Record Quarterly Revenue of $115.8 Million, Up

22% Year-Over-Year Annualized Recurring Revenue of $456.9 Million,

Up 26% Year-Over-Year Net Income of $4.8 Million; Adjusted EBITDA

of $38.3 Million, Up 34% Year-Over-Year Gross Revenue Retention

Rate of 99%; Net Revenue Retention Rate of 114% Operating Cash

Flows of $49.7 Million, Up 57% Year-Over-Year

Clearwater Analytics Holdings, Inc. (NYSE: CWAN)

(“Clearwater Analytics” or the “Company”), a leading worldwide

provider of SaaS-based investment management, accounting,

reporting, and analytics solutions, today announced its financial

results for the quarter ended September 30, 2024.

“It’s very gratifying to see continued excellence in execution.

Our results are truly outstanding – revenue growth, ARR growth,

adjusted EBITDA, cash flow generation, GRR, and NRR were all very

strong. And these results were achieved while continuing to make

substantial investments in R&D, operations, and go-to-market

for the short, medium, and long term,” said Sandeep Sahai, CEO of

Clearwater Analytics. “Little has changed in our strategy. We

continue to make meaningful investments in developing new products

focused on both new logos and current clients. Our single instance,

multi-tenant platform gives us a strong competitive advantage in

developing generative AI applications that are capable of

delivering innovative solutions to clients while increasing our

operational efficiency. By capitalizing on these opportunities and

remaining agile, we’re extending our long-term market

differentiation and accelerating our journey towards building the

world's leading investment management platform.”

Mr. Sahai added: “We are excited to have entered into an

agreement to terminate the Company’s Tax Receivable Agreement. We

believe this transaction, which is subject to approval by our

unaffiliated shareholders, will generate significant savings, allow

for better future use of Company cash flows and provide greater

certainty to the Company’s shareholders about its future financial

performance. We believe that it is advisable to pursue this

transaction at this time while certain of the TRA parties hold

significant equity stakes in Clearwater, which would mean that such

TRA parties would benefit from any potential upside in the

Company’s equity and be more inclined to agree to terms of the

Amendment and the TRA Buyout that are more favorable to the Company

than they otherwise would, which may not be the case in the

future.”

Third Quarter 2024 Financial Results

Summary

- Revenue: Total revenue for the third quarter of 2024 was

$115.8 million, an increase of 22.4%, from $94.7 million in the

third quarter of 2023.

- Gross Profit: Gross profit for the third quarter of 2024

increased to $84.5 million, which equates to a 72.9% GAAP gross

margin, compared with gross profit of $67.7 million and GAAP gross

margin of 71.5% in the third quarter of 2023. Non-GAAP gross profit

for the third quarter of 2024 was $90.9 million, which equates to a

78.5% non-GAAP gross margin and an increase of 110 basis points

over the third quarter of 2023.

- Net Income/(Loss): Net income for the third quarter of

2024 was $4.8 million, compared with net loss of $2.3 million in

the third quarter of 2023.

- Adjusted EBITDA: Adjusted EBITDA for the third quarter

of 2024 was $38.3 million, an increase of 34.3%, from $28.6 million

in the third quarter of 2023. Adjusted EBITDA margin for the third

quarter of 2024 was 33.1%, an increase of 290 basis points over the

third quarter of 2023.

- Cash Flows: Operating cash flows for the third quarter

of 2024 were $49.7 million. Free cash flows for the third quarter

of 2024 were $48.1 million, an increase of 55.6%, from $30.9

million in the third quarter of 2023. Cash flows improved as a

result of generating positive net income as well as positive

working capital changes in the third quarter of 2024 compared to

the third quarter of 2023.

- Earnings Per Share and Non-GAAP Net Income Per Share

attributable to Clearwater Analytics Holdings, Inc.: Earnings

per basic share was $0.02, and earnings per diluted share was $0.02

in the third quarter of 2024. Non-GAAP net income per basic share

was $0.14, and non-GAAP net income per diluted share was $0.12 in

the third quarter of 2024.

- Cash, cash equivalents, and investments were $336.7

million as of September 30, 2024. Total debt, net of debt issuance

cost, was $46.6 million as of September 30, 2024.

