0001373670false00013736702023-08-022023-08-020001373670us-gaap:CommonStockMember2023-08-022023-08-020001373670us-gaap:SeriesAPreferredStockMember2023-08-022023-08-02

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 2, 2023

| | |

Green Brick Partners, Inc. |

_________________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-33530 | | 20-5952523 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| 2805 Dallas Pkwy | , | Ste 400 | | | | | | |

| Plano | , | TX | 75093 | | (469) | | 573-6755 |

| (Address of principal executive offices, including Zip Code) | | (Registrant’s telephone number, including area code) |

(Former name or former address, if changed since last report) Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | GRBK | The New York Stock Exchange |

Depositary Shares (each representing a 1/1000th interest in a share of 5.75% Series A Cumulative Perpetual Preferred Stock, par value $0.01 per share) | GRBK PRA | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On August 2, 2023, Green Brick Partners, Inc. (the “Company”) issued a press release announcing its financial and operational results for the second quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99 to this report.

Item 8.01 Other Events

The Company announced today that on September 15, 2023 holders of record as of September 1, 2023 (the “Record Date”) of its depositary shares (the “Series A Depositary Shares” (NYSE:GRBK.PRA)), each representing a 1/1,000th interest in a share of its 5.75% Series A Cumulative Perpetual Preferred Stock (the “Series A Preferred Stock”) will receive a quarterly dividend in the amount of $359.38 per share of Series A Preferred Stock (equivalent to $0.35938 per Series A Depositary Share), which will cover the period from, and including, June 15, 2023 through, but not including September 15, 2023. The dividend represents dividends at the rate of 5.75% of the $25,000.00 liquidation preference per share (equivalent to $25.00 per depositary share) per year (equivalent to $1,437.50 per share per year or $1.4375 per Series A Depositary Share per year).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | Description of Exhibit | |

| 99 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

GREEN BRICK PARTNERS, INC. |

| By: | /s/ Richard A. Costello |

| Name: | Richard A. Costello |

| Title: | Chief Financial Officer |

Date: August 2, 2023

Exhibit 99

GREEN BRICK PARTNERS, INC. REPORTS SECOND QUARTER 2023 RESULTS

NEW HOME ORDERS UP 50.8% FOR THE QUARTER AND 64.8% YEAR-TO-DATE

RESIDENTIAL UNITS REVENUE OF $454.4 MILLION, SECOND HIGHEST IN COMPANY HISTORY

HOMEBUILDING GROSS MARGIN 31.3%, UP 370 BPS SEQUENTIALLY

DILUTED EPS OF $1.63, SECOND HIGHEST IN COMPANY HISTORY

DEBT TO TOTAL CAPITAL OF 22.9%; RECORD LOW NET DEBT TO TOTAL CAPITAL OF 10.6%

PLANO, Texas, August 2, 2023 — Green Brick Partners, Inc. (NYSE: GRBK) (“we,” “Green Brick” or the “Company”) today reported results for its second quarter ended June 30, 2023.

“We are pleased to report that Green Brick delivered another strong quarter with exceptional execution by our team. During the second quarter, we delivered 783 homes, generating $454 million in home closings revenue, which was our second highest in company history. Homebuilding gross margin was up 370 bps sequentially to 31.3%. These higher margins drove second quarter earnings up to $1.63 per diluted share, which were up 19% sequentially and second best in company history,” said Jim Brickman, CEO and Co-Founder. “We continue to lead the industry with the highest homebuilding gross margins amongst our public peers, a result of our infill locations, self-development land strategy, and focus on operational efficiency.”

