Carpenter Technology Highlights Strategic Priorities and Long-Term Financial Goals at Investor Day

16 Mayo 2023 - 7:45AM

Carpenter Technology Corporation (NYSE: CRS) (the “Company”) will

hold an investor event today covering the company’s strategic

priorities and financial goals. The presentation will also be

broadcast live via webcast.

“Carpenter Technology is at an

inflection point, with the opportunity to realize meaningful,

profitable growth”, said Tony Thene, President and CEO. “We

participate in high growth, high value markets, including the

aerospace and defense and medical end-use markets. And we have the

world-class capabilities and assets that deliver the materials

solutions our customers need.”

“Operating in a strong demand

environment with our unique portfolio of material solutions, we are

well-positioned to accelerate growth. Primarily driven by higher

prices, an improving product mix and increasing volumes, we see a

path to double operating income from fiscal year 2019 levels by

fiscal year 2027. This operating income growth will deliver

meaningful cash flow over the next several years, driving further

value to our shareholders.”

In addition to providing insight

into the business, the Company will provide detail on its stated

goal to double fiscal year 2019 adjusted operating income by fiscal

year 2027:

- Specialty Alloys Operations segment expected to exceed 20

percent adjusted operating income margins on net sales excluding

surcharges of approximately $2.2 billion to 2.4 billion in fiscal

year 2027.

- Performance Engineered Products segment expected to reach

adjusted operating income margins of 13-15 percent on $570 million

to $610 million of net sales excluding surcharges in fiscal year

2027.

- Overall, expected to generate $400-600 million in cumulative

adjusted free cash flow between fiscal year 2024 and fiscal year

2027.

“It is an exciting time for

Carpenter Technology. We have demonstrated our recovering growth

trajectory through fiscal year 2023, with increasing productivity

across our facilities, and we expect to take a significant step

forward in fiscal year 2024. We remain focused on leveraging our

unique capabilities to deliver engineered solutions for critical

applications across high growth, high value end-use markets to

achieve our financial goals.”

Conference Call and Webcast Presentation

Carpenter

Technology will host the Investor Day presentation webcast today,

May 16, 2023, at 9:00 a.m. ET. Access to the live webcast will be

available at Carpenter Technology’s website

(http://ir.carpentertechnology.com), and a replay will soon be made

available at http://ir.carpentertechnology.com. Presentation

materials used during this presentation will be available for

viewing and download at http://ir.carpentertechnology.com.

About Carpenter Technology

Carpenter

Technology Corporation is a recognized leader in high-performance

specialty alloy-based materials and process solutions for critical

applications in the aerospace, defense, medical, transportation,

energy, industrial and consumer electronics markets. Founded in

1889, Carpenter Technology has evolved to become a pioneer in

premium specialty alloys, including titanium, nickel, and cobalt,

as well as alloys specifically engineered for additive

manufacturing (AM) processes and soft magnetics applications.

Carpenter Technology has expanded its AM capabilities to provide a

complete “end-to-end” solution to accelerate materials innovation

and streamline parts production. More information about Carpenter

Technology can be found at www.carpentertechnology.com.

Forward-Looking

Statements This

presentation contains forward-looking statements within the meaning

of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter Technology’s filings with the Securities

and Exchange Commission, including its report on Form 10-K for the

fiscal year ended June 30, 2022, Form 10-Q for the fiscal quarters

ended September 30, 2022, December 31, 2022, and March 31, 2023 and

the exhibits attached to those filings. They include but are not

limited to: (1) the cyclical nature of the specialty materials

business and certain end-use markets, including aerospace, defense,

medical, transportation, energy, industrial and consumer, or other

influences on Carpenter Technology's business such as new

competitors, the consolidation of competitors, customers, and

suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; (2) the ability of Carpenter

Technology to achieve cash generation, growth, earnings,

profitability, operating income, cost savings and reductions,

qualifications, productivity improvements or process changes; (3)

the ability to recoup increases in the cost of energy, raw

materials, freight or other factors; (4) domestic and foreign

excess manufacturing capacity for certain metals; (5) fluctuations

in currency exchange rates; (6) the effect of government trade

actions; (7) the valuation of the assets and liabilities in

Carpenter Technology's pension trusts and the accounting for

pension plans; (8) possible labor disputes or work stoppages; (9)

the potential that our customers may substitute alternate materials

or adopt different manufacturing practices that replace or limit

the suitability of our products; (10) the ability to successfully

acquire and integrate acquisitions; (11) the availability of credit

facilities to Carpenter Technology, its customers or other members

of the supply chain; (12) the ability to obtain energy or raw

materials, especially from suppliers located in countries that may

be subject to unstable political or economic conditions; (13)

Carpenter Technology's manufacturing processes are dependent upon

highly specialized equipment located primarily in facilities in

Reading and Latrobe, Pennsylvania and Athens, Alabama for which

there may be limited alternatives if there are significant

equipment failures or a catastrophic event; (14) the ability to

hire and retain a qualified workforce and key personnel, including

members of the executive management team, management, metallurgists

and other skilled personnel; (15) fluctuations in oil and gas

prices and production; (16) the impact of potential cyber attacks

and information technology or data security breaches; (17)

inability of suppliers to meet obligations due to supply chain

disruptions or otherwise; (18) inability to meet increased demand,

production targets or commitments; (19) the ability to manage the

impacts of natural disasters, climate change, pandemics and

outbreaks of contagious diseases and other adverse public health

developments, such as the COVID-19 pandemic; and (20) geopolitical,

economic, and regulatory risks relating to our global business,

including geopolitical and diplomatic tensions, instabilities and

conflicts, such as the war in Ukraine, as well as compliance with

U.S. and foreign trade and tax laws, sanctions, embargoes and other

regulations. Any of these factors could have an adverse and/or

fluctuating effect on Carpenter Technology's results of operations.

The forward-looking statements in this document are intended to be

subject to the safe harbor protection provided by Section 27A of

the Securities Act of 1933, as amended (the "Securities Act"), and

Section 21E of the Securities Exchange Act of 1934, as amended. We

caution you not to place undue reliance on forward-looking

statements, which speak only as of the date of this presentation or

as of the dates otherwise indicated in such forward-looking

statements. Carpenter Technology undertakes no obligation to update

or revise any forward-looking statements.

| Investor

Inquiries: |

Media

Inquiries: |

| John Huyette |

Heather Beardsley |

| +1 610-208-2061 |

+1 610-208-2278 |

| jhuyette@cartech.com |

hbeardsley@cartech.com |

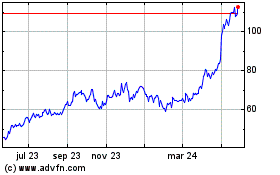

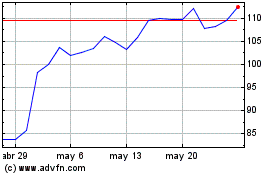

Carpenter Technology (NYSE:CRS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Carpenter Technology (NYSE:CRS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024