Angel Oak Financial Strategies Income Term Trust Declares September 2023 Distribution

01 Septiembre 2023 - 3:30PM

Business Wire

Angel Oak Financial Strategies Income Term Trust (the “Fund”), a

closed-end fund traded on the New York Stock Exchange under the

symbol FINS, today declared a distribution of $0.109 per share for

the month of September 2023. The record date for the distribution

is September 15, 2023, and the payable date is September 29, 2023.

The Fund will trade ex-distribution on September 14, 2023.

We are increasing our monthly distribution from $0.0905 to

$0.109 given the upside to NAV we expect as the banking sector

continues to recover from the regional bank failures earlier this

year. The market dislocation and its impact on pricing present a

compelling opportunity for bank debt to outperform in the current

environment: 1) the fear of contagion risk in the banking sector

has faded, 2) the Federal Reserve is near the end of its rate

hiking cycle, 3) Q1 and Q2 bank earnings have demonstrated the

resiliency of the banking sector, 4) bank equities have begun to

recover, 5) large and regional banks have resumed issuing debt, and

6) M&A is returning to the sector. Additionally, nearly 60% of

the Fund will transition from fixed to floating rate over the next

36 months as the bonds enter their call period, resulting in higher

coupons and/or the bonds getting called and refinanced by the

issuer.

The Fund seeks to pay a distribution at a rate that reflects net

investment income actually earned. A portion of each distribution

may be treated as paid from sources other than net investment

income, including but not limited to short-term capital gain,

long-term capital gain, or return of capital. As required by

Section 19(a) of the Investment Company Act of 1940, a notice will

be distributed to shareholders in the event that a portion of a

monthly distribution is derived from sources other than

undistributed net investment income. The final determination of the

source and tax characteristics of these distributions will depend

upon the Fund’s investment experience during its fiscal year and

will be made after the Fund’s year end. The Fund will send to

investors a Form 1099-DIV for the calendar year that will define

how to report these distributions for federal income tax

purposes.

ABOUT FINS

Led by Angel Oak’s experienced financial services team, FINS

invests predominantly in U.S. financial sector debt as well as

selective opportunities across financial sector preferred and

common equity. Under normal circumstances, at least 50% of FINS’

portfolio is publicly rated investment grade or, if unrated, judged

to be of investment grade quality by Angel Oak.

ABOUT ANGEL OAK CAPITAL ADVISORS, LLC

Angel Oak Capital Advisors is an investment management firm

focused on providing compelling fixed-income investment solutions

to its clients. Backed by a value-driven approach, Angel Oak

Capital Advisors seeks to deliver attractive, risk-adjusted returns

through a combination of stable current income and price

appreciation. Its experienced investment team seeks the best

opportunities in fixed income, with a specialization in

mortgage-backed securities and other areas of structured

credit.

Information regarding the Fund and Angel Oak Capital Advisors

can be found at www.angeloakcapital.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230901966194/en/

Randy Chrisman, Chief Marketing & Corporate IR Officer,

Angel Oak Capital Advisors 404-953-4969

randy.chrisman@angeloakcapital.com

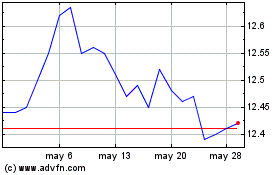

Angel Oak Financial Stra... (NYSE:FINS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Angel Oak Financial Stra... (NYSE:FINS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025