- Demand for railcars across GATX's global fleets remains

strong; Rail North America’s fleet utilization remains above

99%

- Aircraft spare engine portfolio continues strong

performance

- Investment volume was $504.5 million in the third quarter

and totaled over $1.3 billion year to date

- Company updates 2024 full-year earnings guidance to $7.50 –

7.70 per diluted share

GATX Corporation (NYSE: GATX) today reported 2024 third-quarter

net income of $89.0 million, or $2.43 per diluted share, compared

to net income of $52.5 million, or $1.44 per diluted share, in the

third quarter of 2023. The 2024 third-quarter results include a net

negative impact of $2.5 million, or $0.07 per diluted share, from

Tax Adjustments and Other Items.

Net income for the first nine months of 2024 was $207.7 million,

or $5.68 per diluted share, compared to $193.2 million, or $5.30

per diluted share, in the prior year period. The 2024 year-to-date

results include a net negative impact of $9.9 million, or $0.27 per

diluted share, from Tax Adjustments and Other Items. The 2023

year-to-date results include a net negative impact of $1.1 million,

or $0.03 per diluted share, from Tax Adjustments and Other Items.

Details related to these items are provided in the attached

Supplemental Information under Impact of Tax Adjustments and Other

Items.

"Operating conditions across our global markets remain

consistent with our expectations coming into the year," said Robert

C. Lyons, president and chief executive officer of GATX. "Our

commercial and operations teams at Rail North America continue to

execute at a high level. GATX Rail North America's fleet

utilization was 99.3% at the end of the third quarter and the

renewal success rate was over 80%. The renewal lease rate change of

GATX’s Lease Price Index was a positive 26.6% with an average

renewal term of 59 months.

"At Rail North America, we capitalized on an active secondary

railcar market and generated third-quarter remarketing income of

over $43 million, bringing year-to-date remarketing income to over

$96 million. Furthermore, we identified opportunities to grow our

asset base during the quarter, acquiring over 1,000 railcars in

addition to those acquired under our supply agreement.

"Rail International performed well as we continue to take

delivery of new railcars in Europe and India. GATX Rail Europe's

fleet utilization was 95.9% at the end of the quarter. GATX Rail

India, where fleet utilization remained at 100%, continues to

experience very strong demand for railcars and sees substantial

opportunities for new railcar investments.

"In Engine Leasing, third-quarter results were driven by

excellent performance at the Rolls-Royce and Partners Finance

affiliates, as demand for aircraft spare engines remains robust. We

continued to identify attractive opportunities to increase our

investment in engines, both directly and through RRPF affiliates.

In the third quarter, we added four engines to our wholly owned

portfolio for $94.8 million."

Mr. Lyons concluded, "Based on current market conditions and our

year-to-date performance, we expect 2024 full-year earnings to be

in the range of $7.50–$7.70 per diluted share. This guidance

excludes the impact of Tax Benefits and Other Items."

RAIL NORTH AMERICA

Rail North America reported segment profit of $102.4 million in

the third quarter of 2024, compared to $66.1 million in the third

quarter of 2023. Higher 2024 third-quarter segment profit was

driven by higher gains on asset dispositions and higher lease

revenue. Year to date 2024, Rail North America reported segment

profit of $271.5 million, compared to $240.6 million in the same

period of 2023. Higher 2024 year-to-date segment profit was

predominately driven by higher lease revenue, partially offset by

higher interest expense.

As of Sept. 30, 2024, Rail North America’s wholly owned fleet

was composed of over 111,000 cars, including approximately 9,000

boxcars. The following fleet statistics and performance discussion

exclude the boxcar fleet. Fleet utilization was 99.3% at the end of

the third quarter of 2024, consistent with the end of the prior

quarter and the end of the third quarter of 2023.

During the third quarter of 2024, the renewal lease rate change

of the LPI was positive 26.6%. This compares to positive 29.4% in

the prior quarter and positive 33.4% in the third quarter of 2023.

The average lease renewal term for all cars included in the LPI

during the third quarter of 2024 was 59 months, compared to 61

months in the prior quarter and 65 months in the third quarter of

2023. The 2024 third-quarter renewal success rate was 82.0%,

compared to 84.1% in the prior quarter and 83.6% in the third

quarter of 2023. Rail North America’s investment volume during the

third quarter of 2024 was $325.9 million.