Third Quarter 2024 Key Metrics

Summary

- Annualized Recurring Revenue: As of September 30, 2024,

annualized recurring revenue (“ARR”) reached $456.9 million, an

increase of 26.1% from $362.4 million as of September 30, 2023. ARR

is calculated at the end of a period by dividing the recurring

revenue in the last month of such period by the number of days in

the month and multiplying by 365.

- Gross Revenue Retention Rate: As of September 30, 2024,

the gross revenue retention rate was 99%, compared to 98% as of

September 30, 2023. Gross revenue retention rate represents annual

contract value (“ACV”) at the beginning of the 12-month period

ended on the reporting date less client attrition over the prior

12-month period, divided by ACV at the beginning of the 12-month

period, expressed as a percentage. ACV is comprised of annualized

recurring revenue plus contracted-not-billed revenue, which

represents the estimated annual contracted revenue for new and

existing client opportunities prior to revenue recognition.

- Net Revenue Retention Rate: As of September 30, 2024,

the net revenue retention rate was 114%, compared to 110% as of

June 30, 2024 and to 108% as of September 30, 2023. Net revenue

retention rate is the percentage of recurring revenue from clients

on the platform for 12 months and includes changes from the

addition, removal, or value of assets on our platform, contractual

changes that have an impact to annualized recurring revenues and

lost revenue from client attrition.

Recent Business

Highlights

- The Company today announces that it has entered into an

agreement to terminate its Tax Receivable Agreement (the “TRA”) in

return for one-time settlement payments totaling $72.5 million.

These settlement payments will resolve all accrued and potential

liabilities related to the TRA, including $28.8 million in TRA

liabilities reported on the Company’s balance sheet as of September

30, 2024. The Company’s management believes the termination of the

TRA will generate savings of approximately 29% ($29 million) of

estimated aggregate TRA payments that would otherwise be payable

under the TRA over the next five years and approximately 88% ($542

million) of the Company’s estimated total possible TRA liability of

$614 million. The Company will file today a preliminary proxy

statement asking for unaffiliated shareholders to approve the

transaction. The Company will only terminate the agreement if a

majority of its unaffiliated shareholders—a group that excludes all

parties to the TRA, all TRA bonus holders, all executive officers

and those of our directors who are affiliated with the TRA

Participants—vote to approve the termination. The amendment to the

TRA was approved by a Special Committee of the Board consisting

solely of independent and disinterested members of the Board. The

Special Committee was advised by Moelis & Company LLC, as

financial advisor, and Goodwin Procter LLP, as legal counsel.

Please refer to the preliminary proxy statement for additional

information.

- Clearwater Analytics hosted its annual Clearwater Connect

conference from September 17-18 at the Boise Centre, where over 600

customers gathered to explore the Company’s latest innovations. The

event featured the launch of Clearwater Insights, a powerful

benchmarking tool for CFOs and treasury teams to analyze daily

investment portfolios and optimize returns by comparing performance

with peer groups like the 400+ portfolios in the Clearwater

Corporate Treasury Index. Additionally, Clearwater introduced its

new CP Issuance tool, offering a streamlined workflow for issuing

commercial paper, a rates research module for custom reports, and a

reporting engine for tailored insights into balance sheets,

exposures, and performance.

- At Clearwater Connect, the Company announced the winners of its

Excellence Awards, highlighting individuals, teams, and firms that

have achieved growth, operational excellence, and digital

transformation with Clearwater’s award-winning investment

management platform. Company winners included F/m Investments,

Fortitude Re, Neuberger Berman, T. Rowe Price, and UBS. This year’s

client award winners included individuals from ARMOUR Capital

Management LP, Kuvare, Pan-American Life Insurance Group,

Prosperity Life Group, Securian Financial, SSI Investment

Management, and Wellington Management.

- Clearwater Analytics strengthened its leadership team by

appointing Fleur Sohtz as its new Chief Marketing Officer. Ms.

Sohtz is a seasoned marketing executive with 25 years of experience

scaling high-growth companies, achieving double-digit revenue

growth, and creating integrated marketing programs at global

companies such as Collibra, Markit (now part of S&P), and

Thomson Reuters. Clearwater also announced the expansion of its

EMEA leadership team with key go-to-market and client onboarding

appointments.

