Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

01 Agosto 2023 - 5:02AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-265958

Free Writing Prospectus dated July 31, 2023

(to Prospectus dated July 1, 2022 and

Preliminary Prospectus Supplement dated July 31, 2023)

Pricing Term Sheet

B.A.T CAPITAL CORPORATION

$1,000,000,000 6.343% Notes due 2030

$1,250,000,000 6.421% Notes due 2033

$750,000,000 7.079% Notes due 2043

$1,000,000,000 7.081% Notes due 2053

B.A.T. INTERNATIONAL FINANCE P.L.C.

$1,000,000,000 5.931% Notes due 2029

July 31, 2023

| | | | | | | | | | | | | | | | | |

Issuers: | BATCAP Notes (as defined below): B.A.T Capital Corporation (“BATCAP”) BATIF Notes (as defined below): B.A.T. International Finance p.l.c. (“BATIF” and, together with BATCAP, the “Issuers” and each, an “Issuer”) |

| |

Guarantors: | BATCAP Notes: British American Tobacco p.l.c., BATIF, B.A.T. Netherlands Finance B.V. and, unless its guarantee is released in accordance with the indenture governing the BATCAP Notes, Reynolds American Inc. BATIF Notes: British American Tobacco p.l.c., BATCAP, B.A.T. Netherlands Finance B.V. and, unless its guarantee is released in accordance with the indenture governing the BATIF Notes, Reynolds American Inc. |

| |

| | | | | | | | | | | | | | | | | |

Security Title: | BATCAP: $1,000,000,000 6.343% Notes due 2030 (the “2030 BATCAP Notes”) $1,250,000,000 6.421% Notes due 2033 (the “2033 BATCAP Notes”) $750,000,000 7.079% Notes due 2043 (the “2043 BATCAP Notes”) $1,000,000,000 7.081% Notes due 2053 (the “2053 BATCAP Notes” and, together with the 2030 BATCAP Notes, the 2033 BATCAP Notes and the 2043 BATCAP Notes, the “BATCAP Notes”) |

| | | | | |

| BATIF: $1,000,000,000 5.931% Notes due 2029 (the “BATIF Notes”; and the BATIF Notes together with the BATCAP Notes, the “Notes”) |

| |

Ranking: | Senior and Unsubordinated |

| |

Form: | SEC-Registered Global Notes |

| |

Principal Amount: | $1,000,000,000 for the 2030 BATCAP Notes $1,250,000,000 for the 2033 BATCAP Notes $750,000,000 for the 2043 BATCAP Notes $1,000,000,000 for the 2053 BATCAP Notes $1,000,000,000 for the BATIF Notes |

| |

Maturity Date: | August 2, 2030 for the 2030 BATCAP Notes August 2, 2033 for the 2033 BATCAP Notes August 2, 2043 for the 2043 BATCAP Notes August 2, 2053 for the 2053 BATCAP Notes February 2, 2029 for the BATIF Notes |

| |

Interest Rate: | 6.343% per annum for the 2030 BATCAP Notes 6.421% per annum for the 2033 BATCAP Notes 7.079% per annum for the 2043 BATCAP Notes 7.081% per annum for the 2053 BATCAP Notes 5.931% per annum for the BATIF Notes |

| |

| | | | | | | | | | | | | | | | | |

Benchmark Treasury: | 4.000% due July 31, 2030 for the 2030 BATCAP Notes 3.375% due May 15, 2033 for the 2033 BATCAP Notes 3.875% due May 15, 2043 for the 2043 BATCAP Notes 3.625% due February 15, 2053 for the 2053 BATCAP Notes 4.125% due July 31, 2028 for the BATIF Notes |

| |

Benchmark Treasury Price and Yield: | 99-14 / 4.093% for the 2030 BATCAP Notes 95-06+ / 3.971% for the 2033 BATCAP Notes 95-09 / 4.229% for the 2043 BATCAP Notes 93-01 / 4.031% for the 2053 BATCAP Notes 99-24 / 4.181% for the BATIF Notes |

