|

PRICING SUPPLEMENT No. ELN2764 dated July 17, 2024

(To Product Supplement No. WF1 dated July 20, 2022,

Prospectus Supplement dated May 26, 2022

and Prospectus dated May 26, 2022) |

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-264388

|

|

|

| |

Bank of Montreal

Senior Medium-Term Notes, Series I

Equity Index Linked Securities |

| |

Market Linked Securities—Upside Participation

to a Cap and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the Nasdaq-100

Index® due July 22, 2026 |

| n | Linked

to the Nasdaq-100 Index® (the "Index") |

| n | Unlike

ordinary debt securities, the securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the securities

provide for a maturity payment amount that may be greater than, equal to or less than the face amount of the securities, depending on

the performance of the Index from the starting level to the ending level. The maturity payment amount will reflect the following

terms: |

| n | If the level of the Index increases, you will receive

the face amount plus a positive return equal to 100% of the percentage increase in the level of the Index from the starting level, subject

to a maximum return at maturity of 28.00% of the face amount. As a result of the maximum return, the maximum maturity payment amount will

be $1,280.00 |

| n | If the level of the Index decreases but the decrease is not more than the buffer

amount of 10.00%, you will receive the face amount |

| n | If the level of the Index decreases by more than the buffer amount, you will

receive less than the face amount and have 1-to-1 downside exposure to the decrease in the level of the Index in excess of the buffer

amount |

| n | Investors may lose up to 90.00% of

the face amount |

| n | All

payments on the securities are subject to the credit risk of Bank of Montreal, and you will have no ability to pursue any securities included

in the Index for payment; if Bank of Montreal defaults on its obligations, you could lose some or all of your investment |

| n | No periodic interest payments

or dividends |

| n | No exchange listing; designed

to be held to maturity |

On the date of this pricing supplement, the

estimated initial value of the securities was $962.33 per security. As discussed in more detail in this pricing supplement, the actual value

of the securities at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Value of the Securities”

in this pricing supplement.

The securities have complex features and investing

in the securities involves risks not associated with an investment in conventional debt securities. See "Selected Risk Considerations"

beginning on page PRS-8 herein and "Risk Factors" beginning on page PS-5 of the accompanying product supplement.

The securities are the unsecured obligations

of Bank of Montreal, and, accordingly, all payments on the securities are subject to the credit risk of Bank of Montreal. If Bank of Montreal

defaults on its obligations, you could lose some or all of your investment. The securities are not insured by the Federal Deposit Insurance

Corporation, the Deposit Insurance Fund, the Canada Deposit Insurance Corporation or any other governmental agency.

Neither the Securities and Exchange Commission

nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this pricing supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation

to the contrary is a criminal offense.

| |

Original Offering Price

|

Agent Discount(1)(2)

|

Proceeds to Bank of Montreal

|

| Per Security |

$1,000.00 |

$25.75 |

$974.25 |

| Total |

$1,279,000.00 |

$32,934.25 |

$1,246,065.75 |

| (1) | Wells Fargo Securities, LLC is the agent for the distribution of the securities and is acting as principal.

See “Terms of the Securities—Agent” and “Estimated Value of the Securities” in this pricing supplement for

further information. |

| (2) | In respect of certain securities sold in this offering, our affiliate, BMO Capital Markets Corp., may

pay a fee of up to $2.50 per security to selected securities dealers in consideration for marketing and other services in connection with

the distribution of the securities to other securities dealers. |

Wells Fargo Securities

Market Linked Securities—Upside Participation

to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100

Index® due July 22, 2026 |

| Issuer: |

Bank of Montreal. |

| Market Measure: |

Nasdaq-100 Index® (the "Index"). |

| Pricing Date: |

July 17, 2024. |

| Issue Date: |

July 22, 2024. |

Original Offering

Price: |

$1,000 per security. |

| Face Amount: |

$1,000 per security. References in this pricing supplement to a "security" are to a security with a face amount of $1,000. |

Maturity Payment

Amount: |

On the stated maturity date, you will

be entitled to receive a cash payment per security in U.S. dollars equal to the maturity payment amount. The "maturity payment

amount" per security will equal:

• if the ending level is

greater than the starting level: $1,000 plus the lesser of:

(i) $1,000 × index return ×

upside participation rate; and

(ii) the maximum return;

• if the ending level is

less than or equal to the starting level, but greater than or equal to the threshold level: $1,000; or

• if the ending level is

less than the threshold level:

$1,000 + [$1,000 × (index return

+ buffer amount)]

|

| If the ending level is less than the threshold level, you will have 1-to-1 downside exposure to the decrease in the level of the Index in excess of the buffer amount and will lose some, and possibly up to 90.00%, of the face amount of your securities at maturity. |

|

Stated Maturity

Date:

|

July 22, 2026, subject to postponement. The securities are not subject to redemption by Bank of Montreal or repayment at the option of any holder of the securities prior to the stated maturity date. |

| Starting Level: |

19,799.14

, the closing level of the Index on the pricing date. |

| Closing Level: |

Closing level has the meaning set forth under "General Terms of the Securities—Certain Terms for Securities Linked to an Index—Certain Definitions" in the accompanying product supplement. |

| Ending Level: |

The "ending level" will be the closing level of the Index on the calculation day. |

| Maximum Return: |

The “maximum return” is 28.00% of the face amount

per security ($280.00 per security). As a result of the maximum return, the maximum maturity payment amount is $1,280.00 per security. |

| Threshold Level: |

17,819.226 , which is equal to 90.00% of the starting level. |

| Buffer Amount: |

10.00% |

Upside

Participation Rate: |

100%. |

| Index Return: |

The "index return" is

the percentage change from the starting level to the ending level, measured as follows:

ending level – starting

level

starting level

|

| Calculation Day: |

July 17, 2026, subject to postponement. |

Market Disruption

Events and

Postponement

Provisions: |

The calculation day is subject to postponement

due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity date will be postponed if the

calculation day is postponed and will be adjusted for non-business days.

