Alibaba Group Holding Limited (NYSE: BABA and HKEX: 9988 (HKD

Counter) and 89988 (RMB Counter), “Alibaba” or “Alibaba Group”)

today announced its financial results for the quarter ended

September 30, 2024.

“This quarter we continued to invest in the user experience and

strengthen product offerings to serve our consumers. We entered

into long-term collaborations with industry peers to broaden

payment and logistics services on Taobao and Tmall platforms, which

we expect will accelerate our overall growth. Growth in our Cloud

business accelerated from prior quarters, with revenues from public

cloud products growing in double digits and AI-related product

revenue delivering triple-digit growth. We are more confident in

our core businesses than ever and will continue to invest in

supporting long-term growth. Our other businesses continued to

improve their operating efficiency, with most of them continuing to

increase their profitability or reduce losses,” said Eddie Wu,

Chief Executive Officer of Alibaba Group.

“Our revenue growth this quarter was driven by improving

monetization of Taobao and Tmall Group, which included GMV-based

service fees and merchant adoption of our marketing tool

Quanzhantui. Consistent with our strategy, we continue to invest in

our core businesses while enhancing operational efficiency. During

the quarter we repurchased US$4.1 billion of shares, achieving

earnings accretion to our shareholders through a net 2.1% reduction

in total shares outstanding since the end of June,” said Toby Xu,

Chief Financial Officer of Alibaba Group.

BUSINESS HIGHLIGHTS

In the quarter ended September 30,

2024:

- Revenue was RMB236,503 million (US$33,701 million), an

increase of 5% year-over-year.

- Income from operations was RMB35,246 million (US$5,023

million), an increase of 5% year-over-year, primarily due to the

decrease in non-cash share-based compensation expense, partly

offset by the decrease in adjusted EBITA. We excluded non-cash

share-based compensation expense from our non-GAAP measurements.

Adjusted EBITA, a non-GAAP measurement, decreased 5%

year-over-year to RMB40,561 million (US$5,780 million), was

primarily attributable to the increase in investments in our

e-commerce businesses, partly offset by revenue growth and improved

operating efficiency.

- Net income attributable to ordinary shareholders was

RMB43,874 million (US$6,252 million). Net income was

RMB43,547 million (US$6,205 million), an increase of 63%

year-over-year, primarily attributable to the mark-to-market

changes from our equity investments, decrease in impairment of our

investments and increase in income from operations. Non-GAAP net

income in the quarter ended September 30, 2024 was RMB36,518

million (US$5,204 million), a decrease of 9% compared to RMB40,188

million in the same quarter of 2023.

- Diluted earnings per ADS was RMB18.17 (US$2.59).

Diluted earnings per share was RMB2.27 (US$0.32 or HK$2.52).

Non-GAAP diluted earnings per ADS was RMB15.06 (US$2.15), a

decrease of 4% year-over-year. Non-GAAP diluted earnings per

share was RMB1.88 (US$0.27 or HK$2.08), a decrease of 4%

year-over-year.

- Net cash provided by operating activities was

RMB31,438 million (US$4,480 million), a decrease of 36% compared to

RMB49,231 million in the same quarter of 2023. Free cash

flow, a non-GAAP measurement of liquidity, was RMB13,735

million (US$1,957 million), a decrease of 70% compared to RMB45,220

million in the same quarter of 2023. The decrease in free cash flow

was mainly attributed to our investments in Alibaba Cloud

infrastructure, refund to Tmall merchants after we cancelled the

annual service fee and other working capital changes related to

factors including scale down of certain direct sales

businesses.

Reconciliations of GAAP measures to non-GAAP measures presented

above are included at the end of this results announcement.

BUSINESS AND STRATEGIC UPDATES

Taobao and Tmall Group

During the quarter we increased investment in strategic

initiatives such as price-competitive products, customer service,

membership program benefits and technology, with the aim of

enhancing user experience. These efforts led to higher purchase

frequency and improved feedback regarding the overall shopping

experience year-over-year.

We adopted a more open approach for payment and logistics

services on our platforms to make shopping on our platforms more

convenient to a larger base of consumers and improve merchants’

operating efficiency. We have already observed much stronger

momentum in new purchasers, and we believe our focus on user growth

and retention will drive the overall growth of our platforms.

Starting from September 1, we implemented a software service fee

based on the GMV of completed transactions on our platform, which

puts us in line with the common practice of the e-commerce

industry. In the meantime, we cancelled the annual service fee for

Tmall merchants and provided software service fee rebates to

certain small and medium-sized merchants. In addition, Quanzhantui,

our AI-powered platform-wide marketing tool, saw steady increase in

merchant adoption. Merchants benefit from the use of Quanzhantui

through improvement of their marketing efficiency, and with higher

efficiency we expect merchants to increase their marketing spending

on our platform.

During the quarter, online GMV growth was supported by

double-digit order growth year-over-year, mainly driven by the

increase in purchase frequency, partly offset by the decline in

average order value. In October and November, we had a successful

11.11 Global Shopping Festival, during which Taobao and Tmall

achieved robust growth in GMV and a record number of

purchasers.

The number of 88VIP members, our highest spending consumer

group, continued to increase by double-digits year-over-year,

reaching 46 million during the quarter. Our premium shoppers are

loyal customers who increase our purchase frequency and drive GMV

growth. Accordingly, we target to continue to grow the subscription

of 88VIP membership by investing in improved benefits and

services.

Cloud Intelligence Group

For the quarter ended September 30, 2024, revenue from Cloud

Intelligence Group was RMB29,610 million (US$4,219 million), an

increase of 7% year-over-year.

During this quarter, overall revenue excluding

Alibaba-consolidated subsidiaries grew over 7% year-over-year,

driven by double-digit public cloud growth, including increasing

adoption of AI-related products. AI-related product revenue grew at

triple-digits year-over-year for the fifth consecutive quarter. We

will continue to invest in anticipation of customer growth and in

technology, particularly in AI infrastructure, to capture the

increasing trend of cloud adoption for AI and to maintain our

market leadership.

Alibaba Cloud has gained notable recognition as the service

provider of choice in China for public cloud and AI training and

applications. According to The Forrester Wave™: Public Cloud

Platforms in China 2024 report, Alibaba Cloud was named a Leader,

achieving the highest score possible in 23 out of 32 criteria, as

well as the top scores in both the current offering and strategy

categories. During the quarter, Alibaba Cloud was also recognized

as a Leader in the Omdia Universe: Chinese Commercial Foundation

Model 2024 report, ranking first in both strategy execution and

technical capabilities. These achievements underscore Alibaba

Cloud's leadership as the best-in-class public cloud and AI

platform in China.

In September, we held our 16th annual cloud computing developer

summit and exhibition, the Apsara Conference 2024, during which

Cloud Intelligence Group unveiled new technologies, including:

- Qwen (通义千问) Large Model Family Upgrades: We introduced

significant upgrades across the Qwen large model family, including

the release of the open-source Qwen 2.5 series, which has become

one of the leading models in the global open-source ecosystem, with

the flagship Qwen 2.5-72B demonstrating strong results across

benchmarks, outperforming industry players. As of September 30,

2024, more than 70,000 derivative models have been developed on

Hugging Face based on the Qwen family of models since it was first

open-sourced in 2023, demonstrating its position as one of the most

widely adopted open-source models globally.

- Cost-efficient and Accessible AI: Alibaba Cloud remains

committed to providing customers with the best value in AI

capabilities. During this quarter, we significantly improved

cost-efficiency for the customers of Qwen models by reducing the

charge rate for API calls, making advanced AI technologies more

affordable and accessible.