“We have continued to see demand for homes, particularly in infill and infill-adjacent locations where we have a strong presence and where there is limited resale inventory competition because existing homeowners are reluctant to sell their homes and forfeit their low interest rate loans. Sales momentum in 2Q23 was above normal seasonality and remained strong throughout the spring selling season. Net orders increased 51% year-over-year to 822 homes, the highest of any second quarter in company history. Our quarterly absorption rate in 2Q23 remained robust at 9.9 homes per active selling community, while our cancellation rate remained the lowest in the homebuilding industry at 7.4%. As a result, backlog at the end of Q2 is now up 59% from the beginning of the year. During the quarter, we increased ending community count to its highest level in two years, up 10% year over year. We also ramped up our starts during the second quarter by 25% over 1Q23 to 833 units, which has allowed us to better align starts with our improved sales pace. Additionally, we are pleased to have seen further normalization of the supply chain and labor availability in our markets and improved cycle times that we expect will continue to result in higher returns on capital. We believe our scale as the third largest builder in DFW and ongoing operational improvements will continue to decrease our cycle times,” continued Mr. Brickman.

“We were able to generate these results while lowering our leverage. As of June 30, 2023, our debt to total capital ratio decreased 600 bps year-over-year to 22.9%, while net debt to total capital ratio was down 1450 basis points to a record low of 10.6%. With a strong balance sheet and ample lots in infill locations, we believe we are well positioned to take advantage of continuing strong demand and increase our market share in our core markets.”

Results for the Quarter Ended June 30, 2023:

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | Three Months Ended June 30, | | |

| 2023 | | 2022 | | Change |

| New homes delivered | 783 | | | 881 | | | (11.1) | % |

| | | | | |

| Total revenues | $ | 456,289 | | | $ | 525,144 | | | (13.1) | % |

| Total cost of revenues | 313,354 | | | 356,248 | | | (12.0) | % |

| Total gross profit | $ | 142,935 | | | $ | 168,896 | | | (15.4) | % |

| Income before income taxes | $ | 104,212 | | | $ | 138,282 | | | (24.6) | % |

| Net income attributable to Green Brick Partners, Inc. | $ | 75,270 | | | $ | 101,256 | | | (25.7) | % |

| Diluted net income attributable to Green Brick Partners, Inc. per common share | $ | 1.63 | | | $ | 2.08 | | | (21.6) | % |

| | | | | |

| Residential units revenue | $ | 454,445 | | | $ | 512,515 | | | (11.3) | % |

| | | | | | | | | | | | | | | | | |

| Average sales price of homes delivered | $ | 580.0 | | | $ | 579.5 | | | 0.1 | % |

| Homebuilding gross margin percentage | 31.3 | % | | 32.3 | % | | -100 bps |

| | | | | |

| Backlog | $ | 585,951 | | | $ | 710,199 | | | $ | (124,248) | |

| Homes under construction | 1,809 | | | 2,436 | | | (25.7) | % |

Results for the Six Months Ended June 30, 2023:

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | Six Months Ended June 30, | | |

| 2023 | | 2022 | | Change |

| New homes delivered | 1,544 | | | 1,539 | | | 0.3 | % |

| | | | | |

| Total revenues | $ | 908,350 | | | $ | 918,760 | | | (1.1) | % |

| Total cost of revenues | 640,809 | | | 641,508 | | | (0.1) | % |

| Total gross profit | $ | 267,541 | | | $ | 277,252 | | | (3.5) | % |

| Income before income taxes | $ | 191,384 | | | $ | 220,915 | | | (13.4) | % |

| Net income attributable to Green Brick Partners, Inc. | $ | 139,450 | | | $ | 162,833 | | | (14.4) | % |

| Diluted net income attributable to Green Brick Partners, Inc. per common share | $ | 3.00 | | | $ | 3.25 | | | (7.7) | % |

| | | | | |

| Residential units revenue | $ | 904,807 | | | $ | 877,176 | | | 3.1 | % |

| Average sales price of homes delivered | $ | 585.2 | | | $ | 567.6 | | | 3.1 | % |

| Homebuilding gross margin percentage | 29.5 | % | | 30.5 | % | | -100 bps |

| Selling, general and administrative expenses as a percentage of residential units revenue | 10.5 | % | | 8.7 | % | | 180 bps |

Earnings Conference Call:

We will host our earnings conference call to discuss our second quarter ended June 30, 2023 at 12:00 p.m. Eastern Time on Thursday, August 3, 2023. The call can be accessed by dialing 1-888-660-6353 for domestic participants or 1-929-203-2106 for international participants and should reference meeting number 3162560. Participants may also join the call via webcast at: https://events.q4inc.com/attendee/763375419

A telephone replay of the call will be available through September 2, 2023. To access the telephone replay, the domestic dial-in number is 1-800-770-2030, the international dial-in number is 1-647-362-9199 and the access code is 3162560, or by using the link at investors.greenbrickpartners.com.