Additional fleet statistics, including information on the boxcar

fleet, and macroeconomic data related to Rail North America’s

business are provided on the last page of this press release.

RAIL INTERNATIONAL

Rail International’s segment profit was $33.9 million in the

third quarter of 2024, compared to $28.2 million in the third

quarter of 2023. Year to date 2024, Rail International reported

segment profit of $89.2 million, compared to $79.0 million in the

same period of 2023. The 2023 year-to-date results include a net

positive impact of $0.3 million from Tax Adjustments and Other

Items. Additional details are provided in the attached Supplemental

Information under Tax Adjustments and Other Items. Excluding the

impact of these items, higher 2024 third-quarter and year-to-date

segment profit was driven by more railcars on lease and higher

lease rates.

As of Sept. 30, 2024, GATX Rail Europe’s (GRE) fleet consisted

of nearly 30,000 cars. 2024 third-quarter fleet utilization was

95.9%, compared to 95.8% at the end of the prior quarter and 96.0%

at the end of the third quarter of 2023.

As of Sept. 30, 2024, Rail India's fleet consisted of over

10,300 railcars. 2024 third-quarter fleet utilization was 100%,

consistent with the end of the prior quarter and the end of the

third quarter of 2023.

Additional fleet statistics for GRE and Rail India are provided

on the last page of this press release.

ENGINE LEASING

Engine Leasing reported segment profit of $37.5 million in the

third quarter of 2024, compared to segment profit of $20.2 million

in the third quarter of 2023. Year to date 2024, segment profit was

$81.6 million, compared to segment profit of $75.1 million in the

same period of 2023.

2024 and 2023 year-to-date results include a net positive impact

of $0.6 million and a net negative impact of $1.4 million,

respectively, from Tax Adjustments and Other Items. Additional

details are provided in the attached Supplemental Information under

Tax Adjustments and Other Items.

Excluding these impacts, higher 2024 third-quarter and

year-to-date segment profit was predominately driven by strong

performance at the Rolls-Royce and Partners Finance (RRPF)

affiliates. Earnings from GATX Engine Leasing, our wholly owned

portfolio, were also higher in the comparative periods due to more

engines under ownership.

COMPANY DESCRIPTION

At GATX Corporation (NYSE: GATX), we empower our customers to

propel the world forward. GATX leases transportation assets

including railcars, aircraft spare engines and tank containers to

customers worldwide. Our mission is to provide innovative,

unparalleled service that enables our customers to transport what

matters safely and sustainably while championing the well-being of

our employees and communities. Headquartered in Chicago, Illinois

since its founding in 1898, GATX has paid a quarterly dividend,

uninterrupted, since 1919.

TELECONFERENCE

INFORMATION

GATX Corporation will host a teleconference to discuss 2024

third-quarter results. Call details are as follows:

Tuesday, Oct. 22, 2024 11 a.m.

Eastern Time Domestic Dial-In:

1-800-715-9871 International Dial-In: 1-646-307-1963 Replay:

1-800-770-2030 or 1-609-800-9909 / Access Code: 5389470

Call-in details, a copy of this press release and real-time

audio access are available at www.gatx.com. Please access the call

15 minutes prior to the start time. A replay will be available on

the same site starting at 2 p.m. (Eastern Time), Oct. 22, 2024.

AVAILABILITY OF INFORMATION ON GATX'S

WEBSITE

Investors and others should note that GATX routinely announces

material information to investors and the marketplace using SEC

filings, press releases, public conference calls, webcasts and the

GATX Investor Relations website. While not all of the information

that the Company posts to the GATX Investor Relations website is of

a material nature, some information could be deemed to be material.

Accordingly, the Company encourages investors, the media and others

interested in GATX to review the information that it shares on

www.gatx.com under the “Investors” tab.

FORWARD-LOOKING

STATEMENTS

Statements in this Earnings Release not based on historical

facts are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and, accordingly,

involve known and unknown risks and uncertainties that are

difficult to predict and could cause our actual results,

performance, or achievements to differ materially from those

discussed. These include statements as to our future expectations,

beliefs, plans, strategies, objectives, events, conditions,

financial performance, prospects, or future events. In some cases,

forward-looking statements can be identified by the use of words

such as “may,” “could,” “expect,” “intend,” “plan,” “seek,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“outlook,” “continue,” “likely,” “will,” “would,” and similar words

and phrases. Forward-looking statements are necessarily based on

estimates and assumptions that, while considered reasonable by us

and our management, are inherently uncertain. Accordingly, you

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made, and are not

guarantees of future performance. We do not undertake any

obligation to publicly update or revise these forward-looking

statements.

