0000882184false00008821842024-07-182024-07-18

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 18, 2024

______________________________

D.R. Horton, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-14122 | | 75-2386963 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1341 Horton Circle, Arlington, Texas 76011

(Address of principal executive offices)

(817) 390-8200

(Registrant’s telephone number, including area code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | | DHI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On July 18, 2024, D.R. Horton, Inc. issued a press release announcing its results and related information for its third quarter ended June 30, 2024 and declaring its quarterly dividend. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference in its entirety into this Item 2.02.

The information furnished in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | D.R. Horton, Inc. |

Date: | July 18, 2024 | | By: | /S/ BILL W. WHEAT |

| | | | Bill W. Wheat |

| | | | Executive Vice President and |

| | | | Chief Financial Officer |

Exhibit 99.1

D.R. HORTON, INC., AMERICA’S BUILDER, REPORTS FISCAL 2024 THIRD QUARTER EARNINGS AND DECLARES QUARTERLY DIVIDEND OF $0.30 PER SHARE

ARLINGTON, Texas (Business Wire) - July 18, 2024

Fiscal 2024 Third Quarter Highlights - comparisons to the prior year quarter

•Earnings per diluted share increased 5% to $4.10 on net income of $1.4 billion

•Consolidated pre-tax income increased 1% to $1.8 billion, with a pre-tax profit margin of 18.1%

•Consolidated revenues increased 2% to $10.0 billion

•Homes closed increased 5% to 24,155 homes and 6% in value to $9.2 billion

•Net sales orders increased 1% to 23,001 homes and were flat in value at $8.7 billion

•Rental operations pre-tax income of $64.2 million on $413.7 million of revenues from sales of 790 single-family rental homes and 610 multi-family rental units

•Repurchased 3.0 million shares of common stock for $441.4 million and paid cash dividends of $98.5 million

•New share repurchase authorization of $4.0 billion

D.R. Horton, Inc. (NYSE:DHI), America’s Builder, today reported that net income per common share attributable to D.R. Horton for its third fiscal quarter ended June 30, 2024 increased 5% to $4.10 per diluted share compared to $3.90 per diluted share in the same quarter of fiscal 2023. Net income attributable to D.R. Horton in the third quarter of fiscal 2024 increased 1% to $1.35 billion compared to $1.34 billion in the same quarter of fiscal 2023. For the nine months ended June 30, 2024, net income per common share attributable to D.R. Horton increased 11% to $10.43 per diluted share compared to $9.39 per diluted share in the same period of fiscal 2023. Net income attributable to D.R. Horton for the nine months ended June 30, 2024 increased 7% to $3.5 billion compared to $3.2 billion in the same period of fiscal 2023.

Consolidated revenues in the third quarter of fiscal 2024 increased 2% to $10.0 billion compared to $9.7 billion in the same quarter of fiscal 2023. For the nine months ended June 30, 2024, consolidated revenues increased 7% to $26.8 billion compared to $25.0 billion in the same period of fiscal 2023.

The Company's return on equity (ROE) was 21.5% for the trailing twelve months ended June 30, 2024, and homebuilding return on inventory (ROI) was 29.5% for the same period. ROE is calculated as net income attributable to D.R. Horton for the trailing twelve months divided by average stockholders' equity, where average stockholders' equity is the sum of ending stockholders' equity balances of the trailing five quarters divided by five. Homebuilding ROI is calculated as homebuilding pre-tax income for the trailing twelve months divided by average inventory, where average inventory is the sum of ending homebuilding inventory balances for the trailing five quarters divided by five.

During the nine months ended June 30, 2024, net cash provided by operations was $228.2 million. The Company's consolidated cash balance at June 30, 2024 was $3.0 billion and available capacity on its credit facilities was $2.8 billion, for total liquidity of $5.8 billion. Debt at June 30, 2024 totaled $5.7 billion, with $500 million of senior notes maturing in the next twelve months. The Company's debt to total capital ratio at June 30, 2024 was 18.8%. Debt to total capital ratio consists of notes payable divided by stockholders' equity plus notes payable.

David Auld, Executive Chairman, said, “The D.R. Horton team delivered strong results in our third fiscal quarter of 2024, highlighted by earnings of $4.10 per diluted share, up 5% from the same quarter last year. Consolidated pre-tax income was $1.8 billion on revenues of $10.0 billion, with a pre-tax profit margin of 18.1%. Although inflation and mortgage interest rates remain elevated, the supply of both new and existing homes at affordable price points is still limited, and demographics supporting housing demand continue to be favorable.

“We are well-positioned with our affordable product offerings and flexible lot supply, and we are focused on maximizing returns in each of our communities. We expect to generate increasing levels of consolidated operating cash flows, and our strong liquidity and low leverage provide us with significant financial flexibility. We are maintaining our disciplined approach to capital allocation to enhance the long-term value of our company, including consistent and increasing capital returns to our shareholders through share repurchases and dividends. Based on our strong financial position and expectation for increased cash flows, our Board of Directors recently approved a new share repurchase authorization totaling $4.0 billion.

“We continue to mourn the recent passing of our Founder, Don Horton. Don built an incredible legacy with our company platform based upon helping as many Americans as possible achieve the dream of homeownership, and we are privileged to continue to build upon his life’s work. On behalf of Don’s family and all of us at D.R. Horton, we thank everyone who reached out to offer their condolences and share memories or attended Don’s memorial service. We greatly appreciate your kindness and tributes to a remarkable man.”

