Franklin Templeton Reselected as Program Manager for New Jersey’s 529 College Savings Program

15 Agosto 2024 - 7:30AM

Business Wire

Franklin Templeton has provided 529 college

savings plan management for the State of New Jersey since 2003

Franklin Templeton today announced its reselection by The New

Jersey Higher Education Student Assistance Authority (HESAA) as the

program manager for the New Jersey Better Educational Savings Trust

(NJBEST) program. The program includes NJBEST 529 College Savings

Plan, available directly for New Jersey residents, and Franklin

Templeton 529 College Savings Plan, available to investors

nationwide who are working with a Financial Professional.

Franklin Templeton has provided 529 college savings plan

management for the State of New Jersey since 2003 and has seen

sustained interest in the program, with significant asset and

participation growth over that time. Over the past 10 years alone,

total assets under management for the NJBEST’s state and national

program increased by more than 57%, and the number of beneficiaries

increased by a net amount of 15%. The program serves more than

165,000 families nationally, with about half residing in New

Jersey. As of June 30, 2024, Franklin Templeton managed more than

260,000 plan accounts and over $6.8 billion in assets across

NJBEST’s state and national plans.

“Franklin Templeton is proud of the strong relationship we have

built with HESAA and the State of New Jersey over the past 20

years, and we are thrilled to continue to help families in New

Jersey and across the U.S. save and invest for their children’s

higher education goals,” said Sandie Palmer, Head of 529 Education

Savings. “We understand the challenges families face as they plan

and save to meet the rising costs of college. With Franklin

Templeton’s deep expertise in 529 plans, we will be there to

provide the service, support and investment expertise to guide them

along the way.”

Frankin Templeton is committed to providing an affordable option

for New Jersey families to save, with reduced administrative and

management costs. Families can open an NJBEST account with as

little as $25, and Franklin Templeton offers a range of investment

options and asset allocations to best suit individual needs and

risk tolerances. As part of the New Jersey College Affordability

Act, eligible New Jersey residents may also receive special

benefits when saving with NJBEST and Franklin Templeton, including

a state tax deduction of up to $10,0001 and a matching grant of

$750 for new accounts.2 The Program also offers a tax-free college

scholarship of up to $6,000 for account beneficiaries.3

Franklin Templeton has continued to enhance the NJBEST and

national Franklin Templeton 529 plan investment options resulting

in lower shareholder costs and enhanced performance. The NJBEST and

Franklin Templeton 529 plans both rank #1 for 3-year performance in

the most recent analysis by Saving for College, an independent

resource for parents and financial professionals.4 Building on

changes made to the portfolio offering in 2019 and 2022, Franklin

Templeton is preparing to simplify the plans from multiple

age-based glidepaths to a single target enrollment year glide path

and to continue to reduce investor expenses.

Late last year, Franklin Templeton conducted a competitive 529

recordkeeping search and selected Ascensus as its sub-contracted

recordkeeper for the program. Ascensus is the market leader in 529

education savings administration, providing recordkeeping and

administrative services to 45 education plans across 28 states and

the District of Columbia, representing over $226 billion in assets

under management and over 7.2 million serviced accounts.

“We have long respected Franklin Templeton and their ability to

offer excellent 529 plans. Together, we both aim to help families

reach their education savings goals—a mission we’re proud to

partner with Franklin Templeton to achieve,” said Peg Creonte,

President of Ascensus Government Savings. “Our technology and

service expertise will modernize the support participants

experience throughout their savings journey, allowing them to do

things like enroll from their phones and send electronic payments

directly to schools.”

New Jersey residents interested in the NJBEST 529 College

Savings Plan may visit NJBEST.com. For more information on the

Franklin Templeton 529 College Savings Plan, please visit

franklintempleton.com.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

July 31, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

- The New Jersey College Affordability Act allows for a state tax

deduction for contributions into a Franklin Templeton 529 College

Savings Plan of up to $10,000 per year, for those with gross income

of $200,000 or less, beginning with contributions made in tax year

2022. The maximum deduction is $10,000. Because each investor’s

circumstances are different, please consult your tax professional

for more information about considerations that may be relevant to

your particular situation

- The New Jersey College Affordability Act allows NJ taxpayers

with household adjusted gross income between $0 and $75,000 to be

eligible for a one-time grant of up to $750 matched

dollar-for-dollar of the initial deposit into an NJBEST or FT529

account for accounts open on or after June 29, 2021. Visit HESAA's

site for terms and conditions and how to apply. This program is

subject to available funding.

- Investing in NJBEST does not guarantee admission to any

particular elementary or secondary school or to college, or

sufficient funds for elementary or secondary school or for college.

The scholarship is only available for college and is awarded any

fall or spring semester of college. The scholarship may be awarded

only once to an eligible beneficiary. The NJBEST Scholarship is

provided by the New Jersey Higher Education Student Assistance

Authority.

- Each quarter, Saving for College analyzes the investment

performance figures for thousands of 529 portfolios and ranks the

529 savings plans. Rankings are derived using the plans' relevant

portfolio performance in seven unique asset allocation categories.

The asset allocation categories used are 100% Equity, 80% Equity,

60% Equity, 40% Equity, 20% Equity, 100% Fixed and 100% Short Term.

The plan composite ranking is determined by the average of its

performance score in the seven categories. As of June 30, 2024,

NJBEST ranked #1 for Direct-sold 529 Plans 3-year performance out

of 55 plans ranked, and FT529 ranked #1 for 3-year performance

(including max sales charges Class A), out of 32 plans ranked.

All investments involve risk including possible loss of

principal. Diversification does not guarantee a profit or

protect against a loss.

The Program and its associated persons make no representations

regarding the suitability of the Program’s investment portfolios

for any particular investor. This material is intended to be of

general interest only and should not be construed as individual

investment advice or a recommendation by Franklin Distributors,

LLC. Other types of investments and other types of education

savings vehicles may be more appropriate depending on your personal

circumstances.

Investments are not insured by the FDIC or any other government

agency and are not deposits or other obligations of any depository

institution. Investments are not guaranteed by the State of New

Jersey, Franklin Distributors, LLC, or Franklin Templeton.

Franklin Templeton, its affiliates, and its employees are not in

the business of providing tax or legal advice to taxpayers. These

materials and any tax-related statements are not intended or

written to be used, and cannot be used or relied upon, by any such

taxpayer for the purpose of avoiding tax penalties or complying

with any applicable tax laws or regulations. Tax-related

statements, if any, may have been written in connection with the

“promotion or marketing” of the transaction(s) or matter(s)

addressed by these materials, to the extent allowed by applicable

law. Any such taxpayer should seek advice based on the taxpayer's

particular circumstances from an independent tax professional.

© 2024. Franklin Distributors, LLC. Member FINRA/SIPC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815359548/en/

Franklin Templeton Corporate Communications: Rebecca Radosevich,

(212) 632-3207, rebecca.radosevich@franklintempleton.com

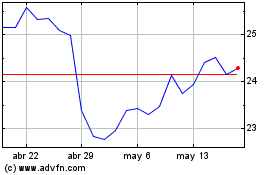

Franklin Resources (NYSE:BEN)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

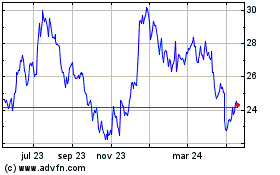

Franklin Resources (NYSE:BEN)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024