Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

02 Marzo 2022 - 3:50PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-233403-05

Entergy Arkansas, LLC

$200,000,000

First Mortgage Bonds,

4.20% Series due April 1, 2049

Final Terms and Conditions

March 2, 2022

| | | | | | | | |

| Issuer: | | Entergy Arkansas, LLC |

| | | |

| Security Type: | | First Mortgage Bonds (SEC Registered) |

| | | |

Expected Ratings(1): | | A2 (positive outlook) by Moody’s Investors Service A (stable outlook) by S&P Global Ratings |

| | | |

Trade Date: | | March 2, 2022 |

| | | |

Settlement Date (T+2): | | March 4, 2022 |

| | | |

| Principal Amount: | | $200,000,000, which will be part of the same series of First Mortgage Bonds issued on March 19, 2019 |

| | | |

| Interest Rate: | | 4.20% |

| | | |

| Interest Payment Dates: | | April 1 and October 1 of each year |

| | | |

| First Interest Payment Date: | | April 1, 2022 |

| | | |

| Final Maturity Date: | | April 1, 2049 |

| | | |

| Qualified Reopening: | | This offering of First Mortgage Bonds is expected to qualify as a “qualified reopening” of the First Mortgage Bonds issued on March 19, 2019 under U.S. Treasury regulations |

| | |

| Optional Redemption Terms: | | Make-whole call at any time prior to October 1, 2048 at a discount rate of Treasury plus 20 bps and thereafter, at par |

| | | |

Benchmark Treasury: | | 1.875% due November 15, 2051 |

| | | |

| Benchmark Treasury Price: | | 92–00 |

| | | |

| Benchmark Treasury Yield: | | 2.245% |

| | |

| | | | | | | | |

| Spread to Benchmark Treasury: | | +160 bps |

| | |

Re-offer Yield: | | 3.845% |

| | | |

Price to Public: | | 105.875% of the principal amount (plus accrued interest from and including October 1, 2021, to and excluding the Settlement Date (such accrued interest totaling $3,570,000)) |

| | | |

Net Proceeds Before Expenses: | | $210,000,000 (exclusive of accrued interest from and including October 1, 2021, to and excluding the Settlement Date (such accrued interest totaling $3,570,000)) |

| | |

| CUSIP / ISIN: | | 29366M AA6 / US29366MAA62 |

| | |

| Joint Book-Running Managers: | | BNP Paribas Securities Corp. Mizuho Securities USA LLC Stephens Inc. Wells Fargo Securities, LLC |

______________________

(1) A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, a copy of the prospectus for the offering can be obtained by calling (i) BNP Paribas Securities Corp. toll-free at 1-800-854-5674, (ii) Mizuho Securities USA LLC toll-free at 1-866-271-740, (iii) Stephens Inc. toll-free at 1-800-643-9691 and (iv) Wells Fargo Securities, LLC toll-free at 1-800-645-3751.

Entergy Arkansas (NYSE:EAI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

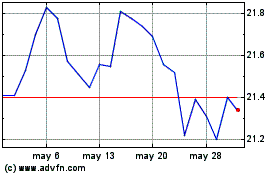

Entergy Arkansas (NYSE:EAI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024