- Comprehensive AI Infrastructure Upgrades: To better

position ourselves to capture AI adoption, we have strengthened AI

infrastructure to enhance scalability and performance. Recently, we

launched GPU container services, and upgraded AI server as well as

high-performance network products. These improvements have

significantly enhanced model training and inference efficiency

across various industries.

Alibaba International Digital Commerce

Group (“AIDC”)

For the quarter ended September 30, 2024, revenue from AIDC grew

29% year-over-year to RMB31,672 million (US$4,513 million). The

strong performance continued to be driven by growth of cross-border

businesses, in particular AliExpress’ Choice business. AliExpress

and Trendyol platforms continued their investment to increase

mindshare in select markets in Europe and the Gulf region. At the

same time, we improved efficiency of our operations and investment.

As a result, the unit economics of the Choice business improved on

a sequential basis.

The AliExpress platform continued to enhance its value

proposition by expanding its supplier base, enriching its product

offerings and meeting the needs of local consumers. During the

quarter, AliExpress launched the “AliExpressDirect” model, aiming

to expand product choice and optimize fulfillment efficiency by

leveraging local inventories. In addition, synergies between

AliExpress and the cross-border logistics operations of Cainiao

have further strengthened AliExpress’ competitiveness, with average

delivery time shortened significantly quarter-over-quarter.

Cainiao Smart Logistics Network Limited

(“Cainiao”)

For the quarter ended September 30, 2024, revenue from Cainiao

grew 8% year-over-year to RMB24,647 million (US$3,512 million),

primarily driven by increase in revenue from cross-border

fulfillment solutions.

We will continue to drive synergies between Cainiao and our

cross-border e-commerce business. To meet the demands of an

expanding cross-border e-commerce business, Cainiao’s strategy is

to strengthen its end-to-end capabilities by developing a

highly-digitalized global logistics network. Furthermore, Cainiao

Express started providing logistics services on other e-commerce

platform in October, further expanding its market reach.

Local Services Group

For the quarter ended September 30, 2024, revenue from Local

Services Group grew by 14% year-over-year to RMB17,725 million

(US$2,526 million), driven by the order growth of both Amap and

Ele.me, as well as revenue growth from marketing services. During

this quarter, Local Services Group losses narrowed significantly

year-over-year, driven by improving operating efficiency as well as

increasing scale. During National Day holiday in October, Amap

recorded an all-time high of over 300 million peak daily active

users.

Digital Media and Entertainment

Group

During the quarter ended September 30, 2024, revenue of Digital

Media and Entertainment Group was RMB5,694 million (US$811

million), a decrease of 1% year-over-year. Loss of Digital Media

and Entertainment Group narrowed year-over-year, with Youku

progressively reducing its operating loss due to increased

advertising revenue as well as improved content investment

efficiency during the quarter.

Share Repurchases

During the quarter ended September 30, 2024, we repurchased a

total of 414 million ordinary shares (equivalent to 52 million

ADSs) for a total of US$4.1 billion. As of September 30, 2024, we

had 18,620 million ordinary shares (equivalent to 2,327 million

ADSs) outstanding, a net decrease of 405 million ordinary shares

compared to June 30, 2024, or a 2.1% net reduction in our

outstanding shares after accounting for shares issued under our

ESOP. The remaining amount of Board authorization for our share

repurchase program, which is effective through March 2027, was

US$22.0 billion as of September 30, 2024.

SEPTEMBER QUARTER SUMMARY FINANCIAL RESULTS

Three months ended September

30,

2023

2024

RMB

RMB

US$

YoY % Change

(in millions, except

percentages and per share amounts)

Revenue

224,790

236,503

33,701

5%

Income from operations

33,584

35,246

5,023

5%(2)

Operating margin

15%

15%

Adjusted EBITDA(1)

49,237

47,327

6,744

(4)%(3)

Adjusted EBITDA margin(1)

22%

20%

Adjusted EBITA(1)

42,845

40,561

5,780

(5)%(3)

Adjusted EBITA margin(1)

19%

17%

Net income

26,696

43,547

6,205

63%(4)

Net income attributable to ordinary

shareholders

27,706

43,874

6,252

58%(4)

Non-GAAP net income(1)

40,188

36,518

5,204

(9)%(3)

Diluted earnings per share(5)

1.35

2.27

0.32

69%(4)(6)

Diluted earnings per ADS(5)

10.77

18.17

2.59

69%(4)(6)

Non-GAAP diluted earnings per

share(1)(5)

1.95

1.88

0.27

(4)%(3)(6)

Non-GAAP diluted earnings per

ADS(1)(5)

15.63

15.06

2.15

(4)%(3)(6)

____________________

(1)

See the sections entitled “Non-GAAP

Financial Measures” and “Reconciliations of Non-GAAP Measures to

the Nearest Comparable U.S. GAAP Measures” for more information

about the non-GAAP measures referred to within this results

announcement.

(2)

The year-over-year increase was primarily

due to the decrease in non-cash share-based compensation expense,

partly offset by the decrease in adjusted EBITA.

(3)

The year-over-year decreases were

primarily attributable to the increase in investments in our

e-commerce businesses, partly offset by revenue growth and improved

operating efficiency.

(4)

The year-over-year increases were

primarily attributable to the mark-to-market changes from our

equity investments, decrease in impairment of our investments and

increase in income from operations, while net income attributable

to ordinary shareholders and earnings per share/ADS would further

take into account the net loss attributable to noncontrolling

interests.

(5)

Each ADS represents eight ordinary

shares.

(6)

The year-over-year percentages as stated

are calculated based on the exact amount and there may be minor

differences from the year-over-year percentages calculated based on

the RMB amounts after rounding.

SEPTEMBER QUARTER SEGMENT RESULTS

Revenue for the quarter ended September 30, 2024 was RMB236,503

million (US$33,701 million), an increase of 5% year-over-year

compared to RMB224,790 million in the same quarter of 2023.

The following table sets forth a breakdown of our revenue by

segment for the periods indicated:

Three months ended September

30,

2023

2024

RMB

RMB

US$

YoY % Change

(in millions, except

percentages)

Taobao and Tmall Group:

China commerce retail

- Customer management

68,661

70,364

10,027

2%

- Direct sales and others(1)

23,899

22,644

3,227

(5)%

92,560

93,008

13,254

0%

China commerce wholesale

5,094

5,986

853

18%

Total Taobao and Tmall Group

97,654

98,994

14,107

1%

Cloud Intelligence Group

27,648

29,610

4,219

7%

Alibaba International Digital Commerce

Group:

International commerce retail

18,978

25,618

3,650

35%

International commerce wholesale

5,533

6,054

863

9%

Total Alibaba International Digital

Commerce Group

24,511

31,672

4,513

29%

Cainiao Smart Logistics Network

Limited

22,823

24,647

3,512

8%

Local Services Group

15,564

17,725

2,526

14%

Digital Media and Entertainment Group

5,779

5,694

811

(1)%

All others(2)

48,052

52,178

7,435

9%

Unallocated

277

469

67

Inter-segment elimination

(17,518)

(24,486)

(3,489)

Consolidated revenue

224,790

236,503

33,701

5%

Six months ended September

30,

2023

2024

RMB

RMB

US$

YoY % Change

(in millions, except

percentages)

Taobao and Tmall Group:

China commerce retail

- Customer management

148,322

150,479

21,443

1%

- Direct sales and others(1)

54,066

49,950

7,118

(8)%

202,388

200,429

28,561

(1)%

China commerce wholesale

10,219

11,938

1,701

17%

Total Taobao and Tmall Group

212,607

212,367

30,262

(0)%

Cloud Intelligence Group

52,713

56,159

8,003

7%

Alibaba International Digital Commerce

Group:

International commerce retail

36,116

49,309

7,026

37%

International commerce wholesale

10,518

11,656

1,661

11%

Total Alibaba International Digital

Commerce Group

46,634

60,965

8,687

31%

Cainiao Smart Logistics Network

Limited

45,987

51,458

7,333

12%

Local Services Group

30,014

33,954

4,838

13%

Digital Media and Entertainment Group

11,160

11,275

1,607

1%

All others(2)

93,850

99,179

14,133

6%

Unallocated

526

888

126

Inter-segment elimination

(34,545)

(46,506)

(6,627)

Consolidated revenue

458,946

479,739

68,362

5%

____________________

(1)

Direct sales and others revenue under

Taobao and Tmall Group primarily represents Tmall Supermarket,

Tmall Global and other direct sales businesses, where revenue and

cost of inventory are recorded on a gross basis.