Homebuilding Operations

Homebuilding revenue for the third quarter of fiscal 2024 increased 6% to $9.2 billion compared to $8.7 billion in the same quarter of fiscal 2023. Homes closed in the quarter increased 5% to 24,155 homes compared to 22,985 homes closed in the same quarter of fiscal 2023. Homebuilding revenue for the first nine months of fiscal 2024 increased 9% to $25.0 billion compared to $22.9 billion in the same period of fiscal 2023. Homes closed in the first nine months of fiscal 2024 increased 10% to 66,043 homes compared to 59,989 homes closed in the same period of fiscal 2023.

Homebuilding pre-tax income in the third quarter of fiscal 2024 increased 7% to $1.6 billion with a pre-tax profit margin of 17.0% compared to $1.5 billion of pre-tax income and a 16.8% pre-tax profit margin in the same quarter of fiscal 2023. Homebuilding pre-tax income for the first nine months of fiscal 2024 increased 11% to $4.0 billion with a pre-tax profit margin of 16.1% compared to $3.6 billion of pre-tax income and a 15.8% pre-tax profit margin in the same period of fiscal 2023.

During the nine months ended June 30, 2024, net cash provided by homebuilding operations was $971.9 million.

Net sales orders for the third quarter ended June 30, 2024 increased 1% to 23,001 homes compared to 22,879 homes in the prior year quarter, and sales order value of $8.7 billion was flat with the same quarter of fiscal 2023. The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the third quarter of fiscal 2024 was 18%, unchanged from the prior year quarter. Net sales orders for the first nine months of fiscal 2024 increased 14% to 67,526 homes and 15% in value to $25.6 billion compared to 59,403 homes and $22.3 billion in the same period of fiscal 2023. The Company's sales order backlog of homes under contract at June 30, 2024 decreased 12% to 16,792 homes and 12% in value to $6.6 billion compared to 19,186 homes and $7.4 billion at June 30, 2023.

At June 30, 2024, the Company had 42,600 homes in inventory, of which 26,200 were unsold. 8,800 of the Company’s unsold homes at June 30, 2024 were completed, of which 990 had been completed for greater than six months. The Company’s homebuilding land and lot portfolio totaled 630,200 lots at the end of the quarter, of which 24% were owned and 76% were controlled through land and lot purchase contracts. Of the Company’s homes closed during the three and nine months ended June 30, 2024, 64% and 63%, respectively, were on lots developed by Forestar or third parties.

Rental Operations

The Company's rental operations generated $64.2 million of pre-tax income on revenues of $413.7 million in the third quarter of fiscal 2024 compared to $162.1 million of pre-tax income on revenues of $667.1 million in the same quarter of fiscal 2023. For the nine months ended June 30, 2024, rental operations pre-tax income was $128.8 million on revenues of $980.2 million compared to pre-tax income of $307.0 million on revenues of $1.2 billion in the prior year period.

During the third quarter of fiscal 2024, the Company sold 790 single-family rental homes for $258.5 million compared to 1,754 homes sold for $589.6 million in the prior year quarter. During the nine months ended June 30, 2024, the Company sold 2,278 single-family rental homes for $675.9 million compared to 3,169 homes sold for $1.0 billion in the prior year period. At June 30, 2024, the consolidated balance sheet included $1.1 billion of single-family rental property inventory consisting of 4,540 homes, of which 4,020 were completed, and 1,900 lots, of which 775 were finished.

During the third quarter of fiscal 2024, the Company sold 610 multi-family rental units for $155.2 million compared to 230 units sold for $77.5 million in the prior year quarter. During the nine months ended June 30, 2024, the Company sold 1,334 multi-family rental units for $304.3 million compared to 530 units sold for $177.0 million in the prior year period. At June 30, 2024, the consolidated balance sheet included $2.0 billion of multi-family rental property inventory consisting of 11,380 units, of which 7,810 units were under active construction and 3,570 units were completed.

Forestar

Forestar Group Inc. (NYSE:FOR) (“Forestar”) is a publicly traded residential lot development company that is a majority-owned subsidiary of D.R. Horton. Forestar’s results of operations for the periods presented are fully consolidated in the Company’s financial statements with the percentage not owned by the Company reported as noncontrolling interests.

For the third quarter ended June 30, 2024, Forestar sold 3,255 lots and generated $318.4 million of revenue compared to 3,812 lots and $368.9 million of revenue in the prior year quarter. For the nine months ended June 30, 2024, Forestar sold 9,694 lots and generated $958.0 million of revenue compared to 9,054 lots and $887.1 million of revenue in the prior year period. Forestar’s pre-tax income in the third quarter of fiscal 2024 was $51.6 million with a pre-tax profit margin of 16.2% compared to $62.4 million of pre-tax income and a 16.9% pre-tax profit margin in the same quarter of fiscal 2023. For the nine months ended June 30, 2024, Forestar’s pre-tax income was $161.6 million with a pre-tax profit margin of 16.9% compared to $126.2 million of pre-tax income and a 14.2% pre-tax profit margin in the same period of fiscal 2023.

Financial Services

For the third quarter ended June 30, 2024, financial services revenues were $242.3 million compared to $228.5 million in the same quarter of fiscal 2023. Financial services pre-tax income for the quarter was $91.3 million with a pre-tax profit margin of 37.7% compared to $94.1 million of pre-tax income and a 41.2% pre-tax profit margin in the prior year quarter. For the nine months ended June 30, 2024, financial services revenues were $660.5 million compared to $582.0 million in the same period of fiscal 2023. Financial services pre-tax income was $235.3 million with a pre-tax profit margin of 35.6% compared to $197.9 million of pre-tax income and a 34.0% pre-tax profit margin in the prior year period.

