Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 Noviembre 2024 - 3:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 Under

the Securities Exchange Act of 1934

November 20, 2024

Commission File Number: 001-36614

Alibaba Group Holding Limited

(Registrant’s name)

26/F Tower One, Times Square

1 Matheson Street

Causeway Bay

Hong Kong S.A.R.

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F

x Form 40-F

¨

EXHIBITS

Exhibit 99.1 – Announcement – Grant of Awards Pursuant to the 2024 Plan

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ALIBABA GROUP HOLDING LIMITED |

| |

|

|

| Date: November 20, 2024 |

By: |

/s/ Kevin Jinwei ZHANG |

| |

Name: |

Kevin Jinwei ZHANG |

| |

Title: |

Company Secretary |

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of

Hong Kong Limited (the “Hong Kong Stock Exchange”) take no responsibility for the contents of this announcement, make

no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from

or in reliance upon the whole or any part of the contents of this announcement.

We have one class of shares, and each holder of our shares is entitled

to one vote per share. As the Alibaba Partnership’s director nomination rights are categorized as a weighted voting rights structure

(the “WVR structure”) under the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange (the

“Hong Kong Listing Rules”), we are deemed as a company with a WVR structure. Shareholders and prospective investors

should be aware of the potential risks of investing in a company with a WVR structure. Our American depositary shares, each representing

eight of our shares, are listed on the New York Stock Exchange in the United States under the symbol BABA.

Alibaba

Group Holding Limited

阿

里 巴 巴 集 團 控 股 有 限 公 司

(Incorporated

in the Cayman Islands with limited liability)

(Stock

Code: 9988 (HKD Counter) and 89988 (RMB Counter))

ANNOUNCEMENT

GRANT

OF AWARDS PURSUANT TO THE 2024 PLAN

Pursuant to Rule 17.06A of the

Hong Kong Listing Rules, the Board announces that on November 19, 2024, the Company granted Awards involving 2,493,400 underlying

Shares (representing approximately 0.01% of the total Shares in issue (excluding treasury shares) as at the date of this announcement),

to certain Employees in accordance with the terms of the 2024 Plan (subject to acceptance by the grantees).

Details of Grant of Awards

The details of the grant of Awards to the grantees are as follows:

| Date of grant: |

November 19, 2024 |

| Grantees and number of underlying Shares of the Awards granted: |

Awards involving 2,493,400 underlying Shares were granted to certain Employees under

the 2024 Plan.

The above grant is not subject to approval by the Shareholders

in general meeting. To the best knowledge of the Directors, as of the date of this announcement, none

of the grantees is (i) a director, chief executive or substantial shareholder of the Company, or

an associate of any of them; (ii) a participant with options and awards granted and to be granted

exceeding the 1% individual limit under the Hong Kong Listing Rules; or (iii) a Related Entity

Participant or a Service Provider.

The above grant would not result in the Shares issued and

to be issued in respect of all options and awards granted to each grantee in the 12-month period up

to and including the date of such grant in aggregate to be over 1% of the Shares in issue (excluding

treasury shares). |

| Purchase price of the Awards granted: |

Nil |

| |

|

| Closing price of the Shares on the date of grant: |

HK$85.25 per Share |

| |

|

| Vesting period: |

The Awards granted have a mixed vesting schedule where the Awards shall vest by batches over 4 years, in which certain Awards will

be vested within 12 months of the date of grant. It is permitted under the 2024 Plan to have a vesting period shorter than 12 months,

given that these Awards (i) shall vest evenly over a period of 12 months or more; and/or (ii) were granted in batches due to administrative

and compliance reasons which caused delays in grant. |

| |

|

| Performance targets: |

The Awards were granted to the grantees without any performance targets. |

| |

|

| Clawback mechanism: |

Subject to applicable laws, (i) all Awards granted to a participant shall become ab initio void and (ii) considering that all of

such participant’s Awards, whether vested or unvested, are ab initio void, such participant shall forthwith return to the Company

(A) all Shares received in settlement or upon the exercise of such void Awards, (B) all cash, or other property that was received in

settlement or upon the exercise of such void Awards, and/or (C) any proceeds, gains and/or economic benefits such participant realized

in connection with the sale, transfer or other disposition of the Shares or other property received in settlement or upon the exercise

of such void Awards, and the Company shall have the right to take all actions to effect the return from such participant of all such

Shares, cash or other property, and/or proceeds, gains and/or economic benefits, upon the occurrence of any applicable event as may

be specified in the applicable award agreements, including but not limited to termination for cause, breaches of restrictive covenants,

or commission of specified tortious conduct. |

Number of Shares Available for Future Grants

The Awards will be satisfied by issuance of new Shares within the

scheme mandate limit under the 2024 Plan.

