FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated May

20, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: May 20, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ/MF 01.838.723/0001-27

NIRE 42.300.034.240

CVM 1629-2

MINUTES OF THE EXTRAORDINARY MEETING OF THE

BOARD OF DIRECTORS

HELD ON MAY 20, 2024

1. Date, Time and

Place: Held on May 20, 2024, at 2:00 p.m., at the office of BRF S.A. ("Company") located at Avenida das

Nações Unidas, nº 14.401, 25th floor, Chácara Santo Antônio, CEP 04794-000, city of São

Paulo, State of São Paulo.

2. Call and

Attendance: Convocation duly held pursuant to Article 21 of the Company's Bylaws, with the presence of all the members of

the Board of Directors, namely, Messrs. Marcos Antonio Molina dos Santos, Marcia Aparecida Pascoal Marçal dos Santos, Sergio

Agapito Lires Rial, Marcos Fernando Marçal dos Santos, Augusto Marques da Cruz Filho, Pedro de Camargo Neto, Eduardo Augusto

Rocha Pocetti, Flávia Maria Bittencourt and Marcio Hamilton Ferreira.

3. Presiding

Board: Chairman: Mr. Marcos Antonio Molina dos Santos. Secretary: Mr. Bruno Machado Ferla.

4. Agenda:

To deliberate on: (i) the Company's execution of its 5th (fifth) issuance of simple, non-convertible debentures, of the

unsecured type, in up to three (3) series ("Debentures" and "Issue", respectively), which will be

subject to private placement with Eco Securitizadora de Direitos Creditórios do Agronegócio S.A., a

securitization company, registered with the Brazilian Securities and Exchange Commission ("CVM") in category S1,

under No. 310, headquartered in the city of São Paulo, state of São Paulo, at Avenida Pedroso de Morais, No. 1,553,

3rd floor, set 32, Pinheiros, CEP 05419-001, registered with the CNPJ under No. 10,753,164/0001-43, with its articles of

incorporation registered at JUCESP under NIRE 35300367308 ("Securitization" or "Debenture

Holder""), to link to the issuance of agribusiness receivables certificates of the 1st (first) series ("CRA

DI"), the 2nd (second) series ("Pre-Fixed CRA") and the 3rd series ("CRA IPCA") of the

332nd (three hundred and thirty-second) issuance of the Securitization Company (being CRA DI and CRA IPCA, together,

"CRA"), backed by agribusiness credits arising from Debentures, under the terms of the "Agribusiness Credit

Rights Securitization Term for the Issuance of Agribusiness Receivables Certificates, in up to three (3) Series of the 332nd (three

hundred and thirty-second) Issuance of Eco Securitizadora de Direitos Creditórios do Agronegócio S.A. Backed by

Agribusiness Credit Rights Due by BRF S.A." ("Securitization Term"), which will be subject to public

distribution, through the automatic distribution registration procedure, pursuant to CVM Resolution No. 160, of July 13, 2022,

as

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 1 from 21 |

amended ("CVM Resolution 160"),

of CVM Resolution 60, of December 23, 2021, as amended ("CVM Resolution 60"), National Monetary Council Resolution No.

5,118, of February 1, 2024, as amended, and other applicable laws and regulations ("Offer"); (ii) the authorization

of the Company, through its legal representatives, to execute any and all necessary documents and perform any and all pertinent acts to

enable due compliance with the provisions of item (i) above, including, but not limited to, the execution of the Deed of Issue (as defined

below) (including any amendments thereto", of the "Contract for the Coordination, Placement and Public Distribution of Agribusiness

Receivables Certificates, under the Firm Placement Guarantee Regime, in up to 3 (Three) Series of the 332nd (three hundred and thirty-second)

Issuance of Eco Securitizadora de Direitos Creditórios do Agronegócio S.A. backed by Debentures issued by BRF S.A"

(including any amendments thereto), the Debentures Subscription Bulletin and other documents necessary for the Issuance and the Offering,

and hiring and remuneration of all service providers inherent to the execution of the Issuance and the Offering; and (iii) the

authorization and ratification of all acts already performed by the Company's legal representatives, by the Company's Executive Board,

directly or indirectly, and/or through its attorneys-in-fact, within the scope of the Issuance and the Offering related to items (i) and

(ii) above and any and all acts and documents that are necessary or convenient for the effectiveness of the above resolutions, including

the respective ancillary instruments necessary for the issuance of Debentures and CRAs, as well as any amendments.

5. Resolutions:

The board members approved, by unanimous vote of those present and without any restrictions, the drafting of these minutes in the

form of a summary. After examining the items on the agenda, the following items were dealt with and the following decisions were

taken:

| (i) | approve and authorize, in accordance with the provisions of article 59 of Law No. 6,404, of December 15,

1976, as amended ("Brazilian Corporation Law"), the execution of the Issuance, in favor of the Securitization Company,

as well as its binding to the CRA, through the execution of the "Private Deed Instrument of the 5th (Fifth) Issuance of Simple Debentures,

Non-Convertible Shares, Unsecured Shares, in up to three (3) Series, for Private Placement, of BRF S.A." ("Deed of Issue"),

in accordance with the following characteristics: |

| (a) | Issue Number: The Issue represents the Company's 5th (fifth) issuance of debentures; |

| (b) | Issue Date: For all legal purposes and effects, the date of issuance of the Debentures shall be

the date to be defined in the Deed of Issue ("Issue Date"); |

| (c) | Total Issue Amount: The total amount of the Issuance will initially |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 2 from 21 |

be R$ 2,000,000,000.00 (two billion

reais) on the Issue Date, subject to the Additional Lot Option (as defined below), in which case it may reach a volume of up to R$ 2,500,000,000.00

(two billion five hundred million reais) ("Total Issue Amount").