For more information regarding adjustments

to the calculation day and the stated maturity date, see "General Terms of the Securities—Consequences of a Market Disruption

Event; Postponement of a Calculation Day—Securities Linked to a Single Market Measure" and "—Payment Dates"

in the accompanying product supplement. In addition, for information regarding the circumstances that may result in a market disruption

event, see "General Terms of the Securities—Certain Terms for Securities Linked to an Index—Market Disruption Events"

in the accompanying product supplement.

|

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

| Calculation Agent: |

BMO Capital Markets Corp. ("BMOCM"). |

|

Material Tax

Consequences:

|

For a discussion of the material U.S. federal income and certain estate tax consequences and the Canadian federal income tax consequences of the ownership and disposition of the securities, see "United States Federal Tax Considerations" below, and the sections of the product supplement entitled "United States Federal Tax Considerations" and "Canadian Federal Income Tax Consequences." |

| Agent: |

Wells Fargo Securities, LLC (“WFS”)

is the agent for the distribution of the securities. The agent will receive an agent discount of $25.75 per security. The agent

may resell the securities to other securities dealers at the original offering price of the securities less a concession not in excess

of $20.00 per security. Such securities dealers may include Wells Fargo Advisors (“WFA”) (the trade name of the retail

brokerage business of WFS’s affiliates, Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC). In

addition to the concession allowed to WFA, WFS will pay $0.75 per security of the agent discount that it receives to WFA as a distribution

expense fee for each security sold by WFA.

In addition, in respect of certain

securities sold in this offering, BMOCM may pay a fee of up to $2.50 per security to selected securities dealers in consideration for

marketing and other services in connection with the distribution of the securities to other securities dealers.

WFS, BMOCM and/or one or more of their

respective affiliates expects to realize hedging profits projected by their proprietary pricing models to the extent they assume the risks

inherent in hedging our obligations under the securities. If WFS or any other dealer participating in the distribution of the securities

or any of their affiliates conduct hedging activities for us in connection with the securities, that dealer or its affiliates will expect

to realize a profit projected by its proprietary pricing models from those hedging activities. Any such projected profit will be in addition

to any discount, concession or fee received in connection with the sale of the securities to you.

|

| Denominations: |

$1,000 and any integral multiple of $1,000. |

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

Additional Information About the Issuer and the Securities |

You should read this pricing supplement together

with product supplement No. WF1 dated July 20, 2022, the prospectus supplement dated May 26, 2022 and the prospectus dated May 26, 2022

for additional information about the securities. Information included in this pricing supplement supersedes information in the product

supplement, prospectus supplement and prospectus to the extent it is different from that information. Certain defined terms used but not

defined herein have the meanings set forth in the product supplement, prospectus supplement or prospectus.

Our Central Index Key, or CIK, on the SEC website

is 927971. When we refer to “we,” “us” or “our” in this pricing supplement, we

refer only to Bank of Montreal.

You may access the product supplement, prospectus

supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing for the relevant

date on the SEC website):

| • | Product Supplement No. WF1 dated July 20, 2022: |

https://www.sec.gov/Archives/edgar/data/927971/000121465922009020/r715220424b5.htm

| • | Prospectus Supplement and prospectus dated May 26, 2022: |

https://www.sec.gov/Archives/edgar/data/927971/000119312522160519/d269549d424b5.htm

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

Estimated Value of the Securities |

Our estimated initial value of the securities on the pricing date that

is set forth on the cover page of this document, equals the sum of the values of the following hypothetical components:

| · | a fixed-income debt component with the same tenor as the securities, valued using our internal funding

rate for structured notes; and |

| · | one or more derivative transactions relating to the economic terms of the securities. |

The internal funding rate used in the determination of the initial estimated

value generally represents a discount from the credit spreads for our conventional fixed-rate debt. The value of these derivative transactions

is derived from our internal pricing models. These models are based on factors such as the traded market prices of comparable derivative

instruments and on other inputs, which include volatility, dividend rates, interest rates and other factors. As a result, the estimated

initial value of the securities on the pricing date was determined based on market conditions at that time.

For more information about the estimated initial

value of the securities, see “Selected Risk Considerations” below.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

The securities are not appropriate for all investors.

The securities may be an appropriate investment for investors who:

| § | seek 1-to-1 exposure to the upside performance of the Index if the ending

level is greater than the starting level, subject to the maximum return at maturity of 28.00% of the face amount; |

| § | desire to limit downside exposure to the Index

through the buffer amount; |

| § | are willing to accept the risk that, if the ending

level is less than the starting level by more than the buffer amount, they will lose some, and possibly up to 90.00%, of the face amount

per security at maturity; |

| § | are willing to forgo interest payments on the

securities and dividends on the securities included in the Index; and |

| § | are willing to hold the securities until maturity. |

The securities may not be an appropriate investment

for investors who:

| § | seek a liquid investment or are unable or unwilling

to hold the securities to maturity; |

| § | are unwilling to accept the risk that the ending

level may decrease from the starting level by more than the buffer amount; |

| § | seek uncapped exposure to the upside performance

of the Index; |

| § | seek full return of the face amount of the securities

at stated maturity; |

| § | are unwilling to purchase securities with an estimated value as of the

pricing date that is lower than the original offering price, as set forth on the cover page of this pricing supplement; |

| § | seek current income over the term of the securities; |

| § | are unwilling to accept the risk of exposure

to the Index; |

| § | seek exposure to the Index but are unwilling

to accept the risk/return trade-offs inherent in the maturity payment amount for the securities; |

| § | are unwilling to accept the credit risk of Bank

of Montreal to obtain exposure to the Index generally, or to the exposure to the Index that the securities provide specifically; or |

| § | prefer the lower risk of fixed income investments

with comparable maturities issued by companies with comparable credit ratings. |

The considerations identified above are not

exhaustive. Whether or not the securities are an appropriate investment for you will depend on your individual circumstances, and you

should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered

the appropriateness of an investment in the securities in light of your particular circumstances. You should also review carefully the

"Selected Risk Considerations" herein and the "Risk Factors" in the accompanying product supplement for risks related

to an investment in the securities. For more information about the Index, please see the section titled "The Nasdaq-100 Index®"

below.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

Determining Payment at Stated Maturity |

On the stated maturity date, you will receive a

cash payment per security (the maturity payment amount) calculated as follows:

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

Selected Risk Considerations |

The securities have complex features and investing

in the securities will involve risks not associated with an investment in conventional debt securities. Some of the risks that apply to

an investment in the securities are summarized below, but we urge you to read the more detailed explanation of the risks relating to the

securities generally in the "Risk Factors" section of the accompanying product supplement. You should reach an investment decision

only after you have carefully considered with your advisors the appropriateness of an investment in the securities in light of your particular

circumstances.

Risks Relating To The Terms And Structure

Of The Securities

If The Ending Level Is Less Than The Threshold

Level, You Will Lose Some, And Possibly Up To 90.00%, Of The Face Amount Of Your Securities At Maturity.

We will not repay you a fixed amount on the securities

on the stated maturity date. The maturity payment amount will depend on the direction of and percentage change in the ending level relative

to the starting level and the other terms of the securities. Because the level of the Index will be subject to market fluctuations, the

maturity payment amount may be more or less, and possibly significantly less, than the face amount of your securities.

