0000025475false00000254752023-11-062023-11-060000025475us-gaap:CommonClassAMember2023-11-062023-11-060000025475us-gaap:CommonClassBMember2023-11-062023-11-06

2,535

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2023

CRAWFORD & COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Georgia

(State or Other Jurisdiction of Incorporation)

|

|

|

1-10356 |

|

58-0506554 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

5335 Triangle Parkway, Peachtree Corners, Georgia |

|

30092 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(404) 300-1000

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Class A Common Stock — $1.00 Par Value |

CRD-A |

New York Stock Exchange, Inc. |

Class B Common Stock — $1.00 Par Value |

CRD-B |

New York Stock Exchange, Inc. |

Item 2.02. Results of Operations and Financial Condition

On November 6, 2023, Crawford & Company (the "Company") issued a press release containing information about the Company's financial results for the third quarter 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

Item 7.01. Regulation FD Disclosure

The Company has made available on the Company's website at https://ir.crawco.com a presentation designed to enhance the information presented at its quarterly earnings conference call on Tuesday, November 7, 2023 at 8:30 a.m. Eastern Time. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by this reference.

Item 9.01. Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

The information contained in this current report on Form 8-K and in the accompanying exhibits shall not be incorporated by reference into any filing of the Company with the SEC, whether made before or after the date hereof, regardless of any general incorporation by reference language in such filing, unless expressly incorporated by specific reference to such filing. The information, including the exhibits hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

2

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CRAWFORD & COMPANY |

|

(Registrant) |

|

|

|

|

|

By: |

|

/s/ W. BRUCE SWAIN |

|

|

|

W. Bruce Swain |

|

|

|

Executive Vice President - |

|

|

|

Chief Financial Officer |

|

|

|

|

Dated: November 6, 2023 |

|

|

|

3

Exhibit 99.1

Crawford & Company®

5335 Triangle Parkway

Peachtree Corners, GA 30092

FOR IMMEDIATE RELEASE

CRAWFORD & COMPANY REPORTS 2023 THIRD QUARTER RESULTS

RECORD QUARTERLY REVENUE DRIVES EARNINGS AND MARGIN EXPANSION

ATLANTA, (November 6, 2023) -- Crawford & Company® (NYSE: CRD-A and CRD-B), is pleased to announce its financial results for the third quarter ended September 30, 2023.

Based in Atlanta, Crawford & Company (NYSE: CRD‐A and CRD‐B) is a leading global provider of claims management and outsourcing solutions to insurance companies and self‐insured entities with an expansive network serving clients in more than 70 countries. The Company’s two classes of stock are substantially identical, except with respect to voting rights for the Class B Common Stock (CRD-B) and protections for the non-voting Class A Common Stock (CRD-A). More information is available on the Company's website.

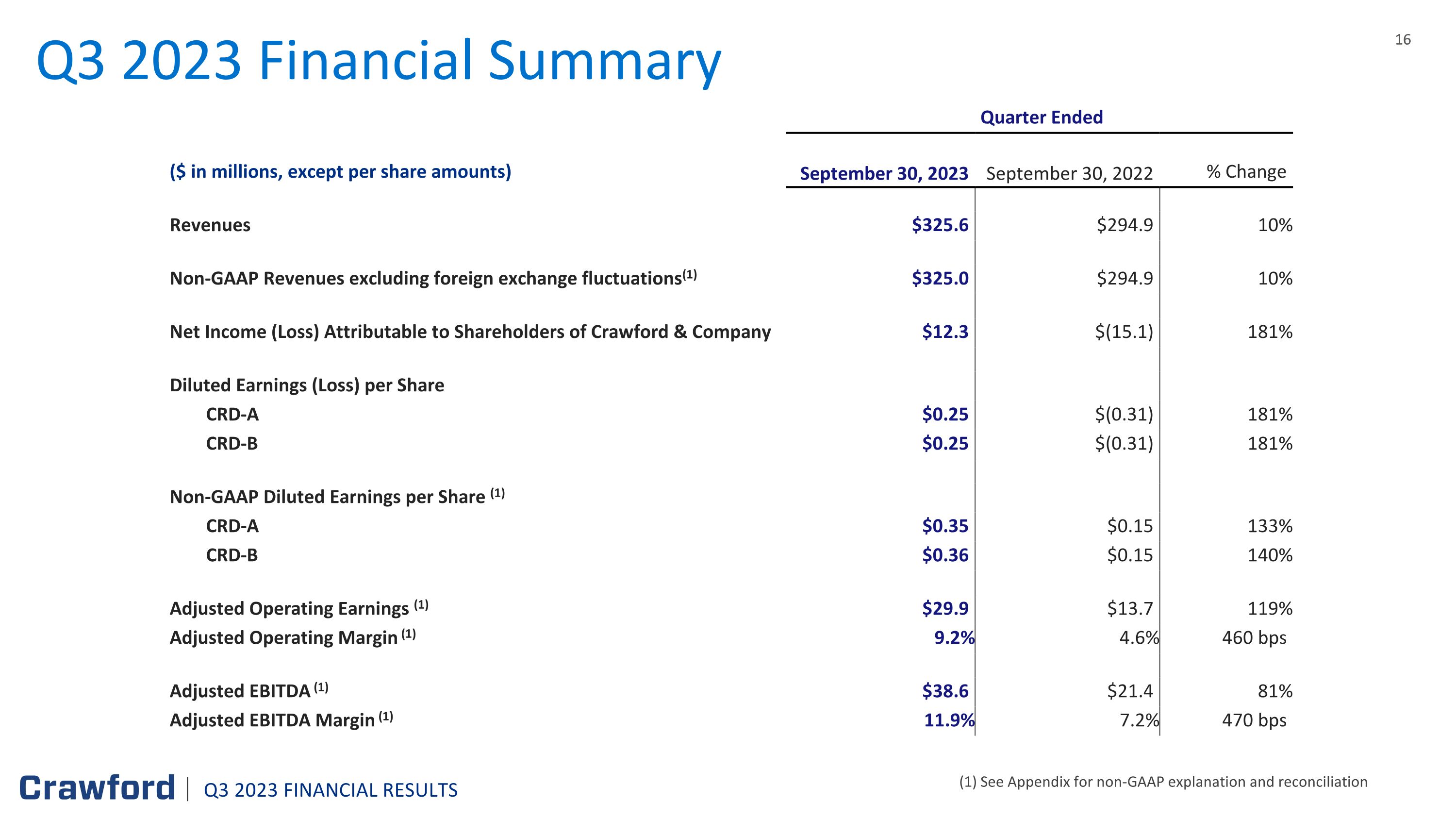

GAAP Consolidated Results

Third Quarter 2023

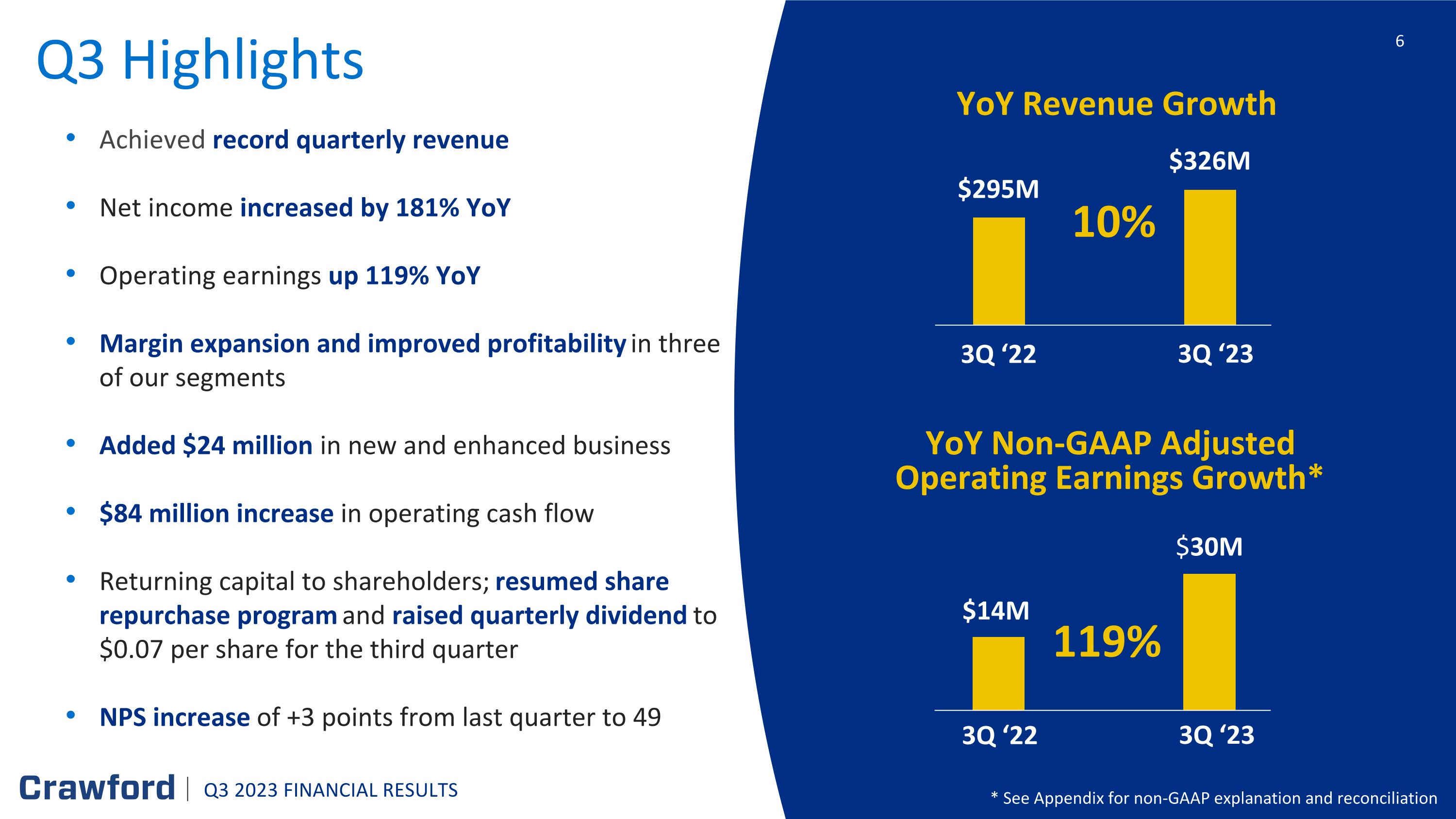

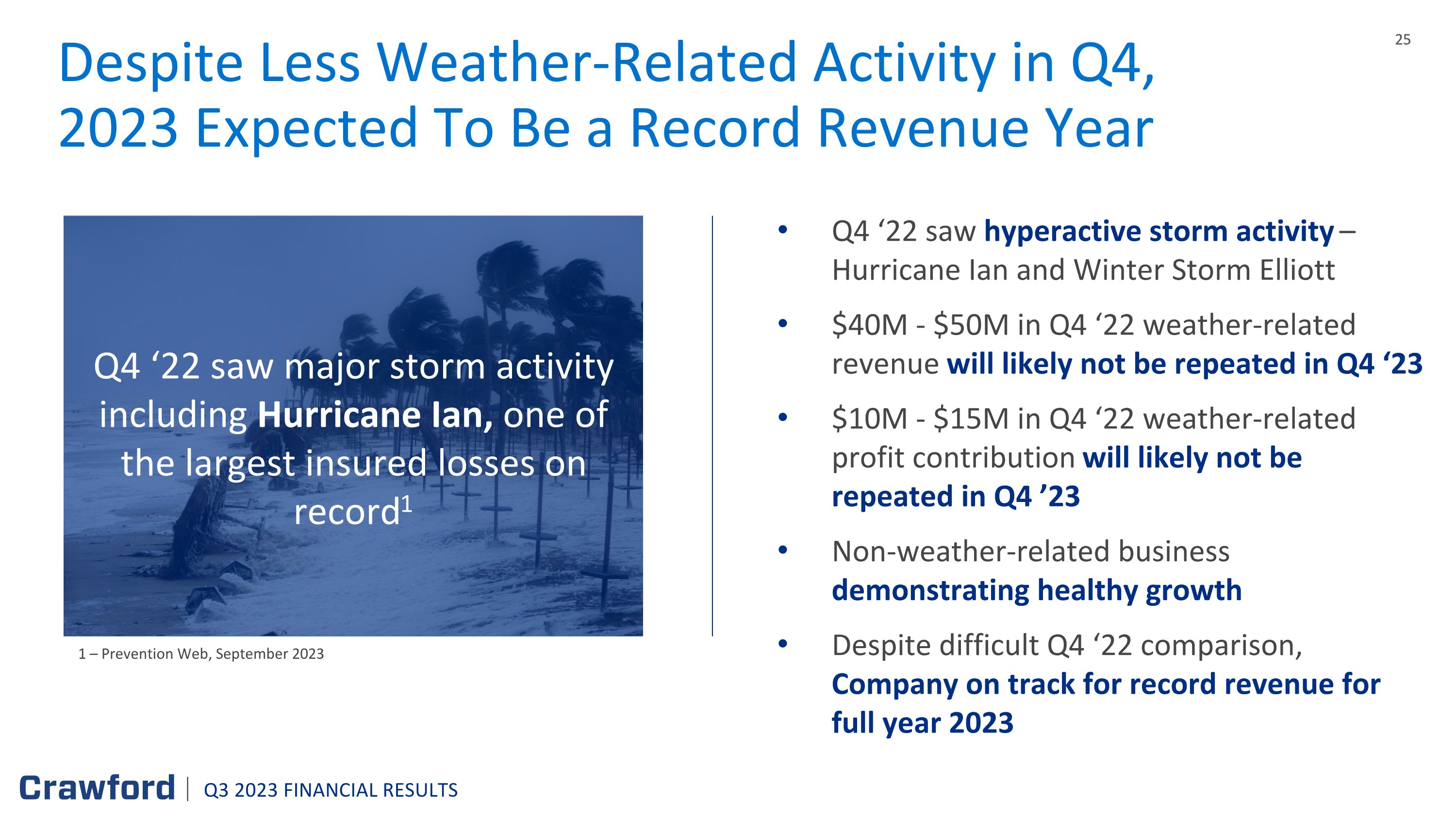

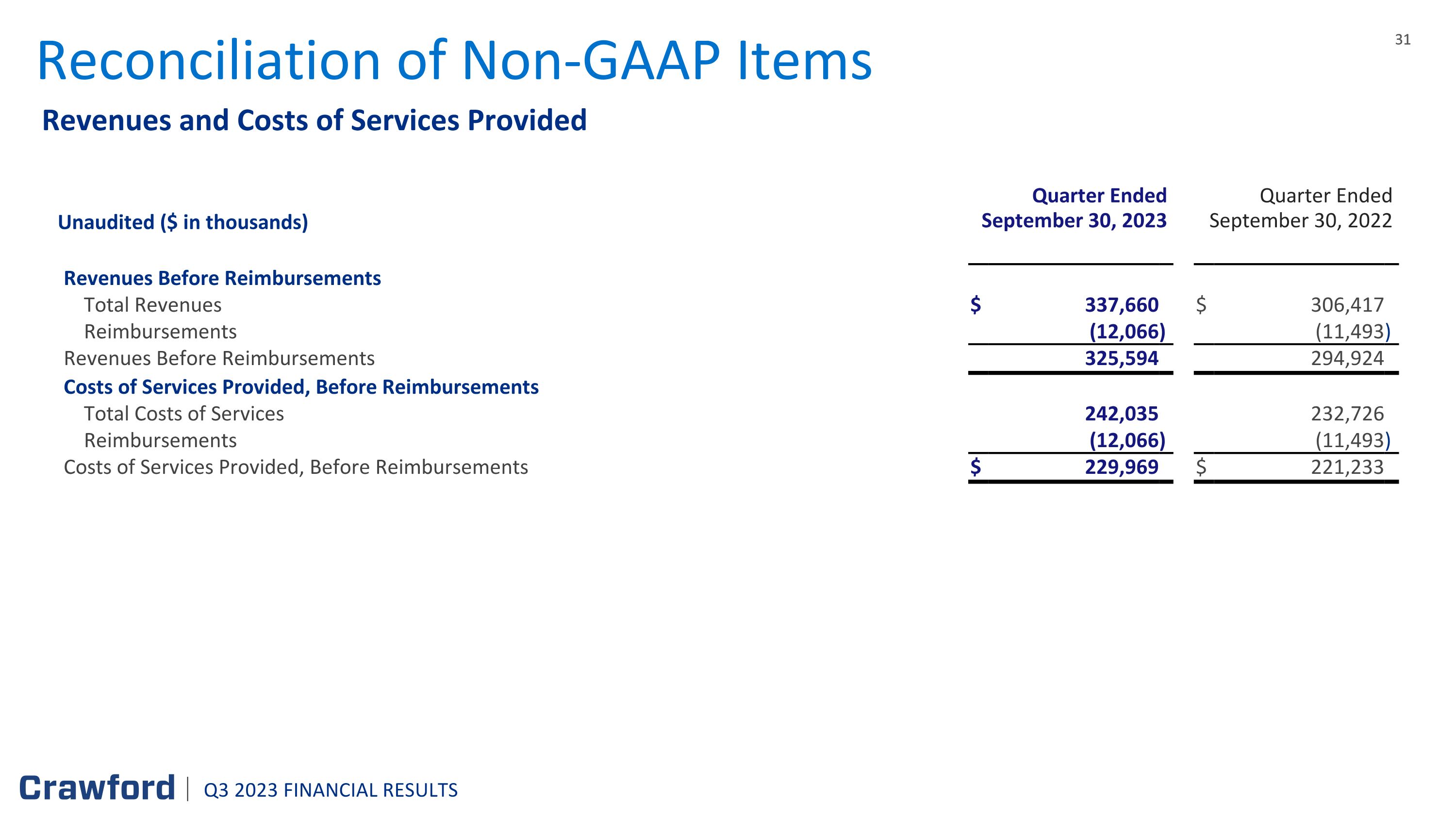

•Revenues before reimbursements of $325.6 million, up 10% over $294.9 million for the 2022 third quarter

