Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs”) today

announced that it has received regulatory and program approvals

under the Investment Canada Act and Strategic Innovation Fund, the

final approvals needed to complete Cliffs’ pending acquisition of

Stelco Holdings Inc. (“Stelco”). With these approvals in hand, the

acquisition can move to closing. The transaction is currently

scheduled to close on November 1, 2024.

About Cleveland-Cliffs Inc.

Cleveland-Cliffs is a leading North America-based steel producer

with focus on value-added sheet products, particularly for the

automotive industry. The Company is vertically integrated from the

mining of iron ore, production of pellets and direct reduced iron,

and processing of ferrous scrap through primary steelmaking and

downstream finishing, stamping, tooling, and tubing. Headquartered

in Cleveland, Ohio, Cleveland-Cliffs employs approximately 28,000

people across its operations in the United States and Canada.

Forward-Looking Statements

This release contains statements that constitute

"forward-looking statements" within the meaning of the federal

securities laws. All statements other than historical facts,

including, without limitation, statements regarding our current

expectations, estimates and projections about our industry, our

businesses or the proposed transaction with Stelco, are

forward-looking statements. We caution investors that any

forward-looking statements are subject to risks and uncertainties

that may cause actual results and future trends to differ

materially from those matters expressed in or implied by such

forward-looking statements. Investors are cautioned not to place

undue reliance on forward-looking statements. Among the risks and

uncertainties that could cause actual results to differ from those

described in forward-looking statements are the following:

continued volatility of steel, iron ore and scrap metal market

prices, which directly and indirectly impact the prices of the

products that we sell to our customers; uncertainties associated

with the highly competitive and cyclical steel industry and our

reliance on the demand for steel from the automotive industry;

