Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 Noviembre 2024 - 10:06AM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated November

20, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: November 20, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

ANNOUNCEMENT TO THE MARKET

BRF S.A. (“BRF” or “Company”)

(B3: BRFS3; NYSE: BRFS), pursuant to CVM Resolution No. 44, of August 23, 2021, informs its shareholders and the market in general that

BRF GmbH, a wholly owned subsidiary of the Company, has signed a binding agreement with Henan Best Foods Co. Ltd., a subsidiary of the

OSI Group, a U.S.-based company specializing in food processing, to acquire a processed foods factory in Henan Province, China (the "Factory").

Completion is subject to the fulfillment of applicable conditions precedent for transactions of this nature, including regulatory approvals

and corporate restructuring of the assets that comprise the Factory. The total value of the transaction is USD 43 million.

Built in 2013, the Factory has two food processing

lines with an annual capacity of 28,000 tons and the potential to expand to two additional lines. After the expansion, which is expected

to require an investment of approximately USD 36 million, production is projected to reach 60,000 tons per year. Additionally, it is estimated

that approximately 850 new jobs will be created at the Factory.

The Company will keep its shareholders and the

market in general duly informed about any relevant matter related to the present announcement.

São Paulo, November 20, 2024

Fabio Luis Mendes Mariano

Chief Financial and Investor Relations Officer

BRF S.A.

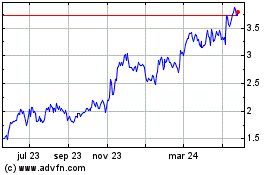

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

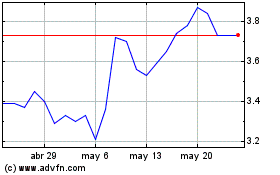

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025