If the ending level is less than the threshold

level, the maturity payment amount will be less than the face amount and you will have 1-to-1 downside exposure to the decrease in the

level of the Index in excess of the buffer amount, resulting in a loss of 1% of the face amount for every 1% decline in the Index in excess

of the buffer amount. The threshold level is 90.00% of the starting level. As a result, if the ending level is less than the threshold

level, you will lose some, and possibly up to 90.00%, of the face amount per security at maturity. This is the case even if the level

of the Index is greater than or equal to the starting level or the threshold level at certain times during the term of the securities.

Even if the ending level is greater than the starting

level, the maturity payment amount may only be slightly greater than the face amount, and your yield on the securities may be less than

the yield you would earn if you bought a traditional interest-bearing debt security of Bank of Montreal or another issuer with a similar

credit rating with the same stated maturity date.

No Periodic Interest Will Be Paid On The Securities.

No periodic payments of interest will be made on

the securities. However, if the agreed-upon tax treatment is successfully challenged by the Internal Revenue Service (the "IRS"),

you may be required to recognize taxable income over the term of the securities. You should review the section of this pricing supplement

entitled "United States Federal Tax Considerations."

Your Return Will Be Limited To The Maximum Return

And May Be Lower Than The Return On A Direct Investment In The Index.

The opportunity to participate in the possible

increases in the level of the Index through an investment in the securities will be limited because any positive return on the securities

will not exceed the maximum return. Therefore, your return on the securities may be lower than the return on a direct investment in the

Index.

The Securities Are Subject To Credit Risk.

The securities are our obligations and are not,

either directly or indirectly, an obligation of any third party. Any amounts payable under the securities are subject to our creditworthiness

and you will have no ability to pursue any securities included in the Index for payment. As a result, our actual and perceived creditworthiness

may affect the value of the securities and, in the event we were to default on our obligations under the securities, you may not receive

any amounts owed to you under the terms of the securities.

Significant Aspects Of The Tax Treatment Of

The Securities Are Uncertain.

The tax treatment of the securities is uncertain.

We do not plan to request a ruling from the IRS or from the Canada Revenue Agency regarding the tax treatment of the securities, and the

IRS, the Canada Revenue Agency or a court may not agree with the tax treatment described in this pricing supplement and/or the accompanying

product supplement.

The IRS has issued a notice indicating that it

and the U.S. Treasury Department are actively considering whether, among other issues, a holder should be required to accrue interest

over the term of an instrument such as the securities even though that holder will not receive any payments with respect to the securities

until maturity or earlier sale or exchange and whether all or part of the gain a holder may recognize upon sale, exchange or maturity

of an instrument such as the securities should be treated as ordinary income. The outcome of this process is uncertain and could apply

on a retroactive basis.

Please read carefully the section entitled “United

States Federal Tax Considerations” in this pricing supplement, the section entitled “United States Federal Income Taxation”

in the accompanying prospectus and the section entitled “Certain Income Tax Consequences — United States Federal Income Taxation”

in the accompanying product supplement. You should consult your tax advisor about your own tax situation.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

For a discussion of the Canadian federal income

tax consequences of investing in the securities, please read the section entitled “Certain Income Tax Consequences — Certain

Canadian Income Tax Considerations” in the accompanying prospectus supplement. You should consult your tax advisor about your own

tax situation.

The Stated Maturity Date May Be Postponed If

The Calculation Day Is Postponed.

The calculation day will be postponed if the originally

scheduled calculation day is not a trading day or if the calculation agent determines that a market disruption event has occurred or is

continuing on the calculation day. If such a postponement occurs, the stated maturity date will be the later of (i) the initial stated

maturity date and (ii) three business days after the calculation day as postponed.

Risks

Relating To The Estimated Value Of The Securities And Any Secondary Market

The Estimated Value Of The Securities On The Pricing Date, Based

On Our Proprietary Pricing Models, Is Less Than The Original Offering Price.

Our initial estimated value of the securities is only an estimate, and

is based on a number of factors. The original offering price of the securities exceeds our initial estimated value, because costs associated

with offering, structuring and hedging the securities are included in the original offering price, but are not included in the estimated

value. These costs include the agent discount and selling concessions, the profits that we and our affiliates and/or the agent and its

affiliates expect to realize for assuming the risks in hedging our obligations under the securities, and the estimated cost of hedging

these obligations.

The Terms Of The Securities Were Not Determined

By Reference To The Credit Spreads For Our Conventional Fixed-Rate Debt.

To determine the terms of the securities, we

used an internal funding rate that represents a discount from the credit spreads for our conventional fixed-rate debt. As a result, the

terms of the securities are less favorable to you than if we had used a higher funding rate.

The Estimated Value Of The Securities Is Not

An Indication Of The Price, If Any, At Which WFS Or Any Other Person May Be Willing To Buy The Securities From You In The Secondary Market.

Our initial estimated value of the securities as of the date of this

pricing supplement was derived using our internal pricing models. This value is based on market conditions and other relevant factors,

which include volatility of the Index, dividend rates and interest rates. Different pricing models and assumptions, including those used

by the agent, its affiliates or other market participants, could provide values for the securities that are greater than or less than

our initial estimated value. In addition, market conditions and other relevant factors after the pricing date are expected to change,

possibly rapidly, and our assumptions may prove to be incorrect. After the pricing date, the value of the securities could change dramatically

due to changes in market conditions, our creditworthiness, and the other factors set forth in this pricing supplement. These changes are

likely to impact the price, if any, at which WFS or its affiliates or any other party (including us or our affiliates) would be willing

to purchase the securities from you in any secondary market transactions. Our initial estimated value does not represent a minimum price

at which WFS or any other party (including us or our affiliates) would be willing to buy your securities in any secondary market at any

time.

WFS has advised us that if it, WFA or any of their

affiliates makes a secondary market in the securities at any time, the secondary market price offered by it, WFA or any of their affiliates

will be affected by changes in market conditions and other factors described in the next risk factor. WFS has advised us that if it, WFA

or any of their affiliates makes a secondary market in the securities at any time up to the issue date or during the 3-month period following

the issue date, the secondary market price offered by it, WFA or any of its affiliates will be increased by an amount reflecting a portion

of the costs associated with selling, structuring and hedging the securities that are included in their original offering price. Because

this portion of the costs is not fully deducted upon issuance, WFS has advised us that any secondary market price it, WFA or any of their

affiliates offers during this period will be higher than it otherwise would be after this period, as any secondary market price offered

after this period will reflect the full deduction of the costs as described above. WFS has advised us that the amount of this increase

in the secondary market price will decline steadily to zero over this 3-month period. WFS has advised us that, if you hold the securities

through an account with WFS, WFA or any of their affiliates, WFS expects that this increase will also be reflected in the value indicated

for the securities on your brokerage account statement. If you hold your securities through an account at a broker-dealer other than WFS,

WFA or any of their affiliates, the value of the securities on your brokerage account statement may be different than if you held your

securities at WFS, WFA or any of their affiliates.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

The Value Of The Securities Prior To Stated

Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways.