Dividends

During the third quarter of fiscal 2024, the Company paid cash dividends of $98.5 million, for a total of $297.5 million of dividends paid during the nine months ended June 30, 2024. Subsequent to quarter end, the Company declared a quarterly cash dividend of $0.30 per common share that is payable on August 8, 2024 to stockholders of record on August 1, 2024.

Share Repurchases

The Company repurchased 3.0 million shares of common stock for $441.4 million during the third quarter of fiscal 2024, for a total of 9.0 million shares repurchased for $1.2 billion during the nine months ended June 30, 2024. The Company’s number of common shares outstanding at June 30, 2024 was 327.4 million, down 3% from 338.2 million shares outstanding at June 30, 2023. The Company’s remaining stock repurchase authorization at June 30, 2024 was $459.7 million. In July 2024, the Company’s Board of Directors authorized the repurchase of up to $4.0 billion of the Company’s common stock, replacing the previous authorization. The authorization has no expiration date.

Guidance

Based on current market conditions and the Company’s results for the first nine months of the year, D.R. Horton is updating its fiscal 2024 guidance as follows:

•Consolidated revenues of approximately $36.8 billion to $37.2 billion

•Homes closed by homebuilding operations of 90,000 homes to 90,500 homes

•Share repurchases of approximately $1.8 billion

The Company reiterates its fiscal 2024 guidance for cash flow provided by homebuilding operations of approximately $3.0 billion.

The Company plans to also provide guidance for its fourth quarter of fiscal 2024 on its conference call today.

Conference Call and Webcast Details

The Company will host a conference call today (Thursday, July 18) at 8:30 a.m. Eastern Time. The dial-in number is 888-506-0062 (reference entry code 956414), and the call will also be webcast from the Company’s website at investor.drhorton.com.

About D.R. Horton, Inc.

D.R. Horton, Inc., America’s Builder, has been the largest homebuilder by volume in the United States since 2002 and has closed more than 1,100,000 homes in its over 45-year history. D.R. Horton has operations in 121 markets in 33 states across the United States and is engaged in the construction and sale of high-quality homes through its diverse product portfolio with sales prices generally ranging from $200,000 to over $1,000,000. The Company also constructs and sells both single-family and multi-family rental properties. During the twelve-month period ended June 30, 2024, D.R. Horton closed 88,971 homes in its homebuilding operations, in addition to 5,284 single-family rental homes and 2,916 multi-family rental units in its rental operations. D.R. Horton also provides mortgage financing, title services and insurance agency services for its homebuyers and is the majority-owner of Forestar Group Inc., a publicly traded national residential lot development company.

Forward-Looking Statements

Portions of this document may constitute “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Although D.R. Horton believes any such statements are based on reasonable assumptions, there is no assurance that actual outcomes will not be materially different. All forward-looking statements are based upon information available to D.R. Horton on the date this release was issued. D.R. Horton does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking statements in this release include that we are well-positioned with our affordable product offerings and flexible lot supply, and we are focused on maximizing returns in each of our communities; we expect to generate increasing levels of consolidated operating cash flows, and our strong liquidity and low leverage provide us with significant financial flexibility; we are maintaining our disciplined capital allocation to enhance the long-term value of our company, including consistent and increasing capital returns to our shareholders through share repurchases and dividends; and based on our strong financial position and expectation for increased cash flows, our Board of Directors recently approved a new share repurchase authorization totaling $4.0 billion. The forward-looking statements also include all commentary in the Guidance section.

Factors that may cause the actual results to be materially different from the future results expressed by the forward-looking statements include, but are not limited to: the cyclical nature of the homebuilding, rental and lot development industries and changes in economic, real estate or other conditions; adverse developments affecting the capital markets and financial institutions, which could limit our ability to access capital and increase our cost of capital and impact our liquidity and capital resources; reductions in the availability of mortgage financing provided by government agencies, changes in government financing programs, a decrease in our ability to sell mortgage loans on attractive terms or an increase in mortgage interest rates; the risks associated with our land, lot and rental inventory; our ability to effect our growth strategies, acquisitions, investments or other strategic initiatives successfully; the impact of an inflationary, deflationary or higher interest rate environment; supply shortages and other risks of acquiring land, building materials and skilled labor and obtaining regulatory approvals; the effects of public health issues such as a major epidemic or pandemic on the economy and our businesses; the effects of weather conditions and natural disasters on our business and financial results; home warranty and construction defect claims; the effects of health and safety incidents; reductions in the availability of performance bonds; increases in the costs of owning a home; the effects of information technology failures, data security breaches, and the failure to satisfy privacy and data protection laws and regulations; the effects of governmental regulations and environmental matters on our homebuilding and land development operations; the effects of governmental regulations on our financial services operations; competitive conditions within the industries in which we operate; our ability to manage and service our debt and comply with related debt covenants, restrictions and limitations; the effects of negative publicity; the effects of the loss of key personnel; and actions by activist stockholders. Additional information about issues that could lead to material changes in performance is contained in D.R. Horton’s annual report on Form 10-K and its most recent quarterly report on Form-10-Q, both of which are filed with the Securities and Exchange Commission.

Contact

D.R. Horton, Inc.