•Net income attributable to shareholders of $12.3 million, compared with a loss of $(15.1) million in the same period last year

•Diluted earnings per share of $0.25 for both CRD-A and CRD-B, compared with diluted loss per share of $(0.31) for both CRD-A and CRD-B in the prior year third quarter

Non-GAAP Consolidated Results

Third Quarter 2023

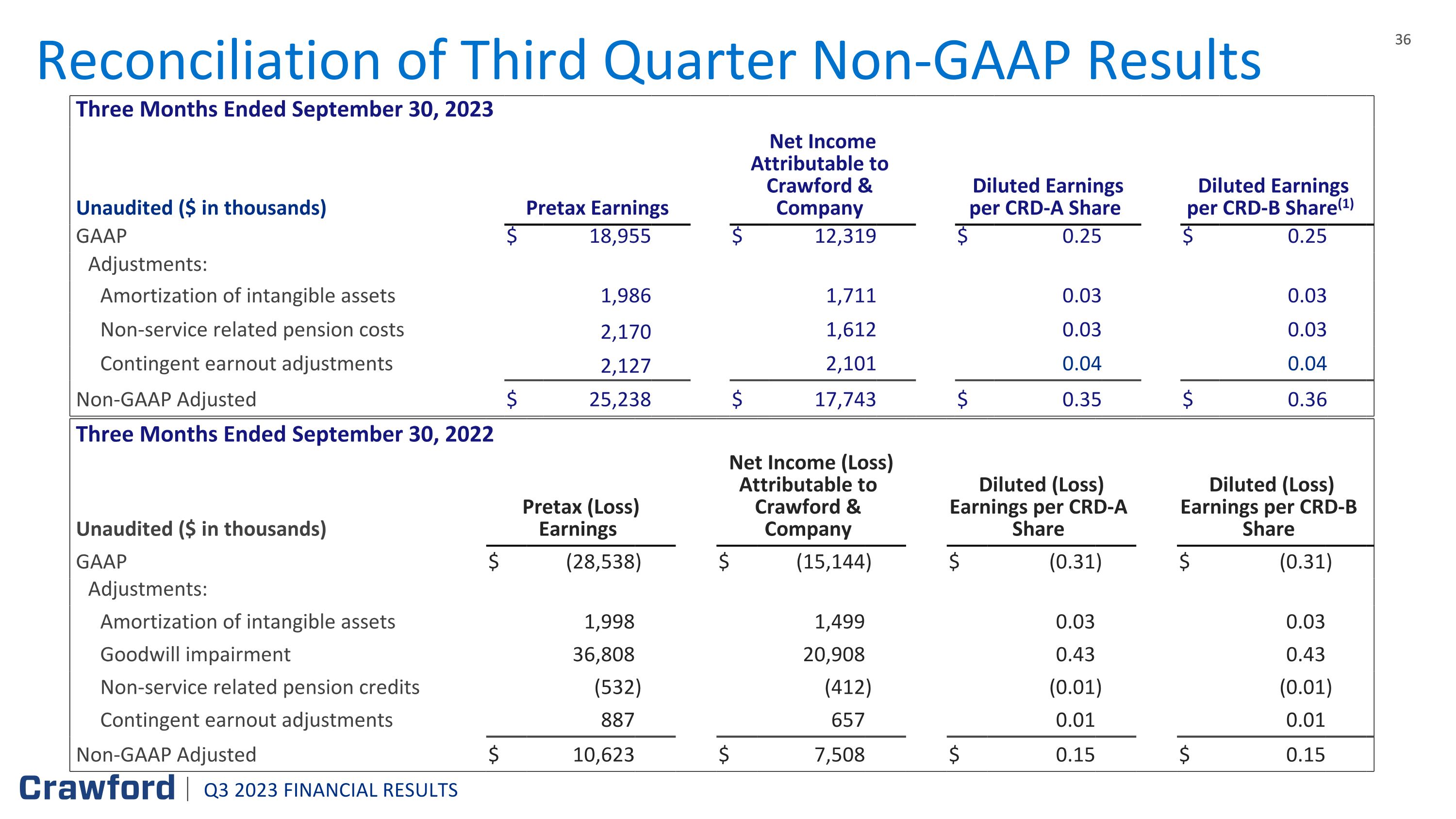

Non-GAAP consolidated results for 2023 exclude the non-cash, after-tax adjustments for amortization of intangible assets of $1.7 million, non-service related pension costs of $1.6 million, and a contingent earnout adjustment of $2.1 million. Non-GAAP consolidated results for 2022 exclude a similar adjustment for amortization of intangible assets of $1.5 million, non-service related pension credits of $(0.4) million, a contingent earnout adjustment of $0.7 million, and a goodwill impairment of $20.9 million.

•Foreign currency exchange rates increased revenues before reimbursements by $0.6 million or less than 1%. Presented on a constant dollar basis to the prior year, revenues before reimbursements totaled $325.0 million, increasing 10% over the 2022 third quarter

•Net income attributable to shareholders, on a non-GAAP basis, totaled $17.7 million in the 2023 third quarter, compared with $7.5 million in the same period last year

•Diluted earnings per share, on a non-GAAP basis, totaled $0.35 for CRD-A and $0.36 for CRD-B in the 2023 third quarter, compared with $0.15 for both CRD-A and CRD-B in the prior year third quarter

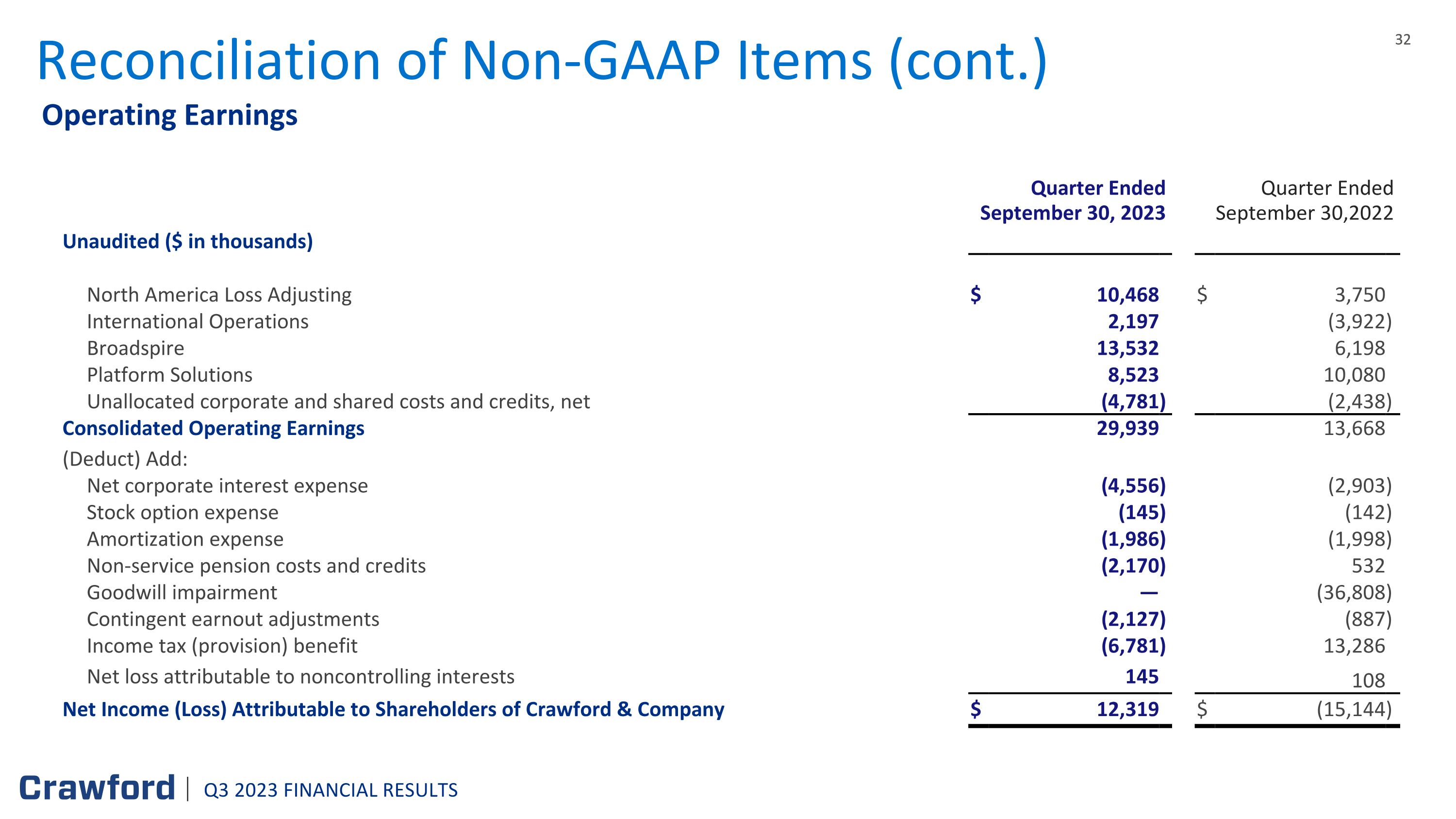

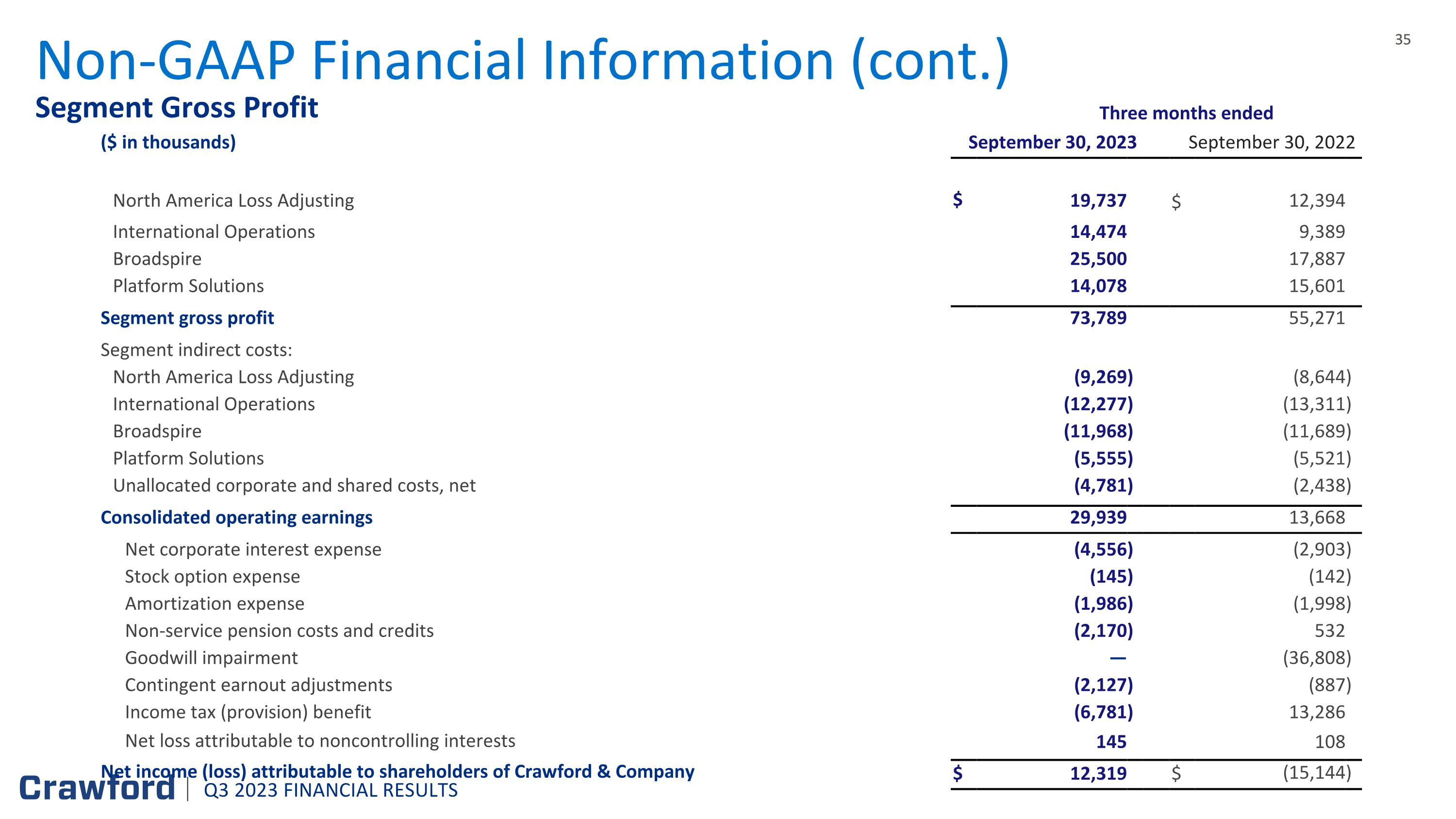

•Consolidated adjusted operating earnings, on a non-GAAP basis, were $29.9 million, or 9.2% of revenues before reimbursements in the 2023 third quarter, more than doubling the $13.7 million, or 4.6% of revenues, in the 2022 period

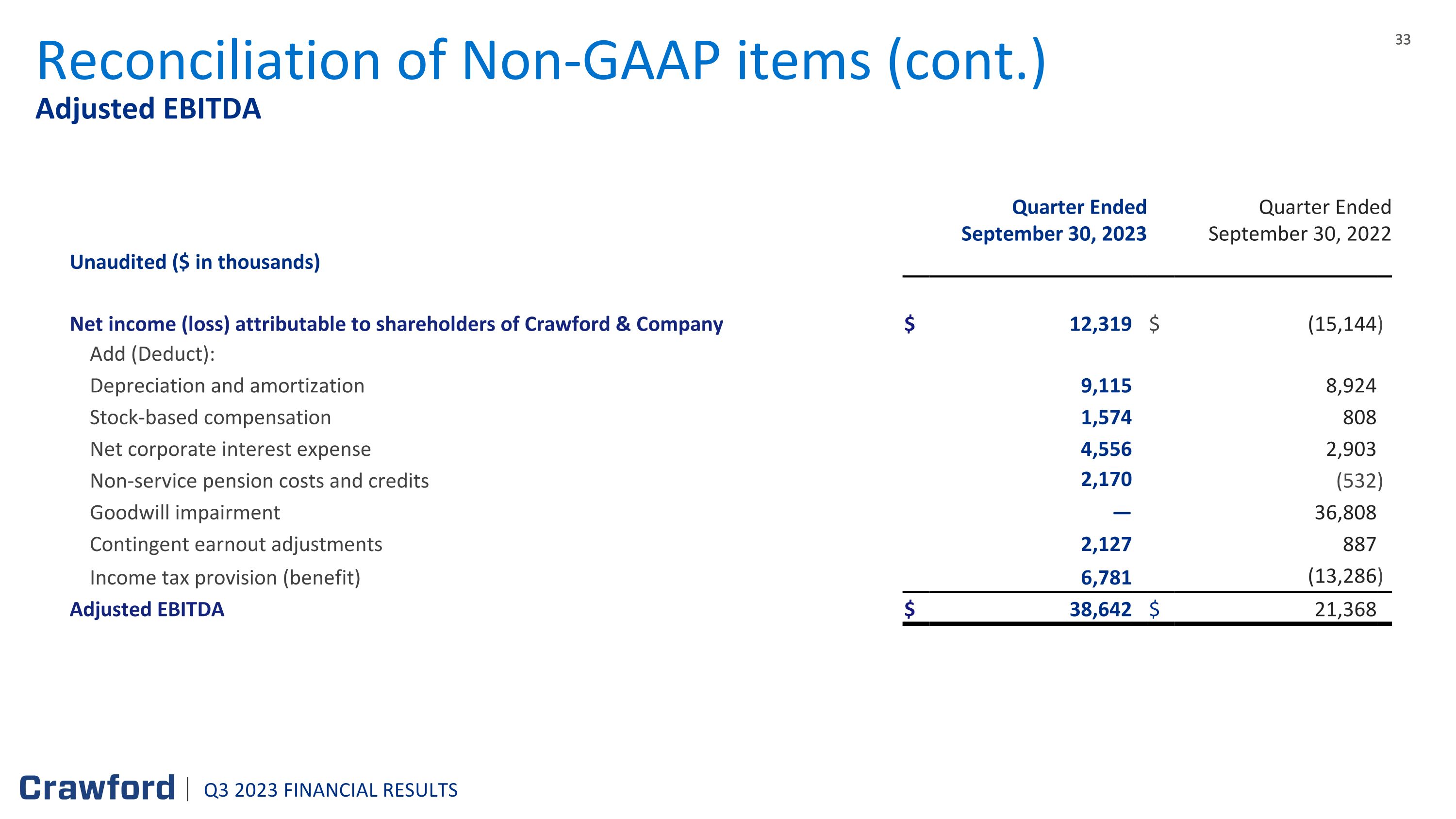

•Consolidated adjusted EBITDA, a non-GAAP measure, was $38.6 million, or 11.9% of revenues before reimbursements in the 2023 third quarter, increasing 81% over the $21.4 million, or 7.2% of revenues, in the 2022 period

Management Comments

“We continued our momentum of growth and profit expansion in the third quarter of 2023 delivering our twelfth consecutive quarter of growth. Revenues grew by 10% to a new quarterly record and profits more than doubled compared to last year. We have built a strong foundation focused on operational excellence at Crawford, and our technology plus people strategy is driving growth and margin improvement across the business,” commented Rohit Verma, Chief Executive Officer of Crawford & Company.