| |

Spread to Benchmark Treasury: | +225 bps for the 2030 BATCAP Notes +245 bps for the 2033 BATCAP Notes +285 bps for the 2043 BATCAP Notes +305 bps for the 2053 BATCAP Notes +175 bps for the BATIF Notes |

| |

Yield to Maturity: | 6.343% for the 2030 BATCAP Notes 6.421% for the 2033 BATCAP Notes 7.079% for the 2043 BATCAP Note 7.081% for the 2053 BATCAP Notes 5.931% for the BATIF Notes |

| |

Day Count Convention: | 30/360 (or, in the case of an incomplete month, the number of days elapsed) |

| |

Business Day Convention: | Following, Unadjusted |

| |

Price to Public: | 100.000% for the 2030 BATCAP Notes 100.000% for the 2033 BATCAP Notes 100.000% for the 2043 BATCAP Notes 100.000% for the 2053 BATCAP Notes 100.000% for the BATIF Notes |

| |

Net Proceeds to Issuers (before Expenses): | $996,000,000 for the 2030 BATCAP Notes $1,244,375,000 for the 2033 BATCAP Notes $744,375,000 for the 2043 BATCAP Notes $991,250,000 for the 2053 BATCAP Notes $996,500,000 for the BATIF Notes |

| |

Interest Payment Dates: | Semi-annually in arrear on August 2 and February 2 of each year, commencing on February 2, 2024 |

| |

| | | | | | | | | | | | | | | | | |

Interest Payment Record Dates: | The close of business on the fifteenth calendar day preceding each Interest Payment Date, whether or not such day is a Business Day |

| | | | | |

Optional Redemption: | Each Issuer may redeem a series of Notes issued by it, in whole or in part, at its option, at any time and from time to time before the applicable “Par Call Date” (as set out in the table below) at a redemption price equal to the greater of (x) 100% of the principal amount of the series of Notes to be redeemed and (y) the sum of the present values of the applicable Remaining Scheduled Payments (as defined in the Prospectus) discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months or, in the case of an incomplete month, the number of days elapsed) at the Treasury Rate (as defined in the Prospectus), plus the applicable Make-Whole Spread (as set out in the table below) together with accrued and unpaid interest on the principal amount of the series of Notes to be redeemed to, but excluding, the date of redemption. Each Issuer may redeem the relevant series of Notes issued by it on or after the applicable Par Call Date at a redemption price equal to 100% of the principal amount of the series of Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. |

| |

| Series | | Par Call Date | | Make-Whole Spread |

| 2030 BATCAP Notes | | June 2, 2030 | | 35 basis points |

| 2033 BATCAP Notes | | May 2, 2033 | | 40 basis points |

| 2043 BATCAP Notes | | February 2, 2043 | | 45 basis points |

| 2053 BATCAP Notes | | February 2, 2053 | | 50 basis points |

| BATIF Notes | | January 2, 2029 | | 30 basis points |

| | | | | |

Trade Date: | July 31, 2023 |

| | | | | |

Expected Settlement Date: | August 2, 2023 (T+2) |

| | | | | |

Expected Ratings: | Baa2 (Moody’s) / BBB+ (S&P) |

| | | | | |

| | | | | | | | | | | | | | | | | |

CUSIP: | 054989 AA6 for the 2030 BATCAP Notes 054989 AB4 for the 2033 BATCAP Notes 054989 AC2 for the 2043 BATCAP Notes 054989 AD0 for the 2053 BATCAP Notes 05530Q AQ3 for the BATIF Notes |

| | | | | |

ISIN: | US054989AA67 for the 2030 BATCAP Notes US054989AB41 for the 2033 BATCAP Notes US054989AC24 for the 2043 BATCAP Notes US054989AD07 for the 2053 BATCAP Notes US05530QAQ38 for the BATIF Notes |

| | | | | |

Governing Law: | State of New York |

| | | | | |

Listing and Trading: | Application will be made to list each series of the Notes on the New York Stock Exchange. No assurance can be given that such application will be approved or that any of the Notes will be listed and, if listed, that such Notes will remain listed for the entire term of such Notes. Currently there is no active trading market for the Notes. |

