false

0000093410

0000093410

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 31, 2024

| Chevron Corporation |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-00368 |

|

94-0890210 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

5001 Executive Parkway, Suite 200

San Ramon, CA |

|

94583 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| (925) 842-1000 |

| Registrant’s telephone number, including area code |

| |

|

N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock, par value $.75 per share |

|

CVX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October 22, 2023, Chevron Corporation (“Chevron”)

entered into a definitive merger agreement with Hess Corporation (“Hess”), pursuant to which, subject

to the terms and conditions of the merger agreement, a subsidiary of Chevron will be merged with and into Hess, with Hess continuing as

the surviving corporation of such merger and as a direct, wholly-owned subsidiary of Chevron (such transaction, the “Merger”).

Hess Guyana Exploration Limited (“HGEL”), a

wholly owned subsidiary of Hess, is currently in arbitration with respect to the right of first refusal (the “Stabroek ROFR”)

contained in an operating agreement among HGEL and affiliates of Exxon Mobil Corporation (“Exxon”) and China National

Offshore Oil Corporation (“CNOOC”) regarding the Stabroek Block offshore Guyana.

The arbitration merits hearing about the applicability of the Stabroek

ROFR to the Merger has been scheduled for May 2025, with a decision expected in the following three months. Chevron and Hess had expected

and requested that this hearing be held earlier, but the arbitrators’ common schedules did not make this possible.

The views of Chevron and Hess on the merits remain unchanged.

Exxon and CNOOC continue to ignore the plain language of the operating agreement, and Chevron and Hess remain confident that the

arbitration will confirm that the Stabroek ROFR does not apply to the Merger.

Chevron and Hess remain committed to the Merger and look forward

to combining the two companies.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements”

within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. You can identify these statements and other forward-looking statements in this document

by words such as “expects,” “focus,” “intends,” “anticipates,” “plans,” “targets,”

“poised,” “advances,” “drives,” “aims,” “forecasts,” “believes,”

“approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,”

“progress,” “may,” “can,” “could,” “should,” “will,” “budgets,”

“outlook,” “trends,” “guidance,” “commits,” “on track,” “objectives,”

“goals,” “projects,” “strategies,” “opportunities,” “potential,” “ambitions,”

“aspires” and similar expressions, and variations or negatives of these words, but not all forward-looking statements include

such words.

Forward-looking statements by their nature address matters

that are, to different degrees, uncertain, such as statements about the consummation of the potential transaction, including the

expected time period to consummate the potential transaction, and the anticipated benefits (including synergies) of the potential

transaction. All such forward-looking statements are based upon current plans, estimates, expectations, and ambitions that are

subject to risks, uncertainties, and assumptions, many of which are beyond the control of Chevron and Hess, that could cause actual

results to differ materially from those expressed in such forward-looking statements. Key factors that could cause actual results to

differ materially from those expressed in such forward-looking statements include, but are not limited to the risk that regulatory

approvals are not obtained or are obtained subject to conditions that are not anticipated by Chevron and Hess; potential delays in

consummating the potential transaction, including as a result of regulatory proceedings or the ongoing arbitration proceedings

regarding preemptive rights in the Stabroek Block joint operating agreement; risks that such ongoing arbitration is not

satisfactorily resolved and the potential transaction fails to be consummated; Chevron’s ability to integrate Hess’

operations in a successful manner and in the expected time period; the possibility that any of the anticipated benefits and

projected synergies of the potential transaction will not be realized or will not be realized within the expected time period; the

occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; risks that

the anticipated tax treatment of the potential transaction is not obtained; unforeseen or unknown liabilities; customer,

shareholder, regulatory and other stakeholder approvals and support; unexpected future capital expenditures; potential litigation

relating to the potential transaction that could be instituted against Chevron and Hess or their respective directors; the

possibility that the potential transaction may be more expensive to complete than anticipated, including as a result of unexpected

factors or events; the effect of the announcement, pendency or completion of the potential transaction on the parties’

business relationships and business generally; risks that the potential transaction disrupts current plans and operations of Chevron

or Hess and potential difficulties in Hess employee retention as a result of the potential transaction, as well as the risk of

disruption of Chevron’s or Hess’ management and business disruption during the pendency of, or following, the potential

transaction; changes to the company’s capital allocation strategies; uncertainties as to whether the potential transaction

will be consummated on the anticipated timing or at all, or if consummated, will achieve its anticipated economic benefits,

including as a result of regulatory proceedings and risks associated with third party contracts containing material consent,

anti-assignment, transfer or other provisions that may be related to the potential transaction and that are not waived or otherwise

satisfactorily resolved; changes in commodity prices; negative effects of the

pendency or completion of the proposed acquisition on the market price of Chevron’s or Hess’ common stock and/or

operating results; rating agency actions and Chevron’s and Hess’ ability to access short- and long-term debt markets on

a timely and affordable basis; various events that could disrupt operations, including severe weather, such as droughts, floods,

avalanches and earthquakes, and cybersecurity attacks, as well as security threats and governmental response to them, and

technological changes; labor disputes; changes in labor costs and labor difficulties; the effects of industry, market, economic,

political or regulatory conditions outside of Chevron’s or Hess’ control; legislative, regulatory and economic

developments targeting public companies in the oil and gas industry; and the risks described in (i) Part I, Item 1A “Risk

Factors” of (a) Chevron’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form

10-Q for the quarterly period ended March 31, 2024 and (b) Hess’ Annual Report on Form 10-K for the year ended December 31,

2023 and Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, (ii) Hess’ definitive proxy statement in

connection with the potential transaction, and (iii) other filings of Chevron and Hess with the U.S. Securities and Exchange

Commission (“SEC”). Other unpredictable or unknown factors not discussed in this communication could also have material

adverse effects on forward-looking statements. Neither Chevron nor Hess assumes an obligation to update any forward-looking

statements, except as required by law. You are cautioned not to place undue reliance on any of these forward-looking statements as

they are not guarantees of future performance or outcomes and that actual performance and outcomes. These forward-looking statements

speak only as of the date hereof.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 31, 2024

| |

CHEVRON CORPORATION

|

|

| |

By: |

/s/ Christine L. Cavallo |

|

| |

Name: |

Christine L. Cavallo |

|

| |

Title: |

Assistant Secretary |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

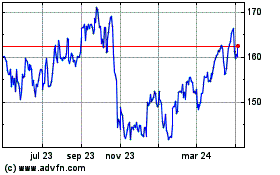

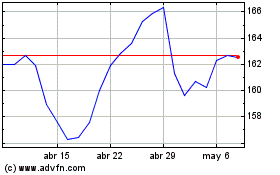

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024