The following factors, in addition to those discussed under

"Risk Factors" and elsewhere in our filings with the SEC, including

our Annual Report on Form 10-K for the year ended December 31,

2023, and any subsequent reports on Form 10-Q, could cause actual

results to differ materially from our current expectations

expressed in forward-looking statements:

- a significant decline in customer demand for our transportation

assets or services, including as a result of:

- prolonged inflation or deflation

- high interest rates

- weak macroeconomic conditions and world trade policies

- weak market conditions in our customers' businesses

- adverse changes in the price of, or demand for,

commodities

- changes in railroad operations, efficiency, pricing and service

offerings, including those related to "precision scheduled

railroading" or labor strikes or shortages

- changes in, or disruptions to, supply chains

- availability of pipelines, trucks, and other alternative modes

of transportation

- changes in conditions affecting the aviation industry,

including global conflicts, geographic exposure and customer

concentrations

- customers' desire to buy, rather than lease, our transportation

assets

- other operational or commercial needs or decisions of our

customers

- inability to maintain our transportation assets on lease at

satisfactory rates due to oversupply of assets in the market or

other changes in supply and demand

- competitive factors in our primary markets, including

competitors with significantly lower costs of capital

- higher costs associated with increased assignments of our

transportation assets following non-renewal of leases, customer

defaults, and compliance maintenance programs or other maintenance

initiatives

- events having an adverse impact on assets, customers, or

regions where we have a concentrated investment exposure

- financial and operational risks associated with long-term

purchase commitments for transportation assets

- reduced opportunities to generate asset remarketing income

- inability to successfully consummate and manage ongoing

acquisition and divestiture activities

- reliance on Rolls-Royce in connection with our aircraft spare

engine leasing businesses, and the risks that certain factors that

adversely affect Rolls-Royce could have an adverse effect on our

businesses

- potential obsolescence of our assets

- risks related to our international operations and expansion

into new geographic markets, including laws, regulations, tariffs,

taxes, treaties or trade barriers affecting our activities in the

countries where we do business

- failure to successfully negotiate collective bargaining

agreements with the unions representing a substantial portion of

our employees

- inability to attract, retain, and motivate qualified personnel,

including key management personnel

- inability to maintain and secure our information technology

infrastructure from cybersecurity threats and related disruption of

our business

- exposure to damages, fines, criminal and civil penalties, and

reputational harm arising from a negative outcome in litigation,

including claims arising from an accident involving transportation

assets

- changes in, or failure to comply with, laws, rules, and

regulations

- environmental liabilities and remediation costs

- operational, functional and regulatory risks associated with

climate change, severe weather events and natural disasters, and

other environmental, social and governance matters

- U.S. and global political conditions and the impact of

increased geopolitical tension and wars, including the ongoing war

between Russia and Ukraine and resulting sanctions and

countermeasures, on domestic and global economic conditions in

general, including supply chain challenges and disruptions

- prolonged inflation or deflation

- fluctuations in foreign exchange rates

- deterioration of conditions in the capital markets, reductions

in our credit ratings, or increases in our financing costs

- the emergence of new variants of COVID-19 or the occurrence of

another widespread health crisis and the impact of measures taken

in response

- inability to obtain cost-effective insurance

- changes in assumptions, increases in funding requirements or

investment losses in our pension and post-retirement plans

- inadequate allowances to cover credit losses in our

portfolio

- asset impairment charges we may be required to recognize

- inability to maintain effective internal control over financial

reporting and disclosure controls and procedures

GATX CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED)

(In millions, except per share

data)

Three Months Ended

September 30

Nine Months Ended

September 30

2024

2023

2024

2023

Revenues

Lease revenue

$

351.7

$

317.2

$

1,024.6

$

927.8

Non-dedicated engine revenue

18.1

13.6

45.0

24.5

Marine operating revenue

—

0.6

—

6.1

Other revenue

35.6

28.7

102.4

83.8

Total Revenues

405.4

360.1

1,172.0

1,042.2

Expenses

Maintenance expense

95.9

87.9

283.9

254.1

Marine operating expense

—

1.0

—

5.4

Depreciation expense

103.4

96.2

297.9

278.1

Operating lease expense

8.0

9.0

26.0

27.0

Other operating expense

14.1

12.0

41.5

34.0

Selling, general and administrative

expense

57.2

51.0

171.7

153.4

Total Expenses

278.6

257.1

821.0

752.0

Other Income (Expense)