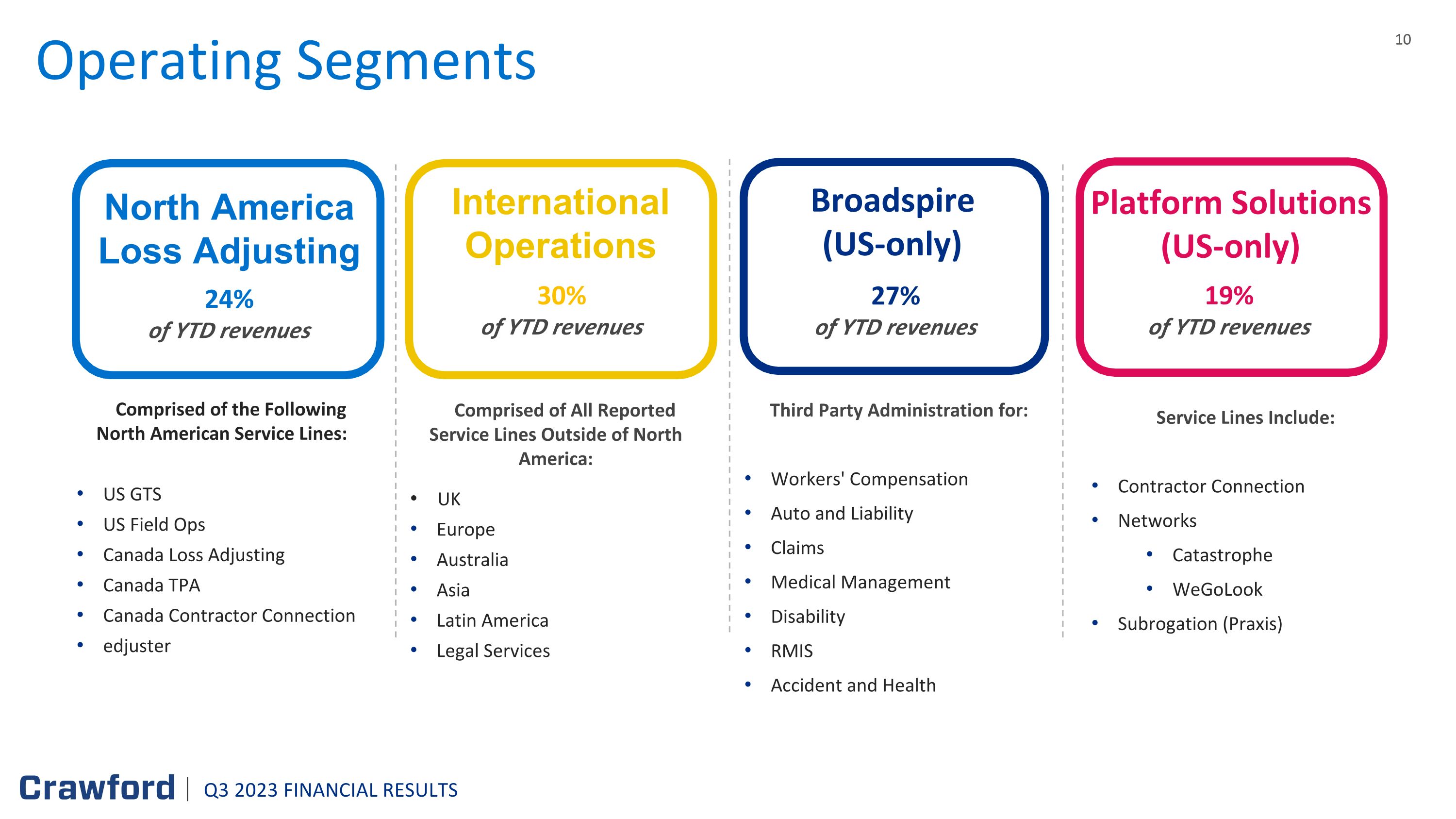

“North America Loss Adjusting revenue grew more than 18% for the third quarter, driven by increased utilization, the addition of new clients, experts, and new account nominations. Broadspire saw record quarterly revenue fueled by business development efforts that have expanded our revenue base and continued growth in Medical Management services as we add workers' compensation clients. Our International segment also showed improved revenues and margins as our transformation of the international business continues. Platforms Solutions had meaningful growth in Contractor Connection and Subrogation, however there was offsetting softness in the Networks group where benign weather and a reduction in high-volume, low severity claim activity impacted results for the quarter. Platforms’ operating margin remained solid at mid-double digits.

“Overall, this was a very strong quarter for Crawford with healthy cash generation and further strengthening of our balance sheet.” Mr. Verma concluded.

Segment Results for the Third Quarter

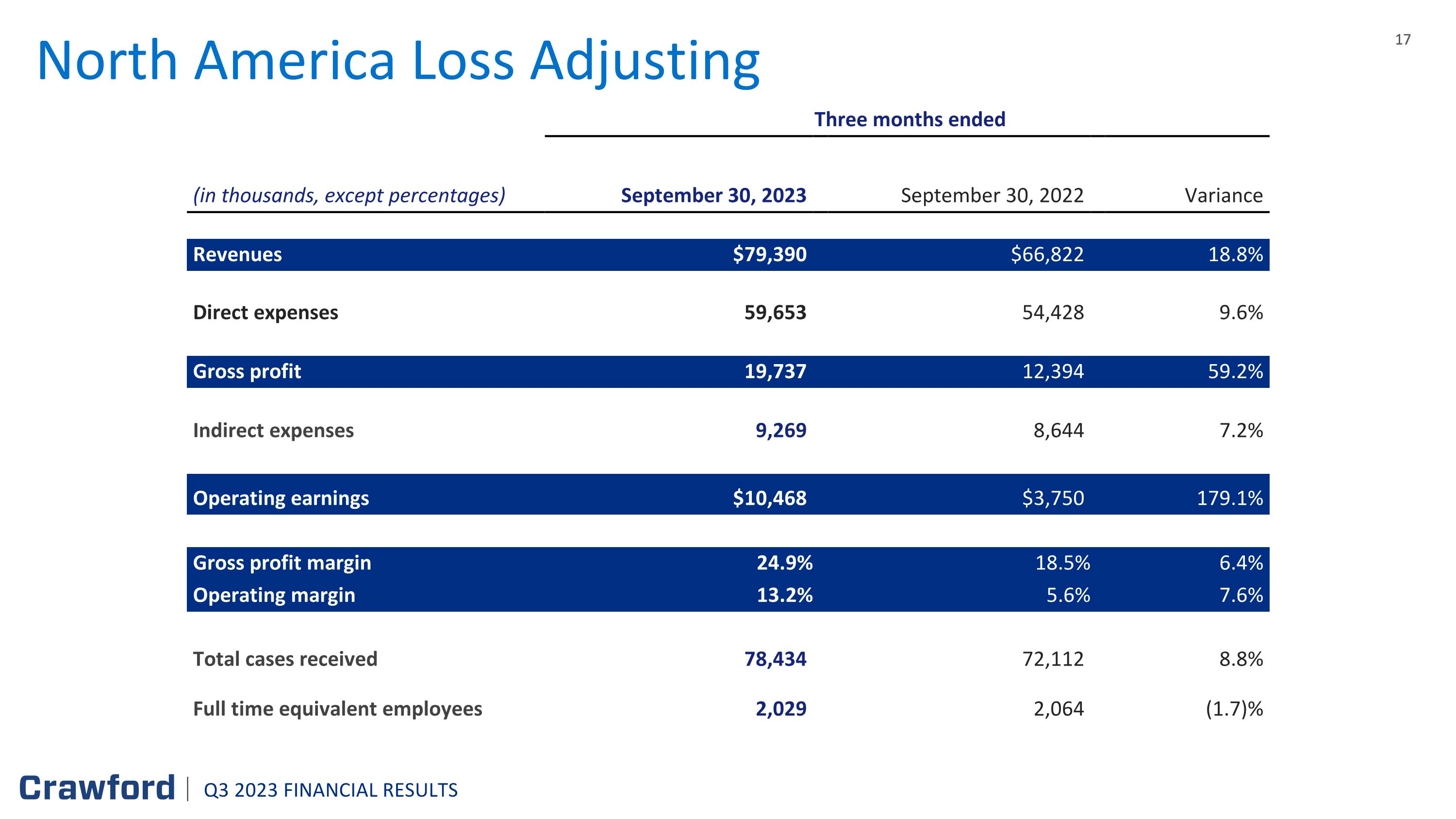

North America Loss Adjusting

North America Loss Adjusting revenues before reimbursements were $79.4 million in the third quarter of 2023, increasing 18.8% from $66.8 million in the third quarter of 2022. Absent foreign exchange rate decreases of $(0.7) million, revenues would have been $80.1 million for the 2023 third quarter.

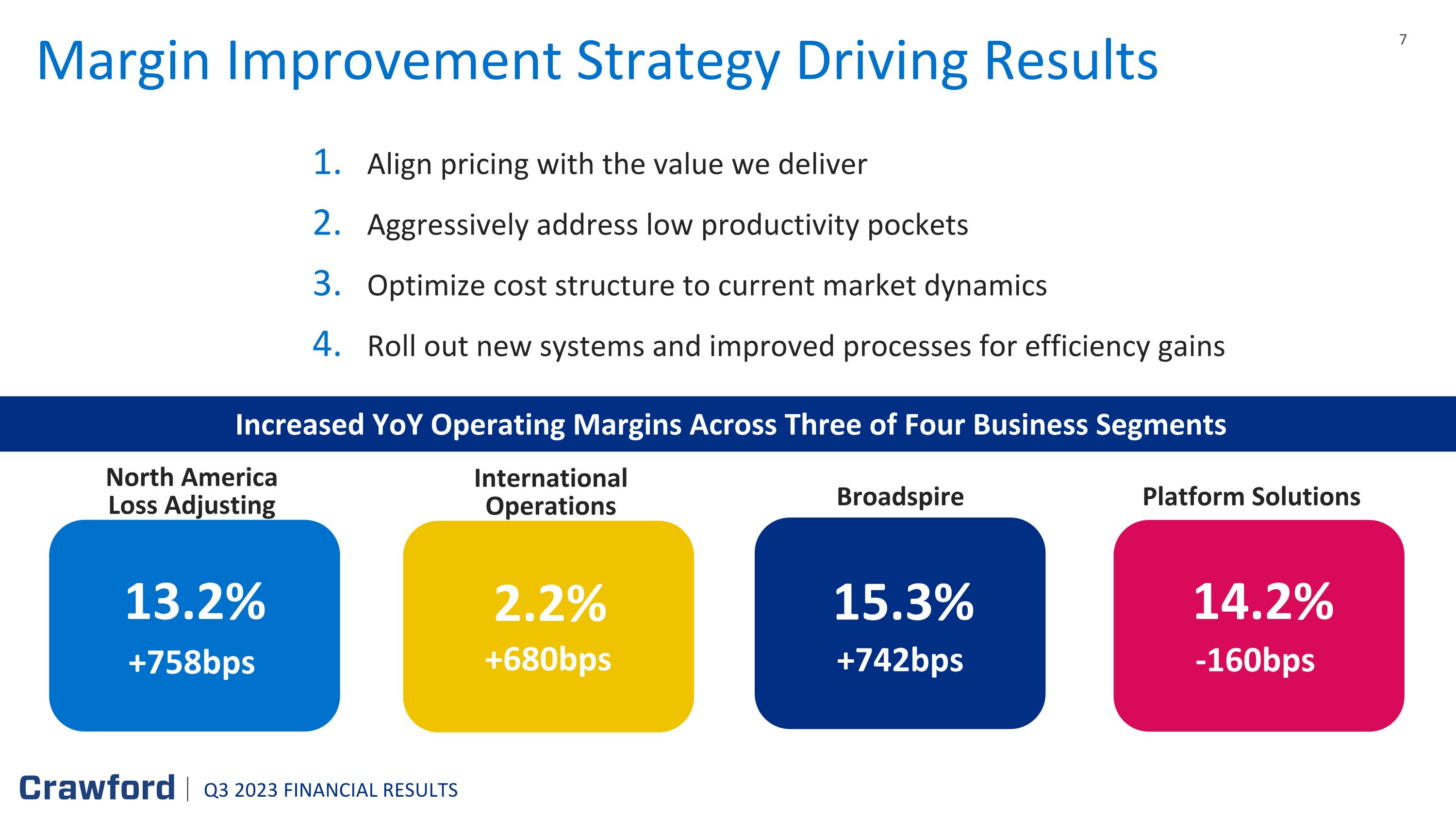

The segment had operating earnings of $10.5 million in the 2023 third quarter, increasing from $3.8 million in the third quarter of 2022. The operating margin was 13.2% in the 2023 quarter and 5.6% in the 2022 quarter.

