0001664703FALSEMay 23, 2024May 29, 202400016647032024-05-232024-05-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 23, 2024

___________________________________________

BLOOM ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

001-38598

(Commission File Number)

___________________________________________

| | | | | | | | | | | |

| Delaware | 77-0565408 |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

| | |

| 4353 North First Street, | San Jose, | California | 95134 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| (408) | 543-1500 |

| (Registrant’s telephone number, including area code) |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | BE | | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into a Material Definitive Agreement.

Indenture and Notes

On May 29, 2024, Bloom Energy Corporation (the “Company”) issued $402,500,000 aggregate principal amount of its 3.00% Green Convertible Senior Notes due 2029 (the “Notes”). The Notes were issued pursuant to, and are governed by, an indenture (the “Indenture”), dated as of May 29, 2024, between the Company and U.S. Bank Trust Company, National Association, as trustee (the “Trustee”). Pursuant to the purchase agreement among the Company and the representative of the initial purchasers of the Notes, the Company granted the initial purchasers an option to purchase, for settlement within a period of 13 days from, and including, the date the Notes are first issued, up to an additional $52,500,000 principal amount of Notes. The Notes issued on May 29, 2024 include $52,500,000 principal amount of Notes issued pursuant to the full exercise by the initial purchasers of such option.

The Notes will be the Company’s senior, unsecured obligations and will be (i) equal in right of payment with the Company’s existing and future senior, unsecured indebtedness (including its 2.50% Green Convertible Senior Notes due 2025 and its 3.00% Green Convertible Senior Notes due 2028); (ii) senior in right of payment to the Company’s future indebtedness that is expressly subordinated to the Notes; (iii) effectively subordinated to the Company’s existing and future secured indebtedness, to the extent of the value of the collateral securing that indebtedness; and (iv) structurally subordinated to all existing and future indebtedness and other liabilities, including trade payables, and (to the extent the Company is not a holder thereof) preferred equity, if any, of the Company’s subsidiaries.

The Notes will accrue interest at a rate of 3.00% per annum, payable semi-annually in arrears on June 1 and December 1 of each year, beginning on December 1, 2024. The Notes will mature on June 1, 2029, unless earlier repurchased, redeemed or converted. Before the close of business on the business day immediately before March 1, 2029, noteholders will have the right to convert their Notes only upon the occurrence of certain events. From and after March 1, 2029, noteholders may convert their Notes at any time at their election until the close of business on the second scheduled trading day immediately before the maturity date. The Company will settle conversions by paying or delivering, as applicable, cash, shares of its Class A common stock, $0.0001 par value per share (the “Class A common stock”), or a combination of cash and shares of its Class A common stock, at the Company’s election. The initial conversion rate is 47.9795 shares of Class A common stock per $1,000 principal amount of Notes, which represents an initial conversion price of approximately $20.84 per share of Class A common stock. The conversion rate and conversion price will be subject to customary adjustments upon the occurrence of certain events. In addition, if certain corporate events that constitute a “Make-Whole Fundamental Change” (as defined in the Indenture) occur, then the conversion rate will, in certain circumstances, be increased for a specified period of time.

The Notes will be redeemable, in whole or in part (subject to the partial redemption limitation described below), at the Company’s option at any time, and from time to time, on or after June 7, 2027 and on or before the 21st scheduled trading day immediately before the maturity date, at a cash redemption price equal to the principal amount of the Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date, but only if (i) the notes are “Freely Tradable” (as defined in the Indenture), and all accrued and unpaid additional interest, if any, has been paid in full, as of the date the Company sends the related redemption notice; and (ii) the last reported sale price per share of the Company’s Class A common stock exceeds 130% of the conversion price on (1) each of at least 20 trading days, whether or not consecutive, during the 30 consecutive trading days ending on, and including, the trading day immediately before the date the Company sends such redemption notice; and (2) the trading day immediately before the date the Company sends such redemption notice. However, the Company may not redeem less than all of the outstanding Notes unless at least $100.0 million aggregate principal amount of Notes are outstanding and not called for redemption as of the time the Company sends the related redemption notice. In addition, calling any Note for redemption will constitute a Make-Whole Fundamental Change with respect to that Note, in which case the conversion rate applicable to the conversion of that Note will be increased in certain circumstances if it is converted during the related redemption conversion period.