Net gain on asset dispositions

48.5

16.9

110.3

105.1

Interest expense, net

(88.9

)

(68.1

)

(249.5

)

(190.8

)

Other (expense) income

(0.9

)

1.8

(10.9

)

(7.1

)

Income before Income Taxes and Share of

Affiliates’ Earnings

85.5

53.6

200.9

197.4

Income taxes

(22.9

)

(14.5

)

(51.9

)

(52.3

)

Share of affiliates’ earnings, net of

taxes

26.4

13.4

58.7

48.1

Net Income

$

89.0

$

52.5

$

207.7

$

193.2

Share Data

Basic earnings per share

$

2.44

$

1.44

$

5.70

$

5.32

Average number of common shares

35.8

35.7

35.8

35.6

Diluted earnings per share

$

2.43

$

1.44

$

5.68

$

5.30

Average number of common shares and common

share equivalents

35.9

35.8

35.9

35.7

Dividends declared per common share

$

0.58

$

0.55

$

1.74

$

1.65

GATX CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(In millions)

September 30

December 31

2024

2023

Assets

Cash and Cash Equivalents

$

503.7

$

450.7

Restricted Cash

0.1

0.1

Receivables

Rent and other receivables

93.9

87.9

Finance leases (as lessor)

124.8

136.4

Less: allowance for losses

(5.3

)

(5.9

)

213.4

218.4

Operating Assets and Facilities

14,243.1

13,081.9

Less: allowance for depreciation

(3,866.7

)

(3,670.7

)

10,376.4

9,411.2

Lease Assets (as lessee)

Right-of-use assets, net of accumulated

depreciation

173.5

212.0

173.5

212.0

Investments in Affiliated

Companies

690.3

627.0

Goodwill

120.9

120.0

Other Assets ($0.4 and $0.8 related

to assets held for sale)

301.6

286.6

Total Assets

$

12,379.9

$

11,326.0

Liabilities and Shareholders’

Equity

Accounts Payable and Accrued

Expenses

$

210.1

$

239.6

Debt

Commercial paper and borrowings under bank

credit facilities

11.1

11.0

Recourse

8,293.5

7,388.1

8,304.6

7,399.1

Lease Obligations (as lessee)

Operating leases

187.5

226.8

187.5

226.8

Deferred Income Taxes

1,132.2

1,081.1

Other Liabilities

108.8

106.4

Total Liabilities

9,943.2

9,053.0

Total Shareholders’ Equity

2,436.7

2,273.0

Total Liabilities and Shareholders’

Equity

$

12,379.9

$

11,326.0

GATX CORPORATION AND

SUBSIDIARIES

SEGMENT DATA

(UNAUDITED)

Three Months Ended September

30, 2024

(In millions)

Rail North America

Rail International

Engine Leasing

Other

GATX Consolidated

Revenues

Lease revenue

$

249.2

$

86.3

$

8.1

$

8.1

$

351.7

Non-dedicated engine revenue

—

—

18.1

—

18.1

Other revenue

29.3

4.3

—

2.0

35.6

Total Revenues

278.5

90.6

26.2

10.1

405.4

Expenses

Maintenance expense

77.7

17.0

—

1.2

95.9

Depreciation expense

69.2

20.3

10.1

3.8

103.4

Operating lease expense

8.0

—

—

—

8.0

Other operating expense

7.0

3.7

2.6

0.8

14.1

Total Expenses

161.9

41.0

12.7

5.8

221.4

Other Income (Expense)

Net gain on asset dispositions

46.7

1.7

—

0.1

48.5

Interest (expense) income, net

(60.2

)

(18.5

)

(11.3

)

1.1

(88.9

)

Other (expense) income

(0.8

)

1.1

0.1

(1.3

)

(0.9

)

Share of affiliates' pre-tax earnings

0.1

—

35.2

—

35.3

Segment profit

$

102.4

$

33.9

$

37.5

$

4.2

$

178.0

Less:

Selling, general and administrative

expense

57.2

Income taxes (includes $8.9 related to

affiliates' earnings)

31.8

Net income

$

89.0

Selected

Data:

Investment volume

$

325.9

$

80.6

$

94.8

$

3.2

$

504.5

Net Gain on Asset Dispositions

Asset Remarketing

Income:

Net gains on disposition of owned

assets

$

43.6

$

1.2

$

—

$

0.1

$

44.9

Residual sharing income

0.1

—

—

—

0.1

Non-remarketing net gains (1)

3.0

0.5

—

—

3.5

$

46.7

$

1.7

$

—

$

0.1

$

48.5

__________

(1) Includes net gains from scrapping of

railcars.

GATX CORPORATION AND

SUBSIDIARIES

SEGMENT DATA

(UNAUDITED)

Three Months Ended September

30, 2023

(In millions)

Rail North America

Rail International

Engine Leasing

Other

GATX Consolidated

Revenues

Lease revenue

$

225.2

$

75.6

$

8.1

$

8.3

$

317.2

Non-dedicated engine revenue

—

—

13.6

—

13.6

Marine operating revenue

—

—

0.6

—

0.6

Other revenue

22.7

3.6

0.1

2.3

28.7

Total Revenues

247.9

79.2

22.4

10.6

360.1

Expenses

Maintenance expense

69.4

17.1

—

1.4

87.9

Marine operating expense

—

—

1.0

—

1.0

Depreciation expense

66.9

17.5

8.4

3.4

96.2

Operating lease expense

9.0

—

—

—

9.0

Other operating expense

6.5

2.7

2.1

0.7

12.0

Total Expenses

151.8

37.3

11.5

5.5

206.1

Other Income (Expense)

Net gain on asset dispositions

15.5

0.9

0.2

0.3

16.9

Interest (expense) income, net

(46.6

)

(14.5

)

(8.7

)

1.7

(68.1

)

Other income (expense)

1.2

(0.1

)

(0.2

)

0.9

1.8

Share of affiliates' pre-tax (loss)

earnings

(0.1

)

—

18.0

—

17.9

Segment profit

$

66.1

$

28.2

$

20.2

$

8.0

$

122.5

Less:

Selling, general and administrative

expense

51.0

Income taxes (includes $4.5 related to

affiliates' earnings)

19.0

Net income

$

52.5

Selected

Data:

Investment volume

$

197.0

$

129.6

$

28.3

$

9.0

$

363.9

Net Gain on Asset Dispositions

Asset Remarketing

Income:

Net gains on disposition of owned

assets

$

13.0

$

—

$

—

$

0.1

$

13.1

Residual sharing income

0.1

—

0.2

—

0.3

Non-remarketing net gains (1)

2.4

0.9

—

0.2

3.5

$

15.5

$

0.9

$

0.2

$

0.3

$

16.9

__________

(1) Includes net gains from scrapping of

railcars.

GATX CORPORATION AND

SUBSIDIARIES

SEGMENT DATA

(UNAUDITED)

Nine Months Ended September

30, 2024

(In millions)

Rail North America

Rail International

Engine Leasing

Other

GATX Consolidated

Revenues

Lease revenue

$

727.8

$

248.9

$

24.3

$

23.6

$

1,024.6

Non-dedicated engine revenue

—

—

45.0

—

45.0

Other revenue

86.1

10.6

—

5.7

102.4

Total Revenues

813.9

259.5

69.3

29.3

1,172.0

Expenses

Maintenance expense

228.0

52.7

—

3.2

283.9

Depreciation expense

201.1

58.6

27.1

11.1

297.9

Operating lease expense

26.0

—

—

—

26.0

Other operating expense

20.1

10.8

7.0

3.6

41.5

Total Expenses

475.2

122.1

34.1

17.9

649.3

Other Income (Expense)

Net gain on asset dispositions

105.8

3.7

0.6

0.2

110.3

Interest (expense) income, net

(169.9

)

(52.7

)

(30.3

)

3.4

(249.5

)

Other (expense) income

(3.2

)

0.8

0.3

(8.8

)

(10.9

)

Share of affiliates' pre-tax earnings

0.1

—

75.8

—

75.9

Segment profit

$

271.5

$

89.2

$

81.6

$

6.2

$

448.5

Less:

Selling, general and administrative

expense

171.7

Income taxes (includes $17.2 related to

affiliates' earnings)