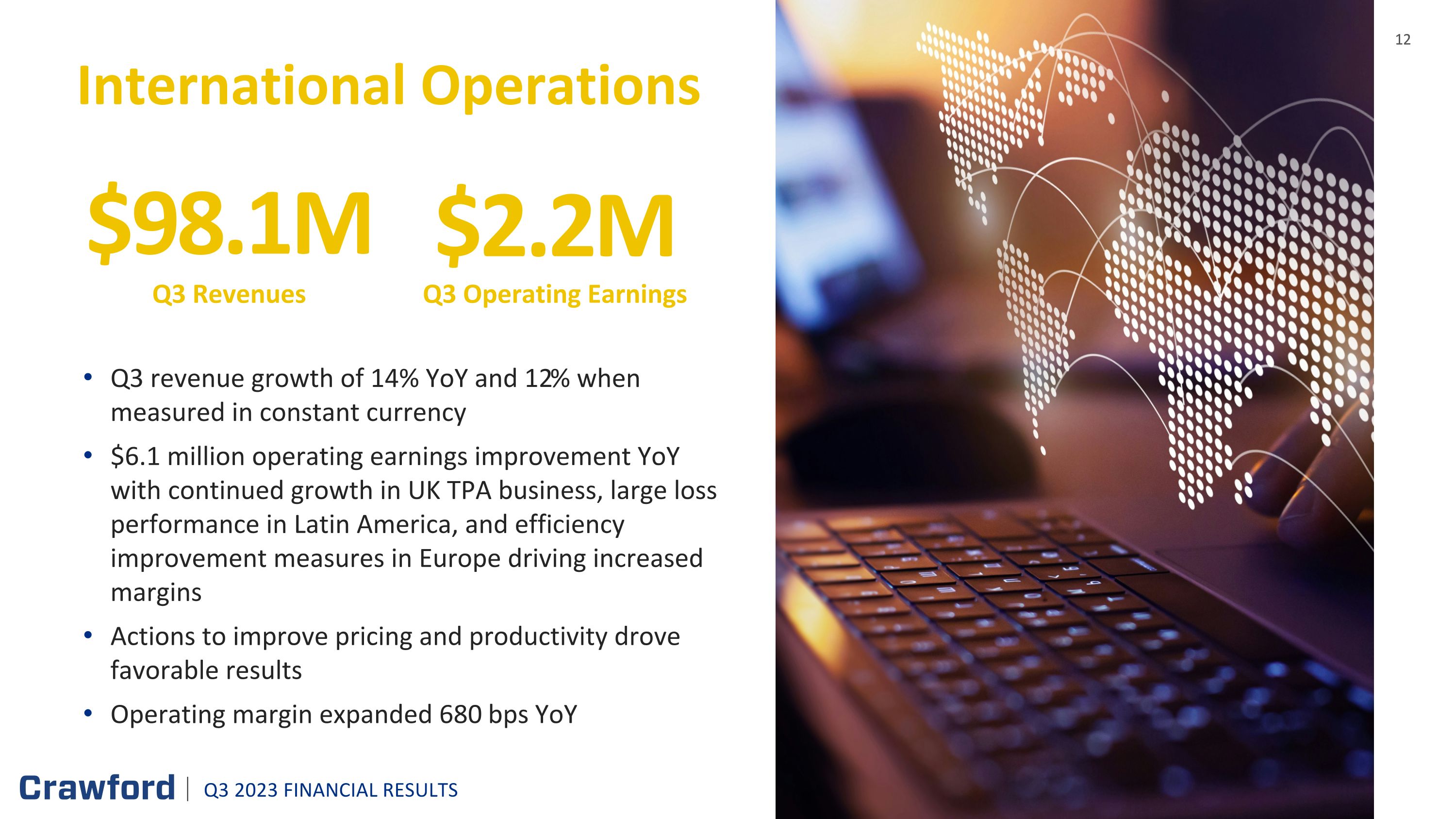

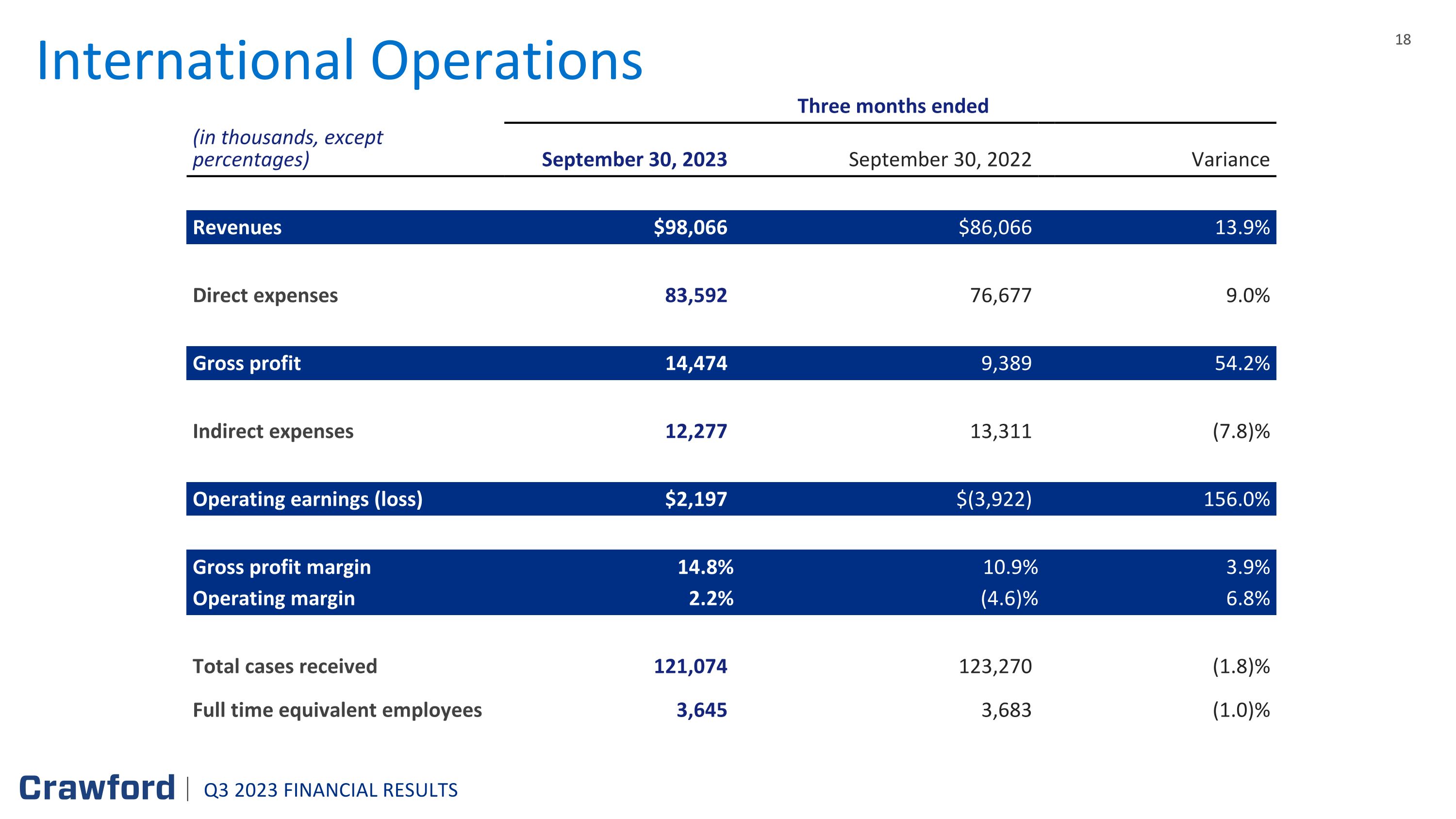

International Operations

International Operations revenues before reimbursements were $98.1 million in the third quarter of 2023, up 13.9% from $86.1 million in the same period of 2022. Absent foreign exchange rate increases of $1.3 million, revenues would have been $96.8 million for the 2023 third quarter.

Operating earnings were $2.2 million in the 2023 third quarter, compared with a $(3.9) million operating loss in the 2022 period. The segment’s operating margin for the 2023 quarter was 2.2% as compared with (4.6)% in the 2022 quarter.

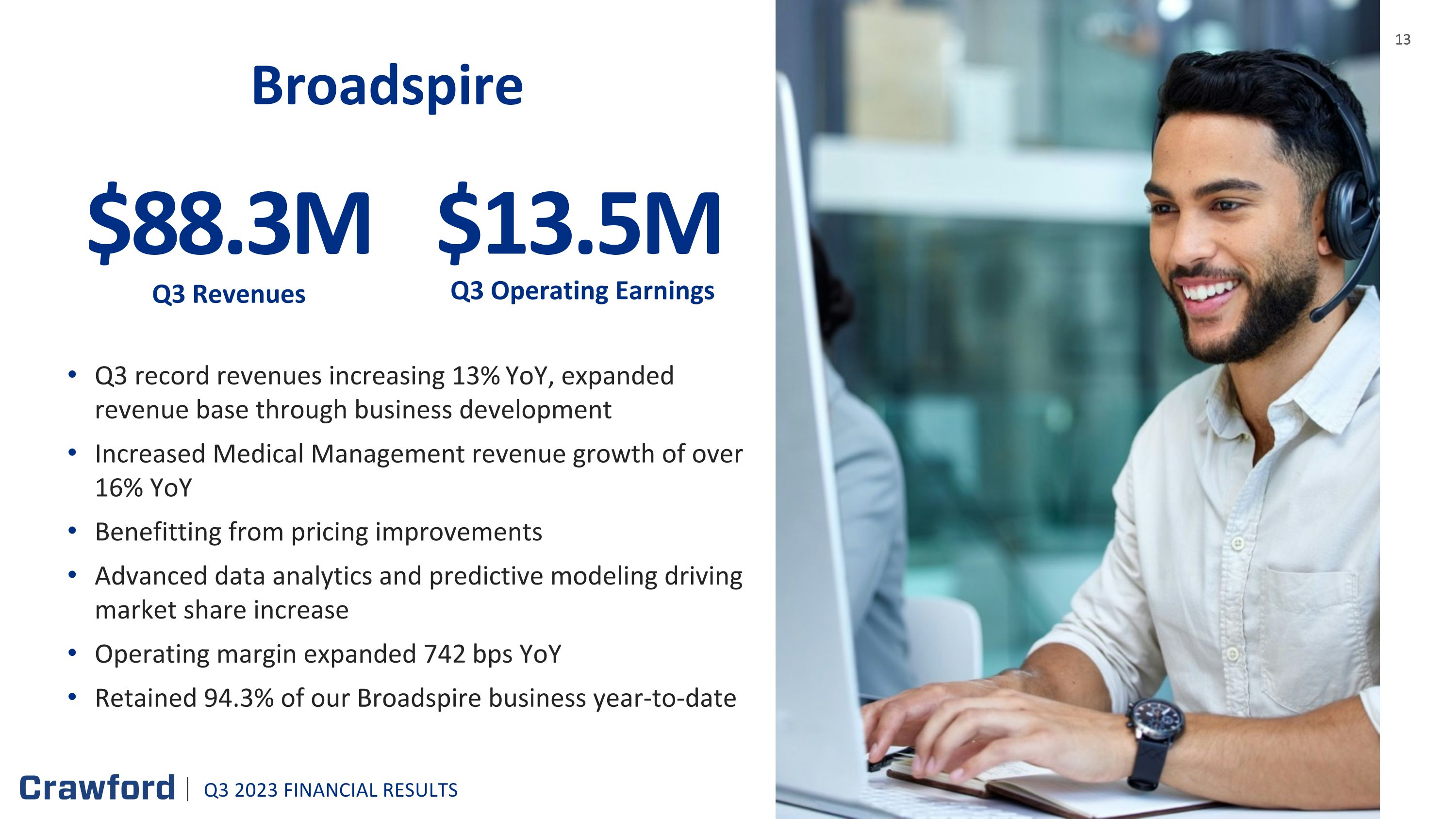

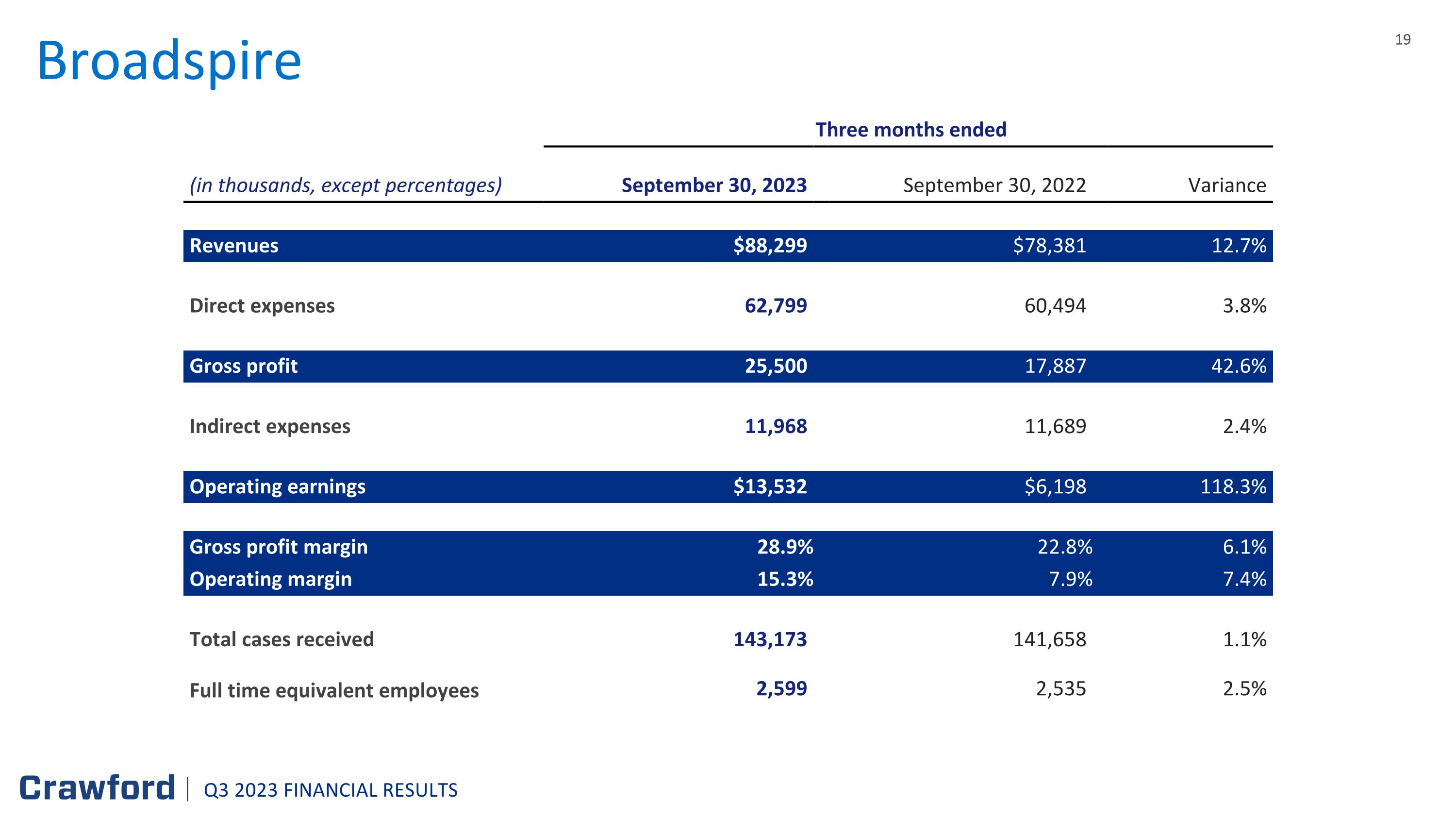

Broadspire

Broadspire segment revenues before reimbursements were $88.3 million in the 2023 third quarter, increasing 12.7% from $78.4 million in the 2022 third quarter.

Broadspire recorded operating earnings of $13.5 million in the third quarter of 2023, representing an operating margin of 15.3%, increasing from $6.2 million, or 7.9% of revenues, in the 2022 third quarter.

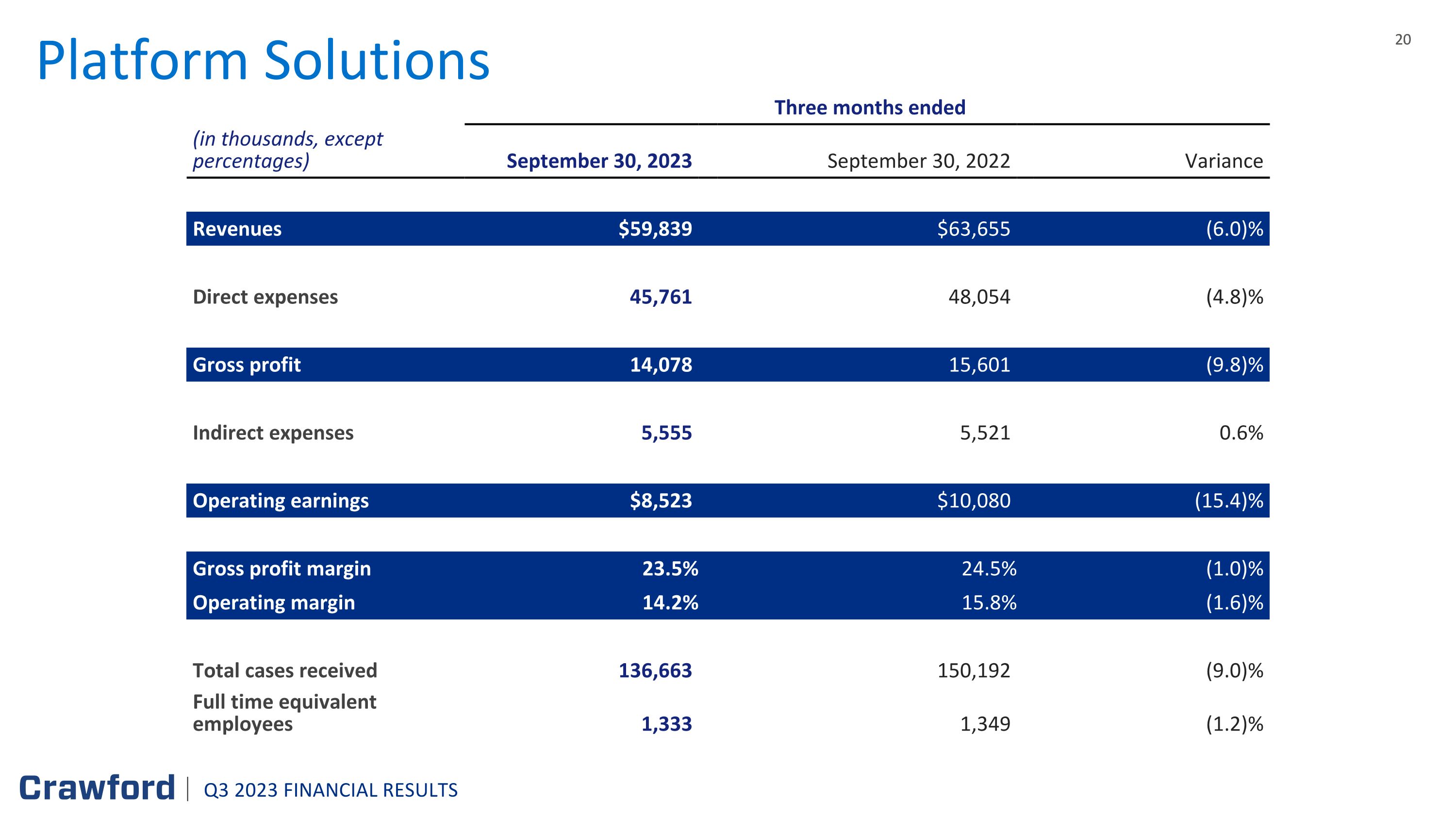

Platform Solutions

Platform Solutions revenues before reimbursements were $59.8 million in the third quarter of 2023, down (6.0)% from $63.7 million in the same period of 2022.

