiliates, whether direct or indirect and whether structured as a stock sale, asset sale, merger, recapitalization, consolidation or other transaction) and, in connection with any such delegation of its obligations hereunder shall be released from such obligations hereunder.

(e) If any provision of this Agreement or the application thereof is held invalid, the invalidity shall not affect the other provisions or application of this Agreement that can be given effect without the invalid provisions or application, and to this end the provisions of this Agreement are declared to be severable. If, in any judicial proceeding, the court shall refuse to enforce any of the separate covenants contained in ARTICLE V or ARTICLE VI hereof because the time limit is too long, it is expressly understood and agreed between Executive and the Company that for purposes of such proceeding, such time limitation shall be deemed reduced to the extent necessary to permit enforcement of such covenants. If, in any judicial proceeding, the court shall refuse to enforce any of the separate covenants contained in ARTICLE V or ARTICLE VI hereof because they are more extensive (whether as to geographic area, scope of

business or otherwise) than necessary to protect the business, its trade secrets, proprietary business information, and goodwill of the Company and/or any of its Affiliates, it is expressly understood and agreed between Executive and the Company that for purposes of such proceeding the geographic area, scope of business or other aspect shall be deemed reduced to the extent necessary to permit enforcement of such covenants.

9.03 Choice of Law, Forum and Consent to Personal Jurisdiction. This Agreement shall be interpreted, construed, and governed by the laws of the State of Texas, regardless of its place of execution or performance. Any cause of action arising between the parties regarding this Agreement shall be brought only in a Texas State Court located in Tarrant County, Texas, or in the U.S. District Court for the Northern District of Texas, Fort Worth division. Executive, by this Section 9.03, consents to personal jurisdiction in any such State or Federal court and waives any entitlement Executive might otherwise have to a transfer of venue under the preferred venue requirements of State or Federal rules of civil procedure rules.

9.04 Taxes. All payments required to be made to Executive hereunder, whether during the term of Executive's employment hereunder or otherwise, shall be subject to all applicable federal, state and local tax withholding laws.

9.05 Headings, Etc. The headings set forth herein are included solely for the purpose of identification and shall not be used for the purpose of construing the meaning of the provisions of this Agreement. Unless otherwise provided, references herein to Exhibits and Sections refer to Exhibits and Sections of this Agreement.

9.06 Arbitration. Subject to Section 6.07 of this Agreement, any dispute or controversy between the Company and Executive, arising out of or relating to this Agreement, the breach of this Agreement, or otherwise, shall be settled by arbitration in Fort Worth, Texas administered by the American Arbitration Association in accordance with its Commercial Rules then in effect and judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. The arbitrator shall have the authority to award any remedy or relief that a court of competent jurisdiction could order or grant, including, without limitation, the issuance of an injunction. However, either party may, without inconsistency with this arbitration provision, apply to any court having jurisdiction over such dispute or controversy and seek interim provisional, injunctive or other equitable relief until the arbitration award is rendered or the controversy is otherwise resolved. Except as necessary in court proceedings to enforce this arbitration provision or an award rendered hereunder, or to obtain interim relief, neither a party nor an arbitrator may disclose the existence, content or results of any arbitration hereunder without the prior written consent of the Company and Executive. Each party shall bear its or his costs and expenses in any arbitration hereunder and one-half of the arbitrator's fees and costs. Executive acknowledges that the duties he will perform for the Company will involve and have a connection with interstate commerce within the meaning of the Federal Arbitration Act ("FAA"), and that this Agreement involves and has a connection with interstate commerce within the meaning of the FAA.

9.07 Survival. Executive's obligations under the provisions of Section 2.06 and ARTICLE IV, ARTICLE V, ARTICLE VI and ARTICLE IX hereof shall survive the termination or expiration of the term of this Agreement.

9.08 Other Agreements. The provisions contained in ARTICLE V and ARTICLE VI hereof shall be independent of and in addition to any other agreement between Executive and the Company or its Affiliates regarding the subject matter.

9.09 Construction. Each party has cooperated in the drafting and preparation of this Agreement. Therefore, in any construction to be made of this Agreement, the same shall not be construed against any party on the basis that the party was the drafter.

9.10 Compliance with Executive Incentive-Based Recoupment Policies. Notwithstanding anything to the contrary herein, any incentive-based payments to the Executive shall be subject to the Company’s Executive Officer Incentive Compensation Recovery Policy and the amended Compensation Recovery Policy, and any subsequent amendments thereto.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

AZZ INC.

By: /s/ Tom Ferguson

Name: Tom Ferguson

Title: President and Chief Executive Officer

/s/ Bryan Stovall

Bryan Stovall

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

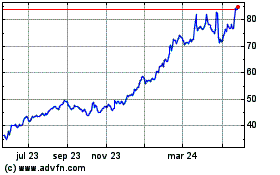

AZZ (NYSE:AZZ)

Gráfica de Acción Histórica

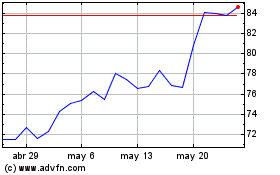

De Nov 2024 a Dic 2024

AZZ (NYSE:AZZ)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024