| (d) | Nominal Value: The unit face value of the Debentures will be R$1,000.00 (one thousand reais) on

the Issue Date ("Nominal Value"). |

| (e) | Number of Series: The Issuance will be carried out in up to three (3) series, which are the Debentures

of the first series ("DI Debentures"), the Debentures of the second series ("Pre-fixed Debentures")

and the Debentures of the third series ("IPCA Debentures" and, together with the DI Debentures and the Pre-fixed Debentures,

the "Debentures"), and the Debentures will be allocated among the series in the Communicating Vessel System, observing

the Maximum DI Volume, and the number of Debentures allocated in each series will be defined according to the Bookbuilding Procedure. |

| (f) | Number of Debentures: Two million (2,000,000) Debentures will be initially issued, which will be

allocated, subject to (i) the Maximum DI Volume (as defined below) of the DI Debentures, according to the demand to be determined in the

Bookbuilding Procedure (as defined below); and (ii) that the number of Debentures originally offered may be increased by up to twenty-five

percent (25%); equivalent to up to 500,000 (five hundred thousand) Debentures, if the option for an additional lot is exercised, in whole

or in part, within the scope of the CRA Offering, in which case it may reach an additional amount of up to R$ 500,000,000.00 (five hundred

million reais) ("Additional Lot Option"). The Debentures will be allocated between the series as a result of the Bookbuilding

Procedure (as defined below) to be carried out within the scope of the CRA Offering and in the Company's allocation interest, subject

to the following conditions: (i) DI Debentures may be issued in a maximum volume of up to 600,000 (six hundred thousand) DI Debentures,

equivalent to the maximum financial volume of up to R$ 600,000,000.00 (six hundred million reais) on the Issue Date ("Maximum

Volume DI"); (ii) there will be no minimum or maximum number of Pre-fixed Debentures and IPCA Debentures; (iii) there will be

no minimum amount of Debentures to be allocated between the series; and (iv) DI Debentures, Pre-fixed Debentures and IPCA Debentures may

not be issued, in which case the Debentures of the respective Series not placed will be canceled. |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 3 from 21 |

The number of Debentures to be allocated

in each Series of the Issuance and the final number of Series will be defined after the conclusion of the Bookbuilding Procedure, provided

that the allocation of Debentures between the Series will occur in the system of communicating vessels, in which the amount of Debentures

allocated in a Series will be subtracted from the total amount of Debentures, provided that any of the Series may not be issued, and the

Maximum DI Volume for DI Debentures ("Communicating Vessel System") is observed. The Issuance will be used to form the

agribusiness credit rights that will constitute the backing of the Offering. In addition, within the scope of the CRA Offering, the procedure

for collecting investment intentions from potential investors in the CRAs will be adopted to define: (i) the number of series of the issuance

of the CRA, and, consequently, the number of series of the issuance of the Debentures, according to the System of Communicating Vessels,

except that any of the respective series may be canceled; (ii) the amount and final volume of the issuance of CRAs and, consequently,

the quantity and final volume of the issuance of Debentures, subject to the Maximum DI Volume; (iii) the amount of CRA to be allocated

in each series of the issuance of CRAs and, consequently, the number of Debentures to be allocated in each series of the issuance of Debentures,

observing the Maximum DI Volume; and (iv) the final rates for the remuneration of the CRAs of each series and, consequently, the final

rates for the remuneration of the Debentures of each series ("Bookbuilding Procedure"). In this sense, the result of

the CRA Bookbuilding Procedure will directly influence the number of Debentures to be issued and their allocation in each of its series,

in which case the Deed of Issue will be amended, without the need for a General Meeting of Debenture Holders or corporate approval by

the Company, to formalize the number of Debentures allocated in each of the series. The CRA Bookbuilding Procedure will be performed in

the Communicating Vessel System, observing the Maximum DI Volume.

| (g) | Term and Maturity Date: Except in the event of early maturity and/or early redemption of all Debentures,

under the terms to be provided for in the Deed of Issue, (i) the DI Debentures will have a term of duration to be defined in the Deed

of Issue ("DI Debentures Maturity Date"); (ii) the Pre-fixed Debentures will have a term of duration to be defined in

the Deed of Issuance ("Maturity Date of the Pre-fixed Debentures"); and (iii) the IPCA Debentures will have a term to

be defined in the Deed of Issuance ("IPCA Debentures |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 4 from 21 |

Maturity Date" and, together

with the Maturity Date of the Pre-fixed Debentures and the Maturity Date of the DI Debentures, the "Maturity Dates").

| (h) | Bookkeeping Agent: The bookkeeping agent of the Debentures will be Oliveira Trust Distribuidora

de Títulos e Valores Mobiliários S.A., a financial institution headquartered in the city of São Paulo, state of São

Paulo, at Avenida Engenheiro Luiz Carlos Berrini, nº 550, 4th floor, Cidade Monções, CEP 04571-925, registered with

the CNPJ under No. 04.200.649/0001-07 ("Bookkeeper", the definition of which includes any other institution that may

succeed the Bookkeeper in the provision of services related to the Issuance and Debentures). |

| (i) | Right of First Refusal: There will be no right of first refusal of the Company's current shareholders

in the subscription of the Debentures; |

| (j) | Allocation of Resources: The net resources obtained by the Company due to the payment of the Debentures

shall be fully and exclusively allocated to its activities as a rural producer in agribusiness. To this end, such net resources will be

used, pursuant to article 2, paragraph 4, item III, of Normative Annex II of CVM Resolution 60, in the ordinary course of its rural business,

in investments, costs and expenses related to its production chain and exploitation of animals in general (poultry, cattle, pork, etc.),

which are: (i) expenses for the maintenance of its own farms; (ii) expenses for the acquisition of breeders, genetics, eggs, breeding,

fattening and slaughter of animals in general; (iii) expenses for the acquisition of inputs for animal feed, such as grains and their

derivatives (soybeans, corn, sorghum, bran, oils, etc.); (iv) expenses for the purpose of production and/or acquisition of feed and other

feed products; (v) expenses with veterinary support and acquisition of medicines for the treatment of animals; and (vi) expenses with

wood shavings and other substrates for the heating and accommodation of the animals and maintenance of the facilities where the exploited

animals are kept, pursuant to article 146 of the Normative Instruction of the Federal Revenue Service of Brazil No. 2,110, of October

17, 2022, as amended, paragraph 1 of article 23 of Law 11,076 and article 2, items I and II, and paragraphs 1, 2 and 9, of Normative Annex