Jessica Hansen, 817-390-8200

Senior Vice President - Communications

InvestorRelations@drhorton.com

D.R. HORTON, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | |

| June 30,

2024 | | September 30,

2023 |

| (In millions) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 2,992.3 | | | $ | 3,873.6 | |

| Restricted cash | 27.7 | | | 26.5 | |

Total cash, cash equivalents and restricted cash | 3,020.0 | | | 3,900.1 | |

| Inventories: | | | |

| Construction in progress and finished homes | 9,880.5 | | | 9,001.4 | |

Residential land and lots — developed, under development, held for development and held for sale | 12,585.0 | | | 10,680.6 | |

| Rental properties | 3,070.6 | | | 2,691.3 | |

| Total inventory | 25,536.1 | | | 22,373.3 | |

| Mortgage loans held for sale | 2,578.8 | | | 2,519.9 | |

Deferred income taxes, net of valuation allowance of $14.7 million and $14.8 million at June 30, 2024 and September 30, 2023, respectively | 156.6 | | | 187.2 | |

| Property and equipment, net | 520.9 | | | 445.4 | |

| Other assets | 3,175.5 | | | 2,993.0 | |

| Goodwill | 163.5 | | | 163.5 | |

| Total assets | $ | 35,151.4 | | | $ | 32,582.4 | |

| LIABILITIES | | | |

| Accounts payable | $ | 1,412.7 | | | $ | 1,246.2 | |

| Accrued expenses and other liabilities | 2,897.0 | | | 3,103.8 | |

| Notes payable | 5,691.0 | | | 5,094.5 | |

| Total liabilities | 10,000.7 | | | 9,444.5 | |

| EQUITY | | | |

Common stock, $.01 par value, 1,000,000,000 shares authorized, 402,771,463 shares issued and 327,373,437 shares outstanding at June 30, 2024 and 401,202,253 shares issued and 334,848,565 shares outstanding at September 30, 2023 | 4.0 | | | 4.0 | |

| Additional paid-in capital | 3,458.9 | | | 3,432.2 | |

| Retained earnings | 26,765.3 | | | 23,589.8 | |

Treasury stock, 75,398,026 shares and 66,353,688 shares at June 30, 2024 and September 30, 2023, respectively, at cost | (5,571.7) | | | (4,329.8) | |

| Stockholders’ equity | 24,656.5 | | | 22,696.2 | |

| Noncontrolling interests | 494.2 | | | 441.7 | |

| Total equity | 25,150.7 | | | 23,137.9 | |

| Total liabilities and equity | $ | 35,151.4 | | | $ | 32,582.4 | |

D.R. HORTON, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Nine Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| (In millions, except per share data) |

| Revenues | $ | 9,965.7 | | | $ | 9,725.6 | | | $ | 26,798.8 | | | $ | 24,956.4 | |

| Cost of sales | 7,323.7 | | | 7,141.8 | | | 19,817.7 | | | 18,429.3 | |

| Selling, general and administrative expense | 923.6 | | | 852.1 | | | 2,639.2 | | | 2,362.6 | |

| Other (income) expense | (80.6) | | | (52.2) | | | (233.1) | | | (131.9) | |

| Income before income taxes | 1,799.0 | | | 1,783.9 | | | 4,575.0 | | | 4,296.4 | |

| Income tax expense | 432.2 | | | 432.2 | | | 1,068.8 | | | 1,026.7 | |

| Net income | 1,366.8 | | | 1,351.7 | | | 3,506.2 | | | 3,269.7 | |

| Net income attributable to noncontrolling interests | 13.2 | | | 16.6 | | | 33.2 | | | 33.7 | |

| Net income attributable to D.R. Horton, Inc. | $ | 1,353.6 | | | $ | 1,335.1 | | | $ | 3,473.0 | | | $ | 3,236.0 | |

| | | | | | | |

| Basic net income per common share attributable to D.R. Horton, Inc. | $ | 4.12 | | | $ | 3.93 | | | $ | 10.50 | | | $ | 9.46 | |

| Weighted average number of common shares | 328.4 | | | 339.9 | | | 330.9 | | | 342.1 | |

| | | | | | | |

| Diluted net income per common share attributable to D.R. Horton, Inc. | $ | 4.10 | | | $ | 3.90 | | | $ | 10.43 | | | $ | 9.39 | |

| Adjusted weighted average number of common shares | 330.1 | | | 342.3 | | | 333.0 | | | 344.7 | |

| | | | | | | |

| Other Consolidated Financial Data | | | | | | | |

| Interest charged to cost of sales | $ | 35.3 | | | $ | 41.3 | | | $ | 96.1 | | | $ | 103.8 | |

| Depreciation and amortization | $ | 22.4 | | | $ | 23.7 | | | $ | 63.5 | | | $ | 70.2 | |

| Interest incurred | $ | 54.5 | | | $ | 57.4 | | | $ | 147.6 | | | $ | 154.2 | |

D.R. HORTON, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| | Nine Months Ended

June 30, |

| | 2024 | | 2023 |

| (In millions) |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 3,506.2 | | | $ | 3,269.7 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 63.5 | | | 70.2 | |

| Stock-based compensation expense | 92.7 | | | 80.6 | |

| Deferred income taxes | 29.9 | | | 19.3 | |

| Inventory and land option charges | 34.4 | | | 62.2 | |

| Changes in operating assets and liabilities: | | | |

| (Increase) decrease in construction in progress and finished homes | (863.0) | | | 576.2 | |