Subsequent to the above grant of Awards and as at

the date of this announcement, the maximum number of Shares available for future grants to be satisfied by new Shares or treasury shares

within the scheme mandate limit under the 2024 Plan is 480,506,600, and the maximum number of Shares available for future grants to be

satisfied by new Shares or treasury shares within the service provider sub-limit under the 2024 Plan is 93,716,368.

Reasons for and Benefits of Grant of Awards

The grant of Awards is to (i) attract and retain

talents by rewarding the grantees for their outstanding performance and contributions to the Group, (ii) provide incentives to such

grantees who will contribute their knowledge, experience, expertise and services to the Group, which are essential to the success, continual

operation and development of the Group, and (iii) align the interests of the grantees with those of the Group and the Shareholders.

Definitions

In this announcement, unless the context otherwise requires, the following

expressions have the following meanings:

| “2024

Plan” |

the

2024 Equity Incentive Plan adopted by the Company on August 22, 2024, in its present form or as amended from time to time in accordance

with the provisions thereof |

| |

|

| “ADS(s)” |

American

depositary share(s) of the Company, each of which represents eight Shares |

| |

|

| “associate” |

has

the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “Awards” |

awards of

restricted share units to grantees pursuant to the 2024 Plan |

| |

|

| “Board” |

the board

of directors of the Company |

| |

|

| “Company” |

Alibaba Group

Holding Limited, an exempted company incorporated in the Cayman Islands with limited liability on June

28, 1999, the ADSs of which are listed on the New York Stock Exchange under the symbol “BABA”, and the Shares of which

are listed on the Main Board of the Hong Kong Stock Exchange (stock codes: 9988 (HKD counter) and 89988 (RMB counter)) |

| |

|

| “Director(s)” |

the director(s)

of the Company |

| |

|

| “Employee” |

a person

who has an employment relationship with any Group Member (including a person who is granted Awards under the 2024 Plan as an inducement

to enter into employment contract with any Group Member) |

| “Executive

Director” |

an

Employee who is a member of the board of directors of a Group Member |

| “Group” |

the

Company and its subsidiaries |

| “Group

Member” |

the

Company, its subsidiaries or Related Entities |

| “Hong

Kong Listing Rules” |

the

Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited |

| “Hong

Kong Stock Exchange” |

The

Stock Exchange of Hong Kong Limited |

| “Related

Entity” |

a

holding company, a fellow subsidiary or an associated company of the Company |

| “Related

Entity Participant” |

an

Employee or Executive Director of any Related Entity |

| “Service

Provider” |

a

person, such as an independent contractor, consultant, agent, adviser and supplier, who (i) is engaged by the Group to render consulting

or advisory services to the Group; and (ii) provides services to the Group on a continuing or recurring basis in its ordinary and

usual course of business which are in the interests of the long term growth of the Group, and in particular, any person who is engaged

by the Group under a service or consultant service contract to provide services or consulting services, including but not limited

to any person who is engaged by the Group under a service or consultant service contract or contracts of similar nature to provide

services or consulting services to a Group Member on matters such as (but not limited to) legal, IT, finance, tax, e-commerce, technology,

business operations, business development, logistics, data center and strategic planning |

| “Shareholder(s)” |

holder(s) of Shares and, where the context requires, ADSs |

| “Share(s)” |

ordinary

share(s) in the capital of the Company with par value of US$0.000003125 each |

| “substantial

shareholder” |

has

the meaning ascribed to it under the Hong Kong Listing Rules |

| “%” |

per cent |

| |

By order of the

Board |

| |

Alibaba Group Holding

Limited |

| |

Kevin Jinwei ZHANG |

| |

Secretary |

Hong Kong, November 20, 2024

As at the date of this announcement, our board of directors comprises

Mr. Joseph C. TSAI as the chairman, Mr. Eddie Yongming WU, Mr. J. Michael EVANS and Ms. Maggie Wei WU as directors,

and Mr. Jerry YANG, Ms. Wan Ling MARTELLO, Mr. Weijian SHAN, Ms. Irene Yun-Lien LEE, Mr. Albert Kong Ping NG

and Mr. Kabir MISRA as independent directors.

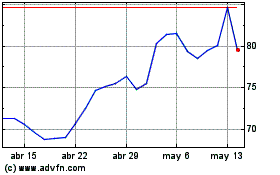

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

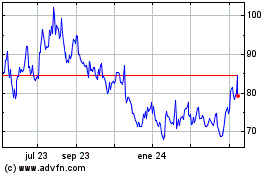

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024