Regulatory News:

Eurofins (Paris:ERF):

Financial highlights

Eurofins delivered a strong set of results in H1 2024:

- Total revenues of €3,419m represented a new record level for

the first half of a fiscal year, as Eurofins has now grown to

exceed its peak pandemic-driven revenue level, but without COVID-19

related revenues. The year-on-year increase was 6.5%, supported by

solid organic growth13 in the Core Business of 5.6% and a strong

pace of acquisitions, but restrained by FX headwinds (-0.5%). The

organic growth13 figure is not corrected for a slightly negative

working day effect as H1 2024 had 0.2 fewer working days than H1

2023. A 1–2-day positive working days impact is expected in H2

2024.

- Adjusted1 EBITDA3 of €757m (22.1% of revenues) was 18.3% higher

than the €640m (19.9% of revenues) achieved in H1 2023. This

improvement resulted from a combination of pricing attainment,

volume growth, and disciplined cost management, in particular

personnel expenses, consumables and building costs. All regions

demonstrated improvement in profitability.

- Net Profit7 increased year-on-year by 46% to €220m in H1 2024

vs €151m in H1 2023.

- Generation of Free Cash Flow before investment in owned sites16

increased by 171% from €125m in H1 2023 to €341m in H1 2024, thanks

to the increase in EBITDA3, continued capex discipline for

programmes related to capacity expansion, and improved net working

capital12 intensity.

- Free Cash Flow to the Firm10 increased 276% from €74m in H1

2023 to €279m in H1 2024.

- Eurofins’ balance sheet remains very solid at the end of June

2024:

- Financial leverage (net debt11 to last 12 months adjusted1

pro-forma EBITDA3) down to 1.9x at the end of June 2024 vs 2.0x at

the end of 2023 and well within its targeted range of

1.5-2.5x.

- Having carried out an early redemption of a €448m Eurobond on

19 June 2024, one month ahead of its maturity date on 25 July 2024,

Eurofins has no major financing requirements for the remainder of

2024. The next maturities are Schuldschein loans totalling €234m,

maturing in July and October 2025 respectively, and €400m in hybrid

capital with a first call date of 13 November 2025.

Strategic highlights

Eurofins companies continue to advance on their long-term

growth, digitalisation and innovation initiatives:

- In terms of M&A, the pace of acquisitions has been strong

so far this year.

- In H1 2024, Eurofins closed 15 business combinations that

generated FY 2023 pro-forma revenues of about €132m at a cost of

€246m, reflecting a sales multiple of 1.9x.

- Companies acquired in H1 2024 include Ascend Clinical, LLC, the

largest independent laboratory for kidney dialysis testing in the

United States, which further supports Eurofins’ efforts to provide

best-in-class testing care to patients in the renal and

transplantation fields.

- Eurofins added 45,000 m2 of net surface area to expand its

network in the first six months of 2024. Through a combination of

building projects, building purchases and acquisitions in the

M&A scope, offset by a decrease in leased surfaces, Eurofins

was able to increase its ownership proportion of the total net

floor area of its sites to 33.1% at the end of June 2024 vs 31.7%

at the end of 2023.

- The pace of start-up activity remained strong in H1 2024 as

Eurofins opened 18 new start-up laboratories and nine new blood

collection points (BCPs). The 319 start-ups and 76 BCPs launched

since 2000 have made material contributions to the overall organic

growth of the Group, accounting for 0.9% out of the 5.6% of organic

growth achieved in H1 2024.

- Eurofins companies continue to make meaningful contributions to

Testing for Life:

- Eurofins Genoma’s Genome-Wide Non-Invasive Prenatal Tests

(GW-NIPT) were recently acknowledged in a paper published in the

journal Prenatal Diagnosis as having extremely high clinical

utility.

- Eurofins Discovery launched DiscoveryAI SAFIRE, an advanced

platform for drug discovery that leverages proprietary datasets,

artificial intelligence (AI) and machine learning (ML) to predict

the ADMET (Absorption, Distribution, Metabolism, Excretion and

Toxicity) properties of molecules.

- Eurofins CDMO Alphora Inc. announced the completion of its

expansion of active pharmaceutical ingredient (API) capacity and

capabilities at its new API manufacturing facility in Mississauga,

Canada. This capacity expansion will allow Eurofins CDMO Alphora to

support existing and prospective partners to address expanding

therapeutic indications and meet the growing demand for emerging

therapies at clinical and commercial stages.

2024 to 2027 Objectives

- Eurofins does not provide guidance on future results. Depending

on long-term interest rate and inflation expectations, Eurofins

management sets multiyear targets (typically valid for 5 to 10

years) for its minimum hurdle rate for return on capital employed

on its investments (currently 16% after 3 years) and average

targets for annual organic growth over the period (currently 6.5%).

Eurofins develops unique levels of depth, breadth, quality and

speed of service for clients and overall efficiency and competitive

advantage through focussed 5-year investment programmes to create

unmatched laboratory and digital infrastructure in its chosen

markets, with increasingly global coverage.

- 2024 is the second year of the 2023-2027 programme. Objectives

for 2027 were shared on 1 March 2023. In addition, once a year when

publishing its annual results, Eurofins management also shares

objectives for the current year. Eurofins’ policy is not to update

these annual objectives unless very significant and unforeseen

changes occur. Objectives for FY 2024, which were announced at the

FY 2023 results presentation on 27 February 2024, and those for

2027, announced on 1 March 2023, thus remain unchanged.

€m

FY 2024

FY 2027

Revenues

€7.075bn – €7.175bn

Approaching €10bn

Adjusted1 EBITDA3

€1.525bn – €1.575bn

Margin: 24%

FCFF before investment in owned

sites16

€800m - €840m

Approaching €1.5bn

- The FY 2024 and FY 2027 objectives assume same average exchange

rates as in FY 2023 and zero contribution from COVID-19 clinical

testing and reagents. From FY 2024 to FY 2027, Eurofins targets

average organic growth13 of 6.5% p.a. and potential average

revenues from acquisitions of €250m p.a. over the period

consolidated at mid-year. In addition, Eurofins will remain prudent

with its acquisition strategy and only acquire businesses that meet

its objectives for return on capital employed.

- Similar to the achievement of an improved adjusted1 EBITDA3

margin in H1 2024 vs H1 2023, anticipated further improvements in

adjusted1 EBITDA3 margin in FY 2024 and towards the FY 2027

objective are underpinned by programmes that continue to align

pricing to cost inflation, as well as innovation, productivity,

digitalisation and automation initiatives, and better utilisation

of Eurofins’ state-of-the-art laboratory network.

- Eurofins continues to conduct reviews of some of its smaller

underperforming businesses.