GREEN BRICK PARTNERS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Residential units revenue | | $ | 454,445 | | | $ | 512,515 | | | $ | 904,807 | | | $ | 877,176 | |

| Land and lots revenue | | 1,844 | | | 12,629 | | | 3,543 | | | 41,584 | |

| Total revenues | | 456,289 | | | 525,144 | | | 908,350 | | | 918,760 | |

| Cost of residential units | | 312,030 | | | 347,142 | | | 638,154 | | | 610,572 | |

| Cost of land and lots | | 1,324 | | | 9,106 | | | 2,655 | | | 30,936 | |

| Total cost of revenues | | 313,354 | | | 356,248 | | | 640,809 | | | 641,508 | |

| Total gross profit | | 142,935 | | | 168,896 | | | 267,541 | | | 277,252 | |

| Selling, general and administrative expenses | | (49,229) | | | (41,798) | | | (95,174) | | | (76,063) | |

| Equity in income of unconsolidated entities | | 5,699 | | | 8,523 | | | 9,920 | | | 14,210 | |

| Other income, net | | 4,807 | | | 2,661 | | | 9,097 | | | 5,516 | |

| Income before income taxes | | 104,212 | | | 138,282 | | | 191,384 | | | 220,915 | |

| Income tax expense | | 23,148 | | | 30,278 | | | 42,179 | | | 48,715 | |

| Net income | | 81,064 | | | 108,004 | | | 149,205 | | | 172,200 | |

| Less: Net income attributable to noncontrolling interests | | 5,794 | | | 6,748 | | | 9,755 | | | 9,367 | |

| Net income attributable to Green Brick Partners, Inc. | | $ | 75,270 | | | $ | 101,256 | | | $ | 139,450 | | | $ | 162,833 | |

| | | | | | | | |

| Net income attributable to Green Brick Partners, Inc. per common share: | | | | | | | | |

| Basic | | $ | 1.64 | | | $ | 2.09 | | | $ | 3.02 | | | $ | 3.27 | |

| Diluted | | $ | 1.63 | | | $ | 2.08 | | | $ | 3.00 | | | $ | 3.25 | |

| Weighted average common shares used in the calculation of net income attributable to Green Brick Partners, Inc. per common share: | | | | | | | | |

| Basic | | 45,371 | | | 48,046 | | | 45,656 | | | 49,309 | |

| Diluted | | 45,755 | | | 48,384 | | | 46,051 | | | 49,639 | |

GREEN BRICK PARTNERS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| ASSETS |