Operating earnings were $8.5 million in the 2023 third quarter, decreasing from the $10.1 million in the 2022 period. The segment’s operating margin for the 2023 quarter was 14.2% as compared with 15.8% in the 2022 quarter.

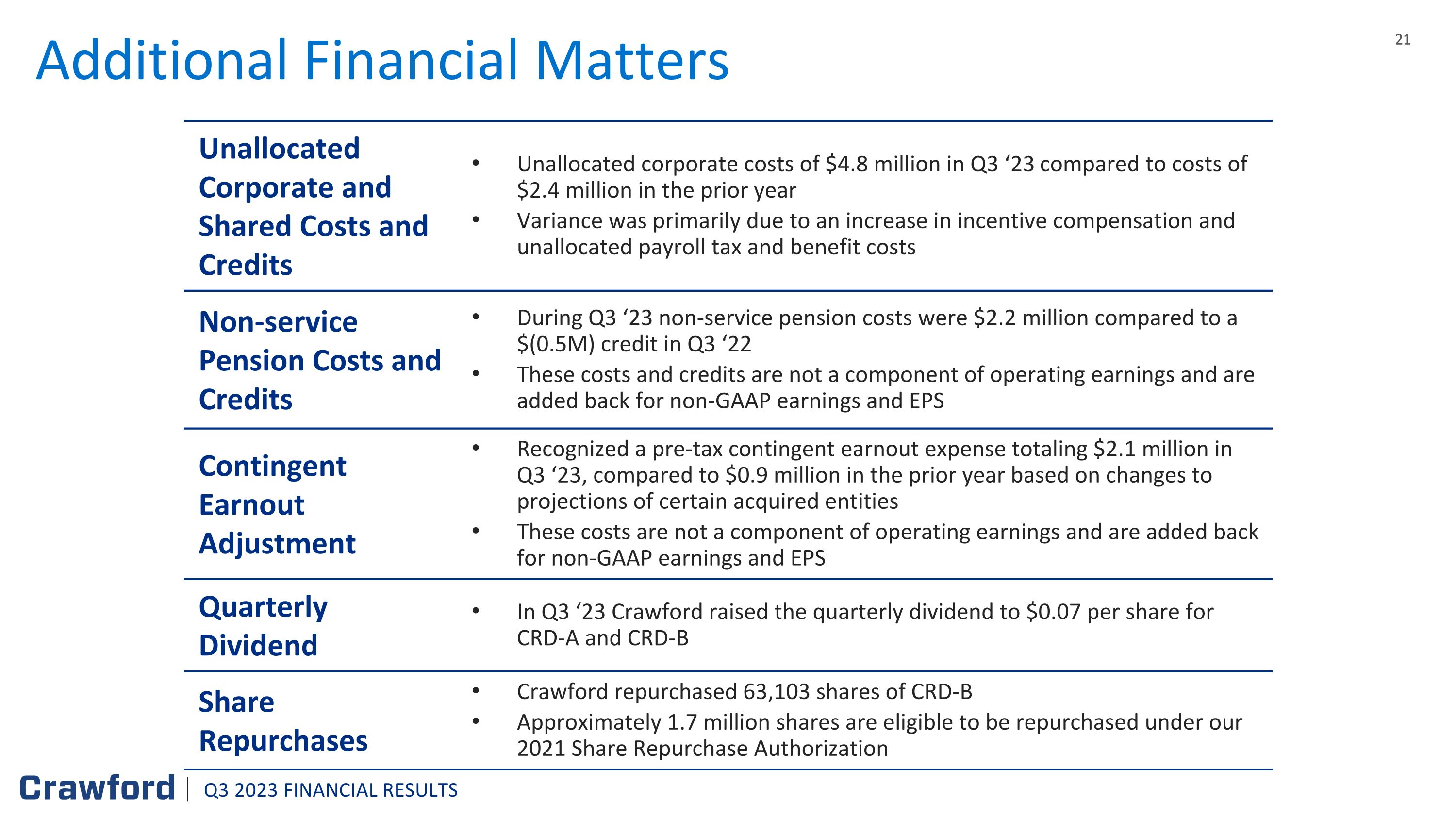

Unallocated Corporate and Shared Costs and Credits, Net

Unallocated corporate costs were $4.8 million in the third quarter of 2023, compared with $2.4 million in the same period of 2022. The increase in the 2023 third quarter was primarily due to increased incentive compensation and an increase in unallocated payroll tax and benefits costs.

2

2022 Goodwill Impairment

The Company recognized a $36.8 million pre-tax non-cash goodwill impairment in the third quarter of 2022. This charge was partially offset by a $15.9 million reduction in income tax expense, for a net impact of $20.9 million, or $0.43 per share. There was no goodwill impairment in 2023.

Other Matters

The Company recognized pretax contingent earnout expenses totaling $2.1 million and $0.9 million in the 2023 third quarter and comparable 2022 period, respectively, related to the fair value adjustment of earnout liabilities arising from recent acquisitions. This adjustment, which is not a component of operating earnings, is based on favorable changes to projections of acquired entities over the respective earnout periods, which span multiple years.

The Company recognized non-service pension costs of $2.2 million in the 2023 third quarter compared with credits of $(0.5) million in the 2022 period. Non-service pension costs represent the U.S. and U.K. non-service defined benefit pension costs, which are non-operating in nature as the U.S. plan is frozen and the U.K. plans are closed to new participants.

