false

0001035201

0001035201

2024-03-11

2024-03-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13

or 15(d) of

The Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

March 11, 2024

CALIFORNIA WATER SERVICE GROUP

(Exact name of Registrant as Specified in its

Charter)

Delaware

(State or other jurisdiction

of incorporation) |

1-13883

(Commission file number) |

77-0448994

(I.R.S. Employer

Identification Number) |

1720 North First Street

San Jose, California

(Address of principal executive offices) |

95112

(Zip Code) |

(408) 367-8200

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares, par value $0.01 |

|

CWT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined by Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

On March 11, 2024, California Water Service Group issued the press

release attached as Exhibit 99.1 to this current report and incorporated by reference herein.

The information furnished pursuant to Item 7.01 of this Current Report

shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange

Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly

set forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

We hereby furnish the following exhibit with this report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CALIFORNIA WATER SERVICE GROUP |

| |

|

|

| |

|

|

| Date: March 11, 2024 |

By: |

/s/ James P. Lynch |

| |

Name: |

James P. Lynch |

| |

Title: |

Senior Vice President, Chief Financial Officer & Treasurer |

Exhibit 99.1

March 11, 2024

For immediate release

California Public Utilities

Commission Adopts Decision on California Water Service’s 2021 General Rate Case and Infrastructure Improvement Plan

SAN JOSE, Calif. – The California Public Utilities

Commission (CPUC) issued a decision on March 7, 2024 on the 2021 General Rate Case and Infrastructure Improvement Plan for California

Water Service (Cal Water), the largest subsidiary of California Water Service Group (NYSE: CWT). The decision marks the end of an extensive

review of the utility’s water system improvement plans, costs, and rates.

The decision adopts a revised version of the alternate

proposed decision issued January 24, 2024, and increases adopted revenues for 2023 by approximately $39.2 million, plus an inflation

factor yet to be determined, retroactive to January 1, 2023. It also increases revenues by up to approximately $32.2 million for 2024

and $31.7 million for 2025, subject to the CPUC’s escalation earnings test and inflationary adjustments.

Importantly, the decision authorizes Cal Water to

invest approximately $1.21 billion from 2021 through 2024 in water system infrastructure projects that are needed to continue providing

safe, reliable water service to customers throughout California. This includes approximately $160 million of infrastructure projects

that may be submitted for recovery via the CPUC’s advice letter process.

The

CPUC’s decision approves a progressive rate design that is intended to provide budget stability while benefiting low-income and

low-water-using customers by significantly decreasing the cost of the first units of water consumed and increasing the percentage

of fixed costs that are recovered in the service charge.

“I am proud of our track record of prioritizing

infrastructure projects that we believe are most critical to achieving our mission. From 2021 through 2023, we completed more than 85%

of the projects previously approved by the CPUC, deferring the remaining projects in order to complete higher-priority projects such

as wildfire hardening and water supply-reliability projects. In total, the Company spent nearly 100% of its approved capital budget.

I’m pleased that the decision authorizes us to continue investing responsibly in our infrastructure,” said Chairman, President

& Chief Executive Officer Martin A. Kropelnicki.

“I was most encouraged by the Commissioners’

comments acknowledging the need to improve the timeliness of their decisions, both those related to General Rate Cases and advice letter

projects,” he said. “With this decision behind us, we will continue preparing our next General Rate Case and Infrastructure

Improvement Plan, which we are scheduled to file in July 2024.”

About

California Water Service Group

California

Water Service Group is the parent company of regulated utilities California Water Service, Hawaii Water Service, New Mexico Water Service,

and Washington Water Service, as well as Texas Water Service, a utility holding company. Together, these companies provide regulated

and non-regulated water and wastewater service to more than 2.1 million people in California, Hawaii, New Mexico, Washington, and Texas.

California Water Service Group’s common stock trades on the New York Stock Exchange under the symbol “CWT.” Additional

information is available online at www.calwatergroup.com.

This

news release contains forward-looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995

(PSLRA). The forward-looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor"

treatment established by the PSLRA. Forward-looking statements in this news release are based on currently available information, expectations,

estimates, assumptions and projections, and our management's beliefs, assumptions, judgments and expectations about us, the water utility

industry and general economic conditions. These statements are not statements of historical fact. When used in our document, statements

that are not historical in nature, including words like will, would, expects, intends, plans, believes, may, could, estimates, assumes,

anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks or variations of these words or similar expressions

are intended to identify forward-looking statements. Examples of forward-looking statements in this news release include, but are not

limited to, statements describing Cal Water’s expected increases in revenue in 2024 and 2025, intentions to seek recovery for capital

expenditures and impacts of the CPUC’s decision on Cal Water’s 2021 General Rate Case. Forward-looking statements are not

guarantees of future performance. They are based on numerous assumptions that we believe are reasonable but are subject to uncertainty

and risks. Actual results may vary materially from what is contained in a forward-looking statement. Factors that may cause actual results

to be different than those expected or anticipated include, but are not limited to: governmental and regulatory commissions' decisions;

consequences of eminent domain actions relating to our water systems; changes in regulatory commissions' policies and procedures; the

outcome and timeliness of regulatory commissions' actions concerning rate relief and other actions; changes in water quality standards;

changes in environmental compliance and water quality requirements; electric power interruptions; the impact of opposition to rate increases;

our ability to recover costs; availability of water supplies; issues with the implementation, maintenance or security of our information

technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security

risks and threats; the ability of our enterprise risk management processes to identify or address risks adequately; changes in customer

water use patterns and the effects of conservation; the impact of weather, climate change, natural disasters, and actual or threatened

public health emergencies; the impact of market conditions and volatility on unrealized gains or losses on our operating results; risks

associated with expanding our business and operations geographically; and other risks and unforeseen events described in our SEC filings.

In light of these risks, uncertainties and assumptions, investors are cautioned not to place undue reliance on forward-looking statements,

which speak only as of the date of this news release. When considering forward-looking statements, you should keep in mind the cautionary

statements included in this paragraph, as well as in our Annual 10-K, Quarterly 10-Q’s, and other reports filed from time-to-time

with the Securities and Exchange Commission (SEC). We are not under any obligation, and we expressly disclaim any obligation to update

or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

# # #

Media Contact

Shannon Dean

sdean@calwater.com

408-367-8243

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

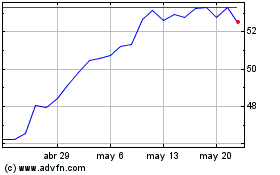

California Water Service (NYSE:CWT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

California Water Service (NYSE:CWT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024