| Cash and cash equivalents | $ | 209,595 | | | $ | 76,588 | |

| Restricted cash | 21,607 | | | 16,682 | |

| Receivables | 7,057 | | | 5,288 | |

| Inventory | 1,404,398 | | | 1,422,680 | |

| Investments in unconsolidated entities | 81,800 | | | 74,224 | |

| Right-of-use assets - operating leases | 2,689 | | | 3,458 | |

| Property and equipment, net | 4,375 | | | 2,919 | |

| Earnest money deposits | 16,136 | | | 23,910 | |

| Deferred income tax assets, net | 16,448 | | | 16,448 | |

| Intangible assets, net | 409 | | | 452 | |

| Goodwill | 680 | | | 680 | |

| Other assets | 11,379 | | | 12,346 | |

| Total assets | $ | 1,776,573 | | | $ | 1,655,675 | |

| LIABILITIES AND EQUITY |

| Liabilities: | | | |

| Accounts payable | $ | 57,464 | | | $ | 51,804 | |

| Accrued expenses | 101,464 | | | 91,281 | |

| Customer and builder deposits | 43,252 | | | 29,112 | |

| Lease liabilities - operating leases | 2,780 | | | 3,582 | |

| Borrowings on lines of credit, net | (2,214) | | | 17,395 | |

| Senior unsecured notes, net | 336,016 | | | 335,825 | |

| Notes payable | 14,591 | | | 14,622 | |

| Total liabilities | 553,353 | | | 543,621 | |

| Commitments and contingencies | | | |

| Redeemable noncontrolling interest in equity of consolidated subsidiary | 32,995 | | | 29,239 | |

| Equity: | | | |

| Green Brick Partners, Inc. stockholders’ equity | | | |

| Preferred stock, $0.01 par value: 5,000,000 shares authorized; 2,000 issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 47,696 | | | 47,696 | |

| Common stock, $0.01 par value: 100,000,000 shares authorized; 45,378,678 issued and outstanding as of June 30, 2023 and 46,032,930 issued and outstanding as of December 31, 2022, respectively | 454 | | | 460 | |

| Additional paid-in capital | 256,965 | | | 259,410 | |

| Retained earnings | 868,962 | | | 754,341 | |

| Total Green Brick Partners, Inc. stockholders’ equity | 1,174,077 | | | 1,061,907 | |

| Noncontrolling interests | 16,148 | | | 20,908 | |

| Total equity | 1,190,225 | | | 1,082,815 | |

| Total liabilities and equity | $ | 1,776,573 | | | $ | 1,655,675 | |

GREEN BRICK PARTNERS, INC.

SUPPLEMENTAL INFORMATION

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential Units Revenue and New Homes Delivered (dollars in thousands) | | Three Months Ended June 30, | | | | | | Six Months Ended June 30, | | | | |

| 2023 | | 2022 | | Change | | % | | 2023 | | 2022 | | Change | | % |

| Home closings revenue | | $ | 454,136 | | | $ | 510,535 | | | $ | (56,399) | | | (11.0)% | | $ | 903,566 | | | $ | 873,598 | | | $ | 29,968 | | | 3.4 | % |

| Mechanic’s lien contracts revenue | | 309 | | | 1,980 | | | (1,671) | | | (84.4)% | | 1,241 | | | 3,578 | | | (2,337) | | | (65.3) | % |

| Residential units revenue | | $ | 454,445 | | | $ | 512,515 | | | $ | (58,070) | | | (11.3)% | | $ | 904,807 | | | $ | 877,176 | | | $ | 27,631 | | | 3.1 | % |

| New homes delivered | | 783 | | | 881 | | | (98) | | | (11.1)% | | 1,544 | | | 1,539 | | | 5 | | | 0.3 | % |

| Average sales price of homes delivered | | $ | 580.0 | | | $ | 579.5 | | | $ | 0.5 | | | 0.1% | | $ | 585.2 | | | $ | 567.6 | | | $ | 17.6 | | | 3.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Land and Lots Revenue

(dollars in thousands) | | Three Months Ended June 30, | | | | | | Six Months Ended June 30, | | | | |

| 2023 | | 2022 | | Change | | % | | 2023 | | 2022 | | Change | | % |

| Lots revenue | | $ | 1,844 | | | $ | 12,081 | | | $ | (10,237) | | | (84.7)% | | $ | 3,543 | | | $ | 14,036 | | | $ | (10,493) | | | (74.8) | % |

| Land revenue | | — | | | 548 | | | (548) | | | (100.0)% | | — | | | 27,548 | | | (27,548) | | | (100.0) | % |

| Land and lots revenue | | $ | 1,844 | | | $ | 12,629 | | | $ | (10,785) | | | (85.4)% | | $ | 3,543 | | | $ | 41,584 | | | $ | (38,041) | | | (91.5) | % |

| Lots closed | | 18 | | 184 | | (166) | | | (90.2)% | | 36 | | | 217 | | | (181) | | | (83.4) | % |

| Average sales price of lots closed | | $ | 102.4 | | | $ | 65.7 | | | $ | 36.7 | | | 55.9% | | $ | 98.4 | | | $ | 64.7 | | | $ | 33.7 | | | 52.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Home Orders and Backlog

