FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated May

14, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: May 14, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 1629-2

MINUTES OF THE EXTRAORDINARY MEETING OF THE

BOARD OF DIRECTORS

HELD ON MAY 07, 2024

1.

Date, Time and Place: Held on May 07, 2024, at 2:00

p.m., at the office of BRF S.A.’s ("Company"), located at Avenida das Nações Unidas, nº 14.401, 25th

floor, Chácara Santo Antônio, CEP 04794-000, City of São Paulo, State of São Paulo.

2.

Call and Attendance: Call duly carried out under the

terms of Article 21 of the Company's Bylaws, with the presence of the totality of the members of the Board of Directors, namely, Mr. Marcos

Antonio Molina dos Santos, Ms. Marcia Aparecida Pascoal Marçal dos Santos, Mr. Sergio Agapito Lires Rial, Mr. Marcos Fernando Marçal

dos Santos, Mrs. Flávia Maria Bittencourt, Mr. Augusto Marques da Cruz Filho, Mr. Eduardo Augusto Rocha Pocetti, Mr. Márcio

Hamilton Ferreira and Mr. Pedro de Camargo Neto.

3.

Presiding Board: Chairman: Mr. Marcos Antonio

Molina dos Santos. Secretary: Mr. Bruno Machado Ferla.

4.

Agenda: (i) Analysis and Approval of the new share buyback

program issued by the Company.

5.

Resolutions: The members of the Company's Board of Directors,

by unanimous vote and without any reservations, reservations or restrictions, observing the provisions of CVM Resolution No. 77/2022,

in the form of item XI of article 23 of the Bylaws, approved the new program to buyback shares issued by the Company for maintenance in

treasury (“Share Buyback Program”), pursuant to the information specified in Annex I of these Minutes under the terms of Annex

G of CVM Resolution No. 80/22.

6.

Documents Filed at the Company: the documents analyzed

by the members of the Board of Directors or information presented during the meeting were filed at the Company’s head office.

7.

Closure: There being no other matters to be discussed,

the meeting was closed, during which time the present minutes were drawn up in summary form by electronic processing and, having been

read and found correct by all those present, were signed.

Page 1 from 5 Minutes of the Extraordinary Meeting of the Board of Directors held on May 07, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON MAY 07, 2024 |

I certify that the above extract

is a faithful copy of the minutes which are filed in the Book of Minutes of Ordinary and Extraordinary Meetings of the Company's Board

of Directors.

São Paulo, May 07, 2024.

Bruno Machado Ferla

Secretary

Page 2 from 5 Minutes of the Extraordinary Meeting of the Board of Directors held on May 07, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON MAY 07, 2024 |

Annex I to the Minutes of the Extraordinary

Meeting of the Board of Directors of BRF S.A.

held on May 07, 2023

Annex G to CVM Resolution No. 80/22

| 1. | Justify in detail the objective and expected economic effects of the

operation; |

The objective of the Company with the Share

Buyback Program: to maximize the generation of shareholder value, promoting the efficient allocation of available resources and the Company's

capital structure. The Company may use the shares to be acquired to remain in treasury, and subsequent sale or cancellation, as well as

to fulfill the obligations and commitments undertaken by the Company under the Stock Option Plan, approved by the Company’s Ordinary

and Extraordinary Shareholders' Meeting dated as of April 8, 2015 ("Stock Option Plan") and under the Restricted Stock Option

Plan, approved by the Company’s Ordinary and Extraordinary Shareholders’ Meeting dated as of April 8, 2015 and amended in

subsequent General Meetings ("Restricted Stock Option Plan");

The Company through the Board of Directors

understands that the acquisition of its own shares will not have an impact on its financial health.

| 2. | Inform the number of shares (i) in circulation and (ii) already held

in treasury; |

| (i) | Amount of free float shares, in accordance with

the definition provided under Article 1, sole paragraph, item I, of CVM Resolution No. 77/2022: 814,523,002 common shares (based on the

shareholding position as of April 30, 2024); |

(ii) Amount

of shares held in treasury on the date hereof: 17,817,179 common shares (based on the shareholding position as of April 30, 2024).

| 3. | Inform the number of shares that may be acquired or sold; |

Maximum amount of shares to be purchased: up

to 14 million common shares.

| 4. | Describe the main characteristics of the derivative instruments that

the company may use, if any; |

The Company will not use derivative instruments.