potential weaknesses and uncertainties in global economic

conditions, excess global steelmaking capacity, oversupply of iron

ore, prevalence of steel imports and reduced market demand; severe

financial hardship, bankruptcy, temporary or permanent shutdowns or

operational challenges of one or more of our major customers, key

suppliers or contractors, which, among other adverse effects, could

disrupt our operations or lead to reduced demand for our products,

increased difficulty collecting receivables, and customers and/or

suppliers asserting force majeure or other reasons for not

performing their contractual obligations to us; risks related to

U.S. government actions with respect to Section 232 of the Trade

Expansion Act of 1962 (as amended by the Trade Act of 1974), the

United States-Mexico-Canada Agreement and/or other trade

agreements, tariffs, treaties or policies, as well as the

uncertainty of obtaining and maintaining effective antidumping and

countervailing duty orders to counteract the harmful effects of

unfairly traded imports; impacts of existing and increasing

governmental regulation, including potential environmental

regulations relating to climate change and carbon emissions, and

related costs and liabilities, including failure to receive or

maintain required operating and environmental permits, approvals,

modifications or other authorizations of, or from, any governmental

or regulatory authority and costs related to implementing

improvements to ensure compliance with regulatory changes,

including potential financial assurance requirements, and

reclamation and remediation obligations; potential impacts to the

environment or exposure to hazardous substances resulting from our

operations; our ability to maintain adequate liquidity, our level

of indebtedness and the availability of capital could limit our

financial flexibility and cash flow necessary to fund working

capital, planned capital expenditures, acquisitions, and other

general corporate purposes or ongoing needs of our business, or to

repurchase our common shares; our ability to reduce our

indebtedness or return capital to shareholders within the currently

expected timeframes or at all; adverse changes in credit ratings,

interest rates, foreign currency rates and tax laws; the outcome

of, and costs incurred in connection with, lawsuits, claims,

arbitrations or governmental proceedings relating to commercial and

business disputes, antitrust claims, environmental matters,

government investigations, occupational or personal injury claims,

property-related matters, labor and employment matters, or suits

involving legacy operations and other matters; supply chain

disruptions or changes in the cost, quality or availability of

energy sources, including electricity, natural gas and diesel fuel,

critical raw materials and supplies, including iron ore, industrial

gases, graphite electrodes, scrap metal, chrome, zinc, other

alloys, coke and metallurgical coal, and critical manufacturing

equipment and spare parts; problems or disruptions associated with

transporting products to our customers, moving manufacturing inputs

or products internally among our facilities, or suppliers

transporting raw materials to us; the risk that the cost or time to

implement a strategic or sustaining capital project may prove to be

greater than originally anticipated; our ability to consummate any

public or private acquisition transactions and to realize any or

all of the anticipated benefits or estimated future synergies, as

well as to successfully integrate any acquired businesses into our

existing businesses; uncertainties associated with natural or

human-caused disasters, adverse weather conditions, unanticipated

geological conditions, critical equipment failures, infectious

disease outbreaks, tailings dam failures and other unexpected

events; cybersecurity incidents relating to, disruptions in, or

failures of, information technology systems that are managed by us

or third parties that host or have access to our data or systems,

including the loss, theft or corruption of sensitive or essential

business or personal information and the inability to access or

control systems; liabilities and costs arising in connection with

any business decisions to temporarily or indefinitely idle or

permanently close an operating facility or mine, which could

adversely impact the carrying value of associated assets and give

rise to impairment charges or closure and reclamation obligations,

as well as uncertainties associated with restarting any previously

idled operating facility or mine; our level of self-insurance and

our ability to obtain sufficient third-party insurance to

adequately cover potential adverse events and business risks;

uncertainties associated with our ability to meet customers' and

suppliers' decarbonization goals and reduce our greenhouse gas

emissions in alignment with our own announced targets; challenges

to maintaining our social license to operate with our stakeholders,

including the impacts of our operations on local communities,

reputational impacts of operating in a carbon-intensive industry

that produces greenhouse gas emissions, and our ability to foster a

consistent operational and safety track record; our actual economic

mineral reserves or reductions in current mineral reserve

estimates, and any title defect or loss of any lease, license,

easement or other possessory interest for any mining property; our

ability to maintain satisfactory labor relations with unions and

employees; unanticipated or higher costs associated with pension

and other post-employment benefit obligations resulting from

changes in the value of plan assets or contribution increases

required for unfunded obligations; uncertain availability or cost

of skilled workers to fill critical operational positions and

potential labor shortages caused by experienced employee attrition

or otherwise, as well as our ability to attract, hire, develop and

retain key personnel; the amount and timing of any repurchases of

our common shares; potential significant deficiencies or material

weaknesses in our internal control over financial reporting; the

risk that the proposed transaction with Stelco may not be

consummated; the risk that the proposed transaction with Stelco may

be less accretive than expected, or may be dilutive, to Cliffs’

earnings per share, which may negatively affect the market price of

Cliffs’ common shares; the risk that adverse reactions or changes

to business or regulatory relationships may result from the

completion of the proposed transaction; the possibility of the

occurrence of any event, change or other circumstance that could

give rise to the right of one or both of Cliffs or Stelco to

terminate the transaction agreement between the two companies; the

risk of shareholder litigation relating to the proposed transaction

that could be instituted against Stelco, Cliffs or their respective

directors and officers; the possibility that Cliffs and Stelco will

incur significant transaction and other costs in connection with

the proposed transaction, which may be in excess of those

anticipated by Cliffs; the risk that the financing transactions to

be undertaken in connection with the proposed transaction may have

a negative impact on the combined company’s credit profile,

financial condition or financial flexibility; the possibility that

the anticipated benefits of the proposed acquisition of Stelco are

not realized to the same extent as projected and that the

integration of the acquired business into our existing business,

including uncertainties associated with maintaining relationships

with customers, vendors and employees, is not as successful as

expected; the risk that future synergies from the proposed

transaction may not be realized or may take longer than expected to

achieve; the possibility that the business and management

strategies currently in place or implemented in the future for the

maintenance, expansion and growth of the combined company’s

operations may not be as successful as anticipated; the risk

associated with the retention and hiring of key personnel,

including those of Stelco; the risk that any announcements relating

to, or the completion of, the proposed transaction could have

adverse effects on the market price of Cliffs' common shares; and

the risk of any unforeseen liabilities and future capital

expenditures related to the proposed transaction.

For additional factors affecting the business of Cliffs, refer

to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K

for the year ended December 31, 2023, Part II – Item 1A. Risk

Factors of our Quarterly Report on Form 10-Q for the quarterly

period ended June 30, 2024, and other filings with the U.S.

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030799831/en/

MEDIA CONTACT: Patricia Persico Senior Director,

Corporate Communications (216) 694-5316

INVESTOR CONTACT: James Kerr Director, Investor Relations

(216) 694-7719

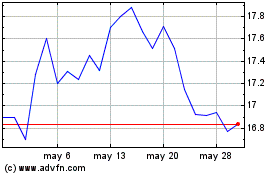

Cleveland Cliffs (NYSE:CLF)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

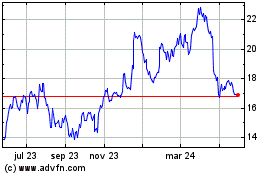

Cleveland Cliffs (NYSE:CLF)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024