(dollars in thousands) | | Three Months Ended June 30, | | | | | | Six Months Ended June 30, | | | | |

| 2023 | | 2022 | | Change | | % | | 2023 | | 2022 | | Change | | % |

| Net new home orders | | 822 | | | 545 | | | 277 | | | 50.8% | | 1,889 | | | 1,146 | | | 743 | | | 64.8 | % |

| Revenue from net new home orders | | $ | 489,495 | | | $ | 354,111 | | | $ | 135,384 | | | 38.2% | | $ | 1,120,423 | | | $ | 713,940 | | | $ | 406,483 | | | 56.9% |

| Average selling price of net new home orders | | $ | 595.5 | | | $ | 649.7 | | | $ | (54.2) | | | (8.3)% | | $ | 593.1 | | | $ | 623.0 | | | $ | (29.9) | | | (4.8)% |

| Cancellation rate | | 7.4 | % | | 11.4 | % | | (4.0) | % | | (35.1)% | | 6.7 | % | | 9.6 | % | | (2.9) | % | | (30.2) | % |

| Absorption rate per average active selling community per quarter | | 9.9 | | | 7.1 | | | 2.8 | | | 39.4% | | 11.5 | | | 7.5 | | | 4.0 | | | 53.3 | % |

| Average active selling communities | | 83 | | | 77 | | | 6 | | | 7.8% | | 82 | | | 76 | | | 6 | | | 7.9 | % |

| Active selling communities at end of period | | 86 | | | 78 | | | 8 | | | 10.3% | | | | | | | | |

| Backlog | | $ | 585,951 | | | $ | 710,199 | | | $ | (124,248) | | | (17.5)% | | | | | | | | |

| Backlog units | | 882 | | | 1,087 | | | (205) | | | (18.9)% | | | | | | | | |

| Average sales price of backlog | | $ | 664.3 | | | $ | 653.4 | | | $ | 10.9 | | | 1.7% | | | | | | | | |

GREEN BRICK PARTNERS, INC.

SUPPLEMENTAL INFORMATION

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Central | | Southeast | | Total | | Central | | Southeast | | Total |

| Lots owned | | | | | | | | | | | |

| Finished lots | 2,651 | | | 1,246 | | | 3,897 | | | 1,901 | | | 998 | | | 2,899 | |

| Lots in communities under development | 9,798 | | | 1,119 | | | 10,917 | | | 10,309 | | | 1,698 | | | 12,007 | |

Land held for future development(1) | 6,575 | | | — | | | 6,575 | | | 6,575 | | | — | | | 6,575 | |

| Total lots owned | 19,024 | | | 2,365 | | | 21,389 | | | 18,785 | | | 2,696 | | | 21,481 | |

| | | | | | | | | | | |

Lots controlled | | | | | | | | | | | |

| Lots under third party option contracts | 1,515 | | | 3 | | | 1,518 | | | 2,212 | | | 6 | | | 2,218 | |

| Land under option for future acquisition and development | 1,731 | | | 129 | | | 1,860 | | | 110 | | | 18 | | | 128 | |

| Lots under option through unconsolidated development joint ventures | 1,289 | | | 378 | | | 1,667 | | | 1,289 | | | 411 | | | 1,700 | |

| Total lots controlled | 4,535 | | | 510 | | | 5,045 | | | 3,611 | | | 435 | | | 4,046 | |

Total lots owned and controlled (2) | 23,559 | | | 2,875 | | | 26,434 | | | 22,396 | | | 3,131 | | | 25,527 | |

| Percentage of lots owned | 80.8 | % | | 82.3 | % | | 80.9 | % | | 83.9 | % | | 86.1 | % | | 84.2 | % |

(1) Land held for future development consists of raw land parcels where development activities have been postponed due to market conditions or other factors.

