0000868671false00008686712024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

____________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

____________________________________________________________

GLACIER BANCORP, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________

| | | | | | | | |

| Montana | 000-18911 | 81-0519541 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 49 Commons Loop | Kalispell, | Montana | 59901 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | | | | | | | |

| (406) | 756-4200 |

| (Registrant’s telephone number, including area code) |

____________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | GBCI | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

Appointment of Executive Officers

On October 30, 2024, the Board of Directors (the “Board”) of Glacier Bancorp, Inc. (the “Company” or “Glacier”), appointed Ryan Screnar to serve as an Executive Vice President and Chief Compliance Officer of the Company and Glacier Bank, the Company’s wholly owned banking subsidiary (the “Bank”). Upon Don Chery’s previously announced retirement, now planned for February 2025, Mr. Screnar will become Chief Administrative Officer of the Company and the Bank, replacing Mr. Chery in that position. As part of the transition, Mr. Screnar will continue to oversee the Bank’s compliance functions as part of a realignment of certain responsibilities assigned to the Chief Administrative Officer. Certain other functions will be assigned to the expanded position of Executive Vice President and Chief Experience Officer, as further described below.

Mr. Screnar, age 50, previously served as the Bank’s Senior Vice President and Chief Compliance Officer since January 2022. Prior to taking the position of Senior Vice President and Chief Compliance Officer, Mr. Screnar held various positions with increasing responsibilities since joining the Bank as an Internal Auditor in the Internal Audit Department in May 2000, including as Audit Director from October 2000 until November 2016. Mr. Screnar is a 1996 graduate of University of Montana. He is also a 2005 graduate of Pacific Coast Banking School and a licensed CPA in the state of Montana.

There are no family relationships, as defined in Item 401 of Regulation S-K, between Mr. Screnar and any of the Company’s executive officers or directors or persons nominated or chosen to become a director or executive officer. There are no arrangements or understandings between Mr. Screnar and any other persons pursuant to which he was appointed to his position, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Also on October 30, 2024, the Board appointed Lee Groom to serve as Executive Vice President and Chief Experience Officer of the Company and the Bank. Mr. Groom, who currently serves as Senior Vice President and Chief Experience Officer of the Bank and oversees the retail customer experience, commercial card products, and mortgage lending businesses, is being promoted to this expanded position and will assume additional responsibilities, including oversight of the information technology function at Glacier. The Board, in consultation with Glacier’s President and CEO, Randy Chesler, expanded the Chief Experience Officer role to better address the increasing complexities of the Glacier businesses that arise out of its growth and the increasingly complex operating and regulatory environments in which it operates. Mr. Groom will continue to report directly Mr. Chesler.

Mr. Groom, age 48, was appointed as Senior Vice President and Chief Experience Officer of the Bank in October of 2018. Prior to that, Mr. Groom had spent nearly two decades in the financial services industry in various roles of increasing responsibility, most notably with HSBC and First Interstate Bank. Mr. Groom is a 1998 graduate of Colorado College with a B.S. in Mathematics, with distinction, and he attended Colorado State from 1999-2001, taking additional courses towards a master’s in statistics.

There are no family relationships, as defined in Item 401 of Regulation S-K, between Mr. Groom and any of the Company’s executive officers or directors or persons nominated or chosen to become a director or executive officer. There are no arrangements or understandings between Mr. Groom and any other persons pursuant to which he was appointed to his current position, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Employment Agreements

Effective November 1, 2024, Glacier entered into new employment agreements with Messrs. Screnar and Groom (each, an “Executive”). The employment agreements are substantially similar to those entered into with the Company’s other executive officers. The material terms of the employment agreements are briefly described below.

The term of each Executive’s employment agreement is a rolling two years, with a renewal in February of each year, and each Executive will be paid an initial annual base salary of $342,000. Each Executive will be eligible to participate in the Company’s short-term cash and long-term equity incentive plans, as well as Glacier’s other employee benefit plans made available to similarly situated employees.

If the Executive’s employment is terminated for conduct constituting Cause, as defined, or due to his death or continuing disability, Glacier will pay the Executive the salary earned through the date of his termination. If Executive’s employment is terminated by Glacier for a legitimate business reason, but without Cause, or by the Executive for Good Reason, as defined, he will be paid an amount equal to the greater of (a) the amount of base salary remaining to be paid during the term of his employment agreement, or (b) the amount he would be entitled to receive under the Bank’s severance plan, over a period of two years.

If either Executive’s employment is terminated by Glacier (or its successor) with a legitimate business reason but without Cause either (1) following the announcement of a Change in Control, as defined, and which Change in Control occurs within six months of such termination, or (2) within two years following a Change in Control, the Executive will be entitled to receive an amount equal to two times his prior year’s compensation, as reported on IRS Form W-2, payable in 24 equal monthly installments. The amounts described above also would be payable if the Executive terminates his employment for Good Reason within two years following a Change in Control. These amounts will also be reduced by any payments the Executive receives following a Change in Control for base salary, cash bonuses, or relating to severance from employment. In addition, to the extent that the payments will be subject to the excise tax imposed under Section 4999 of the Internal Revenue Code, then the total payments will be reduced if and to the extent that a reduction in the total payments would result in Executive retaining a larger amount, on an after-tax basis.

The agreements include non-competition and non-solicitation restrictions that continue for one and two years, respectively, following termination of employment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: | November 5, 2024 | GLACIER BANCORP, INC. |

| | | |

| | /s/ Randall M. Chesler |

| | By: | Randall M. Chesler |

| | | President and Chief Executive Officer |

v3.24.3

Cover Page

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

GLACIER BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

MT

|

| Entity File Number |

000-18911

|

| Entity Tax Identification Number |

81-0519541

|

| Entity Address, Address Line One |

49 Commons Loop

|

| Entity Address, City or Town |

Kalispell,

|

| Entity Address, State or Province |

MT

|

| Entity Address, Postal Zip Code |

59901

|

| City Area Code |

(406)

|

| Local Phone Number |

756-4200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

GBCI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000868671

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

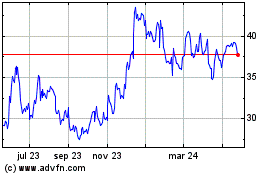

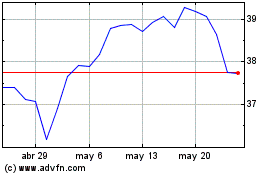

Glacier Bancorp (NYSE:GBCI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Glacier Bancorp (NYSE:GBCI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025