II of CVM Resolution 60, as well as item III of paragraph 4 of article 2 of Normative Annex II of CVM Resolution 60, as provided for in

its corporate purpose and in the ordinary course of its business |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 5 from 21 |

("Allocation of Resources");

| (k) | Linking to the Agribusiness Receivables Certificates: DI Debentures will be linked to CRA DI, Pre-fixed

Debentures will be linked to Pre-Fixed CRAs, and IPCA Debentures to CRA IPCA, such CRAs being distributed through the Offering, pursuant

to CVM Resolution 160 and CVM Resolution 60; |

| (l) | Convertibility: The Debentures will be simple, i.e., not convertible into shares issued by the

Company; |

| (m) | Type, Form and Proof of Ownership: The Debentures will be issued in registered and book-entry form,

without the issuance of certificates and/or cautions. For all legal purposes, the ownership of the Debentures is presumed by the statement

to be issued by the Bookkeeper proving the ownership of the Debentures by the Securitization Company pursuant to articles 63 and 34 of

the Brazilian Corporation Law and by the Subscription Bulletin (as defined in the Deed of Issue); |

| (n) | Type: The Debentures shall be of the unsecured type, pursuant to article 58, caput, of the

Brazilian Corporation Law, and shall not have a real or fiduciary guarantee, or any segregation of the Company's assets as a guarantee

to the debenture holders in the event of the need for judicial or extrajudicial execution of the Company's obligations arising from the

Debentures and the Deed of Issue, and not conferring any privilege, special or general, to debenture holders; |

| (o) | Scheduled Amortization of the Debentures: Without prejudice to payments as a result of any early

maturity and/or early redemption of the Debentures, under the terms to be provided for in the Deed of Issue, (i) the Nominal Value of

the DI Debentures will be amortized in one (1) single installment, on the Maturity Date of the DI Debentures; (ii) the Nominal Value of

the Pre-fixed Debentures will be amortized in one (1) single installment, on the Maturity Date of the Pre-fixed Debentures; and (iii)

the Updated Nominal Value of the IPCA Debentures (as defined below) will be amortized in three (3) consecutive annual installments, according

to the table to be provided for in the Deed of Issue; |

| (p) | Monetary Adjustment of DI Debentures: Monetary adjustment will not be levied on the Nominal Value

of DI Debentures; |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 6 from 21 |

| (q) | Monetary Adjustment of Pre-fixed Debentures: Monetary adjustment will not be levied on the Nominal

Value of Pre-fixed Debentures; |

| (r) | Monetary Adjustment of IPCA Debentures: The Nominal Value of the IPCA Debentures or the balance

of the Nominal Value of the IPCA Debentures, as the case may be, will be monetarily updated, monthly, from the first Payment Date (as

defined below), inclusive, until the date of its effective payment, exclusively, by the accumulated variation of the Extended Consumer

Price Index - IPCA, calculated and disclosed by the Brazilian Institute of Geography and Statistics (IBGE) ("IPCA" and

"Monetary Update of IPCA Debentures", respectively) calculated pro rata temporis per Business Days elapsed, and

the product of the Monetary Update of the IPCA Debentures is automatically incorporated into the Nominal Value of the IPCA Debentures

or the balance of the Nominal Value of the IPCA Debentures, as the case may be ("Updated Nominal Value of IPCA Debentures"),

according to the formula to be provided for in the Deed of Issue. The "Anniversary Date" is considered to be the business

day prior to the anniversary date of the CRA IPCA, under the terms provided for in the Securitization Term. Specifically, for the first

Capitalization Period, the Issuer will pay the Debenture Holder a premium corresponding to one (1) Business Days of monetary adjustment

in the dup. |

| (s) | Remuneration of DI Debentures: As of the first Payment Date, on the Nominal Value of the DI Debentures

or the balance of the Nominal Value of the DI Debentures, as the case may be, remunerative interest will be charged corresponding to the

accumulated variation of 100% (one hundred percent) of the average daily rates of interbank deposits - DI of one day, "over extra

grupo", expressed as a percentage per year, based on two hundred and fifty-two (252) business days, calculated and disclosed daily

by B3, in the daily newsletter available on its website (www.b3.com.br) ("DI Rate"), plus a spread (surcharge) to be

calculated in accordance with the Bookbuilding Procedure, limited to 0.80% (eighty hundredths of a percent) per year ("First Series

Ceiling Rate"), base 252 (two hundred and fifty-two) business days ("Remuneration of DI Debentures"). The Remuneration

of the DI Debentures will be calculated exponentially and cumulatively pro rata temporis, for elapsed business days, levied on

the Nominal Value of the DI |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 7 from 21 |

Debentures (or on the balance of

the Nominal Value of the DI Debentures), from the first Payment Date of the DI Debentures or the Remuneration Payment Date (as defined

below) of the DI Debentures immediately preceding (inclusive) until the Payment Date of the Debentures Remuneration DI in question, the

date of the declaration of early maturity as a result of an early maturity event or the date of any voluntary early redemption, whichever

occurs first. The Remuneration of DI Debentures will be calculated according to the formula to be provided for in the Deed of Issue;

| (t) | Remuneration of the Pre-Fixed Debentures: From the first Payment Date, on the Nominal Value of

the Pre-fixed Debentures or the balance of the Nominal Value of the Pre-fixed Debentures, as the case may be, fixed remunerative interest

corresponding to a certain percentage per year, based on two hundred and fifty-two (252) Business Days, to be defined in accordance with

the Bookbuilding Procedure, being limited to the higher rate between "(a)" and "(b)" below ("Second Series

Ceiling Rate"): (a) the percentage corresponding to the respective DI Rate, as quoted at the close of the Business Day on the

date of the Bookbuilding Procedure, base 252 (two hundred and fifty-two) Business Days, published by B3 on its website, corresponding

to the futures contract maturing on January 2, 2030, plus an exponential surcharge (spread) of 0.80% (eighty hundredths of a percent)

per year; and (b) 12.19% (twelve integers and nineteen hundredths percent) per year, based on two hundred and fifty-two (252) Business