- In the coming year, Eurofins expects to continue its high

intensity of start-up activities. Due to temporary losses related

to these start-ups, Separately Disclosed Items2 (SDI) at the

EBITDA3 level should remain at an elevated level of about €125m in

FY 2024. Thereafter, as newly initiated start-ups ramp up and

become profitable, the objective is that SDI2 at the EBITDA3 level

should decline gradually towards about 0.5% of revenues in

2027.

- Capital allocation for strategically important investments

remain key to Eurofins’ long-term value creation strategy.

Priorities for net operating capex in FY 2024 and in the mid-term

will continue to include start-ups in high-growth/high-return

areas, and the development and deployment of sector-leading

proprietary IT solutions. Capital allocation for net operating

capex is expected to be ca. €400m p.a.

- In addition, Eurofins will prioritise, if required, the

stepwise acquisition of sites owned by related parties, if decided

by a majority of its non-related shareholders, over the acquisition

of new sites from third parties. Investment in site ownership is

assumed to be around €200m p.a.

- Eurofins is fully committed to protecting the sustainability of

its balance sheet within its stated financial leverage objectives

with adequate headroom. It targets to maintain a financial leverage

of 1.5-2.5x in the mid-term period and less than 1.5x by FY

2027.

Comments from the CEO, Dr Gilles Martin:

“Though the first six months of 2024 remained clouded by

geopolitical and macroeconomic uncertainties, Eurofins companies

continued to deliver outstanding results in the areas that matter

most to our stakeholders: operational excellence, speed and quality

of service and innovation for our clients, financial performance

and sustainability for our shareholders, and continued investments

to create a great place to work for our leaders and staff in a

decentral entrepreneurial, fair and inclusive meritocratic

environment.

“In terms of financial performance and operational excellence,

in what historically has been the seasonally weakest semester of

the year, Eurofins achieved solid organic growth, setting a new

revenues record for a first half year and, even more impressively,

achieved a reported EBITDA3 margin of 20.9%, equivalent to a

year-on-year improvement of 260bps. This increase builds upon the

previously recorded year-on-year improvement achieved in H2 2023 vs

H2 2022 of 90bps of reported EBITDA3 margin. The first positive

impacts of Eurofins’ investment in building the best-in-class and

most digital laboratory network in its field are starting to be

felt now in the second year of its most recent 5-year investment

programme. In H1 2024, despite being at the peak investment

intensity of its digitalisation initiatives in 2024 and 2025,

Eurofins was able to reduce its financial leverage (net debt11 to

last 12 months adjusted1 pro-forma EBITDA3) and simultaneously make

large investments in M&A, laboratories buildings, capex,

start-ups, R&D and share buy-backs.

“We are further encouraged by progress in our digitalisation

initiatives. Development of a unique suite of IT solutions is

proving successful with deployment of the newest tools in several

pilot sites of our Life area of activity, with planned completion

of the remaining applications by the end of 2025 for most business

lines. This opens the path for groupwide deployment of these IT

solutions by the end of our 5-year investment programme in 2027,

though substantial benefits should already begin to be felt by

2026. Similarly, the building of a fully new state-of-the-art, more

decentral, secure, and resilient IT infrastructure will have made

large progress by the end of 2024 and should complete next year.

Beyond their large impact on capex, these two initiatives represent

very significant investments in operating expenses that should

significantly decline by 2026. The conclusion of these initiatives,

combined with the benefit of more modern, lean, streamlined and

effective digital tools, should further contribute to improving the

quality and speed of service to clients, reduce costs, and pave the

way for more systematic use of automation and AI solutions across

our network.

"Eurofins companies remain as committed as ever to continue to

deliver innovative, high-quality services and operational

excellence to our clients and financial performance to our

investors. Given this latest set of results and our ongoing

initiatives to further improve on the productivity and

digitalisation of our operations, I remain very confident in the

capabilities and motivation of Eurofins teams, not only to finish

this year strongly and achieve our FY 2024 profitability

objectives, but to sustain that momentum as we progress toward

achieving our FY 2027 objectives.”

Conference Call

Eurofins will hold a conference call with analysts and investors

today at 15:00 CEST to discuss the results and the performance of

Eurofins, as well as its outlook, and will be followed by a

questions and answers (Q&A) session.

Click here to Join Call >> From any device, click the link

above to join the conference call.

The following figures are extracts from the Condensed Interim

Consolidated Financial Statements and should be read in conjunction

with the Condensed Interim Consolidated Financial Statements and

Notes for the period ended 30 June 2024. The Half Year Report 2024

can be found on Eurofins’ website at the following link:

https://www.eurofins.com/investors/reports-and-presentations/

Table 1: Half Year 2024 Results Summary

H1 2024

H1 2023

+/- %

Adjusted

results

+/- %

Reported

results

In €m except otherwise stated

Adjusted1

results

Separately

disclosed

items2

Reported

results

Adjusted1

results

Separately

disclosed

items2

Reported

results

Revenues

3,419

-

3,419

3,209

-

3,209

+6.5%

+6.5%

EBITDA3

757

-43

714

640

-51

589

+18%

+21%

EBITDA3 margin (%)

22.1%

-

20.9%

19.9%

-

18.3%

+220 bp

+260 bp

EBITAS4

497

-65

432

397

-69

327

+25%

+32%

Net profit7

320

-100

220

261

-110

151

+23%

+46%

Basic EPS8 (€)

1.55

-0.54

1.01

1.23

-0.59

0.65

+26%

+57%

Net cash provided by operating

activities

530

333

+59%

Net capex9

252

259

-3%

Net operating capex

190

208

Net capex for purchase and

development of owned sites

62

51

Free Cash Flow to the Firm before

investment in owned sites16

341

125

+171%

M&A spend

246

83

+195%

Net debt11

2,863

2,588

+11%

Leverage ratio (net

debt11/pro-forma adjusted1 EBITDA3)

1.9x

2.0x (end FY 2023)

-0.1x

Note: Definitions of the alternative performance measures used

can be found at the end of this press release

Revenues of €3,419m increased year-on-year in H1 2024 by 6.5%,

supported by solid organic growth13 in the Core Business of 5.6% as

well as a strong pace of acquisitions, as Eurofins closed 15

business combinations with FY 2023 pro-forma revenues of €132m.

These effects more than compensated for the complete disappearance

of COVID-19 clinical testing and reagent revenues, which was small

but in the order of €20m in H1 2023.

