GrafTech International Ltd. (NYSE: EAF) (“GrafTech” or the

“Company”) announced today that GrafTech Finance Inc. (“GrafTech

Finance”) and GrafTech Global Enterprises Inc. (“GrafTech Global”

and, together with GrafTech Finance, the “Issuers”), each a

subsidiary of the Company, have commenced separate offers to

exchange (each an “Exchange Offer” and, together, the “Exchange

Offers”) any and all of (i) GrafTech Finance’s 4.625% senior

secured notes due 2028 (the “Existing 4.625% Notes”) and (ii)

GrafTech Global’s 9.875% senior secured notes due 2028 (the

“Existing 9.875% Notes” and, together with the Existing 4.625%

Notes, the “Existing Notes”), for up to an aggregate principal

amount of $500,000,000 new 4.625% second lien notes due 2029 and up

to an aggregate principal amount of $450,000,000 new 9.875% second

lien notes due 2029, respectively (collectively, the “Exchange

Notes”), pursuant to the terms and conditions described in a

confidential exchange offer memorandum and consent solicitation

statement (as it may be supplemented and amended from time to time,

the “Offering Memorandum”).

Simultaneously with the Exchange Offers, the Company announced

that the Issuers are soliciting consents (with respect to each

series of Existing Notes, a “Consent Solicitation” and,

collectively, the “Consent Solicitations”), on the terms and

subject to the conditions set forth in the Offering Memorandum,

(with respect to each series of Existing Notes, a “Consent” and,

collectively, the “Consents”) from Eligible Holders (as defined

below) of such series of Existing Notes to adopt certain proposed

amendments (the “Proposed Amendments”) to the indentures governing

the Existing Notes (collectively, the “Existing Notes Indentures”).

The Proposed Amendments for each series of Existing Notes would

eliminate substantially all of the restrictive covenants as well as

certain events of default and related provisions and definitions in

the Existing Notes Indentures. Holders of at least a majority of

the outstanding principal amount of a series of the Existing Notes

must consent (the “Indenture Consents”) to the Proposed Amendments

in order for the Proposed Amendments to become effective with

respect to such series of Existing Notes. The Proposed Amendments

with respect to each series of Existing Notes would also release

all of the collateral securing such series of Existing Notes (the

“Collateral Release”) if consents from the holders of at least 66

2/3% of the outstanding principal amount of such series of Existing

Notes are received (the “Collateral Release Consents” and, together

with the Indenture Consents, the “Requisite Consents”). If the

Collateral Release Consents are obtained with respect to a series

of Existing Notes and the Collateral Release becomes operative, all

of the collateral securing such Existing Notes will be released.

Eligible Holders of Existing Notes may not tender Existing Notes

without delivering the related Consents, and Eligible Holders of

Existing Notes may not deliver Consents without tendering the

related Existing Notes.

Certain holders (the “Supporting Noteholders”) representing

approximately 89% of the principal amount of the Existing 4.625%

Notes and 72% of the principal amount of the Existing 9.875% Notes,

have agreed to tender their Existing Notes in the Exchange Offers

and thereby provide their consent to support the Proposed

Amendments in the Consent Solicitations. As a result, we expect the

Supporting Noteholders to tender their Existing Notes pursuant to

the Exchange Offers and provide the Requisite Consents, including,

for the avoidance of doubt, the Collateral Release Consents, with

respect to each series of the Existing Notes to effect the Proposed

Amendments with respect to each series of the Existing Notes.

The following table describes certain terms of the Exchange

Offers and summarizes the consideration for each $1,000 principal

amount of Existing Notes tendered in the Exchange Offers:

Title of Existing

Notes

Issuer

CUSIP No./ISIN(1)

Aggregate Outstanding

Principal Amount

Consideration (which includes

consideration for accompanying Consents delivered pursuant to the

Consent Solicitations)

4.625% Senior Secured Notes due 2028

GrafTech Finance

384311AA4 / US384311AA42 (144A) U3826GAA5

/ USU3826GAA59 (Reg S)

$500,000,000

$1,000 of New 4.625% Notes

9.875% Senior Secured Notes due 2028

GrafTech Global

38431AAA4 / US38431AAA43 (144A) U3830AAA2

/ USU3830AAA26 (Reg S)

$450,000,000

$1,000 of New 9.875% Notes

(1)

No representation is made as to the

correctness or accuracy of the CUSIP numbers listed in this press

release or printed on the Existing Notes. CUSIPs are provided

solely for convenience.