Days ("Remuneration of Pre-fixed Debentures"). The Remuneration of the Pre-fixed Debentures will be calculated exponentially

and cumulatively pro rata temporis, for Business Days elapsed, from the first Date of Payment of the Debentures or the Date of

Payment of the Remuneration of the Pre-fixed Debentures (as defined below) immediately preceding it, whichever occurs later, until the

date of its effective payment, and paid at the end of each Capitalization Period, obeyed the formula to be provided for in the Deed of

Issue; |

| (u) | Remuneration of IPCA Debentures: As of the first Payment Date, on the Updated Nominal Value of

the IPCA Debentures or the balance of the Updated Nominal Value of the IPCA Debentures, as the case may be, remunerative interest corresponding

to a certain percentage per year, based on two hundred and fifty-two (252) Business Days, to be defined in accordance with the Bookbuilding

Procedure, being limited to the highest rate between "(a)" and "(b)" below ("Third |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 8 from 21 |

Series Ceiling Rate" and, together

with the First Series Ceiling Rate and the Second Series Ceiling Rate, "Ceiling Rate"): (a) the indicative rate published

by ANBIMA on its website (http://www.anbima.com.br) of the IPCA+ Treasury Rate with Semiannual Interest (NTN-B), due on May 15, 2035,

to be calculated at the close of the Business Day of the date of completion of the Bookbuilding Procedure, plus exponentially a surcharge

(spread) of 0.85% (eighty-five hundredths of a percent) per year, based on two hundred and fifty-two (252) Business Days; or (b) 7.08%

(seven integers and eight hundredths percent) per year, base 252 (two hundred and fifty-two) Business Days ("Remuneration of IPCA

Debentures" and, when considered together with the Remuneration of DI Debentures and the Remuneration of Pre-fixed Debentures,

"Remuneration"). The Remuneration of the IPCA Debentures will be calculated exponentially and cumulatively pro rata

temporis, for Business Days elapsed, from the first Date of Payment of the Debentures or the Date of Payment of the Remuneration of

the IPCA Debentures (as defined below) immediately before, whichever occurs later, until the date of its effective payment, and paid at

the end of each Capitalization Period, obeyed the formula to be provided for in the Deed of Issue;

| (v) | Calculation of Remuneration: For the purposes of calculating the Remuneration, the "Capitalization

Period" is defined as the time interval in Business Days that begins: (i) from the first Payment Date of the Debentures of the

respective series (inclusive), and ends on the first Payment Date of the Remuneration of the Debentures of each series (exclusive) and,

in the case of the first Capitalization Period; or (ii) on the Date of Payment of the Remuneration of the Debentures, of the respective

series, immediately preceding (inclusive), and ends on the Date of Payment of the Remuneration of the Debentures of the respective series

of the respective period (exclusive), in the case of the other Capitalization Periods. Each Capitalization Period succeeds the previous

one without continuity, until the respective Maturity Date of each series or the date of redemption of the Debentures, as the case may

be. In order to avoid mismatches between the payment amount of the Debentures and the CRA, including, but not limited to, the cases of

Voluntary Early Redemption, Early Maturity and/or full early redemption resulting from the Early Redemption Offer, if, for any reason,

the payment amount of the Debentures is updated by index number or days lower than those used to calculate the payment amount of the CRA,

the |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 9 from 21 |

Company shall add to the amount

due, by way of compensation, the amount necessary to cover the outstanding balance of the respective payment of the CRA.

| (w) | Payment of Remuneration: Subject to the hypotheses of early redemption of the Debentures, the payment

of the Remuneration of the IPCA Debentures, the Remuneration of the Pre-fixed Debentures and the Remuneration of the DI Debentures will

occur on the Debentures Remuneration Payment Dates of each series indicated in the tables to be included in the Deed of Issue, until the

respective Debentures Maturity Date (each of these dates, a "Debenture Remuneration Payment Date"). |

| (x) | Form of Payment: The payment of the Debentures will be made in cash, in local currency, at the

price corresponding to the Payment Price of the CRA (as defined in the Securitization Term), which may be increased by goodwill or discount,

less all expenses provided for in the Securitization Term, including, but not limited to, all expenses for the execution of the Offering

and the constitution of the Expense Fund (as provided for in the Securitization Term) ("Payment Price of Debentures")

within one (1) Business Day of the date of payment of the CRA, after the receipt by the Debenture Holder of the funds arising from the

payment of the CRA, by means of available electronic transfer or other means of payment allowed by the Central Bank of Brazil, in the

current account No. 5273-6, branch 2372, of Banco Bradesco S.A. (No. 237), held by the Issuer ("Free Movement Account"),

in favor of the Company. Without prejudice to the deadline of one (1) Business Day from the date of payment of the CRA for the transfer

of funds, the same date of payment of the Debentures of each series will be considered as the same date of payment of the CRA of the respective

series ("Payment Date"). The Debentures may be placed at a premium and discount, to be defined by mutual agreement between

the Company and the Coordinators, if applicable, at the time of subscription of the CRA, provided that they are applied under equal conditions

to all investors of the same series of CRAs on each Payment Date and, consequently, for all Debentures, in the occurrence of one or more

of the following objective market situations, such as: (a) absence or excess of satisfactory market demand by the CRAs in the respective

remuneration rates to be set according to the Bookbuilding Procedure; (b) change in the SELIC rate; (c) changes in the interest rates

of national treasury securities; (d) material change in the indicative rates for trading fixed income |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 10 from 21 |

securities (debentures, CRIs, CRAs)

disclosed by ANBIMA, or (e) material change in the DI x pre yield curve, constructed from the prices of adjustments to the maturities

of the one-day average rate interbank deposit futures contract, traded on B3, provided that: (i) the price of the Offer will be a single

price and, therefore, any goodwill or discount shall be applied to all Debentures of the same series paid in on the same Payment Date;

(ii) the application of any goodwill or discount will not affect the Issuer's all-in costs with respect to the Issue.