Table 2: Organic Growth13 Calculation and Revenue

Reconciliation

In €m except

otherwise stated

H1 2023 reported revenues

3,209

+ H1 2023 acquisitions - revenue part not

consolidated in H1 2023 at H1 2023 FX rates

45

- H1 2023 revenues of discontinued

activities / disposals15

-18**

= H1 2023 pro-forma revenues (at H1 2023

FX rates)

3,237

+ H1 2024 FX impact on H1 2023 pro-forma

revenues

-15

= H1 2023 pro-forma revenues (at H1

2024 FX rates) (a)

3,222

H1 2024 organic scope* revenues (at H1

2024 FX rates) (b)

3,383

H1 2024 organic growth13 rate

(b/a-1)

5.0%***

H1 2024 acquisitions - revenue part

consolidated in H1 2024 at H1 2024 FX rates

36

H1 2024 revenues of discontinued

activities / disposals15

0

H1 2024 reported revenues

3,419

* Organic scope consists of all companies that were part of the

Group as at 01/01/2024. This corresponds to the 2023 pro-forma

scope ** Q1 2024 impacted by discontinuation15 of the OmniGraf

dual-biomarker rejection panel following revised billing guidance

by MolDX in the U.S. effective 1 April 2023 *** Not corrected for

the decline in COVID-19 related clinical testing and reagent

revenues and not adjusted for public working days

Table 3: Breakdown of Revenue by Operating Segment

€m

H1 2024

As % of

total

H1 2023

As % of

total

Y-o-Y

variation

%

Organic

growth13 in the

Core Business*

Europe

1,748

51%

1,622

51%

7.7%

5.6%

North America

1,311

38%

1,243

39%

5.5%

4.9%

Rest of the World

360

11%

344

11%

4.5%

7.9%

Total

3,419

100%

3,209

100%

6.5%

5.6%

* Excluding COVID-19 related clinical testing and reagent

revenues

Europe

- Reported revenues increased vs H1 2023 by €125m, primarily due

to solid organic growth of 5.6% in the Core Business.

- BioPharma Services in Europe experienced moderate growth in a

market environment characterised by diverse developments in the

first half of 2024. On the one hand, demand for BioPharma Product

Testing, Bioanalytical Services, Toxicology, and Medical Devices

Testing remained stable. On the other hand, Agroscience Services

continues to experience tepid demand growth mirroring the subdued

situation in the global seed and crop protection market and related

to uncertainty regarding regulatory requirements in Europe in

relation to registering new crop protection products. Meanwhile,

demand from customers for Discovery Services has begun to gradually

recover, though volumes still remain below peak levels. In terms of

profitability, volume growth, further implementation of pricing

initiatives and ongoing cost adaptation measures including

footprint optimisation have driven margin improvement.

- Following the challenging years of 2022 and 2023 due to the

persisting effects of inflation on consumer food prices, Food and

Feed Testing in Europe saw a recovery in growth in most countries

in the first half of 2024, supported by pricing attainment as well

as some volume increases driven by product development by food

producers. In parallel, Eurofins continued to implement initiatives

to control costs and boost efficiency, including capacity

optimisation through labour force adaptations and footprint

consolidation. Furthermore, Eurofins has continued to invest in

innovations to improve the productivity of its laboratories. These

large investments include technology, digitalisation and automation

initiatives, such as fully automated sample preparation systems and

the successful deployment of Eurofins’ internally developed

next-generation LIMS software in a number of pilot sites. These IT

solutions, as well as other related bespoke standardized

proprietary IT applications, should be fully deployed throughout

the region by the end of 2026 to replace a vast array of costly and

less-efficient legacy IT solutions.

- The Environment Testing business in Europe set new sales

records to start 2024, driven by market share gains on the back of

strong service and offerings across multiple countries, as well as

pricing initiatives. In terms of organic growth, while continued

pricing and commercial excellence initiatives were supportive,

volume increases in numerous activities ranging from water testing

to asbestos testing and anticipated regulation supporting increased

PFAS testing have been significant contributory factors. The strong

operational performance of the European Environment Testing

laboratories, the acceleration of ongoing lean and automation

programmes, digitalisation, and strong customer-focussed mindset

have supported growth and improved profitability across the

Eurofins Environment Testing network in Europe. Further

improvements are still expected from the continuation of already

engaged productivity programmes, including footprint

rationalisation, the completion of the roll-out of next-generation

LIMS to replace a diverse and costly set of legacy LIMS systems and

the accelerated ramp up of automation projects.

- The Clinical Diagnostics Business in Europe continued taking

measures in H1 2024 to improve its growth and profitability. The

expansion of blood collection point (BCP) coverage in France

continued as nine new BCPs were opened in H1 2024, adding to the 67

BCPs launched in France and Belgium during 2022 and 2023. In Spain,

operational improvements have resulted in a normalisation of growth

and improved profitability. Volumes of specialised testing services

such as clinical genetics and NIPT grew well. In terms of

operational performance, organisational changes made in 2023,

including changes in leadership and network rationalisation

following the end of COVID-19 testing, have helped to improve

profitability, while digitalisation initiatives are supporting

productivity. In terms of innovation, in a paper published in the

journal Prenatal Diagnosis on a study of 71,883 unselected clinical

cases of Genome-Wide Non-Invasive Prenatal Test (GW-NIPT), Eurofins

Genoma demonstrated the clinical utility of its expanded NIPT in

pregnancy management.

North America

- Reported revenues increased year-on-year by €69m, supported by

steady organic growth of 4.9% in the Core Business.

- BioPharma Services revenues in North America were resilient in

the first half of 2024. Promising development has been observed in

Discovery Services, which showed signs of recovery from the

challenging market conditions in 2022 and 2023. Demand and

pipelines in BioPharma Product Testing, and Central and

Bioanalytical Laboratories remained sound as clients continue to

invest in promising therapies across all modalities. Profitability

margins continue improving across most areas of the business,

supported by cost savings and measures to optimise personnel costs.

Investments in future growth opportunities continue to progress,

most notably Eurofins CDMO Alphora’s completion of its 3,300 square

foot pilot-scale biologics development facility with a scale-up

capacity of up to 200L for pre-clinical and phase I supply. In

addition, a new Drug Product Analytical Laboratory will launch,

increasing Eurofins CDMO Alphora’s footprint three-fold. Eurofins

CDMO Alphora also completed a 2,000L scale API manufacturing

facility, which will commence production in the second half of

2024, with capacity already sold via supply agreements. Eurofins

Discovery also continues to introduce new innovations such as

DiscoveryAI Safire, an AI tool that leverages proprietary datasets

launched in early 2024 as a valuable service to help pharmaceutical

clients accelerate their drug discovery timeline.

- The Food and Feed Testing business in North America continued

to grow strongly in H1 2024 supported by steady demand growth and

market share gains driven by new start-up microbiology laboratories

in Missouri and Nebraska to address the stringent turnaround time

requirements of meat and produce customers. Another noteworthy

development that has driven growth is Eurofins Food and Feed

Testing’s selection as one of three third-party testing

organisations to support Amazon’s requirement for certificates of

authenticity from sellers of dietary supplements on Amazon’s

platform. In addition to volume growth and mix enhancement due to

higher value-added testing, pricing attainment, rush pricing,

normalising inflation and higher productivity all contributed to

improving profitability.

- Eurofins Environment Testing in North America delivered strong

organic growth in H1 2024. Growth was underpinned by market share

gains and increased demand across all sectors of environment

testing. Eurofins operates the market leading PFAS Testing Service,

in terms of both processing capacity and capability, in the US.

