UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

| Crown Castle Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The

following is a letter Crown Castle Inc. distributed to shareholders on or about May 13, 2024.

VOTE

TODAY “FOR” ONLY THE COMPANY'S 12 DIRECTOR NOMINEES May 13, 2024 Dear Fellow Shareholders, With this year’s

Annual Meeting just days away, you are being asked to make an important decision that will affect the future of the Company. Protect

the value of your investment by voting today “FOR” ONLY Crown Castle’s 12 highly qualified director nominees –

P. Robert Bartolo, Cindy Christy, Ari Q. Fitzgerald, Jason Genrich, Andrea J. Goldsmith, Tammy K. Jones, Kevin T. Kabat, Anthony J. Melone,

Sunit S. Patel, Bradley E. Singer, Kevin A. Stephens and Matthew Thornton, III (collectively, "Company Nominees") – on

the WHITE proxy card or voting instruction form. The Crown Castle Board has taken Decisive Actions to Transform the Company and

Maximize Shareholder Value The Crown Castle Board has been successfully executing a clear plan of transformative, value-enhancing initiatives

LEADERSHIP ACTION DESCRIPTION STATUS 1 Newly Appointed Industry Veteran as CEO Following a robust search process (including consultation

with leading executive search firm Russell Reynolds), the Board appointed as CEO tower industry veteran Steven Moskowitz, who has over

25 years of experience leading, growing, and advising wireless infrastructure companies and a proven track record of value creation.

COMPLETED 2 Review of Fiber and Small Cell Businesses to Unlock Value The Board has been executing a comprehensive strategic and operating

review of the fiber and small cell business. The operating review is now complete, and the Board is in Phase 2 of the strategic review.

The Company has recently engaged with multiple parties expressing interest in a potential transaction involving all or part of our Fiber

segment. These discussions are ongoing, and newly appointed CEO Steven Moskowitz is concurrently reviewing work carried out to date by

the Board. ~ IN PROCESS (PHASE 2) 3 Strengthened the Board of Directors The Board’s composition reflects its thoughtful refreshment

process, with 7 of our 11 current independent directors being added since 2020. The Board’s rigorous selection criteria is geared

toward safeguarding value, with these recent director additions providing: Tower and fiber expertise, significant leadership records

in highly regulated industries, real estate and REIT insight, public company CEO and CFO experience, and a shareholder viewpoint ü

ONGOING 4 Utilizing our Leadership Position in Towers to Maximize Shareholder Value Our new CEO, Steven Moskowitz, is laser focused on

seeking incremental ways (e.g., driving additional lease-up, maximizing operating efficiency, and managing cash prudently) to build upon

our leadership position in towers to drive cash flows, which will ultimately enhance long-term value for our shareholders. ~ IN PROCESS

Ted

Miller Is Attempting to Execute his Self- Serving Agenda at Crown Castle and Jeopardize our Clear Progress Underway The Board is actively

engaged in overseeing the execution of our strategy to deliver value for our shareholders. We believe Ted Miller’s self-interested

agenda will disrupt the clear progress already underway. The Board evaluated all nominees using its standard selection process; ultimately,

the Board unanimously determined that Boots Capital’s candidates were not the right choice because: Boots Capital’s director

nominees offer nothing new to the Board, and they do not possess overall additive experience or skillsets not already covered the Company's

director nominees X Mr. Miller’s tenure as Chair concluded unsuccessfully, with a stock price of ~$1 per share at his departure

20+ years ago; Crown Castle has evolved since his time and continues to adapt for today’s dynamic operating environment X 3 of

4 Boots Capital director nominees have never served on a U.S. public company board X Boots Capital's nominees lack recent and relevant

operational experience in tower, fiber and telecoms businesses (particularly in light of changes to industry dynamics, the Company’s

geographic focus, and the broader customer landscape) X Boots Capital's nominees demand significant corporate influence (~33% of the

Board for Boots Capital affiliates including Board or executive leadership) despite disproportionate ownership (<0.2% of TSO) –

including roles for family members (~17% of Board) X Mr. Miller’s initial demand to be named Executive Chair posed governance concerns

by merging roles of Board Chair and executive officer, which Crown Castle has kept separate for over 20 years, in line with governance

best practicesX 3 of 4 Boots Capital director nominees either already exceed Crown Castle’s mandatory director retirement age of

72 or are approaching it

Your

Vote Matters — Vote the WHITE Proxy Card or Voting Instruction Form Today Crown Castle’s May 22nd Annual Meeting is fast

approaching and it is extremely important that you vote as soon as possible, no matter how many shares you own. We urge you to use the

enclosed WHITE proxy card or voting instruction form and vote “FOR” ONLY the 12 Company Nominees proposed by the Board. Please

cast your vote in advance of the 2024 Annual Meeting (whether or not you plan to attend the meeting) by marking, signing, dating, and

returning the enclosed WHITE proxy card or voting instruction form by mail in the postage-paid envelope provided, or by voting via Internet

or telephone following instructions on your WHITE proxy card or voting instruction form. Please note that your WHITE proxy card or voting

instruction form has more names on it than the 12 seats that are up for election, pursuant to the requirement that our proxy card list