Increase in residential land and lots – developed, under development, held for development and held for sale | (2,012.1) | | | (915.0) | |

| Increase in rental properties | (375.7) | | | (777.3) | |

| (Increase) decrease in other assets | (154.4) | | | 242.1 | |

| Increase in mortgage loans held for sale | (58.9) | | | (28.4) | |

| Decrease in accounts payable, accrued expenses and other liabilities | (34.4) | | | (338.5) | |

| Net cash provided by operating activities | 228.2 | | | 2,261.1 | |

| INVESTING ACTIVITIES | | | |

| Expenditures for property and equipment | (133.3) | | | (108.3) | |

| Proceeds from sale of assets | 14.9 | | | — | |

| Payments related to business acquisitions, net of cash acquired | (37.9) | | | (202.0) | |

| Other investing activities | (4.8) | | | 1.8 | |

| Net cash used in investing activities | (161.1) | | | (308.5) | |

| FINANCING ACTIVITIES | | | |

| Proceeds from notes payable | 1,270.0 | | | 575.0 | |

| Repayment of notes payable | (640.4) | | | (675.4) | |

| Borrowings on mortgage repurchase facilities, net | 21.8 | | | 67.3 | |

| Proceeds from stock associated with certain employee benefit plans | 12.2 | | | 18.7 | |

| Cash paid for shares withheld for taxes | (82.9) | | | (55.9) | |

| Cash dividends paid | (297.5) | | | (256.9) | |

Repurchases of common stock | (1,230.3) | | | (759.6) | |

| Net proceeds from issuance of Forestar common stock | 19.7 | | | — | |

| Net other financing activities | (19.8) | | | (30.7) | |

| Net cash used in financing activities | (947.2) | | | (1,117.5) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (880.1) | | | 835.1 | |

| Cash, cash equivalents and restricted cash at beginning of period | 3,900.1 | | | 2,572.9 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 3,020.0 | | | $ | 3,408.0 | |

| SUPPLEMENTAL DISCLOSURES OF NON-CASH ACTIVITIES: | | | |

| Notes payable issued for inventory | $ | 43.4 | | | $ | 54.5 | |

| Reduction of notes payable upon deconsolidation of variable interest entity | $ | (127.8) | | | $ | — | |

| Stock issued under employee incentive plans | $ | 173.2 | | | $ | 110.8 | |

| Repurchases of common stock not settled | $ | 1.5 | | | $ | — | |

D.R. HORTON, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 2,174.3 | | | $ | 119.1 | | | $ | 359.2 | | | $ | 305.7 | | | $ | 34.0 | | | $ | 2,992.3 | |

Restricted cash | | 6.3 | | | 2.2 | | | — | | | 19.2 | | | — | | | 27.7 | |

Inventories: | | | | | | | | | | | | |

| Construction in progress and finished homes | | 10,002.2 | | | — | | | — | | | — | | | (121.7) | | | 9,880.5 | |

| Residential land and lots | | 10,502.0 | | | — | | | 2,238.7 | | | — | | | (155.7) | | | 12,585.0 | |

| Rental properties | | — | | | 3,070.3 | | | — | | | — | | | 0.3 | | | 3,070.6 | |

| | 20,504.2 | | | 3,070.3 | | | 2,238.7 | | | — | | | (277.1) | | | 25,536.1 | |

Mortgage loans held for sale | | — | | | — | | | — | | | 2,578.8 | | | — | | | 2,578.8 | |

Deferred income taxes, net | | 200.7 | | | (19.9) | | | — | | | — | | | (24.2) | | | 156.6 | |

Property and equipment, net | | 490.9 | | | 1.5 | | | 6.5 | | | 3.8 | | | 18.2 | | | 520.9 | |

Other assets | | 2,732.2 | | | 71.7 | | | 70.6 | | | 184.9 | | | 116.1 | | | 3,175.5 | |

Goodwill | | 134.3 | | | — | | | — | | | — | | | 29.2 | | | 163.5 | |

| | $ | 26,242.9 | | | $ | 3,244.9 | | | $ | 2,675.0 | | | $ | 3,092.4 | | | $ | (103.8) | | | $ | 35,151.4 | |

| Liabilities | | | | | | | | | | | | |

Accounts payable | | $ | 1,134.6 | | | $ | 314.6 | | | $ | 70.9 | | | $ | 0.1 | | | $ | (107.5) | | | $ | 1,412.7 | |

Accrued expenses and other liabilities | | 2,487.8 | | | 66.7 | | | 385.1 | | | 244.1 | | | (286.7) | | | 2,897.0 | |

Notes payable | | 2,257.8 | | | 1,035.7 | | | 706.1 | | | 1,691.4 | | | — | | | 5,691.0 | |

| | $ | 5,880.2 | | | $ | 1,417.0 | | | $ | 1,162.1 | | | $ | 1,935.6 | | | $ | (394.2) | | | $ | 10,000.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 2,920.2 | | | $ | 136.1 | | | $ | 616.0 | | | $ | 189.1 | | | $ | 12.2 | | | $ | 3,873.6 | |

Restricted cash | | 6.5 | | | 3.3 | | | — | | | 16.7 | | | — | | | 26.5 | |

Inventories: | | | | | | | | | | | | |

| Construction in progress and finished homes | | 9,134.3 | | | — | | | — | | | — | | | (132.9) | | | 9,001.4 | |

| Residential land and lots | | 9,021.5 | | | — | | | 1,790.3 | | | — | | | (131.2) | | | 10,680.6 | |

| Rental properties | | — | | | 2,708.4 | | | — | | | — | | | (17.1) | | | 2,691.3 | |

| | 18,155.8 | | | 2,708.4 | | | 1,790.3 | | | — | | | (281.2) | | | 22,373.3 | |

Mortgage loans held for sale | | — | | | — | | | — | | | 2,519.9 | | | — | | | 2,519.9 | |

Deferred income taxes, net | | 229.8 | | | (19.9) | | | — | | | — | | | (22.7) | | | 187.2 | |

Property and equipment, net | | 415.0 | | | 2.4 | | | 5.9 | | | 4.1 | | | 18.0 | | | 445.4 | |