The value of the securities prior to stated maturity will be affected

by the then-current level of the Index, interest rates at that time and a number of other factors, some of which are interrelated in complex

ways. The effect of any one factor may be offset or magnified by the effect of another factor. The following factors, which we refer to

as the “derivative component factors,” and which are described in more detail in the accompanying product supplement,

are expected to affect the value of the securities: performance of the Index; interest rates; volatility of the Index; time remaining

to maturity; and dividend yields on the securities included in the Index. When we refer to the “value” of your security,

we mean the value you could receive for your security if you are able to sell it in the open market before the stated maturity date.

In addition to the derivative component factors,

the value of the securities will be affected by actual or anticipated changes in our creditworthiness. You should understand that the

impact of one of the factors specified above, such as a change in interest rates, may offset some or all of any change in the value of

the securities attributable to another factor, such as a change in the level of the Index. Because numerous factors are expected to affect

the value of the securities, changes in the level of the Index may not result in a comparable change in the value of the securities. We

anticipate that the value of the securities will always be at a discount to the face amount plus the maximum return.

The Securities Will Not Be Listed On Any Securities

Exchange And We Do Not Expect A Trading Market For The Securities To Develop.

The securities will not be listed or displayed

on any securities exchange or any automated quotation system. Although the agent and/or its affiliates may purchase the securities from

holders, they are not obligated to do so and are not required to make a market for the securities. There can be no assurance that a secondary

market will develop. Because we do not expect that any market makers will participate in a secondary market for the securities, the price

at which you may be able to sell your securities is likely to depend on the price, if any, at which the agent is willing to buy your securities.

If a secondary market does exist, it may be limited.

Accordingly, there may be a limited number of buyers if you decide to sell your securities prior to stated maturity. This may affect the

price you receive upon such sale. Consequently, you should be willing to hold the securities to stated maturity.

Risks Relating To The Index

The Maturity Payment Amount Will Depend Upon

The Performance Of The Index And Therefore The Securities Are Subject To The Following Risks, Each As Discussed In More Detail In The

Accompanying Product Supplement.

| · | Investing In The Securities Is Not The Same

As Investing In The Index. Investing in the securities is not equivalent to investing in the Index. As an investor in the securities,

your return will not reflect the return you would realize if you actually owned and held the securities included in the Index for a period

similar to the term of the securities because you will not receive any dividend payments, distributions or any other payments paid on

those securities. As a holder of the securities, you will not have any voting rights or any other rights that holders of the securities

included in the Index would have. |

| · | Historical Levels Of The Index Should Not

Be Taken As An Indication Of The Future Performance Of The Index During The Term Of The Securities. |

| · | Changes That Affect The Index May Adversely

Affect The Value Of The Securities And The Maturity Payment Amount. |

| · | We Cannot Control Actions By Any Of The Unaffiliated

Companies Whose Securities Are Included In The Index. |

| · | We And Our Affiliates Have No Affiliation

With The Index Sponsor And Have Not Independently Verified Its Public Disclosure Of Information. |

An Investment in the Securities Is Subject To

Risks Associated With Non-U.S. Securities.

The Nasdaq-100 Index® tracks the

value of certain non-U.S. equity securities. You should be aware that investments in securities linked to the value of foreign equity

securities involve particular risks. The foreign securities markets comprising this index may have less liquidity and may be more volatile

than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets.

Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign companies,

may affect trading prices and volumes in these markets.

Prices of securities in foreign countries are subject

to political, economic, financial and social factors that apply in those geographical regions. These factors, which could negatively affect

those securities markets, include the possibility of recent or future changes in a foreign government's economic and fiscal policies,

the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments

in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks

of hostility and political instability and the possibility of natural disaster or adverse public health developments in the region. Moreover,

foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product,

rate of inflation, capital reinvestment, resources and self-sufficiency.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

Risks Relating To Conflicts Of Interest

Our Economic Interests And Those Of Any Dealer

Participating In The Offering Are Potentially Adverse To Your Interests.

You should be aware of the following ways in which

our economic interests and those of any dealer participating in the distribution of the securities, which we refer to as a "participating

dealer," are potentially adverse to your interests as an investor in the securities. In engaging in certain of the activities

described below and as discussed in more detail in the accompanying product supplement, our affiliates or any participating dealer or

its affiliates may take actions that may adversely affect the value of and your return on the securities, and in so doing they will have

no obligation to consider your interests as an investor in the securities. Our affiliates or any participating dealer or its affiliates

may realize a profit from these activities even if investors do not receive a favorable investment return on the securities.

| · | The calculation agent is our affiliate

and may be required to make discretionary judgments that affect the return you receive on the securities. BMOCM, which is our

affiliate, will be the calculation agent for the securities. As calculation agent, BMOCM will determine any values of the Index and make

any other determinations necessary to calculate any payments on the securities. In making these determinations, BMOCM may be required

to make discretionary judgments that may adversely affect any payments on the securities. See the sections entitled "General Terms

of the Securities— Certain Terms for Securities Linked to an Index—Market Disruption Events,"—Adjustments to an

Index" and "—Discontinuance of an Index" in the accompanying product supplement. In making these discretionary judgments,

the fact that BMOCM is our affiliate may cause it to have economic interests that are adverse to your interests as an investor in the

securities, and our determinations as calculation agent may adversely affect your return on the securities. |

| · | The estimated value of the securities was

calculated by us and is therefore not an independent third-party valuation. |

| · | Research reports by our affiliates or any

participating dealer or its affiliates may be inconsistent with an investment in the securities and may adversely affect the level of

the Index. |

| · | Business activities of our affiliates or

any participating dealer or its affiliates with the companies whose securities are included in the Index may adversely affect the level

of the Index. |

| · | Hedging activities by our affiliates or

any participating dealer or its affiliates may adversely affect the level of the Index. |

| · | Trading activities by our affiliates or

any participating dealer or its affiliates may adversely affect the level of the Index. |

| · | A participating dealer or its affiliates

may realize hedging profits projected by its proprietary pricing models in addition to any selling concession and/or fee, creating a further

incentive for the participating dealer to sell the securities to you. |

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

Hypothetical Examples and Returns |

The payout profile, return table and examples below illustrate the

maturity payment amount for a $1,000 face amount security on a hypothetical offering of securities under various scenarios, with the assumptions

set forth in the table below. The terms used for purposes of these hypothetical examples do not represent the actual starting level or

threshold level. The hypothetical starting level of 100.00 has been chosen for illustrative purposes only and does not represent the actual

starting level. The actual starting level and threshold level are set forth under "Terms of the Securities" above. For historical

data regarding the actual closing levels of the Index, see the historical information set forth herein. The payout profile, return table

and examples below assume that an investor purchases the securities for $1,000 per security. These examples are for purposes of illustration

only and the values used in the examples may have been rounded for ease of analysis.