| (y) | Registration for Distribution and Placement: The Issuance will not be subject to registration with

the CVM or ANBIMA, since the placement of the Debentures will be carried out privately, exclusively for the Debenture Holder, without

the intermediation of any institutions, whether they are part of the securities distribution system or not, and will not have any form

of sales effort before the general public. The Debentures will not be registered for distribution in the primary market, trading in the

secondary market, electronic custody or settlement in any organized market; |

| (z) | Scheduled Renegotiation: The Debentures will not be subject to scheduled renegotiation; |

| (aa) | Voluntary Extraordinary Amortization: The Company may, (i) subject to the terms and conditions

set forth in the Deed of Issue and the lock-up period to be defined in the Deed of Issue, carry out the extraordinary amortization of

the DI Debentures, limited to ninety-eight percent (98%) of the Nominal Value of the DI Debentures ("Voluntary Extraordinary Amortization

of the DI Debentures"), (ii) subject to the terms and conditions set forth in the Deed of Issue and the lock-up period to be

defined in the Deed of Issue, carry out the extraordinary amortization of the Pre-fixed Debentures, limited to 98% (ninety-eight percent)

of the Nominal Value of the Pre-fixed Debentures ("Voluntary Extraordinary Amortization of the Pre-fixed Debentures")

and, (iii) subject to the terms and conditions set forth in the Deed of Issue and the lock-up period to be defined in the Deed of Issue,

carry out the extraordinary amortization of the IPCA Debentures, limited to 98% (ninety-eight percent) of the Updated Nominal Value of

the IPCA Debentures ("Voluntary Extraordinary Amortization of the IPCA Debentures")" and, together with the Voluntary

Extraordinary Amortization of DI Debentures and the Voluntary Extraordinary Amortization of Pre-fixed Debentures, the |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 11 from 21 |

"Voluntary Extraordinary

Amortizations" or, individually and indistinctly, "Voluntary Extraordinary Amortization";. The other terms and

conditions of the Voluntary Extraordinary Amortization will be established in the Deed of Issue;

| (bb) | Amount of the Voluntary Extraordinary Amortization of the DI Debentures: On the occasion of the

Voluntary Extraordinary Amortization of the DI Debentures, the debenture holder will be entitled to receive the portion of the Nominal

Value of the DI Debentures or the balance of the Nominal Value of the DI Debentures, as the case may be, subject to the Voluntary Extraordinary

Amortization of the DI Debentures, plus the Remuneration of the DI Debentures, calculated pro rata temporis from the first Payment

Date or the Payment Date of the Remuneration of the DI Debentures immediately preceding it, as the case may be, and other applicable charges

due and unpaid until the date of the Voluntary Extraordinary Amortization of the DI Debentures ("Voluntary Extraordinary Amortization

Amount of DI Debentures"), plus a premium calculated in accordance with the formula to be provided for in the Deed of Issue; |

| (cc) | Amount of the Voluntary Extraordinary Amortization of the Pre-fixed

Debentures: On the occasion of the Voluntary Extraordinary Amortization of the Pre-fixed Debentures, the Debenture Holder will be

entitled to receive the amount indicated in items "(i)" and "(ii)" below, of the two the greater: (i) portion of the

Nominal Value or balance of the Nominal Value of the Pre-fixed Debentures, as the case may be, plus: (a) the calculated Remuneration of

the Pre-fixed Debentures, pro rata temporis, from the first Payment Date or the last Payment Date of the Remuneration of the Pre-fixed

Debentures, as the case may be, until the date of effective payment (exclusive); and (b) Late Fees, if any; or (ii) present value of the

sum of the remaining amounts of amortization payment of the Nominal Value or balance of the Nominal Value of the Pre-fixed Debentures,

as the case may be, and the Remuneration of the Pre-fixed Debentures, using as a discount rate the DI Rate for 252 (two hundred and fifty-two)

Business Days based on the adjustment (interpolation) of the Pre x DI curve, to be disclosed by B3 on its website1,

corresponding to the vertex with the number of |

1

https://www.b3.com.br/pt_br/market-data-e-indices/servicos-de-dados/marketdata/consultas/mercado-de-derivativos/precos-referenciais/taxas-referenciais-bm-fbovespa/

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 12 from 21 |

calendar days closest to the remaining

duration of the Pre-fixed Debentures, to be calculated at the close of the 3rd (third) Business Day immediately prior to the date of the

Voluntary Extraordinary Amortization of the Pre-fixed Debentures ("Voluntary Extraordinary Amortization Amount of the Pre-fixed

Debentures"), calculated according to the formula to be provided for in the Deed of Issue, and added to the Late Fees;

| (dd) | Amount of the Voluntary Extraordinary Amortization of the IPCA Debentures: On the occasion of the

Voluntary Extraordinary Amortization of the IPCA Debentures, the Debenture Holder will be entitled to receive the greater of: (i) the

portion of the Updated Nominal Value of the IPCA Debentures subject to the Voluntary Extraordinary Amortization of the IPCA Debentures,

plus the Remuneration of the IPCA Debentures, calculated pro rata temporis from the first Payment Date of the IPCA Debentures or

the Date of Payment of the Remuneration of the IPCA Debentures immediately preceding it, as the case may be, and other Late Fees, as applicable;

and (ii) the present value of the remaining installments of the amortization payment of the Updated Face Value of the IPCA Debentures

and the Remuneration of the IPCA Debentures, subject to the Voluntary Extraordinary Amortization of the IPCA Debentures, using as a discount

rate the coupon of the IPCA+ Treasury bond with semiannual interest (NTN-B), with a duration closer to the remaining duration of the IPCA

Debentures, according to the indicative quotation published by ANBIMA on its website on the World Wide Web (http://www.anbima.com.br)

calculated on the second Business Day immediately prior to the date of the Voluntary Extraordinary Amortization of the IPCA Debentures,

calculated according to the formula to be provided for in the Deed of Issue, and plus any Default Charges ("Voluntary Extraordinary

Amortization Value of the IPCA Debentures" and, together with the Voluntary Extraordinary Amortization Value of DI Debentures

and the Voluntary Extraordinary Amortization Value of Pre-fixed Debentures, individually and indistinctly, "Voluntary Extraordinary

Amortization Value"); |

| (ee) | Voluntary Early Redemption: The Company may, at any time, in the event that it is required to make

a withholding, deduction or payment related to the addition of taxes and/or fees under the terms to be provided for in the Deed of Issue

("Tax Event"), carry out the Voluntary early redemption of all DI Debentures and/or Pre-fixed Debentures and/or IPCA

Debentures, with the consequent |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 13 from 21 |

cancellation of such Debentures,

by sending a communication and direct proof to the Securitization Company, with a copy to the Trustee Agent of the CRA, under the terms

to be provided for in the Deed of Issue, at least five (5) Business Days prior to the redemption date, carry out the full early redemption

of the DI Debentures and/or the Pre-fixed Debentures and/or the IPCA Debentures ("Voluntary Early Redemption by Tax Event”).