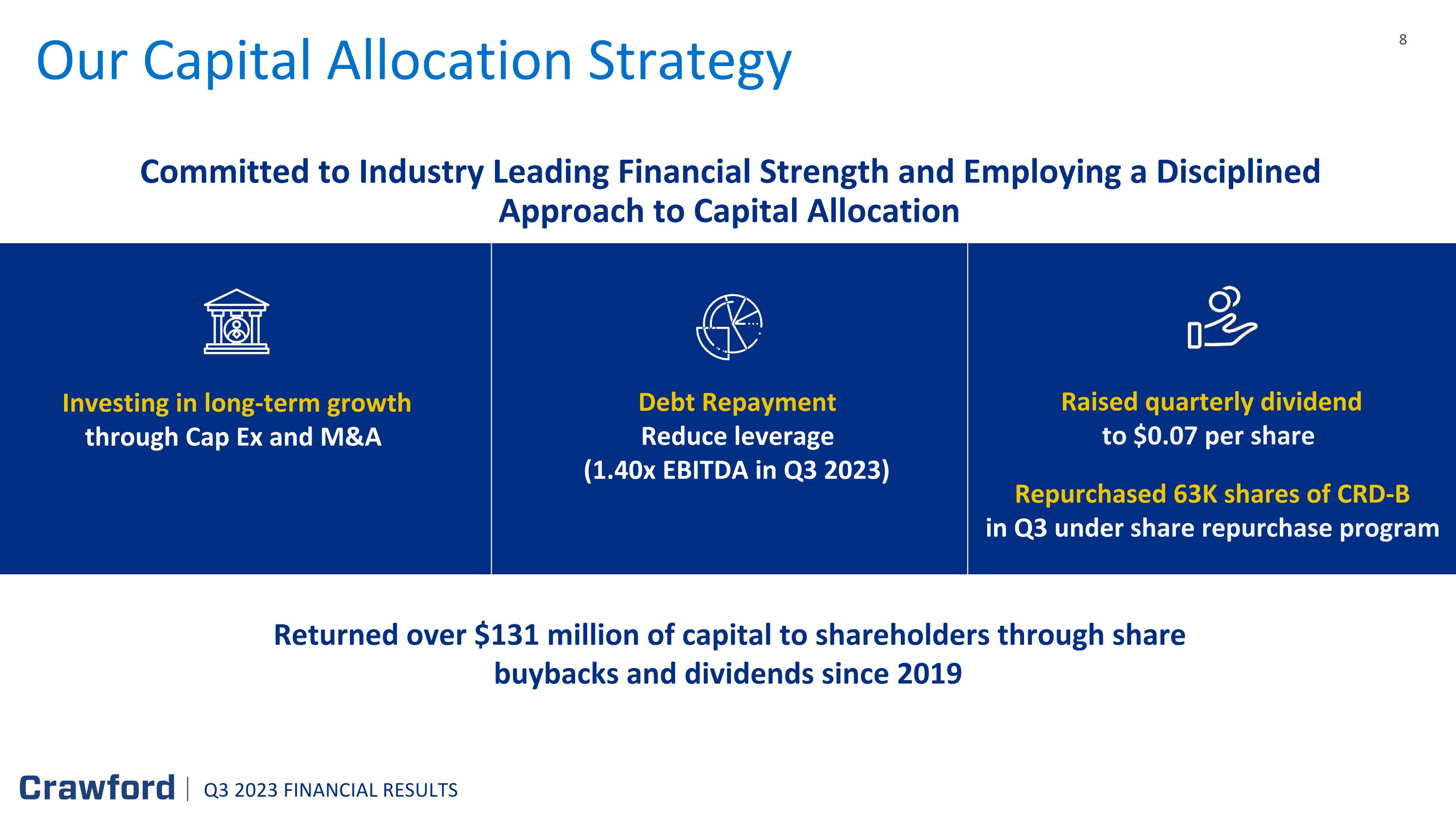

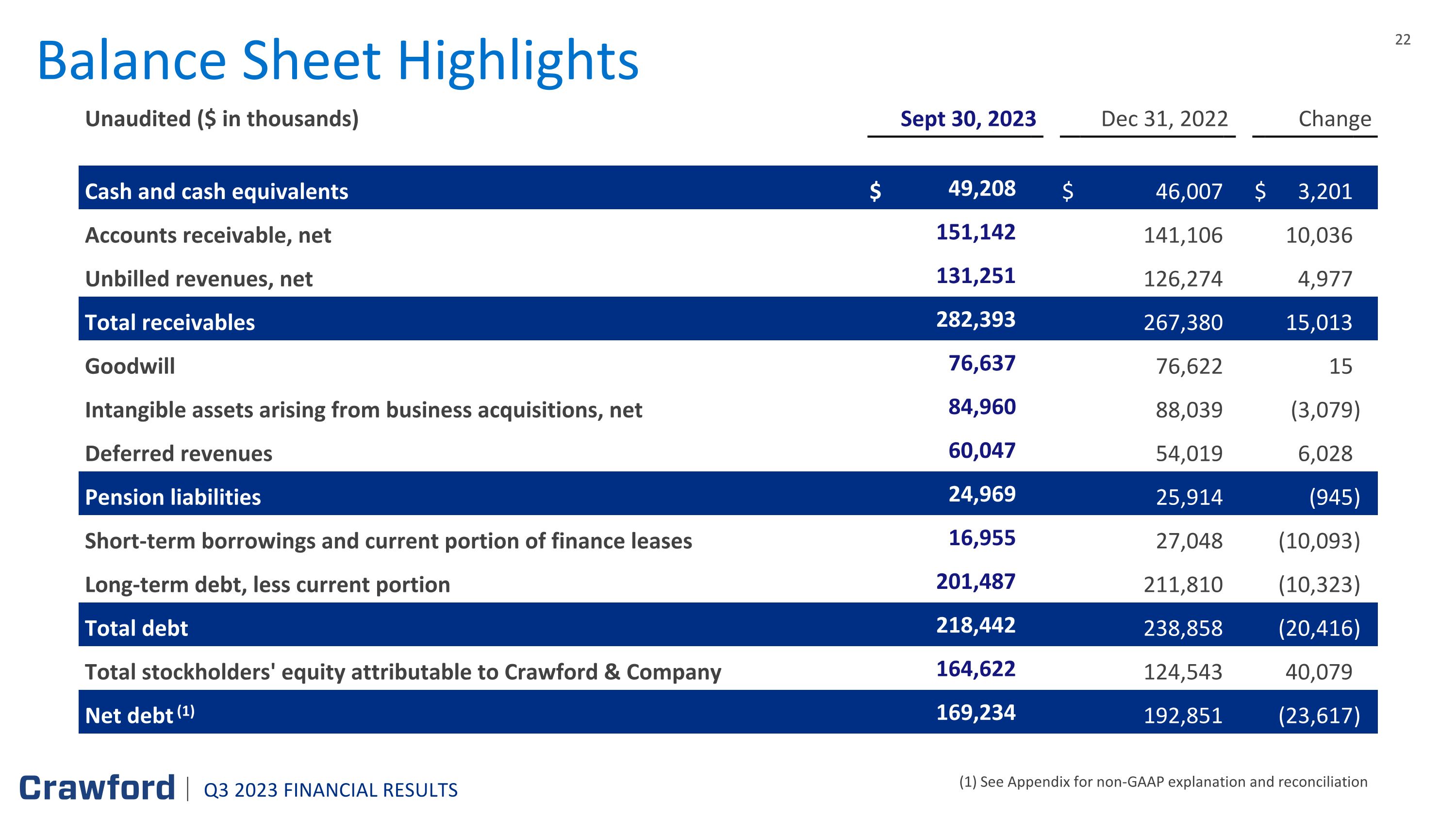

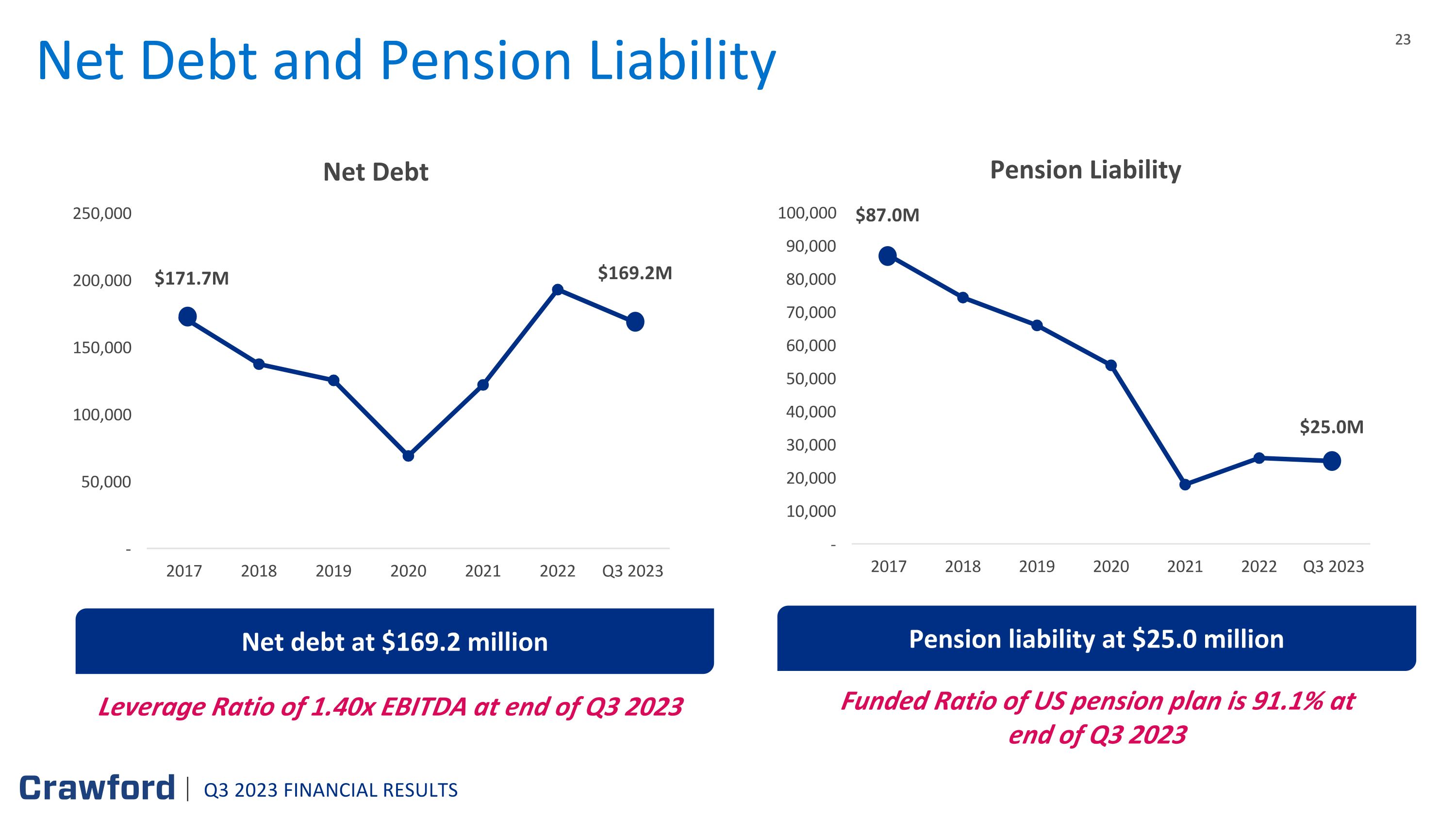

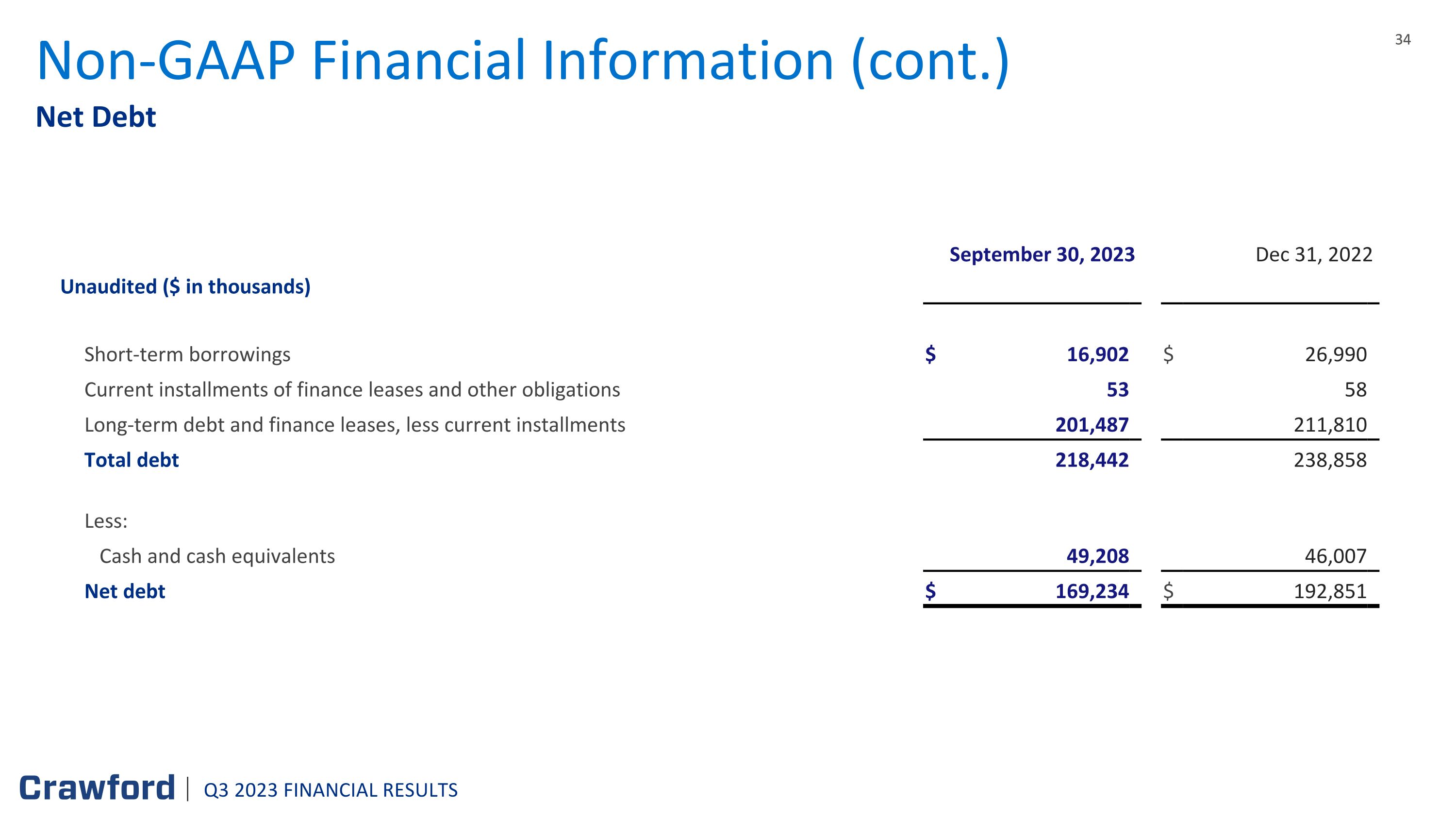

Balance Sheet and Cash Flow

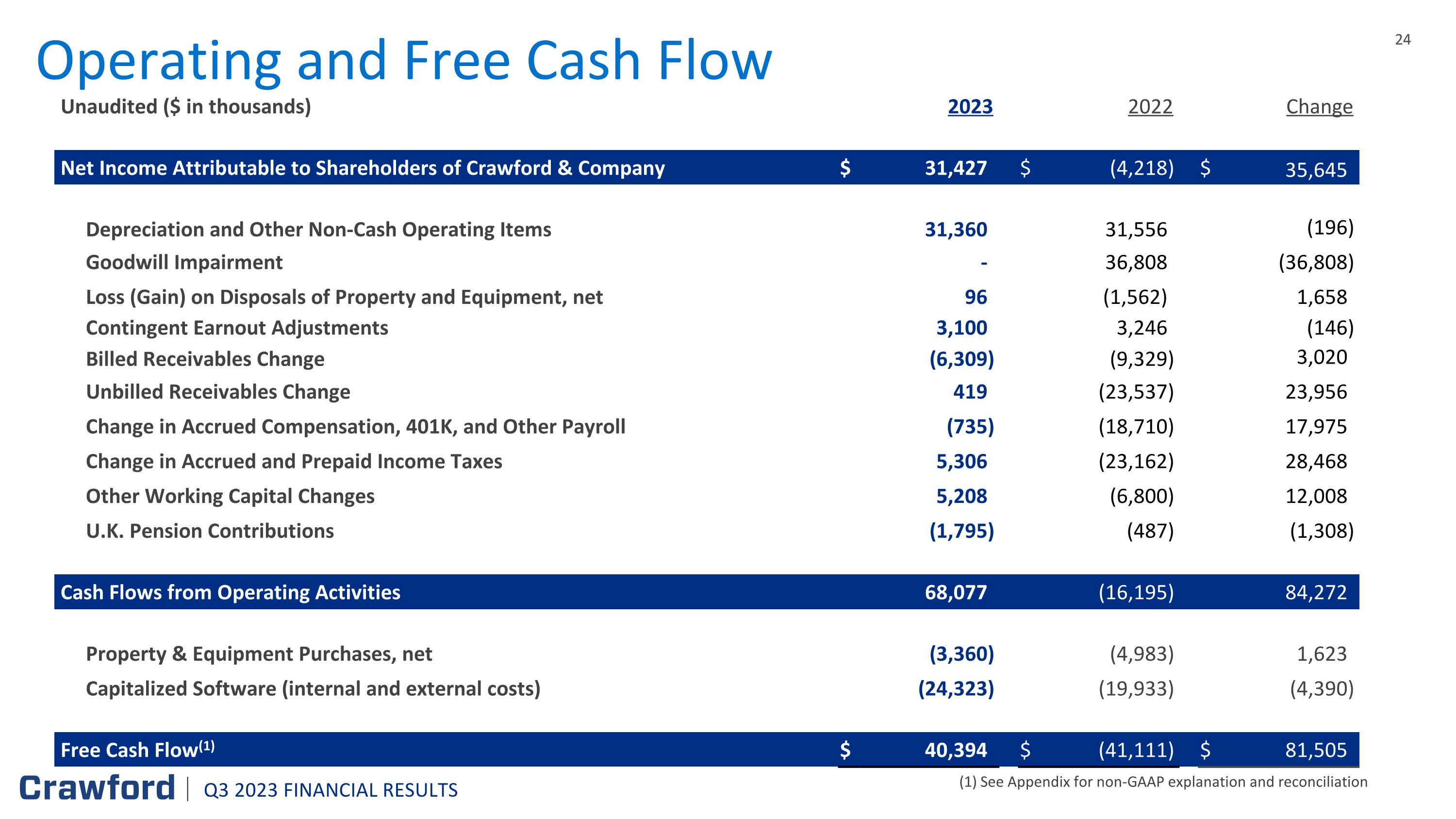

The Company’s consolidated cash and cash equivalents position as of September 30, 2023, totaled $49.2 million, compared with $46.0 million at December 31, 2022. The Company’s total debt outstanding as of September 30, 2023, totaled $218.4 million, compared with $238.9 million at December 31, 2022.

The Company’s operations provided $68.1 million of cash during the first nine months of 2023, compared with $(16.2) million used in 2022. The increase in cash provided was primarily driven by improved earnings, changes in working capital, including a reduction in work in process, increases in accrued incentive compensation as compared to payouts for prior year performance, and an increase in income tax refunds received.

The Company made no contributions to its U.S. defined benefit pension plan and $1.8 million in contributions to its U.K. plans for the first nine months of 2023, compared with no contributions to the U.S. plan and $0.5 million to the U.K. plans in 2022.

During 2023, the Company didn't repurchase any shares of CRD-A, but repurchased 63,103 shares of CRD-B at an average share cost of $9.24. During the first nine months of 2022, the Company repurchased 2,656,474 shares of CRD-A and 963,472 shares of CRD-B at an average per share cost of $7.41 and $7.32, respectively. The total cost of share repurchases during 2023 was $0.6 million through September 30, 2023.

Conference Call

As previously announced, Crawford & Company will host a conference call on November 7, 2023, at 8:30 a.m. Eastern Time to discuss its third quarter 2023 results. The conference call can be accessed live by dialing 1-888-259-6580 and using Conference ID 94766677. A presentation for tomorrow’s call can also be found on the investor relations portion of the Company’s website, https://ir.crawco.com. The call will be recorded and available for replay through December 7, 2023. You may dial 1-877-674-7070 and use passcode 766677# to listen to the replay.

Non-GAAP Presentation

In the normal course of business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under U.S. generally accepted accounting principles (“GAAP”), these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In the foregoing discussion and analysis of segment results of operations, we do not include a gross up of segment expenses and revenues for these pass-through reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our results of operations with no impact to our net income or operating earnings. A reconciliation of revenues before reimbursements to consolidated revenues determined in accordance with GAAP is self-evident from the face of the accompanying unaudited condensed consolidated statements of operations.

3

Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker (“CODM”) to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Unlike net income, segment operating earnings is not a standard performance measure found in GAAP. We believe this measure is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria used by our senior management and CODM. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs, but before net corporate interest expense, stock option expense, goodwill impairment, amortization of customer-relationship intangible assets, contingent earnout adjustments, non-service pension costs and credits, income taxes and net income or loss attributable to noncontrolling interests.

Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. However, adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results. The Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income attributable to shareholders of the Company with adjustments for depreciation and amortization, net corporate interest expense, goodwill impairment, contingent earnout adjustments, non-service pension costs and credits, income taxes and stock-based compensation expense.

Unallocated corporate and shared costs and credits include expenses and credits related to our Chief Executive Officer and Board of Directors, certain provisions for bad debt allowances or subsequent recoveries such as those related to bankrupt clients, certain unallocated professional fees and certain self-insurance costs and recoveries that are not allocated to our individual operating segments.

Income taxes, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, contingent earnout adjustments, and non-service pension costs and credits are recurring components of our net income, but they are not considered part of our segment operating earnings because they are managed on a corporate-wide basis. Income taxes are calculated for the Company on a consolidated basis based on statutory rates in effect in the various jurisdictions in which we provide services and vary significantly by jurisdiction. Net corporate interest expense results from capital structure decisions made by senior management and the Board of Directors, affecting the Company as a whole. Stock option expense represents the non-cash costs generally related to stock options and employee stock purchase plan expenses which are not allocated to our operating segments. Amortization expense is a non-cash expense for finite-lived customer-relationship and trade name intangible assets acquired in business combinations. Contingent earnout adjustments relate to changes in the fair value of earnouts associated with our recent acquisitions. Non-service pension costs and credits represent the U.S. and U.K. non-service defined benefit pension costs, which are non-operating in nature as the U.S. plan was frozen in 2002 and the U.K. plans are closed to new participants. None of these costs relate directly to the performance of our services or operating activities and, therefore, are excluded from segment operating earnings to better assess the results of each segment's operating activities on a consistent basis.

Goodwill impairments arise from time to time due to various factors, but are not allocated to our operating segments since they historically have not regularly impacted our performance and are not expected to impact our future performance on a regular basis.

4

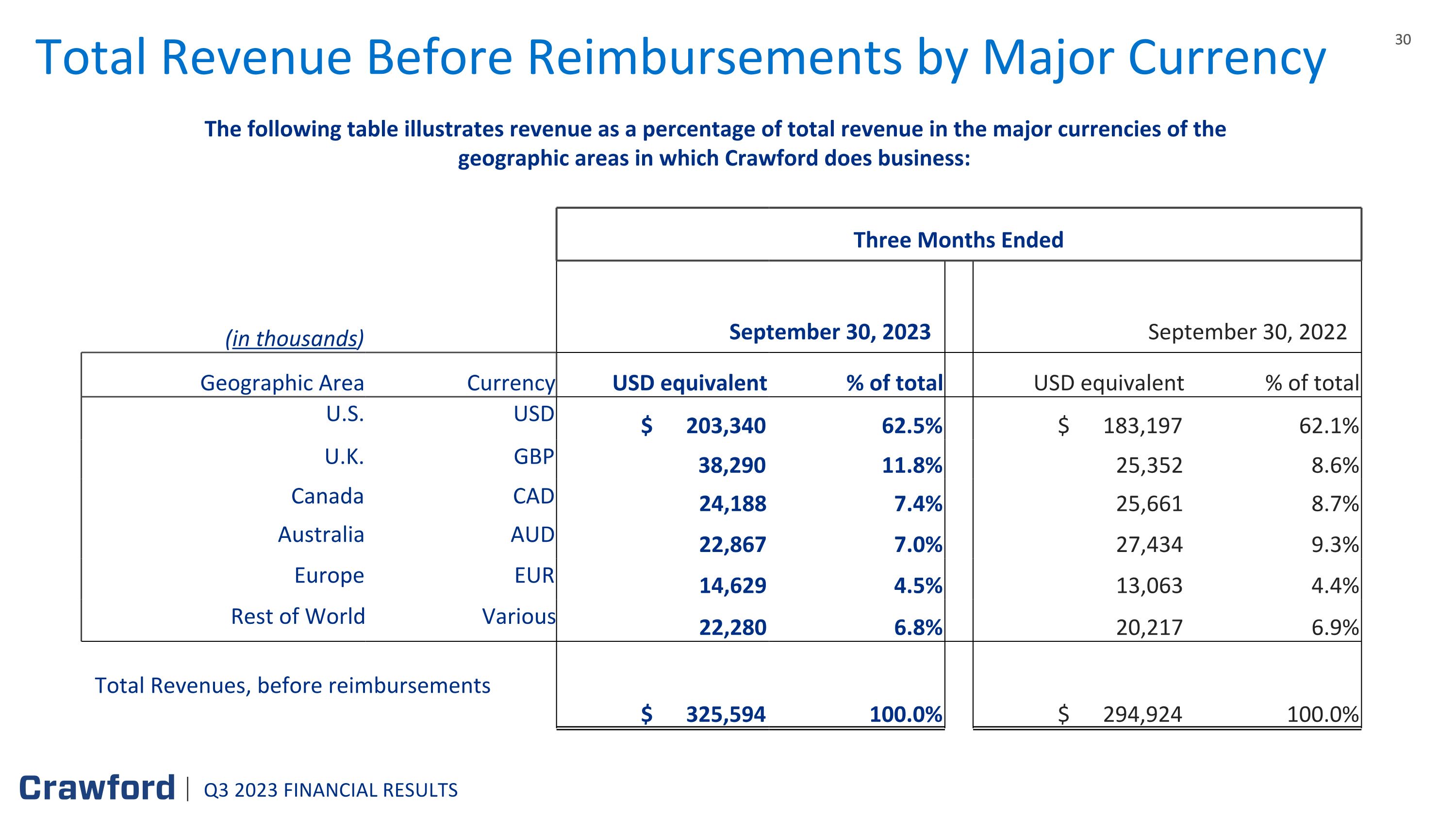

A significant portion of our operations are international. These international operations subject us to foreign exchange fluctuations. The following table illustrates revenue as a percentage of total revenue for the major currencies of the geographic areas that Crawford does business:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