| Maximum Return: |

28.00%

or $280.00 per security |

| Hypothetical Starting Level: |

100.00 |

| Hypothetical Threshold Level: |

90.00 (90.00% of the hypothetical starting level) |

| Buffer Amount: |

10.00% |

Hypothetical Payout Profile

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

Hypothetical Returns

|

Hypothetical

ending level |

Hypothetical

index return(1) |

Hypothetical

maturity payment

amount per security |

Hypothetical

pre-tax total

rate of return(2) |

| 200.00 |

100.00% |

$1,280.00 |

28.00% |

| 175.00 |

75.00% |

$1,280.00 |

28.00% |

| 150.00 |

50.00% |

$1,280.00 |

28.00% |

| 140.00 |

40.00% |

$1,280.00 |

28.00% |

| 130.00 |

30.00% |

$1,280.00 |

28.00% |

| 128.00 |

28.00% |

$1,280.00 |

28.00% |

| 120.00 |

20.00% |

$1,200.00 |

20.00% |

| 110.00 |

10.00% |

$1,100.00 |

10.00% |

| 107.50 |

7.50% |

$1,075.00 |

7.50% |

| 105.00 |

5.00% |

$1,050.00 |

5.00% |

| 100.00 |

0.00% |

$1,000.00 |

0.00% |

| 90.00 |

-10.00% |

$1,000.00 |

0.00% |

| 89.00 |

-11.00% |

$990.00 |

-1.00% |

| 80.00 |

-20.00% |

$900.00 |

-10.00% |

| 70.00 |

-30.00% |

$800.00 |

-20.00% |

| 60.00 |

-40.00% |

$700.00 |

-30.00% |

| 50.00 |

-50.00% |

$600.00 |

-40.00% |

| 25.00 |

-75.00% |

$350.00 |

-65.00% |

| 0.00 |

-100.00% |

$100.00 |

-90.00% |

| (1) | The index return is equal to the percentage change from the starting level to the ending level (i.e.,

the ending level minus the starting level, divided by the starting level). |

| (2) | The hypothetical pre-tax total rate of return is the number, expressed as a percentage, that results from

comparing the maturity payment amount per security to the face amount of $1,000. |

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

Hypothetical Examples

Example 1. Maturity payment amount is greater

than the face amount and reflects a return that is less than the maximum return:

| |

The Index |

| Hypothetical starting level: |

100.00 |

| Hypothetical ending level: |

110.00 |

| Hypothetical threshold level: |

90.00 |

|

Hypothetical index return

(ending level – starting level)/starting level: |

10.00% |

Because the hypothetical ending level

is greater than the hypothetical starting level, the maturity payment amount per security would be equal to the face amount of $1,000

plus a positive return equal to the lesser of:

(i) $1,000

× index return × upside participation rate

$1,000 × 10.00% × 100.00%

= $100.00; and

(ii) the

maximum return of $280.00

On the stated maturity date you would receive $1,100.00

per security.

Example 2. Maturity payment amount is greater

than the face amount and reflects a return equal to the maximum return:

| |

The Index |

| Hypothetical starting level: |

100.00 |

| Hypothetical ending level: |

150.00 |

| Hypothetical threshold level: |

90.00 |

|

Hypothetical index return

(ending level – starting level)/starting level: |

50.00% |

Because the hypothetical ending level

is greater than the hypothetical starting level, the maturity payment amount per security would be equal to the face amount of $1,000

plus a positive return equal to the lesser of:

(i) $1,000

× index return × upside participation rate

$1,000 × 50.00% × 100.00%

= $500.00; and

(ii) the

maximum return of $280.00

On the stated maturity date you would receive $1,280.00

per security, which is the maximum maturity payment amount.

The maximum return limits your return on the securities.

If the ending level is greater than the starting level, you will participate in the performance of the index return on a 1-to-1 basis

up to the maximum return.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

Example 3. Maturity payment amount is equal

to the face amount:

| |

The Index |

| Hypothetical starting level: |

100.00 |

| Hypothetical ending level: |

95.00 |

| Hypothetical threshold level: |

90.00 |

|

Hypothetical index return

(ending level – starting level)/starting level: |

-5.00% |

Because the hypothetical ending level

is less than the hypothetical starting level, but not by more than the buffer amount, you would not lose any of the face amount of your

securities.

On the stated maturity date you would receive $1,000.00

per security.

Example 4. Maturity payment amount is less than

the face amount:

| |

The Index |

| Hypothetical starting level: |

100.00 |

| Hypothetical ending level: |

50.00 |

| Hypothetical threshold level: |

90.00 |

|

Hypothetical index return

(ending level – starting level)/starting level: |

-50.00% |

Because the hypothetical ending level

is less than the hypothetical starting level by more than the buffer amount, you would lose a portion of the face amount of your securities

and receive the maturity payment amount equal to:

$1,000 + [$1,000

× (index return + buffer amount)]

$1,000 + [$1,000

× (-50.00% + 10.00%)]

= $600.00

On the stated maturity date you would receive $600.00

per security.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

The Nasdaq-100 Index® is a modified

market capitalization-weighted index of the 100 largest non-financial companies listed on The Nasdaq Stock Market.

In addition, information about the Nasdaq-100 Index®

may be obtained from other sources including, but not limited to, the Nasdaq-100 Index® sponsor’s website (including

information regarding the Nasdaq-100 Index®’s sector weightings). We are not incorporating by reference into this

pricing supplement the website or any material it includes. Neither we nor the agent makes any representation that such publicly available

information regarding the Nasdaq-100 Index® is accurate or complete.