(2)

All others include Sun Art, Freshippo,

Alibaba Health, Lingxi Games, Intime, Intelligent Information

Platform (which mainly consists of UCWeb and Quark businesses),

Fliggy, DingTalk and other businesses. The majority of revenue

within All others consists of direct sales revenue, which is

recorded on a gross basis.

The following table sets forth a breakdown of our adjusted EBITA

by segment for the periods indicated:

Three months ended September

30,

2023

2024

RMB

RMB

US$

YoY % Change

(3)

(in millions, except

percentages)

Taobao and Tmall Group

47,077

44,590

6,354

(5)%

Cloud Intelligence Group

1,409

2,661

379

89%

Alibaba International Digital Commerce

Group

(384)

(2,905)

(414)

(657)%

Cainiao Smart Logistics Network

Limited

906

55

8

(94)%

Local Services Group

(2,564)

(391)

(56)

85%

Digital Media and Entertainment Group

(201)

(178)

(25)

11%

All others(1)

(1,437)

(1,582)

(225)

(10)%

Unallocated (2)

(1,019)

(1,271)

(181)

Inter-segment elimination

(942)

(418)

(60)

Consolidated adjusted EBITA

42,845

40,561

5,780

(5)%

Less: Non-cash share-based compensation

expense

(6,830)

(3,666)

(522)

Less: Amortization of intangible

assets

(2,431)

(1,649)

(235)

Income from operations

33,584

35,246

5,023

5%

Six months ended September

30,

2023

2024

RMB

RMB

US$

YoY % Change

(3)

(in millions, except

percentages)

Taobao and Tmall Group

96,396

93,400

13,309

(3)%

Cloud Intelligence Group

2,325

4,998

712

115%

Alibaba International Digital Commerce

Group

(804)

(6,611)

(942)

(722)%

Cainiao Smart Logistics Network

Limited

1,783

673

96

(62)%

Local Services Group

(4,546)

(777)

(111)

83%

Digital Media and Entertainment Group

(138)

(281)

(40)

(104)%

All others(1)

(3,170)

(2,845)

(405)

10%

Unallocated (2)

(2,482)

(2,142)

(305)

Inter-segment elimination

(1,148)

(819)

(117)

Consolidated adjusted EBITA

88,216

85,596

12,197

(3)%

Less: Non-cash share-based compensation

expense

(5,201)

(7,775)

(1,108)

Less: Amortization and impairment of

intangible assets

(4,910)

(3,441)

(490)

Less: Impairment of goodwill

(2,031)

–

–

Less: Provision for the shareholder class

action lawsuits

–

(3,145)

(448)

Income from operations

76,074

71,235

10,151

(6)%

____________________

(1)

All others include Sun Art, Freshippo,

Alibaba Health, Lingxi Games, Intime, Intelligent Information

Platform (which mainly consists of UCWeb and Quark businesses),

Fliggy, DingTalk and other businesses.

(2)

Unallocated primarily relates to certain

costs incurred by corporate functions and other miscellaneous items

that are not allocated to individual segments.

(3)

For a more intuitive presentation,

widening of loss in YoY% is shown in terms of negative growth rate,

and narrowing of loss in YoY% is shown in terms of positive growth

rate.

Taobao and Tmall Group

(i) Segment revenue

- China Commerce Retail Business

Revenue from our China commerce retail

business in the quarter ended September 30, 2024 was RMB93,008

million (US$13,254 million), compared to RMB92,560 million in the

same quarter of 2023.

Customer management revenue increased by 2%

year-over-year, primarily due to the online GMV growth, while take

rate remained stable year-over-year.

Direct sales and others revenue under China

commerce retail business in the quarter ended September 30, 2024

was RMB22,644 million (US$3,227 million), a decrease of 5% compared

to RMB23,899 million in the same quarter of 2023, primarily

attributable to the decrease in sales of appliances.

- China Commerce Wholesale Business

Revenue from our China commerce wholesale

business in the quarter ended September 30, 2024 was RMB5,986

million (US$853 million), an increase of 18% compared to RMB5,094

million in the same quarter of 2023, primarily due to the increase

in revenue from value-added services provided to paying

members.

(ii) Segment adjusted EBITA

Taobao and Tmall Group adjusted EBITA

decreased by 5% to RMB44,590 million (US$6,354 million) in the

quarter ended September 30, 2024, compared to RMB47,077 million in

the same quarter of 2023, primarily due to the increase in

investment in user experience, partly offset by the increase in

revenue from customer management service.

Cloud Intelligence Group

(i) Segment revenue

Revenue from Cloud Intelligence Group was

RMB29,610 million (US$4,219 million) in the quarter ended September

30, 2024, an increase of 7% compared to RMB27,648 million in the

same quarter of 2023. Overall revenue excluding

Alibaba-consolidated subsidiaries increased by 7% year-over-year,

mainly driven by the double-digit revenue growth of public cloud

products including AI-related products, partly offset by the

decrease in non-public cloud revenue as we transition away from the

low-margin project-based revenues to focus on high-quality

revenues.

(ii) Segment adjusted EBITA

Cloud Intelligence Group adjusted EBITA

increased by 89% to RMB2,661 million (US$379 million) in the

quarter ended September 30, 2024, compared to RMB1,409 million in

the same quarter of 2023, primarily due to shift in product mix

toward higher-margin public cloud products including AI-related

products and improving operating efficiency, partly offset by the

increasing investments in customer growth and technology.

Alibaba International Digital Commerce

Group

(i) Segment revenue

- International Commerce Retail Business

Revenue from our International commerce

retail business in the quarter ended September 30, 2024 was

RMB25,618 million (US$3,650 million), an increase of 35% compared

to RMB18,978 million in the same quarter of 2023, primarily driven

by the increase in revenue contributed by AliExpress’ Choice and

Trendyol. As certain of our international businesses generate

revenue in local currencies while our reporting currency is

Renminbi, AIDC’s revenue is affected by exchange rate

fluctuations.

- International Commerce Wholesale Business

Revenue from our International commerce

wholesale business in the quarter ended September 30, 2024 was

RMB6,054 million (US$863 million), an increase of 9% compared to

RMB5,533 million in the same quarter of 2023, primarily due to the

increase in revenue generated by cross-border-related value-added

services.

(ii) Segment adjusted EBITA

Alibaba International Digital Commerce Group

adjusted EBITA was a loss of RMB2,905 million (US$414 million) in

the quarter ended September 30, 2024, compared to a loss of RMB384

million in the same quarter of 2023, primarily due to the increase

in investments in AliExpress and Trendyol’s cross-border

businesses, partly offset by Lazada’s significant reduction in

operating loss from improvements in its monetization and operating

efficiency.