For the purposes of the Deed of Issue, the occurrence of any withholding of taxes on the income of the CRA, creating or raising income

tax rates levied on them, due to a misclassification of the Debentures as a valid backing for the CRA due to non-compliance with the provisions

of CMN Resolution 5,118.

If, at any time during the term

of the Issuance and until the maturity dates of the CRA, there is a Tax Event as a result of a declassification of the Debentures as a

valid backing for the CRA due to non-compliance with the provisions of CMN Resolution 5,118, the Issuer hereby undertakes to (i) bear

any fine to be paid, as applicable; and (ii)(a) bear and pay all taxes that may be due by the CRA Holders exclusively as a result of the

Tax Event, so that the Issuer shall add to such payments additional amounts sufficient for the CRA Holders to receive such payments as

if such amounts were not levied if the Tax Event had not occurred, or (b) perform the Voluntary Early Redemption by Tax Event. In addition,

without prejudice to what is provided for in the Deed of Issue, the Company may, at any time, provided that in the context of any corporate

transaction with third parties not belonging to its economic group at the time of the event, announced to the market under the terms of

the applicable legislation, in which it deems appropriate or has as a means of changing its debt profile, as attested by the Company by

means of a statement, carry out the voluntary early redemption of all DI Debentures and/or Pre-Fixed-Rate Debentures and/or IPCA Debentures,

with the consequent cancellation of such Debentures, by sending a direct communication and proof to the Securitization Company, with a

copy to the Trustee Agent of the CRA, under the terms to be provided for in the Deed of Issue, at least five (5) Business Days prior to

the redemption date, carry out the full early redemption of DI Debentures and/or Pre-Fixed Debentures and/or IPCA Debentures ("Voluntary

Early Redemption by Corporate Event"). Finally, the Company may, (1) as of the dates to be set forth in the Deed of Issue, at

its sole discretion, carry out the voluntary early redemption of all DI Debentures; and/or (2) as of the dates to be set forth in the

Deed of Issue, at its sole discretion, perform the voluntary early redemption of all Pre-fixed Debentures; and/or (3) as of the

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 14 from 21 |

dates to be provided for in the

Deed of Issue , at its sole discretion, carry out the voluntary early redemption of all IPCA Debentures, with the consequent cancellation

of such Debentures, by sending a direct communication to the Securitization Company, with a copy to the Trustee Agent of the CRA, under

the terms to be provided for in the Deed of Issue, at least five (5) Business Days prior to the date of redemption, carry out the full

early redemption of DI Debentures and/or Pre-fixed Debentures and/or IPCA Debentures, as the case may be ("Discretionary Voluntary

Early Redemption" and, when referred to together with the Voluntary Early Redemption by Tax Event and the Voluntary Early Redemption

by Corporate Event, "Voluntary Early Redemption”). The remaining terms and conditions of the Voluntary Early Redemption

will be set forth in the Deed of Issue;

| (ff) | Early Redemption Value of DI Debentures: In the case of Voluntary Early Redemption due to a Tax

Event of DI Debentures, the amount to be paid by the Company in relation to each of the DI Debentures will be equivalent to the Nominal

Value (or its balance) of the DI Debentures, plus the respective Remuneration of the DI Debentures, calculated pro rata temporis,

from the first Payment Date of the DI Debentures, or the immediately preceding Date of Payment of the Remuneration of the DI Debentures,

as the case may be, until the date of the effective Voluntary Early Redemption by Tax Event, without the addition of any premium, and

plus any Late Fees. In the case of the Voluntary Early Redemption of DI Debentures by Corporate Event, the amount to be paid by the Company

in relation to each of the DI Debentures will be equivalent to the Nominal Value of the DI Debentures (or the balance of the Nominal Value

of the DI Debentures, as the case may be) to be redeemed, plus (i) the DI Debentures Remuneration calculated pro rata temporis

from the first Payment Date or the date of payment of the previous DI Debentures Remuneration, as the case may be, until the date of the

effective total voluntary early redemption (exclusive); (ii) the Late Fees, if any, and (iii) the premium calculated according to the

formula to be provided for in the Deed of Issue. In the case of Discretionary Voluntary Early Redemption of DI Debentures, the amount

to be paid by the Company in relation to each of the DI Debentures will be equivalent to (i) the Nominal Value of the DI Debentures, as

the case may be, or the balance of the Nominal Value of the DI Debentures, as the case may be, plus the Remuneration of the DI Debentures,

as the case may be, calculated pro rata temporis from the first Payment |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 15 from 21 |

Date of the Debentures or the immediately

preceding Date of Payment of the Remuneration of the DI Debentures, as the case may be, and other applicable charges due and unpaid up

to the date of the Voluntary Early Redemption of the DI Debentures, as the case may be, plus (ii) premium between the date of the effective

Voluntary Early Redemption of the DI Debentures and the Maturity Date of the DI Debentures, calculated according to the formula to be

provided for in the Deed of Issue;

| (gg) | Early Redemption Value of the Pre-fixed Debentures: In the case of Voluntary Early Redemption due

to Tax Event of the Pre-fixed Debentures, the amount to be paid by the Company in relation to each of the Pre-fixed Debentures will be

equivalent to the Nominal Value (or its balance) of the Pre-fixed Debentures, plus the respective Remuneration of the Pre-fixed Debentures,

calculated pro rata temporis, from the first Payment Date of the Pre-fixed Debentures, or the immediately preceding Date of Payment

of the Remuneration of the Pre-fixed Debentures, as the case may be, until the date of the effective Voluntary Early Redemption by Tax