Historical Information

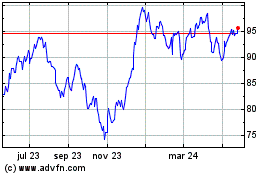

We obtained the closing levels of the Nasdaq-100

Index® in the graph below from Bloomberg Finance L.P., without independent verification.

The following graph sets forth daily closing levels of the Index for

the period from January 1, 2019 to July 17, 2024. The closing level on July 17, 2024 was 19,799.14. The historical performance of the

Index should not be taken as an indication of its future performance during the term of the securities.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

The Nasdaq-100 Index® (“NDX”) is a modified

market capitalization-weighted index of the 100 largest non-financial stocks that have their primary U.S. listing on the Nasdaq Global

Select Market or the Nasdaq Global Market. The NDX excludes securities of companies assigned to the Financials industry according to the

Industry Classification Benchmark. The NDX was launched on January 31, 1985, with a base index value of 250.00. On January 1, 1994, the

base index value was reset to 125.00. The Nasdaq, Inc. (“index sponsor”) publishes the NDX.

Security Eligibility Criteria

To be eligible for initial inclusion in the NDX, a security must meet

the following criteria:

| · | the security must generally be a common stock, ordinary share, American Depositary

Receipt (“ADR”), or tracking stock. Companies organized as real estate investment trusts are not eligible for index inclusion.

If the security is an ADR, then references to the “issuer” are references to the underlying security and the total shares

outstanding is the actual ADRs outstanding as reported by the depositary banks. If an issuer has listed multiple security classes, all

security classes are eligible, subject to meeting all other security eligibility criteria; |

| · | the security’s primary U.S. listing must exclusively be listed on the

Nasdaq Global Select Market or the Nasdaq Global Market; |

| · | if the security is issued by an issuer organized under the laws of a jurisdiction

outside the United States, it must have listed options on a registered options market in the United States or be eligible for listed-options

trading on a registered options market in the United States; |

| · | the security must be issued by a non-financial company (any industry other

than Financials) according to the Industry Classification Benchmark; |

| · | the security must have a minimum average daily trading volume of 200,000

shares (measured over the three calendar months ending with the month that includes the reconstitution reference date; |

| · | the security must have traded for at least three full calendar months, not

including the month of initial listing, on an “eligible exchange,” which includes Nasdaq (Nasdaq Global Select Market, Nasdaq

Global Market, or Nasdaq Capital Market), NYSE, NYSE American or CBOE BZX. Eligibility is determined as of the constituent selection reference

date, and includes that month. A security that was added to the NDX as a result of a spin-off event will be exempt from this requirement; |

| · | the security may not be issued by an issuer currently in bankruptcy proceedings;

and |

| · | the issuer of the security generally may not have entered into a definitive

agreement or other arrangement that would make it ineligible for NDX inclusion and where the transaction is imminent as determined by

the Index Management Committee. |

There is no market capitalization eligibility or float eligibility criterion.

Constituent Selection Process

The index sponsor selects constituents once annually in December. The

security eligibility criteria are applied using market data as of the end of October and total shares outstanding as of the end of November.

All eligible issuers, ranked by market capitalization, are considered for the NDX inclusion based on the following order of criteria.

| · | The top 75 ranked issuers will be selected for inclusion in the NDX. |

| · | Any other issuers that were already members of the NDX as of the reconstitution

reference date and are ranked within the top 100 are also selected for inclusion in the NDX. |

| · | In the event that fewer than 100 issuers pass the first two criteria, the

remaining positions will first be filled, in rank order, by issuers currently in the index ranked in positions 101-125 that were ranked

in the top 100 at the previous reconstitution or replacement-or spin-off-issuers added since the previous reconstitution. In the event

that fewer than 100 issuers pass the first three criteria, the remaining positions will be filled, in rank order, by any issuers ranked

in the top 100 that were not already members of the NDX as of the reconstitution reference date. |

Index reconstitutions are announced in early December and become effective

after the close of trading on the third Friday in December.

Constituent Weighting

The NDX is rebalanced on a quarterly basis in March, June, September

and December and index weights are announced in early March, June, September and December.

Quarterly weight adjustment

The NDX’s quarterly weight adjustment employs a two-stage weight

adjustment scheme according to issuer-level constraints.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

Index securities’ initial weights are determined using up to two

calculations of market capitalization: Total shares outstanding-derived market capitalization and index share-derived market capitalization.

Total shares outstanding-derived market capitalization is defined as a security’s last sale price times its total shares outstanding.

Index share-derived market capitalization is defined as a security’s last sale price times its updated index shares as of the prior

month end. Both total shares outstanding-derived market capitalization and index share-derived market capitalization can be used to calculate

total shares outstanding-derived index weights and index share-derived initial weights by dividing each index security’s total shares

outstanding-derived market capitalization or index share-derived market capitalization by the aggregate total shares outstanding-derived

market capitalization or index share-derived market capitalization of all index securities.

When the rebalance coincides with the reconstitution, only total shares

outstanding-derived initial weights are used. When the rebalance does not coincide with the reconstitution, index share-derived initial

weights are used when doing so results in no weight adjustment; otherwise, total shares outstanding-derived initial weights are used in

both stages of the weight adjustment procedure. Issuer weights are the aggregated weights of the issuers’ respective index securities.

Stage 1

If no initial issuer weight exceeds 24%, initial weights are used as

Stage 1 weights; otherwise, initial weights are adjusted to meet the following Stage 1 constraint, producing the Stage 1 weights:

| · | No issuer weight may exceed 20% of the index. |

Stage 2

If the aggregate weight of the subset of issuers whose Stage 1 weights

exceed 4.5% does not exceed 48%, Stage 1 weights are used as final weights; otherwise, Stage 1 weights are adjusted to meet the following

Stage 2 constraint, producing the final weights:

| · | The aggregate weight of the subset of issuers whose Stage 1 weights exceed

4.5% is set to 40%. |

Annual weight adjustment

The NDX’s annual weight adjustment employs a two-stage weight

adjustment scheme according to security-level constraints.

Index securities’ initial weights are determined via the quarterly

weight adjustment procedure.

Stage 1

If no initial security weight exceeds 15%, initial weights are used

as Stage 1 weights; otherwise, initial weights are adjusted to meet the following Stage 1 constraint, producing the Stage 1 weights:

| · | No security weight may exceed 14% of the index. |

Stage 2

If the aggregate weight of the subset of index securities with the five

largest market capitalizations is less than 40%, Stage 1 weights are used as final weights; otherwise, Stage 1 weights are adjusted to

meet the following constraints, producing the final weights:

| · | The aggregate weight of the subset of index securities with the five largest

market capitalizations is set to 38.5%. |

| · | No security with a market capitalization outside the largest five may have

a final index weight exceeding the lesser of 4.4% or the final index weight of the index security ranked fifth by market capitalization. |

Special rebalance schedule

A special rebalance may be conducted at any time based on the weighting

restrictions described above if it is determined to be necessary to maintain the integrity of the NDX.