Cainiao Smart Logistics Network

Limited

(i) Segment revenue

Revenue from Cainiao Smart Logistics Network

Limited was RMB24,647 million (US$3,512 million) in the quarter

ended September 30, 2024, an increase of 8% compared to RMB22,823

million in the same quarter of 2023, primarily driven by the

increase in revenue from cross-border fulfillment solutions.

(ii) Segment adjusted EBITA

Cainiao Smart Logistics Network Limited

adjusted EBITA decreased by 94% to RMB55 million (US$8 million) in

the quarter ended September 30, 2024, compared to RMB906 million in

the same quarter of 2023, primarily due to the increased

investments in cross-border fulfillment solutions.

Local Services Group

(i) Segment revenue

Revenue from Local Services Group was

RMB17,725 million (US$2,526 million) in the quarter ended September

30, 2024, an increase of 14% compared to RMB15,564 million in the

same quarter of 2023, driven by the order growth of both Amap and

Ele.me, as well as revenue growth from marketing services.

(ii) Segment adjusted EBITA

Local Services Group adjusted EBITA was a

loss of RMB391 million (US$56 million) in the quarter ended

September 30, 2024, compared to a loss of RMB2,564 million in the

same quarter of 2023, primarily due to improved operating

efficiency and increasing scale.

Digital Media and Entertainment

Group

(i) Segment revenue

Revenue from Digital Media and Entertainment

Group was RMB5,694 million (US$811 million) in the quarter ended

September 30, 2024, a decrease of 1% compared to RMB5,779 million

in the same quarter of 2023.

(ii) Segment adjusted EBITA

Digital Media and Entertainment Group

adjusted EBITA in the quarter ended September 30, 2024 was a loss

of RMB178 million (US$25 million), compared to a loss of RMB201

million in the same quarter of 2023.

All Others

(i) Segment revenue

Revenue from All others segment was RMB52,178

million (US$7,435 million) in the quarter ended September 30, 2024,

an increase of 9% compared to RMB48,052 million in the same quarter

of 2023, mainly due to the increase in revenue from retail

businesses including Freshippo and Alibaba Health.

(ii) Segment adjusted EBITA

Adjusted EBITA from All others segment in the

quarter ended September 30, 2024 was a loss of RMB1,582 million

(US$225 million), compared to a loss of RMB1,437 million in the

same quarter of 2023.

SEPTEMBER QUARTER OTHER FINANCIAL RESULTS

Costs and Expenses

The following tables set forth a breakdown of our costs and

expenses, share-based compensation expense, and costs and expenses

excluding share-based compensation expense by function for the

periods indicated:

Three months ended September

30,

% of Revenue YoY

change

2023

2024

RMB

% of Revenue

RMB

US$

% of Revenue

(in millions, except

percentages)

Costs and expenses:

Cost of revenue

139,664

62.1%

144,029

20,524

60.9%

(1.2)%

Product development expenses

14,218

6.3%

14,182

2,020

6.0%

(0.3)%

Sales and marketing expenses

25,485

11.3%

32,471

4,627

13.7%

2.4%

General and administrative expenses

9,408

4.2%

9,777

1,393

4.1%

(0.1)%

Amortization of intangible assets

2,431

1.1%

1,649

235

0.7%

(0.4)%

Total costs and expenses

191,206

202,108

28,799

Share-based compensation

expense:

Cost of revenue

1,244

0.6%

619

89

0.3%

(0.3)%

Product development expenses

3,006

1.3%

1,757

250

0.7%

(0.6)%

Sales and marketing expenses

850

0.4%

549

78

0.2%

(0.2)%

General and administrative expenses

1,730

0.8%

1,221

174

0.5%

(0.3)%

Total share-based compensation

expense(1)

6,830

4,146

591

Costs and expenses excluding

share-based compensation expense:

Cost of revenue

138,420

61.6%

143,410

20,435

60.6%

(1.0)%

Product development expenses

11,212

5.0%

12,425

1,770

5.3%

0.3%

Sales and marketing expenses

24,635

11.0%

31,922

4,549

13.5%

2.5%

General and administrative expenses

7,678

3.4%

8,556

1,219

3.6%

0.2%

Amortization of intangible assets

2,431

1.1%

1,649

235

0.7%

(0.4)%

Total costs and expenses excluding

share-based compensation expense

184,376

197,962

28,208

____________________

(1)

This includes both cash and non-cash

share-based compensation expenses.

Cost of revenue – Cost of revenue in the quarter ended

September 30, 2024 was RMB144,029 million (US$20,524 million), or

60.9% of revenue, compared to RMB139,664 million, or 62.1% of

revenue, in the same quarter of 2023. Without the effect of

share-based compensation expense, cost of revenue as a percentage

of revenue would have decreased from 61.6% in the quarter ended

September 30, 2023 to 60.6% in the quarter ended September 30,

2024.

Product development expenses – Product development

expenses in the quarter ended September 30, 2024 were RMB14,182

million (US$2,020 million), or 6.0% of revenue, compared to

RMB14,218 million, or 6.3% of revenue, in the same quarter of 2023.

Without the effect of share-based compensation expense, product

development expenses as a percentage of revenue would have

increased from 5.0% in the quarter ended September 30, 2023 to 5.3%

in the quarter ended September 30, 2024.

Sales and marketing expenses – Sales and marketing

expenses in the quarter ended September 30, 2024 were RMB32,471

million (US$4,627 million), or 13.7% of revenue, compared to

RMB25,485 million, or 11.3% of revenue, in the same quarter of

2023. Without the effect of share-based compensation expense, sales

and marketing expenses as a percentage of revenue would have

increased from 11.0% in the quarter ended September 30, 2023 to

13.5% in the quarter ended September 30, 2024, primarily due to our

increased investments in e-commerce businesses.

General and administrative expenses – General and

administrative expenses in the quarter ended September 30, 2024

were RMB9,777 million (US$1,393 million), or 4.1% of revenue,

compared to RMB9,408 million, or 4.2% of revenue, in the same

quarter of 2023. Without the effect of share-based compensation

expense, general and administrative expenses as a percentage of

revenue would have increased from 3.4% in the quarter ended

September 30, 2023 to 3.6% in the quarter ended September 30,

2024.

Share-based compensation expense – Total share-based

compensation expense included in the cost and expense items above

in the quarter ended September 30, 2024 was RMB4,146 million

(US$591 million), compared to RMB6,830 million in the same quarter

of 2023.

The following table sets forth our analysis of share-based

compensation expense for the quarters indicated by type of

share-based awards:

Three months ended September

30,

2023

2024

RMB

RMB

US$

YoY % Change

(in millions, except

percentages)

By type of awards:

Alibaba Group share-based awards(1)

4,840

2,786

397

(42)%

Ant Group share-based awards(2)

85

12

2

(86)%

Others(3)

1,905

1,348

192

(29)%

Total share-based compensation

expense(4)

6,830

4,146

591

(39)%

____________________

(1)

This represents Alibaba Group share-based

awards granted to our employees.

(2)

This represents Ant Group share-based

awards granted to our employees, which is subject to mark-to-market

accounting treatment.

(3)

This represents share-based awards of our

subsidiaries.

(4)

This includes both cash and non-cash

share-based compensation expenses.

Share-based compensation expense related to Alibaba Group

share-based awards decreased in the quarter ended September 30,

2024 compared to the same quarter of 2023. This decrease was

primarily due to the decrease in the number of the awards

granted.