Demand for PFAS testing was buoyant across all client groups –

regulators, industrials, consultancies, municipalities, federal and

state governments. Growth outperformance was supported by the

rollout of digitalisation initiatives including electronic chain of

custody (eCOC), internal process AI, and enhancement to myEOL

(Eurofins online), all of which assist process efficiency and

client tracking/retrieval of data online. In terms of

profitability, margin improvement was delivered through volume

growth, consumable cost controls, the rollout of microextraction to

reduce solvent usage and lower logistics costs, and efficiencies

gained from robotics and automation initiatives. The outlook for

profitable growth remains very positive as upgrades in one

California laboratory and two Texas laboratories come online to

extend processing capacity through H2 2024. Additionally, the

in-progress construction of a new, state-of-the-art full-service

environment testing laboratory in Chicago will help drive growth in

the years to come.

- During the reporting period, Eurofins closed the acquisition of

Ascend Clinical, LLC (“Ascend”). Operating a state-of-the-art

laboratory in Sunnyvale, California and employing 170 staff, Ascend

is the largest independent laboratory for kidney dialysis testing

in the United States. This acquisition further reinforces the

Eurofins network’s footprint in transplant testing and associated

renal care, broadening its clinical client base and growing its

exposure to this promising segment.

Rest of the World

- Core Business revenues were up 7.9% year-on-year on an organic

basis due to strong organic growth across many countries and

activities.

- After more muted business conditions in Asia due to softness in

consumer spending in many regions of the world related to high

inflation in 2023, demand from customers has gradually rebounded in

numerous countries, in particular in China. The Food and Feed

Testing, BioPharma Services and Clinical Diagnostics businesses

delivered robust growth across Asia. Start-ups in China, India and

Southeast Asia also contributed to growth, while Eurofins was able

to win numerous nominations in its Consumer Product Testing

business over its competitors due to advancements in new services

and supporting customers’ supply chain movements. However, demand

in the Advanced Material Sciences business remains tepid as the

semiconductor and electronics industry is currently in an inventory

correction cycle. On the other hand, demand from customers engaged

in semiconductor equipment and battery materials has been healthy.

From a profitability perspective, margins benefitted both from the

aforementioned strong growth as well as network optimisation

measures and targeted investment initiatives.

- In Australia, organic growth was fueled by national

infrastructure projects including those being undertaken in

preparation for the 2032 Olympics. Eurofins has also expanded its

PFAS testing capabilities in the region into New Zealand, to

complement existing offerings in Brisbane, Sydney, Melbourne and

Perth.

- In Latin America, Eurofins has made continued progress

regarding footprint optimisation. On the one hand, business

activities in Argentina are being wound down, while on the other

hand acquisitions have been concluded in Brazil and Colombia in

Food and Feed Testing, further expanding the network’s

footprint.

- In the Middle East, Ajal Laboratories continues to generate

good growth in its core Food and Feed Testing business, in

particular in the area of animal health. Eurofins is also expanding

its services in the clinical diagnostics sector in Saudi

Arabia.

Table 4: Breakdown of Revenue by Area of Activity

€m

H1 2024

As % of

total

H1 2023

As % of

total

Y-o-Y

variation %

Organic growth13

in the Core

Business*

Life

1,379

40%

1,257

39%

9.8%

7.9%

BioPharma

1,000

29%

976

30%

2.5%

2.6%

Diagnostic Services &

Products

690

20%

652

20%

5.9%

4.5%

Consumer & Technology

Products Testing

349

10%

325

10%

7.3%

7.5%

Total

3,419

100%

3,209

100%

6.5%

5.6%

* Excluding COVID-19 related clinical testing and reagent

revenues

Life (consisting of Food and Feed

Testing, Agro Testing and Environment Testing)

- Food and Feed Testing in Europe saw a recovery in growth in the

first half of 2024, supported by pricing attainment as well as some

volume increases driven by product development by food

producers.

- The Food and Feed Testing business in North America continued

to grow strongly in H1 2024 driven by steady demand growth and

market share gains.

- In Rest of the World, Food and Feed Testing delivered robust

growth across numerous countries in Asia and the Middle East.

- The Environment Testing business in Europe set new sales

records to start 2024, driven by market share gains on the back of

strong service and offerings across multiple countries, as well as

pricing initiatives.

- Eurofins Environment Testing in North America delivered strong

organic growth in H1 2024. Growth was underpinned by market share

gains and increased demand across all sectors of Environment

Testing.

- Environment Testing in Rest of the World experienced organic

growth in Australia, fueled by national infrastructure projects

including those being undertaken in preparation for the 2032

Olympics. Eurofins has also expanded its PFAS testing capabilities

in the region into New Zealand, to complement existing offerings in

Brisbane, Sydney, Melbourne and Perth.

Biopharma (consisting of BioPharma

Services, Agrosciences, Genomics and Forensic

Services)

- BioPharma Services in Europe experienced moderate growth in a

market environment characterised by diverse developments in the

first half of 2024. Demand for BioPharma Product Testing,

Bioanalytical Services, Toxicology, and Medical Devices Testing

remained stable. Meanwhile, demand from customers for Discovery

Services has begun to gradually recover, though volumes still

remain below peak levels. Professional Scientific Services® (PSS)

was able to outgrow the market by winning new clients.

- BioPharma Services revenues in North America were resilient in

the first half of 2024. Promising developments were observed in

Discovery Services, which showed signs of recovery from the

challenging market conditions in 2022 and 2023. Demand and

pipelines in BioPharma Product Testing and Central and

Bioanalytical Laboratories remained sound as clients continue to

invest in promising therapies across all modalities.

- BioPharma Services in Asia delivered robust growth across

numerous countries.

- Agroscience Services continues to experience tepid demand

growth mirroring the subdued situation in the global seed and crop

protection market and thus remains a very challenged area of

activity with limited improvement in sight.

- Eurofins’ Genomics business line continues its post-COVID pivot

towards activities related to genes, plasmids, biopharma and

large-scale, high-throughput end market applied genomics

solutions.

Diagnostic Services & Products

(consisting of Clinical Diagnostics Testing and In Vitro

Diagnostics (IVD) Solutions)

- The Clinical Diagnostics Business in Europe realised

improvements in growth in H1 2024. The expansion of blood

collection point (BCP) coverage in France continued as nine new

BCPs were opened in H1 2024, adding to the 67 BCPs launched in

France and Belgium during 2022 and 2023. In Spain, operational

improvements have resulted in a normalisation of growth and

improved profitability. Specialised testing services such as

clinical genetics and NIPT have also been growing well.

- During the reporting period, Eurofins closed the acquisition of

Ascend Clinical, LLC (“Ascend”). Operating a state-of-the-art

laboratory in Sunnyvale, California and employing 170 staff, Ascend

is the largest independent laboratory for kidney dialysis testing

in the United States.