Index Calculation

The NDX is a modified market capitalization-weighted index. The level

of the NDX equals the index market value divided by the divisor. The index market value is the sum of each index security's market value,

as may be adjusted for any corporate actions. An index security’s market value is determined by multiplying the last sale price

by the number of shares of the index security represented in the NDX. The NDX is a price return index, which means that the NDX reflects

changes in market value of the index securities and does not reflect regular cash dividends paid on those index securities.

If an index security does not trade on the relevant Nasdaq exchange

on a given day or the relevant Nasdaq exchange has not opened for trading, the previous index calculation day’s closing price for

the index security (adjusted for corporate actions occurring prior to market open on the current day, if any) is used. If an index security

is halted during the trading day, the most recent last sale price is used until trading resumes. For securities where the Nasdaq Stock

Market is the relevant Nasdaq exchange, the last sale price may be the Nasdaq Official Closing Price when it is closed.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

The divisor is calculated as the ratio of (i) the start of day market

value of the NDX divided by (ii) the previous day market value of the NDX. The index divisor is adjusted to ensure that changes in an

index security’s price or shares either by corporate actions or index participation which occur outside of trading hours do not

affect the index level. An index divisor change occurs after the close of the NDX.

Index Maintenance

Deletion Policy

If, at any time other than an index reconstitution, the index sponsor

determines that an index security is ineligible for index inclusion, the index security is removed as soon as practicable. This may include:

| · | Listing on an ineligible index exchange; |

| · | Merger, acquisition, or other major corporate event that would adversely

impact the integrity of the NDX; |

| · | If a company is organized as a real estate investment trust; |

| · | If an index security is classified as a financial company (Financials industry)

according to the Industry Classification Benchmark; |

| · | if the issuer has an adjusted market capitalization below 0.10% of the aggregate

adjusted market capitalization of the NDX for two consecutive month ends; and |

| · | If a security that was added to the NDX as the result of a spin-off event

has an adjusted market capitalization below 0.10% of the aggregate adjusted market capitalization of the NDX at the end of its second

day of regular way trading as an index member. |

In the case of mergers and acquisitions, the effective date for the

removal of an index issuer or security will be largely event-based, with the goal to remove the issuer or security as soon as completion

of the acquisition or merger has been deemed highly probable. Notable events include, but are not limited to, completion of various regulatory

reviews, the conclusion of material lawsuits and/or shareholder and board approvals.

If at the time of the removal of the index issuer or security there

is not sufficient time to provide advance notification of the replacement issuer or security so that both the removal and replacement

can be effective on the same day, the index issuer or security being removed will be retained and persisted in the NDX calculations at

its last sale price until the effective date of the replacement issuer or security’s entry to the NDX.

Securities that are added as a result of a spin-off may be deleted as

soon as practicable after being added to the NDX. This may occur when the index sponsor determines that a security is ineligible for inclusion

because of reasons such as ineligible exchange, security type, industry, or adjusted market capitalization. Securities that are added

as a result of a spin-off may be maintained in the NDX until a later date and then removed, for example, if a spin-off security has liquidity

characteristics that diverge materially from the security eligibility criteria and could affect the integrity of the NDX.

Replacement policy

Securities may be added to the NDX outside of the index reconstitution

when there is a deletion. The index security (or all index securities under the same issuer, if appropriate) is replaced as soon as practicable

if the issuer in its entirety is being deleted from the NDX. The issuer with the largest market capitalization and that meets all eligibility

criteria as of the prior month end which is not in the NDX will replace the deleted Issuer. Issuers that are added as a result of a spin-off

are not replaced until after they have been included in an index reconstitution.

For pending deletions set to occur soon after an index reconstitution

and/or index rebalance effective date, the index sponsor may decide to remove the index security from the NDX in conjunction with the

index reconstitution and/or index rebalance effective date.

Corporate actions

In the periods between scheduled index reconstitution and rebalancing

events, individual index securities may be the subject to a variety of corporate actions and events that require maintenance and adjustments

to the NDX, including special cash dividends, stock splits, stock dividends, bonus issues, reverse stock splits, rights offerings/issues,

stock distributions of another security and spin-offs/de-mergers. Adjustments for corporate actions are made prior to market open on the

effective date, ex-date, ex-dividend date or ex-distribution date of a given corporate action/event. In absence of one of those dates,

there will be no adjustment to the NDX for such corporate action.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

At the quarterly rebalancing, no changes are made to the NDX from the

previous month end until the quarterly share change effective date, with the exception of corporate actions with an ex-date.

Index share adjustments

If a change in total shares outstanding arising from other corporate

events is greater than or equal to 10%, an adjustment to index shares is made as soon as practicable after being sufficiently verified.

If the change in total shares outstanding is less than 10%, then all such changes are accumulated and made effective at one time on a

quarterly basis after the close of trading on the third Friday in each of March, June, September and December. The index shares are adjusted

by the same percentage amount by which the total shares outstanding has changed.

License Agreement

The securities are not sponsored, endorsed, sold

or promoted by Nasdaq, Inc. or its affiliates (Nasdaq, with its affiliates, are referred to as the “Corporations”). The Corporations

have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the securities.

The Corporations make no representation or warranty, express or implied to the owners of the securities or any member of the public regarding

the advisability of investing in securities generally or in the securities particularly, or the ability of the NDX to track general stock

market performance. The Corporations' only relationship to the Issuer (“Licensee”) is in the licensing of the Nasdaq®,

the Nasdaq-100 Index®, and certain trade names of the Corporations and the use of the Nasdaq-100 Index®

which is determined, composed and calculated by Nasdaq without regard to Licensee or the securities. Nasdaq has no obligation to take

the needs of the Licensee or the owners of the securities into consideration in determining, composing or calculating the Nasdaq-100 Index®.

The Corporations are not responsible for and have not participated in the determination of the timing of, prices at, or quantities of

the securities to be issued or in the determination or calculation of the equation by which the securities are to be converted into cash.

The Corporations have no liability in connection with the administration, marketing or trading of the securities.