We expect that our share-based compensation expense will

continue to be affected by changes in the fair value of the

underlying awards and the quantity of awards we grant in the

future.

Amortization of intangible assets – Amortization of

intangible assets in the quarter ended September 30, 2024 was

RMB1,649 million (US$235 million), a decrease of 32% from RMB2,431

million in the same quarter of 2023.

Income from operations and operating

margin

Income from operations in the quarter ended September 30, 2024

was RMB35,246 million (US$5,023 million), or 15% of revenue, an

increase of 5% compared to RMB33,584 million, or 15% of revenue, in

the same quarter of 2023, primarily due to the decrease in non-cash

share-based compensation expense, partly offset by the decrease in

adjusted EBITA.

Adjusted EBITDA and Adjusted

EBITA

Adjusted EBITDA decreased 4% year-over-year to RMB47,327 million

(US$6,744 million) in the quarter ended September 30, 2024,

compared to RMB49,237 million in the same quarter of 2023. Adjusted

EBITA decreased 5% year-over-year to RMB40,561 million (US$5,780

million) in the quarter ended September 30, 2024, compared to

RMB42,845 million in the same quarter of 2023, primarily

attributable to the increase in investments in our e-commerce

businesses, partly offset by revenue growth and improved operating

efficiency. A reconciliation of net income to adjusted EBITDA and

adjusted EBITA is included at the end of this results

announcement.

Adjusted EBITA by

segment

Adjusted EBITA by segment as well as a reconciliation of income

from operations to adjusted EBITA are set forth in the section

entitled “September Quarter Segment Results” above.

Interest and investment income,

net

Interest and investment income, net in the quarter ended

September 30, 2024 was RMB18,607 million (US$2,652 million), an

increase of 262% compared to RMB5,136 million in the same quarter

of 2023, primarily attributable to the mark-to-market changes from

our equity investments.

The above-mentioned investment gains and losses were excluded

from our non-GAAP net income.

Other income (expense),

net

Other income (expense), net in the quarter ended September 30,

2024 was an expense of RMB1,478 million (US$211 million), compared

to income of RMB1,391 million in the same quarter of 2023,

primarily attributable to the net exchange loss compared to the net

exchange gain in the same period last year, arising from the

exchange rate fluctuation between Renminbi and U.S. dollar.

Income tax expenses

Income tax expenses in the quarter ended September 30, 2024 were

RMB7,379 million (US$1,052 million), compared to RMB5,797 million

in the same quarter of 2023.

Share of results of equity method

investees

Share of results of equity method investees in the quarter ended

September 30, 2024 was a profit of RMB978 million (US$139 million),

compared to a loss of RMB5,764 million in the same quarter of 2023,

primarily due to the year-over-year decrease in impairment of

equity method investees. The following table sets forth a breakdown

of share of results of equity method investees for the periods

indicated:

Three months ended September

30,

2023

2024

RMB

RMB

US$

(in millions)

Share of profit (loss) of equity method

investees

- Ant Group

846

2,478

353

- Others

(1,146)

(746)

(106)

Impairment loss

(4,469)

–

–

Others(1)

(995)

(754)

(108)

Total

(5,764)

978

139

____________________

(1)

“Others” mainly include basis differences

arising from equity method investees, share-based compensation

expense related to share-based awards granted to employees of our

equity method investees, as well as gain or loss arising from the

deemed disposal of the equity method investees.

We record our share of results of all equity method investees

one quarter in arrears. The year-over-year increase in share of

profit of Ant Group was mainly because the share of results in the

same quarter last year reflected a RMB7.07 billion fine on Ant

Group imposed by PRC regulators announced in July 2023.

Net income and Non-GAAP net

income

Our net income in the quarter ended September 30, 2024 was

RMB43,547 million (US$6,205 million), compared to RMB26,696 million

in the same quarter of 2023, primarily attributable to the

mark-to-market changes from our equity investments, the decrease in

impairment of our investments and increase in income from

operations.

Excluding non-cash share-based compensation expense,

gains/losses of investments, and certain other items, non-GAAP net

income in the quarter ended September 30, 2024 was RMB36,518

million (US$5,204 million), a decrease of 9% compared to RMB40,188

million in the same quarter of 2023. A reconciliation of net income

to non-GAAP net income is included at the end of this results

announcement.

Net income attributable to ordinary

shareholders

Net income attributable to ordinary shareholders in the quarter

ended September 30, 2024 was RMB43,874 million (US$6,252 million),

compared to RMB27,706 million in the same quarter of 2023,

primarily attributable to the mark-to-market changes from our

equity investments, the decrease in impairment of our investments

and increase in income from operations.

Diluted earnings per ADS/share and

non-GAAP diluted earnings per ADS/share

Diluted earnings per ADS in the quarter ended September 30, 2024

was RMB18.17 (US$2.59), compared to RMB10.77 in the same quarter of

2023. Excluding non-cash share-based compensation expense,

gains/losses of investments, and certain other items, non-GAAP

diluted earnings per ADS in the quarter ended September 30, 2024

was RMB15.06 (US$2.15), a decrease of 4% compared to RMB15.63 in

the same quarter of 2023.

Diluted earnings per share in the quarter ended September 30,

2024 was RMB2.27 (US$0.32 or HK$2.52), compared to RMB1.35 in the

same quarter of 2023. Excluding non-cash share-based compensation

expense, gains/losses of investments, and certain other items,

non-GAAP diluted earnings per share in the quarter ended September

30, 2024 was RMB1.88 (US$0.27 or HK$2.08), a decrease of 4%

compared to RMB1.95 in the same quarter of 2023.

A reconciliation of diluted earnings per ADS/share to non-GAAP

diluted earnings per ADS/share is included at the end of this

results announcement. Each ADS represents eight ordinary

shares.

Cash and cash equivalents, short-term

investments and other treasury investments

As of September 30, 2024, cash and cash equivalents, short-term

investments and other treasury investments included in equity

securities and other investments on the consolidated balance

sheets, were RMB554,378 million (US$78,998 million), compared to

RMB617,230 million as of March 31, 2024. Other treasury investments

consist of fixed deposits, certificate of deposits and marketable

debt securities with original maturities over one year for treasury

purposes. The decrease in cash and cash equivalents, short-term

investments and other treasury investments during the six months

ended September 30, 2024 was primarily due to cash used in

repurchase of ordinary shares of RMB72,889 million (US$10,387

million), dividend payment of RMB29,022 million (US$4,136 million)

and acquisition of additional equity interests in non-wholly owned

subsidiaries of RMB19,947 million (US$2,842 million), partly offset

by free cash flow generated from operations of RMB31,107 million

(US$4,433 million) and net proceeds from convertible unsecured

senior notes and the payments for capped call transactions of

RMB31,065 million (US$4,427 million).

Net cash provided by operating

activities and free cash flow

During the quarter ended September 30, 2024, net cash provided

by operating activities was RMB31,438 million (US$4,480 million), a

decrease of 36% compared to RMB49,231 million in the same quarter

of 2023. Free cash flow, a non-GAAP measurement of liquidity, was

RMB13,735 million (US$1,957 million), a decrease of 70% compared to

RMB45,220 million in the quarter ended September 30, 2023. The

decrease in free cash flow was mainly attributed to our investments

in Alibaba Cloud infrastructure, refund to Tmall merchants after we

cancelled the annual service fee and other working capital changes

related to factors including scale down of certain direct sales

businesses. A reconciliation of net cash provided by operating

activities to free cash flow is included at the end of this results

announcement.