Consumer & Technology Products

Testing (consisting of Consumer Product Testing and Advanced

Material Sciences)

- After more muted business conditions in Asia due to softness in

consumer spending in many regions of the world related to high

inflation in 2023, demand from customers for Consumer Product

Testing has gradually rebounded in numerous countries, in

particular in China.

- Eurofins was able to win numerous nominations in its Consumer

Product Testing business over its competitors due to advancements

in new services supporting customers’ supply chain movements.

- Demand in the Advanced Material Sciences business remains tepid

as the semiconductor and electronics industry is currently in an

inventory correction cycle. On the other hand, demand from

customers engaged in semiconductor equipment and battery materials

has been healthy.

Infrastructure Programme

As part of its strategy to lease less and own more of its

strategic sites, Eurofins has added, in the first six months of

2024, a total of 37,000 m² of laboratory, office, and storage space

through the delivery of building projects as well as building

purchases, while decreasing its leased surfaces by 12,000 m².

Through acquisitions in the M&A scope, Eurofins has added an

additional surface of 20,000 m². Overall, this has resulted in a

net surface increase of 45,000 m² leading to a total net floor area

of 1,779,000 m². In terms of ownership, the proportion of net floor

area owned by Eurofins as at 30 June 2024 reached 33.1%, a

substantial increase compared to the 31.7% owned by Eurofins at the

end of 2023. This growth has been supported by the following

projects, among others.

To support the long-term development of BioPharma Services

businesses in Asia, Eurofins Advinus began utilising a portion of

its new 20,000 m² facility in Bangalore, India. The infrastructure

fitout of the entire facility is set to be completed by the end of

2024, with state-of-the-art bioanalytical laboratories to be

completed in 2025. The facility will enable Eurofins Advinus to

offer end-to-end drug development services and solutions to its

clients. The facility effectively utilises natural lighting,

ventilation, spacious building circulation and attractive

landscaping to provide an outstanding work environment.

In Louisville, a new two-storey 6,500 m² facility has been

successfully completed for Eurofins Genomics. The site is located

on 3.63 acres of land adjacent to an existing Eurofins laboratory

site. The new strategic Eurofins site will employ approximately 100

personnel and will support the expansion of production capacity for

oligonucleotides, in alignment with the global strategy of Eurofins

Genomics. The laboratory boasts state-of-the-art lean design and

accommodates specific market requirements, such as ensuring

separation between research use only (RUO) and good manufacturing

practice (GMP) production from start to finish. This mitigates the

risk of cross contamination between sequences, which is critical

for molecular diagnostics and clinical companies developing

commercial assays.

In response to increasing demand for PFAS testing in drinking

water, a new 650m² space dedicated to PFAS testing was opened in

South Bend, Indiana. The laboratory is located within Eurofins’

existing water testing facility at the location and supports an

increase in PFAS testing capacity for drinking water for Eurofins

Environment Testing USA clients.

In Moss, Norway, Eurofins Food and Feed Testing Norway AS has

consolidated its operations into a newly renovated 600 m²

state-of-the-art microbiology laboratory employing lean design

principles.

In Tamworth, UK, a large 5,000 m² laboratory and office facility

has just been completed following a 2-year long renovation. The

facility will house Eurofins Forensic Services’ operations, which

were previously located on a smaller, leased site. The Tamworth

laboratory will be capable of state-of-the-art DNA recovery, drug

analysis and elemental analysis to complement projects performed by

other Eurofins Forensic Services teams in Warrington and Feltham.

In addition, the facility provides office space for teams of expert

reporters and commercial functions for Workplace Drug Testing. The

strategic site also contains conferencing facilities and warehouse

space and provides ample space for potential future expansion.

For the remainder of 2024 and for 2025, Eurofins is planning to

add 99,000 m² of laboratory and operational space through building

projects, acquisitions, new leases and consolidation of sites, as

well as completing the renovation of 21,000 m² of its current sites

to bring them to the highest standard.

Financial Review

Reported EBITDA3 improved by 21% year-on-year to €714m in H1

2024. In terms of Reported EBITDA3 as a proportion of revenues, the

margin improved year-on-year by 260bps from 18.3% to 20.9%.

Table 5: Breakdown of Reported EBITDA3 by Operating

Segment

€m

H1 2024

Rep. EBITDA3

margin %

H1 2023

Rep. EBITDA3

margin %

Y-o-Y

variation %

Europe

292

16.7%

217

13.4%

+34%

North America

356

27.1%

313

25.2%

+14%

Rest of the World

84

23.4%

66

19.3%

+27%

Other*

-18

-8

Total

714

20.9%

589

18.3%

+21%

*Other corresponds to Group service functions

In Europe, reported EBITDA3 margins improved substantially by

330bps vs H1 2023 to 16.7% of revenues mainly due to pricing

attainment, volume growth and cost management actions which

together enabled a year-on-year decrease in personnel expenses by

ca. 150bps, while costs of purchased materials and services

decreased by ca. 180bps year-on-year, especially in the categories

of consumables and building costs. Margin improvement was

particularly strong in the DACH region, but also in France, which

remains slightly accretive to European margins. Margins also

expanded year-on-year in North America by 190bps, reaching 27.1% of

its revenues in the period, driven by volume growth and

productivity measures which resulted in year-on-year decreases in

personnel expenses by ca. 130bps and purchased materials and

services (comprised especially of consumables) by ca. 60bps. The

greatest increase in margins occurred in Rest of the World, which

saw H1 2024 reported EBITDA3 margins step up by 410bps vs the

prior-year period to 23.4% of revenues, thanks to equal

contributions from volume growth, price increases and productivity

measures.

Adjusted1 EBITDA3 was €757m in H1 2024, representing an

adjusted1 EBITDA3 margin of 22.1% and a margin improvement of

220bps vs H1 2023. The substantial improvement was achieved in part

from the readjustment of the Eurofins organisation to the

post-pandemic situation initiated in 2023 as well as through

pricing adaptations and cost efficiency initiatives, in particular

related to personnel expenses, consumables and building costs.

Table 6: Separately Disclosed Items2

In €m except otherwise stated

H1 2024

H1 2023

One-off costs from integrations,

reorganisations and discontinued operations, and other

non-recurring income and costs

-18

-12

Temporary losses and other costs

related to network expansion, start-ups and new acquisitions in

significant restructuring

-25

-39

EBITDA3 impact

-43

-51

Separately Disclosed Items2 (SDI) at the EBITDA3 level decreased

year-on-year to €43m (equivalent to 6% of reported EBITDA3) and

comprised:

- One-off costs from integrations, reorganisations and

discontinued operations, and other non-recurring income and costs

of €18m that are linked to ongoing integrations and

reorganisations, especially in Germany and France.