THE CORPORATIONS DO NOT GUARANTEE THE ACCURACY

AND/OR UNINTERRUPTED CALCULATION OF NASDAQ-100 INDEX® OR ANY DATA INCLUDED THEREIN, THE CORPORATIONS MAKE NO WARRANTY,

EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF

THE NASDAQ-100 INDEX® OR ANY DATA INCLUDED THEREIN. THE CORPORATIONS MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY

DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE NASDAQ-100 INDEX®

OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE CORPORATIONS HAVE ANY LIABILITY FOR ANY LOST

PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

United States Federal Tax Considerations |

The following discussion supplements, and to the

extent applicable supersedes, the discussion in the accompanying product supplement under the caption “United States Federal Tax

Considerations.”

In the opinion of our special U.S. tax counsel,

Ashurst LLP, it would generally be reasonable to treat a security with terms described herein as a pre-paid cash-settled derivative contract

in respect of the Index for U.S. federal income tax purposes, and the terms of the securities require a holder (in the absence of a change

in law or an administrative or judicial ruling to the contrary) to treat the securities for all tax purposes in accordance with such characterization.

However, the U.S. federal income tax consequences of your investment in the securities are uncertain and the Internal Revenue Service

(the “IRS”) could assert that the securities should be taxed in a manner that is different from that described in the preceding

sentence. If this treatment is respected, a U.S. holder should generally recognize capital gain or loss upon the sale, exchange, redemption

or payment on maturity in an amount equal to the difference between the amount it received at such time and the amount that it paid for

its securities. Such gain or loss should generally be long-term capital gain or loss if the U.S. holder has held the securities for more

than one year. Non-U.S. holders should consult the section entitled "United States Federal Tax Considerations — Tax Consequences

to Non-U.S. Holders" in the product supplement.

Under Section 871(m) of the Code, a “dividend

equivalent” payment is treated as a dividend from sources within the United States. Such payments generally would be subject to

a 30% U.S. withholding tax if paid to a non-U.S. holder. Under U.S. Treasury Department regulations, payments (including deemed payments)

with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend equivalents

if such specified ELIs reference, directly or indirectly, an interest in an “underlying security,” which is generally any

interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could give

rise to a U.S. source dividend. However, the IRS has issued guidance that states that the U.S. Treasury Department and the IRS intend

to amend the effective dates of the U.S. Treasury Department regulations to provide that withholding on dividend equivalent payments will

not apply to specified ELIs that are not delta-one instruments and that are issued before January 1, 2027. Based on our determination

that the securities are not delta-one instruments, non-U.S. holders should not be subject to withholding on dividend equivalent payments,

if any, under the securities. However, it is possible that the securities could be treated as deemed reissued for U.S. federal income

tax purposes upon the occurrence of certain events affecting the Index or the securities (for example, upon the Index rebalancing), and

following such occurrence the securities could be treated as subject to withholding on dividend equivalent payments. Non-U.S. holders

that enter, or have entered, into other transactions in respect of the Index or the securities should consult their tax advisors as to

the application of the dividend equivalent withholding tax in the context of the securities and their other transactions. If any payments

are treated as dividend equivalents subject to withholding, we (or the applicable withholding agent) would be entitled to withhold taxes

without being required to pay any additional amounts with respect to amounts so withheld.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

|

Supplemental Plan of Distribution |

Delivery of the securities will be made against payment therefor on the issue date. Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in one

business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade such securities

at any time prior to the first business day preceding the issue date will be required, by virtue of the fact that the securities will

not settle in T+1, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement; such purchasers

should also consult their own advisors in this regard.

Market Linked Securities—Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the Nasdaq-100 Index® due July 22, 2026 |

| Validity

of the Securities |

In the opinion of Osler, Hoskin & Harcourt

LLP, the issue and sale of the securities has been duly authorized by all necessary corporate action of the Bank in conformity with the

senior indenture, and when this pricing supplement has been attached to, and duly notated on, the master note that represents the securities

the securities will have been validly executed, authenticated, issued and delivered, to the extent that validity of the securities is

a matter governed by the laws of the Province of Ontario and the federal laws of Canada applicable therein and will be valid obligations

of the Bank, subject to the following limitations (i) the enforceability of the senior indenture may be limited by the Canada Deposit

Insurance Corporation Act (Canada), the Winding-up and Restructuring Act (Canada) and bankruptcy, insolvency, reorganization, receivership,

moratorium, arrangement or winding-up laws or other similar laws affecting the enforcement of creditors’ rights generally; (ii)

the enforceability of the senior indenture may be limited by equitable principles, including the principle that equitable remedies such

as specific performance and injunction may only be granted in the discretion of a court of competent jurisdiction; (iii) pursuant to the

Currency Act (Canada) a judgment by a Canadian court must be awarded in Canadian currency and that such judgment may be based on a rate

of exchange in existence on a day other than the day of payment; and (iv) the enforceability of the senior indenture will be subject to

the limitations contained in the Limitations Act, 2002 (Ontario), and such counsel expresses no opinion as to whether a court may find

any provision of the senior indenture to be unenforceable as an attempt to vary or exclude a limitation period under that Act. This opinion

is given as of the date hereof and is limited to the laws of the Provinces of Ontario and the federal laws of Canada applicable therein.

In addition, this opinion is subject to certain assumptions about (i) the Trustees’ authorization, execution and delivery of the

senior indenture, (ii) the genuineness of signatures and (iii) certain other matters, all as stated in the letter of such counsel dated

May 26, 2022, which has been filed as Exhibit 5.3 to Bank of Montreal’s Form 6-K filed with the SEC and dated May 26, 2022.

In the opinion of Ashurst LLP, when the pricing

supplement has been attached to, and duly notated on, the master note that represents the securities, the securities will be executed,

authenticated, issued and delivered, and the securities have been issued and sold as contemplated by the prospectus supplement and the

prospectus, the securities will be valid, binding and enforceable obligations of the Bank, entitled to the benefits of the senior indenture,

subject to applicable bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability

relating to or affecting creditors’ rights and subject to general principles of equity, public policy considerations and the discretion

of the court before which any suit or proceeding may be brought. This opinion is given as of the date hereof and is limited to the laws

of the State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery

of the senior indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain

factual matters, all as stated in the legal opinion dated May 26, 2022, which has been filed as Exhibit 5.4 to the Bank’s Form 6-K

dated May 26, 2022.

PRS-23

Exhibit 107.1

The pricing supplement to which this Exhibit is attached

is a final prospectus for the related offering. The maximum aggregate offering price of the offering is $1,279,000.

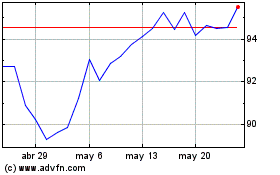

Bank of Montreal (NYSE:BMO)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Bank of Montreal (NYSE:BMO)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024