Alibaba Group Prices US$2.65 Billion Offering of U.S. Dollar-denominated Senior Unsecured Notes and RMB17 Billion Offering of RMB-denominated Senior Unsecured Notes

19 Noviembre 2024 - 5:57PM

Business Wire

Alibaba Group Holding Limited (NYSE: BABA and HKEX: 9988 (HKD

Counter) and 89988 (RMB Counter), “Alibaba,” “Alibaba Group” or the

“Company”) today announced the pricing of (i) an offering of

US$2.65 billion aggregate principal amount of U.S.

dollar-denominated senior unsecured notes, consisting of:

US$1,000,000,000 4.875% notes due 2030 at an

issue price per note of 99.838%; US$1,150,000,000 5.250% notes due

2035 at an issue price per note of 99.649%; and US$500,000,000

5.625% notes due 2054 at an issue price per note of 99.712%

(collectively, the “USD Notes”);

and (ii) an offering of RMB17 billion aggregate principal amount

of RMB-denominated senior unsecured notes, consisting of:

RMB8,400,000,000 2.65% notes due 2028 at an

issue price per note of 100%; RMB5,000,000,000 2.80% notes due 2029

at an issue price per note of 100%; RMB2,500,000,000 3.10% notes

due 2034 at an issue price per note of 100%; and RMB1,100,000,000

3.50% notes due 2044 at an issue price per note of 100%

(collectively, the “RMB Notes,” and together with the USD Notes,

the “Notes”).

The offering of the USD Notes is expected to close on November

26, 2024, and the offering of the RMB Notes is expected to close on

November 28, 2024, both subject to customary closing

conditions.

Alibaba intends to use the net proceeds from the offering of the

Notes for general corporate purposes, including repayment of

offshore debt and share repurchases.

The Notes have not been registered under the U.S. Securities Act

of 1933, as amended (the “U.S. Securities Act”) or any state

securities laws. The USD Notes are being offered and sold in the

United States only to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the U.S.

Securities Act and to certain non-U.S. persons in offshore

transaction in reliance on Regulation S under the U.S. Securities

Act. Alibaba intends to enter into a registration rights agreement

in connection with the offering of the USD Notes, under which it

will agree to use commercially reasonable efforts to file an

exchange offer registration statement to exchange the USD Notes for

a new issue of substantially identical debt securities registered

under the Securities Act or, under specified circumstances, a shelf

registration statement to cover resales of the USD Notes. The RMB

Notes are being offered and sold only to certain non-U.S. persons

in offshore transaction in reliance on Regulation S under the U.S.

Securities Act.

This press release shall not constitute an offer to sell or a

solicitation of an offer to purchase any securities, in the United

States or elsewhere, and shall not constitute an offer,

solicitation or sale of the securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful. Any

offering of securities will be made by means of one or more

offering documents, which will contain detailed material

information about the Company and its management and financial

statements.

This press release contains information about the pending

offering of the Notes, and there can be no assurance that the

offering will be completed.

Safe Harbor Statement

This press release contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “will,” “expect,” “anticipate,” “future,” “aim,” “estimate,”

“intend,” “seek,” “plan,” “believe,” “potential,” “continue,”

“ongoing,” “target,” “guidance,” “is/are likely to” and similar

statements. In addition, statements that are not historical facts,

including statements about the intended use of proceeds, the terms

of the Notes, the intention of the Company to enter into a

registration rights agreement in connection with the offering of

the USD Notes and the terms of such agreement, and whether the

Company will complete the offering of the Notes, are or contain

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to: financial

community and rating agency perceptions of the company and its

business, financial condition and the industries in which it

operates, market conditions, and the satisfaction of customary

closing conditions related to the proposed offering. Further

information regarding these and other risks is included in

Alibaba’s filings with the U.S. Securities and Exchange Commission

and announcements on the website of The Stock Exchange of Hong Kong

Limited. All information provided in this press release is as of

the date of this press release and are based on assumptions that we

believe to be reasonable as of this date, and Alibaba does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119897976/en/

Investor Relations Contact Lydia Liu Investor Relations

Alibaba Group Holding Limited investor@alibaba-inc.com

Media Contacts Cathy Yan cathy.yan@alibaba-inc.com

Ivy Ke ivy.ke@alibaba-inc.com

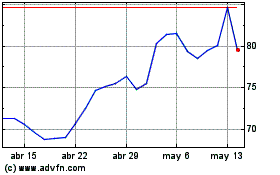

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

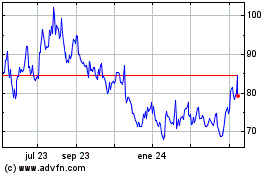

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024