- Temporary losses and other costs related to network expansion,

start-ups and new acquisitions in significant restructuring

totalled €25m. The reduction in this figure was due to improved

profitability year-on-year in many start-up activities, most

notably in the In Vitro Diagnostic (IVD) and Genomics businesses

that are pivoting to new markets and activities post-COVID-19.

Conversely, start-up losses related to Clinical Diagnostics

continued, including the ongoing impact on Transplant Genomics Inc.

in the U.S. related to a billing article concerning Medicare

reimbursement which became effective on 31 March 2023.

Depreciation and amortisation (D&A), including expenses

related to IFRS 16, increased by 8% year-on-year to €282m. As a

percentage of revenues, D&A stood at 8.2% of Group revenues in

H1 2024, the same ratio as in H1 2023.

Net finance costs amounted to €69m in H1 2024, a sizable

increase compared to €42m in H1 2023. On the one hand, financial

income increased to €14.9m in H1 2024 vs €5.5m in H1 2023 thanks to

higher average excess cash (€740m in H1 2024 vs €517m in H1 2023)

bearing higher average interest rates, progress in cash

centralisation through cash pooling and a shift to banking partners

offering better remuneration of positive balances. On the other

hand, the increase in finance costs was driven by higher interest

expenses for bonds, in particular from the €600m of senior

unsecured Eurobonds issued in August 2023 and due in September 2030

that bears an annual fixed rate coupon of 4.75%, but also a net

foreign exchange loss of €7.1m related to the appreciation of USD,

partially offset by the depreciation of JPY vs EUR (H1 2023: net

foreign exchange gain of €11.4m). Overall, Eurofins’ average

interest rate on its financial borrowings in H1 2024 was

approximately 3.5%.

The income tax expense increased from €69m in H1 2023 to €81m in

H1 2024, a year-on-year increase of 18%. However, this increase was

below the 37% increase in profit before income taxes (€220m in H1

2023 vs €301m in H1 2024) due to the decrease in the tax rate from

31.4% in H1 2023 to 27.0% in H1 2024.

Reported net profit7 stood at €220m (6.4% of revenues and 46%

higher than €151m in H1 2023), resulting in a total reported basic

EPS8 of €1.01. Adjusted1 net profit7 stood at €320m compared to

€261m in H1 2023, resulting in total adjusted1 basic EPS8 of €1.55

in H1 2024.

Cash Flow &

Financing

Table 7: Cash Flows Reconciliation

€m

H1 2024

reported

H1 2023

reported

Y-o-Y

variation

Y-o-Y

variation %

Net cash provided by operating

activities

530

333

+197

+59%

Net capex9 (i)

-252

-259

+7

+3%

Net operating capex (includes

LHI)

-190

-208

+18

+9%

Net capex for purchase and

development of owned sites

-62

-51

-11

-22%

Free Cash Flow to the Firm before

investment in owned sites16

341

125

+215

+171%

Free Cash Flow to the Firm10

279

74

+205

+276%

Acquisitions spend and other

investments (ii)

-246

-83

-163

Proceeds from disposals of

subsidiaries, net (iii)

0

8

-8

Other (iv)

14

5

+8

Net cash provided by investing

activities (i) + (ii) + (iii) + (iv)

-484

-329

-155

-47%

Net cash provided by financing

activities

-588

205

-793

Net increase / (decrease) in

Cash and cash equivalents and bank overdrafts

-540

198

-739

Cash and cash equivalents at

end of period and bank overdrafts

681

682

-1

0%

Net cash provided by operating activities increased in H1 2024

to €530m vs €333m in H1 2023. Net working capital12 stood at 6.3%

of the Group’s revenues at the end of June 2024, a decrease of

50bps vs 6.8% at the end of June 2023 (calculated as a percentage

of last quarter revenues times four). The year-on-year improvement

resulted from a decrease in Days of Sales Outstanding (59 in H1

2024 vs 60 in H1 2023) and an increase in Days of Payables

Outstanding (58 in H1 2024 vs 56 in H1 2023).

Cash generation more than adequately financed net capex9 of

€252m in H1 2024 vs €259m in H1 2023. After considering these

investments, Free Cash Flow to the Firm10 (FCFF) was €279m in H1

2024 vs €74m in H1 2023. Cash conversion (FCFF10 / Reported

EBITDA3) improved strongly from 13% in H1 2023 to 39% in H1

2024.

Net capex9 included investments as part of Eurofins’ programmes

to own its laboratory sites, which totalled €62m in H1 2024 vs €51m

in H1 2023. Excluding these investments, FCFF before investment in

owned sites16 was €341m in the reporting period, a substantial

improvement vs €125m in the prior year period.

During the first six months of 2024, the Group completed 15

business combinations including 9 acquisitions of legal entities

and 6 acquisitions of assets. Net cash outflow on acquisitions

completed during the period and in previous years (in case of

payment of deferred considerations) amounted to €246m.

As part of its share buy-back programme, Eurofins allocated

€47.7m to repurchase 910,000 of its own shares in H1 2024 at an

average price of €52.40, representing 0.47% of its share capital.

Note that the cash flow impact in H1 2024 of €30m also includes

inflows received from the exercise of stock options and outflows

related to the liquidity contract but excludes the settlement of

share repurchases performed in the final days of June 2024.

The combination of FCFF10 as well as the aforementioned

acquisitions and share buy-backs resulted in a net debt11 figure of

€2,863m at the end of June 2024. The corresponding leverage (net

debt11/last 12 months proforma adjusted1 EBITDA3) was 1.9x, an

improvement of 0.1x vs the end of December 2023, and within

Eurofins’ 1.5x-2.5x target range. Furthermore, having carried out

an early redemption of a €448m Eurobond on 19 June 2024, one month

ahead of its maturity date on 25 July 2024, Eurofins has no major

financing requirements for the remainder of 2024. The next

maturities are Schuldschein loans totalling €234m maturing in July

and October 2025 respectively, and €400m in hybrid capital with a

first call date of 13 November 2025. Eurofins also possesses a

solid overall liquidity position, which includes a cash position of

€681m as at 30 June 2024 as well as access to over €1bn of

committed, undrawn mid-term (3-5 years) bilateral bank credit

lines.

Start-up Programme

In the first half of 2024, the Group opened 18 new start-up

laboratories and 9 new start-up blood collection points (BCPs). In

total, the 319 start-ups and 76 BCPs launched since 2000 have made

material contributions to the overall organic growth of the Group,

accounting for 0.9% out of the 5.6% organic growth achieved in the

Core Business in H1 2024. The adjusted1 EBITDA3 margin of start-ups

initiated between 2000-2018 are almost in line with the Group’s

margin, while the total margin of start-ups initiated since 2019

remains dilutive to the Group’s margin.

