Blackstone Real Estate Sells Turtle Bay Resort

29 Mayo 2024 - 6:03AM

Business Wire

Inclusive of recent land sale, sale proceeds

total $768 million

Blackstone Real Estate today announced that it has reached an

agreement to sell Turtle Bay Resort for $725 million. Blackstone

purchased the hotel in 2018 for $332 million and subsequently

invested significant capital in renovations.

Rob Harper, Head of Blackstone Real Estate Asset Management

Americas, said, “This transaction is an excellent outcome for our

investors and a testament to Blackstone’s ability, including

through the pandemic, to transform iconic, luxury hospitality

assets. The team executed an ambitious business plan, investing

significant capital to reposition the resort for long-term success

while also adding high-quality jobs on the North Shore.”

With 450 rooms on 1,300 acres along the North Shore of O’ahu,

Turtle Bay Resort is one of the area’s largest employers and boasts

a variety of top-tier amenities. Under Blackstone’s ownership, the

Resort recently benefitted from a transformative renovation,

including the guestrooms and bungalows, lobby, pools, restaurants,

retail, meeting space, spa, a new club lounge, building systems, as

well as an updated exterior and arrival experience.

The sale is expected to close in the third quarter of 2024.

In a separate transaction, Areté Collective, a vertically

integrated development company known for sustainable development

practices that prioritize climate resilience, announced the closing

of a transaction to purchase 65 acres of land at Turtle Bay on

O‘ahu’s North Shore.

Inclusive of the recent land sale to Arete and following the

close of the property sale transaction, sale proceeds generated on

the hotel by Blackstone will total $768 million.

Eastdil Secured, Jones Lang LaSalle and Sumitomo Mitsui Banking

Corporation (SMBC) are acting as Blackstone’s financial advisors,

and Simpson Thacher & Bartlett LLP is serving as Blackstone’s

legal counsel.

About Blackstone Real Estate

Blackstone is a global leader in real estate investing.

Blackstone’s real estate business was founded in 1991 and has US

$339 billion of investor capital under management. Blackstone is

the largest owner of commercial real estate globally, owning and

operating assets across every major geography and sector, including

logistics, residential, office, hospitality and retail. Our

opportunistic funds seek to acquire undermanaged, well-located

assets across the world. Blackstone’s Core+ business invests in

substantially stabilized real estate assets globally, through both

institutional strategies and strategies tailored for income-focused

individual investors including Blackstone Real Estate Income Trust,

Inc. (BREIT), a U.S. non-listed REIT, and Blackstone’s European

yield-oriented strategy. Blackstone Real Estate also operates one

of the leading global real estate debt businesses, providing

comprehensive financing solutions across the capital structure and

risk spectrum, including management of Blackstone Mortgage Trust

(NYSE: BXMT).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240529973758/en/

Jeffrey Kauth (212) 583-5395 Jeffrey.Kauth@Blackstone.com

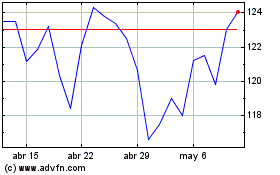

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024