Page 3 from 5 Minutes of the Extraordinary Meeting of the Board of Directors held on May 07, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON MAY 07, 2024 |

| 5. | Describe, if any, any existing agreements or voting guidelines between

the company and the counterparty to the operations; |

Not applicable. The Company will carry out

the operations on the stock exchange, will have no knowledge of who the counterparties to the operations will be and does not have or

will have voting agreements or voting guidance with such counterparties.

| 6. | In the case of operations carried out outside organized securities

markets informs: |

| a. | The maximum (minimum) price at which shares will be acquired (disposed

of); it is |

| b. | if applicable, the reason that justify carrying out the operation at

prices more than 10% (ten percent) higher, in case of acquisition, or more than 10% (ten percent) lower, in the case of disposal, than

the average price, weighted by volume, in the 10 (ten) previous trading sessions; |

Not applicable, since all acquisitions will

be carried out on the stock exchange and at market price.

| 7. | Inform, if any, the impacts that the negotiation will have on the composition

of shareholding control or the administrative structure of the company; |

The Company through the Board of Directors

understands that the acquisition of its own shares will not have an impact on its shareholding structure.

| 8. | Identify the counterparties, if known, and, in the case of a party

related to the company, as defined by the accounting rules that deal with this matter, also provide the information required by article

9th of CVM Resolution No. 81, of March 29, 2022; |

As all operations will be carried out on the

stock exchange and at market prices, the Company is not aware of who the counterparties to the operations will be.

| 9. | Indicate the destination of the resources received, if applicable;

|

See item 1.

Page 4 from 5 Minutes of the Extraordinary Meeting of the Board of Directors held on May 07, 2024. |

BRF S.A. Publicly Held Company CNPJ 01.838.723/0001-27 NIRE 42.300.034.240 CVM 1629-2 MINUTES OF THE EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS HELD ON MAY 07, 2024 |

| 10.Indicate | the maximum period for the settlement of authorized operations; |

Term for the acquisition of the Company’s

shares under the Share Buyback Program: 18 months, starting on May 8, 2024 and ending on October 7, 2025, and the management shall be

responsible for defining the dates on which the repurchases will be effectively executed.

| 11.Identify | the institutions that will act as intermediates, if any; |

The financial institutions that will act as

intermediary are: XP INVESTIMENTOS CCTVM S/A., CNPJ: 02.332.886/0001-04, Av. Chedid Jafet, 75 – 30th floor, South Tower, São

Paulo, SP, Zip Code: 04551-065, BRADESCO S.A CORRETORA DE TITULOS E VALORES MOBILIARIOS., CNPJ: 61.855.045/0001-32, Av. Presidente Juscelino

Kubitscheck, 1309 – 11th floor, São Paulo, SP, Zip Code: 04543-011 or ITAÚ CORRETORA DE VALORES S.A., CNPJ 61.194.353/0001-64,

Avenida Brigadeiro Faria Lima, 3500 – 3th floor, São Paulo – SP, Zip Code: 04538-132.

| 12.Specify | the available resources to be used, in accordance with article 8th, § 1st,

of CVM Resolution No. 77, of March 29, 2022; |

The acquisition of shares under the Share Buyback

Program will be supported by the Company's capital reserve, as shown in the Company’s financial statements relating to the quarter

ending on March 31, 2024, corresponding to R$ 2,763,363,601.

| 13.Specify | the reasons why the members of the Board of Directors feel comfortable that the repurchase of shares

will not jeopardize the fulfillment of obligations assumed with creditors nor the payment of mandatory, fixed or minimum dividends. |

The Company, thought the Board of Directors,

understands that the acquisitions of shares issued by it will not have an impact on its shareholding composition, nor on its financial

health.

Page 5 from 5 Minutes of the Extraordinary Meeting of the Board of Directors held on May 07, 2024. |

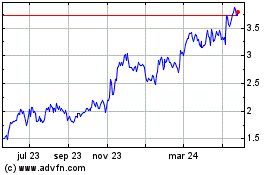

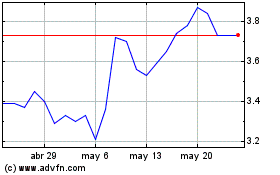

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024