Of the 319 start-ups and 76 BCPs the Group has launched since

2000, 58% are located in Europe, 15% in North America and 28% in

the Rest of the World, with a significant number in high growth

regions in Asia. By area of activity, 36% are in Life (consisting

of Food and Feed Testing, Agro Testing and Environment Testing),

18% are in BioPharma (consisting of BioPharma Services,

Agrosciences, Genomics and Forensic Services), 37% in Clinical

Diagnostics Services and Products (consisting of Clinical

Diagnostics Testing and In Vitro Diagnostics (IVD) Solutions) and

8% in Consumer & Technology Products Testing (consisting of

Consumer Product Testing and Advanced Material Sciences).

Acquisitions

During the first six months of 2024, the Group completed 15

business combinations, made up of 9 acquisitions of legal entities

and 6 acquisitions of assets. These companies/activities have been

fully consolidated from the date the Group took control over these

entities. For the year ended 31 December 2023, these entities

generated revenues of about €132m.

Post-Closing Events

Since 1 July 2024, Eurofins has completed 4 small business

combinations, one in Europe, one in North America and two in Rest

of the World. The total annual revenues of these acquisitions

amounted to over €14m in 2023 for an aggregate acquisition price of

ca. €22m. These acquisitions employ more than 200 employees.

On 16 July 2024, a new stock option plan (1,530,729 options) and

a new Restricted Stock Unit (RSU) plan (106,962 RSUs) were granted,

representing ca. 0.85% of the number of shares issued as of 30 June

2024.

Summary financial statements:

Table 8: Summarised Income Statement

H1 2024

H1 2023

In €m except otherwise stated

Reported

Results

Reported

Results

Revenues

3,419

3,209

Operating costs, net

-2,705

-2,621

EBITDA3

714

589

EBITDA3 Margin

20.9%

18.3%

Depreciation and amortisation

-282

-262

EBITAS4

432

327

Share-based payment charge and

acquisition-related expenses, net5

-63

-66

Gain/(loss) on disposal

-

-

EBIT6

369

262

Finance income

15

17

Finance costs

-84

-59

Share of profit of associates

1

0

Profit before income taxes

301

220

Income tax expense

-81

-69

Net profit7 for the

period

220

151

Attributable to:

Owners of the Company and hybrid

capital investors

221

152

Non-controlling interests

-1

-1

Earnings per share (basic) in

EUR

- Total

1.14

0.79

- Attributable to owners of the

Company8

1.01

0.65

- Attributable to hybrid capital

investors

0.13

0.14

Earnings per share (diluted) in

EUR

- Total

1.13

0.76

- Attributable to owners of the

Company

1.00

0.63

- Attributable to hybrid capital

investors

0.13

0.14

Basic weighted average shares

outstanding - in millions

193.0

192.9

Diluted weighted average shares

outstanding - in millions

195.2

198.2

Table 9: Summarised Balance Sheet

30 June

2024

31 December

2023

In €m except otherwise stated

Reported

Results

Reported

Results

Property, plant and equipment

2,440

2,297

Goodwill

4,718

4,551

Other intangible assets

832

796

Investments in associates

5

5

Non-current financial assets

80

78

Deferred tax assets

108

94

Total non-current

assets

8,184

7,822

Inventories

142

139

Trade receivables

1,084

1,073

Contract assets

333

308

Prepaid expenses and other

current assets

252

203

Current income tax assets

117

118

Derivative financial instruments

assets

4

4

Cash and cash equivalents

681

1,221

Total current assets

2,613

3,066

Total assets

10,797

10,889

Share capital

2

2

Treasury shares

-86

-55

Hybrid capital

1,000

1,000

Other reserves

1,601

1,601

Retained earnings

2,498

2,394

Currency translation reserve

228

136

Total attributable to owners of

the Company

5,243

5,078

Non-controlling interests

54

60

Total shareholders'

equity

5,297

5,137

Borrowings

3,373

3,326

Deferred tax liabilities

117

110

Amounts due for business

acquisitions

82

107

Employee benefit obligations

65

66

Provisions

21

21

Total non-current

liabilities

3,658

3,630

Borrowings

171

601

Interest due on borrowings and

earnings due on hybrid capital

112

59

Trade accounts payable

589

600

Contract liabilities

175

193

Current income tax

liabilities

22

27

Amounts due for business

acquisitions

62

36

Provisions

26

21

Other current liabilities

685

585

Total current

liabilities

1,842

2,122

Total liabilities and

shareholders' equity

10,797

10,889

Table 10: Summarised Cash Flow Statement

H1 2024

H1 2023

In €m except otherwise stated

Reported

Reported

Cash flows from operating

activities

Profit before income taxes

301

220

Depreciation and amortisation

282

262

Share-based payment charge and

acquisition-related expenses, net

63

66

Gain/(loss) on disposal of

subsidiaries, net

-

-

Finance income and costs, net

68

43

Share of profit from

associates

-1

0

Transactions costs and income

related to acquisitions

-4

-3

Changes in provisions and

employee benefit obligations

-1

-11

Other non-cash effects

-1

1

Change in net working

capital12

-78

-154

Cash generated from

operations

629

422

Income taxes paid

-98

-88

Net cash provided by operating

activities

530

333

Cash flows from investing

activities

Purchase of property, plant and

equipment

-218

-228

Purchase, capitalisation of

intangible assets

-36

-35

Proceeds from sale of property,

plant and equipment

2

4

Net capex9

-252

-259

Free cash Flow to the Firm10

279

74

Acquisitions of subsidiaries,

net

-246

-83

Proceeds from disposals of

subsidiaries, net

0

8

Acquisitions of investments,

financial assets and derivative financial instruments, net

-1

0

Interest received

15

5

Net cash used in investing

activities

-484

-329

Cash flows from financing

activities

Proceeds from issuance of share

capital

-

8

Purchase of treasury shares, net

of gains

-30

-37

Proceeds from issuance of hybrid

capital

-

594

Repayment of hybrid capital

-

-183

Proceeds from borrowings

30

17

Repayment of borrowings

-464

-81

Repayment of lease

liabilities

-93

-85

Dividends paid to shareholders

and non-controlling interests

-1

-1

Earnings paid to hybrid capital

investors

-

-9

Interests and premium paid

-31

-19

Net cash provided by financing

activities

-588

205

Net effect of currency

translation on cash and cash equivalents and bank overdrafts

1

-11

Net increase in cash and cash

equivalents and bank overdrafts

-540

198

Cash and cash equivalents and

bank overdrafts at beginning of period

1,221

483

Cash and cash equivalents and

bank overdrafts at end of period

681

682

1

Adjusted results – reflect the

ongoing performance of the mature14 and recurring activities

excluding “separately disclosed items”2.