Net cash provided by investing

activities

During the quarter ended September 30, 2024, net cash provided

by investing activities of RMB964 million (US$137 million)

primarily reflected (i) a decrease in short-term investments by

RMB18,053 million (US$2,573 million) and (ii) cash inflow of

RMB4,013 million (US$572 million) from disposal of investments.

These cash inflows were partly offset by (i) capital expenditures

of RMB17,491 million (US$2,492 million), and (ii) cash outflow of

RMB4,038 million (US$575 million) for investment and acquisition

activities.

Net cash used in financing

activities

During the quarter ended September 30, 2024, net cash used in

financing activities of RMB66,782 million (US$9,516 million)

primarily reflected cash used in repurchase of ordinary shares of

RMB30,194 million (US$4,303 million), dividend payment of RMB28,870

million (US$4,114 million) and acquisition of additional equity

interests in non-wholly owned subsidiaries of RMB11,610 million

(US$1,654 million).

Employees

As of September 30, 2024, we had a total of 197,991 employees,

compared to 198,162 as of June 30, 2024.

WEBCAST AND CONFERENCE CALL INFORMATION

Alibaba Group’s management will hold a conference call to

discuss the financial results at 7:30 a.m. U.S. Eastern Time (8:30

p.m. Hong Kong Time) on Friday, November 15, 2024.

All participants must pre-register to join this conference call

using the Participant Registration link below: English:

https://s1.c-conf.com/diamondpass/10042440-pohtg.html Chinese:

https://s1.c-conf.com/diamondpass/10042441-ywtss.html

Upon registration, each participant will receive details for the

conference call, including dial-in numbers, conference call

passcode and a unique access PIN. To join the conference, please

dial the number provided, enter the passcode followed by your PIN,

and you will join the conference.

A live webcast of the earnings conference call can be accessed

at

https://www.alibabagroup.com/en-US/ir-financial-reports-quarterly-results.

An archived webcast will be available through the same link

following the call. A replay of the conference call will be

available for one week from the date of the conference (Dial-in

number: +1 855 883 1031; English conference PIN 10042440; Chinese

conference PIN 10042441).

Please visit Alibaba Group’s Investor Relations website at

https://www.alibabagroup.com/en-US/investor-relations on November

15, 2024 to view the earnings release and accompanying slides prior

to the conference call.

ABOUT ALIBABA GROUP

Alibaba Group’s mission is to make it easy to do business

anywhere. The company aims to build the future infrastructure of

commerce. It envisions that its customers will meet, work and live

at Alibaba, and that it will be a good company that lasts for 102

years.

EXCHANGE RATE INFORMATION

This results announcement contains translations of certain

Renminbi (“RMB”) amounts into U.S. dollars (“US$”) and Hong Kong

dollars (“HK$”) for the convenience of the reader. Unless otherwise

stated, all translations of RMB into US$ were made at RMB7.0176 to

US$1.00, the exchange rate on September 30, 2024 as set forth in

the H.10 statistical release of the Federal Reserve Board, and all

translations of RMB into HK$ were made at RMB0.90179 to HK$1.00,

the middle rate on September 30, 2024 as published by the People’s

Bank of China. The percentages stated in this announcement are

calculated based on the RMB amounts and there may be minor

differences due to rounding.

SAFE HARBOR STATEMENTS

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “will,” “expect,” “anticipate,” “future,” “aim,” “estimate,”

“intend,” “seek,” “plan,” “believe,” “potential,” “continue,”

“ongoing,” “target,” “guidance,” “is/are likely to” and similar

statements. In addition, statements that are not historical facts,

including statements about Alibaba Group’s new organizational and

governance structure, Alibaba’s strategies and business and

operational plans, Alibaba’s beliefs, expectations and guidance

regarding the growth of its business, revenue and return on

investments, share repurchases and the business outlook and

quotations from management in this announcement, are or contain

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to: the

implementation of Alibaba Group’s new organizational and governance

structure; Alibaba’s ability to compete, innovate and maintain or

grow its business; risks associated with sustained investments in

Alibaba’s businesses; fluctuations in general economic and business

conditions in China and globally; uncertainties arising from

competition among countries and geopolitical tensions, including

national trade, investment, protectionist or other policies and

export control, economic or trade sanctions; and assumptions

underlying or related to any of the foregoing. Further information

regarding these and other risks is included in Alibaba’s filings

with the U.S. Securities and Exchange Commission and announcements

on the website of The Stock Exchange of Hong Kong Limited. All

information provided in this results announcement is as of the date

of this results announcement and are based on assumptions that we

believe to be reasonable as of this date, and Alibaba does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

NON-GAAP FINANCIAL MEASURES

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we use the

following non-GAAP financial measures: for our consolidated

results, adjusted EBITDA (including adjusted EBITDA margin),

adjusted EBITA (including adjusted EBITA margin), non-GAAP net

income, non-GAAP diluted earnings per share/ADS and free cash flow.

For more information on these non-GAAP financial measures, please

refer to the table captioned “Reconciliations of Non-GAAP Measures

to the Nearest Comparable U.S. GAAP Measures” in this results

announcement.

We believe that adjusted EBITDA, adjusted EBITA, non-GAAP net

income and non-GAAP diluted earnings per share/ADS help identify

underlying trends in our business that could otherwise be distorted

by the effect of certain income or expenses that we include in

income from operations, net income and diluted earnings per

share/ADS. We believe that these non-GAAP measures provide useful

information about our core operating results, enhance the overall

understanding of our past performance and future prospects and

allow for greater visibility with respect to key metrics used by

our management in its financial and operational decision-making. We

present three different income measures, namely adjusted EBITDA,

adjusted EBITA and non-GAAP net income in order to provide more

information and greater transparency to investors about our

operating results.

We consider free cash flow to be a liquidity measure that

provides useful information to management and investors about the

amount of cash generated by our business that can be used for

strategic corporate transactions, including investing in our new

business initiatives, making strategic investments and acquisitions

and strengthening our balance sheet.

Adjusted EBITDA, adjusted EBITA, non-GAAP net income, non-GAAP

diluted earnings per share/ADS and free cash flow should not be

considered in isolation or construed as an alternative to income

from operations, net income, diluted earnings per share/ADS, cash

flows or any other measure of performance or as an indicator of our

operating performance. These non-GAAP financial measures presented

here do not have standardized meanings prescribed by U.S. GAAP and

may not be comparable to similarly titled measures presented by

other companies. Other companies may calculate similarly titled

measures differently, limiting their usefulness as comparative

measures to our data.

Adjusted EBITDA represents net income before interest and

investment income, net, interest expense, other income (expense),

net, income tax expenses, share of results of equity method

investees, certain non-cash expenses, consisting of share-based

compensation expense, amortization and impairment of intangible

assets, impairment of goodwill, depreciation and impairment of

property and equipment, and operating lease cost relating to land

use rights, and others (including provision in relation to matters

outside the ordinary course of business), which we do not believe

are reflective of our core operating performance during the periods

presented.

Adjusted EBITA represents net income before interest and

investment income, net, interest expense, other income (expense),

net, income tax expenses, share of results of equity method

investees, certain non-cash expenses, consisting of share-based

compensation expense, amortization and impairment of intangible

assets, impairment of goodwill, and others (including provision in

relation to matters outside the ordinary course of business), which

we do not believe are reflective of our core operating performance

during the periods presented.

Non-GAAP net income represents net income before non-cash

share-based compensation expense, amortization and impairment of

intangible assets, gain or loss on deemed

disposals/disposals/revaluation of investments, impairment of

goodwill and investments, and others (including provision in

relation to matters outside the ordinary course of business), and

adjustments for the tax effects.