(2) Total lots excludes lots with homes under construction.

The following table presents additional information on the lots we owned as of June 30, 2023 and December 31, 2022.

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Total lots owned | 21,389 | | | 21,481 | |

| Add certain lots included in Total Lots Controlled | | | |

| Land under option for future acquisition and development | 1,860 | | | 128 | |

| Lots under option through unconsolidated development joint ventures | 1,667 | | | 1,700 | |

| Total lots self-developed | 24,916 | | | 23,309 | |

| Self-developed lots as a percentage of total lots owned and controlled | 94.3 | % | | 91.3 | % |

Non-GAAP Financial Measures

In this press release, we utilize certain financial measures that are non-GAAP financial measures as defined by the Securities and Exchange Commission. We present these measures because we believe they and similar measures are useful to management and investors in evaluating our operating performance and financing structure. We also believe these measures facilitate the comparison of our operating performance and financing structure with other companies in our industry. Because these measures are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), they may not be comparable to other similarly titled measures of other companies and should not be considered in isolation or as a substitute for, or superior to, financial measures prepared in accordance with GAAP.

The following table represents the non-GAAP measure of adjusted homebuilding gross margin for the three and six months ended June 30, 2023 and 2022 and reconciles these amounts to homebuilding gross margin, the most directly comparable GAAP measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, in thousands): | | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Residential units revenue | | $ | 454,445 | | | $ | 512,515 | | | $ | 904,807 | | | $ | 877,176 | |

| Less: Mechanic’s lien contracts revenue | | (309) | | | (1,980) | | | (1,241) | | | (3,578) | |

| Home closings revenue | | $ | 454,136 | | | $ | 510,535 | | | $ | 903,566 | | | $ | 873,598 | |

| Homebuilding gross margin | | $ | 142,302 | | | $ | 165,106 | | | $ | 266,217 | | | $ | 266,079 | |

| Homebuilding gross margin percentage | | 31.3 | % | | 32.3 | % | | 29.5 | % | | 30.5 | % |

| | | | | | | | |

| Homebuilding gross margin | | 142,302 | | | 165,106 | | | 266,217 | | | 266,079 | |

| Add back: Capitalized interest charged to cost of revenues | | 3,862 | | | 4,337 | | | 7,488 | | | 7,198 | |

| Adjusted homebuilding gross margin | | $ | 146,164 | | | $ | 169,443 | | | $ | 273,705 | | | $ | 273,277 | |

| Adjusted homebuilding gross margin percentage | | 32.2 | % | | 33.2 | % | | 30.3 | % | | 31.3 | % |

About Green Brick Partners, Inc.

Green Brick Partners, Inc. is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida and has a non-controlling interest in a Colorado homebuilder. Green Brick owns five subsidiary homebuilders in Texas (CB JENI Homes, Normandy Homes, Southgate Homes, Trophy Signature Homes, and a 90% interest in Centre Living Homes), as well as a controlling interest in a homebuilder in Atlanta, Georgia (The Providence Group) and an 80% interest in a homebuilder in Port St. Lucie, Florida (GHO Homes). Green Brick also owns a noncontrolling interest in Challenger Homes in Colorado Springs, Colorado, and retains interests in related financial services platforms, including Green Brick Title and BHome Mortgage. The Company is engaged in all aspects of the homebuilding process, including land acquisition and development, entitlements, design, construction, marketing, and sales for its residential neighborhoods and master-planned communities. For more information about Green Brick Partners Inc.’s subsidiary homebuilders, please visit greenbrickpartners.com/homebuilders.