- La France Mutualiste selected Clearwater to modernize its

investment operations and reporting processes and successfully

onboarded all its unit-linked activities onto the Clearwater

platform. The partnership marks a significant digital

transformation for La France Mutualiste as it moves to automate

manual tasks, enhance operational efficiency, and drive future

growth.

- Clearwater Analytics was honored with an Insurance Investor

European Award, winning the Investment & Portfolio Management

Technology of the Year category.

Fourth Quarter and Full Year 2024

Guidance

Fourth Quarter 2024

Full Year 2024

Revenue

$120.2 million

$445.5 million

Year-over-Year Growth %

~21%

~21%

Adjusted EBITDA

$38.5 million

$142.5 million

Adjusted EBITDA Margin %

~32%

~32%

Total Equity-based compensation expense

and related payroll taxes

~$106 million

Depreciation and Amortization

~$12 million

Non-GAAP effective tax rate

25%

Diluted non-GAAP share count

~258 million

Certain components of the guidance given above are provided on a

non-GAAP basis only without providing a reconciliation to guidance

provided on a GAAP basis. Information is presented in this manner

because the preparation of such a reconciliation could not be

accomplished without “unreasonable efforts.” The Company does not

have access to certain information that would be necessary to

provide such a reconciliation, including non-recurring items that

are not indicative of the Company’s ongoing operations. The Company

does not believe that this information is likely to be significant

to an assessment of the Company’s ongoing operations.

Conference Call Details

Clearwater Analytics will hold a conference call and webcast on

November 6, 2024, at 5:00 p.m. Eastern time to discuss third

quarter 2024 financial results, provide a general business update,

and respond to analyst questions.

A live webcast of the call will also be available on the

Company’s investor relations website. Please visit

investors.clearwateranalytics.com at least fifteen minutes prior to

the start of the event to register, download and install any

necessary audio software.

If you are unable to participate live, a replay of the webcast

will be available following the conference call on the Company’s

investor relations website, along with the earnings press release,

and related financial tables.

About Clearwater

Analytics

Clearwater Analytics (NYSE: CWAN), a global, industry-leading

SaaS solution, automates the entire investment lifecycle. With a

single instance, multi-tenant architecture, Clearwater offers

award-winning investment portfolio planning, performance reporting,

data aggregation, reconciliation, accounting, compliance, risk, and

order management. Each day, leading insurers, asset managers,

corporations, and governments use Clearwater’s trusted data to

drive efficient, scalable investing on more than $7.3 trillion in

assets spanning traditional and alternative asset types. Additional

information about Clearwater can be found at

clearwateranalytics.com.

Use of non-GAAP

Information

This press release contains certain non-GAAP measures, including

non-GAAP gross profit, non-GAAP gross margin, adjusted EBITDA,

adjusted EBITDA margin, non-GAAP net income, non-GAAP net income

per basic and diluted share, non-GAAP effective tax rate, diluted

non-GAAP share count and free cash flow.

The non-GAAP measures are not based on any standardized

methodology prescribed by GAAP and are not necessarily comparable

to similar measures presented by other companies. However, the

Company believes that this non-GAAP information is useful as an

additional means for investors to evaluate its operating

performance, when reviewed in conjunction with its GAAP financial

statements. These measures should not be considered in isolation or

as a substitute for measures prepared in accordance with GAAP, and

because these amounts are not determined in accordance with GAAP,

they should not be used exclusively in evaluating the Company's

business and operations. In addition, undue reliance should not be

placed upon non-GAAP or operating information because this

information is neither standardized across companies nor subjected

to the same control activities and audit procedures that produce

the Company's GAAP financial results.

The Company's non-GAAP statement of operations measures,

including non-GAAP gross profit, non-GAAP gross margin, adjusted

EBITDA, adjusted EBITDA margin, non-GAAP net income, non-GAAP net

income per basic and diluted share, non-GAAP effective tax rate,

diluted non-GAAP share count and free cash flow, are adjusted to

exclude the impact of certain costs, expenses, gains and losses and

other specified items that management believes are not indicative

of its ongoing operations. These adjusted measures exclude the

impact of share-based compensation and eliminate potential

differences in results of operations between periods caused by

factors such as financing and capital structures, taxation

positions or regimes, restructuring, transaction expenses,

impairment and other charges.