Non-GAAP diluted earnings per share represents non-GAAP

net income attributable to ordinary shareholders divided by the

weighted average number of outstanding ordinary shares for

computing non-GAAP diluted earnings per share on a diluted basis.

Non-GAAP diluted earnings per ADS represents non-GAAP

diluted earnings per share after adjusting for the ordinary

share-to-ADS ratio.

Free cash flow represents net cash provided by operating

activities as presented in our consolidated cash flow statement

less purchases of property and equipment (excluding acquisition of

land use rights and construction in progress relating to office

campuses) and intangible assets (excluding those acquired through

acquisitions), as well as adjustments to exclude from net cash

provided by operating activities the buyer protection fund deposits

from merchants on our marketplaces. We deduct certain items of cash

flows from investing activities in order to provide greater

transparency into cash flow from our revenue-generating business

operations. We exclude “acquisition of land use rights and

construction in progress relating to office campuses” because the

office campuses are used by us for corporate and administrative

purposes and are not directly related to our revenue-generating

business operations. We also exclude buyer protection fund deposits

from merchants on our marketplaces because these deposits are

restricted for the purpose of compensating buyers for claims

against merchants.

The table captioned “Reconciliations of Non-GAAP Measures to the

Nearest Comparable U.S. GAAP Measures” in this results announcement

has more details on the non-GAAP financial measures that are most

directly comparable to GAAP financial measures and the related

reconciliations between these financial measures.

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONSOLIDATED INCOME

STATEMENTS

Three months ended September

30,

Six months ended September

30,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

(in millions, except per share

data)

(in millions, except per share

data)

Revenue

224,790

236,503

33,701

458,946

479,739

68,362

Cost of revenue

(139,664)

(144,029)

(20,524)

(282,011)

(290,135)

(41,344)

Product development expenses

(14,218)

(14,182)

(2,020)

(24,683)

(27,555)

(3,927)

Sales and marketing expenses

(25,485)

(32,471)

(4,627)

(52,532)

(65,167)

(9,286)

General and administrative expenses

(9,408)

(9,777)

(1,393)

(16,705)

(23,057)

(3,285)

Amortization and impairment of intangible

assets

(2,431)

(1,649)

(235)

(4,910)

(3,441)

(490)

Impairment of goodwill

–

–

–

(2,031)

–

–

Other gains, net

–

851

121

–

851

121

Income from operations

33,584

35,246

5,023

76,074

71,235

10,151

Interest and investment income, net

5,136

18,607

2,652

(762)

17,129

2,441

Interest expense

(1,854)

(2,427)

(346)

(3,638)

(4,615)

(658)

Other income (expense), net

1,391

(1,478)

(211)

2,755

(1,221)

(174)

Income before income tax and share of

results of equity method investees

38,257

49,948

7,118

74,429

82,528

11,760

Income tax expenses

(5,797)

(7,379)

(1,052)

(11,819)

(17,442)

(2,485)

Share of results of equity method

investees

(5,764)

978

139

(2,914)

2,483

354

Net income

26,696

43,547

6,205

59,696

67,569

9,629

Net loss attributable to noncontrolling

interests

1,151

486

70

2,393

854

121

Net income attributable to Alibaba Group

Holding Limited

27,847

44,033

6,275

62,089

68,423

9,750

Accretion of mezzanine equity

(141)

(159)

(23)

(51)

(280)

(40)

Net income attributable to ordinary

shareholders

27,706

43,874

6,252

62,038

68,143

9,710

Earnings per share attributable to

ordinary shareholders(1)

Basic

1.36

2.34

0.33

3.04

3.58

0.51

Diluted

1.35

2.27

0.32

3.01

3.50

0.50

Earnings per ADS attributable to

ordinary shareholders(1)

Basic

10.90

18.71

2.67

24.31

28.62

4.08

Diluted

10.77

18.17

2.59

24.08

28.00

3.99

Weighted average number of shares used

in calculating earnings per ordinary share (million

shares)(1)

Basic

20,335

18,761

20,414

19,045

Diluted

20,526

19,322

20,567

19,459

____________________

(1)

Each ADS represents eight ordinary

shares.

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONSOLIDATED BALANCE

SHEETS

As of March 31,

As of September 30,

2024

2024

RMB

RMB

US$

(in millions)

Assets

Current assets:

Cash and cash equivalents

248,125

182,992

26,076

Short-term investments

262,955

155,530

22,163

Restricted cash and escrow receivables

38,299

45,480

6,481

Equity securities and other

investments

59,949

50,266

7,163

Prepayments, receivables and other

assets

143,536

174,834

24,913

Total current assets

752,864

609,102

86,796

Equity securities and other

investments

220,942

344,658

49,113

Prepayments, receivables and other

assets

116,102

115,960

16,524

Investment in equity method investees

203,131

202,548

28,863

Property and equipment, net

185,161

207,917

29,628

Intangible assets, net

26,950

22,906

3,264

Goodwill

259,679

259,621

36,996

Total assets

1,764,829

1,762,712

251,184

Liabilities, Mezzanine Equity and

Shareholders’ Equity

Current liabilities:

Current bank borrowings

12,749

16,938

2,414

Current unsecured senior notes

16,252

15,786

2,249

Income tax payable

9,068

8,115

1,156

Accrued expenses, accounts payable and

other liabilities

297,883

322,743

45,991

Merchant deposits

12,737

3,813

543

Deferred revenue and customer advances

72,818

77,473

11,040

Total current liabilities

421,507

444,868

63,393

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONSOLIDATED BALANCE SHEETS

(CONTINUED)

As of March 31,

As of September 30,

2024

2024

RMB

RMB

US$

(in millions)

Deferred revenue

4,069

4,318

615

Deferred tax liabilities

53,012

54,747

7,801

Non-current bank borrowings

55,686

51,302

7,311

Non-current unsecured senior notes

86,089

83,608

11,914

Non-current convertible unsecured senior

notes

–

34,626

4,934

Other liabilities

31,867

31,365

4,470

Total liabilities

652,230

704,834

100,438

Commitments and contingencies

Mezzanine equity

10,728

11,592

1,651

Shareholders’ equity:

Ordinary shares

1

1

–

Additional paid-in capital

397,999

380,145

54,170

Treasury shares at cost

(27,684)

(36,185)

(5,156)

Statutory reserves

14,733

15,885

2,264

Accumulated other comprehensive income

3,598

467

66

Retained earnings

597,897

593,612

84,589

Total shareholders’ equity

986,544

953,925

135,933

Noncontrolling interests

115,327

92,361

13,162

Total equity

1,101,871

1,046,286

149,095

Total liabilities, mezzanine equity and

equity

1,764,829

1,762,712

251,184

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three months ended September

30,

Six months ended September

30,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

(in millions)

(in millions)

Net cash provided by operating

activities

49,231

31,438

4,480

94,537

65,074

9,273

Net cash (used in) provided by investing

activities

(23,761)

964

137

(11,166)

(34,865)

(4,968)

Net cash used in financing activities

(12,382)

(66,782)

(9,516)

(37,018)

(86,364)

(12,307)

Effect of exchange rate changes on cash

and cash equivalents, restricted cash and escrow receivables

813

(2,456)

(350)

5,132

(1,797)

(256)

Increase (Decrease) in cash and cash

equivalents, restricted cash and escrow receivables

13,901

(36,836)

(5,249)

51,485

(57,952)

(8,258)