Event, without the addition of any premium, and plus any Late Charges. In the case of the Voluntary Early Redemption of the Pre-fixed

Debentures by Corporate Event, the amount to be paid by the Company in relation to each of the Pre-fixed Debentures will be equivalent

to the Nominal Value of the Pre-fixed Debentures plus: (i) the Remuneration of the Pre-fixed Debentures, calculated, pro rata temporis,

from the first Payment Date of the Pre-fixed Debentures or the Date of Payment of the Remuneration of the Pre-fixed Debentures immediately

preceding it, as the case may be, until the date of effective redemption (exclusive); and (ii) Late Fees; and (c) any pecuniary obligations

and other accruals related to the Fixed Debentures. In the case of Discretionary Voluntary Early Redemption of the Pre-fixed Debentures,

the amount to be paid by the Company in relation to each of the Pre-fixed Debentures will be equivalent to the amount indicated in item

(i) or item (ii) below, whichever is greater: (i) Nominal Value or balance of the Nominal Value of the Pre-fixed Debentures, as the case

may be, accrued: (a) the Remuneration of the Pre-fixed Debentures calculated, pro rata temporis, from the first Payment Date or

the last Payment Date of the Remuneration of the Pre-fixed Debentures, as the case may be, until the date of effective redemption (exclusive);

and (b) Late Fees, if any; or (ii) present value of the sum of the remaining amounts of amortization payment of the Nominal Value or balance

of the Nominal Value of the Pre-fixed |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 16 from 21 |

Debentures, as the case may be,

and the Remuneration of the Pre-fixed Debentures, using as a discount rate the DI Rate for 252 (two hundred and fifty-two) Business Days

based on the adjustment (interpolation) of the Pre x DI curve, to be disclosed by B3 on its website2,

corresponding to the vertex with the number of calendar days closest to the remaining duration of the Pre-fixed Debentures, to be calculated

at the close of the 3rd (third) Business Day immediately prior to the date of the Voluntary Early Redemption of the Pre-fixed Debentures,

calculated according to the formula to be provided for in the Deed of Issue, and added to the Late Fees;

| (hh) | IPCA Debentures Early Redemption Value: In the case of Voluntary Early Redemption due to a Tax

Event of the IPCA Debentures, the amount to be paid by the Company in relation to each of the IPCA Debentures will be equivalent to the

Nominal Value (or its balance) of the IPCA Debentures, plus the respective IPCA Debenture Remuneration, calculated pro rata temporis,

from the first Payment Date of the IPCA Debentures, or the immediately preceding IPCA Debentures Payment Date, as the case may be, until

the date of the effective Voluntary Early Redemption by Tax Event, without the addition of any premium, plus any Late Fees. In the case

of the Voluntary Early Redemption of IPCA Debentures by Corporate Event, the amount to be paid by the Company in relation to each of the

IPCA Debentures will be equivalent to the amount indicated in item (A) or item (B) below, whichever is greater: (A) Updated Nominal Value

of the IPCA Debentures plus: (a) the IPCA Debentures Remuneration, calculated, pro rata temporis, from the first Payment Date of

the IPCA Debentures or the immediately preceding Date of Payment of the Remuneration of the IPCA Debentures, as the case may be, until

the date of effective redemption (exclusive); (b) Late Fees, if any; and (c) any pecuniary obligations and other accruals related to the

IPCA Debentures; or (B) present value of the remaining installments of the amortization payment of the Updated Nominal Value of the IPCA

Debentures and the IPCA Debentures Remuneration, using as a discount rate the internal rate of return of the Treasury IPCA+ with semiannual

interest with an approximate duration equivalent to the remaining duration of the IPCA Debentures on the date of the Voluntary Early Redemption

("NTNB"), according to the indicative quotation published by ANBIMA on its website on the World Wide |

2 https://www.b3.com.br/pt_br/market-data-e-indices/servicos-de-dados/marketdata/consultas/mercado-de-derivativos/precos-referenciais/taxas-referenciais-bm-fbovespa/

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 17 from 21 |

Web (htttp://www.anbima.com.br)

calculated on the Business Day immediately prior to the date of the Voluntary Early Redemption of the IPCA Debentures, calculated according

to the formula to be provided for in the Deed of Issue, and added to the Default Charges, if any, to any pecuniary obligations and other

additions related to the IPCA Debentures. In the case of Voluntary Discretionary Early Redemption of IPCA Debentures, the amount to be

paid by the Company in relation to each of the IPCA Debentures will be equivalent to the amount indicated in item (i) or item (ii) below,

whichever is greater: (i) the Updated Nominal Value of the IPCA Debentures (or its respective balance), as the case may be; plus the IPCA

Debentures Remuneration, calculated pro rata temporis from the first IPCA Debentures Payment Date or the immediately preceding

IPCA Debentures Payment Payment Date, as the case may be, and any Late Fees; and (ii) the present value of the remaining installments

of the amortization payment of the Updated Face Value of the IPCA Debentures and the Remuneration of the IPCA Debentures, using as a discount

rate the coupon of the IPCA+ Treasury bond with semiannual interest (NTN-B), with a duration closer to the remaining duration of the IPCA

Debentures, according to the indicative quotation published by ANBIMA on its website on the World Wide Web (http://www.anbima.com.br)

calculated on the second Immediately Business Day prior to the date of the Voluntary Early Redemption of IPCA Debentures, calculated according

to the formula to be provided for in the Deed of Issue, plus any Late Fees;

| (ii) | Mandatory Early Redemption of Debentures: If, at any time during the term of the Debentures, the

Company ceases to be registered as a publicly-held company with the CVM, the Company shall carry out the mandatory total early redemption

of the Debentures ("Total Mandatory Early Redemption"). At the time of the Total Mandatory Early Redemption, the amount

due by the Company will be equivalent to: (i) the Nominal Value of the Debentures or the balance of the Nominal Value of the Debentures,

as the case may be, plus (ii) the Remuneration, calculated pro rata temporis from the First Date of Payment of the Debentures,

or the Date of Payment of the Remuneration of the Debentures immediately preceding it, as the case may be, until the date of the effective