In addition to the consideration described in the table above,

the Issuers will pay in cash accrued and unpaid interest on the

Existing Notes accepted in the Exchange Offer from the applicable

latest interest payment date to, but not including, the settlement

date for the Exchange Offers. Interest on the New Notes will accrue

from the date of first issuance of the New Notes.

The New 4.625% Notes will bear interest at a rate of 4.625% per

year, to be paid semi-annually on June 23 and December 23,

commencing on June 23, 2025. The 9.875% Notes will bear interest at

a rate of 9.875% per year, to be paid semi-annually on June 23 and

December 23, commencing on June 23, 2025.

The payment of principal and interest on the New Notes will be

guaranteed by the guarantors under the Existing Notes (including

the Company), as well as certain additional guarantors that are not

organized under the laws of the United States (“Non-U.S.

Guarantors”). The New Notes and each guarantee will be senior

obligations that rank pari passu in right of payment with all of

our and the guarantors’ existing and future senior indebtedness,

subject to certain exceptions set forth in the Offering Memorandum.

The New Notes will be secured by a perfected second-priority

security interest in all of the assets and property of the Issuers

and the guarantors (the “Collateral”) (subject to certain

exclusions and limitations on perfection steps); provided, that the

trustee of the New Notes will first enforce against Collateral of

guarantors that are organized under the laws of the United States

prior to any Collateral of Non-U.S. Guarantor, subject to certain

limitations as set forth in the Offering Memorandum.

Each Exchange Offer and Consent Solicitation will expire at 5:00

pm, New York City time, on December 20, 2024, or any other date and

time to which the Issuers extend such date and time in its sole

discretion (such date and time for such Exchange Offer and Consent

Solicitation, as each may be extended, the “Expiration Time”),

unless earlier terminated. To be eligible to receive the exchange

consideration set forth in the table above in the applicable

Exchange Offer and Consent Solicitation, Eligible Holders must

validly tender (and not validly withdraw) their Existing Notes at

or prior to the Expiration Time. Rights to withdraw tendered

Existing Notes and revoke consents will terminate at 5:00 pm, New

York City time on December 20, 2024, unless extended (such time and

date as it may be extended, the “Withdrawal Deadline”), except for

certain limited circumstances where additional withdrawal rights

are required by law.

Each Exchange Offer and Consent Solicitation is a separate offer

and solicitation and each may be individually amended, extended,

terminated or withdrawn, subject to certain conditions and

applicable law, at any time in the Issuers’ sole discretion, and

without amending, extending, terminating or withdrawing any other

Exchange Offer or Consent Solicitation. The Expiration Time with

respect to the Exchange Offers and Consent Solicitations can be

extended independently of the Withdrawal Deadline for the Exchange

Offers and Consent Solicitations.

The consummation of each of the Exchange Offers and the Consent

Solicitations is subject to, and conditioned upon, the satisfaction

or waiver by the Issuers of certain conditions, including, the

Commitment Conditions (as defined in the Offering Memorandum) and

the tender of at least 80% of the outstanding principal amount of

Existing Notes (in the aggregate) in the Exchange Offers. Subject

to applicable law, the Issuers may amend, extend, terminate or

withdraw one of the Exchange Offers and related Consent

Solicitation without amending, extending, terminating or

withdrawing the other, at any time and for any reason, including if

any of the conditions set forth under “Conditions to the Exchange

Offers and the Consent Solicitations” in the Offering Memorandum

with respect to the applicable Exchange Offer is not satisfied as

determined by the Issuers in their sole discretion.

The Exchange Offers and Consent Solicitations are being made,

and the New Notes are being offered, only to holders of the

Existing Notes who are either (a) reasonably believed to be

“qualified institutional buyers” as defined in Rule 144A under the

Securities Act of 1934, as amended (the “Securities Act”) or (b)

not “U.S. persons,” as defined in Regulation S who agree to

purchase the New Notes outside of the United States and who are

otherwise in compliance with the requirements of Regulation S under

the Securities Act. A person in, or subject to the securities laws

of any province or territory of Canada, must be a resident of one

of the Provinces of Ontario, Quebec or Alberta and both an

“accredited investor” and a “permitted client”, as such terms are

defined under Canadian securities laws in order to be eligible to

participate in the Exchange Offers. The holders of Existing Notes

who have certified to the Issuers that they are eligible to

participate in the Exchange Offers and Consent Solicitations

pursuant to at least one of the foregoing conditions are referred

to as “Eligible Holders.” Eligible Holders may go to

https://epiqworkflow.com/cases/GrafTechEL to confirm their

eligibility.