Please refer to the reconciliations of these measures below to

what the Company believes are the most directly comparable measures

evaluated in accordance with GAAP.

Use of Forward-Looking

Statements

This press release contains "forward-looking statements" within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

based on management’s beliefs and assumptions and on information

currently available to management. Forward-looking statements

include information concerning the Company's possible or assumed

future results of operations, business strategies, technology

developments, financing and investment plans, dividend policy,

competitive position, industry, economic and regulatory

environment, potential growth opportunities and the effects of

competition. Forward-looking statements include statements that are

not historical facts and can be identified by terms such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“aim,” “may,” “plan,” “potential,” “predict,” “project,” “seek,”

“should,” “will,” “would” or similar expressions and the negatives

of those terms, but are not the exclusive means of identifying such

statements.

Forward-looking statements involve known and unknown risks,

uncertainties, and other factors, many of which are beyond

Clearwater Analytics’ control, that may cause the Company's actual

results, performance, or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. These risks and

uncertainties may cause actual results to differ materially from

Clearwater Analytics’ current expectations and include, but are not

limited to, risks that the Company may not be able to satisfy the

conditions to the effectiveness of the Amendment (as defined below)

and the consummation of the TRA Buyout (as defined below), risks

related to the disruption of management's attention from the

Company's ongoing business operations due to the TRA Buyout, risks

related to the significant transaction costs to be paid in

connection with the TRA Buyout and their impact on the Company's

financial condition, risks of legal proceedings that may arise as a

result of the TRA Buyout, changes in applicable laws or

fluctuations in the Company's taxable income that could impact the

Company's ability to realize the anticipated benefits from the TRA

Buyout, the Company's ability to keep pace with rapid technological

change and market developments, including artificial intelligence,

competitors in its industry, the possibility that market

volatility, a downturn in economic conditions or other factors may

cause negative trends or fluctuations in the value of the assets on

the Company’s platform, the Company's ability to manage growth, the

Company's ability to attract and retain skilled employees, the

possibility that the Company's solutions fail to perform properly,

disruptions and failures in the Company's and third parties’

computer equipment, cloud-based services, electronic delivery

systems, networks and telecommunications systems and

infrastructure, the failure to protect the Company, its customers’

and/or its vendors’ confidential information and/or intellectual

property, claims of infringement of others’ intellectual property,

factors related to the Company's ownership structure and status as

a “controlled company” as well as other risks and uncertainties

detailed in Clearwater Analytics’ periodic public filings with the

U.S. Securities and Exchange Commission (the “SEC”), including but

not limited to those discussed under “Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 filed on February 29, 2024, in the Proxy Statement (as

defined below) to be filed by the Company in connection with the

TRA Buyout, and in other periodic reports filed by Clearwater

Analytics with the SEC. These filings are available at www.sec.gov

and on Clearwater Analytics’ website.

Given these uncertainties, you should not place undue reliance

on forward-looking statements. Also, forward-looking statements

represent management’s beliefs and assumptions only as of the date

of this press release and should not be relied upon as representing

Clearwater Analytics’ expectations or beliefs as of any date

subsequent to the time they are made. Clearwater Analytics does not

undertake to and specifically declines any obligation to update any

forward-looking statements that may be made from time to time by or

on behalf of Clearwater Analytics.

Additional Information and Where to

Find It

This communication is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. In connection with

the agreement to terminate its Tax Receivable Agreement described

above (the “Amendment”) and the TRA Buyout (as defined in the

preliminary proxy statement to be filed in relation to the

Amendment, the “Proxy Statement”), the Company will file relevant

materials with the SEC, including the Proxy Statement. This

communication is not a substitute for the Proxy Statement or any

other document that the Company may file with the SEC or send to

its shareholders in connection with the Amendment and the TRA

Buyout. THE COMPANY URGES YOU TO READ THE PROXY STATEMENT AND OTHER

RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AS

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE COMPANY, THE AMENDMENT AND THE TRA BUYOUT AND

RELATED MATTERS. Investors will be able to obtain a free copy of

the Proxy Statement and other related documents (when available)

filed by the Company with the SEC at the website maintained by the

SEC at www.sec.gov. Investors also will be able to obtain a free

copy of the Proxy Statement and other documents (when available)

filed by the Company with the SEC by accessing the Investors

section of the Company’s website at

https://investors.clearwateranalytics.com/overview/default.aspx.