69.1

Net income

$

207.7

Selected

Data:

Investment volume

$

955.7

$

190.1

$

166.1

$

13.2

$

1,325.1

Net Gain on Asset Dispositions

Asset Remarketing

Income:

Net gains on disposition of owned

assets

$

96.3

$

1.3

$

0.6

$

0.2

$

98.4

Residual sharing income

0.3

—

—

—

0.3

Non-remarketing net gains (1)

9.2

2.4

—

—

11.6

$

105.8

$

3.7

$

0.6

$

0.2

$

110.3

__________

(1) Includes net gains from scrapping of

railcars.

GATX CORPORATION AND

SUBSIDIARIES

SEGMENT DATA

(UNAUDITED)

Nine Months Ended September

30, 2023

(In millions)

Rail North America

Rail International

Engine Leasing

Other

GATX Consolidated

Revenues

Lease revenue

$

659.2

$

219.1

$

24.5

$

25.0

$

927.8

Non-dedicated engine revenue

—

—

24.5

—

24.5

Marine operating revenue

—

—

6.1

—

6.1

Other revenue

68.0

9.6

0.1

6.1

83.8

Total Revenues

727.2

228.7

55.2

31.1

1,042.2

Expenses

Maintenance expense

203.1

47.6

—

3.4

254.1

Marine operating expense

—

—

5.4

—

5.4

Depreciation expense

198.5

49.8

19.9

9.9

278.1

Operating lease expense

27.0

—

—

—

27.0

Other operating expense

20.2

7.2

4.4

2.2

34.0

Total Expenses

448.8

104.6

29.7

15.5

598.6

Other Income (Expense)

Net gain on asset dispositions

97.4

2.4

4.7

0.6

105.1

Interest (expense) income, net

(133.4

)

(40.5

)

(20.9

)

4.0

(190.8

)

Other (expense) income

(1.3

)

(7.0

)

(0.5

)

1.7

(7.1

)

Share of affiliates' pre-tax (losses)

earnings

(0.5

)

—

66.3

—

65.8

Segment profit

$

240.6

$

79.0

$

75.1

$

21.9

$

416.6

Less:

Selling, general and administrative

expense

153.4

Income taxes (includes $17.7 related to

affiliates' earnings)

70.0

Net income

$

193.2

Selected

Data:

Investment volume

$

654.8

$

288.0

$

267.3

$

27.4

$

1,237.5

Net Gain on Asset Dispositions

Asset Remarketing

Income:

Net gains on disposition of owned

assets

$

88.4

$

0.5

$

5.5

$

0.3

$

94.7

Residual sharing income

0.3

—

0.4

—

0.7

Non-remarketing net gains (1)

8.7

1.9

—

0.3

10.9

Asset impairments

—

—

(1.2

)

—

(1.2

)

$

97.4

$

2.4

$

4.7

$

0.6

$

105.1

__________

(1) Includes net gains from scrapping of

railcars.

GATX CORPORATION AND

SUBSIDIARIES

SUPPLEMENTAL INFORMATION

(UNAUDITED)

(In millions, except per share

data)

Impact of Tax

Adjustments and Other Items on Net Income (1)

Three Months Ended

September 30

Nine Months Ended

September 30

2024

2023

2024

2023

Net income (GAAP)

$

89.0

$

52.5

$

207.7

$

193.2

Adjustments attributable to consolidated

pre-tax income:

Litigation claims settlements (2)

3.3

—

3.3

—

Environmental reserves (3)

$

—

$

—

$

10.7

$

—

Net (gain) loss on Specialized Gas Vessels

at Engine Leasing (4)

—

—

(0.6

)

1.4

Net gain on Rail Russia at Rail

International (5)

—

—

—

(0.3

)

Total adjustments attributable to

consolidated pre-tax income

$

3.3

$

—

$

13.4

$

1.1

Income taxes thereon, based on applicable

effective tax rate

(0.8

)

—

(3.5

)

—

Net income, excluding tax adjustments and

other items (non-GAAP)

$

91.5

$

52.5

$

217.6

$

194.3

Impact of Tax

Adjustments and Other Items on Diluted Earnings per Share

(1)

Three Months Ended

September 30

Nine Months Ended

September 30

2024

2023

2024

2023

Diluted earnings per share (GAAP)