Other assets | | 2,838.5 | | | 29.8 | | | 58.5 | | | 250.3 | | | (184.1) | | | 2,993.0 | |

Goodwill | | 134.3 | | | — | | | — | | | — | | | 29.2 | | | 163.5 | |

| | $ | 24,700.1 | | | $ | 2,860.1 | | | $ | 2,470.7 | | | $ | 2,980.1 | | | $ | (428.6) | | | $ | 32,582.4 | |

| Liabilities | | | | | | | | | | | | |

Accounts payable | | $ | 1,033.7 | | | $ | 698.6 | | | $ | 68.4 | | | $ | 0.1 | | | $ | (554.6) | | | $ | 1,246.2 | |

Accrued expenses and other liabilities | | 2,585.5 | | | 43.2 | | | 337.4 | | | 280.4 | | | (142.7) | | | 3,103.8 | |

Notes payable | | 2,329.9 | | | 400.0 | | | 695.0 | | | 1,669.6 | | | — | | | 5,094.5 | |

| | $ | 5,949.1 | | | $ | 1,141.8 | | | $ | 1,100.8 | | | $ | 1,950.1 | | | $ | (697.3) | | | $ | 9,444.5 | |

_________________

(1)Amounts include the balances of the Company's other businesses and the elimination of intercompany transactions.

D.R. HORTON, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Revenues | | | | | | | | | | | | |

Home sales | | $ | 9,231.2 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 9,231.2 | |

Land/lot sales and other | | 10.3 | | | — | | | 318.4 | | | — | | | (250.2) | | | 78.5 | |

| Rental property sales | | — | | | 413.7 | | | — | | | — | | | — | | | 413.7 | |

Financial services | | — | | | — | | | — | | | 242.3 | | | — | | | 242.3 | |

| | 9,241.5 | | | 413.7 | | | 318.4 | | | 242.3 | | | (250.2) | | | 9,965.7 | |

| Cost of sales | | | | | | | | | | | | |

| Home sales (2) | | 7,017.3 | | | — | | | — | | | — | | | (72.5) | | | 6,944.8 | |

| Land/lot sales and other | | 5.6 | | | — | | | 246.2 | | | — | | | (201.1) | | | 50.7 | |

| Rental property sales | | — | | | 319.3 | | | — | | | — | | | (5.9) | | | 313.4 | |

| Inventory and land option charges | | 12.6 | | | 1.5 | | | 0.7 | | | — | | | — | | | 14.8 | |

| | 7,035.5 | | | 320.8 | | | 246.9 | | | — | | | (279.5) | | | 7,323.7 | |

Selling, general and administrative expense | | 656.5 | | | 55.0 | | | 29.3 | | | 178.0 | | | 4.8 | | | 923.6 | |

| Other (income) expense | | (22.7) | | | (26.3) | | | (9.4) | | | (27.0) | | | 4.8 | | | (80.6) | |

| Income before income taxes | | $ | 1,572.2 | | | $ | 64.2 | | | $ | 51.6 | | | $ | 91.3 | | | $ | 19.7 | | | $ | 1,799.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended June 30, 2024 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Revenues | | | | | | | | | | | | |

Home sales | | $ | 24,974.2 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 24,974.2 | |

Land/lot sales and other | | 37.6 | | | — | | | 958.0 | | | — | | | (811.7) | | | 183.9 | |

| Rental property sales | | — | | | 980.2 | | | — | | | — | | | — | | | 980.2 | |

Financial services | | — | | | — | | | — | | | 660.5 | | | — | | | 660.5 | |

| | 25,011.8 | | | 980.2 | | | 958.0 | | | 660.5 | | | (811.7) | | | 26,798.8 | |

| Cost of sales | | | | | | | | | | | | |

| Home sales (2) | | 19,130.8 | | | — | | | — | | | — | | | (195.0) | | | 18,935.8 | |

| Land/lot sales and other | | 23.0 | | | — | | | 729.6 | | | — | | | (657.8) | | | 94.8 | |

| Rental property sales | | — | | | 763.4 | | | — | | | — | | | (10.7) | | | 752.7 | |

| Inventory and land option charges | | 31.2 | | | 2.2 | | | 1.0 | | | — | | | — | | | 34.4 | |

| | 19,185.0 | | | 765.6 | | | 730.6 | | | — | | | (863.5) | | | 19,817.7 | |

Selling, general and administrative expense | | 1,874.1 | | | 163.8 | | | 86.5 | | | 500.6 | | | 14.2 | | | 2,639.2 | |

| Other (income) expense | | (73.2) | | | (78.0) | | | (20.7) | | | (75.4) | | | 14.2 | | | (233.1) | |

| Income before income taxes | | $ | 4,025.9 | | | $ | 128.8 | | | $ | 161.6 | | | $ | 235.3 | | | $ | 23.4 | | | $ | 4,575.0 | |

Summary Cash Flow Information | | | | | | | | | | | | |

| Cash provided by (used in) operating activities | | $ | 971.9 | | | $ | (656.8) | | | $ | (277.6) | | | $ | 156.9 | | | $ | 33.8 | | | $ | 228.2 | |

_____________________

(1)Amounts include the results of the Company's other businesses and the elimination of intercompany transactions.

(2)Amount in the Eliminations and Other column represents the recognition of profit on lots sold from Forestar to the homebuilding segment. Intercompany profit is eliminated in the consolidated financial statements when Forestar sells lots to the homebuilding segment and is recognized in the consolidated financial statements when the homebuilding segment closes homes on the lots to homebuyers.