Participants in the

Solicitation

The Company and certain of its directors, executive officers and

employees may be considered to be participants in the solicitation

of proxies from the Company’s shareholders in connection with the

Amendment and the TRA Buyout. Information regarding the persons who

may, under the rules of the SEC, be deemed participants in the

solicitation of the shareholders of the Company in connection with

the TRA Buyout, including a description of their respective direct

or indirect interests, by security holdings or otherwise, will be

included in the Proxy Statement when it is filed with the SEC. You

may also find additional information about the Company’s directors

and executive officers in the Company’s definitive proxy statement

for its 2024 annual meeting of shareholders, which was filed with

the SEC on April 29, 2024, or in its Annual Report on Form 10-K for

the year ended December 31, 2023, which was filed with the SEC on

February 29, 2024, and in other documents filed by the Company with

the SEC. You can obtain free copies of these documents from the

Company using the contact information above.

Clearwater Analytics Holdings,

Inc.

Consolidated Balance

Sheets

(In thousands, except share

amounts and per share amounts, unaudited)

September 30

December 31

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

228,694

$

221,765

Short-term investments

77,134

74,457

Accounts receivable, net

100,377

92,091

Prepaid expenses and other current

assets

24,635

27,683

Total current assets

430,840

415,996

Property and equipment, net

15,279

15,349

Operating lease right-of-use assets,

net

25,752

22,554

Deferred contract costs, non-current

6,172

6,439

Intangible assets, net

34,014

26,132

Goodwill

74,160

45,338

Long-term investments

30,889

21,495

Other non-current assets

6,347

5,440

Total assets

$

623,453

$

558,743

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

4,238

$

3,062

Accrued expenses and other current

liabilities

60,680

49,535

Notes payable, current portion

2,750

2,750

Operating lease liability, current

portion

7,806

6,551

Tax receivable agreement liability

16,928

18,894

Total current liabilities

92,402

80,792

Notes payable, less current maturities and

unamortized debt issuance costs

43,830

45,828

Operating lease liability, less current

portion

19,121

16,948

Tax receivable agreement, less current

portion

11,900

—

Other long-term liabilities

2,581

5,518

Total liabilities

169,834

149,086

Stockholders' Equity

Class A common stock, par value $0.001 per

share; 1,500,000,000 shares authorized, 172,013,431 shares issued

and outstanding as of September 30, 2024, 127,604,185 shares issued

and outstanding as of December 31, 2023

172

128

Class B common stock, par value $0.001 per

share; 500,000,000 shares authorized, 111,191 shares issued and

outstanding as of December 31, 2023

—

—

Class C common stock, par value $0.001 per

share; 500,000,000 shares authorized, 27,424,288 shares issued and

outstanding as of September 30, 2024, 32,684,156 shares issued and

outstanding as of December 31, 2023

27

33

Class D common stock, par value $0.001 per

share; 500,000,000 shares authorized, 47,549,757 shares issued and

outstanding as of September 30, 2024, 82,955,977 shares issued and

outstanding as of December 31, 2023

48

83

Additional paid-in-capital

564,331

532,507

Accumulated other comprehensive income

4,626

2,909

Accumulated deficit

(165,957

)

(181,331

)

Total stockholders' equity attributable to

Clearwater Analytics Holdings, Inc.

403,247

354,329

Non-controlling interests

50,372

55,328

Total stockholders' equity

453,619

409,657

Total liabilities and stockholders'

equity

$

623,453

$

558,743

Clearwater Analytics Holdings,

Inc.