Cash and cash equivalents, restricted cash

and escrow receivables at beginning of period

267,094

265,308

37,806

229,510

286,424

40,815

Cash and cash equivalents, restricted cash

and escrow receivables at end of period

280,995

228,472

32,557

280,995

228,472

32,557

ALIBABA GROUP HOLDING LIMITED

RECONCILIATIONS OF NON-GAAP MEASURES TO

THE NEAREST COMPARABLE U.S. GAAP MEASURES

The table below sets forth a

reconciliation of our net income to adjusted EBITA and adjusted

EBITDA for the periods indicated:

Three months ended September

30,

Six months ended September

30,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

(in millions)

(in millions)

Net income

26,696

43,547

6,205

59,696

67,569

9,629

Adjustments to reconcile net income to

adjusted EBITA and adjusted EBITDA:

Interest and investment income, net

(5,136)

(18,607)

(2,652)

762

(17,129)

(2,441)

Interest expense

1,854

2,427

346

3,638

4,615

658

Other (income) expense, net

(1,391)

1,478

211

(2,755)

1,221

174

Income tax expenses

5,797

7,379

1,052

11,819

17,442

2,485

Share of results of equity method

investees

5,764

(978)

(139)

2,914

(2,483)

(354)

Income from operations

33,584

35,246

5,023

76,074

71,235

10,151

Non-cash share-based compensation

expense

6,830

3,666

522

5,201

7,775

1,108

Amortization and impairment of intangible

assets

2,431

1,649

235

4,910

3,441

490

Impairment of goodwill

–

–

–

2,031

–

–

Provision for the shareholder class action

lawsuits

–

–

–

–

3,145

448

Adjusted EBITA

42,845

40,561

5,780

88,216

85,596

12,197

Depreciation and impairment of property

and equipment, and operating lease cost relating to land use

rights

6,392

6,766

964

13,073

12,892

1,837

Adjusted EBITDA

49,237

47,327

6,744

101,289

98,488

14,034

ALIBABA GROUP HOLDING LIMITED

RECONCILIATIONS OF NON-GAAP MEASURES TO

THE NEAREST COMPARABLE U.S. GAAP MEASURES (CONTINUED)

The table below sets forth a

reconciliation of our net income to non-GAAP net income for the

periods indicated:

Three months ended September

30,

Six months ended September

30,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

(in millions)

(in millions)

Net income

26,696

43,547

6,205

59,696

67,569

9,629

Adjustments to reconcile net income to

non-GAAP net income:

Non-cash share-based compensation

expense

6,830

3,666

522

5,201

7,775

1,108

Amortization and impairment of intangible

assets

2,431

1,649

235

4,910

3,441

490

Provision for the shareholder class action

lawsuits

–

–

–

–

3,145

448

(Gain) Loss on deemed disposals/disposals/

revaluation of investments

(1,731)

(12,697)

(1,809)

7,307

(8,116)

(1,157)

Impairment of goodwill and investments,

and others

7,604

756

108

11,873

5,067

722

Tax effects (1)

(1,642)

(403)

(57)

(3,877)

(1,672)

(238)

Non-GAAP net income

40,188

36,518

5,204

85,110

77,209

11,002

____________________

(1)

Tax effects primarily comprise tax effects

relating to non-cash share-based compensation expense, amortization

and impairment of intangible assets and certain gains and losses

from investments, and others.

ALIBABA GROUP HOLDING LIMITED

RECONCILIATIONS OF NON-GAAP MEASURES TO

THE NEAREST COMPARABLE U.S. GAAP MEASURES (CONTINUED)

The table below sets forth a

reconciliation of our diluted earnings per share/ADS to non-GAAP

diluted earnings per share/ADS for the periods indicated:

Three months ended September

30,

Six months ended September

30,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

(in millions, except per share

data)

(in millions, except per share

data)

Net income attributable to ordinary

shareholders – basic

27,706

43,874

6,252

62,038

68,143

9,710

Dilution effect on earnings arising from

non-cash share-based awards operated by equity method investees and

subsidiaries

(66)

(56)

(8)

(134)

(131)

(19)

Adjustments for interest expense

attributable to convertible unsecured senior notes

–

69

10

–

95

14

Net income attributable to ordinary

shareholders – diluted

27,640

43,887

6,254

61,904

68,107

9,705

Non-GAAP adjustments to net income

attributable to ordinary shareholders(1)

12,478

(7,524)

(1,072)

22,949

8,521

1,214

Non-GAAP net income attributable

to ordinary shareholders for computing non-GAAP diluted earnings

per share/ADS

40,118

36,363

5,182

84,853

76,628

10,919

Weighted average number of shares on a

diluted basis for computing non-GAAP diluted earnings per share/ADS

(million shares)(2)

20,526

19,322

20,567

19,459

Diluted earnings per

share(2)(3)

1.35

2.27

0.32

3.01

3.50

0.50

Non-GAAP diluted earnings per

share(2)(4)

1.95

1.88

0.27

4.13

3.94

0.56

Diluted earnings per ADS(2)(3)

10.77

18.17

2.59

24.08

28.00

3.99

Non-GAAP diluted earnings per

ADS(2)(4)

15.63

15.06

2.15

33.00

31.50

4.49

____________________

(1)

Non-GAAP adjustments excluding the

attributions to the noncontrolling interests. See the table above

for items regarding the reconciliation of net income to non-GAAP

net income (before excluding the attributions to the noncontrolling

interests).

(2)

Each ADS represents eight ordinary

shares.

(3)

Diluted earnings per share is derived from

dividing net income attributable to ordinary shareholders by the

weighted average number of outstanding ordinary shares, on a

diluted basis. Diluted earnings per ADS is derived from the diluted

earnings per share after adjusting for the ordinary share-to-ADS

ratio.

(4)

Non-GAAP diluted earnings per share is

derived from dividing non-GAAP net income attributable to ordinary

shareholders by the weighted average number of outstanding ordinary

shares for computing non-GAAP diluted earnings per share, on a

diluted basis. Non-GAAP diluted earnings per ADS is derived from

the non-GAAP diluted earnings per share after adjusting for the

ordinary share-to-ADS ratio.

ALIBABA GROUP HOLDING LIMITED

RECONCILIATIONS OF NON-GAAP MEASURES TO

THE NEAREST COMPARABLE U.S. GAAP MEASURES (CONTINUED)

The table below sets forth a

reconciliation of net cash provided by operating activities to free

cash flow for the periods indicated:

Three months ended September

30,

Six months ended September

30,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

(in millions)

(in millions)

Net cash provided by operating

activities

49,231

31,438

4,480

94,537

65,074

9,273

Less: Purchase of property and equipment

(excluding land use rights and construction in progress relating to

office campuses)

(4,112)

(16,977)

(2,419)

(10,119)

(28,916)

(4,120)

Less: Changes in the buyer protection fund

deposits

101

(726)

(104)

(109)

(5,051)

(720)

Free cash flow

45,220

13,735

1,957

84,309

31,107

4,433

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114291910/en/

Investor Relations Contact

Lydia Liu Head of Investor Relations Alibaba Group Holding

Limited investor@alibaba-inc.com

Media Contacts

Cathy Yan cathy.yan@alibaba-inc.com

Ivy Ke ivy.ke@alibaba-inc.com

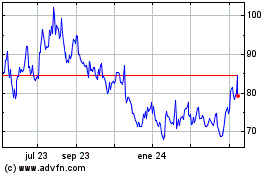

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

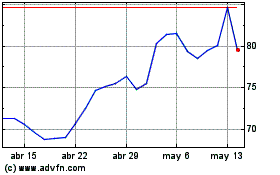

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024