If certain corporate events that constitute a “Fundamental Change” (as defined in the Indenture) occur, then, subject to a limited exception for certain cash mergers, noteholders may require the Company to repurchase their Notes at a cash repurchase price equal to the principal amount of the Notes to be repurchased, plus accrued and unpaid interest, if any, to, but excluding, the fundamental change repurchase date. The definition of Fundamental Change includes certain change-of-control events relating to the Company, certain business combination transactions involving the Company and certain de-listing events with respect to the Company’s Class A common stock.

The Notes will have customary provision relating to the occurrence of “Events of Default” (as defined in the Indenture), which include the following: (i) certain payment defaults on the Notes (which, in the case of a default in the payment of interest on the Notes, will be subject to a 30-day cure period); (ii) the Company’s failure to send certain notices under the Indenture within specified periods of time; (iii) the Company’s failure to comply with certain covenants in the Indenture relating to the Company’s ability to consolidate with or merge with or into, or sell, lease or otherwise transfer, in one transaction or a series of transactions, all or substantially all of the assets of the Company and its subsidiaries, taken as a whole, to another person; (iv) a default by the Company in its other obligations or agreements under the Indenture or the Notes if such default is not cured or waived within 60 days after notice is given in accordance with the Indenture; (v) certain defaults by the Company or any of its subsidiaries with respect to indebtedness for borrowed money of at least $50,000,000; and (vi) certain events of bankruptcy, insolvency and reorganization involving the Company or any of the Company’s significant subsidiaries.

If an Event of Default involving bankruptcy, insolvency or reorganization events with respect to the Company (and not solely with respect to a significant subsidiary of the Company) occurs, then the principal amount of, and all accrued and unpaid interest on, all of the Notes then outstanding will immediately become due and payable without any further action or notice by any person. If any other Event of Default occurs and is continuing, then, the Trustee, by notice to the Company, or noteholders of at least 25% of the aggregate principal amount of Notes then outstanding, by notice to the Company and the Trustee, may declare the principal amount of, and all accrued and unpaid interest on, all of the Notes then outstanding to become due and payable immediately. However, notwithstanding the foregoing, the Company may elect, at its option, that the sole remedy for an Event of Default relating to certain failures by the Company to comply with certain reporting covenants in the Indenture consists exclusively of the right of the noteholders to receive special interest on the Notes for up to 180 days at a specified rate per annum not exceeding 0.50% on the principal amount of the Notes.

The above description of the Indenture and the Notes is a summary and is not complete. A copy of the Indenture and the form of the certificate representing the Notes are filed as Exhibits 4.1 and 4.2, respectively, to this Current Report on Form 8-K, and the above summary is qualified by reference to the terms of the Indenture and the Notes set forth in such exhibits.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosure set forth in Item 1.01 above is incorporated by reference into this Item 3.02. The Notes were issued to the initial purchasers in reliance upon Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), in transactions not involving any public offering. The Notes were initially resold by each initial purchaser to persons whom each such initial purchaser reasonably believes are “qualified institutional buyers,” as defined in, and in accordance with, Rule 144A under the Securities Act. Any shares of the Company’s Class A common stock that may be issued upon conversion of the Notes will be issued in reliance upon Section 3(a)(9) of the Securities Act as involving an exchange by the Company exclusively with its security holders. Initially, a maximum of 25,588,011 shares of the Company’s Class A common stock may be issued upon conversion of the Notes, based on the initial maximum conversion rate of 63.5727 shares of Class A common stock per $1,000 principal amount of Notes, which is subject to customary anti-dilution adjustment provisions.

Item 8.01. Other Events.