Consolidated Statements of

Operations

(In thousands, except share

amounts and per share amounts, unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

115,828

$

94,664

$

325,338

$

269,149

Cost of revenue(1)

31,357

27,013

89,426

78,792

Gross profit

84,471

67,651

235,912

190,357

Operating expenses:

Research and development(1)

36,618

32,250

109,654

90,198

Sales and marketing(1)

17,889

15,020

49,369

44,049

General and administrative(1)

22,626

26,268

65,873

75,445

Total operating expenses

77,133

73,538

224,896

209,692

Income (loss) from operations

7,338

(5,887

)

11,016

(19,335

)

Interest income, net

(2,290

)

(1,733

)

(6,191

)

(4,422

)

Tax receivable agreement (benefit)

expense

5,344

(566

)

11,545

6,112

Other (income) expense, net

1

(971

)

(1,113

)

(1,205

)

Income (loss) before income taxes

4,283

(2,617

)

6,775

(19,820

)

Benefit from income taxes

(486

)

(274

)

(505

)

(184

)

Net income (loss)

4,769

(2,343

)

7,280

(19,636

)

Less: Net income (loss) attributable to

non-controlling interests

1,140

(454

)

2,184

(2,442

)

Net income (loss) attributable to

Clearwater Analytics Holdings, Inc.

$

3,629

$

(1,889

)

$

5,096

$

(17,194

)

Net income (loss) per share attributable

to Class A and Class D common stockholders stock:

Basic

$

0.02

$

(0.01

)

$

0.02

$

(0.09

)

Diluted

$

0.02

$

(0.01

)

$

0.02

$

(0.09

)

Weighted average shares of Class A and

Class D common stock outstanding:

Basic

219,009,124

201,582,951

216,880,515

197,903,361

Diluted

231,467,214

201,582,951

227,768,434

197,903,361

(1) Amounts include equity-based

compensation as follows:

Cost of revenue

$

3,460

$

3,346

$

9,879

$

8,837

Operating expenses:

Research and development

8,674

6,768

26,767

17,393

Sales and marketing

3,905

4,010

10,418

11,221

General and administrative

9,937

16,233

27,995

44,675

Total equity-based compensation

expense

$

25,976

$

30,357

$

75,059

$

82,126

Clearwater Analytics Holdings,

Inc.

Consolidated Statements of

Cash Flows

(In thousands,

unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

OPERATING ACTIVITIES

Net income (loss)

$

4,769

$

(2,343

)

$

7,280

$

(19,636

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

3,239

2,476

8,730

7,336

Noncash operating lease cost

2,345

1,898

6,900

5,667

Equity-based compensation

25,976

30,357

75,059

82,126

Amortization of deferred contract

acquisition costs

1,160

1,212

3,573

3,563

Amortization of debt issuance costs,

included in interest expense

70

71

209

210

Deferred tax benefit

(1,084

)

(314

)

(3,076

)

(524

)

Accretion of discount on investments

(556

)

(502

)

(1,732

)

(901

)

Realized (gain) loss on investments

—

—

24

(89

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(3,157

)

(8,966

)

(7,875

)

(18,864

)

Prepaid expenses and other assets

3,654

4,759

2,561

4,219

Deferred contract acquisition costs

(1,645

)

(1,376

)

(3,416

)

(2,662

)

Accounts payable

1,306

9

1,586

109

Accrued expenses and other liabilities

8,001

4,983

3,763

(6,171

)

Tax receivable agreement liability

5,579

(566

)

9,934

6,122

Net cash provided by operating

activities

49,657

31,698

103,520

60,505

INVESTING ACTIVITIES

Purchases of property and equipment

(1,546

)

(770

)

(4,437

)

(4,062

)

Purchase of held to maturity

investments

—

—

(3,009

)

—

Purchases of available-for-sale

investments

(26,578

)

(19,334

)

(93,968

)

(111,018

)

Proceeds from sale of available-for-sale

investments

—

—

—

5,950

Proceeds from maturities of

investments

27,025

10,275

86,867

13,517

Acquisition of business, net of cash

acquired

—

—

(40,121

)

—

Payment of initial direct costs for

operating leases

—

—

(104

)

—

Net cash used in investing activities

(1,099

)

(9,829

)

(54,772

)

(95,613

)

FINANCING ACTIVITIES

Proceeds from exercise of options

101

1,286

210

4,465

Taxes paid related to net share settlement

of equity awards

(9,582

)

(6,440

)

(42,663

)

(14,887

)

Repayments of borrowings

(1,375

)

(688

)

(2,062

)

(2,062

)

Payment of business acquisition holdback

liability

—

—

(780

)

—

Proceeds from employee stock purchase

plan

—

—

2,795

2,595

Payment of tax distributions

(17

)

(35

)

(25

)

(35

)

Net cash used in financing activities

(10,873

)

(5,877

)