(in thousands) |

|

September 30,

2023 |

|

|

September 30,

2022 |

|

|

September 30,

2023 |

|

|

September 30,

2022 |

|

Geographic Area |

Currency |

USD equivalent |

|

% of total |

|

|

USD equivalent |

|

% of total |

|

|

USD equivalent |

|

% of total |

|

|

USD equivalent |

|

% of total |

|

U.S. |

USD |

$ |

203,340 |

|

|

62.5 |

% |

|

$ |

183,197 |

|

|

62.1 |

% |

|

$ |

601,354 |

|

|

62.7 |

% |

|

$ |

523,650 |

|

|

60.4 |

% |

U.K. |

GBP |

|

38,290 |

|

|

11.8 |

% |

|

|

25,352 |

|

|

8.6 |

% |

|

|

106,139 |

|

|

11.0 |

% |

|

|

92,837 |

|

|

10.7 |

% |

Canada |

CAD |

|

24,188 |

|

|

7.4 |

% |

|

|

25,661 |

|

|

8.7 |

% |

|

|

72,656 |

|

|

7.6 |

% |

|

|

74,597 |

|

|

8.6 |

% |

Australia |

AUD |

|

22,867 |

|

|

7.0 |

% |

|

|

27,434 |

|

|

9.3 |

% |

|

|

68,787 |

|

|

7.2 |

% |

|

|

69,794 |

|

|

8.1 |

% |

Europe |

EUR |

|

14,629 |

|

|

4.5 |

% |

|

|

13,063 |

|

|

4.4 |

% |

|

|

42,968 |

|

|

4.5 |

% |

|

|

41,973 |

|

|

4.8 |

% |

Rest of World |

Various |

|

22,280 |

|

|

6.8 |

% |

|

|

20,217 |

|

|

6.9 |

% |

|

|

67,347 |

|

|

7.0 |

% |

|

|

64,443 |

|

|

7.4 |

% |

Total Revenues, before reimbursements |

$ |

325,594 |

|

|

100.0 |

% |

|

$ |

294,924 |

|

|

100.0 |

% |

|

$ |

959,251 |

|

|

100.0 |

% |

|

$ |

867,294 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Following is a reconciliation of consolidated operating earnings to net income (loss) attributable to shareholders of Crawford & Company on a GAAP basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

(in thousands) |

September 30, 2023 |

|

September 30, 2022 |

|

|

September 30, 2023 |

|

September 30, 2022 |

|

Operating earnings (loss): |

|

|

|

|

|

|

|

|

|

North America Loss Adjusting |

$ |

10,468 |

|

$ |

3,750 |

|

|

$ |

22,433 |

|

$ |

10,533 |

|

International Operations |

|

2,197 |

|

|

(3,922 |

) |

|

|

8,974 |

|

|

(7,648 |

) |

Broadspire |

|

13,532 |

|

|

6,198 |

|

|

|

29,607 |

|

|

20,299 |

|

Platform Solutions |

|

8,523 |

|

|

10,080 |

|

|

|

26,595 |

|

|

22,714 |

|

Unallocated corporate and shared costs, net |

|

(4,781 |

) |

|

(2,438 |

) |

|

|

(9,998 |

) |

|

(7,378 |

) |

Consolidated operating earnings |

|

29,939 |

|

|

13,668 |

|

|

|

77,611 |

|

|

38,520 |

|

(Deduct) add: |

|

|

|

|

|

|

|

|

|

Net corporate interest expense |

|

(4,556 |

) |

|

(2,903 |

) |

|

|

(13,264 |

) |

|

(6,201 |

) |

Stock option expense |

|

(145 |

) |

|

(142 |

) |

|

|

(440 |

) |

|

(478 |

) |

Amortization of intangible assets |

|

(1,986 |

) |

|

(1,998 |

) |

|

|

(5,864 |

) |

|

(5,784 |

) |

Non-service pension costs and credits |

|

(2,170 |

) |

|

532 |

|

|

|

(6,436 |

) |

|

1,646 |

|

Goodwill impairment |

|

— |

|

|

(36,808 |

) |

|

|

— |

|

|

(36,808 |

) |

Contingent earnout adjustments |

|

(2,127 |

) |

|

(887 |

) |

|

|

(3,100 |

) |

|

(3,246 |

) |

Income tax (provision) benefit |

|

(6,781 |

) |

|

13,286 |

|

|

|

(17,258 |

) |

|

8,092 |

|

Net loss attributable to noncontrolling interests |

|

145 |

|

|

108 |

|

|

|

178 |

|

|

41 |

|

Net income (loss) attributable to shareholders of Crawford & Company |

$ |

12,319 |

|

$ |

(15,144 |

) |

|

$ |

31,427 |

|

$ |

(4,218 |

) |

|

|

|

|

|

|

|

|

|

|

5

Following is a reconciliation of net income (loss) attributable to shareholders of Crawford & Company on a GAAP basis to non-GAAP adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

(in thousands) |

September 30,

2023 |

|

September 30,

2022 |

|

|

September 30,

2023 |

|

September 30,

2022 |

|

Net income (loss) attributable to shareholders of Crawford & Company |

$ |

12,319 |

|

$ |

(15,144 |

) |

|

$ |

31,427 |

|

$ |

(4,218 |

) |

Add (Deduct): |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

9,115 |

|

|

8,924 |

|

|

|

27,356 |

|

|

27,379 |

|

Stock-based compensation |

|

1,574 |

|

|

808 |

|

|

|

4,183 |

|

|

4,218 |

|

Net corporate interest expense |

|

4,556 |

|

|

2,903 |

|

|

|

13,264 |

|

|

6,201 |

|

Non-service pension costs and credits |

|

2,170 |

|

|

(532 |

) |

|

|

6,436 |

|

|

(1,646 |

) |

Goodwill impairment |

|

— |

|

|

36,808 |

|

|

|

— |

|

|

36,808 |

|

Contingent earnout adjustments |

|

2,127 |

|

|

887 |

|

|

|

3,100 |

|

|

3,246 |

|

Income tax provision (benefit) |

|

6,781 |

|

|

(13,286 |

) |

|

|

17,258 |

|

|

(8,092 |

) |

Non-GAAP adjusted EBITDA |

$ |

38,642 |

|

$ |

21,368 |

|

|

$ |

103,024 |

|

$ |

63,896 |

|

|

|

|

|

|

|

|

|

|

|

Following is a reconciliation of operating cash flow to free cash flow for the nine months ended September 30, 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

(in thousands) |

September 30, 2023 |

|

|

September 30, 2022 |

|

|

Change |

|

Net Cash Provided by (Used in) Operating Activities |

$ |

68,077 |

|

|

$ |

(16,195 |

) |

|

$ |

84,272 |

|

Less: |

|

|

|

|

|

|

|

|

Property & Equipment Purchases, net |

|

(3,360 |

) |

|

|

(4,983 |

) |

|

|

1,623 |

|

Capitalized Software (internal and external costs) |

|

(24,323 |

) |

|

|

(19,933 |

) |

|

|

(4,390 |

) |

Free Cash Flow |

$ |

40,394 |

|

|

$ |

(41,111 |

) |

|

$ |

81,505 |

|

|

|

|

|

|

|

|

|

|

6

Following are the reconciliations of GAAP Pretax Earnings (Loss), Net Income (Loss) and Earnings (Loss) Per Share to related non-GAAP Adjusted figures, which reflect each of 2023 and 2022 before amortization of intangible assets, goodwill impairments, non-service related pension costs (credits) and contingent earnout adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023 |

|

(in thousands) |

Pretax earnings |

|

Net income

attributable to Crawford & Company |

|

Diluted earnings per

CRD-A

share |

|

Diluted earnings per

CRD-B

share(1) |

|

GAAP |

$ |

18,955 |

|

$ |

12,319 |

|

$ |

0.25 |

|

$ |

0.25 |

|

Adjustments: |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

1,986 |

|

|

1,711 |

|

|

0.03 |

|

|

0.03 |

|

Non-service related pension costs |

|

2,170 |

|

|

1,612 |

|

|

0.03 |

|

|

0.03 |

|

Contingent earnout adjustments |

|

2,127 |

|

|

2,101 |

|

|

0.04 |

|

|

0.04 |

|

Non-GAAP Adjusted |

$ |

25,238 |

|

$ |

17,743 |

|

$ |

0.35 |

|

$ |

0.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2022 |

|

(in thousands) |

Pretax (loss) earnings |

|

Net (loss) income

attributable to Crawford & Company |

|

Diluted (loss) earnings per

CRD-A

share |

|

Diluted (loss) earnings per

CRD-B

share |

|

GAAP |

$ |

(28,538 |

) |

$ |

(15,144 |

) |

$ |

(0.31 |

) |

$ |

(0.31 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

1,998 |

|

|

1,499 |

|

|

0.03 |

|

|

0.03 |

|

Goodwill impairment |

|

36,808 |

|

|

20,908 |

|

|

0.43 |

|

|

0.43 |

|

Non-service related pension credits |

|

(532 |

) |

|

(412 |

) |

|

(0.01 |

) |

|

(0.01 |

) |

Contingent earnout adjustments |

|

887 |

|

|

657 |

|

|

0.01 |

|

|

0.01 |

|

Non-GAAP Adjusted |

$ |

10,623 |

|

$ |

7,508 |

|

$ |

0.15 |

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2023 |

|

(in thousands) |

Pretax earnings |

|

Net income

attributable to Crawford & Company |

|

Diluted earnings per

CRD-A

share |

|

Diluted earnings per

CRD-B

share |

|

GAAP |

$ |

48,507 |

|

$ |

31,427 |

|

$ |

0.63 |

|

$ |

0.64 |

|

Adjustments: |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

5,864 |

|

|

5,039 |

|

|

0.10 |

|

|

0.10 |

|

Non-service related pension costs |

|

6,436 |

|

|

4,782 |

|

|

0.10 |

|

|

0.10 |

|

Contingent earnout adjustments |

|

3,100 |

|

|

2,503 |

|

|

0.05 |

|

|

0.05 |

|

Non-GAAP Adjusted |

$ |

63,907 |

|

$ |

43,751 |

|

$ |

0.88 |

|

$ |

0.89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2022 |

|

(in thousands) |

Pretax (loss) earnings |

|

Net (loss) income

attributable to Crawford & Company |

|

Diluted (loss)

earnings per

CRD-A

share(1) |

|

Diluted (loss)

earnings per

CRD-B

share |

|

GAAP |

$ |

(12,351 |

) |

$ |

(4,218 |

) |

$ |

(0.08 |

) |

$ |

(0.09 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

5,784 |

|

|

4,338 |

|

|

0.09 |

|

|

0.09 |

|

Goodwill impairment |

|

36,808 |

|

|

20,908 |

|

|

0.42 |

|

|

0.42 |

|

Non-service related pension credits |

|

(1,646 |

) |

|

(1,277 |

) |

|

(0.03 |

) |

|

(0.03 |

) |

Contingent earnout adjustments |

|

3,246 |

|

|

2,403 |

|

|

0.05 |

|

|

0.05 |

|

Non-GAAP Adjusted |

$ |

31,841 |

|

$ |

22,154 |

|

$ |

0.44 |

|

$ |

0.44 |

|

|

|

|

|

|

|

|

|

|

(1) Sum of reconciling items may differ from total due to rounding of individual components.

7

Following is information regarding the weighted average shares used in the computation of basic and diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

(in thousands) |

September 30, 2023 |

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

Weighted-Average Shares Used to Compute Basic Earnings Per Share: |

|

|

|

|

|

|

|

|

Class A Common Stock |

|

29,140 |

|

|

28,553 |

|

|

28,980 |

|

|

29,397 |

|

Class B Common Stock |

|

19,837 |

|

|

19,848 |

|

|

19,845 |

|

|

20,202 |

|

Weighted-Average Shares Used to Compute Diluted Earnings Per Share: |

|

|

|

|

|

|

|

|

Class A Common Stock |

|

30,063 |

|

|

28,553 |

|

|

29,659 |

|

|

29,397 |

|

Class B Common Stock |

|

19,837 |

|

|

19,848 |

|

|

19,845 |

|

|

20,202 |

|

|

|

|

|

|

|

|

|

|

Non-GAAP (1) |

|

|

|

|

|

|

|

|

Weighted-Average Shares Used to Compute Diluted Earnings Per Share: |

|

|

|

|

|

|

|

|

Class A Common Stock |

|

30,063 |

|

|

28,930 |

|

|

29,659 |

|

|

29,754 |

|

Class B Common Stock |

|

19,837 |

|

|

19,848 |

|

|

19,845 |

|

|

20,202 |

|

|

|

|

|

|

|

|

|

|

(1) The Company had a net loss for GAAP reporting during the three and nine months ended September 30, 2022, resulting in no additional dilutive securities added to the basic weighted average shares in calculating diluted weighted average shares for GAAP reporting as their impact would be anti-dilutive. As the Company has Non-GAAP positive net income for the three and nine months ended September 30, 2022, these dilutive securities were added back to calculate Non-GAAP earnings per share.

Further information regarding the Company’s operating results for the three and nine months ended September 30, 2023, financial position as of September 30, 2023, and cash flows for the nine months ended September 30, 2023 is shown on the attached unaudited condensed consolidated financial statements.

About Crawford & Company

Based in Atlanta, Crawford & Company (NYSE: CRD-A and CRD-B) is a leading provider of claims management and outsourcing solutions to insurance companies and self-insured entities with an expansive network serving clients in more than 70 countries. The Company's two classes of stock are substantially identical, except with respect to voting rights for the Class B Common Stock (CRD-B) and protections for the non-voting Class A Common Stock (CRD-A). More information is available at www.crawco.com.