D.R. HORTON, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Revenues | | | | | | | | | | | | |

Home sales | | $ | 8,703.1 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 8,703.1 | |

Land/lot sales and other | | 30.5 | | | — | | | 368.9 | | | — | | | (272.5) | | | 126.9 | |

| Rental property sales | | — | | | 667.1 | | | — | | | — | | | — | | | 667.1 | |

Financial services | | — | | | — | | | — | | | 228.5 | | | — | | | 228.5 | |

| | 8,733.6 | | | 667.1 | | | 368.9 | | | 228.5 | | | (272.5) | | | 9,725.6 | |

| Cost of sales | | | | | | | | | | | | |

| Home sales (2) | | 6,675.6 | | | — | | | — | | | — | | | (69.6) | | | 6,606.0 | |

| Land/lot sales and other | | 26.1 | | | — | | | 283.0 | | | — | | | (238.2) | | | 70.9 | |

| Rental property sales | | — | | | 458.0 | | | — | | | — | | | (3.9) | | | 454.1 | |

| Inventory and land option charges | | 9.0 | | | 0.9 | | | 0.9 | | | — | | | — | | | 10.8 | |

| | 6,710.7 | | | 458.9 | | | 283.9 | | | — | | | (311.7) | | | 7,141.8 | |

Selling, general and administrative expense | | 584.9 | | | 80.0 | | | 26.4 | | | 154.7 | | | 6.1 | | | 852.1 | |

| Other (income) expense | | (26.4) | | | (33.9) | | | (3.8) | | | (20.3) | | | 32.2 | | | (52.2) | |

| Income before income taxes | | $ | 1,464.4 | | | $ | 162.1 | | | $ | 62.4 | | | $ | 94.1 | | | $ | 0.9 | | | $ | 1,783.9 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended June 30, 2023 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Revenues | | | | | | | | | | | | |

Home sales | | $ | 22,862.0 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 22,862.0 | |

Land/lot sales and other | | 85.2 | | | — | | | 887.1 | | | — | | | (678.5) | | | 293.8 | |

| Rental property sales | | — | | | 1,218.6 | | | — | | | — | | | — | | | 1,218.6 | |

Financial services | | — | | | — | | | — | | | 582.0 | | | — | | | 582.0 | |

| | 22,947.2 | | | 1,218.6 | | | 887.1 | | | 582.0 | | | (678.5) | | | 24,956.4 | |

| Cost of sales | | | | | | | | | | | | |

| Home sales (2) | | 17,625.3 | | | — | | | — | | | — | | | (180.4) | | | 17,444.9 | |

| Land/lot sales and other | | 44.4 | | | — | | | 675.1 | | | — | | | (590.1) | | | 129.4 | |

| Rental property sales | | — | | | 799.2 | | | — | | | — | | | (6.4) | | | 792.8 | |

| Inventory and land option charges | | 47.4 | | | 2.3 | | | 23.6 | | | — | | | (11.1) | | | 62.2 | |

| | 17,717.1 | | | 801.5 | | | 698.7 | | | — | | | (788.0) | | | 18,429.3 | |

Selling, general and administrative expense | | 1,657.5 | | | 181.0 | | | 71.3 | | | 435.7 | | | 17.1 | | | 2,362.6 | |

| Other (income) expense | | (54.1) | | | (70.9) | | | (9.1) | | | (51.6) | | | 53.8 | | | (131.9) | |

| Income before income taxes | | $ | 3,626.7 | | | $ | 307.0 | | | $ | 126.2 | | | $ | 197.9 | | | $ | 38.6 | | | $ | 4,296.4 | |

| Summary Cash Flow Information | | | | | | | | | | | | |

| Cash provided by (used in) operating activities | | $ | 2,133.1 | | | $ | (78.1) | | | $ | 136.1 | | | $ | 13.9 | | | $ | 56.1 | | | $ | 2,261.1 | |

_____________________

(1)Amounts include the results of the Company's other businesses and the elimination of intercompany transactions.

(2)Amount in the Eliminations and Other column represents the recognition of profit on lots sold from Forestar to the homebuilding segment. Intercompany profit is eliminated in the consolidated financial statements when Forestar sells lots to the homebuilding segment and is recognized in the consolidated financial statements when the homebuilding segment closes homes on the lots to homebuyers.

D.R. HORTON, INC. AND SUBSIDIARIES

SALES, CLOSINGS AND BACKLOG

HOMEBUILDING SEGMENT

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NET SALES ORDERS |

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Nine Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | Homes | | Value | | Homes | | Value | | Homes | | Value | | Homes | | Value |

| Northwest | | 1,458 | | $ | 729.5 | | | 1,208 | | $ | 647.2 | | | 4,254 | | $ | 2,158.4 | | | 3,491 | | $ | 1,831.0 | |

| Southwest | | 2,488 | | 1,215.3 | | | 2,815 | | 1,345.6 | | | 7,719 | | 3,762.5 | | | 6,064 | | 2,879.8 | |

| South Central | | 5,880 | | 1,917.8 | | | 6,078 | | 2,029.6 | | | 17,733 | | 5,759.6 | | | 15,905 | | 5,145.2 | |

| Southeast | | 6,089 | | 2,165.1 | | | 6,021 | | 2,182.9 | | | 17,875 | | 6,360.1 | | | 16,617 | | 5,972.9 | |

| East | | 4,546 | | 1,614.6 | | | 4,547 | | 1,615.0 | | | 12,825 | | 4,574.9 | | | 11,342 | | 4,031.3 | |

| North | | 2,540 | | 1,073.4 | | | 2,210 | | 899.7 | | | 7,120 | | 2,952.9 | | | 5,984 | | 2,413.0 | |

| | 23,001 | | $ | 8,715.7 | | | 22,879 | | $ | 8,720.0 | | | 67,526 | | $ | 25,568.4 | | | 59,403 | | $ | 22,273.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOMES CLOSED |