(42,525

)

(9,924

)

Effect of exchange rate changes on cash

and cash equivalents

914

(543

)

706

(27

)

Change in cash and cash equivalents during

the period

38,599

15,449

6,929

(45,059

)

Cash and cash equivalents, beginning of

period

190,095

190,216

221,765

250,724

Cash and cash equivalents, end of

period

$

228,694

$

205,665

$

228,694

$

205,665

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION

Cash paid for interest

$

865

$

310

$

2,627

$

2,530

Cash paid for income taxes

$

589

$

416

$

1,179

$

1,484

NON-CASH INVESTING AND FINANCING

ACTIVITIES

Purchase of property and equipment

included in accounts payable and accrued expense

$

25

$

2

$

25

$

2

Tax distributions payable to Continuing

Equity Owners included in accrued expenses

$

3,889

$

3,838

$

3,889

$

3,838

Clearwater Analytics Holdings,

Inc.

Reconciliation of Net Loss to

Adjusted EBITDA

(In thousands,

unaudited)

Three Months Ended September

30,

2024

2023

(in thousands, except

percentages)

Net income (loss)

$

4,769

4

%

$

(2,343

)

(2

%)

Adjustments:

Interest income, net

(2,290

)

(2

%)

(1,733

)

(2

%)

Depreciation and amortization

3,239

3

%

2,476

3

%

Equity-based compensation expense and

related payroll taxes

26,907

23

%

31,225

33

%

Tax receivable agreement (benefit)

expense

5,344

5

%

(566

)

(1

%)

Transaction expenses

248

0

%

61

0

%

Other (benefit) expenses(1)

123

0

%

(564

)

(1

%)

Adjusted EBITDA

38,340

33

%

28,556

30

%

Revenue

$

115,828

100

%

$

94,664

100

%

Nine Months Ended September

30,

2024

2023

(in thousands, except

percentages)

Net income (loss)

$

7,280

2

%

$

(19,636

)

(7

%)

Adjustments:

Interest income, net

(6,191

)

(2

%)

(4,422

)

(2

%)

Depreciation and amortization

8,730

3

%

7,336

3

%

Equity-based compensation expense and

related payroll taxes

80,540

25

%

84,417

31

%

Tax receivable agreement (benefit)

expense

11,545

4

%

6,112

2

%

Transaction expenses

1,926

1

%

1,612

1

%

Other (benefit) expenses(1)

162

0

%

504

—

%

Adjusted EBITDA

103,992

32

%

75,923

28

%

Revenue

$

325,338

100

%

$

269,149

100

%

(1)

Other (benefit) expenses include gain on

investments, management fees to our investors, income taxes, and

foreign exchange gains and losses.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands)

Amortization of prepaid management fees

and reimbursable expenses

$

608

$

681

$

1,780

$

1,894

Benefit from income tax expense

(486

)

(274

)

(505

)

(184

)

Other (income) expense, net

1

(971

)

(1,113

)

(1,205

)

Total other (benefit) expenses

$

123

$

(564

)

$

162

$

504

Clearwater Analytics Holdings,

Inc.

Reconciliation of Free Cash

Flow

(In thousands,

unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

49,657

$

31,698

$

103,520

$

60,505

Less: Purchases of property and

equipment

1,546

770

4,437

4,062

Free Cash Flow

$

48,111

$

30,928

$

99,083

$

56,443

Clearwater Analytics Holdings,

Inc.

Reconciliation of Non-GAAP

Information

(In thousands, except share

amounts and per share amounts, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

115,828

$

94,664

$

325,338

$

269,149

Gross profit

$

84,471

$

67,651

$

235,912

$

190,357

Adjustments:

Equity-based compensation expense and

related payroll taxes

3,743

3,589

10,583

9,324

Depreciation and amortization

2,702

1,994

7,298

5,897

Gross profit, non-GAAP

$

90,916

$

73,234

$

253,793

$

205,578

As a percentage of revenue, non-GAAP

78

%

77

%

78

%

76

%

Cost of Revenue

$

31,357

$

27,013

$

89,426

$

78,792

Adjustments:

Equity-based compensation expense and

related payroll taxes

3,743

3,589

10,583

9,324

Depreciation and amortization

2,702

1,994

7,298

5,897

Cost of revenue, non-GAAP

$

24,912

$

21,430

$

71,545

$

63,571

As a percentage of revenue, non-GAAP

22

%

23

%

22

%

24

%

Research and development

$

36,618

$

32,250

$

109,654

$

90,198

Adjustments:

Equity-based compensation expense and

related payroll taxes

9,085

7,086

30,265

18,244

Depreciation and amortization

215

255

580

786

Research and development, non-GAAP

$

27,318

$

24,909

$

78,809

$

71,168

As a percentage of revenue, non-GAAP

24

%

26

%

24

%

26

%

Sales and marketing

$

17,889

$

15,020

$

49,369

$

44,049

Adjustments:

Equity-based compensation expense and

related payroll taxes

4,052

4,196

10,994

11,772

Depreciation and amortization

174

143

464

441

Sales and marketing, non-GAAP

$

13,663

$

10,681

$

37,911

$

31,836

As a percentage of revenue, non-GAAP

12

%

11

%

12

%

12

%

General and administrative

$

22,626

$

26,268

$

65,873

$

75,445

Adjustments:

Equity-based compensation expense and

related payroll taxes

10,027

16,354

28,698

45,076

Depreciation and amortization

148

84

388

212

Amortization of prepaid management fees

and reimbursable expenses

608

681

1,780

1,894

Transaction expenses

248

61

1,926

1,612

General and administrative, non-GAAP

$

11,595

$

9,088

$

33,081

$

26,651

As a percentage of revenue, non-GAAP

10

%

10

%

10

%

10

%

Income (loss) from operations

$

7,338

$

(5,887

)

$

11,016

$

(19,335

)

Adjustments:

Equity-based compensation expense and

related payroll taxes

26,907

31,225

80,540

84,416

Depreciation and amortization

3,239

2,476

8,730

7,336

Amortization of prepaid management fees

and reimbursable expenses

608

681

1,780

1,894

Transaction expenses

248

61

1,926

1,612

Income from operations, non-GAAP

$

38,340

$

28,556

$

103,992

$

75,923

As a percentage of revenue, non-GAAP

33

%

30

%

32

%

28

%

Net income (loss)

$

4,769

$

(2,343

)

$

7,280

$

(19,636

)

Adjustments:

Equity-based compensation expense and

related payroll taxes

26,907

31,225

80,540

84,416

Depreciation and amortization

3,239

2,476

8,730

7,336

Tax receivable agreement expense

5,344

(566

)

11,545

6,112

Amortization of prepaid management fees

and reimbursable expenses

608

681

1,780

1,894

Transaction expenses

248

61

1,926

1,612

Tax impacts of adjustments to net income

(loss)(1)

(10,157

)

(7,815

)

(27,824

)

(20,388

)

Net income, non-GAAP

$

30,958

$

23,719

$

83,977

$

61,346

As a percentage of revenue, non-GAAP

27

%

25

%

26

%

23

%

Net income per share - basic, non-GAAP

$

0.14

$

0.12

$

0.39

$

0.31

Net income per share - diluted,

non-GAAP

$

0.12

$

0.09

$

0.33

$

0.24

Weighted-average common shares outstanding

- basic

219,009,124

201,582,951

216,880,515

197,903,361

Weighted-average common shares outstanding

- diluted

258,965,226

255,494,034

255,291,333

256,998,500

(1)

The non-GAAP effective tax rate was 25%

for the three and nine months ended September 30, 2024 and 2023,

respectively, and has been used to adjust the provision for income

taxes for non-GAAP net income and non-GAAP basic and diluted net

income per share.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106969155/en/

Investors: Joon Park | +1 415-906-9242 |

investors@clearwateranalytics.com

Media: Claudia Cahill | +1 703-728-1221 |

press@clearwateranalytics.com

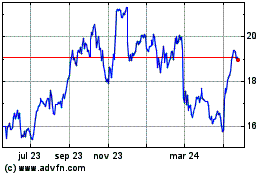

Clearwater Analytics (NYSE:CWAN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

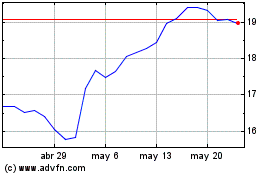

Clearwater Analytics (NYSE:CWAN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025