Full details of the terms and conditions of the Exchange Offers

and Consent Solicitations are described in the Offering Memorandum.

The Exchange Offers and Consent Solicitations are only being made

pursuant to, and the information in this press release is qualified

in its entirety by reference to, the Offering Memorandum, which is

being made available to Eligible Holders of the Existing Notes.

Eligible Holders of the Existing Notes are encouraged to read the

Offering Memorandum, as it contains important information regarding

the Exchange Offers and Consent Solicitations.

Requests for the eligibility letter related to the Offering

Memorandum may be directed to Epiq Corporate Restructuring, LLC,

the exchange agent and information agent for the Exchange Offers by

email at registration@epiqglobal.com.

None of the Company, any of its subsidiaries (including the

Issuers) or affiliates, or any of their respective officers, boards

of directors, members or managers, the exchange agent and

information agent or the trustee of the Existing Notes or the New

Notes is making any recommendation as to whether Eligible Holders

should tender any Existing Notes in response to the Exchange Offers

or Consent to the Proposed Amendments, and no one has been

authorized by any of them to make such a recommendation.

The Exchange Offers are not being made to Eligible Holders of

the Existing Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction in

which the Exchange Offers are required to be made by a licensed

broker or dealer, the Exchange Offers will be deemed to be made on

behalf of the Company and the Issuers by one or more registered

brokers or dealers that are licensed under the laws of such

jurisdiction. The New Notes have not been and will not be

registered under the Securities Act, or any state securities laws

and may not be offered or sold in the United States, except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws.

No Offer or Solicitation

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy the Existing Notes or the New Notes

in the United States and shall not constitute an offer,

solicitation or sale of the New Notes in any jurisdiction where

such offering or sale would be unlawful. There shall not be any

sale of the New Notes in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction.

About GrafTech

GrafTech International Ltd. is a leading manufacturer of

high-quality graphite electrode products essential to the

production of electric arc furnace steel and other ferrous and

non-ferrous metals. The Company has a competitive portfolio of

low-cost, ultra-high power graphite electrode manufacturing

facilities, with some of the highest capacity facilities in the

world. GrafTech is the only large-scale graphite electrode producer

that is substantially vertically integrated into petroleum needle

coke, GrafTech’s key raw material for graphite electrode

manufacturing. This unique position provides GrafTech with

competitive advantages in product quality and cost.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements reflect our current views with respect to, among other

things, the Exchange Offers and the Consent Solicitations. You can

identify these forward-looking statements by the use of

forward-looking words such as “will,” “may,” “plan,” “estimate,”

“project,” “believe,” “anticipate,” “expect,” “foresee,” “intend,”