$

2.43

$

1.44

$

5.68

$

5.30

Diluted earnings per share, excluding tax

adjustments and other items (non-GAAP)

$

2.50

$

1.44

$

5.95

$

5.33

_________

(1)

In addition to financial results reported

in accordance with GAAP, we compute certain financial measures

using non-GAAP components. Specifically, we exclude the effects of

certain tax adjustments and other items for purposes of presenting

net income and diluted earnings per share because we believe these

items are not attributable to our business operations. Management

utilizes net income, excluding tax adjustments and other items,

when analyzing financial performance because such amounts reflect

the underlying operating results that are within management’s

ability to influence. Accordingly, we believe presenting this

information provides investors and other users of our financial

statements with meaningful supplemental information for purposes of

analyzing year-to-year financial performance on a comparable basis

and assessing trends.

(2)

Expenses recorded for the settlement of

litigation claims arising out of legacy business operations.

(3)

Reserves recorded for our share of

anticipated environmental remediation costs arising out of prior

operations and legacy businesses.

(4)

In 2022, we made the decision to sell the

Specialized Gas Vessels. We have recorded gains and losses

associated with the subsequent impairments and sales of these

assets. As of December 31, 2023, all vessels had been sold.

(5)

In 2022, we made the decision to exit our

rail business in Russia ("Rail Russia"). In the first quarter of

2023, we sold Rail Russia and recorded a gain on the final sale of

this business.

GATX CORPORATION AND

SUBSIDIARIES

SUPPLEMENTAL INFORMATION

(UNAUDITED)

(In millions, except

leverage)

9/30/2024

6/30/2024

3/31/2024

12/31/2023

9/30/2023

Total Assets,

Excluding Cash, by Segment

Rail North America

$

7,643.7

$

7,416.0

$

7,214.1

$

6,984.9

$

6,760.5

Rail International

2,298.6

2,168.3

2,142.1

2,150.8

1,951.5

Engine Leasing

1,544.7

1,431.7

1,354.4

1,343.2

1,363.8

Other

389.1

382.8

389.3

396.3

368.5

Total Assets, excluding cash

$

11,876.1

$

11,398.8

$

11,099.9

$

10,875.2

$

10,444.3

Debt and Lease

Obligations, Net of Unrestricted Cash

Unrestricted cash

$

(503.7

)

$

(823.6

)

$

(479.1

)

$

(450.7

)

$

(203.1

)

Commercial paper and bank credit

facilities

11.1

10.7

10.8

11.0

12.3

Recourse debt

8,293.5

8,235.7

7,624.5

7,388.1

6,835.6

Operating lease obligations

187.5

209.3

215.2

226.8

233.2

Total debt and lease obligations, net of

unrestricted cash

$

7,988.4

$

7,632.1

$

7,371.4

$

7,175.2

$

6,878.0

Total recourse debt (1)

$

7,988.4

$

7,632.1

$

7,371.4

$

7,175.2

$

6,878.0

Shareholders’ Equity

$

2,436.7

$

2,343.4

$

2,324.3

$

2,273.0

$

2,174.5

Recourse Leverage (2)

3.3

3.3

3.2

3.2

3.2

_________

(1)

Includes recourse debt, commercial paper

and bank credit facilities, and operating and finance lease

obligations, net of unrestricted cash.

(2)

Calculated as total recourse debt /

shareholder's equity.

Reconciliation of

Total Assets to Total Assets, Excluding Cash

Total Assets

$

12,379.9

$

12,222.6

$

11,579.1

$

11,326.0

$

10,647.5

Less: cash

(503.8

)

(823.8

)

(479.2

)

(450.8

)

(203.2

)

Total Assets, excluding cash

$

11,876.1

$

11,398.8

$

11,099.9

$

10,875.2

$

10,444.3

GATX CORPORATION AND

SUBSIDIARIES

SUPPLEMENTAL INFORMATION

(UNAUDITED)

(Continued)

9/30/2024

6/30/2024

3/31/2024

12/31/2023

9/30/2023

Rail North

America Statistics

Lease Price Index (LPI) (1)

Average renewal lease rate change

26.6

%

29.4

%

33.0

%

33.5

%

33.4

%

Average renewal term (months)

59

61

64

65

65

Renewal Success Rate (2)

82.0

%

84.1

%

83.4

%

87.1

%

83.6

%

Fleet Rollforward (3)