Forward-Looking and Cautionary Statements:

This press release and our earnings call contain “forward-looking statements” within the meaning of the Private Securities Litigation Act of 1995. These statements concern expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts and typically include the words “anticipate,” “believe,” “consider,” “estimate,” “expect,” “feel,” “intend,” “plan,” “predict,” “seek,” “strategy,” “target,” “will” or other words of similar meaning. Forward-looking statements in this press release and in our earnings call include statements regarding (i) our position to adapt and succeed in a rapidly changing environment, including our ability to maintain industry-leading performance and gross margins; (ii) our expectations regarding trends in our markets, such as demand for single-family homes and levels of resale inventory; (iii) our ability to mitigate inventory buildup and manage pace of sales and starts; (iv) our ability to increase our market share; (v) our priorities and strategies for growth, the drivers of that growth, and the impact on our future results, including in the Austin market and expansion of our Trophy brand; (vi) our capital resources and flexibility to capitalize on market opportunities and the impact on our financial and operational performance; (vii) the advantages of our lot and land strategies and locations, including the benefits to our margins and adaptability; (viii) our beliefs that we operate in the most advantageous markets in the U.S. and the resilience of our core markets; (ix) our intention to continue strengthening our financial position and reducing leverage; (x) our beliefs regarding our position and scale, including our ability to manage costs and cycle times; and (xi) our expectations regarding returns on capital, including the impact of improvements in cycle times, supply chain and labor availability. These forward-looking statements reflect our current views about future events and involve estimates and assumptions which may be affected by risks and uncertainties in our business, as well as other external factors, which could cause future results to materially differ from those expressed or implied in any forward-looking statement. These risks include, but are not limited to: (1) changes in macroeconomic conditions, including increasing interest rate and inflation that could adversely impact demand for new homes or the ability of potential buyers to qualify; (2) general economic conditions, seasonality, cyclicality and competition in the homebuilding industry; (3) shortages, delays or increased costs of raw materials and increased demand for materials, or increases in other operating costs, including costs related to labor, real estate taxes and insurance, which in each case exceed our ability to increase prices; (4) a shortage of qualified labor; (5) an inability to acquire land in our current and new markets at anticipated prices or difficulty in obtaining land-use entitlements; (6) our inability to successfully execute our strategies, including an inability to grow our operations or expand our Trophy brand; (7) our inability to implement new strategic investments; (8) a failure to recruit, retain or develop highly skilled and competent employees; (9) government regulation risks; (10) a lack of availability or volatility of mortgage financing for homebuyers; (11) severe weather events or natural disasters;

(12) difficulty in obtaining sufficient capital to fund our growth; (13) our ability to meet our debt service obligations; (14) a decline in the value of our inventories and resulting write-downs of the carrying value of our real estate assets; (15) changes in accounting standards that adversely affect our reported earnings or financial condition. For a more detailed discussion of these and other risks and uncertainties applicable to Green Brick please see our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission.

Contact:

Benting Hu

Vice President of Finance

469-573-6755

IR@greenbrickpartners.com

v3.23.2

Document and Entity Information Document And Entity Information

|

Aug. 02, 2023 |

| Entity Information [Line Items] |

|

| Document Period End Date |

Aug. 02, 2023

|

| Written Communications |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Registrant Name |

Green Brick Partners, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33530

|

| Entity Tax Identification Number |

20-5952523

|

| Entity Address, Address Line One |

2805 Dallas Pkwy

|

| Entity Address, Address Line Two |

Ste 400

|

| Entity Address, City or Town |

Plano

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75093

|

| City Area Code |

(469)

|

| Entity Central Index Key |

0001373670

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Local Phone Number |

573-6755

|

| Entity Emerging Growth Company |

false

|

| Series A Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing a 1/1000th interest in a share of 5.75% Series A Cumulative Perpetual Preferred Stock, par value $0.01 per share)

|

| Trading Symbol |

GRBK PRA

|

| Security Exchange Name |

NYSE

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GRBK

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

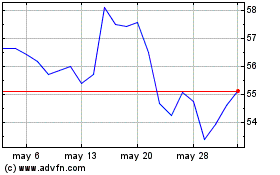

Green Brick Partners (NYSE:GRBK)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Green Brick Partners (NYSE:GRBK)

Gráfica de Acción Histórica

De May 2023 a May 2024