Boots Capital’s nominees in addition to the Company Nominees. Shareholders can vote “FOR” less than 12 nominees at

the 2024 Annual Meeting but cannot vote “FOR” more than 12 nominees. If you have already voted using a prior proxy card or

voting instruction form listing 13 Company Nominees, your votes for all director nominees and other proposals will not be counted. Accordingly,

you are urged to re-vote using the WHITE proxy card or voting instruction form listing 12 Company Nominees to ensure that your vote is

counted. You may receive solicitation materials from Mr. Miller, including an opposition proxy statement and gold proxy card. The Board

does NOT endorse Boots Capital’s nominees or Boots Capital’s By-Laws Proposal and unanimously recommends that shareholders

discard any proxy materials from Boots Capital. If you have already submitted a gold proxy card, you can revoke such proxy and vote for

the Company Nominees and on the other matters to be voted on at the 2024 Annual Meeting in one of the ways outlined above. Only your

latest validly executed proxy card or voting instruction form will count and you can revoke any proxy at any time prior to the 2024 Annual

Meeting as described in the Company’s proxy statement. Please mark your WHITE proxy card or voting instruction form carefully and

vote "FOR" ONLY the 12 Company Nominees. Thank you for your continued support. Sincerely, The Crown Castle Board of Directors

If

you have any questions or require any assistance with voting your shares, please call the Company’s proxy solicitor: INNISFREE

M&A INCORPORATED at (877) 717-3904 (toll-free from the United States and Canada) or +1 (412) 232-3651 (from other locations)CAUTIONARY

LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS This letter contains forward-looking statements for purposes of the safe harbor provisions

of The Private Securities Litigation Reform Act of 1995. Statements that are not historical facts are hereby identified as forward-looking

statements. In addition, words such as “estimate,” “anticipate,” “project,” “plan,” “intend,”

“believe,” “expect,” “likely,” “predicted,” “positioned,” “continue,”

“target,” “seek,” “focus” and any variations of these words and similar expressions are intended

to identify forward-looking statements. Examples of forward-looking statements include (1) statements and expectations regarding the

process and outcomes of Company’s Fiber Review Committee, including that it will help enhance and unlock shareholder value, (2)

that the actions set forth in this letter best position the Company for long term success, including our Board’s regular evaluation

of all paths to enhance shareholder value, (3) that the Company will benefit from the experience and insights of the directors and the

new CEO, and (4) that the Company will identify the best path forward to capitalize on significant opportunities for growth in our industry.

Such forward-looking statements should, therefore, be considered in light of various risks, uncertainties and assumptions, including

prevailing market conditions, risk factors described in “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 and other factors. Should one or more of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those expected. Unless legally required, the Company undertakes

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Our filings with the SEC are available through the SEC website at www.sec.gov or through our investor relations website at investor.crowncastle.com.

We use our investor relations website to disclose information about us that may be deemed to be material. We encourage investors, the

media and others interested in us to visit our investor relations website from time to time to review up-to-date information or to sign

up for e-mail alerts to be notified when new or updated information is posted on the site. Important Stockholder Information The Company

filed a definitive proxy statement and a WHITE proxy card on April 11, 2024, as well as a proxy supplement and revised WHITE proxy card

on April 22, 2024, with the SEC in connection with its solicitation of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS

ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND THE PROXY SUPPLEMENT, THE ACCOMPANYING REVISED WHITE PROXY CARD, AND

ANY AMENDMENTS AND SUPPLEMENTS TO THESE DOCUMENTS WHEN THEY BECOME AVAILABLE, AS THEY CONTAIN IMPORTANT INFORMATION. Stockholders may

obtain the proxy statement and the proxy supplement, any amendments or supplements to these documents and other documents, as and when

they become available, without charge from the SEC’s website at www.sec.gov. Participant Information The Company, its directors,

director nominees, certain of its officers, and other employees are or will be “participants” (as defined in Section 14(a)

of the U.S. Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s stockholders in connection

with the matters to be considered at the 2024 Annual Meeting. The identity, their direct or indirect interests (by security holdings

or otherwise), and other information relating to the participants is available in the Company’s definitive proxy statement on Schedule

14A filed with the SEC on April 11, 2024, in the section entitled “Beneficial Ownership of Common Stock” (on page 90) and

Appendix C (on page C-1). To the extent the holdings by the “participants” in the solicitation reported in the Company’s

definitive proxy statement have changed, such changes have been or will be reflected on “Statements of Change in Ownership”

on Forms 3, 4 or 5 filed with the SEC (where applicable). All these documents are or will be available free of charge at the SEC’s

website at www.sec.gov. LEARN MORE AT www.VoteCrownCastle.com

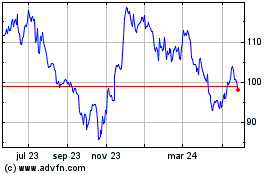

Crown Castle (NYSE:CCI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

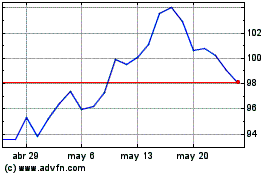

Crown Castle (NYSE:CCI)

Gráfica de Acción Histórica

De May 2023 a May 2024