On May 23, 2024, the Company issued a press release announcing the pricing of the Notes in a private offering that is exempt from the registration requirements of the Securities Act of 1933, as amended. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

On May 29, 2024, the Company used approximately $141.8 million of the net proceeds from the offering of the Notes to repurchase $115.0 million of its outstanding 2.50% Green Convertible Senior Notes due 2025 in privately negotiated transactions.

Item 9.01 Financial Statements and Exhibits.

Exhibits

| | | | | |

| |

Exhibit | Description |

| Indenture, dated as of May 29, 2024, between Bloom Energy Corporation and U.S. Bank Trust Company, National Association, as trustee. |

| Form of certificate representing the 3.00% Green Convertible Senior Notes due 2029 (included as Exhibit A to Exhibit 4.1). |

| Press release dated May 23, 2024. |

104 | Cover page interactive data file (embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | |

| BLOOM ENERGY CORPORATION |

| | | | | |

| Date: | May 29, 2024 | By: | | | /s/ Shawn Soderberg | |

| | | | | | Shawn Soderberg | |

| | | | | | Chief Legal Officer and Corporate Secretary | |

| | | | | |

Bloom Energy Corporation Prices Upsized $350.0 Million Green Convertible Senior Notes Offering

May 23, 2024

SAN JOSE, Calif. — (BUSINESS WIRE) — Bloom Energy Corporation (NYSE: BE) today announced the pricing of its offering of $350.0 million aggregate principal amount of 3.00% green convertible senior notes due 2029 (the “notes”) in a private offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The offering size was increased from the previously announced offering size of $250.0 million aggregate principal amount of notes. The issuance and sale of the notes is scheduled to settle on May 29, 2024, subject to customary closing conditions. Bloom Energy also granted the initial purchasers of the notes an option to purchase, for settlement within a period of 13 days from, and including, the date the notes are first issued, up to an additional $52.5 million principal amount of notes.

The notes will be senior, unsecured obligations of Bloom Energy and will accrue interest at a rate of 3.00% per annum, payable semi-annually in arrears on June 1 and December 1 of each year, beginning on December 1, 2024. The notes will mature on June 1, 2029, unless earlier repurchased, redeemed or converted. Before March 1, 2029, noteholders will have the right to convert their notes only upon the occurrence of certain events. From and after March 1, 2029, noteholders may convert their notes at any time at their election until the close of business on the second scheduled trading day immediately before the maturity date. Bloom Energy will settle conversions by paying or delivering, as applicable, cash, shares of its Class A common stock or a combination of cash and shares of its Class A common stock, at Bloom Energy’s election. The initial conversion rate is 47.9795 shares of Class A common stock per $1,000 principal amount of notes, which represents an initial conversion price of approximately $20.84 per share of Class A common stock. The initial conversion price represents a premium of approximately 32.5% over the last reported sale price of $15.73 per share of Bloom Energy’s Class A common stock on May 23, 2024. The conversion rate and conversion price will be subject to adjustment upon the occurrence of certain events. If a “make-whole fundamental change” (as defined in the indenture for the notes) occurs, Bloom Energy will, in certain circumstances, increase the conversion rate for a specified time for holders who convert their notes in connection with that make-whole fundamental change.

The notes will be redeemable, in whole or in part (subject to certain limitations on partial redemptions), for cash at Bloom Energy’s option at any time, and from time to time, on or after June 7, 2027 and on or before the 21st scheduled trading day immediately before the maturity date, but only if the last reported sale price per share of Bloom Energy’s Class A common stock exceeds 130% of the conversion price for a specified period of time and certain other conditions are satisfied. The redemption price will be equal to the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date. If Bloom Energy calls any or all notes for redemption, holders of notes called for redemption may convert their notes during the related redemption conversion period, and any such conversion will also constitute a “make-whole fundamental change” with respect to the notes so converted.

If a “fundamental change” (as defined in the indenture for the notes) occurs, then, subject to a limited exception, noteholders may require Bloom Energy to repurchase their notes for cash. The repurchase price will be equal to the principal amount of the notes to be repurchased, plus accrued and unpaid interest, if any, to, but excluding, the applicable repurchase date.