2

Separately disclosed items –

include one-off costs from integration and reorganisation,

discontinued operations, other non-recurring income and costs,

temporary losses and other costs related to network expansion,

start-ups and new acquisitions undergoing significant

restructuring, share-based payment charge5, impairment of goodwill,

amortisation of acquired intangible assets and negative goodwill,

gains/losses on disposal of businesses and transaction costs

related to acquisitions as well as income from reversal of such

costs and from unused amounts due for business acquisitions, net

finance costs related to borrowing and investing excess cash and

one-off financial effects (net of finance income), net finance

costs related to hybrid capital and the related tax effects.

3

EBITDA – Earnings before

interest, taxes, depreciation and amortisation, share-based payment

charge and acquisition-related expenses, net5 and gain and loss on

disposal of subsidiaries, net.

4

EBITAS – EBITDA less depreciation

and amortisation.

5

Share-based payment charge and

acquisition-related expenses, net – Share-based payment charge,

impairment of goodwill, amortisation of acquired intangible assets,

negative goodwill, and transaction costs related to acquisitions as

well as income from reversal of such costs and from unused amounts

due for business acquisitions.

6

EBIT – EBITAS less Share-based

payment charge, acquisition-related expenses, net5 and gain and

loss on disposal of subsidiaries, net.

7

Net Profit – Net profit for

owners of the Company and hybrid capital investors before

non-controlling interests.

8

Basic EPS – basic earnings per

share attributable to owners of the Company.

9

Net capex – Purchase,

capitalisation of intangible assets, property, plant and equipment

less capex trade payables change of the period and proceeds from

disposals of such assets.

10

Free Cash Flow to the Firm – Net

cash provided by operating activities, less Net capex9.

11

Net debt – Current and

non-current borrowings, less cash and cash equivalents.

12

Net working capital –

Inventories, trade receivables and contract assets, prepaid

expenses and other current assets less trade accounts payable,

contract liabilities and other current liabilities excluding

accrued interest receivable and payable.

13

Organic growth for a given period

(Q1, Q2, Q3, Half Year, Nine Months or Full Year) – non-IFRS

measure calculating the growth in revenues during that period

between 2 successive years for the same scope of businesses using

the same exchange rates (of year Y) but excluding discontinued

operations.

For the purpose of organic growth

calculation for year Y, the relevant scope used is the scope of

businesses that have been consolidated in the Group's income

statement of the previous financial year (Y-1). Revenue

contribution from companies acquired in the course of Y-1 but not

consolidated for the full year are adjusted as if they had been

consolidated as of 1st January Y-1. All revenues from businesses

acquired since 1st January Y are excluded from the calculation.

14

Mature scope: excludes start-ups

and acquisitions in significant restructuring. A business will

generally be considered mature when: i) The Group’s systems,

structure and processes have been deployed; ii) It has been

audited, accredited and qualified and used by the relevant

regulatory bodies and the targeted client base; iii) It no longer

requires above-average annual capital expenditures, exceptional

restructuring or abnormally large costs with respect to current

revenues for deploying new Group IT systems. The list of entities

classified as mature is reviewed at the beginning of each year and

is relevant for the whole year.

15

Discontinued activities /

divestments: discontinued operations are a component of the Group’s

Core Business or product lines that have been disposed of, or

liquidated; or a specific business unit or a branch of a business

unit that has been shut down or terminated, and is reported

separately from continued operations. For more information, please

refer to Note 2.26 of the Consolidated Financial Statements for the

year ended 31 December 2023 and to Note 2.3 and Note 2.6 of the

Interim Condensed Consolidated Financial Statements for the period

ended 30 June 2024.

16

FCFF before investment in owned

sites: FCFF10 less Net capex9 spent on purchase of land, buildings

and investments to purchase, build or modernise owned

sites/buildings (excludes laboratory equipment and IT).

Notes to Editors:

About Eurofins – the global leader in bio-analysis

Eurofins is Testing for Life. The Eurofins Scientific S.E.

network of independent companies believes that it is a global

leader in food, environment, pharmaceutical and cosmetic product

testing and in discovery pharmacology, forensics, advanced material

sciences and agroscience contract research services. It is also one

of the market leaders in certain testing and laboratory services

for genomics, and in the support of clinical studies, as well as in

biopharma contract development and manufacturing. It also has a

rapidly developing presence in highly specialised and molecular

clinical diagnostic testing and in-vitro diagnostic products.

With ca. 62,000 staff across a decentralised and entrepreneurial

network of more than 900 laboratories in over 1,000 companies in 62

countries, Eurofins offers a portfolio of over 200,000 analytical

methods to evaluate the safety, identity, composition,

authenticity, origin, traceability and purity of a wide range of

products, as well as providing innovative clinical diagnostic

testing services and in-vitro diagnostic products.

Eurofins companies’ broad range of services are important for

the health and safety of people and our planet. The ongoing

investment to become fully digital and maintain the best network of

state-of-the-art laboratories and equipment supports our objective

to provide our customers with high-quality services, innovative

solutions and accurate results in the best possible turnaround time

(TAT). Eurofins companies are well positioned to support clients’

increasingly stringent quality and safety standards and the

increasing demands of regulatory authorities as well as the

evolving requirements of healthcare practitioners around the

world.

The Eurofins network has grown very strongly since its inception

and its strategy is to continue expanding its technology portfolio

and its geographic reach. Through R&D and acquisitions, its

companies draw on the latest developments in the field of

biotechnology and analytical chemistry to offer their clients

unique analytical solutions.

Shares in Eurofins Scientific S.E. are listed on the Euronext

Paris Stock Exchange (ISIN FR0014000MR3, Reuters EUFI.PA, Bloomberg

ERF FP).

Until it has been lawfully made public widely by Eurofins

through approved distribution channels, this document contains

inside information for the purpose of Regulation (EU) 596/2014 of

the European Parliament and of the Council of 16 April 2014 on

market abuse, as amended.

Important disclaimer:

This press release contains forward-looking statements and

estimates that involve risks and uncertainties. The forward-looking

statements and estimates contained herein represent the judgment of

Eurofins Scientific’s management as of the date of this release.

These forward-looking statements are not guarantees for future

performance, and the forward-looking events discussed in this

release may not occur. Eurofins Scientific disclaims any intent or

obligation to update any of these forward-looking statements and

estimates. All statements and estimates are made based on the

information available to the Company’s management as of the date of

publication, but no guarantees can be made as to their completeness

or validity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723918507/en/

For more information, please visit www.eurofins.com or

contact:

Investor Relations Eurofins Scientific SE Phone: +32 2 766 1620

E-mail: ir@sc.eurofinseu.com

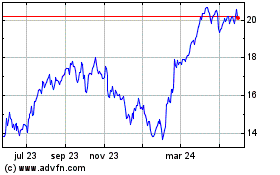

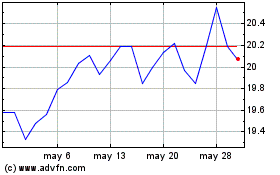

Enerplus (NYSE:ERF)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Enerplus (NYSE:ERF)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024