Beginning balance

102,086

101,687

101,167

100,656

100,585

Railcars added

1,474

1,337

1,422

1,688

791

Railcars scrapped

(360

)

(389

)

(375

)

(354

)

(292

)

Railcars sold

(503

)

(549

)

(527

)

(823

)

(428

)

Ending balance

102,697

102,086

101,687

101,167

100,656

Utilization

99.3

%

99.3

%

99.4

%

99.3

%

99.3

%

Average active railcars

101,629

101,181

100,677

100,197

99,796

Boxcar Fleet Rollforward

Beginning balance

8,990

9,670

9,311

9,087

8,959

Boxcars added

—

—

587

424

316

Boxcars scrapped

(211

)

(555

)

(228

)

(152

)

(95

)

Boxcars sold

—

(125

)

—

(48

)

(93

)

Ending balance

8,779

8,990

9,670

9,311

9,087

Utilization

99.8

%

99.8

%

99.8

%

100.0

%

99.7

%

Average active railcars

8,848

9,304

9,583

9,207

8,985

Rail North

America Industry Statistics

Manufacturing Capacity Utilization Index

(4)

77.5

%

78.2

%

77.8

%

78.7

%

79.5

%

Year-over-year Change in U.S. Carloadings

(excl. intermodal) (5)

(3.3

)%

(4.5

)%

(4.2

)%

0.7

%

30.0

%

Year-over-year Change in U.S. Carloadings

(chemical) (5)

4.2

%

4.3

%

4.5

%

(0.3

)%

(2.6

)%

Year-over-year Change in U.S. Carloadings

(petroleum) (5)

10.4

%

11.1

%

7.7

%

11.1

%

10.5

%

Production Backlog at Railcar

Manufacturers (6)

n/a (7)

45,238

46,413

51,836

58,680

_________

(1)

GATX's Lease Price Index (LPI) is an

internally-generated business indicator that measures renewal

activity for our North American railcar fleet, excluding boxcars.

The LPI calculation includes all renewal activity based on a

12-month trailing average, and the renewals are weighted by the

count of all renewals over the 12 month period. The average renewal

lease rate change is reported as the percentage change between the

average renewal lease rate and the average expiring lease rate. The

average renewal lease term is reported in months and reflects the

average renewal lease term in the LPI.

(2)

The renewal success rate represents the

percentage of railcars on expiring leases that were renewed with

the existing lessee. The renewal success rate is an important

metric because railcars returned by our customers may remain idle

or incur additional maintenance and freight costs prior to being

leased to new customers.

(3)

Excludes boxcar fleet.

(4)

As reported and revised by the Federal

Reserve.

(5)

As reported by the Association of American

Railroads (AAR).

(6)

As reported by the Railway Supply

Institute (RSI).

(7)

Not available, not published as of the

date of this release.

GATX CORPORATION AND

SUBSIDIARIES

SUPPLEMENTAL INFORMATION

(UNAUDITED)

(Continued)

9/30/2024

6/30/2024

3/31/2024

12/31/2023

9/30/2023

Rail Europe

Statistics

Fleet Rollforward

Beginning balance

29,649

29,371

29,216

29,102

28,759

Railcars added

410

388

322

371

446

Railcars scrapped or sold

(106

)

(110

)

(167

)

(257

)

(103

)

Ending balance

29,953

29,649

29,371

29,216

29,102

Utilization

95.9

%

95.8

%

95.3

%

95.9

%

96.0

%

Average active railcars

28,626

28,198

27,984

28,003

27,884

Rail India

Statistics

Fleet Rollforward

Beginning balance

9,904

9,501

8,805

7,884

6,927

Railcars added

457

408

696

921

957

Railcars scrapped or sold

—

(5

)

—

—

—

Ending balance

10,361

9,904

9,501

8,805

7,884

Utilization

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Average active railcars

10,165

9,711

9,089

8,321

7,366

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022955661/en/

GATX Corporation Shari Hellerman Senior Director, Investor

Relations, ESG, and External Communications 312-621-4285

shari.hellerman@gatx.com

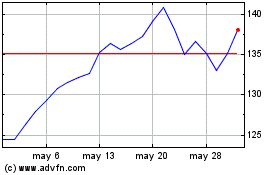

GATX (NYSE:GATX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

GATX (NYSE:GATX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024