“should,” “would,” “could,” “target,” “goal,” “forecast,” “continue

to,” “positioned to,” “are confident,” or the negative versions of

those words or other comparable words. Any forward-looking

statements contained in this press release are based upon our

historical performance and on our current plans, estimates and

expectations considering information currently available to us. The

inclusion of this forward-looking information should not be

regarded as a representation by us that the future plans,

estimates, or expectations contemplated by us will be achieved. Our

expectations and targets are not predictions of actual performance

and historically our performance has deviated, often significantly,

from our expectations and targets. Forward-looking statements are

subject to various risks and uncertainties and assumptions relating

to our operations, financial results, financial condition,

business, prospects, growth strategy and liquidity. Accordingly,

there are or will be important factors that could cause our actual

results to differ materially from those indicated in these

statements. We believe that these factors include, but are not

limited to: our ability to complete the Exchange Offers, Consent

Solicitations and other related transactions on the terms

contemplated or at all; our ability to satisfy the required

conditions for the consummation of the Exchange Offers, Consent

Solicitations and other related transactions; our dependence on the

global steel industry generally and the electric arc furnace steel

industry in particular; the cyclical nature of our business and the

selling prices of our products, which may continue to decline in

the future, and may lead to prolonged periods of reduced

profitability and net losses or adversely impact liquidity; the

sensitivity of our business and operating results to economic

conditions, including any recession, and the possibility others may

not be able to fulfill their obligations to us in a timely fashion

or at all; the possibility that we may be unable to implement our

business strategies in an effective manner; the possibility that

global graphite electrode overcapacity may adversely affect

graphite electrode prices; the competitiveness of the graphite

electrode industry; our dependence on the supply of raw materials,

including decant oil and petroleum needle coke, and disruptions in

supply chains for these materials; our primary reliance on one

facility in Monterrey, Mexico for the manufacturing of connecting

pins; the cost of electric power and natural gas, particularly in

Europe; our manufacturing operations are subject to hazards; the

legal, compliance, economic, social and political risks associated

with our substantial operations in multiple countries; the

possibility that fluctuation of foreign currency exchange rates

could materially harm our financial results; the possibility that

our results of operations could further deteriorate if our

manufacturing operations were substantially disrupted for an

extended period, including as a result of equipment failure,

climate change, regulatory issues, natural disasters, public health

crises, such as a global pandemic, political crises or other

catastrophic events; the risks and uncertainties associated with

litigation, arbitration, and like disputes, including disputes

related to contractual commitments; our dependence on third parties

for certain construction, maintenance, engineering, transportation,

warehousing and logistics services; the possibility that we are

subject to information technology systems failures, cybersecurity

attacks, network disruptions and breaches of data security; the

possibility that we are unable to recruit or retain key management

and plant operating personnel or successfully negotiate with the

representatives of our employees, including labor unions; the

sensitivity of long-lived assets on our balance sheet to changes in

the market; our dependence on protecting our intellectual property

and the possibility that third parties may claim that our products

or processes infringe their intellectual property rights; the

impact of inflation and our ability to mitigate the effect on our

costs; the impact of macroeconomic and geopolitical events on our

business, results of operations, financial condition and cash

flows, and the disruptions and inefficiencies in our supply chain

that may occur as a result of such events; the possibility that our

indebtedness could limit our financial and operating activities or

that our cash flows may not be sufficient to service our

indebtedness; past increases in benchmark interest rates and the

fact that any future borrowings may subject us to interest rate

risk; risks and uncertainties associated with our ability to access

the capital and credit markets could adversely affect our results

of operations, cash flows and financial condition; the possibility

that disruptions in the capital and credit markets could adversely

affect our customers and suppliers; the possibility that

restrictive covenants in our financing agreements could restrict or

limit our operations; changes in, or more stringent enforcement of,

health, safety and environmental regulations applicable to our

manufacturing operations and facilities; the possibility that the

cash dividends on our common stock, which are currently suspended,

will remain suspended and we may not pay cash dividends on our

common stock in the future; our ability to continue to meet NYSE

continued listing standards; and the ability to satisfy the

conditions precedent with respect to the new financings.

These factors should not be construed as exhaustive and should

be read in conjunction with the Risk Factors and other cautionary

statements that are included in our most recent Annual Report on

Form 10-K and other filings with the U.S. Securities and Exchange

Commission. Additionally, there can be no assurances that the

Exchange Offers and Consent Solicitations will be successfully

consummated as they remain subject to the satisfaction of certain

conditions precedent. The forward-looking statements made in this

press release relate only to events as of the date on which the

statements are made. Except as required by law, we do not undertake

any obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise. If one or more of these or other risks

or uncertainties materialize, or if our underlying assumptions

prove to be incorrect, our actual results may vary materially from

what we may have expressed or implied by these forward-looking

statements. We caution that you should not place undue reliance on

any of our forward-looking statements. You should specifically

consider the factors identified in this press release that could

cause actual results to differ before making an investment decision

to purchase our common stock. Furthermore, new risks and

uncertainties arise from time to time, and it is impossible for us

to predict those events or how they may affect us.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121121195/en/

Michael Dillon 216-676-2000 investor.relations@graftech.com

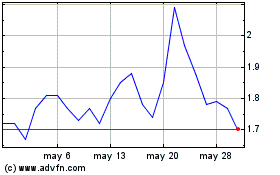

GrafTech (NYSE:EAF)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

GrafTech (NYSE:EAF)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024