Bloom Energy estimates that the net proceeds from the offering of the notes will be approximately $338.8 million (or approximately $389.7 million if the initial purchasers exercise their option to purchase additional notes in full), after deducting the initial purchasers’ discounts and commissions and estimated offering expenses. Bloom Energy intends to use approximately $141.8 million of the net proceeds from the offering of the notes to repurchase $115.0 million aggregate principal amount of its outstanding 2.50% Green Convertible Senior Notes due 2025 (the “existing 2025 convertible notes”) in privately negotiated transactions concurrently with the pricing of the offering. Bloom Energy intends to use the remainder of the net proceeds from the offering of the notes for general corporate purposes, including research and development and sales and marketing activities, general and administrative matters and capital expenditures, all related to projects that meet the “Eligibility Criteria” referred to below. Bloom Energy intends to allocate an amount equal to the net proceeds from the sale of the notes to refinance or finance, in whole or in part, new or on-going projects that meet the “Eligibility Criteria” as defined in the offering disclosure relating to the offering of the notes.

Holders of the existing 2025 convertible notes that are repurchased in the concurrent repurchases described above may purchase shares of Bloom Energy’s Class A common stock in the open market to unwind any hedge positions they may have with respect to the existing 2025 convertible notes. These activities may affect the trading price of Bloom Energy’s Class A common stock and the initial conversion price of the notes.

The offer and sale of the notes and any shares of Class A common stock issuable upon conversion of the notes have not been, and will not be, registered under the Securities Act or any other securities laws, and the notes and any such shares cannot be offered or sold except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any other applicable securities laws. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, the notes or any shares of Class A common stock issuable upon conversion of the notes, nor will there be any sale of the notes or any such shares, in any state or other jurisdiction in which such offer, sale or solicitation would be unlawful. This press release does not constitute an offer to purchase or notice of redemption with respect to the existing 2025 convertible notes, and Bloom Energy reserves the right to elect not to proceed with the repurchase.

Forward-Looking Statements

This press release includes forward-looking statements, including statements regarding the completion of the offering, the expected amount and intended use of the net proceeds and the repurchase transactions described above. Forward-looking statements represent Bloom Energy’s current expectations regarding future events and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those implied by the

forward-looking statements. Among those risks and uncertainties are market conditions, the satisfaction of the closing conditions related to the offering and risks relating to Bloom Energy’s business, including those described in periodic reports that Bloom Energy files from time to time with the Securities Exchange Commission. Bloom Energy may not consummate the offering described in this press release and, if the offering is consummated, cannot provide any assurances regarding its ability to effectively apply the net proceeds as described above. The forward-looking statements included in this press release speak only as of the date of this press release, and Bloom Energy does not undertake to update the statements included in this press release for subsequent developments, except as may be required by law.

Bloom Media Contact

press@bloomenergy.com

Bloom Investor Contact

Ed Vallejo

Edward.vallejo@bloomenergy.com

v3.24.1.1.u2

Cover

|

May 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 23, 2024

|

| Document Creation Date |

May 29, 2024

|

| Entity Registrant Name |

BLOOM ENERGY CORPORATION

|

| Entity File Number |

001-38598

|

| Entity Tax Identification Number |

77-0565408

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Postal Zip Code |

95134

|

| Entity Address, State or Province |

CA

|

| Entity Address, City or Town |

San Jose,

|

| Entity Address, Address Line One |

4353 North First Street,

|

| Local Phone Number |

543-1500

|

| City Area Code |

(408)

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

BE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001664703

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

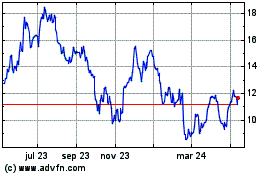

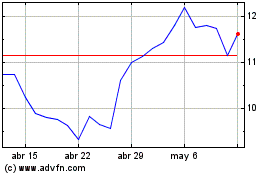

Bloom Energy (NYSE:BE)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Bloom Energy (NYSE:BE)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024