Crown Castle Announces Proposed Offering of Senior Notes

01 Agosto 2024 - 7:26AM

Crown Castle Inc. (NYSE: CCI) (“Crown Castle”) announced today that

it is commencing a public offering of one or more series of senior

notes, subject to market and other conditions. The notes will be

issued by Crown Castle. Crown Castle intends to use the net

proceeds from this offering to repay a portion of the outstanding

indebtedness under its commercial paper program and pay related

fees and expenses.

BofA Securities, Inc., BNP Paribas Securities

Corp., MUFG Securities Americas Inc., PNC Capital Markets LLC, RBC

Capital Markets, LLC and Truist Securities, Inc. are the joint

book-running managers of the offering.

The offering is being made pursuant to Crown

Castle’s existing effective shelf registration statement filed with

the Securities and Exchange Commission (“SEC”). The

offering will be made only by means of a prospectus supplement and

the accompanying base prospectus, copies of which may be obtained

by contacting any joint book-running manager using the information

provided below. An electronic copy of the preliminary prospectus

supplement, together with the accompanying prospectus, is also

available on the SEC’s website, www.sec.gov.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

CAUTIONARY LANGUAGE REGARDING

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements that are based on Crown Castle management’s current

expectations. Such statements include plans, projections and

estimates regarding the proposed offering, including the use of

proceeds therefrom. Such forward-looking statements are subject to

certain risks, uncertainties and assumptions, including prevailing

market conditions and other factors. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those expected. More information about potential risk factors

that could affect Crown Castle and its results is included in Crown

Castle’s filings with the SEC. The term “including,” and any

variation thereof, means “including, without limitation.”

ABOUT CROWN CASTLE

Crown Castle owns, operates and leases more than

40,000 cell towers and approximately 90,000 route miles of fiber

supporting small cells and fiber solutions across every major U.S.

market. This nationwide portfolio of communications infrastructure

connects cities and communities to essential data, technology and

wireless service – bringing information, ideas and innovations to

the people and businesses that need them.

JOINT BOOK-RUNNING MANAGERS CONTACT

INFORMATION

| BofA Securities,

Inc.NC1-022-02-25201 North Tryon StreetCharlotte, North

Carolina 28255Attention: Prospectus Department Email:

dg.prospectus_requests@bofa.com |

BNP Paribas Securities Corp.787

Seventh Avenue, 3rd FloorNew York, New York 10019 Attention: Debt

SyndicatePhone: 1-800-854-5674 |

| MUFG Securities Americas Inc.1221

Avenue of the Americas, 6th Floor New York, New York 10020

Attention: Capital Markets Group Facsimile: 1-646-434-3455 |

PNC Capital Markets LLC300 Fifth

Avenue, 10th FloorPittsburgh, Pennsylvania 15222Toll Free:

1-855-881-0697 |

| RBC Capital Markets,

LLCBrookfield Place200 Vesey Street, 8th FloorNew York, New York

10281Attention: Syndicate OperationsEmail:

rbcnyfixedincomeprospectus@rbccm.comToll Free: 1-866-375-6829Fax:

1-212-428-6308 |

Truist Securities, Inc.50 Hudson

Yards, 70th FloorNew York, New York 10001Toll Free:

1-800-685-4786 |

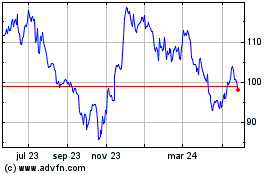

Crown Castle (NYSE:CCI)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

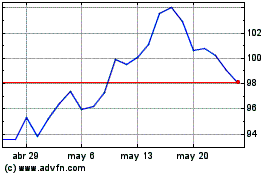

Crown Castle (NYSE:CCI)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024