TAG: Crawford-Financial, Crawford-Investor-News-and-Events

FOR FURTHER INFORMATION REGARDING THIS PRESS RELEASE, PLEASE CALL BRUCE SWAIN AT (404) 300-1051.

|

This press release contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not historical facts may be “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company’s present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. For further information regarding Crawford & Company, including factors that could cause our actual financial condition, results or earnings to differ from those described in any forward-looking statements, please read Crawford & Company’s reports filed with the SEC and available at www.sec.gov and in the Investor Relations section of Crawford & Company’s website at www.crawco.com. |

8

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

2023 |

|

|

2022 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Revenues Before Reimbursements |

|

$ |

325,594 |

|

|

$ |

294,924 |

|

|

|

10 |

% |

Reimbursements |

|

|

12,066 |

|

|

|

11,493 |

|

|

|

5 |

% |

Total Revenues |

|

|

337,660 |

|

|

|

306,417 |

|

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

Costs of Services Provided, Before Reimbursements |

|

|

229,969 |

|

|

|

221,233 |

|

|

|

4 |

% |

Reimbursements |

|

|

12,066 |

|

|

|

11,493 |

|

|

|

5 |

% |

Total Costs of Services |

|

|

242,035 |

|

|

|

232,726 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

Selling, General, and Administrative Expenses |

|

|

69,920 |

|

|

|

62,983 |

|

|

|

11 |

% |

Corporate Interest Expense, Net |

|

|

4,556 |

|

|

|

2,903 |

|

|

|

57 |

% |

Goodwill Impairment |

|

|

- |

|

|

|

36,808 |

|

|

|

(100 |

)% |

Total Costs and Expenses |

|

|

316,511 |

|

|

|

335,420 |

|

|

|

(6 |

)% |

|

|

|

|

|

|

|

|

|

|

Other (Loss) Income, Net |

|

|

(2,194 |

) |

|

|

465 |

|

|

|

(572 |

)% |

|

|

|

|

|

|

|

|

|

|

Income (Loss) Before Income Taxes |

|

|

18,955 |

|

|

|

(28,538 |

) |

|

|

166 |

% |

Provision (Benefit) for Income Taxes |

|

|

6,781 |

|

|

|

(13,286 |

) |

|

|

151 |

% |

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

|

|

12,174 |

|

|

|

(15,252 |

) |

|

|

180 |

% |

|

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Noncontrolling Interests |

|

|

145 |

|

|

|

108 |

|

|

|

34 |

% |

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Shareholders of Crawford & Company |

|

$ |

12,319 |

|

|

$ |

(15,144 |

) |

|

|

181 |

% |

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share - Basic: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.25 |

|

|

$ |

(0.31 |

) |

|

|

181 |

% |

Class B Common Stock |

|

$ |

0.25 |

|

|

$ |

(0.31 |

) |

|

|

181 |

% |

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share - Diluted: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.25 |

|

|

$ |

(0.31 |

) |

|

|

181 |

% |

Class B Common Stock |

|

$ |

0.25 |

|

|

$ |

(0.31 |

) |

|

|

181 |

% |

|

|

|

|

|

|

|

|

|

|

Cash Dividends Per Share: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.07 |

|

|

$ |

0.06 |

|

|

|

17 |

% |

Class B Common Stock |

|

$ |

0.07 |

|

|

$ |

0.06 |

|

|

|

17 |

% |

9

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

2023 |

|

|

2022 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Revenues Before Reimbursements |

|

$ |

959,251 |

|

|

$ |

867,294 |

|

|

|

11 |

% |

Reimbursements |

|

|

36,743 |

|

|

|

30,564 |

|

|

|

20 |

% |

Total Revenues |

|

|

995,994 |

|

|

|

897,858 |

|

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

Costs of Services Provided, Before Reimbursements |

|

|

691,078 |

|

|

|

644,948 |

|

|

|

7 |

% |

Reimbursements |

|

|

36,743 |

|

|

|

30,564 |

|

|

|

20 |

% |

Total Costs of Services |

|

|

727,821 |

|

|

|

675,512 |

|

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

Selling, General, and Administrative Expenses |

|

|

199,871 |

|

|

|

193,222 |

|

|

|

3 |

% |

Corporate Interest Expense, Net |

|

|

13,264 |

|

|

|

6,201 |

|

|

|

114 |

% |

Goodwill Impairment |

|

|

- |

|

|

|

36,808 |

|

|

|

(100 |

)% |

Total Costs and Expenses |

|

|

940,956 |

|

|

|

911,743 |

|

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

Other (Loss) Income, Net |

|

|

(6,531 |

) |

|

|

1,534 |

|

|

|

(526 |

)% |

|

|

|

|

|

|

|

|

|

|

Income (Loss) Before Income Taxes |

|

|

48,507 |

|

|

|

(12,351 |

) |

|

|

493 |

% |

Provision (Benefit) for Income Taxes |

|

|

17,258 |

|

|

|

(8,092 |

) |

|

|

313 |

% |

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

|

|

31,249 |

|

|

|

(4,259 |

) |

|

|

834 |

% |

|

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Noncontrolling Interests |

|

|

178 |

|

|

|

41 |

|

|

|

334 |

% |

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Shareholders of Crawford & Company |

|

$ |

31,427 |

|

|

$ |

(4,218 |

) |

|

|

845 |

% |

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share - Basic: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.64 |

|

|

$ |

(0.08 |

) |

|

|

900 |

% |

Class B Common Stock |

|

$ |

0.64 |

|

|

$ |

(0.09 |

) |

|

|

811 |

% |

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share - Diluted: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.63 |

|

|

$ |

(0.08 |

) |

|

|

888 |

% |

Class B Common Stock |

|

$ |

0.64 |

|

|

$ |

(0.09 |

) |

|

|

811 |

% |

|

|

|

|

|

|

|

|

|

|

Cash Dividends Per Share: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.19 |

|

|

$ |

0.18 |

|

|

|

6 |

% |

Class B Common Stock |

|

$ |

0.19 |

|

|

$ |

0.18 |

|

|

|

6 |

% |

10

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

As of September 30, 2023 and December 31, 2022

Unaudited

(In Thousands, Except Par Values)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

49,208 |

|

|

$ |

46,007 |

|

Accounts Receivable, Net |

|

|

151,142 |

|

|

|

141,106 |

|

Unbilled Revenues, at Estimated Billable Amounts |

|

|

131,251 |

|

|

|

126,274 |

|

Income Taxes Receivable |

|

|

4,245 |

|

|

|

9,098 |

|

Prepaid Expenses and Other Current Assets |

|

|

44,145 |

|

|

|

28,782 |

|

Total Current Assets |

|

|

379,991 |

|

|

|

351,267 |

|

|

|

|

|

|

|

|

Net Property and Equipment |

|

|

24,322 |

|

|

|

27,809 |

|

|

|

|

|

|

|

|

Other Assets: |

|

|

|

|

|

|

Operating Lease Right-of-Use Asset, Net |

|

|

91,364 |

|

|

|

93,334 |

|

Goodwill |

|

|

76,637 |

|

|

|

76,622 |

|

Intangible Assets Arising from Business Acquisitions, Net |

|

|

84,960 |

|

|

|

88,039 |

|

Capitalized Software Costs, Net |

|

|

93,370 |

|

|

|

82,975 |

|

Deferred Income Tax Assets |

|

|

18,142 |

|

|

|

19,573 |

|

Other Noncurrent Assets |

|

|

58,405 |

|

|

|

51,888 |

|

Total Other Assets |

|

|

422,878 |

|

|

|

412,431 |

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

827,191 |

|

|

$ |

791,507 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ INVESTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Short-Term Borrowings |

|

$ |

16,955 |

|

|

$ |

27,048 |

|

Accounts Payable |

|

|

44,473 |

|

|

|

50,847 |

|

Accrued Compensation and Related Costs |

|

|

81,579 |

|

|

|

79,285 |

|

Self-Insured Risks |

|

|

22,545 |

|

|

|

12,614 |

|

Income Taxes Payable |

|

|

632 |

|

|

|

1,208 |

|

Operating Lease Liability |

|

|

24,766 |

|

|

|

22,910 |

|

Other Accrued Liabilities |

|

|

65,219 |

|

|

|

56,293 |

|

Deferred Revenues |

|

|

34,512 |

|

|

|

29,282 |

|

Total Current Liabilities |

|

|

290,681 |

|

|

|

279,487 |

|

|

|

|

|

|

|

|

Noncurrent Liabilities: |

|

|

|

|

|

|

Long-Term Debt and Finance Leases, Less Current Installments |

|

|

201,487 |

|

|

|

211,810 |

|

Operating Lease Liability |

|

|

80,411 |

|

|

|

84,628 |

|

Deferred Revenues |

|

|

25,535 |

|

|

|

24,737 |

|

Accrued Pension Liabilities |

|

|

24,969 |

|

|

|

25,914 |

|

Other Noncurrent Liabilities |

|

|

41,138 |

|

|

|

41,553 |

|

Total Noncurrent Liabilities |

|

|

373,540 |

|

|

|

388,642 |

|

|

|

|

|

|

|

|

Shareholders’ Investment: |

|

|

|

|

|

|

Class A Common Stock, $1.00 Par Value |

|

|

29,148 |

|

|

|

28,764 |

|

Class B Common Stock, $1.00 Par Value |

|

|

19,785 |

|

|

|

19,848 |

|

Additional Paid-in Capital |

|

|

83,548 |

|

|

|

78,158 |

|

Retained Earnings |

|

|

234,718 |

|

|

|

213,094 |

|

Accumulated Other Comprehensive Loss |

|

|

(202,577 |

) |

|

|

(215,321 |

) |

Shareholders’ Investment Attributable to Shareholders of Crawford & Company |

|

|

164,622 |

|

|

|

124,543 |

|

Noncontrolling Interests |

|

|

(1,652 |

) |

|

|

(1,165 |

) |

Total Shareholders’ Investment |

|

|

162,970 |

|

|

|

123,378 |

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Investment |

|

$ |

827,191 |

|

|

$ |

791,507 |

|

11

CRAWFORD & COMPANY

SUMMARY RESULTS BY OPERATING SEGMENT WITH DIRECT COMPENSATION AND OTHER EXPENSES

Unaudited

(In Thousands, Except Percentages)

Three Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America Loss Adjusting |

|

% |

|

International Operations |

|

% |

|

Broadspire |

|

% |

|

Platform Solutions |

|

% |

|

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

|

2023 |

|

2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues Before Reimbursements |

|

$ |

79,390 |

|

$ |

66,822 |

|

18.8% |

|

$ |

98,066 |

|

$ |

86,066 |

|

13.9% |

|

$ |

88,299 |

|

$ |

78,381 |

|

12.7% |

|

$ |

59,839 |

|

$ |

63,655 |

|

(6.0)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Compensation, Fringe Benefits & Non-Employee Labor |

|

|

53,635 |

|

|

48,331 |

|

11.0% |

|

|

66,426 |

|

|

61,666 |

|

7.7% |

|

|

54,310 |

|

|

49,863 |

|

8.9% |

|

|

39,638 |

|

|

42,106 |

|

(5.9)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

|

67.6 |

% |

|

72.3 |

% |

|

|

|

67.7 |

% |

|

71.6 |

% |

|

|

|

61.5 |

% |

|

63.6 |

% |

|

|

|

66.2 |

% |

|

66.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor |

|

|

15,287 |

|

|

14,741 |

|

3.7% |

|

|

29,443 |

|

|

28,322 |

|

4.0% |

|

|

20,457 |

|

|

22,320 |

|

(8.3)% |

|

|

11,678 |

|

|

11,469 |

|

1.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

|

19.3 |

% |

|

22.1 |

% |

|

|

|

30.0 |

% |

|

32.9 |

% |

|

|

|

23.2 |

% |

|

28.5 |

% |

|

|

|

19.5 |

% |

|

18.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

|

68,922 |

|

|

63,072 |

|

9.3% |

|

|

95,869 |

|

|

89,988 |

|

6.5% |

|

|

74,767 |

|

|

72,183 |

|

3.6% |

|

|

51,316 |

|

|

53,575 |

|

(4.2)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Earnings (Loss) (1) |

|

$ |

10,468 |

|

$ |

3,750 |

|

179.1% |

|

$ |

2,197 |

|

$ |

(3,922 |

) |

nm |

|

$ |

13,532 |

|

$ |

6,198 |

|

118.3% |

|

$ |

8,523 |

|

$ |

10,080 |

|

(15.4)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

|

13.2 |

% |

|

5.6 |

% |

|

|

|

2.2 |

% |

|

(4.6 |

)% |

|

|

|

15.3 |

% |

|

7.9 |

% |

|

|

|

14.2 |

% |

|

15.8 |

% |

|

Nine Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America Loss Adjusting |

% |

International Operations |

% |

|

Broadspire |

% |

|

Platforms Solutions |

% |

|

|

2023 |

2022 |

Change |

|

2023 |

2022 |

Change |

|

2023 |

2022 |

Change |

|

2023 |

2022 |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues Before Reimbursements |

|

$232,344 |

$197,035 |

17.9% |

|

$285,241 |

$269,048 |

6.0% |

|

$253,369 |

$234,949 |

7.8% |

|

$188,297 |

$166,262 |

13.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Compensation, Fringe Benefits & Non-Employee Labor |

|

162,418 |

142,937 |

13.6% |

|

190,178 |

190,273 |

(0.0)% |

|

161,451 |

147,611 |

9.4% |

|

124,238 |

110,424 |

12.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

69.9% |

72.5% |

|

|

66.7% |

70.7% |

|

|

63.7% |

62.8% |

|

|

66.0% |

66.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor |

|

47,493 |

43,565 |

9.0% |

|

86,089 |

86,423 |

(0.4)% |

|

62,311 |

67,039 |

(7.1)% |

|

37,464 |

33,124 |

13.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

20.4% |

22.1% |

|

|

30.2% |

32.1% |

|

|

24.6% |

28.5% |

|

|

19.9% |

19.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

209,911 |

186,502 |

12.6% |

|

276,267 |

276,696 |

(0.2)% |

|

223,762 |

214,650 |

4.2% |

|

161,702 |

143,548 |

12.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Earnings (Loss)(1) |

|

$22,433 |

$10,533 |

113.0% |

|

$8,974 |

$(7,648) |

nm |

|

$29,607 |

$20,299 |

45.9% |

|

$26,595 |

$22,714 |

17.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

9.7% |

5.3% |

|

|

3.1% |

(2.8)% |

|

|

11.7% |

8.6% |

|

|

14.1% |

13.7% |

|

(1) A non-GAAP financial measurement which represents net income attributable to the applicable reporting segment excluding income taxes, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, non-service pension costs and credits, contingent earnout adjustments, goodwill impairments, and certain unallocated corporate and shared costs and credits. See pages 3 and 4 for additional information about segment operating earnings.

12

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Year to Date Period Ended September 30, 2023 and September 30, 2022

Unaudited

(In Thousands)

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

Cash Flows From Operating Activities: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

31,249 |

|

|

$ |

(4,259 |

) |

Reconciliation of net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

27,355 |

|

|

|

27,379 |

|

Goodwill impairment |

|

|

— |

|

|

|

36,808 |

|

Stock-based compensation |

|

|

4,183 |

|

|

|

4,218 |

|

Loss (gain) on disposal of property and equipment |

|

|

96 |

|

|

|

(1,562 |

) |

Contingent earnout adjustments |

|

|

3,100 |

|

|

|

3,246 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

(6,309 |

) |

|

|

(9,329 |

) |

Unbilled revenues, net |

|

|

419 |

|

|

|

(23,537 |

) |

Accrued or prepaid income taxes |

|

|

5,306 |

|

|

|

(23,162 |

) |

Accounts payable and accrued liabilities |

|

|

(1,437 |

) |

|

|

(20,612 |

) |

Deferred revenues |

|

|

4,869 |

|

|

|

(191 |

) |

Accrued retirement costs |

|

|

4,818 |

|

|

|

(1,684 |

) |

Prepaid expenses and other operating activities |

|

|

(5,572 |

) |

|

|

(3,510 |

) |

Net cash provided by (used in) operating activities |

|

|

68,077 |

|

|

|

(16,195 |

) |

|

|

|

|

|

|

|

Cash Flows From Investing Activities: |

|

|

|

|

|

|

Acquisitions of property and equipment |

|

|

(3,360 |

) |

|

|

(4,983 |

) |

Capitalization of computer software costs |

|

|

(24,323 |

) |

|

|

(19,933 |

) |

Payments for business acquisitions, net of cash acquired |

|

|

— |

|

|

|

(26,309 |

) |

Cash proceeds from sale of property and equipment |

|

|

— |

|

|

|

3,032 |

|

Net cash used in investing activities |

|

|

(27,683 |

) |

|

|

(48,193 |

) |

|

|

|

|

|

|

|

Cash Flows From Financing Activities: |

|

|

|

|

|

|

Cash dividends paid |

|

|

(9,284 |

) |

|

|

(8,938 |

) |

Repurchases of common stock |

|

|

(582 |

) |

|

|

(26,749 |

) |

Increases in short-term and revolving credit facility borrowings |

|

|

20,958 |

|

|

|

99,952 |

|

Payments on short-term and revolving credit facility borrowings |

|

|

(43,719 |

) |

|

|

(15,129 |

) |

Payments of contingent consideration on acquisitions |

|

|

(6,760 |

) |

|

|

(2,118 |

) |

Other financing activities |

|

|

1,317 |

|

|

|

(87 |

) |

Net cash (used in) provided by financing activities |

|

|

(38,070 |

) |

|

|

46,931 |

|

|

|

|

|

|

|

|

Effects of exchange rate changes on cash and cash equivalents |

|

|

1,313 |

|

|

|

(2,351 |

) |

Increase (Decrease) in cash, cash equivalents, and restricted cash(1) |

|

|

3,637 |

|

|

|

(19,808 |

) |

Cash, cash equivalents, and restricted cash at beginning of year(1) |

|

|

46,645 |

|

|

|

53,689 |

|

Cash, cash equivalents, and restricted cash at end of period(1) |

|

$ |

50,282 |

|

|

$ |

33,881 |

|

(1) The 2023 amounts include beginning restricted cash of $638 at December 31, 2022, and ending restricted cash of $1,074 at September 30, 2023, and the 2022 amounts include beginning restricted cash of $461 at December 31, 2021, and ending restricted cash of $782 at September 30, 2022, which we present as part of "Prepaid expenses and other current assets" on the Balance Sheets.

13

Third Quarter 2023 Financial Results CRD-A & CRD-B (NYSE) ® Crawford & Company