| | | | | |

Joint Book-Running Managers: | BofA Securities, Inc. Deutsche Bank Securities Inc. Goldman Sachs & Co. LLC Santander US Capital Markets LLC Wells Fargo Securities, LLC |

| | | | | |

Bookrunners: | Citigroup Global Markets Inc. Commerz Markets LLC Mizuho Securities USA LLC SMBC Nikko Securities America, Inc. |

| | | | | |

| Co-managers: | Bank of China Limited, London Branch Barclays Capital Inc. BBVA Securities Inc. HSBC Securities (USA) Inc. Lloyds Securities Inc. NatWest Markets Securities Inc. Standard Chartered Bank |

Note: A security rating is not a recommendation to buy, sell or hold securities and should be evaluated independently of any other rating. The rating is subject to revision or withdrawal at any time by the assigning rating organization.

It is expected that delivery of the Notes will be made against payment therefor on or about August 2, 2023, which will be two business days (as such term is used for purposes of Rule 15c6-1 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”)) following the date hereof (such settlement cycle being referred to as “T+2”).

Bank of China Limited, London Branch and Standard Chartered Bank will not effect any offers or sales of any Notes in the United States unless it is through one or more U.S. registered broker-dealers as permitted by the Financial Industry Regulatory Authority.

The Issuers and the Guarantors have filed a registration statement (including a Prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the Prospectus in that registration statement and other documents the Issuers and the Guarantors have filed with the Securities and Exchange Commission (the “SEC”) for more complete information about the Issuers, the Guarantors and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any underwriter or any dealer participating in the offering of the Notes will arrange to send you the Prospectus if you request it by calling BofA Securities, Inc. toll-free at 1-800-294-1322, Deutsche Bank Securities Inc. toll free at 1-800-503-4611, Goldman Sachs & Co. LLC toll-free at 1-866-471-2526, Santander US Capital Markets LLC toll-free at 1-855-403-3636 and Wells Fargo Securities, LLC toll-free at 1-800-645-3751.

This Pricing Term Sheet is only being distributed to and is only directed at persons who are located outside the United Kingdom (the “UK”) or persons who are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the “Order”), (ii) persons falling within Article 49(2)(a) to (d) of the Order or (iii) persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) in connection with the issue or sale of any Notes may lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). Accordingly, by accepting delivery of this Pricing Term Sheet, the recipient warrants and acknowledges that it is such a relevant person. The Notes are available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such Notes will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents. No part of this Pricing Term Sheet should be published, reproduced, distributed or otherwise made available in whole or in part to any other person without the prior written consent of the Issuers. The Notes are not being offered or sold to any person in the United Kingdom, except in circumstances which will not result in an offer of securities to the public in the United Kingdom within the meaning of Part VI of the FSMA.

Prohibition of sales to European Economic Area (“EEA”) retail investors: The Notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the EEA. For these purposes, a “retail

investor” means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”), or (ii) a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

Prohibition of sales to UK retail investors: The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to, any retail investor in the UK. For these purposes, a “retail investor” means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended, the “EUWA”); (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of UK domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of UK domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

UK MiFIR product governance / Professional investors and Eligible Counterparties only target market: Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook, and professional clients, as defined in Regulation (EU) No. 600/2014 as it forms part of UK domestic law by virtue of the EUWA (as amended, “UK MiFIR”); and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturer’s target market assessment; however, a distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate distribution channels.

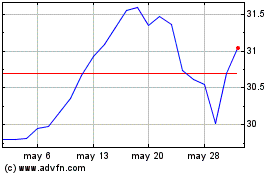

British American Tobacco (NYSE:BTI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

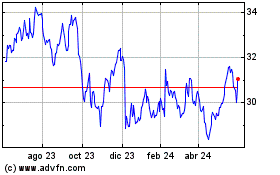

British American Tobacco (NYSE:BTI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024