Total Mandatory Early Redemption; and (iii) any Late Payments (if any). |

| (jj) | Early Redemption Offer of Debentures: The Company may, at any time, make an offer for full early

redemption of DI Debentures |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 18 from 21 |

and/or Pre-fixed Debentures and/or

IPCA Debentures, which may be carried out at a maximum interval of one (1) time each quarter, addressed to the Securitization Company

and the Fiduciary Agent of the CRA, and the Securitization Company may or may not accept the redemption of DI Debentures and/or Pre-fixed

Debentures and/or IPCA Debentures held by it, in accordance with the manifestation of adhesion to the Early Redemption Offer by the CRA

holders of the respective series, in the manner established in the Securitization Term ("Early Redemption Offer"). The

amount proposed for the early redemption of DI Debentures and/or Pre-fixed Debentures and/or IPCA Debentures, as applicable, which shall

be equivalent to (a) the Nominal Value of DI Debentures and/or Pre-fixed Debentures (or their balance), as the case may be, in the case

of DI Debentures and Pre-fixed Debentures; and/or (b) the Discounted Nominal Value of the IPCA Debentures (or their balance), in the case

of IPCA Debentures; plus (i) the respective Remuneration, calculated pro rata temporis, from the first Payment Date or the last

Remuneration Payment Date until the Early Redemption Date; (ii) one (1) additional Business Day of the respective Remuneration, in accordance

with the provisions of the Securitization Agreement, if the payment for the early redemption of the CRA is made by the Debenture Holder

to the CRA Holders of the respective Series on the day immediately following the payment by the Company to the Debenture Holder of the

amounts due for the Voluntary Early Redemption Offer of the Debentures; (iii) if other taxes, Late Charges, fines, penalties and contractual

and legal charges to be provided for in the Deed of Issuance or provided for in the applicable legislation are due, calculated, calculated

or incurred, as the case may be, until the respective date of payment; and (iv) the prize eventually offered, at the Company's sole discretion,

which may not be negative

| (kk) | Fines and Late Charges: In the event that the Company fails to make any payments of any amounts

due to the Securitization Company on the dates on which they are due under the terms to be provided for in the Deed of Issue, such payments

due and unpaid will continue to be subject to any remuneration levied on them and will also be subject to the following default charges

("Late Charges")."): (1) a conventional, irreducible and non-compensatory late payment fine of two percent (2%)

of the amount due and unpaid; and (2) non-compensatory default interest calculated at the rate of one percent (1%) per month, pro rata

temporis. The Late Payments established herein will be levied on the amount due and unpaid from the effective |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 19 from 21 |

non-compliance with the respective

obligation until the date of its effective payment, regardless of notice, notification or judicial or extrajudicial interpellation;

| (ll) | Place of Payment: The payments to which the Debentures are entitled shall be made by the Company

by means of credit to the Centralizing Account (to be defined in the Securitization Agreement), at least one (1) Business Day in advance

of the CRA payment dates. |

| (mm) | Early Maturity: Subject to the provisions of the Deed of Issue, the debt represented by the Deed

of Issue will be considered prematurely due and immediately payable, in the event of any of the hypotheses to be provided for in the Deed

of Issue. |

| (nn) | Expense Fund: The Securitization Company, as securitization company and issuer of the CRA, on behalf

of and on behalf of the Company, will retain the amount equivalent to the amount necessary for the payment of the Expenses related to

a period of twelve (12) months for the payment of expenses by the Securitization Company, from the payment resulting from the payment

of the Debentures of each series. as a securitization company and issuer of the CRAs of each series, within the scope of the Securitization

Transaction (as defined in the Deed of Issue), as provided for in the Securitization Term, and the Securitization Company shall annually

inform the Company, as of the Issue Date, of the amount necessary for the payment of expenses related to the immediately subsequent 12

(twelve) month period, so that, if necessary, the Company deposits such amount in the Expense Fund Account (as defined in the Deed of

Issue), in accordance with the procedures and amounts to be provided for in the Deed of Issue and in the Securitization Term; |

| (oo) | Possibility of Splitting: The splitting of the Nominal Value, Remuneration and other rights conferred

to debenture holders will not be allowed, pursuant to item IX of article 59 of the Brazilian Corporation Law; and |

| (pp) | Other Characteristics: The other characteristics of the Debentures will be described in the Deed

of Issue, in the Securitization Term and in other documents related to the Issuance and the Offering; |

| (ii) | authorize the Company, through its legal representatives, to execute any and all necessary documents and

perform any and all relevant acts to enable due |

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 20 from 21 |

compliance with the provisions of item

(i) above, including, but not limited to, the execution of the Deed of Issue, the CRA distribution agreement (including any amendments),

the Debentures Subscription Bulletin and any and all amendments to the aforementioned instruments; in addition to the other documents

necessary for the Issuance and the Offering, and the hiring and remuneration of all service providers inherent to the execution of the

Issuance and the Offering; and

| (iii) | ratify all acts already performed by the Company's legal representatives within the scope of the Issuance

and the Offering related to items (i) and (ii) above. |

6. Documents Filed

with the Company: Documents that support the resolutions taken by the members of the Board of Directors or that are related

to the information provided during the meeting are filed at the Company's headquarters.

Closing: As there was nothing further

to discuss, the meeting was closed, and these Minutes were drawn up by means of electronic processing, which, after being read and approved,

was signed by all the directors present.

I certify that the above extract is a faithful

transcription of an excerpt from the minutes drawn up in the Book, of the Minutes of Ordinary and Extraordinary Meetings of the Company's

Board of Directors.

São Paulo, May 20, 2024.

_______________________________

Bruno Machado Ferla

Secretary

| |

Minutes of the Extraordinary Meeting of the Board of Directors of BRF S.A. held on May 20, 2024. |

| Page 21 from 21 |

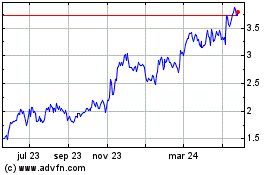

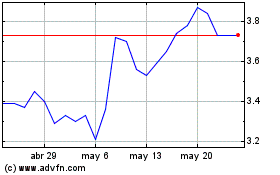

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024