Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

16 Octubre 2024 - 4:29PM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated October

16, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: October 16, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ 01.838.723/0001-27 NIRE 42.300.034.240

CVM 16269-2

ANNOUNCEMENT OF RELATED PARTY TRANSACTION

BRF S.A. ("BRF" or "Company") (B3:

BRFS3; NYSE: BRFS), in accordance with item XXXII of article 33 of CVM Resolution No. 80/2022, hereby informs its shareholders and the

market in general of the following related party transaction:

| Related Party Names |

BRF S.A. and Marfrig Global Foods

S.A. ("Marfrig"). |

| Relationship with the Company |

Marfrig is BRF's controlling shareholder. |

| Date of the Transaction |

October 16, 2024. |

| Object, Main Terms and Conditions of the Transaction |

BRF and Marfrig entered into an agreement for

the acquisition by BRF of up to R$350.000.000,00 (three hundred and fifty million reais) in ICMS credits generated in the state of São

Paulo (“ICMS/SP Credits”) held by Marfrig. The ICMS/SP Credits will be used by BRF to offset ICMS debts generated by the Company

in the State. Marfrig has already transferred to BRF ICMS/SP Credits in the amount of R$ 123.000.000,00 (one hundred and twenty-three

million reais). The payment will be made in installments following the use of such ICMS/SP Credits by BRF. The first payment will be made

on October 31, 2024 by BRF to Marfrig in the amount of R$

20.000.000,00 (twenty million reais). |

| Reasons why the Company's management deems the transaction to be equitable |

The Company's management considers that the acquisition

of ICMS/SP Credits is equitable and in the interest of BRF, since (i) the amount of the discount to be paid by the Company in relation

to the ICMS/SP Credits was fixed taking into account the volume of credits made available to BRF and is comparable to negotiations between

BRF and other companies that generate ICMS/SP Credits; and (ii) the execution of the transaction with Marfrig allows the Company to immediately

make use of the ICMS/SP Credits acquired, thus promoting the reduction of the amount of cash to be spent monthly

by BRF. |

|

Eventual involvement of

the counterparty, its partners or administrators in the Company's decision process regarding the Transaction or negotiation of the Transaction

as representatives of the Company, describing these

involvements |

There was no participation by Marfrig or its managers in BRF's decision- making regarding the acquisition of ICMS/SP Credits, nor did such persons participate in the negotiation of the transaction as representatives of BRF. |

São Paulo, October 16, 2024.

Fabio Luis Mendes Mariano

Chief Financial and Investor Relations Officer

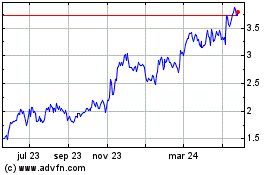

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

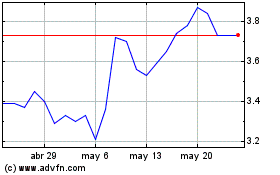

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025