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Nine Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | Homes | | Value | | Homes | | Value | | Homes | | Value | | Homes | | Value |

| Northwest | | 1,427 | | $ | 720.7 | | | 1,209 | | $ | 653.6 | | | 4,037 | | $ | 2,034.3 | | | 3,471 | | $ | 1,864.4 | |

| Southwest | | 2,673 | | 1,313.7 | | | 2,316 | | 1,120.1 | | | 7,556 | | 3,647.8 | | | 5,896 | | 2,828.2 | |

| South Central | | 6,104 | | 2,009.0 | | | 6,477 | | 2,169.7 | | | 17,323 | | 5,631.4 | | | 16,893 | | 5,609.9 | |

| Southeast | | 6,669 | | 2,415.9 | | | 6,616 | | 2,384.0 | | | 18,281 | | 6,591.3 | | | 17,654 | | 6,483.1 | |

| East | | 4,748 | | 1,709.0 | | | 4,102 | | 1,464.2 | | | 12,389 | | 4,418.1 | | | 10,469 | | 3,814.0 | |

| North | | 2,534 | | 1,062.9 | | | 2,265 | | 911.5 | | | 6,457 | | 2,651.3 | | | 5,606 | | 2,262.4 | |

| | 24,155 | | $ | 9,231.2 | | | 22,985 | | $ | 8,703.1 | | | 66,043 | | $ | 24,974.2 | | | 59,989 | | $ | 22,862.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SALES ORDER BACKLOG |

| | | | | | | | |

| | As of June 30, |

| | 2024 | | 2023 |

| | Homes | | Value | | Homes | | Value |

| Northwest | | 764 | | $ | 402.2 | | | 744 | | $ | 393.7 | |

| Southwest | | 1,570 | | 795.9 | | | 1,928 | | 956.5 | |

| South Central | | 4,037 | | 1,354.8 | | | 4,807 | | 1,617.6 | |

| Southeast | | 4,410 | | 1,642.4 | | | 6,001 | | 2,308.0 | |

| East | | 3,817 | | 1,409.2 | | | 3,959 | | 1,432.2 | |

| North | | 2,194 | | 949.5 | | | 1,747 | | 739.7 | |

| | 16,792 | | $ | 6,554.0 | | | 19,186 | | $ | 7,447.7 | |

D.R. HORTON, INC. AND SUBSIDIARIES

LAND AND LOT POSITION AND HOMES IN INVENTORY

HOMEBUILDING SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LAND AND LOT POSITION |

| | | | | | | | | | | |

| | June 30, 2024 | | September 30, 2023 |

| | Land/Lots

Owned | | Lots Controlled

Through

Land and Lot

Purchase

Contracts (1) | | Total

Land/Lots

Owned and

Controlled | | Land/Lots

Owned | | Lots Controlled

Through

Land and Lot

Purchase

Contracts (1) | | Total

Land/Lots

Owned and

Controlled |

| Northwest | 13,100 | | 19,300 | | 32,400 | | 14,100 | | 20,300 | | 34,400 |

| Southwest | 22,600 | | 27,000 | | 49,600 | | 22,600 | | 30,500 | | 53,100 |

| South Central | 38,100 | | 108,400 | | 146,500 | | 36,700 | | 69,500 | | 106,200 |

| Southeast | 28,600 | | 139,000 | | 167,600 | | 24,700 | | 132,900 | | 157,600 |

| East | 31,900 | | 128,900 | | 160,800 | | 27,700 | | 118,400 | | 146,100 |

| North | 16,600 | | 56,700 | | 73,300 | | 15,300 | | 55,700 | | 71,000 |

| 150,900 | | 479,300 | | 630,200 | | 141,100 | | 427,300 | | 568,400 |

| 24 | % | | 76 | % | | 100 | % | | 25 | % | | 75 | % | | 100 | % |

_____________

(1)Lots controlled at June 30, 2024 included approximately 36,200 lots owned or controlled by Forestar, 19,500 of which our homebuilding divisions had under contract to purchase and 16,700 of which our homebuilding divisions had a right of first offer to purchase. Lots controlled at September 30, 2023 included approximately 31,400 lots owned or controlled by Forestar, 14,400 of which our homebuilding divisions had under contract to purchase and 17,000 of which our homebuilding divisions had a right of first offer to purchase.

| | | | | | | | | | | | | | |

HOMES IN INVENTORY (1) |

| | | | |

| | June 30, 2024 | | September 30, 2023 |

| Northwest | | 2,500 | | 2,800 |

| Southwest | | 4,500 | | 4,700 |

| South Central | | 10,700 | | 10,800 |

| Southeast | | 11,500 | | 12,100 |

| East | | 8,300 | | 7,100 |

| North | | 5,100 | | 4,500 |

| | 42,600 | | 42,000 |

_____________

(1)Homes in inventory exclude model homes and homes related to our rental operations.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

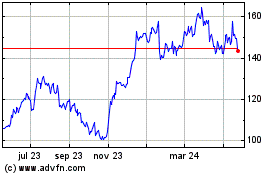

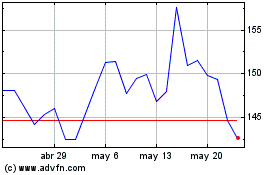

D R Horton (NYSE:DHI)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

D R Horton (NYSE:DHI)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024